Share transfer of the European automotive coatings business and India businesses

—A move based on discussions at the Board of Directors and the Special Committee from the standpoint of protecting the interests of minority shareholders—

NPHD’s Board of Directors is committed to improving the transparency, objectivity, and fairness of management by holding thorough exchanges of opinions and discussions, mainly by the Independent Directors who comprise the majority of the Board. The Board of Directors* held many discussions on whether NPHD can ensure the protection of the interests of minority shareholders in association with the transfer of the European automotive coatings business and India businesses to Wuthelam Group. This page explains the objective of this transaction and views of each Director.

* Director Goh is an interested party and did not participate in any meetings regarding this transaction.

Key points of this transaction

- The transfer of these businesses to Wuthelam Group will sufficiently contribute to Nippon Paint Group’s sustained growth over the medium and long term.

- Risk involving this transaction is diversified because Wuthelam Group will be responsible for additional investments and expenses required for short-term business restructuring.

- The board determined that the transaction is rational because it will be EPS accretive and NPHD will have an option to buy back the businesses in the future (call option). This transaction is also rational regarding the protection of the interests of minority shareholders and Maximization of Shareholder Value (MSV).

- Impact on consolidated earnings (Billion yen)*1

-

Revenue -14.4 Operating profit +2.9 Profit before tax +2.9 Profit*2 +2.9 *1 Assuming that the transaction was reflected in consolidated earnings starting on August 1, 2021

*2 Profit attributable to owners of parent

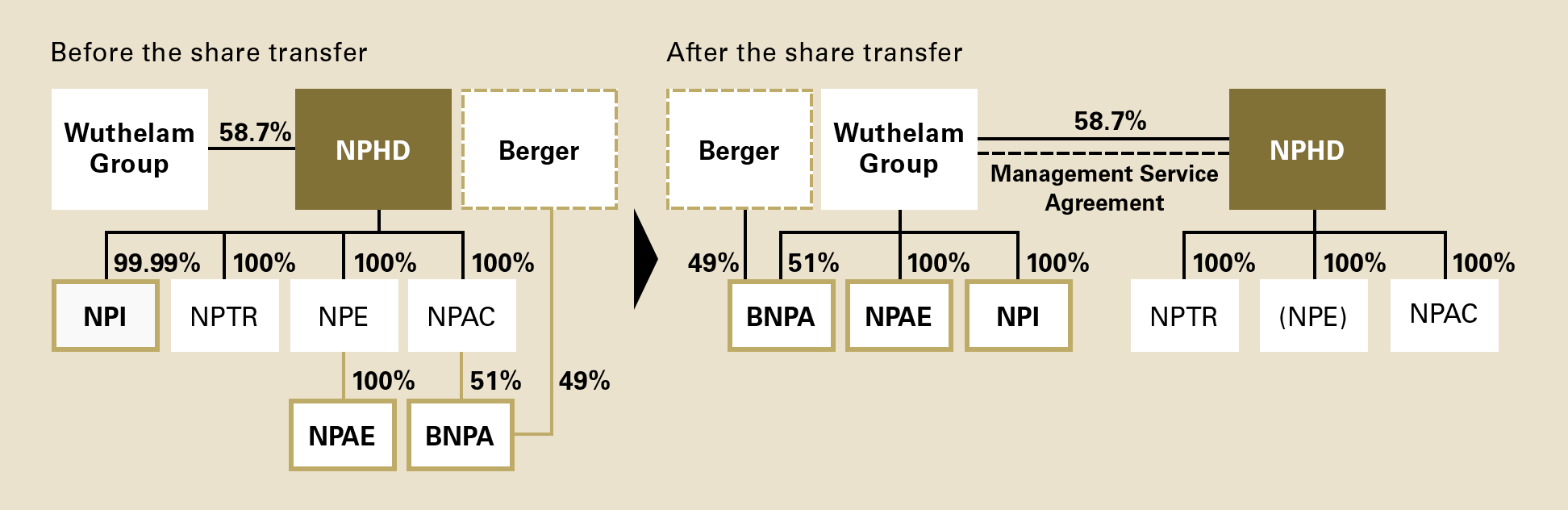

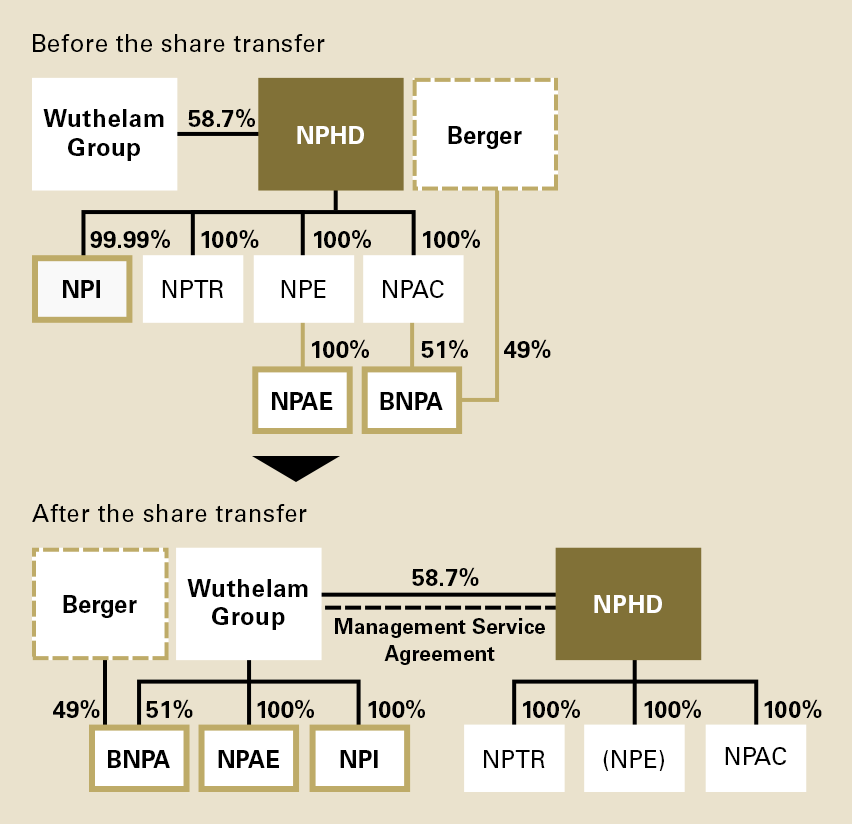

- Change in the capital relationship due to the transfer of the businesses to Wuthelam Group

-

* NPI: Nippon Paint (India) Private Limited / NPTR: Nippon Paint Türkiye Boya San. Ve Tic. Anonim.Sti / NPE: Nippon Paint (Europe) Ltd. / NPAE: Nippon Paint Automotive Europe GmbH / BNPA: Berger Nippon Paint Automotive Coatings Private Limited

Q&A at the Board of Directors Meeting

-

AThe business environment changed significantly after 2019 due to the pandemic, shortage of semiconductor chips, and high prices of raw materials. As a result, we started considering the transaction in order to reexamine the strategy that we had established when the impairment loss was recorded. One option was to withdraw from the European market. However, we needed to keep our operations in Europe to maintain access to European automobile manufacturers, which have a growing presence in China. In addition, we knew that the Indian market has many opportunities for growth. Taking these factors into account, we determined that we must make significant investments for business restructuring and reinforcement in order to achieve growth in these regions over the medium and long term.

-

AWe examined numerous options, all based on the recognition that the European and India markets will remain strategically important. Two possibilities were restructuring the businesses by ourselves and divesting the businesses to a third party. If we attempt to restructure the businesses by ourselves, there would be a significant short-term financial burden. In addition, Europe and India are difficult markets. We were concerned about the possibility that the use of funds to turn around these businesses would not contribute to MSV from the perspective of risk and return. Moreover, divesting the businesses to a third party would make it difficult for us to buy them back, causing us to lose an option involving the growth potential of our businesses. The Wuthelam Group decided to bear the risks involved and allow us to make a decision about buying back the businesses in the future. After comparing this with other restructuring plans, we decided that the share transfer to Wuthelam Group would be the best plan from the perspective of MSV and protection of the interests of minority shareholders.

-

AThere is no guarantee that the businesses will be turned around as a result of this transaction. The Wuthelam Group will entrust management of the businesses to Nippon Paint Group while bearing the financial risk. Nippon Paint Group will continue to be responsible for supplying automotive coatings in Europe and assume business risk. This scheme of delisting a business temporarily to implement drastic, medium- and long-term measures aimed at a turnaround is often used in management buyout (MBO) deals.

-

AWe have confirmed that the businesses will be excluded from the scope of consolidation even if a call option is granted assuming that the buyback will not take place within one year after the share transfer.

-

AThis is strictly a business divestiture. NPHD will have the right to buy back the businesses in the future but is not obligated to do so. Therefore, this transaction is not intended to postpone impairment charges and losses.

-

AThe Special Committee has verified that entrusting the management of the businesses that were transferred is reasonable. Furthermore, this transaction will not significantly affect Nippon Paint Group’s earnings. Regarding business risk, Nippon Paint Group will be entrusted by Wuthelam Group to continue to manage and operate the businesses that were transferred without changing their names. As a result, we believe the impact of the transfer of the businesses, including customer relationships, will be minimal. Regarding capital risk, Wuthelam Group will bear the cost of restructuring measures, such as strengthening the business structure and conducting aggressive sales promotion activities.

-

AWe will explain that Director Goh did not participate in the Board of Directors and Special Committee meetings to examine and negotiate the share transfer to ensure independence from Wuthelam Group and that we make a fair judgment about the pros and cons of the share transfer and the rationality of the terms. Just as when NPHD fully integrated the Asian JVs, Wuthelam Group’s stance remains unchanged that Nippon Paint Group’s earnings growth will be in the interests of Wuthelam Group. Our explanation to the public will emphasize that Wuthelam Group is not expecting to profit from this transaction nor does it expect to earn a capital gain if Nippon Paint Group exercises the call option.

Pages related to Corporate Governance

- Integrated Report 2022 (Digital Edition)