- Joint development activities aimed for solving social issues (new-generation technologies such as decorative films and target line paint for assisting automated driving)

- Periodic factory tour events and customer satisfaction surveys (technology and sales areas, etc.)

- Provision of high-quality products with considerations to health and safety

- Exhibit and participate at events aimed for obtaining industry trends and information sharing (lectures at SURCAR (automotive), International Auto Aftermarket EXPO (auto refinish), High Performance Paint Exhibition and other industry events, and writing professional articles)

- Respond to questionnaire surveys such as CDP (an international NGO) by request from customers

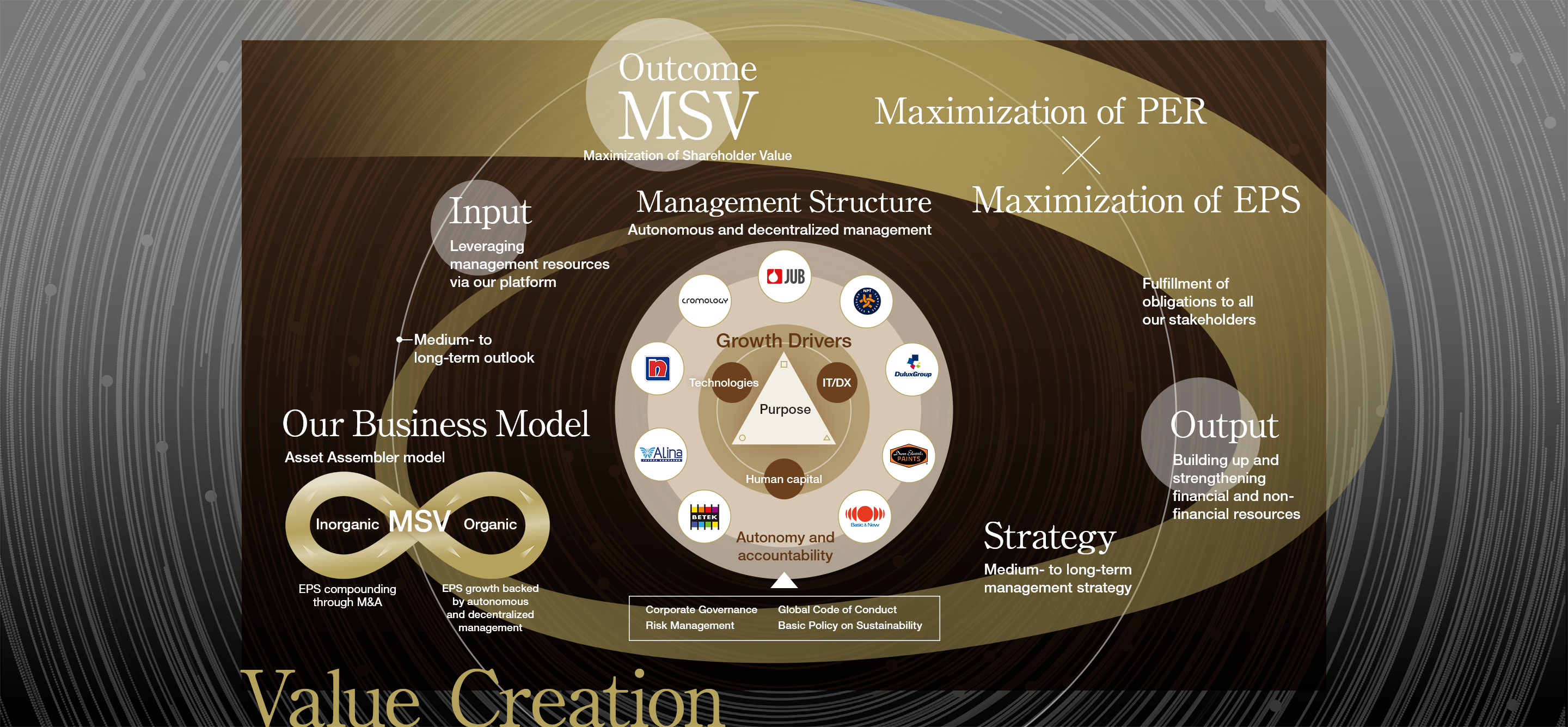

Our Sole Mission: Maximization of Shareholder Value (MSV)

Maximization of Shareholder Value (MSV)

MSV is about maximizing residual value after fulfilling our obligations to all stakeholders

We pursue Maximization of Shareholder Value (MSV) as our sole mission. Our goal is to maximize the shareholder value that remains after fulfilling our obligations to customers, suppliers, employees, society, and other stakeholders by leveraging our Asset Assembler model.

Fulfilling obligations to stakeholders

The major premise of MSV, before everything else, is the fulfillment of our obligations to customers, suppliers, employees, society, and other stakeholders. The relationship of trust with stakeholders through engagement is an asset integral to our Asset Assembler model. We will continue to strive for the maximization of shareholder value that remains after fulfilling our obligations to all stakeholders.

- Conduct questionnaires aimed for sustainable procurement of materials and services

- Eliminate organizations involved in human rights abuses and the use of raw materials made through human rights abuses

- Keep tabs on employee satisfaction levels using questionnaires by the Labor Union and external surveys and conduct employee engagement activities

- Design and implement training programs to gain knowledge and skills about products, businesses, etc.

- Establish an internal reporting system that enables employees to speak up and report violations without experiencing unfair treatment

Our Value Creation Model

We aim to maximize both EPS and PER from a long-term perspective, while harnessing the advantage of our platform based on our Asset Assembler model, towards the achievement of MSV.

and updates

resources based on

our medium-

to long-term management strategy

organizations

-

Ratio of overseas employees (global)

87.0% (2018)➡ 89.9% (2023)

-

Ratio of women in managerial positions (global)

23.8% (2020)➡ 26.5% (2023)

-

Employee satisfaction rate (Japan Group)

83% (2019)➡ 79% (2023)

- Creating a workplace environment that allows diverse people to play an active role

- Accepting reforms and changing workstyle

- Instilling Purpose and Global Code of Conduct

- Improving effectiveness of risk management

-

Number of engineering talents (global)

3,545 (2019)➡ c.4,300 (2023)

-

Number of factories (global)

119 (2019)➡ 163 (2023)

-

Number of registered patents (global)

1,000 (2021)➡ 1,610 (2023)

- Cultivating engineering talent

- Stepping up R&D activities

- Maintaining and reinforcing production facilities

- Developing sustainable products

-

Number of stores implementing the “New Generation Dealer” program (Betek Boya)

c.50 (2019)➡ c.380 (2023)

-

Number of IR meetings (global)

281 (2019)➡ 707 (2023)

-

Shareholding of the majority shareholder Wuthelam Group (private company)

14.5% (2013)➡ 58.7% (2023)

- Active open innovation activities with universities, research institutions, automobile manufacturers, and other external partners

- Facilitating engagement with investors and other stakeholders

- Advancing and deepening the partnership with Wuthelam Group

-

Number of distribution stores (NIPSEA China)

c.50,000 (2019)➡ c.290,000 (2023)

-

Number of CCM-installed stores (NIPSEA China)

c.3,000 (2019)➡ c.19,000 (2023)

-

No.1 market share in decorative paints (global)

8 countries (2019)➡ 13 countries (2023)

- Developing distribution channels that enable us to supply products to consumers worldwide

- Increasing strategic partnerships with property developers

- Developing strong trust relationships with automobile manufacturers and other customers

-

Number of key brands (global)

31 (2019)➡ 41 (2023)

-

Top of Mind rating (NIPSEA China)

51% (2019)➡ 51% (2023)

-

Top of Mind rating (Indonesia)

26% (2021)➡ 26% (2023)

- Promoting advertising, marketing, and social contribution activities

- Sharing and accumulating expertise and know-how through our platform

- Holding AYDA Awards international architectural and interior design competition

-

Operating cash flows (consolidated)

¥92.1 bn (2019)➡ ¥189.8 bn (2023)

-

Net D/E ratio (consolidated)

0.56x (2019)➡ 0.36x (2023)

-

Total equity (consolidated)

¥688.0 bn (2019)➡ ¥1,368.1 bn (2023)

- Strict adherence to financial discipline

- Prioritizing debt finance and maintaining leverage capacity

- Promoting engagement with financial institutions and credit rating agencies

- Developing a global base of investors

environment

-

GHG emissions (Scope 1 & 2; global)

54.3 kg/ton of production (2019)➡ 40.2 kg/ton of production (2023)

-

Ratio of hazardous waste (global)

45% (2019)➡ 37% (2023)

-

Water consumption (global)

0.44 kL/ton of production (2019)➡ 0.47 kL/ton of production (2023)

- Declaration of support for the TCFD and expansion of climate change-related measures and information disclosure

- Sustainable use of resources and protection of environment/biodiversity

- Mitigating environmental impact through the development of eco-friendly products