Features of the asset

- A leading paint supplier in the Southwestern U.S., offering an extensive lineup of paints and services to professionals in the paint and coatings industry

- Despite having a modest 2.5% market share in the overall U.S. decorative paints market, Dunn-Edwards is estimated to hold a 12% market share in California and 10-20% in neighboring areas

- Focusing on the West Coast within the U.S. market, aiming to achieve both sustainable growth and profitability

Competitive advantages

| Established position as a leading paint supplier in the Southwestern U.S. |

|

|---|---|

| Diversified portfolio of high-quality and innovative products |

|

Financial outcomes

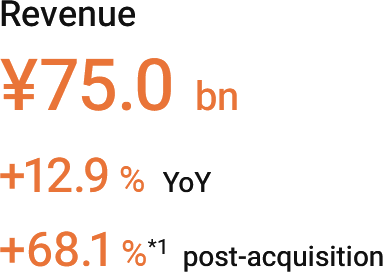

2024 results

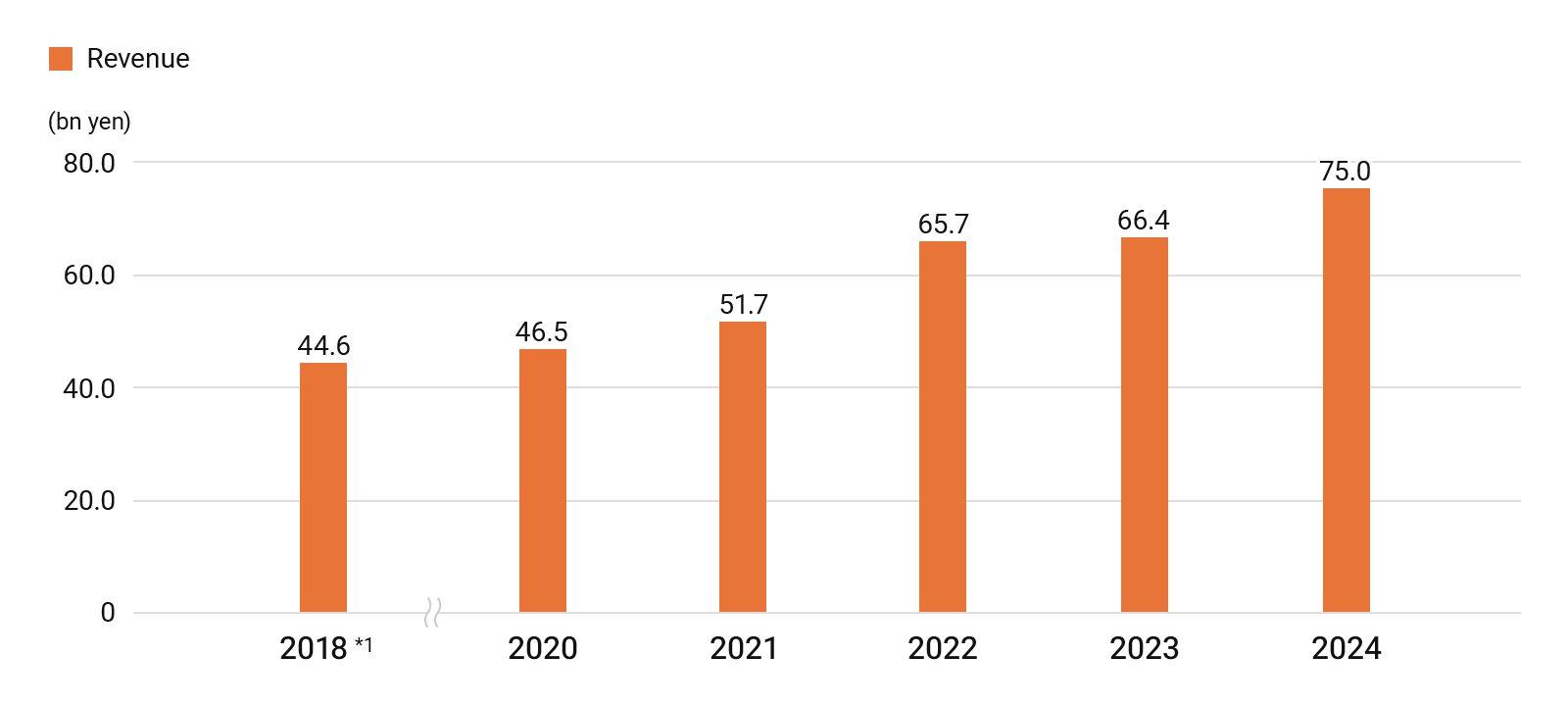

Revenue increased, supported by pass-through of price increases, reduced impact from adverse weather in California, and new store openings, which offset the challenges posed by a weak U.S. economy and housing market. As a result, revenue rose by 12.9% from the previous year to JPY75.0 billion.

Meanwhile, its market share remained steady at 2.5%, roughly the same as the previous year.

Growth since the acquisition (2018*1)

Dunn-Edwards offers unique customer services that differentiate it from competitors, along with high-quality, wide-ranging products. By leveraging our Group’s marketing know-how, Dunn-Edwards has promoted the supply of new products through both new stores and its existing distribution network. As a result, its revenue has successfully grown by 68.1% compared to 2018.

Trends in revenues

Market share*2: 2.5% (YoY +0.0pt / growth since acquisition +0.1pt)

- Dunn-Edwards’ performance was compared using the 2018 figures because the 2017 figures, the first year post-acquisition, only covered 10 months following its acquisition in March 2017

- NPHD’s estimates

Non-financial outcomes (2024 results)

|

|

|

|---|---|

|

|

|

|

|

|