Risk Management

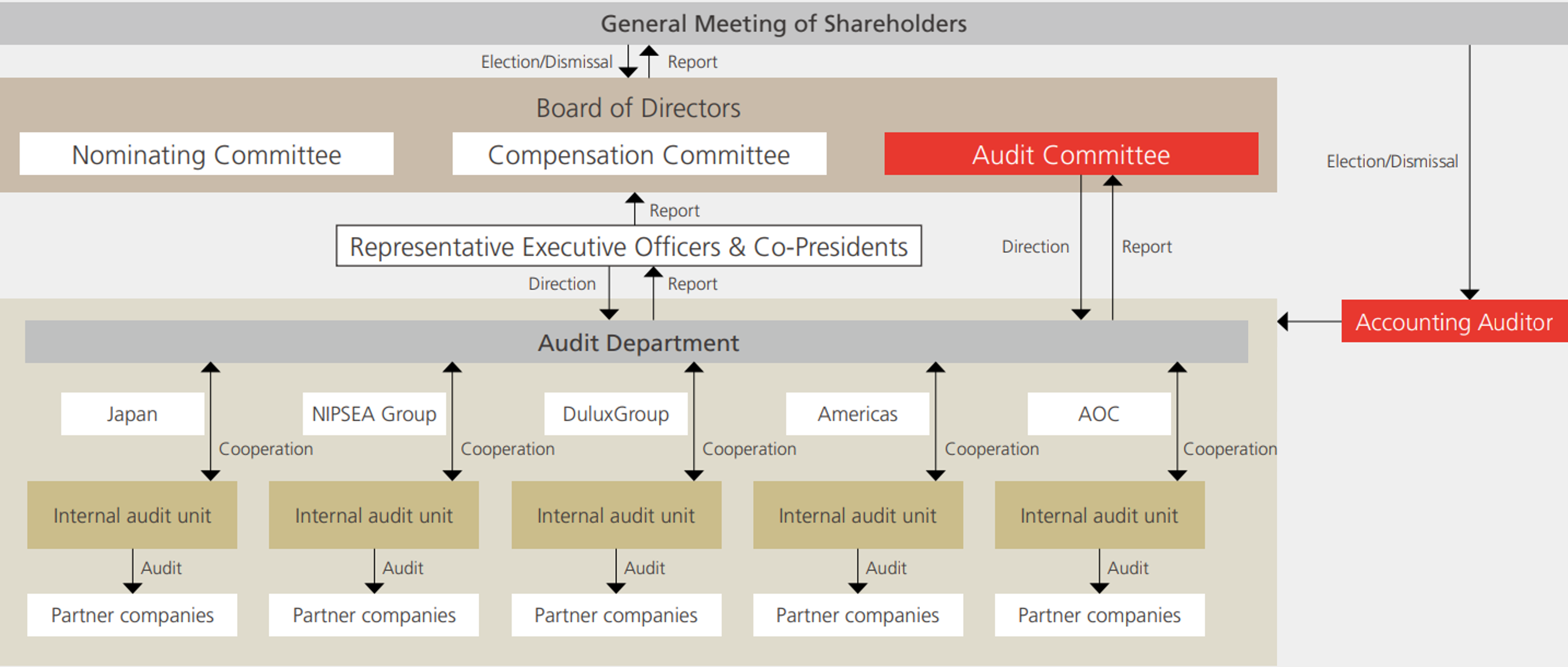

As Asset Assembler based on mutual trust with all PCGs, the Company has a risk management system in place that has,as its core components, the internal control systems operated autonomously by every PCG*.

*PCG: Nippon Paint Group companies grouped by region or business

Our approach to internal control

Sound risk management is the premise for the pursuit ofMSV. We closely monitor changes in society and the needsof stakeholders to reexamine and update the internal controlsystem in an appropriate and timely manner.The paint and adjacencies businesses of every PCG have strong regional characteristics, which make thesebusinesses ideally suited for the autonomous managementof business operations along with local production for localconsumption. We essentially give each head of PCG theauthority to conduct business operations and responsibilityfor operating the internal control system. The heads ofPCGs identify and respond to risks specific to theirbusinesses, and our Co-Presidents oversee the Group’soperations through evaluation and appointment/dismissalof the head of PCGs through various reports fromthese executives.

Summary of the “Group management system” in the Basic Policy on Internal Control System

| Oversight of PCGs | Prior approval rule for important matters and timely reporting system of incidents with material impacts |

|---|---|

| Election/Dismissal of the heads of PCGs | Evaluations and decisions that include financial and non-financial considerations such as responsibilities for internal controls |

| Direct participation of the Co-Presidents in main partner company meetings | Participation of Co-Presidents and other executive officers in important meetings of important partner companies |

| Group audits based on the “Audit on Audit” system | Oversight utilizing the close ties between the NPHD Audit Department and the internal audit unit of each PCG |

The three key components of the Basic Policy on Internal Control System

| Basic Policy on Internal Control System | Nippon Paint Group Global Code of Conduct This code defines the standards/requirements of compliance/ethics rules and Sustainability points that apply to global group companies |

|---|---|

| Global Risk Management Basic Policy This policy defines practical roles and responsibilities of each company for its effective risk management based on Asset Assembler model. |

|

| Global Basic Policy of Whistleblowing Hotline Clarify policy for Whistleblowing operated by each partner company. This policy defines guidelines for the operation of hotlines at all partner companies. |

Internal control system

*For more information, see "'Audit on Audit' Group audit

system"

4 of the directors have risk management experience and skills.

For more information,

please see Required experience/skills for the Board of

Directors.

In addition to this autonomous and

decentralized internal control system,

there are five sustainability teams under

the leadership of Co-Presidents. These

teams focus on issues that affect all

PCGs, such as climate change and

other problems on a global scale as well

as social issues that will require actions

in the coming years. The teams, which

operate on a global scale, are

Environment & Safety, People &

Community, Innovation & Product

Stewardship, Governance, and

Sustainable Procurement. Every team is

led by a business leader with sufficient

skills and experience for the issues the

team covers.

See “Sustainability as the Prerequisitefor MSV"

About risk management conducted

in each region in the Group’s internal

control framework and global activities

of the sustainability teams for future

issues and the social demands,

information is shared with each PCG

under the direction of Co-Presidents as

well as at the Group Audit Committee

(GAC). Communications made possible

by these frameworks are the foundation

for the mutual trust that underpins Asset

Assembler model.

Sound risk management is the

premise for the pursuit of MSV. NPHD

will continue to closely monitor changes

in society and the needs of stakeholders

in order to reexamine and update the

internal control system in an appropriate

and timely manner.

*1 For more information, see the Internal Control part in

Sustainability section on our website.

*2 This meeting, attended by the head of internal audit unit

of each PCG, is held twice every year by the NPHD

Audit Committee and Audit Department

Risk management system

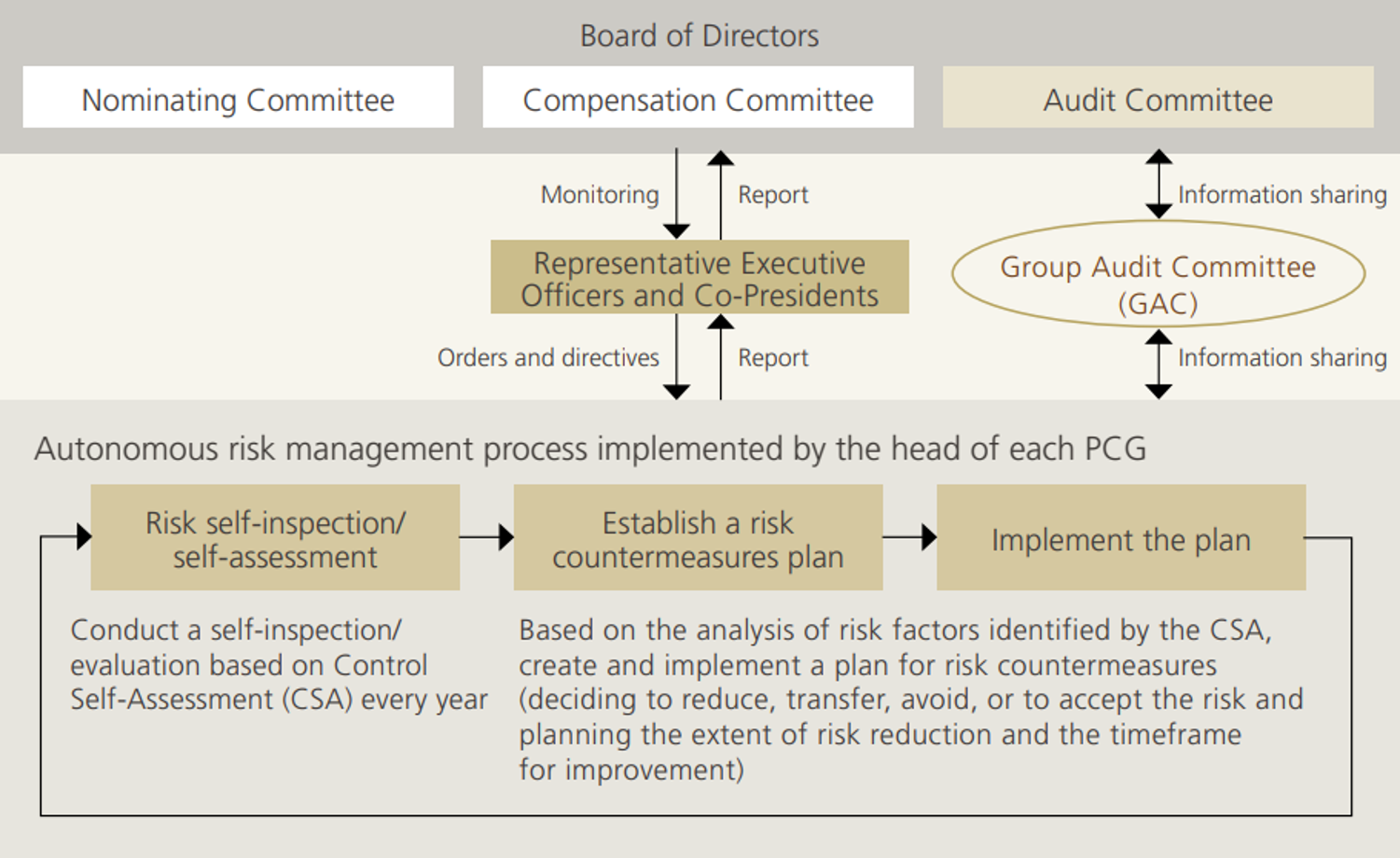

Our Global Risk Management Basic Policy states that Co-Presidents have overall responsibility for risk management in our Group. The policy also defines the roles of each head of PCG as a frontline. In this manner, autonomous risk management at each PCG is implemented appropriately by Co-Presidents and the head of each PCG based on their respective roles. Each head of PCG conducts the control self-assessment (CSA), consisting of self inspections and self-assessments based on a risk-based approach. They are responsible for using CSA to identify risk factors requiring actions, create risk management plans, and make improvements. Results of CSA are reported to Co-Presidents, who, based on this information, grasp risk factors at our Group in individual regions and businesses. Then Co-Presidents perform effective monitoring by attending important management meetings of the PCGs and other activities and give the PCGs directions for responses against the identified risks. Co-Presidents report the results of the risk analysis to the Audit Committee and the Board of Directors. In addition, the results are discussed at the Group Audit Committee (GAC), which brings together the personnel responsible for risk management and internal audit at each PCG. Separately from these activities, a framework is in place for sharing information with Co-Presidents, in a timely or prompt manner, about the occurrence of crises. This system enables Co-Presidents, when necessary, to give orders covering the entire Group.

The group risk management process

Risk management activities

Risk heat map

| Priority risk items for FY2023 | Change in risk sensitivity (vs FY2022) |

Description of risk and key countermeasures |

|---|---|---|

| Risk related to IT use and IT systems | Higher |

Management of information assets, data leakage, systems

prepared for disasters and other potential disruptions, formulation of information security

policies and rules, etc.

|

| Supply chain risk |

Unchanged |

Disruptions of raw material supply, exchange rate fluctuations,

inventory/logistics management and credit management, etc.

|

| Risk related to human capital | Lower |

Succession for management teams of the Group

|

| Compliance risk | Slightly lower |

Management of classified information and other risk factors

that are intensifying in society

|

Compliance Systems and Activities

Enhancement of the Global Code of Conduct

All Nippon Paint Group companies share and comply with the Nippon Paint Group Global Code of Conduct, which sets out

standards/requirements of compliance/ethics rules and sustainability. The code has been refined by each PCG for the

purpose of applying these guidelines in a manner that matches the business climates of different regions. As a

result, with the leadership of Co-Presidents, the code has been embraced by group companies in each country and

region.

Additionally, to clarify our role in preventing corruption

and money laundering in our business activities, we

included statements on these matters in our Global Code of Conduct in November 2023 and disseminated them both

internally and externally.

Compliance education

In Japan, we regularly deliver compliance-related newsletters to all officers (excluding independent directors of Nippon Paint Holdings) and employees (including contract employees and temporary employees), conduct trainings for prevention of harassment, promote dissemination of the "Japan Region Code of Conduct," and plan and implement theme-based training sessions as needed. As a measure of their effectiveness, we annually conduct compliance comprehension test (e.g. checking for understanding and compliance with laws, and regulations, and internal rules regarding marketing activities, corruption prevention, and the Subcontract Act) and utilize the results for the following year's educational training to enhance compliance knowledge and awareness. Additionally, in light of the increasing threat of cyber attacks, we regularly provide training on handling targeted attack emails and e-learning to prevent information leakage.

Whistleblowing Hotline

The Nippon Paint Group Global Code of Conduct and the Global Basic Policy of Whistleblowing Hotline stipulate confidentiality and prohibit unfair treatment of whistleblowers. Each PCG has autonomously established a whistleblowing hotline based on this policy. They have effectively communicated this system to their employees and are operating it appropriately. The head of each PCG submits a whistleblowing hotline operations status report once every year to the Audit Committee and Board of Directors. In addition to these activities, Co-Presidents, in a prompt or timely manner, receive information about whistleblowing reports concerning serious violations of laws and regulations, scandals, violations of laws and regulations by the management team of each PCG, other misconduct, or specific information about the possibility of this type of event. This reporting system enables Co-Presidents to quickly give orders for responding to these events as required.

In FY2024, internal investigations were conducted on a total of 105 whistleblowing cases across the Group companies in response to whistleblowing reports. Depending on the nature of each case, the appropriate department within each PCG conducted investigations, analyses and responses, implementing measures to address issues and prevent recurrence. Additionally, during normal operations, efforts such as raising awareness of whistleblowing hotlines and providing compliance educations to employees are carried out to prevent misconduct and violations before they occur. Through the GAC, we share updates on reporting, responses, and awareness initiatives from each PCG, aiming to enhance the effectiveness of our Whistleblowing Hotline.

Whistleblowing reports received in FY2024

(Number of reports)

| Working environment (industrial accidents, harassment, discrimination, etc.) | 31 |

|---|---|

| Loss of assets/Leakage of information (conflict of interest, embezzlement, illegal use of data, etc.) | 46 |

| Accounting fraud | 2 |

| Violations of laws and regulations (anti-trust law violations, insider trading, bribery, business laws violations, etc.) | 9 |

| Other | 17 |

| Total | 105 |

Anti-corruption initiatives

We at the Nippon Paint Group work to prevent bribery and corruption based on the Nippon Paint Global Code of Conduct, which stipulates that we "compete fairly," "not tolerate bribery or corruption," and "avoid conflicts of interest and act in a sensible manner when giving and receiving gifts and entertainment."

Transparency of taxes

The Nippon Paint Group is engaged in global business activities and business development based on our “Global Code of

Conduct”, and complies with applicable laws and regulations in all countries where we do business. We believe it is

our social responsibilities to maintain our compliance system and to pay taxes appropriately, and to play an

important role in the society.

Further, the Nippon Paint Group ensures it builds a relationship of trust with

our stakeholders, maximizes corporate value and shareholder value based on transparency of an appropriate tax

management, and aims to achieve a sustainable growth as the Group.

The Nippon Paint Group tax policy is shown

below:

The Nippon Paint Group Tax Policy

- Compliance with Laws and Regulations

The Nippon Paint Group complies with the spirit of the tax laws and regulations in each country where we engage in business activities and we file and pay taxes in each country.We do not engage in any tax avoidance measures, such as secrecy jurisdictions, or so-called ‘tax havens', in tax planning. We appropriately evaluate and minimize tax risks by seeking tax advice from external tax professionals as necessary.- Tax Transparency

The Nippon Paint Group understands that international initiatives such as the BEPS Project are critical for promoting tax avoidance prevention and maintaining tax transparency. We ensure tax transparency of appropriate tax management stipulated in the BEPS Project.- Transfer Price Taxation Initiatives

The Nippon Paint Group makes appropriate tax payment in each country and region by applying the arm’s length principle to determine prices for transactions conducted with foreign related parties in accordance with the OECD Transfer Pricing Guidelines.

Further, the Nippon Paint Group evaluates appropriateness in allocating profits among foreign related parties, based on function, assets and risk analysis of each group company, and also prepares transfer pricing documentation accordingly.- Relationship with Tax Authorities

The Nippon Paint Group strives to build a relationship of trust with tax authorities by maintaining open transparent communication in each country. We respond to tax information request from tax authorities in a timely manner and endeavor to immediately resolve matters of opinion between the Nippon Paint Group and tax authorities in a sincere manner.

Environmental and social activities

The Nippon Paint Group believes that the process of achieving Maximization of Shareholder Value (MSV) is predicated on the fulfillment of its environmental and social responsibilities. Based on this conviction, we conduct many environmental and social activities.

Environmental activities

The Nippon Paint Group has established the Global Team with members from our key partner companies around the

world that works directly under the Directors, Representative Executive Officers & Co-Presidents. The Global

Team conducts activities to identify environmental issues and measures.

We are implementing many environmental

measures including climate change responses based on the Group-wide policies that have been established.

Please

see here for the details.

Examples of activities concerning the strategy for climate change risks and opportunities available here.

Social activities

The Nippon Paint Group aims to achieve sustainable growth based on market growth, brand empowerment, and good

relationships with communities by investing in communities through its value chains. In addition, we conduct

business activities to support and promote sustainable development of every region in which the Nippon Paint Group

operates.

Since our founding we have retained a firm commitment to bringing colors, comfort and peace of mind to

people around the world.

Please see here for the details.