Excerpts of Sustainability Strategy from the Medium-Term Plan Update Meeting Presentation Summary

1. Front Cover

Good afternoon, everyone. I’m Yuichiro Wakatsuki, Co-President of Nippon Paint Holdings.

Thank you very much for taking the time today to participate in this update meeting on our Medium-Term Plan for FY2021-2023.

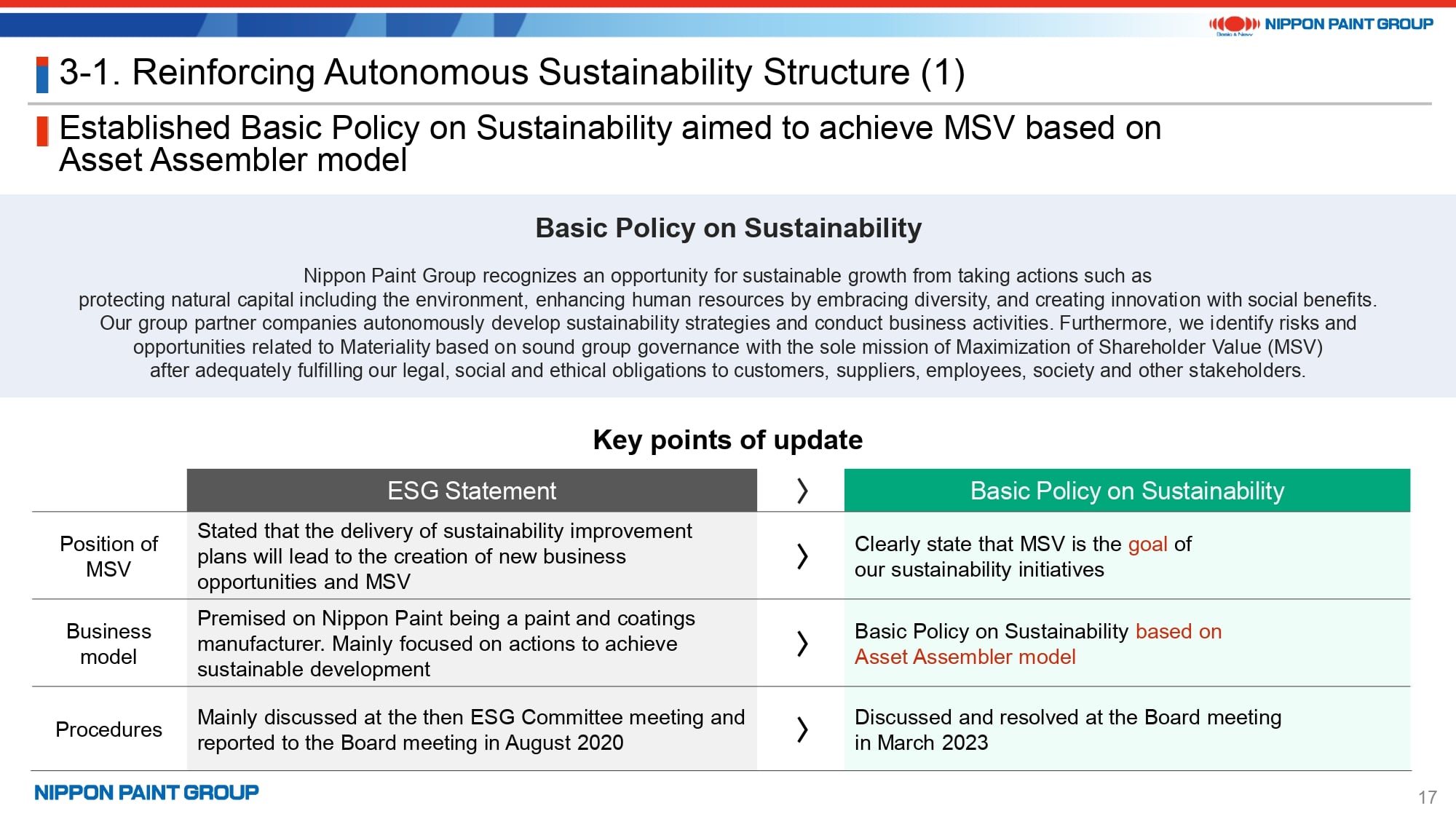

14. Reinforcing Autonomous Sustainability Structure (1)

This concludes the updates on each asset. The updates on our sustainability strategy start on page 17.

Firstly, the Basic Policy on Sustainability was approved by the Board of Directors to replace the existing ESG Statement. This policy clarified MSV as the goal of our sustainability initiatives. In addition, our sustainability initiatives are based on Asset Assembler model and are not based on a centralized, HQ-driven structure as I have stated in prior occasions. This basic policy embodies our approach to sustainability.

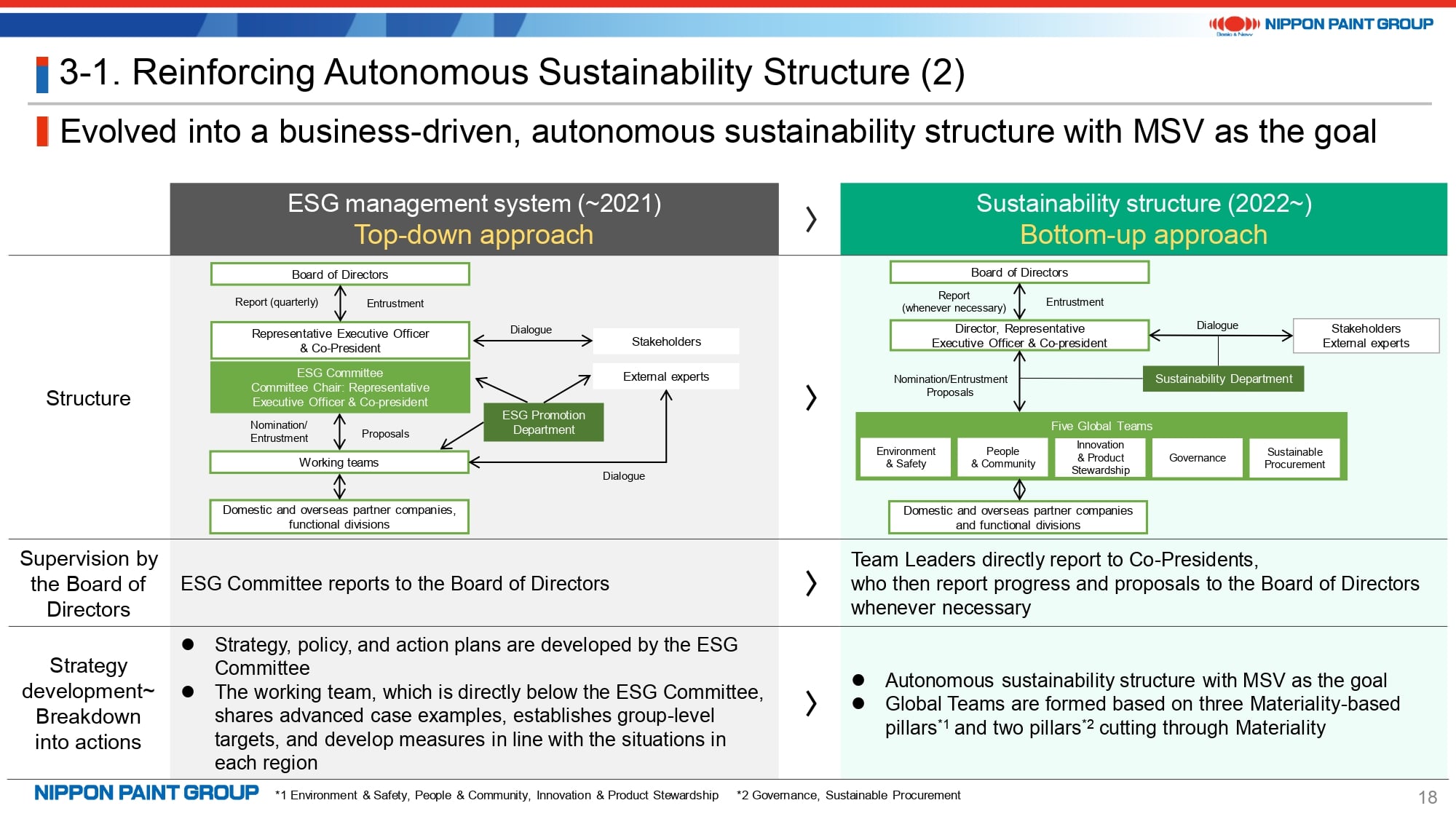

15. Reinforcing Autonomous Sustainability Structure (2)

We have revised our sustainability structure as I have stated before. Specifically, we adopted a structure where initiatives are taken by management teams and business leaders of partner companies starting with FY2022. This is a change from the top-down, NPHD-led approach used in FY2021 and prior years. Sustainability Team Leaders, who were appointed from business leaders, coordinate agendas from a global perspective and report progress and proposals to the Co-Presidents roughly on a quarterly basis.

Page 19 shows the actions and initiatives of each Sustainability Team. Our sustainability goal is to fulfill our obligations to stakeholders, which is the premise for MSV and is directly linked to MSV. We will properly identify social trends to meet the requirements of society that change from time to time in terms of content and the extent of disclosure. I will not go into the details.

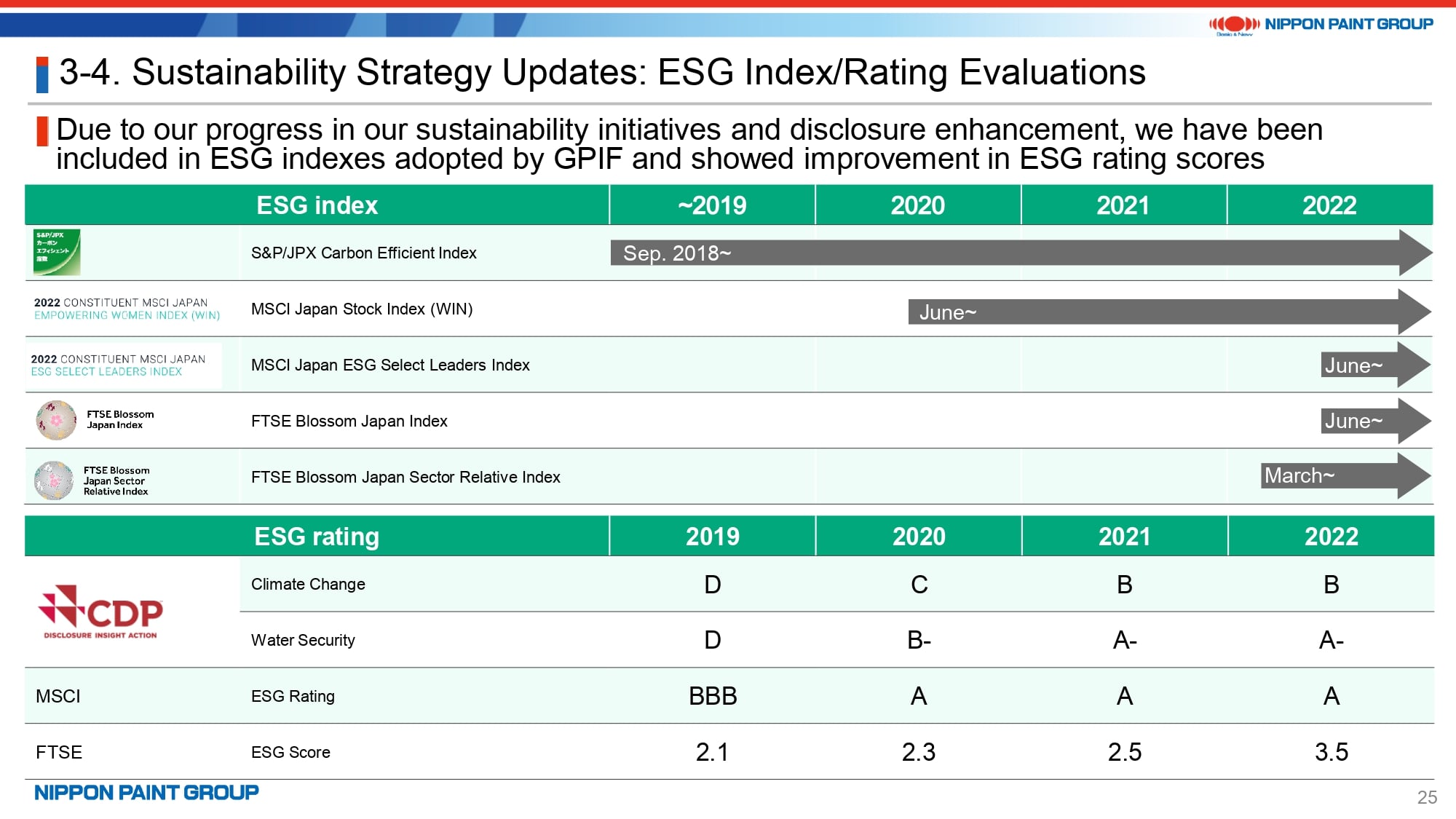

16. Sustainability Strategy Updates: ESG Index/Rating Evaluations

Page 25 shows that we have been included in all ESG indexes adopted by GPIF with an improvement in ESG rating scores owing to the progress of our sustainability initiatives and increased sustainability disclosures.