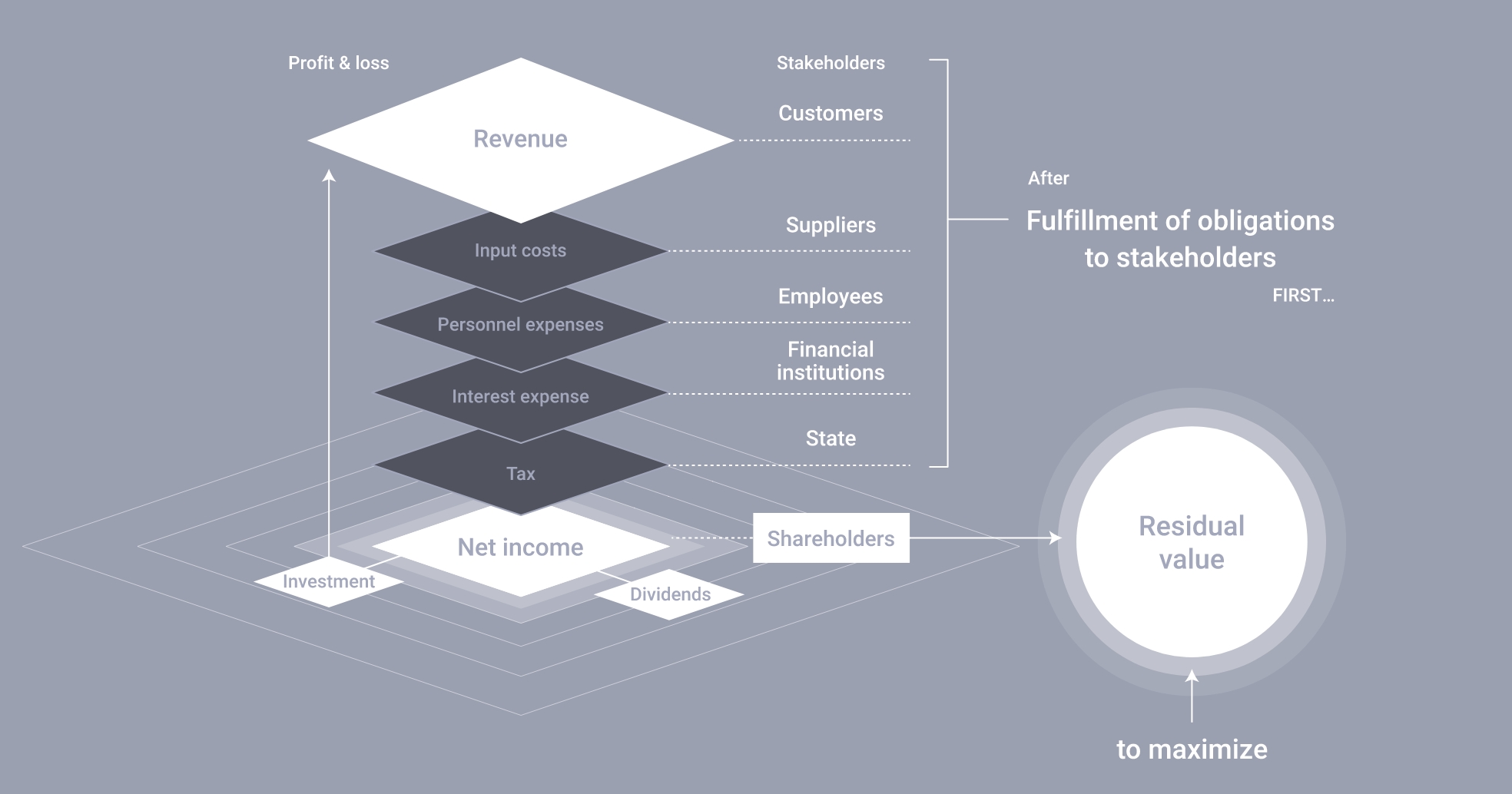

Our mission: Maximization of Shareholder Value (MSV)

MSV is about maximizing the residual value after fulfilling our obligations to customers, suppliers, employees, society, and other stakeholders.

The diagram below shows the stakeholder relationship for profit and loss statement items: customers for revenue, suppliers for input costs, employees for personnel expenses, financial institutions for interest expenses, and states for taxes. Fulfilling our obligations to each stakeholder group is the primary premise for MSV. Fulfillment of obligations includes not only legal contracts but also social and ethical obligations, as well as the concept of sustainability.

MSV entails maximizing the residual value that remains after fulfilling obligations to all stakeholders as a way of rewarding shareholders that make an investment with an awareness of the associated risks.

Pursuing the Maximization of Both EPS and PER Toward the Achievement of MSV

Stock price equates to EPS (earnings per share) multiplied by PER (price-to-earnings ratio).

We aim to maximize both EPS and PER in pursuit of MSV.

Maximize EPS

Two pillars of EPS maximization:

- Organic growth of existing assets

- Inorganic asset assembly

We strive to maximize both pillars through operational initiatives as well as disciplined M&A accompanied by ideal financing.

We pursue the maximization of EPS rather than just net income. Simply put, EPS-dilutive share issuance can undermine shareholder value even if net income increases.

Maximize PER

PER basically reflects capital markets' expectation of the company's EPS growth. We focus on maximizing our PER by using a variety of IR activities, a carefully formulated finance strategy, and sustainability initiatives, as well as by assembling quality assets to raise our EPS growth potential.

How Shareholder Value Is Maximized

EPS and PER are important benchmarks for achieving MSV. Nippon Paint Group is taking various actions that will contribute to maximizing EPS and PER in order to achieve MSV over the medium and long term.

MSV

Maximize

EPS

Maximize

PER

-

Organic growth from existing businesses

EPS growth backed by autonomous and

decentralized management

(improve market share and profitability)Relentless pursuit of technologies,

talents, intensive use of ITVigorous pursuit of higher quality,

lower cost, capex efficiencyUtilization of our Asset Assembler platform

-

Inorganic growth through M&A

EPS compounding through M&A

Rally targets aspiring to join the federation

Strive to lower funding cost & risk and

maintain high PER -

Balance-sheet management

Rigorous financial discipline

Debt leverage with market acceptance

+

Equity financing with EPS accretion -

Communications with capital markets

Nurture market expectations

Ingrain equity story

+

Increase engagement

+

Enhance disclosure materials

Closely integrating

sustainability into

our business

operations is the

prerequisite for

MSV

-

Sustainability

Environment & Safety

Develop low-carbon/eco-friendly products

+

Ensure safe people and operations -

People & Community

Recruit/train diverse employees

+

Earn the trust of stakeholders -

Innovation & Product Stewardship

Develop sustainable products

(NPSI↗︎・monitor LCA)

+

Chemicals of concern -

Corporate Governance

Monitor management

+

Encourage risk-taking -

Sustainable Procurement

Low-cost and sustainable procurement

+

Reduce environmental and human rights risks

Human Capital as the Key to Achieving MSV

Human capital is the key to our Asset Assembler model and serves as the primary engine of our growth.

Through the distinct roles carried out by our Co-President structure, majority shareholder Wuthelam Group, the Board of Directors, and every individual within each partner company (from the CEO and managers to employees), we strive to achieve MSV--our common values and mission.

MSV

Our majority

shareholder

Wuthelam Group

A long-term business partner of ours for 62 years that operates investment management business as a private asset management company

Shares with us MSV as the same values and basis of judgment and is fully aligned with the interests of minority shareholders

Co-President structure

Supported by a robust partnership, each Co-President undertakes their respective duties while jointly making management decisions, executing corporate actions that contribute to MSV.

The Board of Directors

All the Board members are aligned in the pursuit of MSV

Rigorous safeguarding of minority shareholder interests

Our proficiency in M&A built on rich experience

Partner companies

10-plus years of management experience in the paint and adjacencies businesses

With relentless pursuit of growth, launching new businesses and tapping into new markets

Strong leadership driving market share expansion

and

employees

Insatiable appetite for growth embodying the LFG (Lean For Growth) and other codes of conduct

Professionals with extensive product knowledge and applied technologies/skills

Ability to agilely and flexibly respond to market trends and customer needs