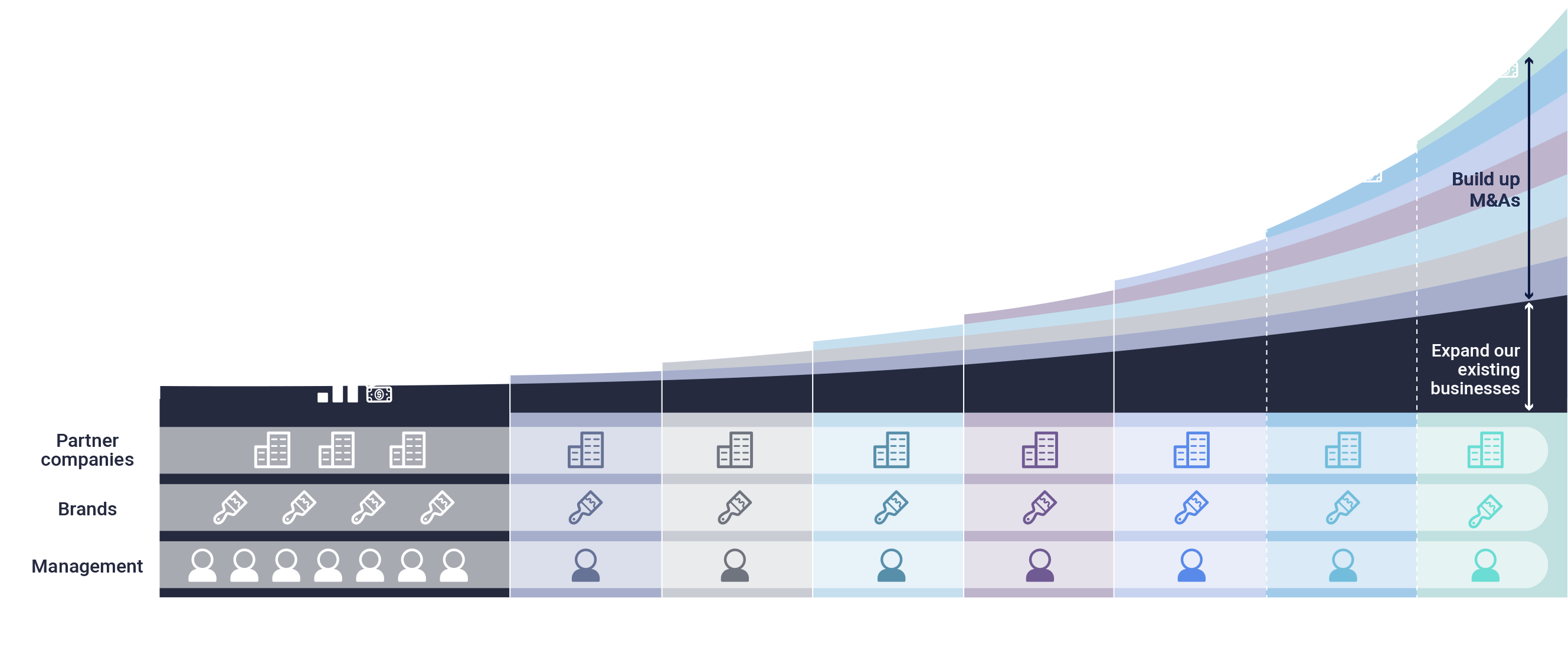

Our Business Model: Asset Assembler

Our Asset Assembler model aims for sustainable EPS compounding through both organic growth (existing businesses) and inorganic growth (accumulating high-quality and low-risk M&A deals). This unique business model is designed to pursue Maximization of Shareholder Value (MSV), our sole mission.

Compounding EPS via organic and inorganic growth towards MSV

Accumulating excellent

assets (newly acquired

brands, talent, and

technology)

Inorganic

EPS compounding

through M&A

Organic

EPS growth through

autonomous and

decentralized

management

Aggressively sharing

and leveraging

technologies, channels,

sourcing, know-how,

brands, etc., across

the Group

Relentlessly pursuing unlimited upside in shareholder value

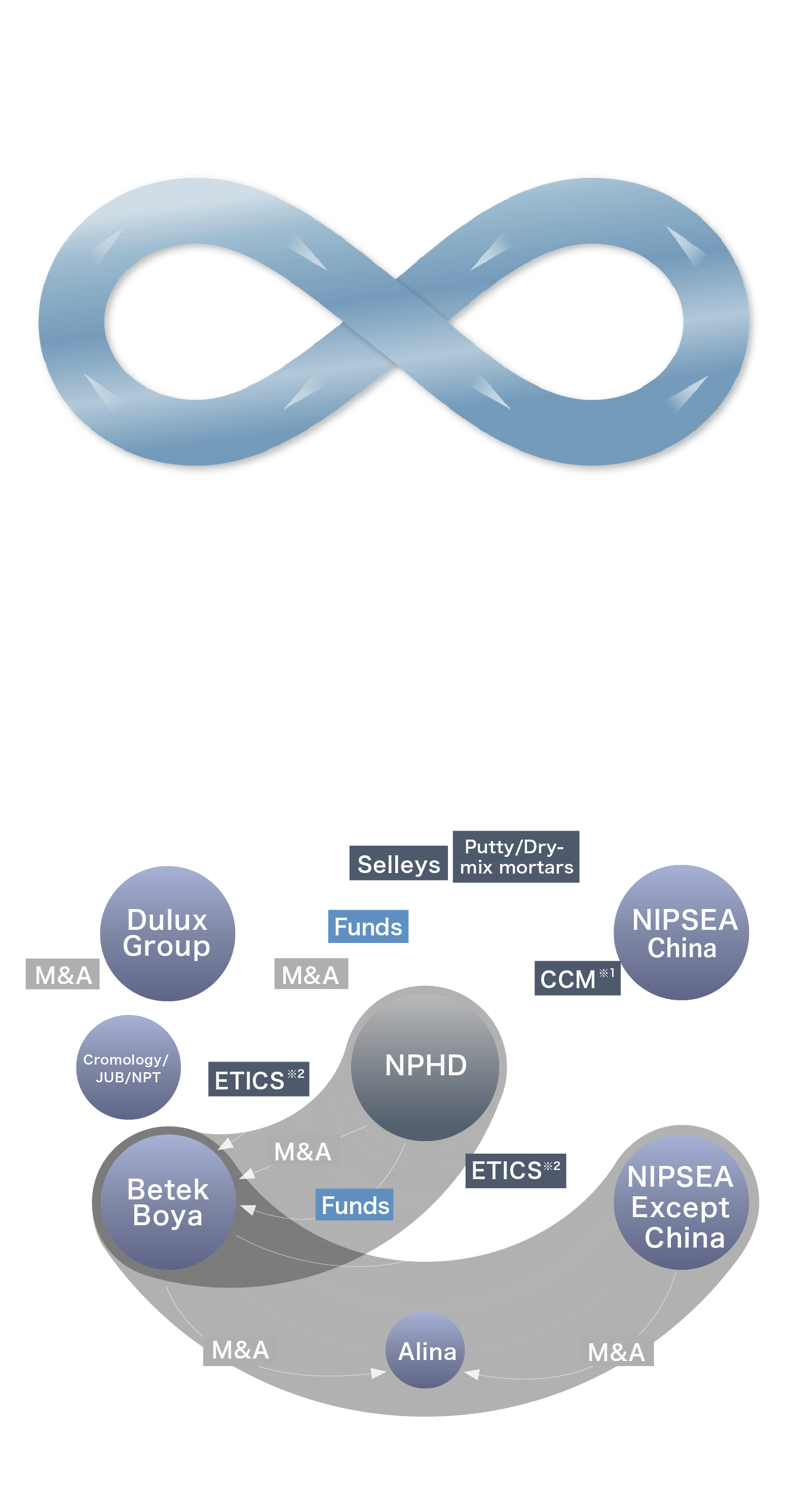

Operating under the assumption that the macroeconomic environment will always be uncertain and unclear, we consistently accumulate low-risk assets that offer good returns that still exist globally. In our M&A activities, we leverage not only the advantage of low-cost funding in Japanese yen, but also the trust placed in Japanese companies as acquirers, capitalizing on our unique position as a Japan-based company.

We strive to earn recognition and favorable evaluations from capital markets for our Asset Assembler model, which is committed to the safe and consistent compounding of EPS via organic and inorganic growth. This approach aims to enhance our PER and ultimately achieve MSV. By unlocking the maximum potential of the assets we acquire, we aim to accelerate our organic growth, thereby attracting new assets to our Group. This virtuous cycle enables us to relentlessly pursue unlimited shareholder value upside.

| Assumptions (medium- to long-term outlook) |

|

|---|---|

| Features |

|

Three primary features of good assets

1. Autonomous growth enabled by excellent management teams aligned with MSV

2. Low-cost operations and strong cash generation

3. Capturing resilient market demand and exploiting operating leverage

Compounding EPS via organic and inorganic growth towards MSV

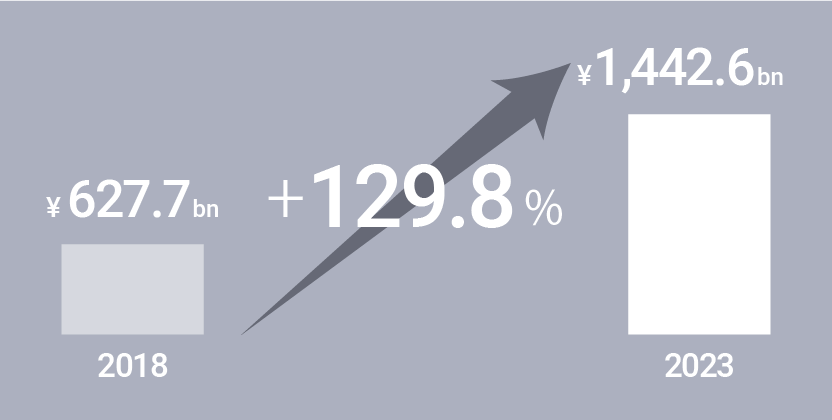

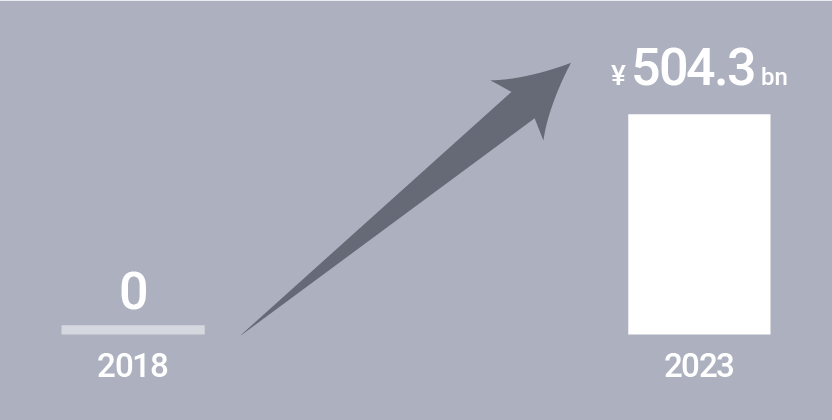

In our existing businesses, the excellent management team in each region pursues autonomous growth by creating synergies through the proactive sharing of technical capability, distribution networks, purchasing capability, know-how, and brands within the Group. At the same time, we execute good and low risk M&As, thereby boosting our performance and building up newly acquired brands and human resources, which can be further leveraged within the Group.