Our Business Model: Asset Assembler

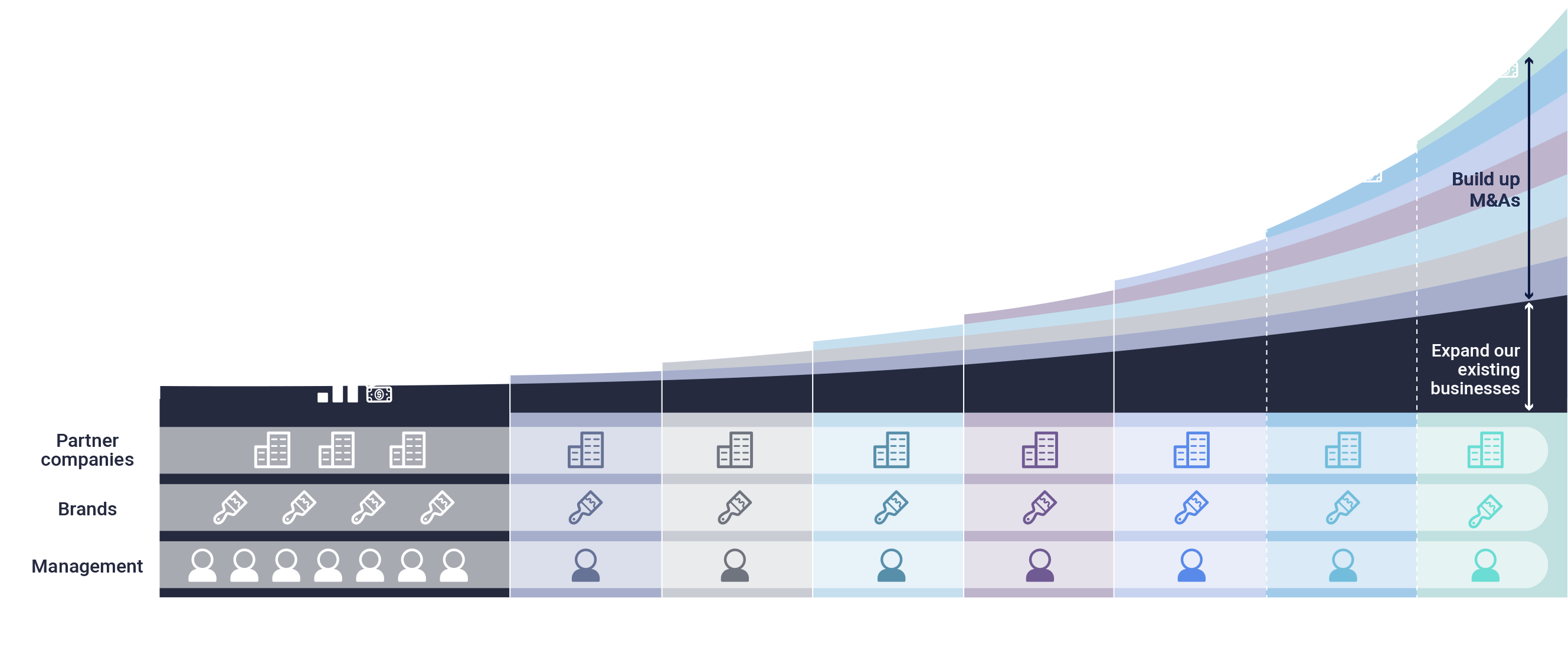

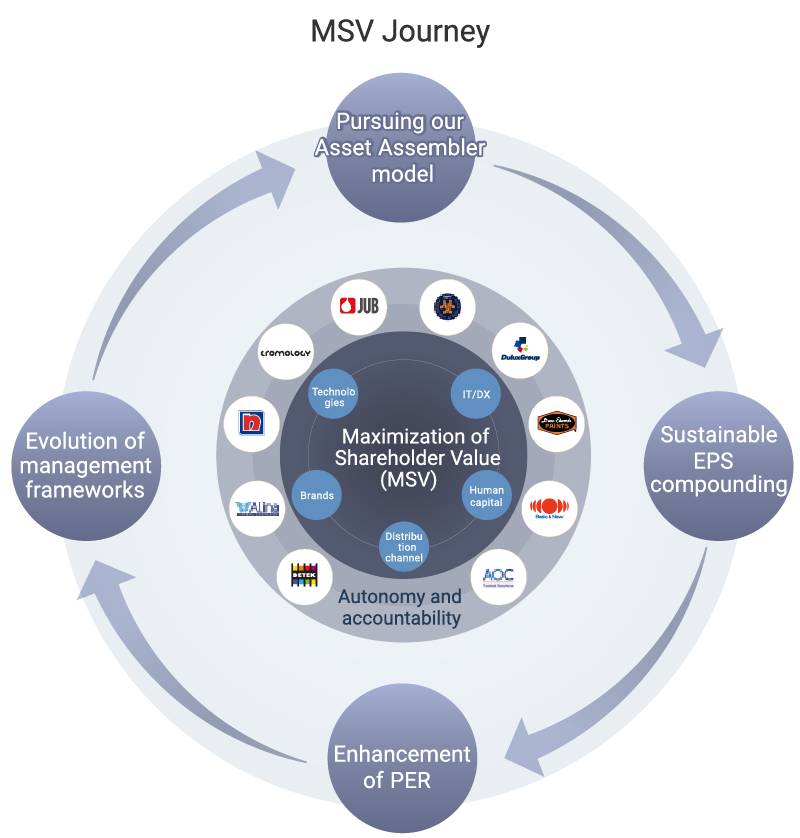

Our Asset Assembler model aims for sustainable EPS compounding through both organic growth (existing businesses) and inorganic growth (accumulating high-quality and low-risk M&A deals). This unique business model is designed to pursue Maximization of Shareholder Value (MSV), our sole mission.

Compounding EPS via organic and inorganic growth towards MSV

Accumulating excellent

assets (newly acquired

brands, talent, and

technology)

Inorganic

EPS compounding

through M&A

Organic

EPS growth through

autonomous and

decentralized

management

Aggressively sharing

and leveraging

technologies, channels,

sourcing, know-how,

brands, etc., across

the Group

Relentlessly pursuing unlimited upside in shareholder value

Operating under the assumption that the macroeconomic environment will always be uncertain and unclear, we consistently accumulate low-risk assets that offer good returns that still exist globally. In our M&A activities, we leverage not only the advantage of low-cost funding in Japanese yen, but also the trust placed in Japanese companies as acquirers, capitalizing on our unique position as a Japan-based company.

We strive to earn recognition and favorable evaluations from capital markets for our Asset Assembler model, which is committed to the safe and consistent compounding of EPS via organic and inorganic growth. This approach aims to enhance our PER and ultimately achieve MSV. By unlocking the maximum potential of the assets we acquire, we aim to accelerate our organic growth, thereby attracting new assets to our Group. This virtuous cycle enables us to relentlessly pursue unlimited shareholder value upside.

|

Assumptions (medium- to long-term outlook) |

|

|---|---|

| Features |

|

Three primary features of good assets

1. Autonomous growth enabled by excellent management teams aligned with MSV

2. Low-cost operations and strong cash generation

3. Capturing resilient market demand and exploiting operating leverage

Compounding EPS via organic and inorganic growth towards MSV

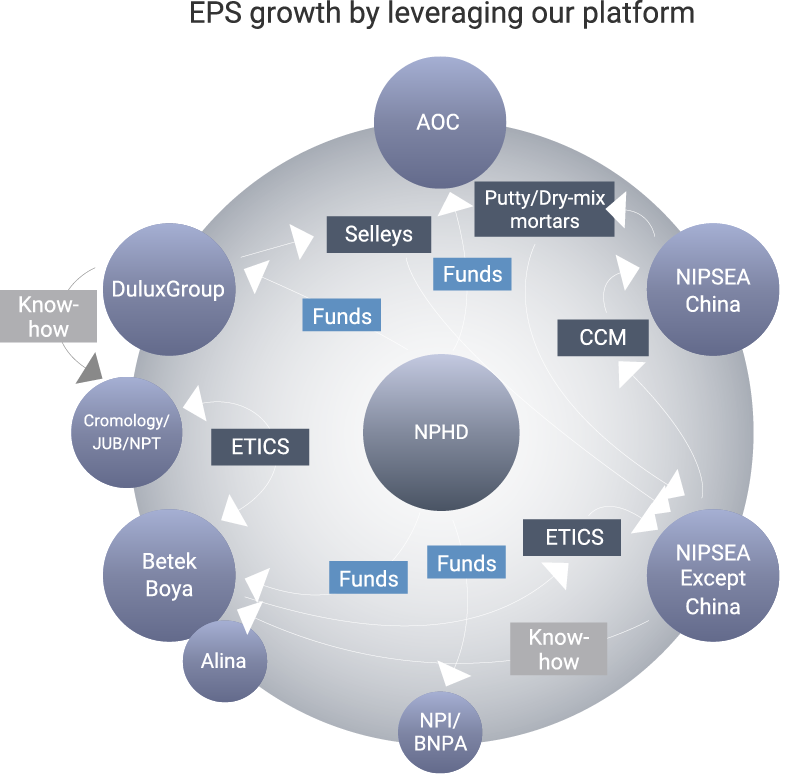

In our existing businesses, the excellent management team in each region pursues autonomous growth by creating synergies through the proactive sharing of technical capability, distribution networks, purchasing capability, know-how, and brands within the Group. At the same time, we execute good and low risk M&As, thereby boosting our performance and building up newly acquired brands and human resources, which can be further leveraged within the Group.

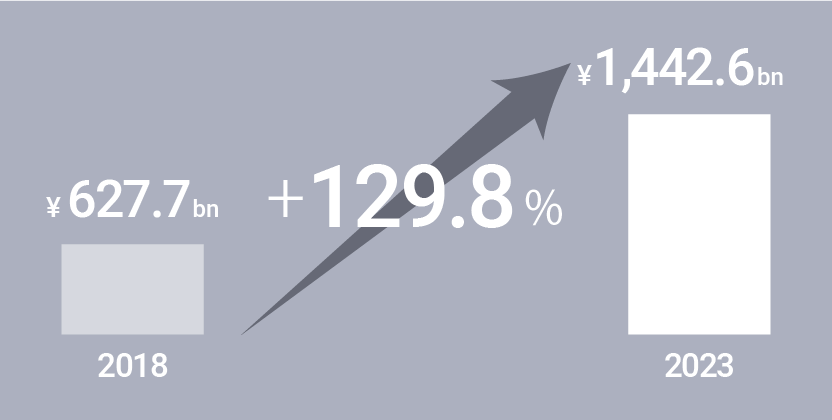

Asset Assembled to Date

-

Revenue

-

Existing businesses

-

New M&A*

*Total revenue of companies acquired in FY2018 and afterwards

-

Number of key brands

-

M&A transactions (cumulative total)

-

Engineering talent (consolidated)

Autonomous and decentralized management that accelerates EPS compounding through organic growth

Built on trust in the management teams of our partner companies in Japan and overseas, our Group has adopted a unique autonomous and decentralized management framework that combines delegation of authority with accountability.

This approach empowers management teams in each region and business segment to make swift and flexible decisions. Its greatest strength is the ability to allow us to exercise agility and competitiveness in a rapidly changing business environment.

As our core business in decorative paints operates under a local production for local consumption model, it does not make much sense for Nippon Paint Holdings as a holding company to to centrally control its partner companies across the Group. Rather, it is essential for our partner companies to learn from one another and to generate synergies as a Group.

At the core of autonomous and decentralized management are the values of autonomy and accountability. By

granting a high degree of discretion to the management teams of each partner company while holding them

accountable for outcomes, we promote prompt, agile, and autonomous decision-making, while maintaining a

flexible level of control as a Group.

The balance between autonomy and accountability is the key to recruiting and retaining exceptional

talents and strengthening competitiveness, and serves as the driving force behind sustainable EPS

compounding.

From a governance perspective, decisions regarding the appointment and dismissal of partner company CEOs and financial strategy are made by the management team of the holding company, acting as the Group’s top decision-makers. In all other areas, each partner company autonomously pursues its own initiatives, enabling the creation of diverse synergies across the Group.

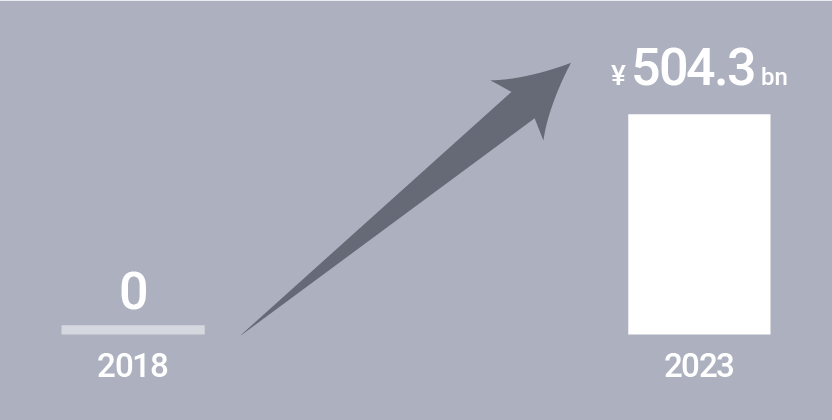

Our Platform That Underpins Autonomous and Decentralized Management

Each partner company, operating under autonomous and decentralized management, proactively leverages our Group's management resources including financial strength, technical capabilities, and brand power, while voluntarily learnig from each other occasionally. This approach fueld their ongoing growth.

Asset Assembler Model

Inorganic

EPS compounding

through M&A

MSV

Organic

EPS growth

driven by

autonomous and

decentralized

management

EPS growth via

collaboration

among

our partner

companies

within our

existing portfolio

Safe EPS compounding

through new acquisitions

EPS growth by leveraging our platform

*1 Brands in the adjacencies business, such as adhesives and sealants.*2 Computerized color matching machine

*3 External thermal insulation composite system

Three Key Investor Questions About Our Asset Assembler Model

Frequently asked investor questions and our perspectives|

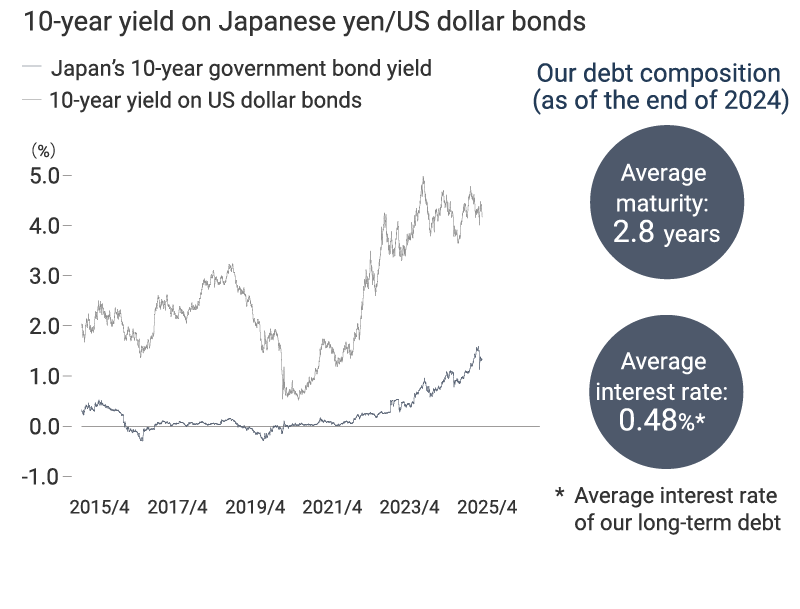

Point1 Can the Asset Assembler model, particularly for inorganic growth initiatives, maintain its competitive advantage even if interest rates in Japan rise further? |

Point2 Under autonomous and decentralized management, how do you foster collaboration and synergy among partner companies? |

Point3 Is the Asset Assembler model versatile enough to function effectively after a transition to the next generation of management? |

|---|---|---|

|

We have both the capability and a strong will to leverage the benefits of low funding costs in

Japanese yen. |

We have established a system that enables our partner companies to learn from one another

autonomously and voluntarily by leveraging the Group platform to share best practices and

success cases, all while respecting the autonomy of our exceptional partner companies.

|

Our Asset Assembler model is not a management scheme reliant on specific individuals but a

systematic and replicable model that enables sustainable EPS compounding through both organic

and inorganic initiatives. |

|

|

|