Why is Nippon Paint an attractive investment opportunity?

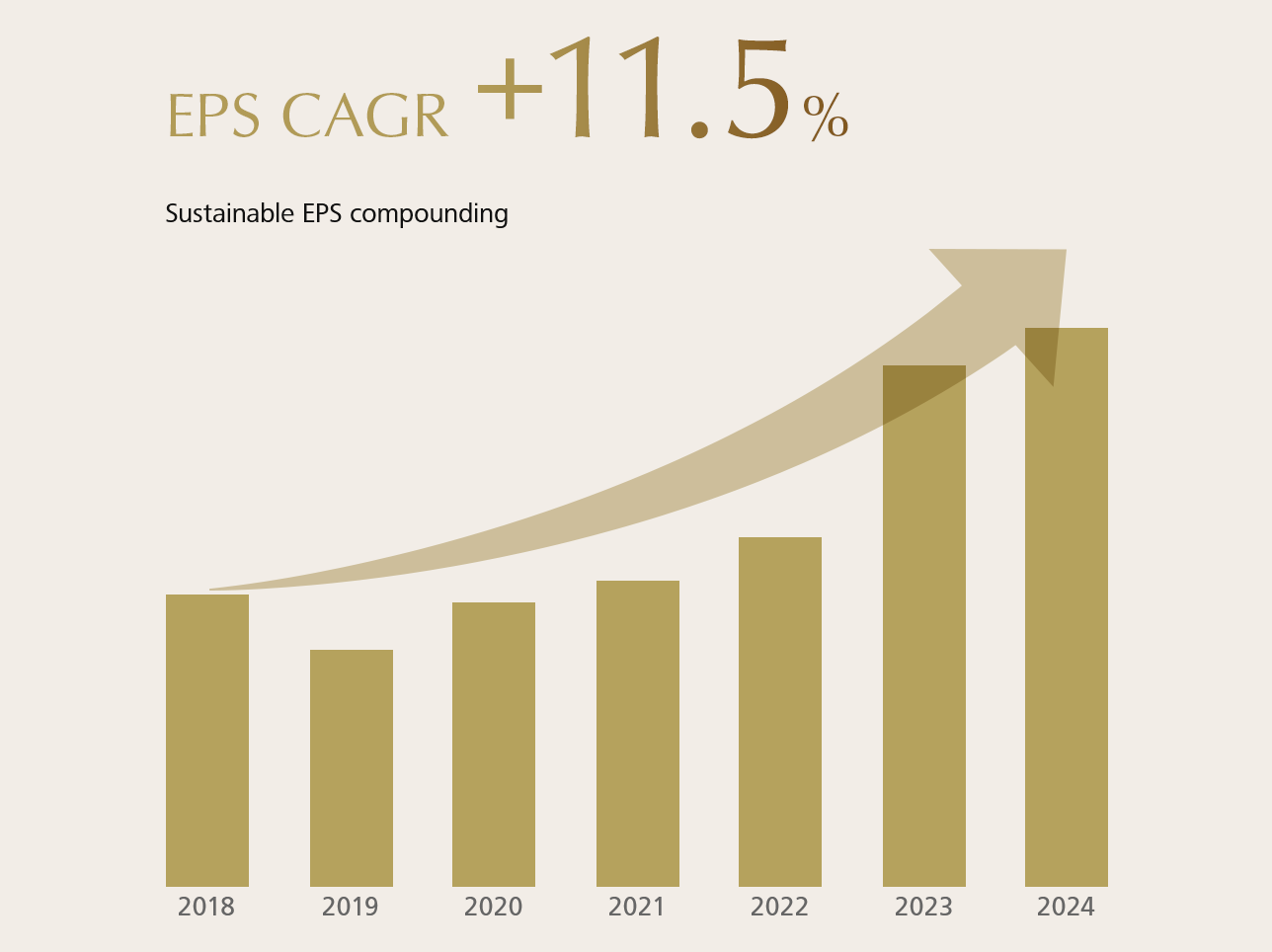

Nippon Paint as EPS Compounding Machine

With MSV as our sole mission, we remain fully committed to sustainable EPS compounding, driving growth through both organic and inorganic initiatives.

Despite headwinds such as the COVID-19 pandemic, logistic disruptions, and inflation, Nippon Paint Group has delivered EPS growth for five consecutive years and built a solid track record of successful M&A activity.

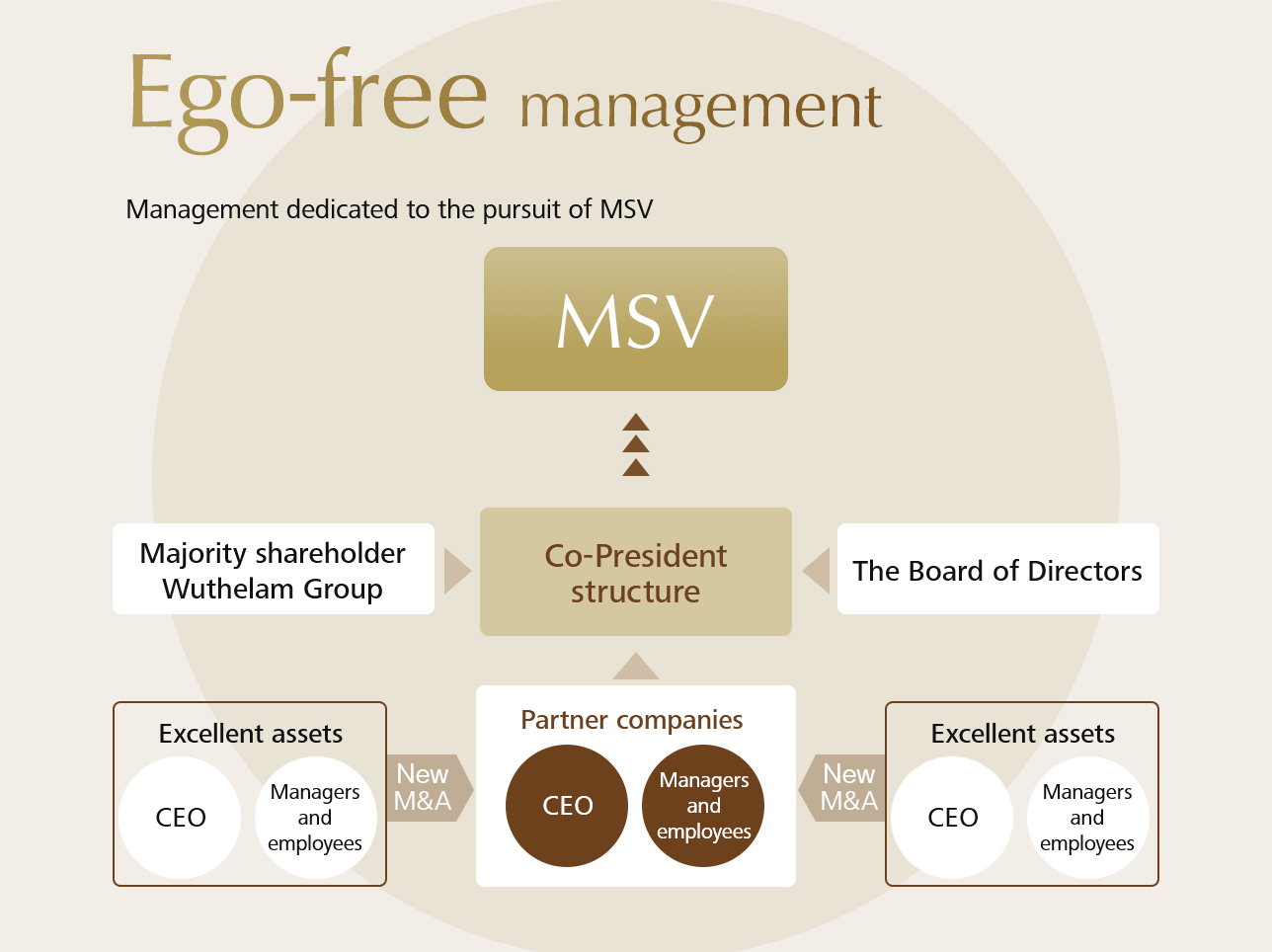

“Ego-free management” approach dedicated to the pure pursuit of MSV

Our Group is committed to an “ego-free management” approach, focused solely on the achievement of MSV. With strong alignment between management and the Board of Directors, we uphold a disciplined stance that does not tolerate any actions misaligned with the MSV mission.

By pursuing sustainable EPS compounding through both organic and inorganic growth, we strive to meet the expectations of the capital markets.

Relentlessly pursuing unlimited growth while minimizing risk

Balancing growth and soundness at the core of our management approach, our Group has delivered solid growth even through the challenges of the COVID-19 pandemic and inflationary periods.

On the inorganic side, we have consistently executed safe M&A, placing emphasis on sound valuation and autonomous post-acquisition growth. Looking ahead, we remain committed to pursuing unlimited growth potential while minimizing risk.

Investment appeal driven by operational excellence

Each partner company within our Group operates under an autonomous and decentralized management structure, leveraging competitive advantages such as strong market share, powerful brands, and extensive distribution channels to achieve sustainable EPS compounding.

1. Market share

- 14 countries

- No.1 market share

in decorative paints (global)

Our Group holds leading market shares, including 75% in the decorative paints market in Singapore, 50% in Australia, and 49% in Malaysia.

This strong market presence serves as a barrier to new entrants and supports our sustained growth and profitability improvement.

2. Brands

- 51%

- Top of Mind rating

(NIPSEA China)

Our Group has built strong brands, particularly in decorative paints, earning high recognition and trust among consumers, especially in the Asia Pacific market.

This brand strength sets us apart from competitors and underpins our ability to maintain and enhance price competitiveness.

3. Distribution channel

- c. 260,000

- Number of retail outlets

(NIPSEA China)

Our Group has developed extensive and diverse distribution channels for the decorative paints market in each country and region, with a primary focus on B2C segments, such as retail stores, distributors, and e-commerce.

By leveraging these robust distribution networks, we drive market penetration through strategies tailored to the unique characteristics of each local market.