Number of shares

Balance sheet amount

5,554 (million yen)

Shareholder meeting materials, information concerning shareholder returns and the stock price, and analyst ratings and analyst consensus

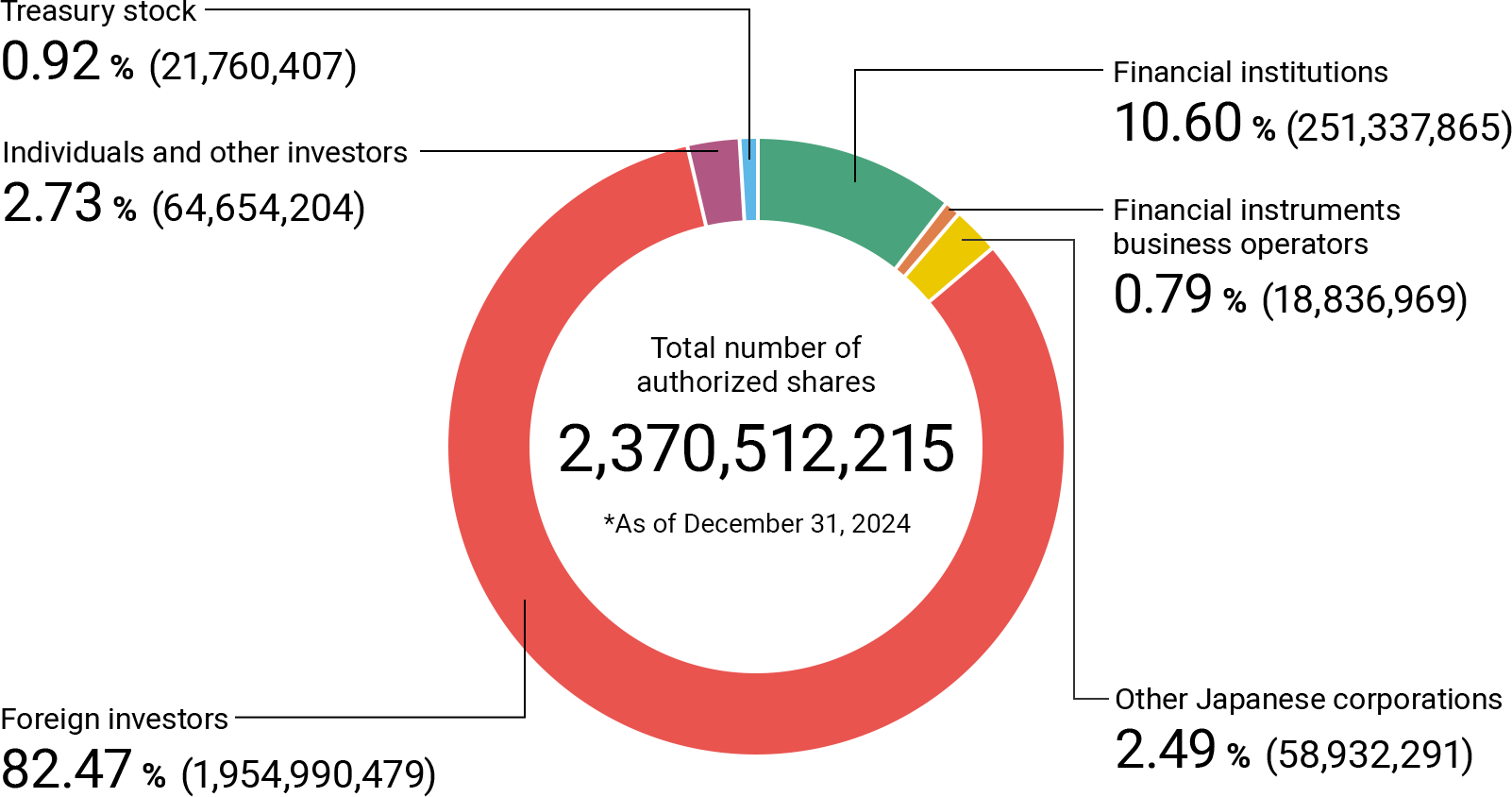

| Total number of authorized shares | 5,000,000,000 |

|---|---|

| Total number of issued shares | 2,370,512,215 |

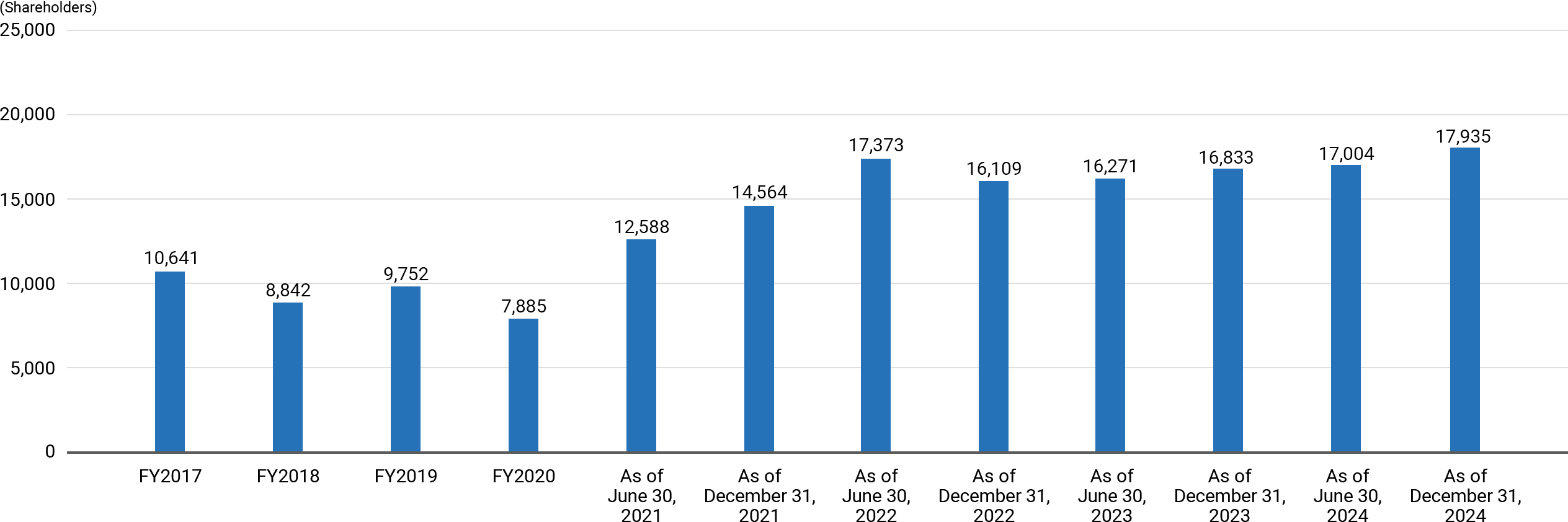

| Number of shareholders | 17,935 |

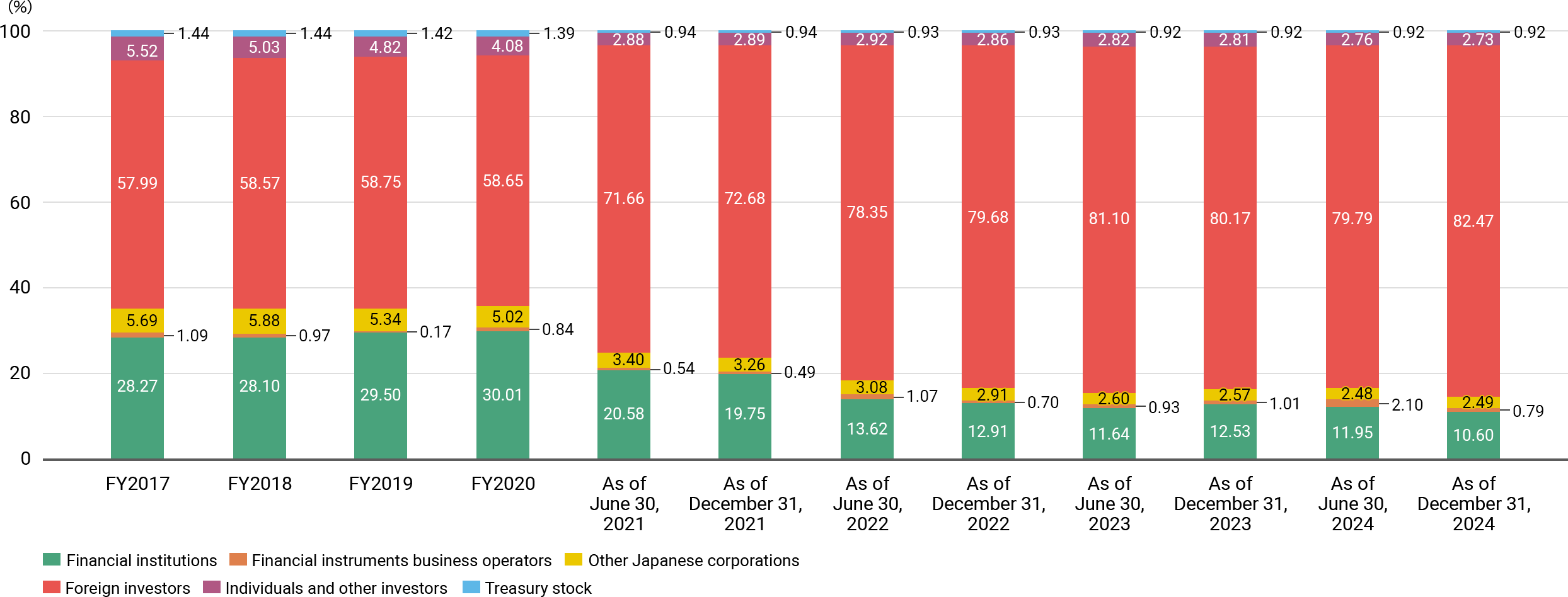

* Shareholding ratios are rounded to two decimal places.

* Shareholding ratios are rounded to two decimal places.

Our cross-shareholdings policy is outlined in Corporate Governance Policies as follows:

|

|---|

In December 2024, the Board of Directors, based on the above policy, conducted a thorough review of all the Company’s shareholdings to assess the rationale for each holding. When exercising voting rights,the Company makes informed decisions guided by the aforementioned policy and internal criteria.

| Strategic shareholdings and total balance sheet amount | FY2020 | FY2021 | FY2022 | FY2023 | FY2024 |

|---|---|---|---|---|---|

| Total number of companies | 24 | 22 | 18 | 18 | 18 |

| (Listed companies) | 6 | 6 | 2 | 2 | 2 |

| Total balance sheet amount (Million yen) | 23,645 | 30,191 | 5,831 | 8,126 | 7,930 |

| (The amount for listed companies) (Million yen) | 22,704 | 29,268 | 4,834 | 7,090 | 6,824 |

*1: Purpose of holding, quantitative benefits of holding, reasons for an increase in number of shares.

| Account closing date | December 31 |

|---|---|

| General meeting of shareholders | March |

| Record date for shareholders | Year-end dividend: December 31 Interim dividend: June 30 |

| Shareholder registry administrator | Mitsubishi UFJ Trust and Banking Corporation Osaka Corporate Agency Division 3-6-3 Fushimi-machi, Chuo-ku, Osaka 541-8502 |

| Stock listing | Tokyo Stock Exchange |

Exercise of Shareholders' Rights

- The Company sets the appropriate schedule of a General Meeting of Shareholders in order to ensure that shareholders can attend the shareholders meeting after giving sufficient consideration to the proposals, or can exercise their voting rights before the date of the General Meeting of Shareholders.

- The Company, in order to ensure that shareholders can appropriately exercise their voting rights, shall provide accurate information including electronic disclosure of the convocation notice of the General Meeting of Shareholders and disclosure in English, and shall work on the improvement of environment for exercise of voting rights, including the use of the Electronic Voting Platform.

- The Company, in the event of a proposal submitted by the Company have an opposition rate of 20% or more, shall examine the subsequent response through the analysis at the Board of Directors of the causes and issues surrounding such significant negative votes.

- The Company, upon receipt of a request for attendance from a beneficial shareholder who owns shares under the name of, for example, a trust bank, the Company will permit the shareholder to attend the General Meeting of Shareholders (including the attendance as an observer) after conducting a reasonable identity confirmation of the shareholder.

(From our "Corporate Governance Policies")

For reference: Ratio of voting rights required for voting at the General Meeting

| Proposal | Resolution Method | Source |

|---|---|---|

| Election of Directors | The election of directors shall take place when shareholders with 1/3 or more of the votes of shareholders entitled to exercise their votes are in attendance, by a majority decision of said votes. Cumulative voting shall not be applied for the election of directors. | Article 341 of the Companies Act Articles 21 [2] and 21 [3] of the Company’s Articles of Incorporation |

| Amendment of Articles of Incorporation |

Resolutions may be made where shareholders with 1/3 or more of the votes of shareholders entitled to exercise their votes are in attendance, by a 2/3 or more majority of said votes. | Article 309, Paragraph 2 of the Companies Act Article 18 [2] of the Company’s Articles of Incorporation |

| Other resolutions | A resolution of the General Meeting of Shareholders shall be passed by a majority of the votes of the shareholders in attendance. | Article 309, Paragraph 1 of the Companies Act Article 18 [1] of the Company’s Articles of Incorporation |

For reference: Ratio of voting rights required for exercise of shareholders’ rights

| Shareholder rights | Voting rights ratio and requirements required for exercise | Source |

|---|---|---|

| Demand for Calling of Meetings by Shareholders | A demand to call a shareholders meeting may be made by shareholders who have held not less than three hundredths (3/100) of the votes of all shareholders consecutively for the preceding six months or more. | Article 297, Paragraphs 1 and 2 of the Companies Act |

| Shareholders’ Right to Propose | A proposal may be made by shareholders who have held not less than one hundredth (1/100) of the votes of all shareholders, or not less than three hundred votes of all shareholders, consecutively for the preceding six months or more. | Article 303 of the Companies Act |

| Action for pursuing liability | An action for pursuing liability may be brought by a shareholder who has held shares consecutively for the preceding six months or more. | Article 847, Paragraph 1 of the Companies Act |