Q & A with Independent Director

The Lead Independent Director Masayoshi Nakamura comments on and answers to feedback and questions on governance topics received through engagement with investors.

Compensation for Representative Executive Officers & Co-Presidents

-

Before addressing these questions, I’d like to mention that the governance structure we aim for, including the procedures for nominating and compensating Representative Executive Officers & Co-Presidents, is fundamentally grounded in the principle of aligning our interests with those of the shareholders. This includes a specific focus on protecting the interests of minority shareholders.

In 2020, Nippon Paint Holdings transitioned to a Company with Three Committees structure to enhance management transparency, objectivity, and integrity, while also strengthening the separation between execution and oversight functions. Furthermore, in pursuit of a more sophisticated governance framework, we bolstered independence and effectiveness of the Board of Directors by establishing a Board whose majority is composed of Independent Directors, and which is also chaired by an Independent Director. Additionally, we ensured the independence of the three Committees from executive functions by forming the Committees thoroughly of Non-Executive Directors, with Independent Directors comprising the majority and serving as Chairperson of each Committee. Approximately 50% of the compensation for Independent Directors consists of restricted stock compensation. This approach enables us to oversee the management team from a standpoint closely aligned with that of our shareholders.

Under this governance structure, Representative Executive Officers & Co-Presidents are appointed through Board of Directors' approval upon recommendation from the Nominating Committee. We believe that management selected through this process are well-suited to actively pursue the Group’s goal, which is Maximization of Shareholder Value (MSV). In terms of their compensation, the Compensation Committee works diligently to establish a compensation package that serves as a powerful motivator, empowering Co-Presidents to fully harness their capabilities and contribute to achieving MSV.

Now that I summarized our governance framework, I will explain how exactly we determine the total compensation for our Co-Presidents. As elaborated in the "Compensation Committee" section (pages 111 and 112) of the Integrated Report 2023, issued at the end of September 2023, the compensation is determined through a series of Compensation Committee discussions where we comprehensively assess the Co-Presidents’ performance towards MSV, encompassing both financial and non-financial aspects. Additionally, these discussions revolve around designing a compensation package that motivates the Co-Presidents, inspiring them to elevate the Group to greater heights.

Let’s take a look at how we assessed the performance of the Co-Presidents in FY2022. In terms of the financial aspects, we conducted a comprehensive evaluation based on our Group’s business performance trends and the benchmarking of our revenue, profit growth, and key MSV indicators such as EPS and PER against those of our competitors. This approach facilitates an objective assessment, taking into account external market dynamics and conditions. When comparing the six largest global paint manufacturers in terms of revenue (with NPHD ranking as the fourth largest), it's worth noting that NPHD achieved an impressive two-year CAGR of 10.2% in EPS through the end of FY2022, post-transition to the Co-President structure. This growth rate, when measured on a presentation currency basis, was the highest among its peers, surpassing the runner-up by approximately five percentage points. Furthermore, as of the end of FY2022, NPHD's PER*1 was 32.1 times when calculated on a Last Twelve Months basis and 24.6 times on a Next Twelve Months basis. These PER values, both the highest among the six largest players in the industry, underscored NPHD's strong performance in the market. The Compensation Committee regarded these performance results highly, recognizing them as a testament to our Company's commitment to pursuing MSV.

In terms of non-financial considerations, we thoroughly evaluated how the Co-Presidents contributed to progress in multiple fields. The items covered here included enhancements in the profitability and financial stability of existing businesses, growth-oriented strategies focused on acquiring new assets companies, strengthening of the sustainability structure and human capital based on Asset Assembler model, and the implementation of effective and efficient governance structure, i.e. monitoring progress in strengthening the internal control system. For instance, when assessing the performance of Co-President Wee, his proactive attention from early on to the risks associated with the Chinese real estate market and their potential impact on our Group was noteworthy. He has taken appropriate measures for risk management, including close communication and information sharing with local management, devising response strategies, and providing regular updates to the Board of Directors. Furthermore, he spearheaded structural reforms in the relatively sluggish Japan segment and bolstered the engineering talent pool and training framework. He also drove profitability enhancements in the marine coatings business by streamlining the cost structure and optimizing the organization. In such ways, he significantly contributed to enhancing the value of our existing businesses.

Meanwhile, Co-President Wakatsuki was highly recognized for consistently sharing the Group's medium to long-term M&A strategy with the Directors and effectively implementing transactions that were aligned with our MSV goals, such as the acquisitions of European paint manufacturers Cromology and JUB. His proactive efforts were further exemplified by his involvement in the secondary offering of shares in the overseas markets, which was intended to enhance the liquidity of our stock and build a global investor base. Additionally, he played a key role in establishing and reinforcing structures for risk management and sustainability to refine our autonomous and decentralized management.

As another point to note, in light of the present uncertainties owing to significant shifts in both the business and social landscapes, it has become imperative to take decisive actions that involve bold and appropriate risk-taking, without missing the opportunities to pursue MSV over the medium and long term. Therefore, when evaluating the Co-Presidents, we attach equal or even greater importance on this factor than on their contribution to the Group's performance over a single year.

The results of the assessment are shared at the meetings of the Independent Directors and the Nominating Committee for use not only for determining compensation but also for making informed decisions regarding the selection and potential dismissal of Representative Executive Officers & Co-Presidents. On this basis, we work on the total compensation package*2 with the view to maintaining and boosting the motivation of the Co-Presidents to whom we continue to entrust the pursuit of MSV in the following fiscal year. Specifically, total compensation was finalized based on assessment of the Co-Presidents’ performance, their current compensation levels, and trends among competitors.

To answer the question on why Co-Presidents' compensation does not include stock-based components, firstly, the composition of their compensation is regularly discussed by the Compensation Committee. This includes an ongoing evaluation of whether stock components should be incorporated or excluded, drawing insights from the perspectives of Independent Directors, investors, and other participants in the capital markets. The primary rationale behind the current decision not to grant stock compensation to the Co-Presidents stems from our belief that it may not inherently promote their prudent and daring risk-taking—the very engine that propels our Group's growth, nor serve as an additional source of motivation.

Stock compensation can certainly serve as a mechanism to ensure the alignment of interests with shareholders over the medium and long term. However, the extent of its value as compensation and incentive could vary depending on how we set the evaluation criteria and period in order to best reflect the Group’s medium to long-term growth as well as the contribution made by the Co-Presidents. Other factors such as the method of granting shares, trading restrictions, and stock price transitions during the holding period could also have an impact. Since all these elements need to be taken into consideration, stock compensation can be extremely complex. The Co-Presidents bear the responsibility of maintaining the financial stability of the Group, even amidst a dynamically changing and unstable environment. They do so by leveraging the competitive advantage of Asset Assembler model they uphold and by strategically and courageously embracing risks while seizing opportunities, all in pursuit of MSV. Meanwhile, the value of stock compensation may fluctuate substantially, affected not only by our Group's business performance and initiatives but also by external factors, including global economic trends and societal issues. This could result in discrepancy between the actual remuneration and what the Co-Presidents deem reasonable judgment based on their contribution and the evaluation they receive, in which case the stock compensation would be ineffective in sustaining or boosting their motivation. As such, we believe that a compensation structure incorporating stock components may not be the optimal choice at this time, in light of our mission to encourage appropriate risk-taking by the Co-Presidents. That said, we are confident that NPHD's compensation for Co-Presidents is sufficiently aligned with the interests of our shareholders, as we make nomination and compensation decisions based on MSV-driven assessments under the aforementioned governance structure.

In determining the compensation for Co-Presidents, we also consider the compensation of CEOs in peer companies. The benchmark is drawn from the average total compensation*3 of CEOs from the world's six largest paint manufacturers in terms of revenue, excluding NPHD, for FY2021 and FY2022. This average amounted to approximately JPY1.15 billion (with stock compensation accounting for roughly JPY830 million or 72.4% of the total). The average of the highest total CEO compensation*3 from each year came to around JPY1.71 billion (roughly JPY1.26 billion or 73.9%). As evident from this data, stock compensation represented over 70% of the total compensation in our peer companies. In contrast, the total compensation*4 for our Co-Presidents in FY2022, without any stock component, was approximately JPY720 million for Co-President Wee and approximately JPY400 million for Co-President Wakatsuki. We believe that this level of compensation contributes to MSV as evidenced by the proven track record of our Co-Presidents in vigorously driving the Group's growth*5.

We will continue to engage in discussions led by the Compensation Committee to determine the compensation for our Co-Presidents, factoring in the present state of our Group and external environmental trends. Through such efforts, we will seek to establish a compensation structure that supports our commitment to MSV premised on the alignment of interests with those of our shareholders.

*1 Source: FactSet (as of December 30, 2022)

*2 A question was posed to us: "What are the factors contributing to the increase in Co-President Wakatsuki's compensation for FY2022, despite the decrease in profit before tax in FY2021 compared to the previous year?" Profit before tax for FY2021, calculated on a Tanshin basis, declined by approximately JPY3.0 billion compared to FY2020. However, this decrease is accounted for after adjusting for one-off expenses totaling around JPY7.8 billion. These expenses include the expensing of stamp tax and inventory step-up from PPA associated with the acquisition of the Indonesia business, costs related to restructuring projects in Japan, and losses stemming from the phased acquisition of subsidiaries, among others. Taking this into account, our assessment indicates that the financial performance of the Group did not register a decline from the previous year.

*3 Calculated based on year-end exchange rates, excluding factors such as pension, retirement payments, and welfare benefits, which vary depending on individual company circumstances and country-specific considerations. The FY2022 figure excludes one company due to the CEO's resignation during that period.

*4 Source: Annual Securities Report for the 197th Business Term ending on December 31, 2022 (only available in Japanese)

*5 As of June 30, 2023, Co-President Wee owns 100,000 shares, while Co-President Wakatsuki holds 180,110 shares, some of which were acquired using their personal funds after they assumed their positions as Co-Presidents.

Sustainability

-

The sole mission of Nippon Paint Holdings is Maximization of Shareholder Value (MSV). And in achieving MSV, the fulfillment of obligations to customers, suppliers, employees, society and other stakeholders is a fundamental prerequisite. Here, the fulfillment of obligations is not limited to duties based on legal contracts but also the fulfillment of social and ethical obligations are indispensable to the MSV that we envision.

In an installment of this series published on June 30, 2023, titled the “Asset Assembler Model,” I gave an overview of the Group’s sustainability structure, which is one of the key elements of risk management under the Asset Assembler model, led by our Co-Presidents.

Within our sustainability structure, we have sustainability teams engaging in activities centered on wide-scoped themes such as tackling climate change and other global issues and addressing forthcoming social challenges that demand proactive measures. In terms of risk management, we have in place a group-wide internal control system based on which each Partner Company Group (PCG: partner companies grouped by region or business) makes autonomous risk management efforts with a keen eye on what is happening at the respective frontlines. Additionally, the wide-scoped global initiatives led by the sustainability teams allow the Group to address forthcoming challenges and social demands ahead of the competition, which in turn enhances the Group’s relevance and helps sharpen its competitive edge.

In this article, I will focus on our sustainability structure in the Asset Assembler model, explaining the context and elaborating on the positive results we have come to appreciate thus far.

Our current sustainability structure comprises five autonomous sustainability teams led by the Co-Presidents. These include the three teams of “Environment & Safety,” “People & Communities” and “Innovation & Product Stewardship,” which are directly tied to the key sustainability issues (Materiality) we have identified. The remaining two teams, ”Governance” and “Sustainable Procurement,” address issues that apply across the board. We have assembled experts from the PCGs, starting with business leaders well-versed in individual sustainability themes, to create these teams that undertake global initiatives.

The leaders of each sustainability team (“Team Leaders”) provide updates on the progress of their team's undertakings and presents proposals directly to the Co-Presidents, who then report the state of the Group’s sustainability endeavors to the Board of Directors as needed. Through this process, the Board gains the comprehensive understanding of the materiality-related risks and opportunities for the medium to long term, based on which it supports and supervises the management team’s bold risk-taking towards MSV under the Asset Assembler model.

The Nippon Paint Group’s materiality comprises six themes: “climate change,” “resources and environment,” and “safe people and operations” covered by the Environment & Safety Team; “diversity & inclusion” and “growth with communities” falling under the People & Communities Team; and “innovation for a sustainable future” handled by the Innovation & Product Stewardship Team. These materiality themes were established in 2020 when Nippon Paint Holdings transitioned to a Company with Three Committees structure. More specifically, we formed the ESG Committee comprising 25 proficient members chosen from our key partner companies (PCs: NPHD’s consolidated subsidiaries) and deliberated on potential themes from two angles: their significance to our shareholders and their relevance to our Group. Building upon these dialogues, the Board of Directors officially established the aforementioned six materiality themes in August 2020. (Refer to the section titled "Materiality.")

After the implementation of the Co-President structure in April 2021, our governance framework underwent a transformation, adopting the Asset Assembler model as its foundation. As a result, we transitioned from a headquarters-driven sustainability structure to an autonomous model led by local management and businesses, united in their pursuit of MSV.

Multinational enterprises often embrace a globally standardized and centralized management approach where their headquarters determine the themes and devise plans to address challenges that call for collaborative efforts across the entire organization. These plans are then imposed on subsidiaries in a hierarchical manner. For our Group’s attainment of MSV, however, sustainable growth based on the PCGs’ autonomy grounded in their regions and markets becomes the key. Formerly, the ESG Promotion Department based at the Group’s headquarters was responsible for identifying themes and overseeing progress. This system made our Board apprehensive that the time lag and perceptional differences emerging between the ESG Promotion Department and the frontline PCs may hinder our achievement of MSV in the future. To address this concern, the Board concluded that transitioning from the HQ-led centralized management model to the current sustainability structure, which respects the autonomy of each PCG based on mutual trust, was a rational step forward.

Previously, the Head Office took the lead in orchestrating the Group’s sustainability initiatives to meet the social demands associated with each theme. Under the existing framework, we select the Team Leaders from across the organization and from among those individuals who have extensive expertise in their respective themes and are currently tackling with the themes hands-on. This new framework has enabled our Group not only to meet our social responsibilities but also to further link the sustainability initiatives to our business operations. This includes identifying potential business prospects and venturing into new markets.

The autonomous sustainability framework was inaugurated with a four-team structure, excluding the Sustainable Procurement Team. However, in July 2022, the Governance Team proposed that the Group integrate the human rights issues into the sustainability framework in order to address the heightening public concerns. Thus, initially prompted by the drive to launch group-wide activities focused on ethical procurement, the sustainability procurement team was newly established to pursue long-term and stable sourcing of raw materials and manufactured goods. Consequently, our sustainability framework was strengthened and evolved into the present five-team structure.

In light of the progress of sustainability initiatives within the Group, in March 2023, the Board of Directors collaborated with the Co-Presidents to formulate the Basic Policy on Sustainability, which supersedes the ESG Statement previously upheld by the management team. This policy clarified the stance of sustainability initiatives geared towards attaining MSV, reaffirming the collective trajectory of our Group.

In the July 2023 Board meeting, key members from the five sustainability teams were invited to discuss various themes relevant to each team. This was a good opportunity because two years had passed since the implementation of the present sustainability structure and our upcoming Medium-Term Plan was slated for development in the current fiscal year. Our Board meetings include a segment dedicated to updates from the Co-Presidents, and we generally use this time to hear sustainability-related reports from the Co-Presidents and engage in discussions as necessary. The July Board meeting was different in that it was the first time the five Team Leaders and pivotal team members congregated to participate in discussions alongside the Board members. We engaged in an open and forthright dialogue regarding each team’s composition and progress, as well as the roadmap going forward and obstacles. The opportunity facilitated a comprehensive understanding of our Group's sustainability activities for both the Directors and the sustainability teams. Additionally, it affirmed our notion that each PCG was conducting a diverse array of activities with agility, effectively addressing business demands while remaining attuned to public expectations and local market characteristics.

The overview of the deliberations at this Board meeting will be detailed in the upcoming Integrated Report 2023, set to be released in the near future. Kindly consider taking a moment to read the article as well.

The discourse at the Board meeting allowed us Directors to deepen our understanding of the Group's sustainability initiatives. This interaction gave us the chance to gain insight into the resolute approach adopted by each sustainability team in tackling challenges and propelling their initiatives forward. Personally, I found it both impressive and genuinely reassuring to see each team take actions consistently and independently, and with integrity based on their well-thought-out strategies. Moreover, I also gained a renewed recognition of the Co-Presidents' astute judgment in entrusting leadership to these teams.

The foundation of our Asset Assembler model rests upon mutual trust among the Directors, Co-Presidents, management teams of PCs, and employees. The discourse surrounding individual sustainability themes has renewed our recognition that the sustainability efforts based on the five-team structure have essentially developed “five common languages” that foster mutual trust.

Under the Asset Assembler model, our Group's sustainability endeavors, propelled by local management and businesses, will undergo further refinement and expansion in view of future shifts in the business landscape, leading us further towards the achievement of MSV.

Asset Assembler Model

-

The Co-Presidents execute the Asset Assembler model to pursue Maximization of Shareholder Value (MSV) by using autonomous and decentralized management based on mutual trust. Every partner company (PC), led by its management team, autonomously aims for sustainable business growth.

I believe many of the risks are in the field. In that sense, risk management can be performed most effectively by PCs, which are well versed in their respective regions and markets, rather than by Nippon Paint Holdings (NPHD), which is a pure holding company. Our PCs are pushing the boundaries of business activities beyond the conventional paint and coatings area into the adjacencies area (Paint++). In these areas, market characteristics vary from region to region, resulting in a good match with our autonomous business operations for producing locally for local consumption. The Nippon Paint Group currently operates in 45 countries and regions with the ratio of sales outside Japan exceeding 80% and approximately 33,000 employees around the world. In order for the Group to continue to grow and pursue MSV, it is crucial to maintain an environment where the management teams of our PCs, whom we selected and trust, can unlock their growth potential to the maximum extent. I believe this will increase the effectiveness of risk management at NPHD as the holding company. The Board of Directors properly monitors and responds to risks at the Group while respecting the autonomous growth of each PC based on mutual trust.

The Board of Directors must be able to constantly confirm that internal controls at each PC, with the oversight of the Co-Presidents, is effective as part of risk management for the entire Group. This is the major premise for the effective functioning of our trust-based autonomous and decentralized management based on the Asset Assembler model. This is why the Board worked with the Co-Presidents to revamp the Group’s internal control system in FY2021 with the aim of increasing the effectiveness of the Asset Assembler model.

Based on the redesigned Group internal control system, governance of the management team led by the Co-Presidents is based mainly on “the Global Risk Management Basic Policy” and “the Global Basic Policy of Whistleblowing Hotline," which both comply with “the Global Code of Conduct” and “the Basic Policy on Internal Control System.” I will briefly explain each of these guidelines.

“The Global Code of Conduct” is the preeminent guideline. The code sets out a list of 22 dos and don’ts as norms of compliance, ethics, and sustainability that must be shared and observed by everyone in the Group when dealing with integrity, working together, and respecting the environment and communities. This code was drafted under the leadership of the Co-Presidents and with a strong commitment of the heads of key PCs around the world. There were discussions from a global perspective that involved the heads of the compliance, finance, and HR departments with an eye on future growth in each region and market. I believe the code has been widely accepted and endorsed in every country and region precisely because it was drawn up with participation by the heads of our key PCs, rather than being created by the headquarters in a top-down fashion.

The revamped “Basic Policy on Internal Control System” stipulates that the Board of Directors delegates as much authority as possible for business operations to the Co-Presidents. In addition, the policy clearly specifies that every PC belongs to a Partner Company Group (PCG) based on regions or business activities. The Co-Presidents will give the head of each PCG the authority to conduct business operations and the responsibility for internal controls in order to pursue the maximization of autonomous growth of each PCG.

In accordance with the Basic Policy on Internal Control System, we revised “the Global Risk Management Basic Policy” as well as “the Global Basic Policy of Whistleblowing Hotline” that sets out rules for the establishment and operation of the hotline of each PCG.

In accordance with “the Global Risk Management Basic Policy,” we started in FY2022 a PCG assurance process, which includes a risk assessment survey called the Control Self-Assessment (CSA). Based on the shared values of the Global Code of Conduct, the heads of the PCGs will be required to perform self-inspections and autonomously evaluate risk items in the CSA, which encompasses important internal control risk factors. The PCG heads will also specify five major risks that they have identified and submit measures to respond to these risks to the Co-Presidents. Based on the reports from the heads of the PCGs, the Co-Presidents will identify risks at the Group in individual regions and businesses. They will give directions about effective monitoring and necessary risk responses by participating in the executive committee meetings of each PCG and on other occasions. The results will be reported to the Board of Directors after deliberations by the Audit Committee.

At the same time, every PCG has been autonomously operating their own internal report hotlines in accordance with “the Global Basic Policy of Whistleblowing Hotline.” Reports submitted in each region are submitted to the Co-Presidents and are subsequently reviewed by the Audit Committee and the Board of Directors.

There are challenges and risks that cannot be identified solely by the Group’s internal control system, which respects the autonomy of each PCG under the oversight of the Co-Presidents as described above. These are issues that require collective actions by all PCGs or that cannot be solved by activities by a single PCG in its business operations.

Typical examples are challenges and risks related to the six Materiality themes identified by NPHD, including "Climate change," "Diversity & Inclusion," and "Innovation for a sustainable future." I believe we will face more challenges and risks involving changes in global public opinion and our business environment as well as the activities of our competitors.

To respond to these challenges and risks, NPHD reorganized the sustainability structure in FY2022 under the leadership of the Co-Presidents into sustainability teams based on Materiality. Again, rather than using a top-down approach from headquarters, we established autonomous teams for a stronger link between sustainability and business operations. Led by business leaders with expertise in their respective theme areas, our Group is conducting sustainability initiatives globally.

Our sustainability structure started in FY2022 with four teams: "Environment & Safety," "People & Community," and "Innovation," which are based on Materiality, and "Governance," which has even broader coverage. In the second half of FY2022, the Sustainable Procurement team was added, resulting in a five-team structure. The aim is to strengthen our initiatives on ethical procurement, including the incorporation of human rights issues in procurement activities, in all themes of Materiality.

The Board of Directors, working with the Co-Presidents, have reaffirmed that sustainability activities of the Group are premised on our pursuit of MSV based on the Asset Assembler model. We have formulated and announced a Basic Policy on Sustainability that makes this stance clear.

These redesigned frameworks for the Group’s internal controls and sustainability have been thoroughly implemented at all PCGs due to the initiatives of the Co-Presidents. This is a key element of the strong mutual trust within our Group. The audit function at each PCG inspects the status of governance by their management team. Then, NPHD’s Audit Committee performs audits to confirm that the autonomous audit framework of the PCGs is working properly. By using this “Audit on Audit” system, we have improved the effectiveness and efficiency of the Group’s internal controls.

I have explained the key elements of the framework that the Board of Directors has built to fulfill our responsibility to properly monitor business operations at each PC and to respond to the Group’s risks through a sound check and balance function under the Co-Presidents, based on the Asset Assembler model that respects for the autonomy of every PC based on mutual trust.

Proper risk management is crucial for pursuing MSV through autonomous and decentralized management based on mutual trust. We will implement and update systems and frameworks wherever needed by closely monitoring trends in society and the status of our Group’s internal controls.

Our Governance Issues and Challenges

-

I believe the biggest governance issue and challenge at the Nippon Paint Group is whether the management team can continue to boldly take risks in a timely and appropriate manner for achieving Maximization of Shareholder Value (MSV).

The Asset Assembler model currently executed by the Co-Presidents pursues MSV based on autonomous and decentralized management built on mutual trust, which is a refinement of our previous business model called the Spider Web Management. Based on this model, we are aiming for more growth of existing businesses and making acquisitions to create additional opportunities for growth in the future by adding to our Group more high-quality businesses led by talented management teams.

Under the leadership of the Co-Presidents, the management of our partner companies, which are our existing assets, manage their operations with agility in the current very challenging business climate. Directors must fully understand the intent of proposals submitted by management and properly perform their supervision and support roles in order to avoid hindering the speed of decision making. In addition, Directors must constantly share their views and goals regarding the acquisition strategy with the management team so as not to miss an opportunity to add a new asset. The right path to pursue MSV is to aim for increasing the value of existing assets and adding new assets with strict adherence to financial discipline while making efforts to further deepen understanding of our Group by the capital markets.

Mutual trust between the parties performing the supervisory function in the Board of Directors and the management team, which conducts business operations, is essential for accomplishing this process. As a Company with Three Committees (Nominating, Compensation and Audit), Nippon Paint Holdings (NPHD) delegates significant authority to the management team. Naturally, the delegation of authority is premised on the Board’s confidence in the management team. Without this confidence, Directors would be required to closely analyze and manage risks associated with every proposal, resulting in excessive involvement in business decisions. This would slow down decision making, which could cause us to miss opportunities for growth. On the other hand, if Directors blindly trust the management team and automatically approves their proposals, we may incorrectly assess a proposal or miss an opportunity to avoid risks. This would increase the possibility of missing the next opportunity for growth. In addition, the management team cannot be expected to trust the supervisory function of the Board if we cannot give them proper advice. The management team will then lose motivation to discuss their growth strategies at the Board of Directors meetings in order to refine these strategies. The management may feel that they might as well opt to take actions that are neither good nor bad within the scope of their responsibility.

Achieving the proper balance is very difficult. The Nominating Committee of NPHD prioritizes experience involving corporate management, global business operations, and M&A for every Director (see another article of this series, titled “The Board’s Size and Skills Matrix” released on February 28, 2023.) Each Director has experience of making decisions on his/her own responsibility as a corporate executive to take risks with a commitment to the outcome, or to be required to give up on a project, by conducting a detailed analysis and gaining insight into risks associated with each proposal and measuring risk tolerance. Directors with this kind of background are expected to accurately identify the critical points of every agenda item and give appropriate advice without becoming excessively involved with the execution of business operations. Every Director needs to keep updated with the latest information both inside and outside the Group to examine proposals. As you would expect, our responsibility requires significant commitment and determination. We also hold the Independent Directors meetings at the same frequency as the Board of Directors meetings. At these meetings we exchange views and opinions and maintain our independence while enhancing mutual trust.

Let me go through the secondary offering of common stock by NPHD in January 2022* to explain the type of governance the Board of Directors is seeking. I hope this will further explain my true intent as the Board Chair when I say that the biggest governance issue and challenge at our Group is whether the management can continue to boldly take risks in a timely and appropriate manner for achieving MSV.

The low market liquidity of our stock relative to our market capitalization was obviously one of the major challenges we needed to deal with. The management team also has been seeking solutions for many years. We had confirmed the intention of six financial institutions to liquidate their holdings of our stock. However, we had only limited windows to conduct a secondary offering because we are constantly examining potential acquisitions and other projects. Stock prices were generally weak or decreasing, including our stock, due to the worldwide supply chain disruptions caused by the pandemic. There were concerns that a secondary offering at that time could significantly erode the price of our stock due to a temporary deterioration in the supply and demand balance. As a result, it was extremely difficult for us to determine the best time for the secondary offering. The Board of Directors carefully examined whether the management team was exploring every possible opportunity and method for a secondary offering and was able to monitor market conditions accurately. We also considered the possibility that not conducting a secondary offering at that time would impose restrictions on growth opportunities in the future. We maintained our support framework in order to reach quick decisions about proposals to be submitted by management.

The management team’s proposal for the secondary offering came when market visibility was not clear. However, management clearly explained that an international secondary stock offering would allow the Group to build a base of global investors who support our growth strategy with a long-term viewpoint. Furthermore, the offering was aimed at alleviating concerns about the potential sale of our stock held as crossholdings. Management also explained that the offering would improve the liquidity of our stock and contribute to meeting the listing maintenance criteria for the Prime Market of the Tokyo Stock Exchange. All things considered, the Board of Directors concluded that the offering was consistent with our commitment to pursue MSV based on the Asset Assembler model and approved the proposal.

If the Board’s highest priority was to avoid risks, we might have been inclined to postpone the offering because of insufficient objective information about market conditions. However, the Board of Directors must support the appropriate assumptions concerning risk by the management team in order to achieve our sole mission of MSV. It is our responsibility as Directors to make the best decisions based on all the information available at that time and by using our own wisdom. Our stock price was temporarily weak following the secondary offering. However, we were able to accomplish the initial objective and the price recovered in the second half of the year to a level comparable with the P/E ratios of prominent global competitors. Looking back, we couldn’t have achieved this outcome if we had delayed the decision. Naturally, the Compensation Committee of NPHD did not lower the evaluation of the management team on account of the temporary stock price decrease. We believe that a clear demonstration of the Board’s resolute stance on evaluations and recognition of the management team’s performance will further support their proper risk taking.

I stated that our group’s biggest governance issue and challenge is whether the management team can continue to boldly take risks in a timely and appropriate manner for achieving MSV. In other words, can the Board of Directors keep moving forward with the management team with a firm commitment to our responsibilities? This is the management based on mutual trust that the Board of Directors is seeking. We are confident that our Group can achieve sustainable growth based on the Asset Assembler model, which will definitely enable us to achieve MSV.

*This transaction was awarded Deal of the Year 2022 in the Equity Finance category selected by Nikkei Veritas.

The Co-President Structure

-

We decided that our current Co-President structure is the best management structure because Mr. Wee is the most capable executive for maximizing EPS while Mr. Wakatsuki is the most qualified for maximizing PER. We believe that collaboration between these two individuals on a truly equal footing is the best way to achieve MSV. (See here for our thinking underlying MSV.)

Mr. Wee studied aeronautical engineering and started his career with a Singapore-based aerospace and defense engineering company. He held various positions during his approximately 20 years with this company. He eventually managed this company as Deputy CEO. He also served as Member of the Singapore Parliament, and he has extensive experience in the public and private sectors. Since 2009, he has been the Group CEO of NIPSEA Group, which was our Asia JV at that time. While aggressively expanding business operations with a focus on Asia, he has implemented drastic reforms to turn around struggling businesses and companies. Under the leadership of Mr. Wee, NIPSEA Group had grown to become the core business of the Nippon Paint Group with revenue accounting for a little nearly 50% and operating profit nearly 70%* of the our group totals. During the acquisitions of Betek Boya in Tϋrkiye and DuluxGroup in Australia in 2019, his strong leadership created synergies across the Nippon Paint Group. Since his appointment as Deputy President and Executive Corporate Officer of Nippon Paint Holdings (NPHD) in March 2020, he has been instrumental in expanding our global operations.

Mr. Wakatsuki studied law at college and started his career with a Japanese bank. After moving to a global investment bank, he held senior positions in M&A and investment banking operations in Japan. His career as investment banker culminated in the Vice Chairman of the Investment Banking Division in the Japan Region. Based on his nearly 20 years of experience, he is well-versed in capital markets and has a broad range of knowledge and expertise for executing corporate growth strategies. He joined NPHD in November 2019 and was named CFO in January 2020. Immediately after this appointment, he started utilizing his acumen for enhancing communication with capital markets and efficiently obtaining long-term acquisition financing. He oversaw the full integration of the Asia JVs and the acquisition of the Indonesia business that were completed in January 2021. These transactions were highly rated by capital markets. He demonstrated his suitability as a next-generation leader even before his appointment as the Co-President. For instance, he made proposals for far-reaching measures to improve profitability in the Japan segment.

The Co-President structure could raise concerns about slowing decision-making due to the dual leadership and complications in the chain of command. However, our Co-Presidents share the same underlying view. Specifically, they are dedicated to management that values practical benefits by eliminating formalities and expediating decision-making and business execution to improve our performance. In addition, they are moving in the same direction. After carefully taking these factors into consideration, we determined that the organic combination of their management skills will contribute to the achievement of MSV.

It has been two years since we adopted the Co-President structure under the leadership of Co-Presidents Wakatsuki and Wee. During this time, the two Co-Presidents have pursued MSV by rapidly taking numerous actions with a view to the future. Examples include the transfer of the European automotive coatings business and India businesses to Wuthelam Group, the acquisitions of Cromology and JUB followed by the acquisition of NPT in Europe, the secondary offering of shares in overseas markets, creation of the Japan-focused functional company (NPCS), and the Next Career Plan voluntary retirement program. Under the Co-President structure, Co-Presidents Wakatsuki and Wee have utilized in many ways their expertise and strengths backed by their respective careers and based on the solid relationship of trust built on shared values and goals. This structure has led to the expansion of viewpoints and speedy and decisive corporate actions for management of the Nippon Paint Group.

At the Medium-Term Plan (FY2021-2023) Update Meeting held on April 7, Co-President Wakatsuki explained that our Medium-Term Plan is progressing steadily. Our performance is exceeding the guidance despite the dramatic changes in the business climate due to the pandemic, the conflict in Ukraine and other events. Of course we were not immune to the impact of these crises and experienced difficulties such as temporary closures of production bases and disruptions of supply of raw materials. However, our Group was able to overcome these challenges because management teams of our group partner companies autonomously implemented risk avoidance measures and group partner companies collaborated vertically and horizontally across regions and businesses with the leadership of our Co-Presidents. These activities clearly demonstrate the benefits of speedy decision-making under the Co-President structure. I believe we are well under way with the building of a solid foundation based on Asset Assembler model for pursuing MSV.

* Calculated based on the combined total of the FY2020 results of the NIPSEA business and Betek Boya

The Roles and Contributions of Independent Directors

-

First, as a Company with Three Committees (Nominating, Compensation and Audit), Nippon Paint Holdings has a strong commitment to separating the functions of execution and supervision by taking actions such as appointing the majority of Directors as Independent Directors. The key to the success of our governance structure is whether the Board of Directors, the supervisory body, and in particular Independent Directors, can truly fulfill our responsibility as representatives of shareholders.

The Independent Directors regard the general meeting of shareholders as the primary opportunity to hear the thoughts of shareholders and value this meeting as an occasion of overriding importance to directly engage with shareholders. However the shareholders meeting takes place only once a year. We create opportunities to receive information in a timely manner through monthly reports shared by the Co-Presidents and IR Department, keep track of the performance and stock price of Nippon Paint as well as competitors, and monitor industry trends in a timely manner. In addition, we use research reports to proactively collect and analyze information. In this manner, we constantly listen to the ideas and opinions of shareholders and investors.

We are committed to the timely and appropriate disclosure of information because we understand that investor engagement starts with communicating the thoughts of the management and the status of Group operations to shareholders and investors.

For instance, in the Integrated Report 2022, Chairman Goh explained anew the concept underlying our sole mission of Maximization of Shareholder Value (MSV). (See here for more information.) The report also has a dialogue between Independent Directors that explained in great detail the activities of the Compensation Committee as they created, by trial and error, executive compensation that contributes to MSV. (See here for more information.) In addition, the report had a feature article on the transfers of the European automotive coatings business and India businesses to Wuthelam Group that was decided in August 2021. This article explained thoroughly how the Special Committee and Board of Directors examined whether the transaction would protect the interests of minority shareholders and align with our pursuit of MSV.(See here for more information.)

We also launched another website series featuring Independent Directors that includes their profiles, strengths, approaches to deal with Nippon Paint’s challenges and other topics. (See here for more information.)

We believe that communicating our thoughts and messages from various angles will give our shareholders and potential shareholders a better understanding of our company and increase interest in our company, which in turn will produce more feedback. We are convinced that this process will build a foundation for a sound dialogue with shareholders and investors.

It is regrettable that I cannot meet each shareholder in person. However, as the Lead Independent Director and Board Chair, acting on behalf of the Board of Directors of Nippon Paint, I chair small investor meetings (FY2021, FY2022) and one-on-one investor meetings as activities for the Board of Directors to directly understand the comments and feedback of shareholders and investors. These inputs are made available to the public on our website and are shared at Board of Directors meetings. I may not be able to answer all questions from shareholders and investors at small investor meetings due to time constraints. However, I try to capitalize on an opportunity like this series of articles as a substitute for face-to-face dialogues with shareholders and investors to thoroughly answer questions. I hope that these activities will help shareholders and investors to evaluate the Nippon Paint Group.

As I stated earlier, the Directors place great value on the comments and opinions of shareholders and investors obtained through communication via the Integrated Report and our website as well as face-to-face investor meetings. We hope that these activities will move us closer to achieving MSV and thereby allow us to fulfill our responsibility as representatives of shareholders.

Finally, Nippon Paint Holdings has a compensation plan for Independent Directors in which restricted stock compensation makes up around 50 percent of the total compensation. Independent Directors also are minority shareholders of Nippon Paint Holdings and in this respect are in the same position with our shareholders in our pursuit of MSV. -

Our management team is guided by the Asset Assembler model, which is the autonomous and decentralized management of the Nippon Paint Group. Independent Directors, who are the counterpart in our responsibility to fulfill the supervisory function, never seek centralized management. Let alone micromanagement that controls even minute details of operations and conflicts with the separation of execution and supervision. Instead, we give the greater authority for execution to the local management teams. The natural outcome is the strong centrifugal force that characterizes our Group.

On the other hand, strengthening and speeding up our business operations also requires more powerful management oversight that reflects these changes. The Independent Directors have a duty to play a central role in this supervision of management. I believe that you are asking what types of activities we are using to fulfill this duty.

Independent Directors have requested the Co-Presidents to submit Co-President Reports to the Board of Directors with information about strategies and management’s actions regarding these strategies. These reports provide us with information that is the basis for our activities.

Our activities are not confined to the Board of Directors meetings. For instance, we hold off-site meetings for discussions about growth strategies and exchange views with Group Key Persons (GKP) and other leading management personnel of Group partner companies whenever necessary. I talked about this subject in the January article of this series, titled “Effectiveness of Board of Directors.” The article was posted on our website on January 31, 2023.

We also visit production sites to obtain more information about the front line of business activities. By taking some examples since 2020, we have visited production sites and had discussions with local management teams in Tochigi, Chiba, and Aichi in Japan as well as at a Group company in Malaysia, despite restrictions related to the pandemic.

Furthermore, we monitor the Group’s operations by participating in the Group Management Meeting (GMM). These meetings are held biannually by NIPSEA Group, which manages the Asia business that accounts for more than 50 percent of the Group’s revenue and operating profit.

The Board of Directors obtains information mainly through these activities. Insights gained by analyzing this information form the basis of discussions by the Board of Directors.

Ultimately, Independent Directors are expected to act as the supervisory body. Management of the Group’s businesses should be entirely entrusted to the leadership of the Co-Presidents, whom we trust and selected.

We spare no effort in constantly keeping up with the updates on the Group’s businesses, directly and indirectly acquiring knowledge about production sites, and listening to the GKPs and other leading management personnel. The purpose is to maintain the quality of communications and a suitable level of tension with the Co-Presidents to whom we entrusted the future of our Group.

In the February article of this series, titled “The Board’s Size and Skills Matrix,” I explained that the criteria we prioritize when selecting candidates for Directors of Nippon Paint Holdings are experience involving corporate management, global business operations and M&A. We are well aware of the risk that we may end up slowing down management or moderating decisions when bold decisions should be taken by excessively interfering with business operations because of our experience in these three areas.

The sole mission of Nippon Paint Group is MSV. Independent Directors will continue our efforts to deepen our understanding of the Group’s management as I have just explained. At the same time, we will strengthen the separation of the functions of execution and supervision and pursue MSV backed by sound governance.

The Board’s Size and Skills Matrix

-

The Board of Directors of Nippon Paint is responsible for properly exercising authority based on the recognition of obligations to all stakeholders, with the ultimate goal of achieving Maximization of Shareholder Value (MSV) in the medium and long term. For this purpose, we have currently 11 members of Directors, which is suitable to deepen our mutual trust, and Independent Directors are the majority of the Board. In nominating Director candidates, we also take into consideration the balance of experience and skills of individual board members based on a skills matrix.

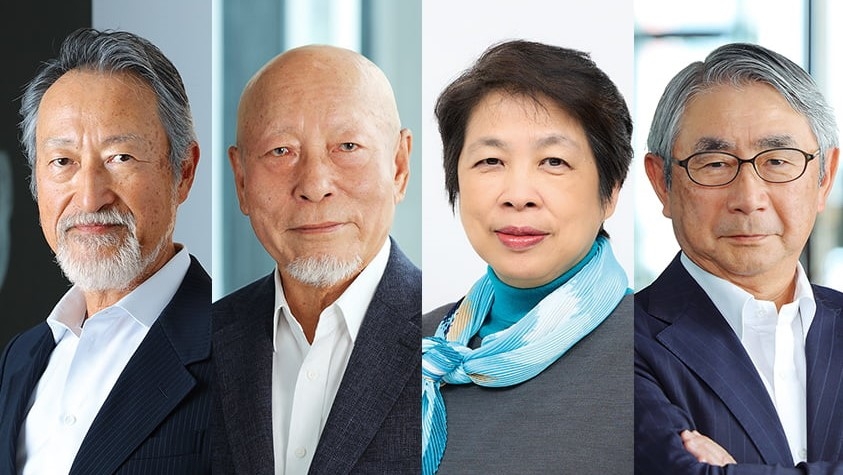

Contributions of Independent Directors are a premise for achieving MSV. Since we shifted to a Company with Three Committees (Nominating, Compensation and Audit) in 2020, we have constantly maintained a Board structure with Independent Directors forming a majority as the size of the Board varied slightly from time to time. This Board structure allows Independent Directors to perform the supervisory function by giving advice to the management based on their knowledge and expertise in order to encourage Nippon Paint Group to achieve sustainable growth and MSV in the medium and long term. We currently have 11 Directors (as of February 28, 2023), of which eight are Independent Directors. Besides these Independent Directors, the Board has Director Goh, who serves as the Non-Executive Chairman of the Board, as well as Directors Wakatsuki and Wee, who concurrently serve as Representative Executive Officers & Co-Presidents, with the aim of strengthening communication between execution and supervision.

The Directors have diverse backgrounds including extensive experience at business companies, financial institutions, and professional service providers. In addition, our Board is sufficiently diverse regarding nationality and gender.

We have a unique process for maintaining the diversity of the Board of Directors.

We do not simply create one-size-fits-all successor plans for Directors and Executive Officers first and then identify and narrow down the list of candidates who fit in the missing pieces. The Board of Directors of Nippon Paint Holdings is committed to deepening and broadening truly effective discussions. Rather than pursuing the appropriate size of the Board or ideal skill sets required of Board members, we are focused on determining whether our candidates are trustworthy. This comprehensive process takes into account their backgrounds and characters to determine what kind of performance can be expected. In other words, our approach, throughout the whole process, is based solely on the characteristics of each individual and personal connections.

Everyone we identified based on this approach as absolutely trustworthy board members to share the common mission of MSV has experience in three areas: corporate management, global business operations, and M&A. The experience gained in the course of their careers in these areas, which are designated in our skills matrix, is vital for the Directors of the Nippon Paint Group as we evolve based on Asset Assembler model. The people we determine to be trustworthy have specialized skills (finance, legal affairs, IT/digital, manufacturing/technology/R&D and other professional fields) backed by experience in those areas. The Directors’ performance of their professional capabilities to the fullest is what enables deep and thorough discussions at the Board of Directors meetings of Nippon Paint Holdings.

Future Director candidates may not be automatically selected or rejected based on these criteria. The selection of Director candidates should be strictly based on connections with people and mutual trust that is firmly established through sufficient communication.

For example, Director Kirby, who was newly elected in March 2022, was the CEO of a global paint manufacturer for many years. We knew very well about his business acumen and character before he was nominated as a Director candidate. Director Lim has experience at Temasek Holdings, which is owned by the Government of Singapore, and has also demonstrated her leadership in Singapore political circles, which we saw on a first-hand basis. They were selected as candidates by the Nominating Committee after direct communications. This process of selecting Director candidates by getting to know them well and assessing their qualification is very insightful. Therefore, the current Board structure and skills matrix are the outcome of our efforts to find individuals with the skills and characteristics required for more progress with our Asset Assembler model to achieve MSV.

Nippon Paint Groups adopts the same approach for selecting M&A targets. We never use the approach of narrowing down a long list of paint and coatings manufacturers worldwide by the so-called acquisition criteria. As we grow in our paint business and expand operations in the Paint++ business, we are adding new relationships based on direct contact. We thoroughly communicate with these new members of our group to identify people who are truly trustworthy and then work with these management teams as partners. We are convinced that this is the best approach for our Asset Assembler model based on autonomous and decentralized management.

As the Nippon Paint Group grows, the Board of Directors must use an even broader perspective in order to provide guidance needed to determine the future of the group. Naturally, the characteristics of the supervisory function that is demanded of the Directors is always changing. The Board of Directors will continue its evolution by constantly building and maintaining a team that can meet the ever-changing requirements for the sound management of the Nippon Paint Group.

Effectiveness of Board of Directors

-

In pursuit of our sole mission of Maximization of Shareholder Value (MSV), we should assess the “effectiveness of Board of Directors” by shareholder value from a medium- and long-term perspective.

We firmly believe that the best approach to achieve MSV is group management based on mutual trust, which we call Asset Assembler model. Naturally, it is essential for the Board of Directors to make an effort to deepen trust among Directors and between Directors and the executives. This trust is the crucial key to improve the effectiveness of Board of Directors. We recognize that mutual trust can be a measure of the Board’s effectiveness at this time.

To build mutual trust, each Director maintains close communications with other Directors even outside the Board of Directors meetings and the Committee meetings. In addition, we hold a meeting of Independent Directors after every Board of Directors meeting to exchange opinions on the operations and discussions of Board of Directors. We also receive the input of the executives, including the group’s leading management personnel called Global Key Persons (GKPs). For example, at the Audit Committee, we constantly engage in dialogues with the management team of each partner company. In 2022, there were 16 of these sessions. Our feedback on the outcome of growth strategies and recognition of challenges involving local operations obtained through such communication are shared in the Board of Directors. As we pursue autonomous and decentralized management, these communications with the management of partner companies have allowed us to discuss effective growth strategies based on the actual status of our businesses without falling into armchair planning. We believe the cornerstone of our contribution as Independent Directors is to share opinions collected in this way with the Co-Presidents and Chairman Goh, to ensure an alignment of opinions with them. We believe that discussions in the Board of Directors based on this opinion-sharing will enhance the quality of the Board’s decision-making.

We conduct an objective assessment of the progress of our actions to improve the effectiveness of Board of Directors every year, including comparisons with other companies, through Board Advisors Japan, Inc., a third-party organization. Overall, the results of the Board’s evaluation in 2022 showed that “the Board’s effectiveness is generally ensured” and all Directors are “engaging in active discussions from the viewpoint of supporting the management” by applying insights linked to their professional knowledge. Based on these results, we think we have made progress to a certain degree. In addition, we recognize that there is a greater need for “contributions of Independent Directors” than ever to further improve the effectiveness of Board of Directors. We accept the results sincerely and constantly review and take actions to address the Board’s challenges with a commitment to take the board’s discussions to a higher level and achieve MSV. -

We aim to drive the growth of our businesses based on two major strategies. One is the organic growth of our existing businesses; the other is inorganic growth driven by assembling new assets through acquisitions.

To achieve these two types of growth, I believe the timely and appropriate financing as well as the perspective of building a proper business portfolio are essential. For instance, the Board of Directors is expected to provide assistance to enable the executives to make the best judgements for growth, such as existing business investments and divestitures and acquisitions of new businesses, based on a bird’s eye grasp of different situations involving our business fields.

In the global paint and coatings market, the 10 leading companies including Nippon Paint have a share of less than 50%. Small and mid-sized companies are competing intensely for the remaining share. Furthermore, the adjacencies market, which we coined “Paint++”, is estimated to be around three times larger than the paint and coatings market. I believe that Directors can further upgrade discussions about growth strategies by viewing all of these businesses as growing in the global markets and optimizing investment decisions based on a rigorous and objective assessment of our business portfolio with our eyes on business opportunities for growth.

At the off-site meeting held in August 2022, we examined the uniqueness and superiority of our strategy compared to the strategies of our global competitors. We thoroughly discussed our growth strategy such as by reexamining the positioning of Asset Assembler model in relation to the business models of other companies in broad range of sectors. We also deepened our discussions on our group’s growth potential based on the “Paint ++” strategy that is overseen by the Co-presidents and other executives, and on the adequate forms of financing for implementing this strategy. These discussions have allowed us to establish in greater detail our road map to MSV. Achieving a common understanding and deepening a mutual understanding of issues facing our group in order to drive the group’s growth have contributed to improving the quality of deliberations about each agenda item at the Board of Directors meetings. The assessment of the Board of Directors’ effectiveness in 2022 highly rated the Board’s activities for “creating an opportunity to discuss the company’s key strategy over time.” Also, there were comments that “the Board of Directors mostly discussed important subjects, such as medium- to long-term management strategy” with “the commitment to pursue Maximization of Shareholder Value (MSV) shared among the board members.”

The biggest challenge concerning our group’s corporate governance is whether the executives can continue to boldly take risks in a timely and appropriate manner in the pursuit of MSV. Based on mutual trust as I mentioned earlier, the Board of Directors is constantly receiving necessary updates from the executives, in response to which the Board members are strengthening our support for their risk taking in the pursuit of MSV.

The archive of Q&A summary

Please visit the Presentation and Videos page for the archive of materials.