Medium-Term Strategy (2024)

Released April 4, 2024

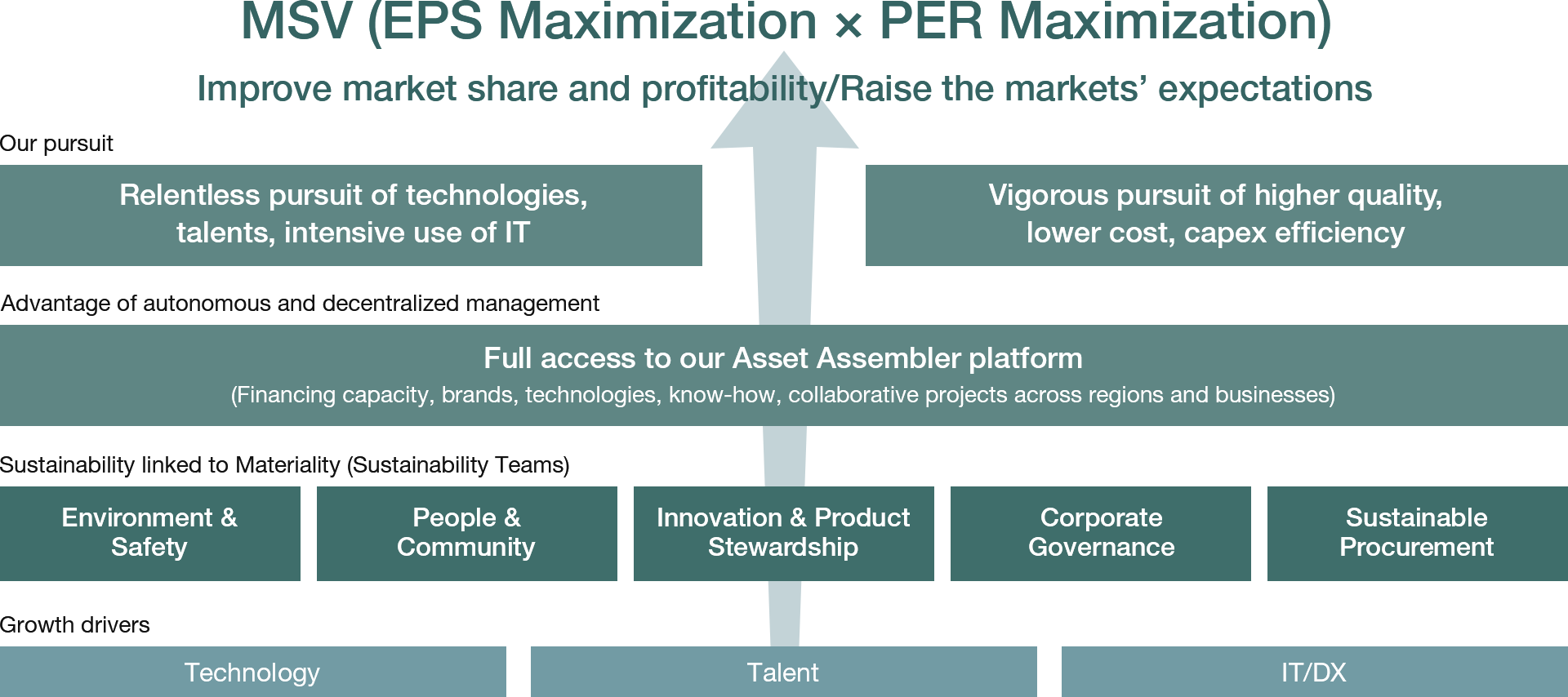

As Asset Assembler, we are striving to achieve MSV in the long term,

not bound by a three-year timeframe

In April 2024, we revisited the advantage of our Asset Assembler model and unveiled a Medium-Term Strategy focused on sustainable EPS compounding across both organic and inorganic growth. We will pursue MSV as our sole mission in the long term, not bound by a three-year timeframe.

Key points of the Medium-Term Strategy

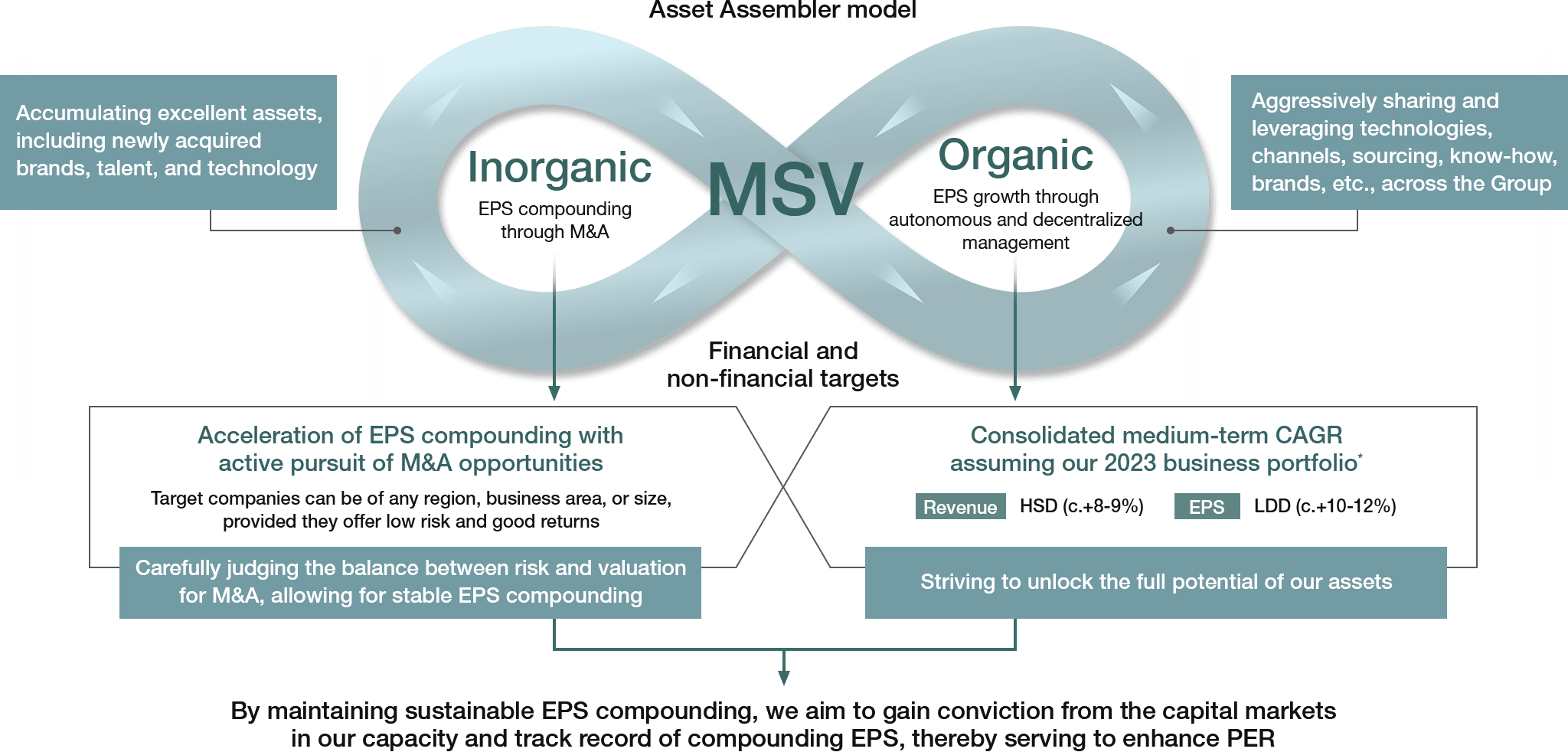

- Aiming to maximize EPS in the long term, we focus on sustainable EPS compounding through both organic and inorganic growth by leveraging the advantage of our Asset Assembler platform

- For organic growth, based on our 2023 business portfolio, we are targeting a medium-term consolidated CAGR of 8-9% in revenue and 10-12% in EPS

- For inorganic growth, we are focused on M&A that ensure safe and sustainable EPS compounding, thereby further accelerating the compounding of EPS

- We aim to raise PER by securing conviction from the capital markets towards our capacity and track record in EPS compounding

Asset Assembler Model

As Asset Assembler, we compound EPS via organic and inorganic growth towards MSV

* 2023 portfolio including the two India businesses (NPI and BNPA) and Alina (Kazakhstan)

Our financial and non-financial targets as Asset Assembler

| Inorganic Growth EPS compounding through M&A |

Further accelerating EPS compounding with active pursuit of M&A opportunities

|

|---|---|

| Organic Growth EPS growth through autonomous and decentralized management |

Consolidated medium-term CAGR assuming our 2023 business portfolio*

|

* 2023 portfolio including the two India businesses (NPI and BNPA) and Alina (Kazakhstan)

EPS compounding through organic growth

EPS compounding through market +α growth of each asset

For organic growth, we leverage the advantage of our autonomous and decentralized management, fostering autonomous growth of each asset through low-cost and strong cash generating capability, and the utilization of operating leverage. Simultaneously, we aim for EPS compounding through market +α growth by harnessing our Group’s platform, creating synergies among assets and achieving breakthroughs.

Growth forecast by asset/Market growth forecast

| 2020-2023 results | Medium-term forecast (in LCY) | Market growth forecast*2 (2024-2026) | |||||

|---|---|---|---|---|---|---|---|

| Revenue CAGR (in LCY) |

2023 OP margin (Tanshin) |

Revenue CAGR | 2026 OP margin*1 (vs 2023) |

Volume basis | Value basis*3 | ||

| Japan Group | +7.5% | 9.5% | +0–5% |  |

-1% (Decorative) | +1% (Decorative) | |

| NIPSEA China | Segment total | +12.4% | 12.5% | c. +10% | → | ||

| TUC | +23.5%*4 | +10–15% | +3% | +1% | |||

| TUB | +0.5%*4 | c. +5% | +1% | +2% | |||

| NIPSEA Except China |

Segment total | +32.5% | 17.4% | +15–20% | → | ||

| Singapore Grp. Malaysia Grp. Thailand Grp. |

+17.8% | +5–10% | → |

Singapore +1% Malaysia +3% Thailand +2% |

Singapore +1% Malaysia +5% Thailand +2% |

||

| PT Nipsea (Indonesia) | +12.6% | 32.9% | c. +10% | → | +3% | +6% | |

| Betek Boya (Türkiye) | +87.3% | 10.9% | c. +10% | (→)*5 | +1% | +7% | |

| NPI/BNPA (India) | (For reference) +26.6%*6 |

(For reference) 4.7%*6 |

c. +10% | → | +6% (NPI) | +4% (NPI) | |

| Alina (Kazakhstan) | (For reference) +20.6%*6 |

(For reference) 20.2%*6 |

c. +10% | → | +3% | +4% | |

| DuluxGroup | DGL (Pacific) | +5.7%*7 | 12.8% | c. +5% | → | –+1% | +2–2.5% |

| DGL (Europe) | +12.4%*8 | 4.4% | +5–10% | ↑ | ±0–+1% (France) | +1–3% (France) | |

| Dunn-Edwards (U.S.) | +2.5% | c. +5% |  |

+2% (overall U.S.) | +5% (overall U.S.) | ||

*1 ↑: ≧+2%, ↗: +1–2%, →: –1–+1%, ↘: –1– –2%, ↓: ≦–2%

*2 Internal estimates

*3 Including the impact of volume changes

*4 2020 figures are based on the former segmentation (DIY/Project)

*5 Subject to change due to the impact of hyperinflationary accounting

*6 The 2020-2023 results are unaudited pro forma figures. The 2023 OP margin (Tanshin) was calculated using the exchange rates of 1 INR=1.74 JPY and 1 KZT=0.31 JPY

*7 2020 figures include Craig & Rose and Maison Deco

*8 Calculated using 2022-2023 figures

For more information about the market growth forecast and medium- to long-term growth strategy for each asset, please refer to pages 19 and 20 and the Appendix of the “Medium-Term Strategy” briefing presentation.

EPS compounding through inorganic growth

Accumulating excellent assets that contribute to EPS accretion from Year 1

Regarding inorganic initiatives, we will leverage our advantage of lean headquarters to sustainably compound EPS through M&A endeavors targeting companies of any region, business area, or size, provided they offer low risk and good returns. By assessing the balance of risk and returns, we will pursue safe and sustainable EPS compounding that contribute to EPS accretion from Year 1 post-acquisition.

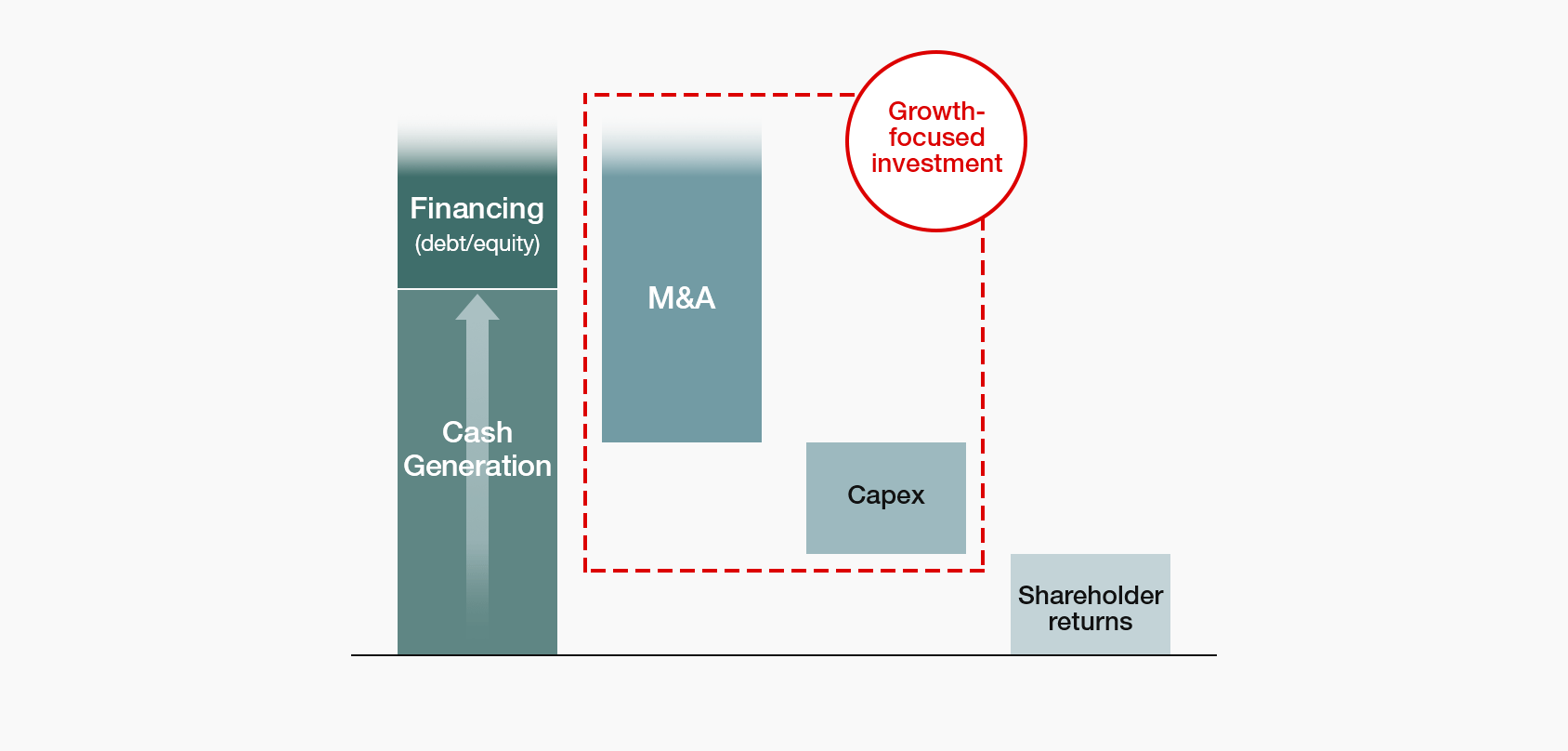

Finance strategy aimed at accelerating EPS compounding

As Asset Assembler, we are pursuing a finance strategy to drive EPS compounding.

Financial discipline/Balance sheet management

- 1. Utilize our financial leverage to execute M&A with low risk and good returns

- 2. Strengthen our cash flow generation capability

- 3. Maintain leverage capacity while repaying debt

- 4. Allocate generated cash to growth-oriented investments

-

Financial discipline

- Prioritize debt financing

- Maintain leverage capacity and promote engagement with financial institutions

- Equity financing remains an option assuming EPS accretive

-

Balance sheet management

KPI: Cash Conversion Cycle (CCC), Cash flow (CF), Net Debt/EBITDA, Return on Invested Capital (ROIC), etc.

Cash allocation

- 1. Utilize our financial leverage to execute M&A with low risk and good returns

-

M&A

Aggressive M&A activities

Repay debts if no M&A occurs, to prepare for the next acquisition opportunity -

Capex

Facility updates in response to organic growth (c. 3% of revenue) -

Shareholder returns

Maintain stable dividend payments with a target payout ratio of 30%

Increase TSR by earnings growth mainly through M&A

Sustainability initiatives that drive EPS and PER

We aim to achieve MSV by increasing the earnings and capital markets’ expectations via sustainability activities.

Our sole mission of MSV is premised on the fulfillment of our obligations to stakeholders, encompassing legal, social, and ethical duties. We view sustainability initiatives as integral to MSV, rather than viewing sustainability as an end in itself. Following this philosophy, the heads of our five sustainability teams have been selected from among the leaders of our partner companies. Utilizing our Asset Assembler platform, we aim to achieve MSV by engaging in cross-organizational efforts that not only develop technologies and nurture talent but also address our environmental and human rights obligations.

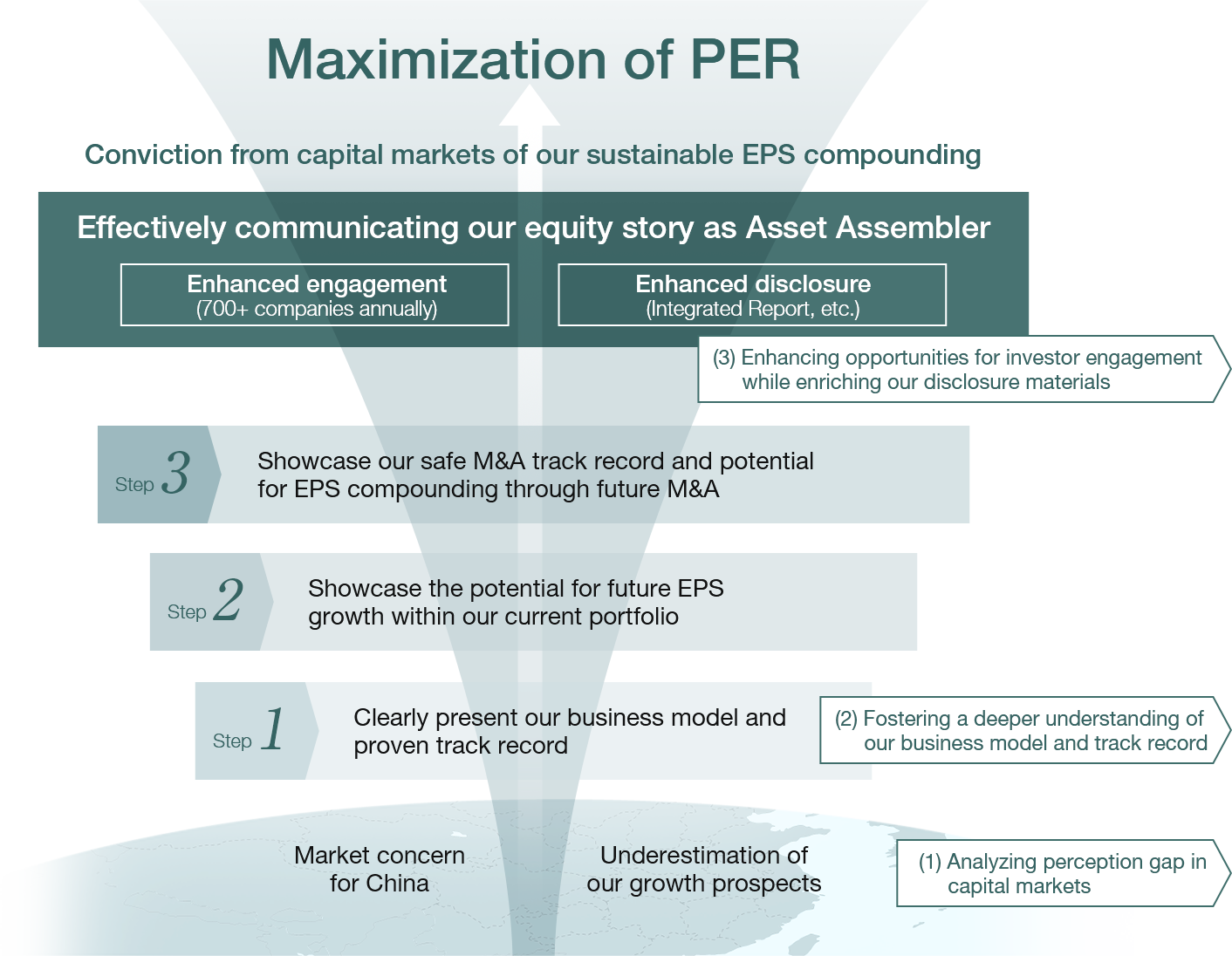

Our approach to maximizing PER

We aim to elevate capital markets’ expectations by effectively communicating our equity story as Asset Assembler

We are dedicated to sustainable EPS compounding, aiming to raise capital market expectations in our pursuit of maximizing PER. Our detailed plans of action are: (1) analyzing perception gap in capital markets, (2) fostering a deeper understanding of our business model and track record, and (3) enhancing opportunities for investor engagement while enriching our disclosure materials.

Medium-Term Strategy: Related materials