Overview of Corporate Governance

Corporate Governance Policies/Corporate Governance Report

Nippon Paint Holdings is implementing the principles of Japan's Corporate Governance Code.

Basic approach to governance

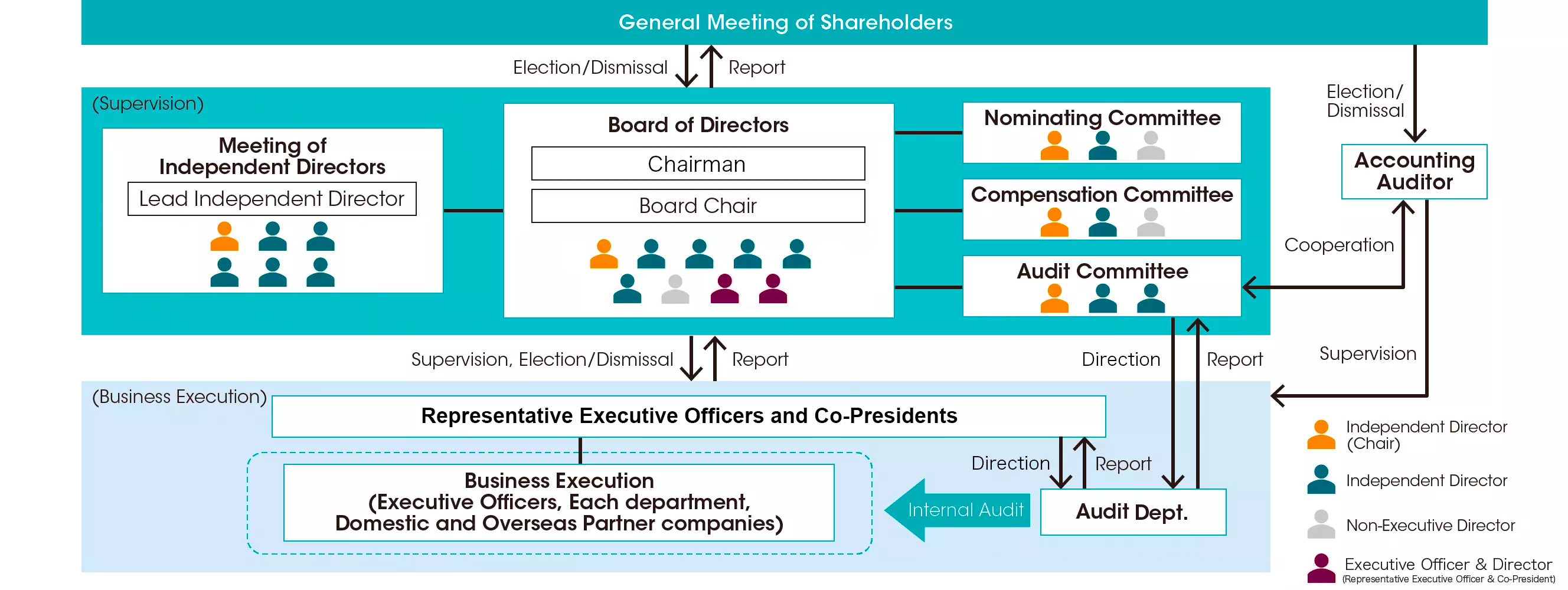

NPHD has adopted a governance structure consisting of a Company with Three Committees in order to bolster management transparency, objectivity, and fairness. This structure aims to effectively separate and strengthen the functions of business execution and management oversight. We seek to create wealth by consistently striving to reinforce corporate governance and pursue MSV that remains after fulfilling our obligations to customers, suppliers, employees, society, and other stakeholders, as well as our sustainability obligations.

As a company committed to achieving MSV, our basic approach is autonomous and decentralized management, respecting the autonomy of partner companies underpinned by the relationship of mutual trust they forge with the Co-Presidents. We strive to strengthen governance suited for an Asset Assembler relentlessly pursuing growth by empowering each partner company to excel in their performance. The Board of Directors, which plays the oversight role, encourages risk-taking by the management in a timely and appropriate manner without slowing down the speed of decision making on management proposals.

Furthermore, we have established an internal control framework based on the Nippon Paint Group Global Code of Conduct which serves as our paramount guiding principle. This code outlines essential standards of compliance, ethics, and sustainability that must be shared and observed by all individuals in the Group. This framework includes the Global Risk Management Basic Policy and the Global Basic Policy of Whistleblowing Hotline, which serve as pillars supporting our autonomous and decentralized management.

*See the section titled Corporate Governance Policy (“Independence Criteria for Outside Director” on a separate page) and the section on Corporate Governance Report.

History of governance reform

Beginning in FY2014, NPHD has progressively increased the number of Independent Directors and transferred authority from the Board of Directors to the executive departments. This strategy is designed to delineate and enhance the functions of business execution and management oversight. To advance these reforms, in March 2020, the Company transitioned to a Three Committees structure. Following the management structure change in April 2021, the role of Board Chair has been assumed by the Lead Independent Director. As of 2025, Independent Directors hold a majority stake in the Board of Directors, constituting 66.7% of the Board, with six out of the nine Board members being Independent Directors.

Relationship with the major shareholder and protection of the interests of minority shareholders

Our relationship with the majority shareholder and protection of minority interests With a business partnership spanning over 60 years, NPHD and Wuthelam Group, our majority shareholder, unite under the common mission of MSV, and protecting the interests of minority shareholders. The full integration of the Asian JVs and the acquisition of the Indonesia business in January 2021 simplified our capital relationship, aligning the interests of the majority shareholder and minority shareholders. This created a management structure dedicated to pursuing MSV while ensuring the protection of minority interests.

To protect the interests of minority shareholders, we maintain a diligent approach and involve Independent Directors in all such transactions with the majority shareholder to ensure proper oversight and scrutiny. To achieve this, all such transactions require approval at the Board of Directors meeting, where the Lead Independent Director serves as Board Chair and Independent Directors hold the majority of seats. We adhere to a strict policy regarding significant related-party transactions, (including those between the Company and the majority shareholder, competing transactions involving Directors and/ or Executive Officers, self-dealing, and conflict of interest transactions).

Any such transactions surpassing a predetermined threshold are promptly reported to the Board of Directors. Moreover, these transactions are disclosed in the Notice of the Annual General Meeting of Shareholders and the Annual Securities Report (available only in Japanese) to ensure transparency and accountability. Furthermore, when we conduct related-party transactions, we exercise comprehensive judgment regarding the reasonableness of the transaction, taking into consideration its terms and conditions, profit and cost levels and other relevant factors. The objective is to ensure that the transaction will not harm the interests of NPHD or of its minority shareholders. As a part of this process, we require the approval of relevant individuals with appropriate decision-making authority.Status of Company shares, execution of share rights

See “Stock Information”.

Corporate governance system

-

With the shift to being a Company with Nominating Committee, etc., we aim to separate and strengthen business execution and supervision, improve the transparency, objectivity and fairness of management, strengthen the global auditing system, protect minority shareholder rights and strengthen relations with domestic and international stakeholders.

-

Directors are elected by a resolution of the General Meeting of Shareholders for a term of one year.

-

The Company selects and appoints the Lead Independent Director, and the Board Chair has been filled by the Lead Independent Director.

- The Board of Directors has three statutory committees: Nominating, Audit and Compensation. The majority of their members are Independent Directors.

-

See “Committees”, for members of each committee and their roles.

- In order to ensure the effectiveness of each committee and the Board of Directors, the Company provides a secretarial office for each meeting body, with an appropriate budget and personnel.

-

We have established the meeting of the Independent Directors, which is composed entirely of Independent Directors.

See “meeting of the Independent Directors” for details of this Meeting. -

Business execution is done by the Representative Executive Officer and the Executive Officers elected by the Board of Directors, and the Board of Directors supervises the business execution.

-

We have established an Internal Audit Department in the Company, which evaluates the effectiveness of the Group’s governance, processes, risk management and other internal control systems on a risk basis. In addition, the Internal Audit Department ensures the independence and appropriateness of audits by establishing a double reporting line to both the Audit Committee and the Representative Executive Officer and Co-Presidents.

See "Initiatives to Establish the Global Audit Framework" for information related to the Internal Audit Department. -

The Company has appointed KPMG AZSA LLC as an Accounting Auditor.