Climate change

Approach to climate change

Group policy

Climate change is impacting our business, people, and communities. We will work to reduce our greenhouse gas emissions, manage climate-related risks, and capture climate-related opportunities.

Pursuant to this group policy, the Group is now working to rein in its greenhouse gas (GHG) emissions and minimize business risks caused by the progression of climate change. The reduction of energy used in the paint manufacturing process and proactive use of renewable energy will not only help to combat climate change by controlling GHG emissions, but also make a difference in the issue of energy resource depletion.

Report based on the TCFD recommendations

In September 2021, Nippon Paint Group expressed its support for the final report of the Task Force on Climate-related Financial Disclosures (TCFD) recommendations. For Maximization of Shareholder Value (MSV), we are working to enhance climate change-related measures and information disclosure.

Governance

Our Group has shifted to an autonomous management structure based on Asset Assembler model, with a revamped sustainability framework implemented in 2022. This new structure is designed to strengthen the link between sustainability initiatives and business activities, rather than having them enforced by the headquarters. Five Sustainability Teams, established based on Materiality including climate change, directly report to the Directors, Representative Executive Officers & Co-Presidents, and implement the sustainability strategy across the Group globally. Updates and suggestions on climate change initiatives are reported directly from the Sustainability Teams to the Co-Presidents, who then report them to the Board of Directors. The Board thus monitors sustainability activities in the Group.

Strategies

Global warming is of interest to society as a whole, including the Group’s major customers. While it entails physical and regulatory risks, global warming can be linked to opportunities to expand our business by addressing its impacts strategically. We have identified climate-related risks and opportunities that are critical to the Group’s strategies and are progressively working to assess their financial impacts. Key risks include regulatory changes and impacts (e.g. carbon pricing, emissions reduction targets), increased supplier costs (e.g. energy, raw materials), supply chain disruption from increased extreme weather events, changes in customer expectations and behavior, and increased product claims and brand damage (e.g. product performance deterioration). Key opportunities include development of new products and services (e.g. low carbon, temperature mitigation) and market growth or entry into new markets for more sustainable products.

We are incorporating our analysis of these climate-related risks and opportunities in formulating the medium- and long-term growth strategy of the Group. Each PCG currently develops their strategies and actions their plans to address the relevant risks and opportunities, with current priority actions across the businesses including carbon mitigation (e.g. energy efficiency, solar system installations, renewable power purchase) and innovation projects for development of more sustainable products. The PCGs are supported by global working groups for environment and safety, innovation and product stewardship, and procurement, with these groups enabling sharing of knowledge and adoption of common, best practice approaches for management of these risks and opportunities. Consolidated group outcomes from each working group are reviewed with the responsible Co-President every six months.

Climate-related scenario analysis

| Risks | Opportunities | ||

|---|---|---|---|

| Variables | 1.5℃ | 4℃ | |

| Changes in regulations and their impacts, such as carbon pricing and greenhouse gas emission reduction targets* | Introduction of strict regulations | Regulations strengthened in limited areas | Market growth for sustainable products

Development of new products and services to capture climate-related business opportunities

|

| Increase in supplier costs arising from climate adaptation and decarbonization actions | Large increase in supplier costs due to climate adaptation and decarbonization actions | Certain increase in supplier costs due mainly to climate adaptation rather than to the limited decarbonization actions | |

| Changes in customer and consumer expectations and behavior | Higher disposition for low-carbon products and lower demand for carbon products | Higher disposition for low-carbon products | |

| Higher temperature affecting product functions | Occasional product claims and brand damage due to performance deterioration | Frequent product claims and brand damage due to performance deterioration or malfunction | |

| Increase in floods and/or water stress negatively affecting operations and supply chain | Occasional floods and/or water stress affecting operations and supply chain | Frequent floods and/or water stress routinely impacting operations and supply chain | |

* Based on the net zero scenario (IEA), the carbon price (impact on our Group) is estimated to be JPY4.3 billion in 2030 and JPY7.4 billion in 2040 (Assumptions: carbon price of USD130 for Advanced economies and USD90 for Selected emerging market and developing economies in 2030; and USD205 for Advanced economies and USD160 for Selected emerging market and developing economies in 2040. The exchange rate is the actual rate for FY2022 (USD/JPY =132.1).) Our Group plans to avoid this impact through emission reductions and other initiatives.

Risk management

The Sustainability Team that works directly under the Co-Presidents identifies and assesses risks, including their importance, based on the criteria of factors directly related to our operations (e.g. raw materials, energy, and water consumption, greenhouse gas emissions) and our products and customers (e.g. product impacts, product application and feature needs). Each PCG is responsible for developing action plans and associated targets to address identified risks and opportunities associated with climate change. Consolidated group progress is shared and reviewed via the Sustainability Team, with progress and outcomes six-monthly with the responsible Co-President.

See here for details on the integration of climate change risk management to comprehensive company-wide risk management

Metrics and targets

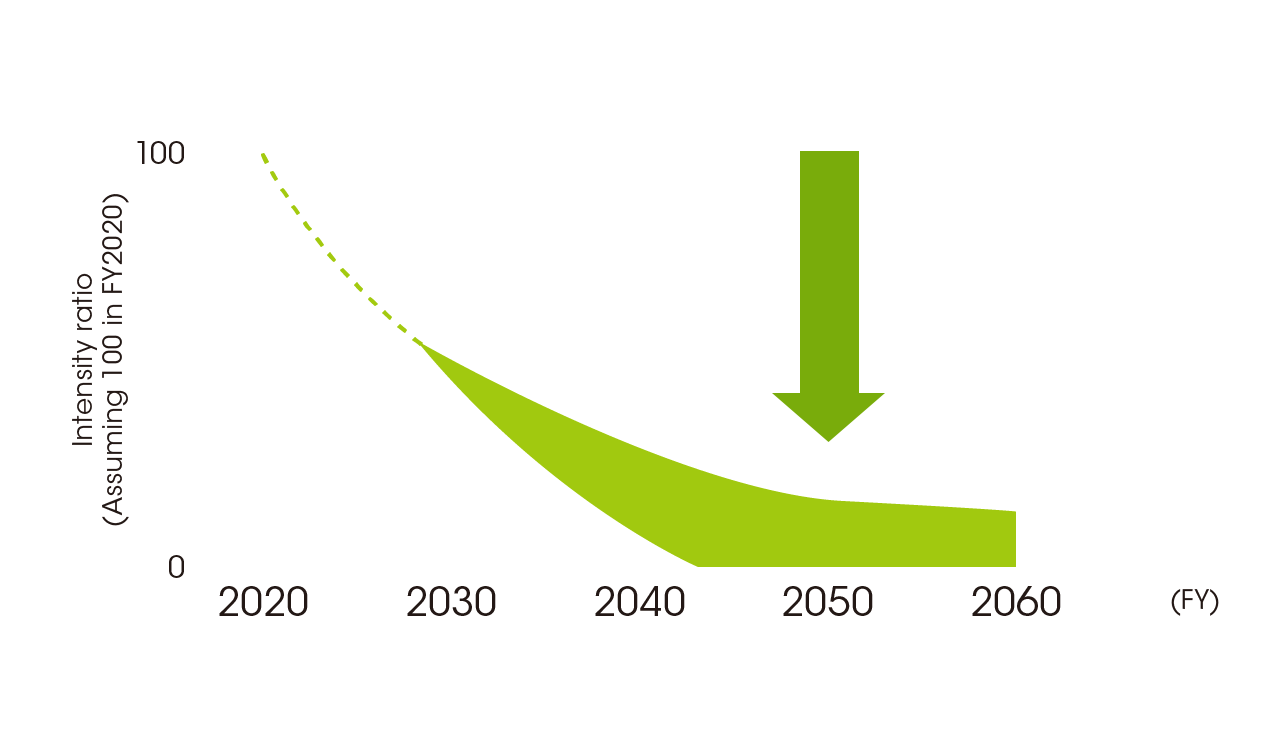

Our PCGs continue to accelerate their responses to climate change by identifying and progressing roadmaps and action plans to achieve their net zero targets through reductions in carbon emissions and adaptation to a net zero future. Key actions currently being progressed across PCG businesses for Scope 1 and 2 improvements include energy efficiency initiatives, renewable power purchase, solar system installations, and transitioning fleets to electric vehicle and hybrid vehicles. By taking these actions, our Japan Group and DuluxGroup businesses aim to achieve net zero for Scope 1 and 2 greenhouse gas emissions by 2050, Dunn Edwards by 2045, and NIPSEA Group by 2060. Scope 3 emissions are currently calculated for Japan Group, DuluxGroup, and the majority of NIPSEA Group, and is being progressively expanded across our remaining businesses, and PCGs have also commenced development of Scope 3 emissions reduction plans. Japan Group has recently formulated its Scope 3 target and reduction plan. A key element for Scope 3 reduction is strengthening collaboration with suppliers to achieve reductions in category 1 emissions. As part of this effort, Japan Group has initiated a Carbon Footprint (CFP) supplier survey of top 30 CO2-intensive raw materials.

Ambition & improvement

Each PCG has continued to develop their individual goals and improvement plans for climate-related impacts, risks, and opportunities during the year. The current targets and plan progress for each PCG are summarized in the following table.

Climate Change-related targets

| PCG | Targets*1 | Improvement Priorities (2024) | |

|---|---|---|---|

| GHG emissions | Energy Consumption |

||

| NIPSEA Group |

Scope 1 and 2 2025: 15% reduction 2060: Net zero |

2025: 8% energy consumption reduction |

Carbon mitigation best practices were disseminated across the NIPSEA Group to facilitate consistent adoption across operations. |

| DuluxGroup*2 |

Scope 1 and 2 2030: 50% reduction 2050: Net zero |

2030: 50% renewable electricity consumption |

Delivery of an additional 1,400 kW of solar generation capacity, ongoing energy efficiency initiatives across operational sites, continued roll-out of the fleet transition plan in the Pacific and Cromology business, review of climate targets across the entire DuluxGroup including Scope 3 target setting. |

| Japan Group | Scope 1 and 2 2030: 37% reduction 2050: Net zero Scope 3 2030: 13% reduction |

2030: 62% renewable energy, 10% energy intensity reduction |

Increased renewable-electricity purchase and commenced an off-site solar Power Purchase Agreement (PPA). Formulated a Scope 3 target and reduction plan. Strengthened collaboration with suppliers for reductions of Category 1 emissions. |

| Dunn-Edwards | 2045: Net zero | - | Use of renewable electricity in the LA office and PHX. |

*1 Baseline years for targets are 2021 for NIPSEA Group, 2020 for DuluxGroup, and

Japan Group (Scope 1 and 2 2019, Scope 3 and Energy 2021)

*2 DGL (Pacific) only

Performance

In 2024, our greenhouse gas emissions (Scope 1 and 2 location based) increased 9.4% to 45.0

kilograms per tonne (kg/t). Dual GHG emissions reporting for 2024 has commenced for both

Market Based and Location Based emissions where possible. The increases in Scope 1 and 2 and

energy consumption are being mitigated by implementation of operational and energy

efficiency initiatives (such as switching to LED lighting), investment in solar generation at sites,

fleet transition plans and purchasing electricity from renewable sources.

GHG Scope 3 emissions increased 10.2% to 10.2 million tonnes (Mt). The increase is mainly

due to NIPSEA Group’s increased production and expanded reporting to include additional

businesses. Scope 3 emissions in DGL (Pacific) also increased due to acquisitions of new

businesses, Pental and Seasol. Japan Group reduced Scope 3 emissions by 1.6%. PCGs are

working to expand the Scope 3 emissions reporting to include DGL (Europe), smaller parts of

NIPSEA Group, and Dunn-Edwards.

Total energy consumption increased 18.4% year-on-year to 0.54 gigajoules per tonne (GJ/t).

These increases are mainly due to new acquisitions and enhancements in data capture and

reporting. Notably, our consumption of renewable energy increased by 390 bps to 9.6% of total

energy consumption as well as renewable electricity consumption now at 19.1% of the total.

Performance and changes versus the prior year for individual PCGs are summarized in the following table, together with the key performance drivers for the changes.

Metrics and results related to Climate Change (2024)

* Figures in brackets indicate year-on-year change

| PCG | GHG emissions (Scope 1 and 2 Market based) (kg/t) |

GHG emissions (Scope 1 and 2 Location based) (kg/t) |

GHG emissions (Scope 3)(Mt)* |

Total Energy consumption (GJ/t) |

Renewable energy consumption (% of total) |

Renewable electricity consumption (% of total) |

|---|---|---|---|---|---|---|

| NIPSEA Group | 36.8 (n/a) |

36.6 (+13.5%) |

8.0 (+11.5%) |

0.4 (+28.6%) |

8.8% (+5.7pp) |

21.8% (+15.9pp) |

| DuluxGroup | 85.5 (-4.4%) |

74.3 (-8.2%) |

1.0 (+16.6%) |

0.9 (+6.8%) |

2.6% (-4.8pp) |

7.3% (-6.5pp) |

| Japan Group | 139.5 (-6.9%) |

164.3 (+3.0%) |

1.2 (-1.6%) |

3.3 (+0.5%) |

15.9% (+5.7pp) |

22.2% (+7.8pp) |

| Dunn-Edwards | - | - | - | 0.3 (+26.5%) |

- | - |

| Total | - | 45.0 (+9.4%) |

10.2 (+10.2%) |

0.5 (+18.4%) |

9.6% (+3.9pp) |

19.1% (+10.4pp) |

* NIPSEA Group includes the China, Malaysia Group and Betek Boya only (representing approximately 90% of NIPSEA production). DuluxGroup includes DGL (Pacific) only (representing 45% of the DuluxGroup total production)

For details on Climate change, see the ESG Data page.

Initiatives Nippon Paint is involved in

We participated in the Keidanren Voluntary Action Plan on the Environment from fiscal 1997 to fiscal 2012 as a member of the chemical industry through the Japan Chemical Industry Association. During this time, we continued to promote energy conservation and activities that mitigated CO2 emissions. From fiscal 2013, we began participating in Keidanren’s Commitment to a Low Carbon Society. Since then, we have been promoting global warming countermeasures following the four pillars of: (a)curtail CO2 emissions from domestic business operations; (b) strengthened co-operation with lead actors for reducing CO2 emissions across the entire supply chain through the spread of low-carbon products and technologies; (c) contributions on the international level, including the promotion of technology transfers to developing countries of Japan’s chemical products and processes; and (d) the development of innovative technologies using medium- to long-term technical development focused on commercialization in 2020 and beyond.

Nippon Paint endorses the targets and initiatives of the Japan Chemical Industry Association and we are cooperating

to propel initiatives forward as a company driving the paint industry.

In addition, through our membership in

the Japan Chemical Industry Association, we confirm whether policies align with our strategies. Our main direct and

indirect activities with external parties are reported to the ESG Committee on a quarterly basis to verify whether

they align with our climate change strategy. To ensure consistency of these initiatives, the ESG Promotion

Department, which is the secretariat for the ESG Committee, regularly checks whether responses align with our

strategies. Material matters are delegated to subcommittees and the global team, with these matters taken up as

issues of the ESG Committee to check whether they align with our strategies and policies. In the event consistency

is found to be lacking, we hold discussions again with related parties inside the company and stakeholders involved

in the policy, repeating this process until consistency is achieved. Matters requiring approval are discussed by the

ESG Committee and then approved by the Board of Directors to ensure they align with strategies and policies.