Features of the asset

- Engaging in a wide range of businesses, including automotive coatings, decorative paints, industrial coatings, fine chemicals, and marine coatings

- Leading the Japanese paint market by leveraging advanced technological capabilities and strong brand power

- In the mature Japanese market, aiming to achieve both growth and profitability through unified group efforts

Outstanding management teams driving our leadership in the Japanese paint market

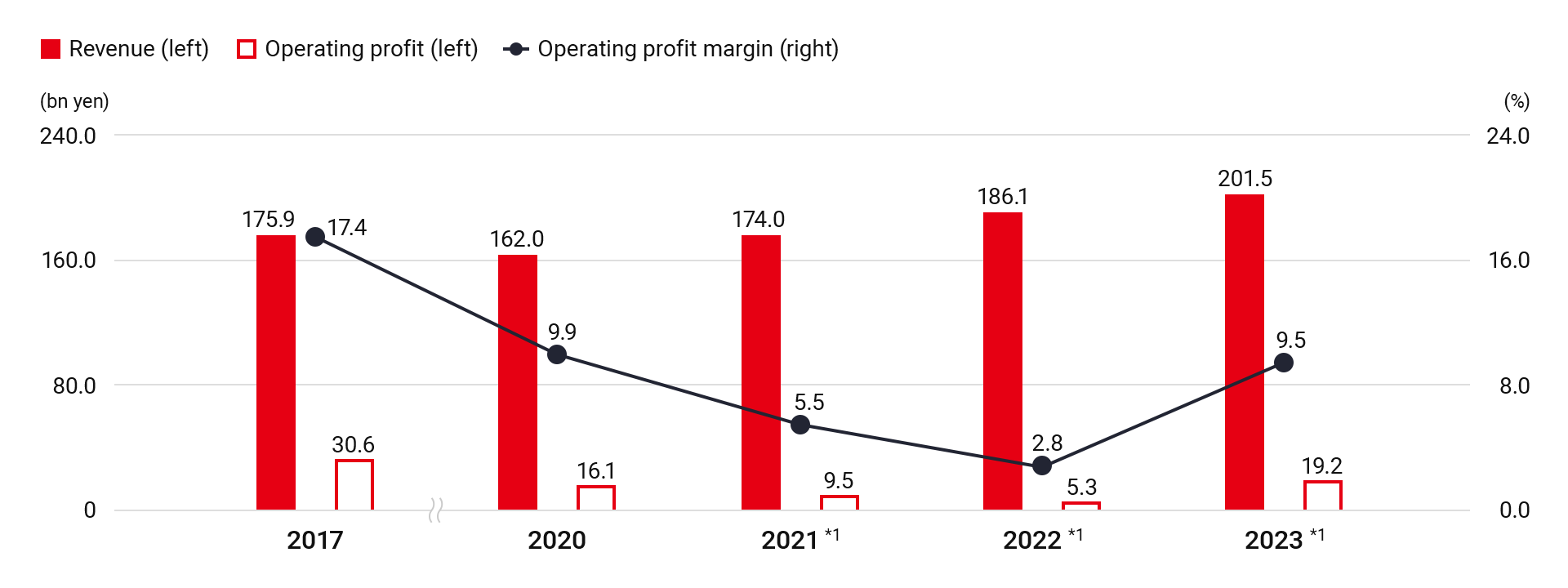

Financial outcomes

2023 results

Revenue from the automotive business increased compared to the previous year due to the continued recovery in automotive production. Revenue from the decorative business also increased despite consumers holding off on spending and the increased demand for lower-priced products in response to inflation, thanks to the flow-through of price increases. In the industrial business, revenue remained flat compared to the previous year despite the flow-through of price increases, due to weaker market conditions. Consequently, overall revenue increased by 8.3% YoY to JPY201.5 billion.

Operating profit surged by 261.9% YoY from the previous year to JPY19.2 billion, driven by an improved raw material cost contribution (RMCC) ratio and reduced SG&A expenses, along with the absence of expenses related to Nippon Paint Corporate Solutions (NPCS), the Japan-focused functional company, and special retirement payments, both of which were recorded in 2022.

Trends in revenue, operating profit, and operating profit margin

- The reportable segments were changed beginning in FY2022 1Q. Figures from 2021 onwards are based on the new reportable segments and include the overseas marine business.

Non-financial outcomes

|

|

|

|---|---|

|

|

|

|

|

|