Accelerating EPS compounding by leveraging the combined advantage of autonomous and decnetralized management and lean headquarters

Organic-Advantage of autonomous and decentralized management

-

1.

Autonomous growth of excellent assets by harnessing low-cost operations, high cash generation capability, and operating leverage

-

2.

Accelerating growth through the use of our Group's platform (financial strength, brand, etc.)

-

3.

Achieving synergy and breakthroughs through collaboration among excellent assets

Inorganic-Advantage of lean headquarters

Organic-Advantage of autonomous and decentralized management

1. Autonomous growth of excellent assets by harnessing low-cost operations, high cash generation capability, and operating leverage

Each of our partner companies features low-cost operations and high cash generation capability enabled by the low-capex characteristics of the paint industry. The holding company typically provides capital to each partner company primarily for executing M&A. By creating operating leverage and capturing resilient market demand, each partner company aims to expand its market share in respective local regions.

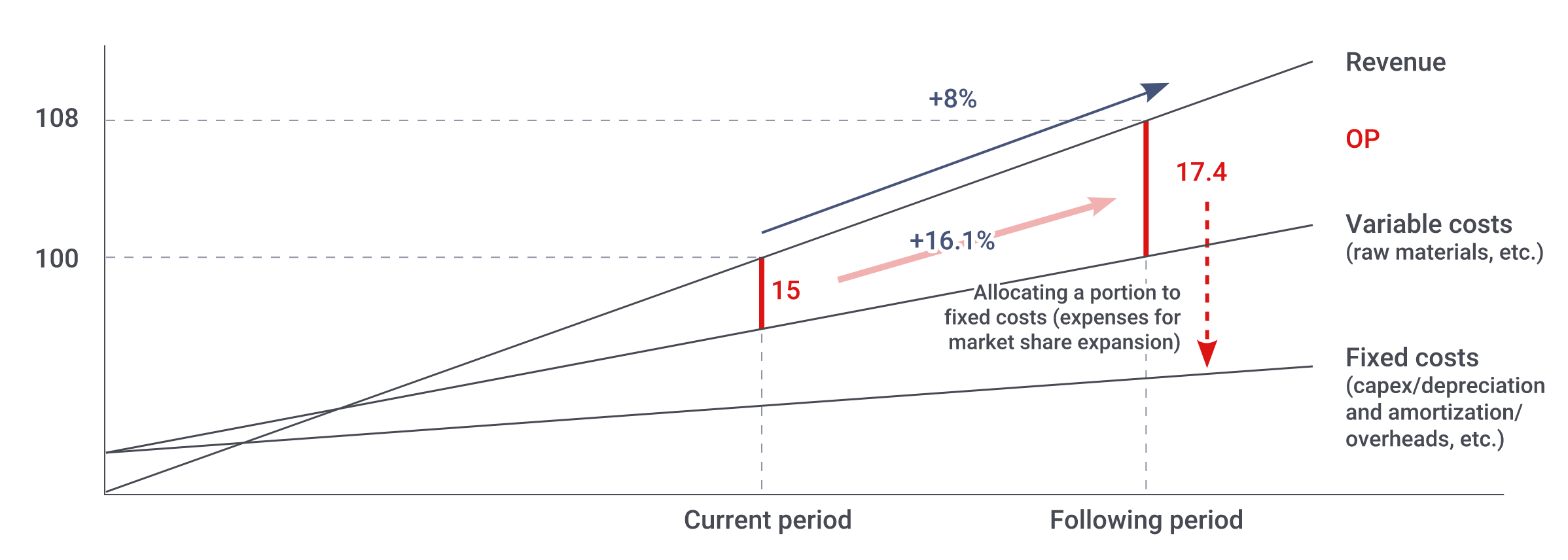

Illustrative operating leverage model

The paint business, characterized by its relatively low requirements for fixed costs including capital expenditures, typically facilitates the generation of leverage effects. This enables us to achieve operating profit growth that surpasses revenue growth. However, these effects can vary across different regions and business segments. In a standard model (see the illustration below), variable costs account for approximately 50% of revenue, while fixed costs constitute around 35%, leading to an operating profit margin of 15%. Under normal conditions, increases in fixed costs and capital expenditures are outpaced by revenue growth. Consequently, an 8% growth in revenue can result in a 16% increase in operating profit. While operating under this illustrative model, we aim to strategically reinvest our excess margins into growth-oriented initiatives, such as advertising and sales incentives, maintaining our operating profit margin levels. This strategy remains vital until we reach market dominance, which we define as securing a market share of approximately 50-60%; we will emphasize growth-focused investments during this phase. Furthermore, depending on the competitive landscape, additional investments might still be needed even after achieving market dominance.

Our illustrative model

Maintaining margin levels until achieving dominance, while reinvesting excess margins to growth initiatives to expand market share

Current period Following period Revenue 100 +8% 108 Variable costs (raw material and other variable costs) -50 +8% -54 Fixed costs Capex/depreciation and amortization -3 ±0% -3 Overhead -32 +5% -33.6 OP 15 +16.1% 17.4 OP margin 15% +1pp 16%

2. Accelerating growth through the use of our Group's platform (financial strength, brand, etc.)

Each partner company leverages our Asset Assembler model platform, proactively incorporating management resources such as financial strength, technical capabilities, brand power, distribution network, and purchasing power that our Group possesses, aiming to drive autonomous growth. Many of our partner companies, including Betek Boya and DuluxGroup, which were acquired in 2019, have a track record of accelerating growth after joining our Group.

3. Our ability to attract world-class management talent who empathize with our business model

Our M&A approach stands apart from the typical Western cost-cutting model, and our established track record and reputation are fostering new M&A opportunities. Our platform promotes enhanced EPS contribution through a combination of autonomy and accountability for talent resonating with MSV. The powerful combination has a strong appeal to high-caliber management talent.

Inorganic-Advantage of lean headquarters

1. Our capability to fully leverage the benefits of low funding costs

As a company based in Japan, a market known for its stable currency and safety, we have committed to fully leveraging the benefits of low funding costs, thanks to our enduring relationships and strong support from financial institutions.

By strategically capitalizing on the persistently low interest rates in Japan, even amidst the stability of the Japanese yen, we are bolstering our competitive edge over Western companies that face higher interest rates.

Illustration of sustainable EPS growth through high-quality acquisitions at a low PER

Acquisition target

- Low-risk and good returns

- Cash generative

- Can be of any region, business area, or size

- Balance between risk and valuation

Assumptions

- Sustainable EPS accretion from Year 1

- Profit generation capabilities not reliant on specific individuals (emphasis on the brand, talent, technology, etc.)

Our strength

- Our ability to assess and identify suited targets

- Maintain and boost motivation of talent who join our Group

- Our platform balancing autonomy with accountability, proactively avoiding standardization

- Low cost funding/debt financing a priority but with possibility of equity financing premised on EPS accretion in Year 1

- Our M&A model allows for continuation of sustainable EPS compounding through our funding, asset identification and potential maximizing capabilities

2. Our Ability to Maintain and Boost the EPS Contribution from Assets Companies without Intervention

Our Company, while maintaining lean headquarters, generously provides each of our partner companies with our unique platform grounded in autonomous and decentralized management. Additionally, we identify low-risk assets and acquire them at reasonable valuations. Following acquisition, we demand autonomy and accountability from our top-tier local management teams. This approach successfully unlocks the full growth potential of each partner company

3. Our Unique Appeal to Management-Class Talents Who Empathize with Our Modus Operandi

Our M&A approach stands apart from the typical Western cost-cutting model, and our established track record and reputation are fostering new M&A opportunities. Our platform promotes enhanced EPS contribution through a combination of autonomy and accountability for talents resonating with MSV. This powerful combination has a strong appeal to high-caliber management talent.