The ideal form of the group audit system to pursue MSV based on Asset Assembler model

What is the effective and efficient implementation of group audits based on respect for autonomy of partner companies (PCs), which we aim for as a global business group? Independent Directors Masayoshi Nakamura (Board Chair) and Masataka Mitsuhashi (Audit Committee Chairperson) look back on discussions held repeatedly by the Board of Directors and the Audit Committee regarding the appropriate approach to group audits at NPHD and changes in the audit system for group audits. The focus of discussion in this dialogue are the ideal form of group audits that contributes to MSV and the challenges that must be overcome.

1. Transition from the Board of Corporate Auditors to the Audit Committee

| Nakamura |

It’s been three years since NPHD changed its corporate governance structure from a Company with a Board of Corporate Auditors to a Company with Three Committees (Nominating, Compensation and Audit). One of the aims set out by the Board for implementing this change was to strengthen our global audit system. Under Asset Assembler model led by our Co-Presidents, NPHD is now working to build up quality assets to accomplish sustainable growth and to ultimately achieve MSV. In this model, Co-Presidents delegate the business execution authority and the internal controls responsibility to the head of each Partner Company Group (PCG) based on a relationship of mutual trust. The underlying idea is to maximize autonomous growth of every PCG. The Board is responsible for oversight of the Group’s management team, starting with Co-Presidents, that is in charge of business operations spanning 45 countries and regions around the world. And in terms of the Board’s functions, maintaining appropriate transparency in Group operations and supporting timely and appropriate risk-taking by the management are of utmost importance. In this respect, there is a growing need to strengthen the group audit system and ensure its effectiveness. “What is the ideal form of group audit system for pursuing MSV under Asset Assembler model?” This is the topic explored in today’s discussion with Mr. Mitsuhashi, who has been the Audit Committee Chairperson since NPHD became a Company with Three Committees. We will look back on our past activities and discuss our current challenges and goals for the future. First, please explain the situation when you were elected the Audit Committee Chairperson in March 2020. What was your intention when we changed to the Audit Committee under a Company with Three Committees from the Board of Corporate Auditors? |

|---|---|

| Mitsuhashi | In 2019, the year before the establishment of the Audit Committee, NPHD completed the acquisition of Betek Boya in Turkey and DuluxGroup in Australia. Following these acquisitions, our Group’s portfolio further expanded globally. During this time, the Board had its eyes set on the full integration of the Asian JVs as our Company’s next step towards achieving MSV. We believed that our Company needed to separate the oversight of business operations from the execution and strengthen both of these functions. We also wanted to establish an objective and transparent corporate governance structure from a global perspective. The Board of Corporate Auditors is a common organizational structure for Japanese companies. Overseas investors consider companies with this structure as lacking sufficient checks and balances on management from the corporate governance perspective because Corporate Auditors do not have voting rights at the Board meeting. On the other hand, at a Company with Three Committees, Independent Directors are the majority of the Audit Committee that performs the management oversight function. The Audit Committee members participate in management decision making by voting at meetings of the Board of Directors, which is responsible for protecting the interests of shareholders. This process increases the transparency of management. I believe it was only natural that NPHD as a global business group transitioned to a Company with Three Committees. |

| Nakamura | Let me dig deeper into the background that required NPHD to quickly strengthen its group audit system at that time. What were the issues you had identified that instigated this move? |

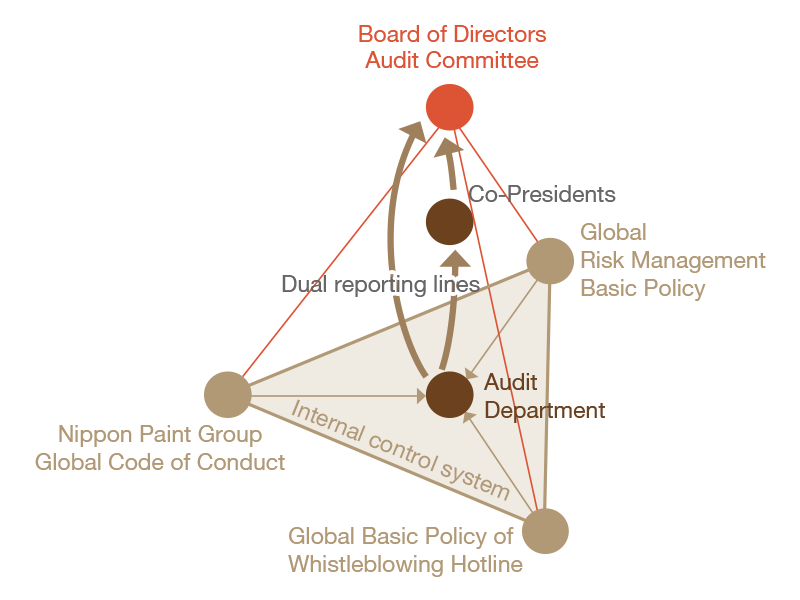

| Mitsuhashi | Following the occurrence of quality fraud issues at a number of manufacturing companies in Japan that started around the end of 2017, rebuilding internal controls and internal audits at Japanese companies became the focus of attention. We couldn’t see this as somebody else’s problem. In fact, there were instances at our key Japanese subsidiaries involving the failure to promptly report to our headquarters about customers’ complaints caused by inadequate quality management. As a result, there was an urgent need for the reform of our organization and culture to correct the distortions and insufficient discipline in our customs and rules. We believed that a reexamination of the business processes in our Group by the Audit Committee, whose members are Independent Directors, from an objective viewpoint can catalyze the organizational shakeup needed to eliminate routine work done just for the sake of conforming to official procedures. We created dual reporting lines to the President and the Audit Committee for the Audit Department, which is the internal audit unit of NPHD, when this committee was established. We believe this laid the groundwork for strengthening cooperation involving audits between the internal audit function on the management side and the Audit Committee. |

| Nakamura | In addition to these dual reporting lines, you proposed the concept of “Audit on Audit” as a group audit system as soon as the Audit Committee was established. What was the aim of this concept, Mr. Mitsuhashi? How did you arrive at this concept? |

| Mitsuhashi |

The group audit system plays a part in the management structure and business model of our Group. Before explaining “Audit on Audit”, let’s look back on the significant changes in the management structure and business model of our Group in recent years. The transition process can be broken down into three stages. The initial stage is the period between the consolidation of the Asian JVs (an increase in NPHD’s ownership ratio from 40% to 51%) in December 2014 and the end of 2019, when we pursued the World Headquarters (WHQ)/Regional Headquarters (RHQ) model. The second stage is Spider Web Management, which we started with the transition to a Company with Three Committees in March 2020. The third stage is the current period with Asset Assembler model based on autonomous and decentralized management, which we started following the establishment of the Co-President structure after the completion of the full integration of the Asian JVs and the acquisition of the Indonesia business in January 2021. In the WHQ/RHQ model stage, the management team was pursuing a stronger group control function with the headquarters in Japan serving as WHQ in a centralized manner. Another goal was growth suited to the business environment of each region and business through regional controls based on the delegation of authority to RHQs, which are managed by executives seconded from WHQ. The start of my time as the Audit Committee Chairperson was when our Group was transitioning from the WHQ/ RHQ model to taking a step forward towards Spider Web Management with greater focus on the autonomy of every PC. NPHD was the core of the Group control function as WHQ. At the newly established Audit Committee, I proposed the concept of “Audit on Audit” that aims to increase the effectiveness of audits across the Group. NPHD’s internal audit unit performs on-site audits of PCs in every region and country while referring to and utilizing the audit results submitted by the PCs. The aim was to effectively utilize audits that were performed autonomously in Japan and overseas based on the RHQ structure that was already in place. The Audit Committee was just starting up at that time. The NPHD Audit Department as well as the Audit Committee members were conducting on-site audits of PCs in order to check their status by using the objective viewpoint of the Audit Committee. |

| Nakamura | What were the challenges you identified when you were working to improve the effectiveness of the group audit system based on “Audit on Audit”? |

| Mitsuhashi |

The “Audit on Audit” framework in those days was primarily focused on on-site audits at PCs by the NPHD Audit Department while also referring to and utilizing the audit results submitted by the PCs. As a result, the challenge I identified for the NPHD Audit Department to address was to have sufficient resources and strengthen knowhow concerning on-site audits. There were issues such as delays in reporting deficiencies in quality management at our PCs in Japan, as I mentioned earlier. In addition, risk assessments and responses as well as risk reporting were not done appropriately. Also, these PCs did not appear to have a sufficient commitment to taking actions to remediate the issues identified by audits. On the other hand, there were some instances of successful auditing practices in our Group, which was already operating worldwide. One of them was DuluxGroup in Australia, which was using an advanced, risk-based approach by outsourcing internal audits to a local audit firm. DuluxGroup determined the importance of risk factors and performed risk management by measuring the possibility of events and the impact of the events when they happened. In addition, there were recommendations from the standpoint of opportunity loss and other perspectives. DuluxGroup used its Audit Risk Committee, which meets three times a year, to share information about risk factors with senior management. Another example was NIPSEA, which operates mainly in Asia. NIPSEA was using the approach of proposing solutions to business challenges based on Corporate Assurance Reviews, rather than using the conventional approach of merely pointing out issues. NIPSEA used a small team to perform assessments focused on business operations with the goal of increasing the value of their businesses. |

| Nakamura | As the Audit Committee Chairperson, you thought at that time that increasing the trustworthiness of audit information in every region would be essential for enhancing the effectiveness of group audits based on “Audit on Audit” framework. And you believed that our internal audit function needed to be strengthened to improve the audit quality across the entire Group. Is that correct? |

| Mitsuhashi | Exactly. The Audit Committee understood that it was vital to improve audit quality throughout the Group by incorporating these best practices and deploying them at all Group companies. When we established the Audit Committee, we formulated an Audit Policy of the Audit Committee by foreseeing an ideal status of our Group’s global audit system to be achieved 10 years later in 2030 with the mission of “Provide risk-based, objective assurance, protection, advice, and insight to maximize shareholder value which is our management mission.” I believe that further enhancing the effectiveness of the group audit by implementing and evolving “Audit on Audit” framework will lead to accomplishing our mission. |

2. Adoption of Asset Assembler model based on the Co-President structure

| Nakamura | A comparison of our performance in FY2019, just before the transition of NPHD to a Company with Three Committees, and our FY2023 guidance reflects a double-fold growth in consolidated revenue from JPY692 bn to JPY1,400 bn, a climb in number of employees from around 26,000 to around 34,000, and an increase in number of consolidated subsidiaries from 197 to over 240. During this time, we completed the full integration of the Asian JVs and the acquisition of the Indonesia business in January 2021, achieving further unity as a Group. Following the start of the Co-President structure in April 2021, our Company’s governance structure changed significantly based on Asset Assembler model spearheaded by Co-Presidents. The group audit system is an important component of our governance structure. How did the group audit system centered on “Audit on Audit” change during this process? |

|---|---|

| Mitsuhashi |

During the evolution of our Group’s management structure and business model from the Spider Web Management model to Asset Assembler model based on autonomous and decentralized management, the Audit Committee explored the ideal form of the group audit system regarding effectiveness and efficiency. Previously, members of the NPHD Audit Department in Japan who were assigned to a specific PC visited companies to conduct audits in accordance with the policy of strengthening the group’s control functions with NPHD as WHQ. However, I identified some issues. For instance, when we conduct audits in Indonesia, wouldn’t audits be more effective if we entrust the work to the internal audit unit of our Indonesian PC? After all, these people know the actual business conditions and have much better understanding of local laws and regulations, business customs, and labor practices than auditors sent from Japan do. And wouldn’t audits be more efficient by using an approach in which the PCGs autonomously establish and operate governance and risk control systems and NPHD would monitor the status of their governance and risk controls by using a small number of people rather than implementing centralized controls by maintaining a large team of internal auditors at the headquarters? Considering the quality and scale of resources necessary for establishing an audit system and the cost of implementing this system, I believed that we can better keep a balance between the effectiveness and efficiency of audits by conducting group audits based on the results of audits performed by the PCGs, rather than having the NPHD Audit Department perform on-site audits. Our “Audit on Audit” framework, which was launched in March 2020, started evolving based on Asset Assembler model. |

| Nakamura | I believe you faced challenges pursuing an audit system that relies on audits performed by each PCG. What actions did you take to lay the groundwork for evolving the “Audit on Audit” framework? |

| Mitsuhashi |

3. Further upgrading the "Audit on Audit" framework based on a trust-based relationship

The foundation of the “Audit on Audit” framework is trust-based relationships with Co-Presidents, the head of each PCG and other key executives.

| Nakamura | Under the “Audit on Audit” framework, PCGs’ autonomous management is key to effective and efficient group audits. Well understood. Now, for this framework to function successfully, I believe trust, which is an essential premise in our group management, plays an important role. How have you been building, maintaining, and increasing trust with members of each PCG and other key management personnel? |

|---|---|

| Mitsuhashi |

The foundation of the “Audit on Audit” framework is trust-based relationships with external audit organizations in each region and country as well as with Co-Presidents, the head of each PCG and other key executives. Firstly, everything starts with the trustbased relationship with Co-Presidents. Prior to the current Co-President structure, we were unable to make a decision to change our audit system to the “Audit on Audit” framework based on trust. Mr. Wee was the driving force for making NIPSEA the core business of our Group, with revenue accounting for approximately 50% and operating profit for over 60% of our consolidated results of operations. He is well versed in the global management of the paint and coatings and adjacencies businesses. Mr. Wakatsuki has extensive knowledge of the capital markets and excels in the assessment and management of assets based on his experience of successfully completing numerous M&A transactions. We were very fortunate to have the opportunity to name these two highly skilled executives with exceptional communication skills as Co-Presidents following the full integration of the Asian JVs. As I mentioned earlier, Directors worked with Co-Presidents to revamp the Group internal control structure to ensure that internal controls autonomously implemented by PCGs are effective as group-level internal controls. The successful operation of this framework will depend on the leadership of Co-Presidents. Close and substantive communications based on mutual trust with Co-Presidents are vital for this success. Another important element is the trust-based relationship with the heads of PCGs and other key management personnel. As I stated earlier, we use the following audit approach. The internal audit unit of each PCG autonomously conducts audits with a focus on key points with an awareness of risks by taking into consideration factors such as local business customs, laws, and labor practices. Our approach is not to have the NPHD Audit Department visit every PCG and perform audits on predetermined items. Based on our audit approach, close communications by the Audit Committee and NPHD Audit Department with the internal audit unit of the PCGs is essential to share audit results and know-how across the Group. In addition, the Audit Committee needs to confirm that the internal audit departments of all PCGs are properly conducting audits as expected. These audits are possible only if we have sound lines of communication and highquality information sharing based on mutual trust. For instance, NPHD recorded provisions for doubtful accounts amounting to JPY3.6 bn in FY2021 and JPY13.0 bn in the 2Q of FY2022. For these provisions, the Board of Directors and the Audit Committee closely monitored real estate market conditions in China and focused on controlling risk from the initial stage of this matter. I believe this is another example of how communications among Co-Presidents, management teams in China and the Board, based on mutual trust, were extremely useful for an accurate understanding of the overall picture and discussions to determine appropriate responses. The Audit Committee and NPHD Audit Department regularly receive reports from every PCG. In addition, we regularly interview management teams and external auditors to confirm that they are aware of management issues or potential risks in order to confirm that “Audit on Audit” is working effectively. The key to the efficient operation of this system is autonomous and effective audits by the PCGs and our full understanding of the status of each PCG through close communication based on mutual trust and the multifaceted information. The Audit Committee has created many opportunities for communication with the management teams of PCGs in order to build trust-based relationships. Since 2020, when the Audit Committee was established, the Committee members have directly communicated with the management teams of PCGs as often as the circumstances allowed under pandemic-related restrictions. We have had around 40 meetings, which allowed us to have candid and reciprocal communications about identified risk factors and their solutions, including the management strategies of each PCG. I believe that these communications made it possible to build the trust-based relationships we have now. GAC was established right after the Audit Committee was launched. At the sixth GAC meeting in Tokyo in March 2023, key members of PCGs around the world met in person for the first time. I believe that the “Audit on Audit” framework will be strengthened further by building trustbased relationships through these communications. |

4. Aiming to further contribute to MSV

The Audit Committee will pursue MSV by enhancing the effectiveness and efficiency of its oversight activities.

| Nakamura | Your explanations have helped me understand the background on why our Company adopted the concept of “Audit on Audit.” Now, let me ask you about your future vision of the group audit structure that contributes to MSV. What are the challenges you have identified and how are you going to address them? |

|---|---|

| Mitsuhashi |

The Audit Committee conducts an evaluation of its effectiveness every year and incorporates the results in our activities during the following year. The evaluation is also used to identify important themes for the following year. Topics identified for FY2022 were “effectiveness of responses to ESG and SDGs” and “effectiveness of the IT governance and information system structures.” For FY2023, our activities will be focused more on themes such as “effectiveness of risk management system monitoring” and “effectiveness of linkage between internal audit monitoring and audits by the Audit Committee.” Looking slightly to the future, I want to mention what the Audit Committee has been discussing for addressing long-term challenges related to our group audit system. The Audit Committee has identified “limitations of the human activities” as a challenge. Due to progress with the digitalization of management data, the Audit Committee needs to consider the possibility of shifting to digital-based committee activities that effectively use digital information. In addition, our own auditing activities will have to start using digital tools for the use of digital data. Properly performing audits that reflect risk levels requires an awareness of risk factors in each risk category and accurately identifying remaining risks to confirm that these inherent risks are correctly managed. Identifying remaining risk factors in all the key risk areas in this manner will allow the PCGs to objectively determine the areas with high potential risk and the appropriate allocation of audit resources. Some PCGs in the Group have already established audit plans by using a digital approach and efficiently and objectively allocating audit resources. We need to deploy these approaches at all Group companies to improve the quality and efficiency of audits. This will enable us to track changes in remaining risks through comparisons with the prior year data. Then, PCG management teams will be able to share their recognition of risks with the headquarters on a more timely basis. In addition, this will enable us to more efficiently monitor detailed risk information at PCGs, which is an asset of our Group, and the risk status of the Group as a whole in our group audit based on the ]“Audit on Audit” framework. |

| Nakamura | Once the management data and audit approaches are digitalized, how will the Audit Committee be involved and what roles will it play? |

| Mitsuhashi |

The Audit Committee will oversee every PCG from the perspective of how they utilize digitized management data and the results of the analysis of this information. Our stance on respecting the autonomous management of PCGs will remain the same. What will change is that our activities will focus on what advice we can provide to PCGs based on digitized management data. As our Group shifts from human responses to digital-based governance, risk controls using AI and other digital technology, the Audit Committee will pursue MSV by enhancing the effectiveness and efficiency of its oversight activities. |

| Nakamura | Thank you for the fruitful discussion today. We were able to cover the evolution of the management structure of our Group, the reasons for the launch of the “Audit on Audit” framework, which the Audit Committee proposed and implemented, and the future of the group audit system that contributes to MSV. |