Towards the establishment of an executive compensation plan that truly contributes to Maximization of Shareholder Value (MSV)

Why we considered the executive compensation plan compensation system developed by the Compensation Committee will contribute to the achievement of MSV and what were the discussions we held toward creating such a plan?

— On this page, Independent Directors, Masayoshi Nakamura (Board Chair) and Takashi Tsutsui (The Compensation Committee Chairperson), look back at previous discussions held at the Compensation Committee and explain how the optimal executive compensation plan is contributing to MSV, the role of the Compensation Committee, and their thoughts about the design of the compensation plan for the future.

PROFILE

-

-

Takashi Tsutsui Independent Director and

Compensation Committee Chairperson -

Takashi Tsutsui was elected Independent Director of NPHD in March 2018, serving as Compensation Advisory Committee Chairperson, and from March 2020, as the Compensation Committee Chairperson. Thanks to his many years of experience in executive election and compensation design he played an important role in formulating Compensation Philosophy and in a reform of the executive compensation plan that aims to achieve MSV. Mr. Tsutsui has ample experience in global business operations for around 30 years at listed companies including Nomura Securities Co., Ltd. and has a keen insight into corporate governance.

-

-

-

Masayoshi Nakamura Lead Independent Director and

Board Chair -

Masayoshi Nakamura was elected Independent Director of NPHD in March 2018, serving as a member of both the Nominating Advisory Committee and the Compensation Advisory Committee member and, from March 2020, as the Lead Independent Director. He has served as the Board Chair since April 2021, and is playing an important role in deepening the content of the discussions in the Board of Directors meetings, such as consolidating the views of the Independent Directors and communicating them to the management team. He has more than 30 years of experience as a specialized professional in M&A advisory services and financing in the capital markets from his roles at Morgan Stanley and at other leading investment banks.

-

Retracing the footsteps of the Compensation Committee

| Nakamura |

It has now been over a year since we adopted the Co-President structure on April 28, 2021. Mr. Wee Siew Kim, one of the Co-Presidents, is a Singaporean residing in Singapore, and he became the first non-Japanese president of the company under the current Co-President structure. In early 2022, we announced the adoption of Asset Assembler model for pursuing MSV. By these actions, we have taken the group management to the next stage. We believe that our executive compensation plan is also undergoing a major transformation. The Compensation Committee members have been and will continue adhering to “what compensation plan will contribute to MSV.” As we drive this transformation, Mr. Tsusui, the Compensation Committee Chairperson, and I will look back on why we considered the executive compensation plan developed by the Compensation Committee will contribute to the achievement of MSV and what were the discussions we held towards creating such a plan. |

|---|---|

| Tsutsui |

Well, compensation design needs to maintain some degree of continuity. It is not necessarily a good idea to suddenly switch our compensation plan to an ideal one. Naturally, we need to develop a compensation plan that is fair and rational and can fulfill accountability requirements by taking into account objective information and specialized advice by making use of the help of external advisors and other parties. Also, an ideal compensation plan should be able to adapt to fit the company’s growth stage and the social circumstances in which it operates. I don’t think there is any single perfect goal to always aim at. It may be a roundabout approach to explaining our conclusion to “what compensation plan will contribute to MSV” but let us begin by retracing our footsteps. |

| Nakamura |

Mr. Tsutsui and I were elected as Directors of NPHD at the General Meeting of Shareholders in March 2018. NPHD transitioned to “a Company with a Nominating Committee, etc.” structure in March 2020. As you know, in August 2020, we decided to fully include the Asian JVs, which had grown to account for roughly 50% of the consolidated revenue and over 60% of the consolidated operating profit, into the consolidation by acquiring their remaining 49% equity stakes. Decision to acquire the Indonesia business was also taken at the same time. These events required a major transformation of management teams and their compensation to take the Group to the next growth stage. It was also in 2020 that the Compensation Philosophy was established. Now, let us look back at NPHD’s initiatives for business expansion and changes in the structure of our compensation design for the President in terms of timelines: First, the period “Up until the full integration of the Asian JVs (2018-2020);” and second, the period “From the full integration of the Asian JVs to the adoption of the Co-President structure (2021-2022).” Then we will turn our thoughts to “our vision for the future.” |

Compensation Philosophy

- Overarching Principle

-

- In order to implement MSV, to build a compensation plan that is transparent and satisfactory and to continue to provide appropriate motivation and incentives to key executives by implementing individual treatment based on the plan.

- Guiding Principles

-

- To be able to attract and keep management talent that excels at practicing MSV.

- To be able to continuously provide motivation so that maximum potential can be encouraged even under changing environments.

- To function effectively and in harmony with the current state of business development, level of maturity of organizational systems, organizational values, and the community.

Design Policies for the Compensation of the Representative Executive Officer and Co-Presidents

- Compensation that contributes to MSV

- Total compensation is commensurate with the performance of the Representative Executive Officers & Co-Presidents

- A compensation structure that promotes appropriate and decisive risk-taking

“Up until the full integration of the Asian JVs” (2018-2020)

What kind of executive compensation plan was necessary to prepare for the full integration of the Asian JVs?

| Nakamura | At the time we were elected as Directors, our committee was the Compensation Advisory Committee based on the corporate governance structure of “a Company with a Board of Company Auditors.” What was your first impression of the executive compensation plan and the issues it faced when you were initially briefed? |

|---|---|

| Tsutsui |

It may be misleading, but my first impression was that NPHD’s executive compensation plan was “an ordinary executive compensation plan of Japanese companies without any special features”. We both already had a clear vision when we became the Directors that it would be an inevitable decision for NPHD to fully integrate the Asian JVs in the near future to achieve MSV and we had to prepare for this and, at the same time, guide the executives to make that decision. Based on the executive compensation plan back then, the President’s total compensation exceeded 100 million yen and the plan included short-term incentives (STI) in the form of performance-linked compensation and long-term incentives (LTI) through stock options. However, based on what we had in our mind as an ideal executive compensation plan, we thought something was missing—it needed a new approach, and one that was not limited by conventional arrangements, in order to boost the motivation and incentives of the President and other senior management to achieve MSV. |

| Nakamura | I felt the same way. I visualized a President who would make the decision on the full integration of the Asian JVs or a President who would drive the globalized Nippon Paint Group to the next growth stage following the full integration of the Asian JVs. Then, thinking what kind of compensation plan would be appropriate for this person, I felt that NPHD would not be able to attract the person it required under the existing compensation plan. |

| Tsutsui |

That’s right. What we needed was an executive compensation plan that motivated all of the management teams, from the President and other executives to bring out their maximum potential. If the right candidate is outside the Group, it should be able to attract and retain that person. Accordingly, we proceeded to reform it, focusing on “working out a satisfactory total amount of compensation, raising our compensation to a competitive level,” and “designing a compensation structure that requires a clear commitment by the President to achieving MSV.” That said, if we were to determine compensation as the occasion demanded, we would be naturally required to determine compensation that is commensurate with the performance of the President in office at that time. While applying a strict performance assessment for the President, we proactively adopted a new approach to the composition of the President’s compensation, by means such as increasing the proportion of stock-based compensation. In this manner, we enhanced our compensation plan in terms both of the total amount and of the composition of the compensation. |

| Nakamura |

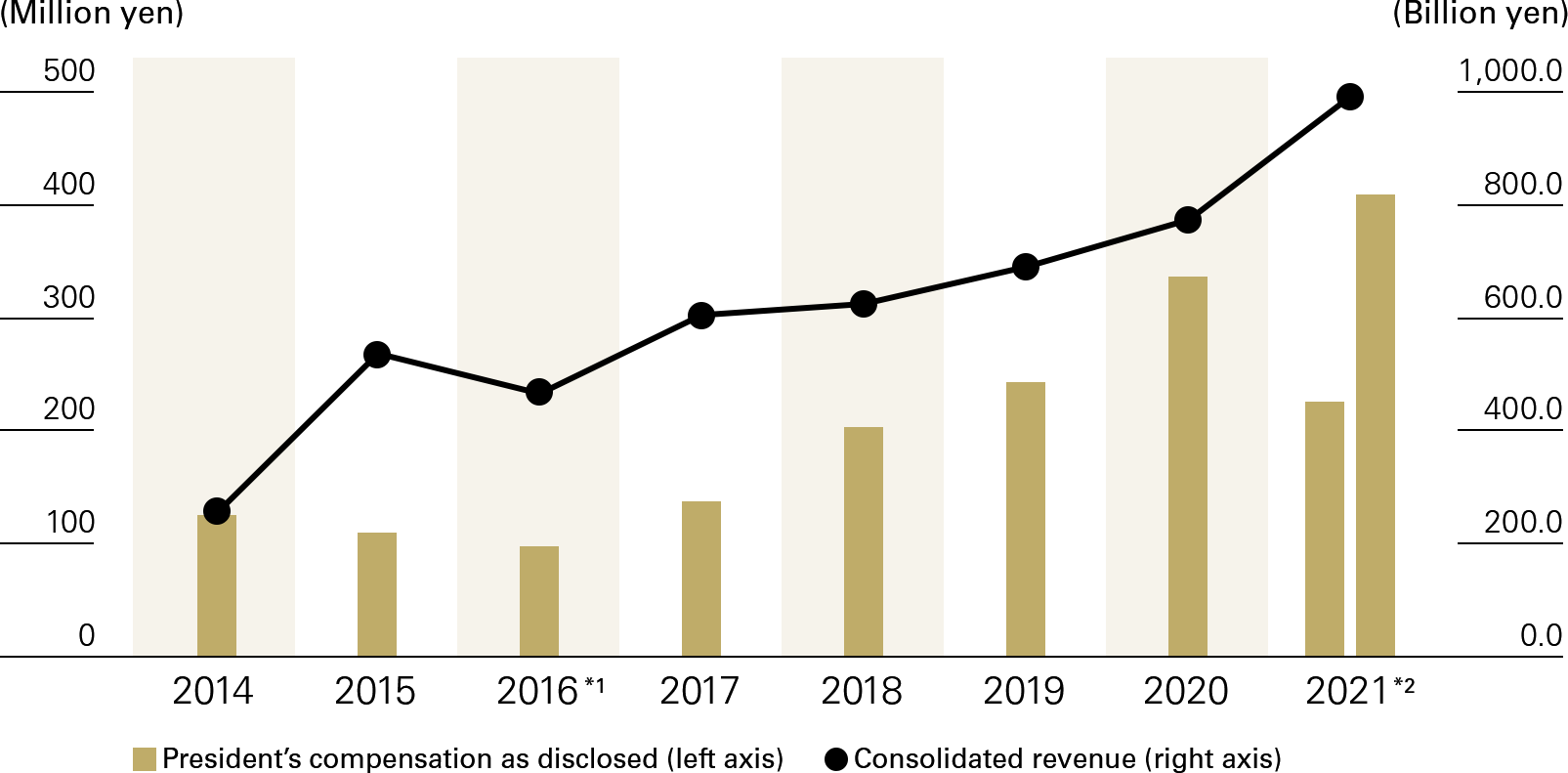

As a result of those compensation reforms, we increased the compensation for the President in FY2020, when NPHD shifted to “a Company with a Nominating Committee, etc.” structure, by around 2.4 times compared to the FY2017 prior to our election to the Directors. This was, even from a global perspective, a competitive level of compensation. We invited candidates for the President from outside the Group as well, and we believe that the reform of executive compensation plan paved the way for attracting external talent. During this time, NPHD further expanded its global operations through the acquisitions of DuluxGroup in Australia and Betek Boya in Türkiye, full integration of the Asian JVs, and acquisition of the Indonesia business. As a result, the Group’s overseas revenue increased to 70% of consolidated revenue and NPHD rose to the fourth place in the global paint and coating market after the top three dominant global players. At the same time, the Company reformed its executive compensation for the President to a level and composition appropriate to the leader that will further drive its growth strategy. |

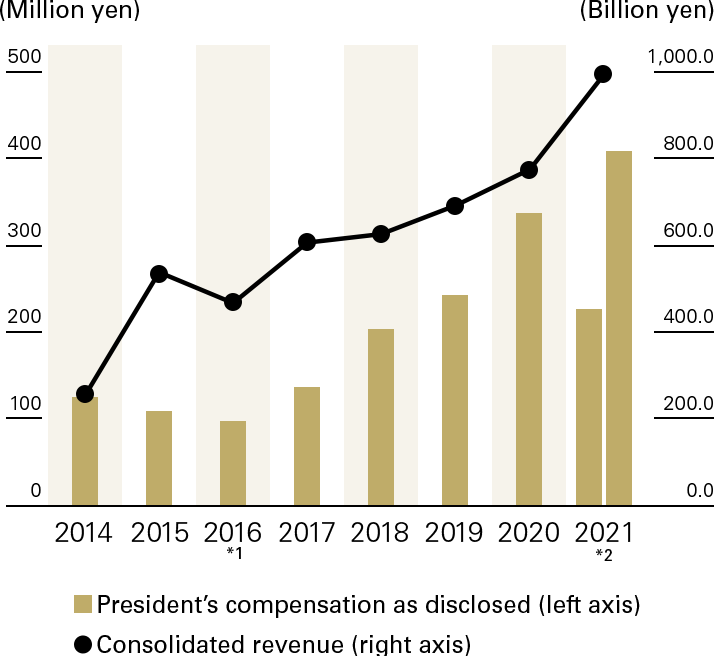

President’s compensation

| Prior to 2017 | 2018-2020 Up until the full integration of the Asian JVs | 2021-2022 Under the Co-President structure | |

|---|---|---|---|

| Concept |

|

|

|

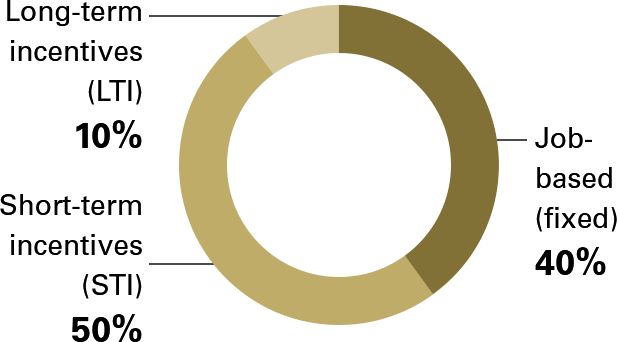

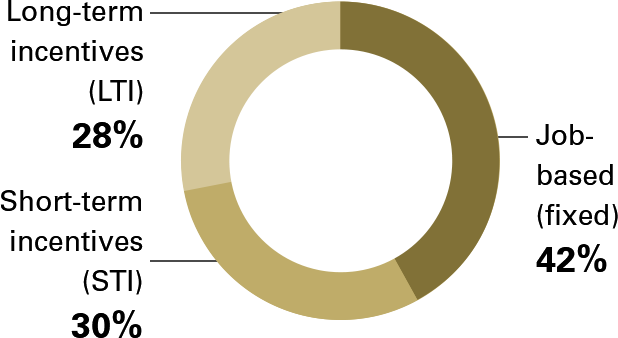

| Composition |

Based on a fixed compensation table established in 2012 (example)

|

|

Based on comprehensive evaluation

|

| Indicators used to determine performance-linked compensation (STI) |

Financial indicators

|

Financial indicators (20% weight)

Non-financial indicators (60% weight)

EPS indicators (20% weight) |

Comprehensive evaluation indicators

|

| Long-term incentives |

|

|

|

Fruition of the Compensation Philosophy

| Tsutsui |

During this time, we certainly increased the compensation for the President. This reflects an appropriate evaluation and recognition of the President’s job responsibility and performance, while at the same time incorporating the tough requirements that are expected in return. I can proudly say that our stance is reflected in our Compensation Philosophy. What I would like to emphasize, especially regarding the compensation design that we laboriously developed, is the following: The compensation for the President in FY2020 was comprised of job-based compensation as a fixed compensation accounting for around 40% of the total compensation. Of the remaining 60% variable compensation, the proportion of the STI, which varies according to the performance evaluation, was reduced, while the proportion of the LTI, using restricted stock compensation, was increased by around three times. The idea behind this composition of the compensation is that the STI portion will be strictly evaluated by the Compensation Committee, while the LTI portion should be evaluated by shareholders through the stock market. We wanted to develop a compensation plan which would make the President keenly aware of our and shareholders’ constant scrutiny about his/her commitment to achieving MSV. To put it in extreme terms, our stance is that the President’s compensation is never guaranteed in advance. |

|---|

Why stock-based compensation is part of the compensation for Independent Directors?

| Nakamura | So far, we have been looking back at our thoughts about the compensation for the President. What is required of Independent Directors is the same, in that our performance is always subject to shareholders’ scrutiny. |

|---|---|

| Tsutsui | Indeed. Although business execution is not a part of our roles, we not only supervise the group management as an Asset Assembler but also assume the role and risk involved in making important decisions regarding the allocation of management resources entrusted to us by our shareholders. We believe that it is important to further enhance value sharing with shareholders, in other words, incentives for achieving MSV. That’s why we have introduced stock-based compensation as part of the compensation for the Directors who do not serve concurrently as Executive Officers. This is restricted stock compensation that cannot be sold during the term of office. Also, Malus and Clawback clauses are in place, enabling the Independent Directors to properly share values with our shareholders, especially minority shareholders. |

| Nakamura | I believe that our compensation plan for Independent Directors is appropriate for a company that sees MSV as its sole mission. Specifically, the current compensation for Independent Directors is equally divided between cash and restricted stock. In principle, when the restriction is lifted after Independent Directors retire from their office, they have almost nothing left, except NPHD’s stock, net of tax. In other words, the only incentive the Independent Directors receiving the restricted stock have is to boost NPHD’s stock price continuously, both during their terms of office and after their retirement. The difference before our election and after our retirement as NPHD’s Independent Directors is an indication that we will have truly become minority shareholders of NPHD. |

| Tsutsui | That is how we have designed the compensation for Independent Directors. In order for the Group to expand operations globally through M&A based on Asset Assembler model and to build a really sustainable management base to achieve MSV, with all possible concerns for the Group eliminated, Independent Directors must not only supervise the Group’s management from both “independent and outside” perspectives, but also be committed to devoting a considerable amount of their time and maintaining close and excellent discussions on individual agenda items requiring management decision-making. Considering these points, I believe that it is an appropriate compensation composition for NPHD’s Independent Directors to include stock-based compensation. |

Major M&A transactions/Group reorganizations

| 2014 |

NPHD/Japan

Asia

|

|---|---|

| 2015 |

NPHD/Japan

|

| 2016 |

India business European business

|

| 2017 |

Asia

Americas

|

| 2019 |

Other

Oceania

|

| 2020 |

NPHD/Japan

|

| 2021 |

NPHD/Japan

Asia

India business European business

Oceania

|

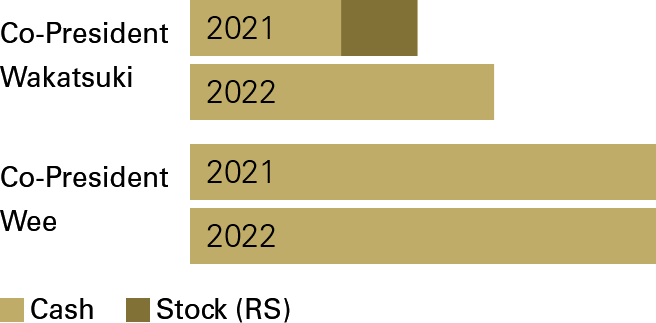

The total amount of the President’s compensation (disclosed in the Annual Securities Report)

*1 FY2016 was nine months due to a change of the fiscal year-end

*2 The Co-President structure started from April 2021

“From the full integration of the Asian JVs to the adoption of the Co-President structure” (2021-2022)

| Nakamura | We were able to reflect on the discussions and issues surrounding our executive compensation plan that culminated in our Compensation Philosophy. I would now like to take a fresh look at the new reform initiatives of the Compensation Committee to prepare for transition to the current Co-President structure. |

|---|

Discussions centered on evaluating and determining compensation for the President

| Nakamura | I believe that the Compensation Committee worked from the premise that we should focus on the evaluation and determination of the compensation for the President, who is the head of the Company. Therefore, we have separately established the “Design Policies for the Compensation of the Representative Executive Officers and Co-Presidents Compensation,” in compliance with the Compensation Philosophy. First, let us outline the background of this concept. |

|---|---|

| Tsutsui |

Since our election as Directors, we have envisioned a business model for Nippon Paint Group of expanding its operations for even further growth globally, considering the characteristics of its business areas centered on paint and coatings. What we had in mind specifically was a business model in which NPHD will attract partner companies around the globe and drive growth at each partner company by essentially entrusting these companies with autonomous management based on trust. The key to the success of this growth model is, unquestionably, the Co-Presidents of NPHD, which is a pure holding company. Therefore, the Compensation Committee determined that the evaluation and determination of compensation for the Co-Presidents to be our most important role. We needed to establish a compensation plan that would strongly support the group management led by the Co-Presidents. In the meantime, we decided to delegate to the Co-Presidents the responsibility for evaluating and determining the compensation for the management teams of partner companies. |

| Nakamura | These discussions led to the development of the current Asset Assembler model. We thought the key parameters for properly evaluating the performance of the Co-Presidents would be: “how well the Co-Presidents lead other Executive Officers, and Global Key Persons (GKPs), who are the key management teams of partner companies,” and “how well they determine compensation for GKPs.” |

| Tsutsui |

I believe that is at the core of our approach to the evaluations we will perform. The Compensation Committee members are responsible for evaluating the performance and determining the compensation of the Executive Officers, including the Co-Presidents. The prerequisite for our evaluation of the Co-Presidents is an understanding by the Compensation Committee members of the personalities and performance of the Co-Presidents, as well as GKPs, including the Executive Officers. Therefore, we have established a procedure by which the Co-Presidents’ report to the Compensation Committee on how they manage and evaluate other Executive Officers and GKPs, while the Compensation Committee evaluates and determines the compensation for the Co-Presidents and other Executive Officers after carefully considering the content of reports from the Co-Presidents. Every partner company has its own approach to evaluation and compensation decisions according to the culture and business practices of each region. Based on Asset Assembler model, we do not impose a standardized compensation structure. Rather, we are required to work with the Co-Presidents to explore a better direction that suits each region and business based on a deep understanding of the uniqueness of each partner company. We believe the diversity of our compensation is going to expand beyond our imagination. The Co-Presidents make a report to the Compensation Committee jointly with the Nominating Committee members. This enables an organic coordination between proper nomination and compensation decisions for the Co-Presidents and other Executive officers. We believe these integrated activities will contribute practically to Nippon Paint Group’s achievement of MSV. |

Focusing on communications with the GKPs

| Nakamura | We have been taking the evaluation of the GKPs reported by the Co-Presidents quite seriously. At the same time, our focus has been on seeing for ourselves the Co-President’s evaluation of GKPs by directly communicating with GKPs. |

|---|---|

| Tsutsui | In order to properly evaluate the performance of the Executive Officers, including the Co-Presidents, and determine their compensation, it is not right to make decisions based solely on the degree of achievement of numerical targets, not is it right to do so by taking the reports from the Co-Presidents at face value. The important thing is to evaluate a person’s value as a manager from multifaceted perspectives and so to understand the merit of each person. |

| Nakamura |

Adequate communication is essential for this purpose, and both the Nominating Committee and the Audit Committee have been working on expanding communication with GKPs. The Audit Committee follows an “Audit on Audit” system, in which our partner companies are grouped by business or region and NPHD audits the status of auditing within each group. The Audit Committee also interviews each GKP on a regular basis. the meetings of Independent Directors, where I serve as the Chairperson, have also spent time to increase communication with GKPs through meetings over lunch and on other occasions. The qualitative information and relationship building that these opportunities provide is invaluable for the Board of Directors in understanding the Group’s human capital at the senior management level that goes beyond the scope of the Committees. |

| Nakamura |

Mr. Goh Hup Jin has been in the paint and coatings businesses, working with GKPs longer than any of the other Directors, and he therefore knows them better than any of us. Mr. Goh’s relationship with GKPs, which is based on trust, was therefore essential when we began communicating with them. His experience-based insight will be invaluable as we work to expand communications with GKPs. In view of the above, we have nominated Mr. Goh to serve on both the Nominating and Compensation Committees. While Mr. Goh brings shareholder perspectives to the Compensation Committee’s deliberations, his opinion carries only one-third the weight as it is a three-member committee. We believe that it is important for the Compensation Committee to ensure that Mr. Goh’s views are not expressed outside the committee and are taken into consideration in decision making. We believe that this will help in gaining the confidence of the management team of NPHD, including the Co-Presidents. |

Going beyond formula-based compensation decisions

| Nakamura | Through these communications, we have made an effort to assess the merits of the Co-Presidents and other Executive Officers. We have also had many discussions on how we should reflect the results of evaluations based on this assessment for making compensation decisions. |

|---|---|

| Tsutsui |

Under the executive compensation plan that was in place prior to our election as Directors, the amount of performance-linked compensation for the President was automatically calculated by using a formula that used consolidated net sales and profit before tax as indicators. This compensation is linked directly to Nippon Paint Group’s performance and had the advantage of being fair and transparent to some degree. However, we didn’t think that it was really the best way to evaluate the performance of executives, nor did we think that each member of the management team would be convinced that their performance had been properly evaluated and recognized. We thought that calculating and determining the compensation based on formulas have limitations because Nippon Paint Group must respond with agility to the rapid changes in business environment, which have been exacerbated by the pandemic. Therefore, we continued to explore an optimal evaluation and compensation determination method that can quickly reflect the current business climate. |

| Nakamura |

I believe this is the core of the transformation, led by the Compensation Committee, from the conventional “evaluation and compensation decisions using a position-based fixed compensation table” to “compensation decisions based on comprehensive evaluations.” Based on our activities to enhance the compensation for the President in terms of both the total amount and composition, we decided to comprehensively evaluate the performance of the Co-Presidents through dialogues with them and close communications with GKPs for determining their compensation in FY2021. We also decided that total compensation, starting in FY2022, will be determined every year from the ground up and the percentages of cash and stock-based compensation will be reviewed every year. |

| Tsutsui |

We often hear people say that compensation based on a clearly defined formula makes it more transparent as performance-linked compensation. However, Nippon Paint Group is undergoing drastic transformations. Group companies establish initial plans and budgets as well as KPIs from both financial and non-financial perspectives. We have held many discussions on whether compensation decisions using a formula based on company business plans would really work as an appropriate incentive to achieve MSV at a time when the Group is undergoing growth amid drastic changes in the business environment. It is our responsibility to strongly support the Co-Presidents as they review business plans with agility and a sense of vigilance. We must also support their relentless pursuit of major goals and by extension growth to achieve MSV. We intend to work with the Co-Presidents to determine actions that are needed to keep changing based on the concept of MSV. |

| Nakamura | This may not be a good analogy, but members of the Compensation Committee were thinking about the fact that “An officer going to the war is not asked to only follow predetermined KPIs or review KPIs every time.” Willis Towers Watson, which is our external compensation advisor, commented that we are oriented toward the OODA (Observe, Orient, Decide, Act) model, which is more flexible and responsive to different situations, rather than the PDCA (Plan, Do, Check, Action) model, which requires careful planning. |

| Tsutsui |

We constantly discuss group activities more at the Board of Directors meetings than at the Compensation Committee meetings. These discussions involve both financial indicators and non-financial indicators, such as ESG and sustainability performance. However, we do not believe that we can arrive at the compensation plan we seek to achieve by simply calculating compensation by doing additions and subtractions based on the degree of attainment of KPI targets. For example, we could add 5 points because performance exceeded the initial target by 5% for a particular KPI involving ESG. Rather, it is important to comprehensively evaluate each individual’s actions, performance and contributions at that point, taking into consideration the changing environment and other situations. Even if revenue and profits decline, for instance, we may give someone a positive evaluation if the decrease was caused by external factors and the market share increased despite the decline. On the contrary, we may give someone a negative evaluation even when revenue and profit increase if the benefits of price increases to reflect higher expenses did not emerge in a timely manner. We believe that a comprehensive evaluation that carefully examines performance will serve as a proper incentive for executives to maximize their performance, as well as lead to the retention of these people. |

| Nakamura |

The compensation for the Co-President is based solely on a comprehensive evaluation by the Compensation Committee, and total compensation for the following year will be reviewed from the ground up. Therefore, the Co-Presidents’ compensation consists entirely of variable compensation. From the standpoint of people being evaluated, this may be a very demanding compensation plan. For this compensation system to really function properly, the prerequisite is that we win the trust of the Co-Presidents that our judgments will definitely lead to MSV. I am convinced that the relationship we have developed with them through communications and the mutual trust backed by our track record will be the driving force behind our compensation plan. |

Our vision for the future

| Nakamura | We have covered the main topics that we considered and discussed leading up to the current Co-President structure. From here on, I would like to summarize our thoughts looking to the future. |

|---|

What kind of compensation is conducive to sharing value with our shareholders?

| Tsutsui | When considering our future compensation design, I believe we should place even more emphasis on determining what kind of compensation is truly conducive to raising incentives for achieving MSV and furthering value sharing with shareholders. |

|---|---|

| Nakamura | From that perspective, there is also the question of who should share value with shareholders in the first place. We also need to think about whether the best approach is holding stock, receiving stock as compensation, having compensation linked to the stock price, and so on. |

| Tsutsui |

Directors are directly elected by shareholders. Therefore, it is obvious that we need to share value especially with minority shareholders. From a global perspective, there are many examples of companies that establish shareholding guidelines for their presidents. Simply put, the Co-Presidents are subject to these guidelines. It is natural to believe that the shortest path to value sharing with shareholders is for the Co-Presidents to hold a significant number of shares of NPHD stock. In this regard, we should either establish a policy that allows the Co-Presidents to purchase this stock or design our stock-based compensation in a suitable manner. But in reality, it’s not that simple. Even if the Co-Presidents intend to purchase NPHD stock, they will definitely be exposed to material facts constantly as they implement growth strategies such as our Asset Assembler model. That means they will have very few opportunities to purchase stock. To deal with this issue, we are considering upgrading our insider information management system, including the development of contracts that allow trading of our shares through advance planning. We are still considering whether these steps can address all the issues. Whether or not the use of stock-based compensation will solve the issues, it is not a good idea to impose a one-size-fits-all compensation plan. This is because, for a company like NPHD, where we consider external candidates for becoming the President or electing a person from an overseas partner company, we must take into account the continuity with existing compensation and the different levels and composition of compensation in other countries, which are strongly influenced by cultural differences. |

| Nakamura |

The Compensation Committee is responsible for ensuring that the Co-Presidents’ compensation is structured to allow value sharing with shareholders. In other words, it is our critical mission to maximize the motivation of the Co-Presidents, who are responsible for business execution to pursue MSV, and to rigorously evaluate their performance with emphasis on value sharing with shareholders. In fact, this is a more demanding task than might be expected and a very serious responsibility. |

Our next move to create compensation that further contributes to MSV

| Tsutsui | We are determined to fulfill this role. An ideal compensation plan has no goal. We must continue to explore the best way to compensate our executives. I believe the validity of the concept of MSV we have created and our thoughts on the evaluation and compensation decisions based on trust to achieve MSV will be put to the test from now on. I am convinced that our initiatives for achieving MSV will advance to the next stage from here on. |

|---|---|

| Nakamura |

Today, we had an opportunity to reflect on our thoughts on each stage and reaffirm the role of the Compensation Committee. We will do our best to take the committee activities to the next level. Thank you very much for your time. |

Pages related to Corporate Governance

- Integrated Report 2022 (Digital Edition)