Features of the asset

- Engaging in a wide range of businesses, including automotive coatings, decorative paints, industrial coatings, fine chemicals, and marine coatings

- Leading the Japanese paint market by leveraging advanced technological capabilities and strong brand power

- In the mature Japanese market, aiming to achieve both growth and profitability through unified group efforts

Competitive advantages

| Leading Japan's paint and coatings market across all segments |

|

|---|---|

| Robust distribution networks supporting the No.1 market share |

|

| Comprehensive technological capabilities cultivated across business segments |

|

Financial outcomes

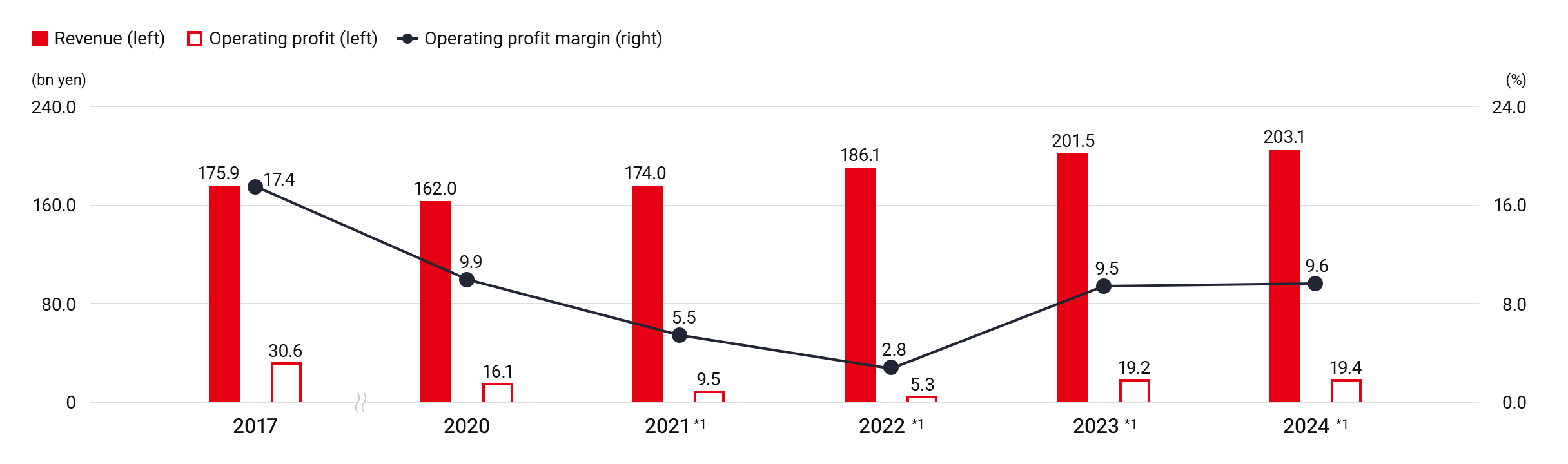

2024 results

Revenue from automotive coatings declined from the previous year due to a reduction in automobile production. Industrial coatings revenue remained stable, as the impact of weak market conditions was offset by the pass-through of price increases. Decorative paints revenue was unchanged, with consumer spending restraint and a shift toward economy products in response to inflation being counterbalanced by pass-through of price increases and effective sales initiatives. As a result, revenue grew by 0.8% from the previous year to JPY203.1 billion. Operating profit increased by 1.5% to JPY19.4 billion, driven by an improved gross profit margin resulting from the pass-through of price increases.

Trends in revenue, operating profit, and operating profit margin

- The reportable segments were changed beginning in FY2022 1Q. Figures from 2021 onwards are based on the new reportable segments and include the overseas marine business.

Non-financial outcomes

|

|

|

|---|---|

|

|

|

|

|

|