- Investor Relations (IR)

- 2021.08.10

Notice Regarding Transfer of Shares Accompanying Change in Consolidated Subsidiary

August 10, 2021

Company:Nippon Paint Holdings Co., Ltd.Representative:Yuichiro Wakatsuki

Representative Executive Officer & Co-President

Wee Siew Kim

Representative Executive Officer & Co-President

(Code: 4612; TSE 1st Section)

Contact:Ryosuke Tanaka

General Manager of Investor Relations

(TEL: +81-50-3131-7419)

Notice Regarding Transfer of Shares Accompanying Change in Consolidated Subsidiary

Nippon Paint Holdings Co., Ltd. (the “Company”) hereby announces that it adopted a resolution at its board of directors meeting held today to transfer to Isaac Newton Corporation (“INC”), which is a member of the Wuthelam Group (“Wuthelam Group” means collectively the Company’s major shareholder Wuthelam Holdings Limited (“Wuthelam”), its parent company, and Mr. Goh Hup Jin, persons substantively controlled by Wuthelam, its parent company, and Mr. Goh Hup Jin, and subsidiaries of Wuthelam; hereinafter the same), the shares in NIPPON PAINT (INDIA) PRIVATE LIMITED (“NPI”) held by the Company, the shares in Nippon Paint Automotive Europe GmbH (“NPAE”) held by the Company’s consolidated subsidiary NIPPON PAINT (EUROPE) LTD. (“NPE”), and the shares in Berger Nippon Paint Automotive Coatings Private Limited (“BNPA,” and collectively with NPI and NPAE, the “Target Companies”) held by the Company’s consolidated subsidiary Nippon Paint Automotive Coatings Co., Ltd. (“NPAC”; that transfer, the “Share Transfer”) and that the Company and INC executed a Master Agreement, and the Company and NPAC respectively executed Share Purchase Agreements with INC, on the same date.

The Share Purchase Agreement between NPE and INC (collectively with the aforementioned Master Agreement and the Share Purchase Agreements, the “Share Purchase Agreements”) is scheduled to be executed prior to the closing date of the Share Transfer.

1. Summary of the Share Transfer

The Company will transfer to INC, which is a member of the Wuthelam Group, all shares in NPI held by the Company, all shares in NPAE held by NPE, and all shares in BNPA held by NPAC.

Upon the determination of the purchase price for the shares of the three Target Companies, the Company requested third-party valuators independent from the Company, the Wuthelam Group, and the Target Companies to perform a valuation of the Target Companies. Based on the performed valuation, the purchase price is approx. 18.6 billion yen in total, and the profit and loss on the transfer are expected to be minor compared to the revision of the consolidated performance forecast for the fiscal year ending December 31, 2021 which was announced separately today.

The Company expects that the transfer will affect the performance of the Company for the fiscal year ending December 2021 as follows in terms of the total for the three companies.

|

|

Revenue | Operating profit | Profit before tax | Profit attributable to owners of parent |

| Amount of increase or decrease | (14,409) million yen | 2,924 million yen | 2,941 million yen | 2,879 million yen |

Note: The effect on the performance for the fiscal year ending December 2021 is indicated above based on the assumption that the impact of the Share Transfer will be reflected in the consolidated performance from the first day of August 2021.

The Company has also executed a Management Services Agreement with INC and agreed that the Company’s group would continuously assist administrative operations and other areas of management without changing the names of the three companies after the Share Transfer. Consequently, the Company’s group will dispatch management teams to the three companies, ascertain financial conditions and the like, and monitor their business management.

In addition, the Share Purchase Agreements provide for call options where the Company may, by itself or through its subsidiary, buy back the shares in the three companies from INC. The exercise period for the call options will be a period of five years from the first anniversary of the closing date of the Share Transfer (which may be extended for a period of one year unless 6 months’ prior notice is served by either party; the same will apply thereafter). The Company and the Wuthelam Group have agreed and stipulated in the Share Purchase Agreements that, with respect to repurchase prices, the parties will obtain valuation reports from the independent third-party valuators upon the exercise of the options, and the share value will be the fair value agreed upon with INC within the valuation range.

Reference:

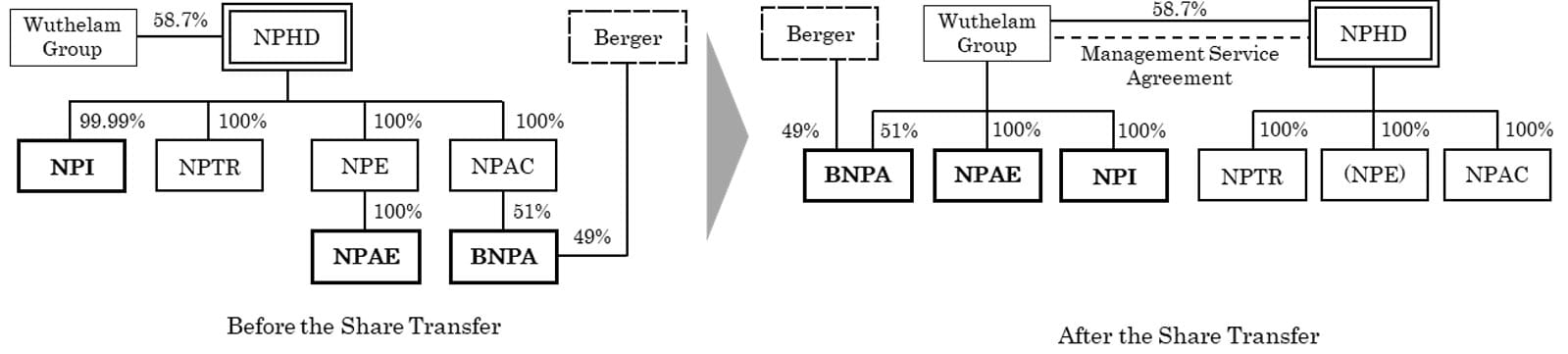

Change in capital relationship upon the Share Transfer

Note: “NPHD” means Nippon Paint Holdings.

Note: “Berger” means Berger Paints India Limited.

Note: “NPTR” means Nippon Paint Turkey Boya San. Ve Tic. Anonim. Sti. NPTR is not subject to the Share Transfer.

Note: NPE will be dissolved and liquidated.

2. Reasons for the Share Transfer

In order to achieve maximization of shareholder value (MSV), which is the Company’s management mission, the Company has strengthened its growth strategy in each region and business and implemented a variety of measures, such as actively proceeding with M&A. In addition, the Company has established a dominant No. 1 management base in Asia that overwhelmingly surpasses all others through the acquisition of full ownership of joint ventures in Asia and the completion of acquisition procedures for the Indonesia business on January 25, 2021 and continues to accelerate global development while at the same time constantly reviewing its group portfolio from the perspective of MSV.

Under these circumstances, while two of the three companies subject to transfer this time and that are mainly engaged in the Automotive OEM paint business, namely NPAE and BNPA, remain important in Europe and India from a strategic perspective based on the policy of globally integrated management of the Automotive OEM paint business conducted by NPAC, there have been significant changes in the business climate, with market stagnation due to the impact of COVID-19 and recent shortages in semiconductors and rising raw material prices, among other factors. As a result of revising the Company’s strategy, the Company has determined that in order to improve its corporate value in the medium and long term, it needs to take significant measures for fundamental business restructuring and enhancement. In addition, NPI, which is mainly engaged in the Decorative and Industrial paint and Automotive Refinish paint business in India, has similarly been affected by market stagnation due to the impact of COVID-19 and rising raw material prices in the short term, and competition is expected to become even fiercer. Therefore, the Company has determined that further structural reinforcement, implementation of bold promotions, and other similar measures will be necessary in order to bolster the Company’s presence in the continuously promising Indian market in the medium and long term.

However, in order to proceed with fundamental business restructuring and enhancement, and structural reinforcement and promotions described above, the Company bears financial burdens as a result of recording significant additional investments and costs in its accounts in the short term, and those burdens could affect the allocation of capital for promoting future M&A. As a result, there is a possibility that the promotion of those measures will not contribute to MSV. In addition, there is a risk of uncertainty regarding the success of the reorganization of the three companies through these restructuring measures and the duration required to complete such restructuring measures, and in light of these issues, the Company examined all possible options, including a sale of the three companies to a third party. Under these circumstances, a sale to a third party would significantly limit our future strategic options in the European and Indian market, so in order to enable the Company to benefit from further growth in the European and Indian market in the case where restructuring measures are successful while shielding it from any associated short term risk or uncertainty. For this purpose, the Company has executed the Share Purchase Agreements that include call options for the Company to buy back the shares in the three companies at a future point in time following consultation and negotiation with the Wuthelam Group.

Based on the above, the Company will secure sustainable growth in the medium and long term and will diversify risk by having the Wuthelam Group bear additional investments and costs for restructuring in the short term and any uncertainty in the restructuring plan. The Company has determined that the Share Transfer is reasonable from the standpoint that the transfer of the Target Companies contributes to the Company’s EPS and the Company has options to buy back the shares in the Target Companies with mid- to long-term potential growth, as well as from the standpoint of protecting minority shareholders and Maximization of Shareholder Value (MSV).

3.Outline of the relevant subsidiaries

(1)NPI

| (1)Name | NIPPON PAINT (INDIA) PRIVATE LIMITED | |||

| (2)Address | Plot No. K-8(l), Phase-II, SIPCOT Industrial Park, Mambakkam Village, Sunguvarchatiram, Kancheepuram, Tamil Nadu - 602 106, India | |||

| (3)Names and positions of representatives |

Shae Toch Hock, Managing Director |

|||

| (4)Description of business | Purchase, manufacturing, and sale of paint and provision of related services | |||

| (5)Stated capital | INR5,628 million (JPY 9,005 million) | |||

| (6)Date of establishment | January 19, 2006 | |||

| (7)Major shareholders and ownership ratio | NIPPON PAINT HOLDINGS CO., LTD.: 99.99% | |||

| (8)Relationship with the listed company | Capital relationship | The Company holds 99.99% of the voting rights of this company. | ||

| Personnel relationship | The Company has dispatched three personnel to this company as a director. | |||

| Transactional relationship | Not applicable | |||

| (9)Management results and financial situation over the last three years | Fiscal year ended | March 2018 | March 2019 | March 2020 |

| Total equity |

INR 5,570 million (JPY 8,912 million) |

INR 5,878 million (JPY 9,405 million) |

INR 6,007 million (JPY 9,611 million) |

|

| Total assets |

INR 8,226 million (JPY 13,162 million) |

INR 9,245 million (JPY 14,792 million) |

INR 9,768 million (JPY 15,629 million) |

|

| Net sales |

INR 9,544 million (JPY 15,270 million) |

INR 12,350 million (JPY 19,760 million) |

INR 12,578 million (JPY 20,125 million) |

|

| Income before taxes |

INR 335 million (JPY 536 million) |

INR 469 million (JPY 750 million) |

INR 193 million (JPY 309 million) |

|

| Profit |

INR 215 million (JPY 344 million) |

INR 307 million (JPY 491 million) |

INR 126 million (JPY 202 million) |

|

| Dividend per share | - | - | - | |

(2)NPAE

| (1)Name | Nippon Paint Automotive Europe GmbH | |||

| (2)Address | Vitalis Strasse 114, 50827 Cologne, Federal Republic of Germany | |||

| (3)Names and positions of representatives | Hiroshi Hanaoka, Managing Director/CEO | |||

| (4)Description of business | Manufacturing and sale of vehicle paint and related products | |||

| (5)Stated capital | EUR 55,000 (JPY 7,211 thousand) | |||

| (6)Date of establishment | 1919 | |||

| (7)Major shareholders and ownership ratio | Nippon Paint (Europe) Ltd.: 100% | |||

| (8)Relationship with the listed company | Capital relationship | The Company’s 100% subsidiary, Nippon Paint (Europe) Ltd. holds 100% of the voting rights of this company. | ||

| Personnel relationship | The Company has dispatched four personnel to this company as directors. | |||

| Transactional relationship | The Company’s subsidiaries sell products, raw materials, etc. to this company. | |||

| (9)Management results and financial situation over the last three years | Fiscal year ended | December 2018 | December 2019 | December 2020 |

| Total equity |

GBP 55 million (JPY 8,360 million) |

GBP 70 million (JPY 10,640 million) |

GBP 114 million (JPY 17,328 million) |

|

| Total assets |

GBP 109 million (JPY 16,568 million) |

GBP 111 million (JPY 16,872 million) |

GBP 142 million (JPY 21,584 million) |

|

| Net sales |

GBP 88 million (JPY 13,376 million) |

GBP 87 million (JPY 13,224 million) |

GBP 70 million (JPY 10,640 million) |

|

| Operating profit |

GBP -8 million (JPY -1,216 million) |

GBP -16 million (JPY -2,432 million) |

GBP -10 million (JPY -1,520 million) |

|

| Income before taxes |

GBP -8 million (JPY -1,216 million) |

GBP -18 million (JPY -2,736 million) |

GBP -10 million (JPY -1,520 million) |

|

| Profit |

GBP -9 million (JPY -1,368 million) |

GBP -18 million (JPY -2,736 million) |

GBP -10 million (JPY -1,520 million) |

|

| Dividend per share | - | - | - | |

Note: Figures for NPE have been stated in “(9) Management results and financial situation over the last three years” because the Company has determined it more appropriate to disclose information regarding NPE with respect to information for the fiscal year ended December 2020 and previous fiscal years due to the fact that NPAE started operations as headquarters in Europe instead of NPE from April 2021.

(3)BNPA

| (1)Name | Berger Nippon Paint Automotive Coatings Private Limited | |||

| (2)Address | A-99/3, Okhla Industrial Estate, Phase-II, New Delhi 110020, India | |||

| (3)Names and positions of representatives | Yoshinori Ikeda, President | |||

| (4)Description of business | Manufacture and sale of automotive paints | |||

| (5)Stated capital | INR 2,760 million (JPY 4,416 million) | |||

| (6)Date of establishment | June 21, 2007 | |||

| (7)Major shareholders and ownership ratio | Nippon Paint Automotive Coating Co., Ltd. | 51% | ||

| Berger Paints India Limited | 49% | |||

| (8)Relationship with the listed company | Capital relationship | The Company indirectly holds 51% of the voting rights of this company. | ||

| Personnel relationship | Three directors and employees of the Company’s subsidiary also serve as directors of this company. In addition, the Company’s subsidiary has seconded three employees to this company. | |||

| Transactional relationship | The Company’s subsidiaries sell products, raw materials, etc. to this company. | |||

| (9)Management results and financial situation over the last three years | Fiscal year ended | March 2018 | March 2019 | March 2020 |

| Total equity |

INR 1,999 million (JPY 3,198 million) |

INR 2,658 million (JPY 4,523 million) |

INR 2,359 million (JPY 3,774 million) |

|

| Total assets |

INR 2,798 million (JPY 4,477 million) |

INR 3,193 million (JPY 5,109 million) |

INR 3,037 million (JPY 4,859 million) |

|

| Net sales |

INR 1,267 million (JPY 2,027 million) |

INR 1,565 million (JPY 2,504 million) |

INR 1,550 million (JPY 2,480 million) |

|

| Income before taxes |

INR -64 million (JPY -102 million) |

INR -140 million (JPY -224 million) |

INR -297 million (JPY -475 million) |

|

| Profit |

INR -52 million (JPY -83 million) |

INR -140 million (JPY -224 million) |

INR -297 million (JPY -475 million) |

|

| Dividend per share | - | - | - | |

Note: Figures for “(9) Management results and financial situation over the last three years” do not include impairment losses recorded in the Company's consolidated performance.

4. Summary of the counterparties in the share transfer

| (1)Name | Isaac Newton Corporation | |||

| (2)Address | Vistra Corporate Services Centre, Wickhams Cay II, Road Town, Tortola, VG1110, British Virgin Islands | |||

| (3)Names and positions of representatives | Goh Hup Jin, Sole Director | |||

| (4)Description of business | Investment holding company | |||

| (5)Stated capital | USD 4 | |||

| (6)Date of establishment | March 20, 2002 | |||

| (7)Net assets | USD 33 million (as of May 2021) | |||

| (8)Total assets | USD 298 million (as of May 2021) | |||

| (9)Major shareholders and ownership ratio | Rainbow Light Limited | 75% | ||

| Thurloe Limited | 25% | |||

| (10)Relationship with the listed company | Capital relationship | Not applicable | ||

| Personnel relationship | One director of the Company also serves as a director of this company. | |||

| Transactional relationship | Not applicable | |||

| Status as a related party | This company is an affiliated company of the Company’s major shareholder Wuthelam, and therefore constitutes a related party. | |||

5. Number of shares transferred, and status of shareholdings before and after the transfer

(1)NPI

| (1)Number of shares held before the change |

562,799,999 shares (Number of voting rights: 562,799,999 voting rights) (Ownership ratio of voting rights: 99.99%) |

|---|---|

| (2)Number of shares to be transferred |

562,799,999 shares (Number of voting rights: 562,799,999 voting rights) |

| (3)Number of shares held after the change |

0 shares (Number of voting rights: 0 voting rights) (Ownership ratio of voting rights: 0%) |

(2)NPAE

| (1)Number of shares held before the change |

55,000 shares (Number of voting rights: 55,000 voting rights) (Ownership ratio of voting rights: 100%) |

|---|---|

| (2)Number of shares to be transferred |

55,000 shares (Number of voting rights: 55,000 voting rights) |

| (3)Number of shares held after the change |

0 shares (Number of voting rights: 0 voting rights) (Ownership ratio of voting rights: 0%) |

(3)BNPA

| (1)Number of shares held before the change |

1,611,597 shares (Number of voting rights: 1,611,597 voting rights) (Ownership ratio of voting rights: 51%) |

|---|---|

| (2)Number of shares to be transferred |

1,611,597 shares (Number of voting rights: 1,611,597 voting rights) |

| (3)Number of shares held after the change |

0 shares (Number of voting rights: 0 voting rights) (Ownership ratio of voting rights: 0%) |

6.Schedule

| (1)Date of resolution by the board of directors | August 10, 2021 (today) |

|---|---|

| (2)Date of execution of the Share Purchase Agreements | August 10, 2021 (today) |

| (3)Closing date of the Share Transfer | August 27, 2021 (scheduled) |

Note: The Share Purchase Agreement between NPE and INC will be executed sometime between today and the execution date of the Share Transfer.

7.Future outlook

The amount of financial impact on the performance forecast for the fiscal year ending December 2021 accompanying the Share Transfer is as described in “1. Summary of the Share Transfer.”

8.Matters concerning a transaction, etc., with a controlling shareholder

Because the Share Transfer constitutes a transaction with INC, which is a member of the Wuthelam Group, it constitutes a transaction, etc., with a controlling shareholder.

(1) Whether the Share Transfer is a transaction, etc., with a controlling shareholder, and status of compliance with the guidelines regarding the policy for protection of minority shareholders

In the Corporate Governance Report disclosed on June 7, 2021, the Company provides, as guidelines for measures to protect minority shareholders in conducting transactions with the controlling shareholder, that in order to protect minority shareholders, when the company intends to conduct a transaction with its parent company, the Independent Directors appropriately conduct engagement and supervision, such as obtaining approval at the Board of Directors with the majority of the Independent Directors, etc.

As described in “(2) Matters concerning measures to ensure fairness and avoid conflicts of interest” below, because the Company established a special committee consisting of outside independent directors and obtained a report from the special committee, the Company believes the Share Transfer compiles with the above guidelines.

(2) Matters concerning measures to ensure fairness and avoid conflicts of interest

The Company has taken the following measures to ensure the fairness of the Share Transfer and avoid conflicts of interest:

(i)Procurement by the Company of a valuation report from an independent third-party valuator.

In determining the purchase price, the Company engaged PwC Advisory LLC and DURV and Associates LLP, which are both third-party valuators independent from the Company, the Wuthelam Group, and the Target Companies, to perform a valuation of the Target Companies in order to ensure the fairness of the purchase price in the Share Transfer, and received a valuation report for each Target Company, dated July 28, 2021 from PwC Advisory LLC, and July 27 and August 3, 2021 from DURV and Associates LLP.

(ii)Establishment by the Company of an independent special committee and receipt of the Committee Report

For the purpose of eliminating arbitrary decision-making and ensuring a fair, transparent, and objective decision-making process with respect to the Share Transfer, the Company adopted a resolution to establish a special committee (the “Special Committee”) consisting of Hisashi Hara, Masayoshi Nakamura, and Masataka Mitsuhashi, each of whom is an outside independent director of the Company, and to request that the Special Committee consider whether a decision of the board of directors of the Company to conduct the Share Transfer and the restructuring of the Target Companies after the Share Transfer (the “Transactions”) would be disadvantageous to minority shareholders (including analyzing the existence of the call option and other terms, the “Matters for Consideration”). In making that request, the board of directors of the Company has also resolved that it will respect the determination of the Special Committee to the maximum extent when conducting decision-making and will not decide to conduct the Transactions if the Special Committee determines that the Transactions are inappropriate.

The Special Committee conducted careful and comprehensive deliberations based on the materials and information provided to the Special Committee by the Company and its advisors, with a focus on the Matters for Consideration. Based on those deliberations, the Special Committee submitted a report to the board of directors of the Company on August 9, 2021 to the effect that the decision to conduct the Transaction would not be disadvantageous to minority shareholders based on grounds including those set out below (the “Report”).

(a)The Special Committee has determined that the Transactions are reasonable from the standpoint of maximization of shareholder value based on the following grounds, among others: the purpose of the Transactions is reasonable; the Transactions are an option for contributing to the growth of the entire Company’s group; and while the Transactions entail INC bearing risks arising from the case where the restructuring of the Target Companies is not successful, they also make possible a scenario where the Company benefits from further growth in the European and Indian markets in the case where the restructuring of the Target Companies is successful.

(b)The Special Committee has determined that the procedures for the Transactions are fair from the standpoint of protecting minority shareholders of the Company based on the following grounds, among others: the Company has obtained valuation reports from independent third-party valuators; the Company has established the Special Committee independent from the Company, the Wuthelam Group, and the Target Companies; the Company has obtained legal advice from Mori Hamada & Matsumoto, an independent legal advisor; the Company has not allowed Mr. Goh Hup Jin, who is a director of the Company and concurrently serves as the representative of the Wuthelam Group, to participate in any deliberations or resolutions with respect to the Transactions or to participate in any discussions or negotiations regarding the Transactions on behalf of the Company; appropriate disclosure is planned; and there are no other circumstances that give rise to any question regarding the fairness of the Transactions.

(c)The Special Committee has determined that the appropriateness of transaction terms for the Transactions has been secured from the standpoint of protecting minority shareholders of the Company in light of the following points, among others: the consideration for the Share Transfer has been determined to be appropriate in light of the calculation results of the valuation reports prepared by the independent third-party valuators DURV and PwC; and appropriate provisions are stipulated in each agreement regarding the Transactions.

(iii)Procurement by the Company of advice from an independent law firm

In order to ensure the transparency and objectivity of the decision-making process of the board of directors with respect to the Share Transfer, the Company appointed Mori Hamada & Matsumoto, a law firm independent of the Company, the Wuthelam Group, and the Target Companies, as its legal advisor and received necessary legal advice from that firm concerning the method and process of decision-making with respect to the Share Transfer and other matters to be noted.

(iv)Unanimous approval of all disinterested directors of the Company

Mr. Goh Hup Jin is a director of the Company and concurrently serves as the director of INC, the counterparty in the Share Transfer. From the standpoint of increasing the fairness and objectivity of decision-making by the Company’s board of directors with respect to the Share Transfer and avoiding any suspicion of a conflict of interest, Mr. Goh Hup Jin did not participate in any deliberations or resolutions with respect to the Share Transfer, and did not participate in the negotiations with the Wuthelam Group on behalf of the Company. At the meeting of the Company’s board of directors held on August 10, 2021, attended by all of the disinterested directors other than Mr. Goh Hup Jin, a resolution was adopted to enter into the Share Purchase Agreements with the unanimous approval of all directors in attendance.

(3) Summary of the opinion from a person who has no conflict of interest with a controlling shareholder stating that the transaction, etc. is not disadvantageous to the minority shareholders

The Company obtained a Report from the Special Committee stating that a decision to conduct the Transactions would not be disadvantageous to minority shareholders on August 9, 2021. For a summary of the Report, please refer to “(ii) Establishment by the Company of an independent special committee and receipt of the Committee Report” in “(2) Matters concerning measures to ensure fairness and avoid conflicts of interest” above.

Note: The exchange rates applied herein are based on the following rates applied to the revision of consolidated performance forecast for the fiscal year ending December 31, 2021, stated in “Notice regarding the Revision of Consolidated Performance Forecast (IFRS),” which was announced separately today.

EUR 1 = JPY 131.1

INR 1 = JPY 1.6

GBP 1 = JPY 152.0