Features of the asset

- With a market presence in 22 countries across the Pacific*1 and Europe, commanding the No.1 market share in decorative paints in four countries, including Australia, and ranking in the top 3 in six other countries

- Anchoring its growth on three strategic pillars, being (1) extending its market leading position in the Pacific, (2) leveraging capability for growth into the mature European paint and coatings market, and (3) leveraging capability for growth into global SAF*2 segments

- Pursuing sustainable growth through organic growth and strategic M&As

- Australia, New Zealand, Papua New Guinea

- Sealants, Adhesives & Fillers

An excellent management team instrumental in achieving continuous growth each year

-

Patrick Jones COO Dulux Paints & Coatings Australia and New Zealand

-

Richard Stuckes COO DGL Europe Paints & Coatings (including Cromology and JUB)

-

Martin Ward COO DGL Sealants, Adhesives & Fillers (including Selleys and NPT)

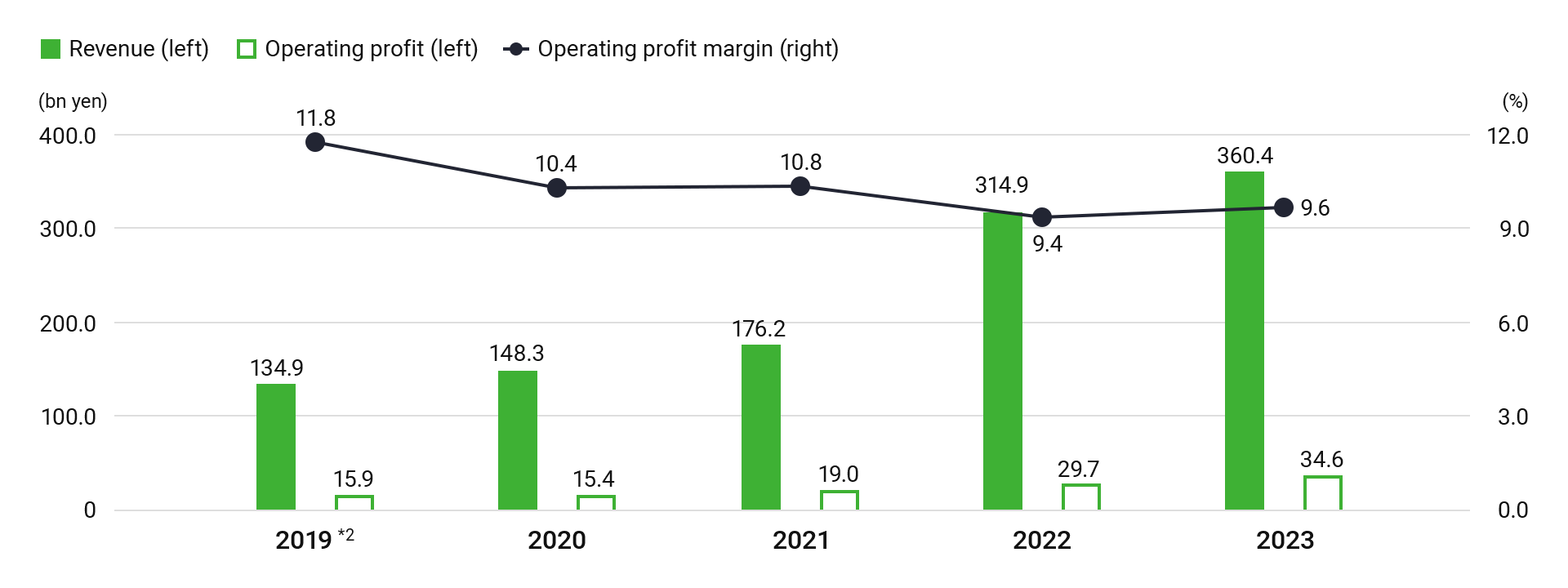

Financial outcomes

-

2023 results

Revenue from the decorative paints business increased from the previous year in both the Pacific and European markets, despite market volumes generally flat or declining from economic and geopolitical pressures, underpinned by ongoing focus on brand investment, innovation and customer service. Revenue from the adjacencies business increased, mainly due to the benefit of the new consolidation of NPT. This was partly offset by lower sales of External Thermal Insulation Composite System (ETICS) in Europe, due to reduced government incentives. Overall, our consolidated revenue rose by 14.4% YoY to JPY360.4 billion.

Operating profit increased by 16.7% YoY to JPY34.6 billion, driven by the effects of new consolidation and revenue growth, coupled with the normalised gross profit margin (post COVID).Growth since the acquisition (2019)

Under the guidance of its excellent management team, DuluxGroup has consistently achieved strong earnings growth through focus on organic and inorganic strategic growth initiatives across its three strategic pillars. As a result, since the acquisition, revenue increased by 167.2%, with operating profit up 117.7%. DuluxGroup’s focus on strategic M&A has played an important role in complementing its organic growth initiatives, with over 30 acquisitions (including a mixture of strategic and small bolt-on businesses) executed since it joined Nippon Paint Group in 2019.

Trends in revenue, operating profit, and operating profit margin

- Segment basis (after elimination of inter-segment transactions and after PPA)

- Pro forma figures. Including one-off items such as M&A cost

-

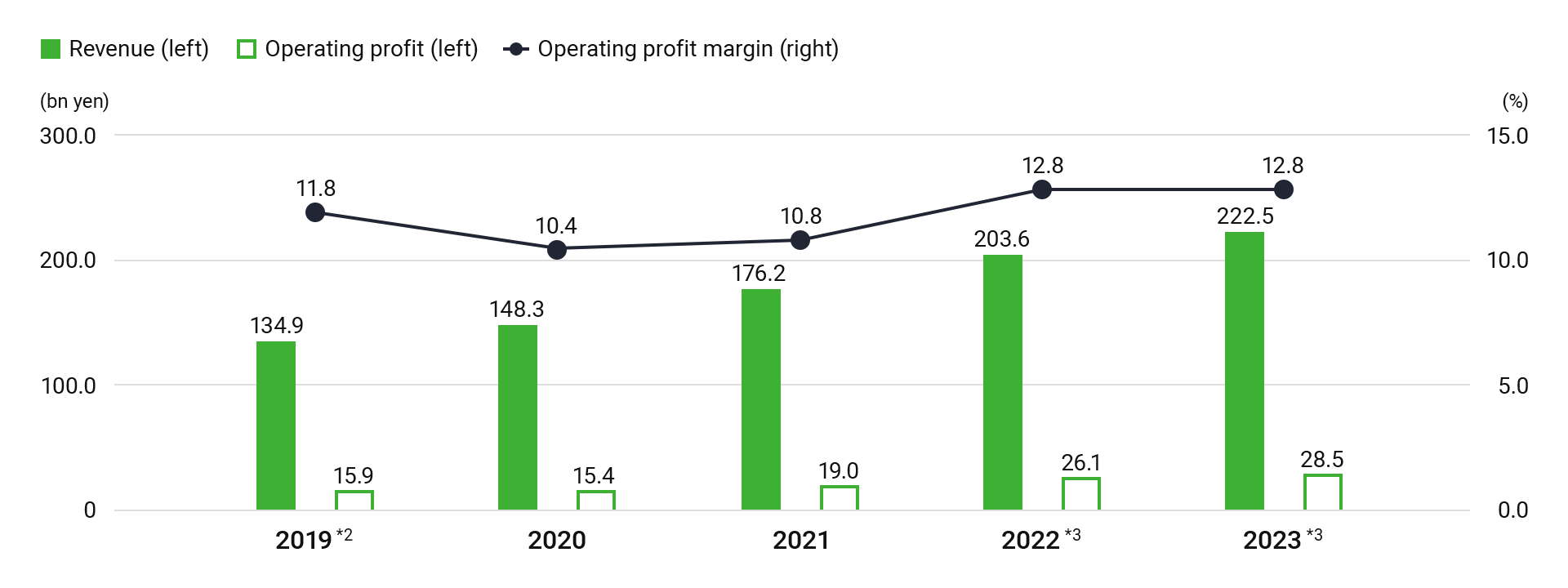

2023 results

Revenue from the decorative paints business increased from the previous year despite flat volumes, with higher volumes in the trade-use market offset by lower retail market volumes (normalizing post-COVID). Revenue in the adjacencies business increased, mainly from the benefit of bolt-on acquisitions. Consequently, revenue rose 9.3% YoY to JPY222.5 billion.

Operating profit increased by 9.3% YoY to JPY28.5 billion, as the effects of higher sales and normalized gross profit margin (post COVID) offset inflation-driven increases in SG&A expenses.

In terms of both volume and value, Dulux has successfully maintained its leading market share in the Australian decorative paints sector.Growth since the acquisition (2019)

By relentlessly focusing on continuous investment in premium brand products, consumer insights, innovations, marketing, customer services catering to retail and trade-use customers, DuluxGroup has continued to outpace the market growth. Furthermore, the company has complemented its consistent organic growth with multiple strategic and bolt-on acquisitions.

As a result, since the acquisition, revenue has grown by 65.0% and operating profit by 79.4%.

Trends in revenue, operating profit, and operating profit margin

Market share*4 (Australia Decorative): 50% (+0pt YoY / +2pt post-acquisition)

20192020202120222023201948%202050%202150%202250%202350%- Segment basis (after elimination of inter-segment transactions and after PPA)

- Pro forma figures. Including one-off items such as M&A cost

- Due to a change in reporting segments within DuluxGroup, figures for 2022 and 2023 do not include Craig & Rose and Maison Deco

- NPHD’s estimates of decorative paint market volume

-

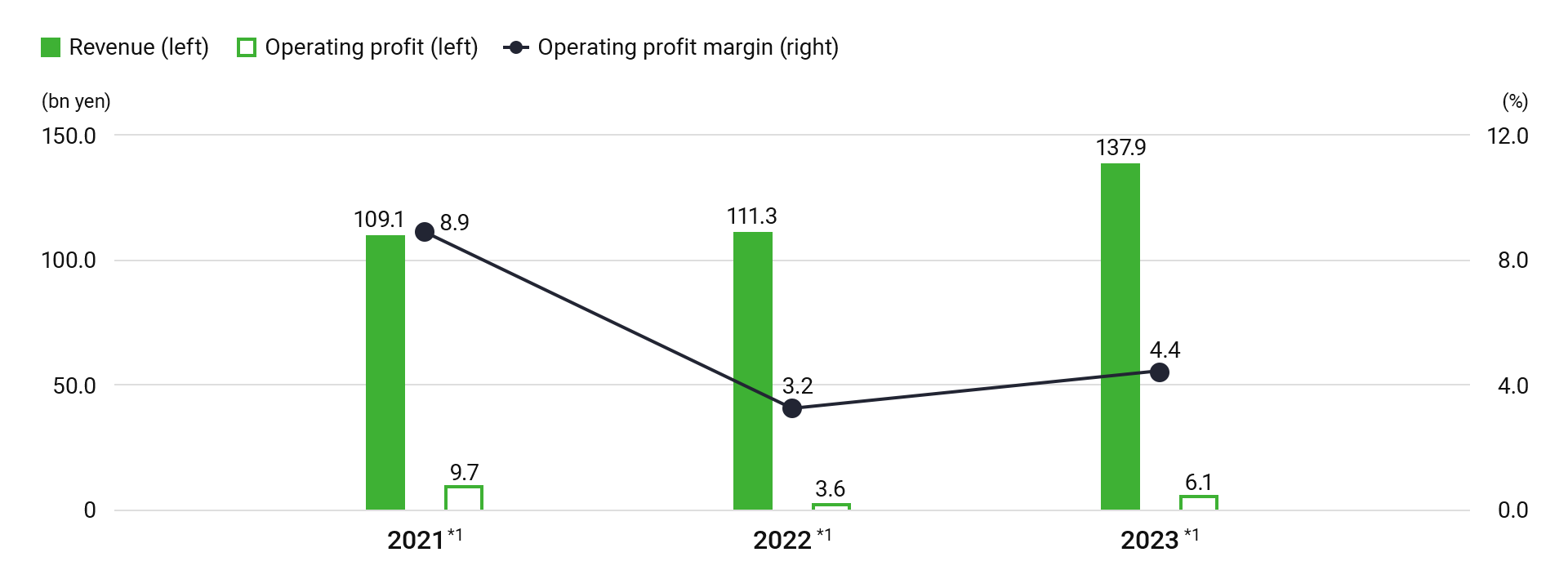

2023 results

Revenue from the decorative paints business increased from the previous year despite market volume in most countries declining, most notably in France, due to economic and geopolitical factors. Revenue from the adjacencies business was higher, mainly from the new consolidation of NPT. Consequently, the overall revenue rose 23.9% YoY to JPY137.9 billion.

As for operating profit, the increased revenue, benefit of new consolidation, and normalised gross profit margin (post COVID) offset the inflation-driven rise in SG&A expenses. As a result, operating profit increased 70.4% YoY to JPY6.1 billion (the operating profit for 2022 includes one-off factors, such as step-up from PPA).

Both Cromology and JUB have successfully maintained their leading positions in the key European decorative paints market in which they operate.Growth since the acquisition (2022)

DuluxGroup is leveraging its core growth capabilities that have contributed to its long term, consistent growth in the Pacific market to accelerate expansion, primarily through Cromology, the fourth largest player in the European decorative paints market, and JUB, a leader in central European decorative paint markets. Additionally, DuluxGroup is broadening its base in the adjacent SAF business though the acquisition of its interest in NPT, a specialist in adhesives and adhesives based in Italy.

As a result, since the acquisition, revenue has risen by 26.4% with the acquisition of NPT offsetting market volume decline in France. Operating profit, fell by 37.2% primarily due to market contraction in France and NPT M&A related costs.

Trends in revenue, operating profit, and operating profit margin

Market share*3

Cromology  No.1 in Italy and No.2 in France (Trade only) and Portugal in decorative paints market

No.1 in Italy and No.2 in France (Trade only) and Portugal in decorative paints marketJUB  No.1 in Slovenia, Croatia, Bosnia and Herzegovina, and Kosovo in interior paints market

No.1 in Slovenia, Croatia, Bosnia and Herzegovina, and Kosovo in interior paints market- The annotation has been revised to clarify that the 2021 figures represent the simple sum of Cromology and JUB figures. JUB’s earnings for FY2022 are pro forma figures for 12 months and converted to JPY at the following exchange rate: EUR/JPY=138.5 yen. Due to a change in reporting segments within DuluxGroup, figures for 2022 and 2023 include Cromology, JUB, NPT, Craig & Rose, and Maison Deco

- Including one-off items such as M&A cost

- NPHD’s estimates

Non-financial outcomes (2023 results)

| DuluxGroup (Consolidated) |

|

|

|---|---|---|

|

|

|

|

| DGL (Pacific) |

|

|

|

|

|

|

|

|

|

|

| DGL (Europe) |

|

|

|

|

|