1. Front Cover

Thank you for taking the time out of your busy schedule to attend today’s briefing on the Integrated Report 2025. I’m Ryosuke Tanaka, General Manager of Investor Relations.

In this session, I will present the key highlights of the Integrated Report 2025, which was released at the end of June.

The 2025 edition was published one month earlier than the 2024 edition, which itself was released two months earlier than the 2023 edition. As a result, we have successfully accelerated the publication schedule by a total of three months over the past two years.

This achievement reflects the valuable input and constructive feedback we’ve received from our investors, which have helped us continuously refine and streamline the report development process. I would also like to take this opportunity to express my sincere appreciation for your ongoing support, which contributed to the Integrated Report 2024 receiving the Grand Prize at the NIKKEI Integrated Report Awards.

We intend to reflect the valuable feedback and suggestions shared today in the planning and preparation of the 2026 edition. Your candid input is sincerely welcomed and greatly appreciated.

2. Objectives of Today’s Briefing

Let me begin by outlining three objectives of today’s briefing:

- As with the 2024 edition, the 2025 Integrated Report has been condensed to 100 pages to ensure efficient reading for investors. In this session, I will highlight the key sections that merit your attention, offering a clearer understanding of our strategic initiatives aimed at Maximization of Shareholder Value (MSV).

- The insights we have gathered through ongoing engagement with investors, spanning our unique business model, management strategies, and sustainability initiatives, will be reflected in efforts to further enhance our corporate management and investor relations activities.

- These initiatives are expected to contribute to the maximization of our PER and will serve as valuable input for the planning and development of the 2026 edition of the Integrated Report.

3. Production Process and Editorial Policy

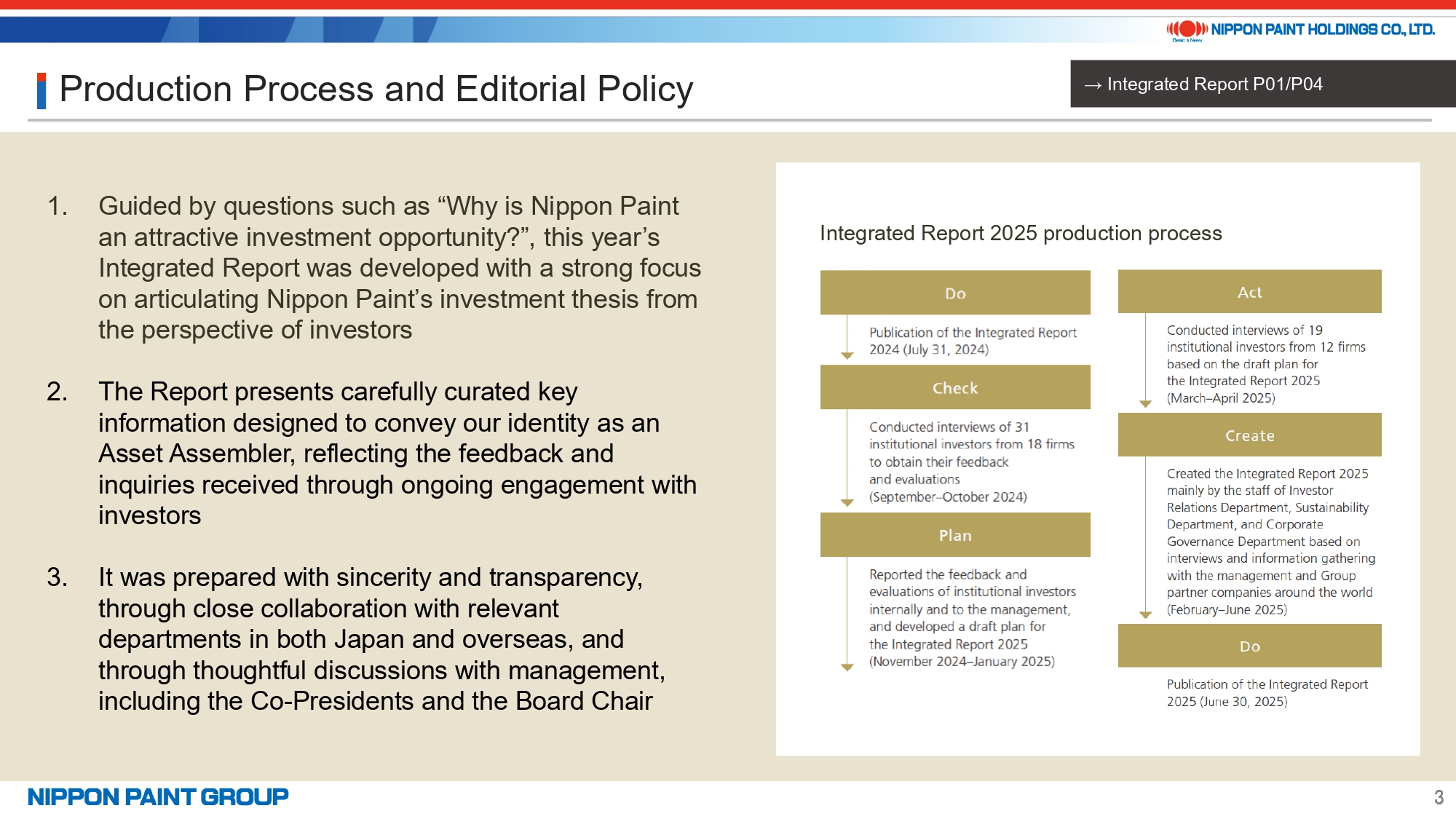

The editorial policy for the 2025 edition was guided by three key objectives:

- To clearly convey the investment appeal of our Group by asking ourselves, “Why is Nippon Paint an attractive investment opportunity,?” with a strong emphasis on the investor’s perspective.

- To validate this perspective, we engaged in numerous dialogues with investors. Drawing on the feedback and questions received, we carefully selected and presented the most relevant information about our Asset Assembler model.

- The content of the Report was shaped through in-depth discussions with management, particularly Co-Presidents Wakatsuki and Wee, and Lead Independent Director Nakamura, and through close collaboration with relevant departments across Japan and overseas, with a continued focus on enhancing both transparency and credibility.

4. Overall Structure

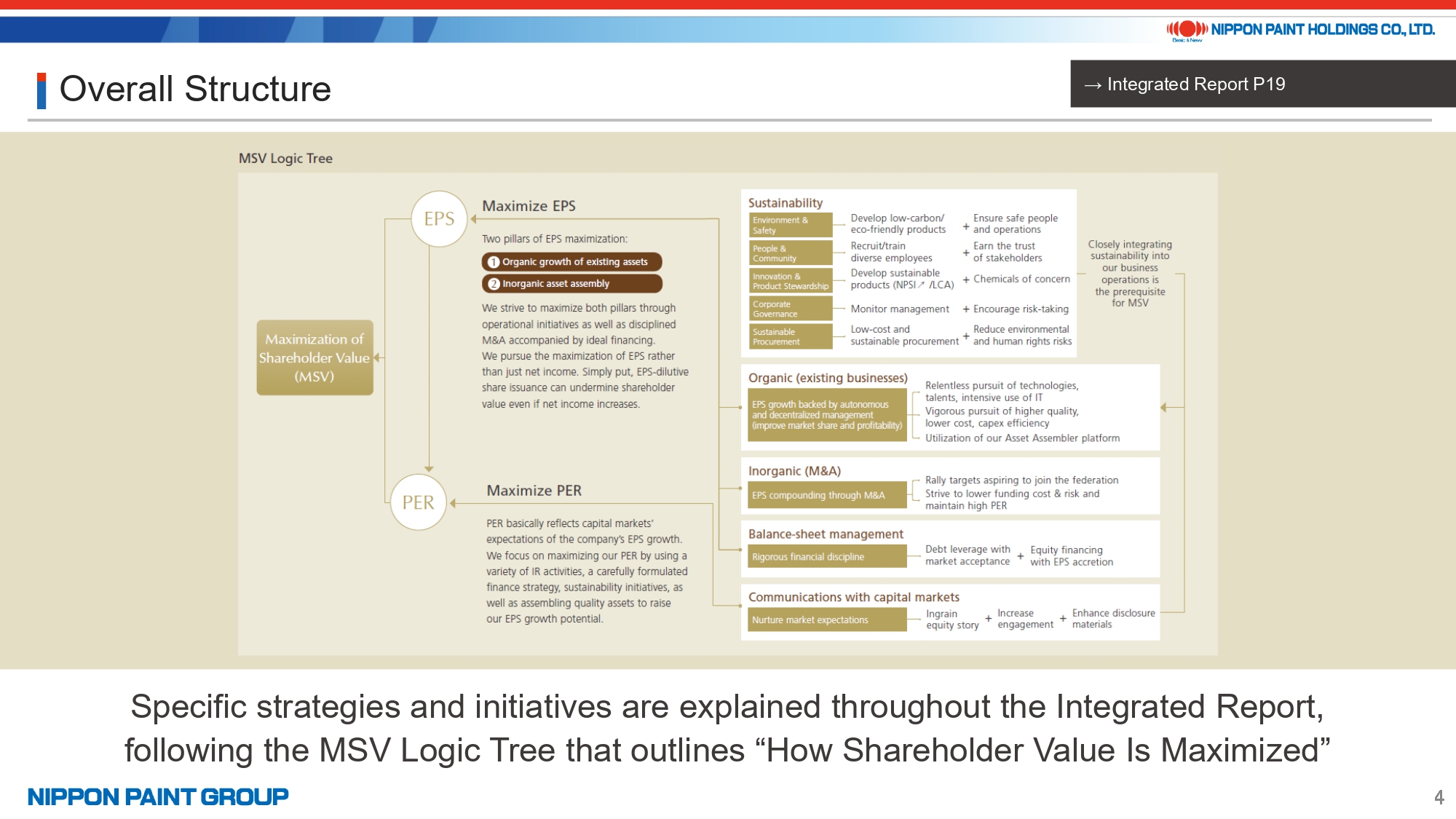

This page presents the overall structure of the 2025 edition of the Integrated Report.

At its core is a Logic Tree that illustrates how shareholder value is maximized. The Report provides a clear and logical explanation of the specific strategies and initiatives we employ to maximize both EPS and PER.

Each initiative, across sustainability, existing businesses, M&A, balance sheet management, and capital markets communication, is aligned with our pursuit of EPS and PER maximization, ultimately supporting MSV. The formulas shown for each area offer a simple yet effective expression of what we aim to achieve and how we intend to achieve it.

5. Key Improvements

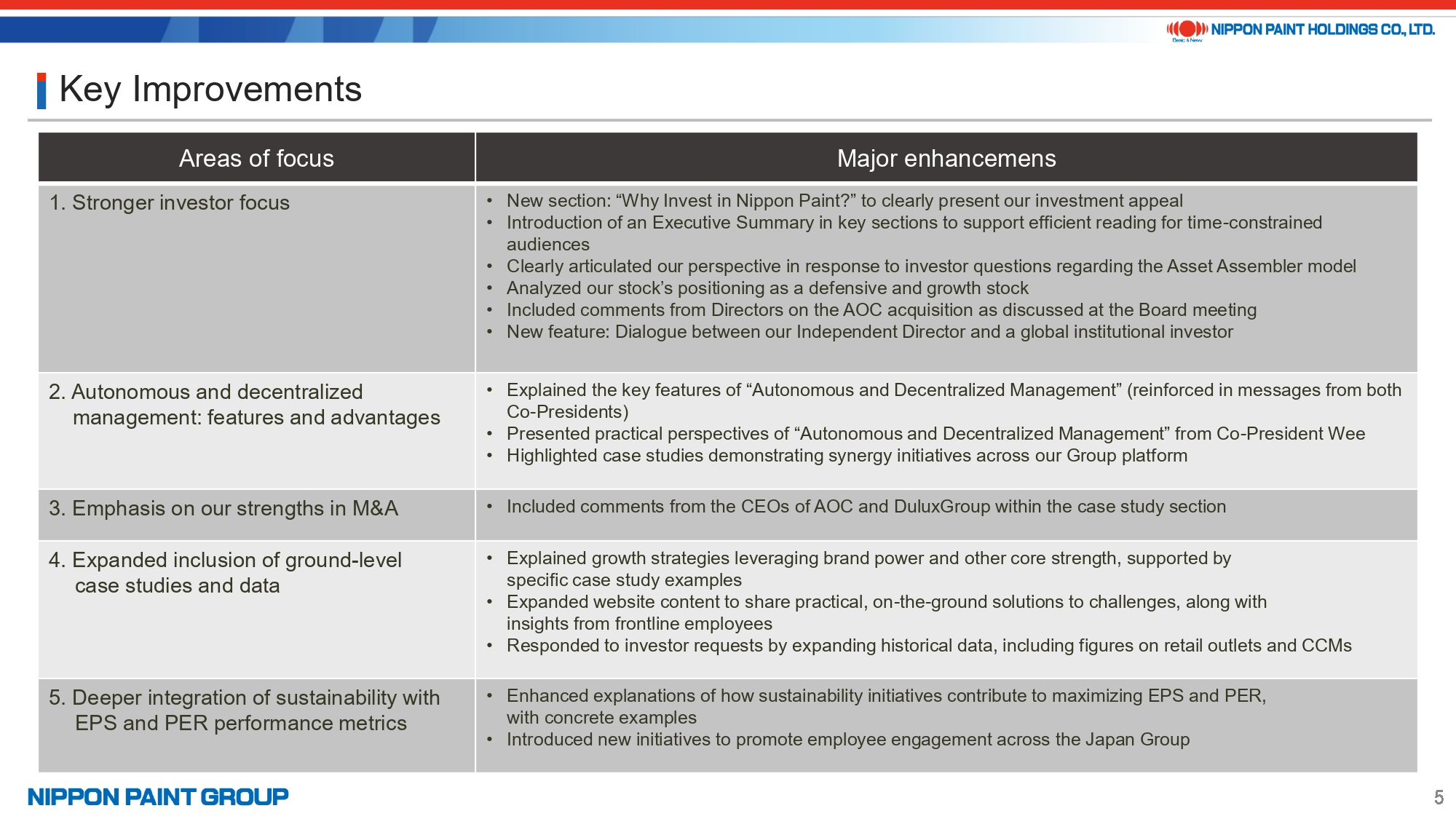

This page outlines the key enhancements made in the 2025 edition of the Integrated Report.

Drawing on insights from investor engagement, we placed particular emphasis on the following five areas:

- Strong investor focus

- Autonomous and decentralized management: features and advantages

- Our strengths in M&A

- Expanded ground-level case studies and data

- Integration of sustainability with EPS and PER

In today’s briefing, I will walk you through each of these enhancements. Of particular note is the fourth point, expanded ground-level case studies and data, which illustrates how our Asset Assembler model and M&A strategy are delivering results through tangible, on-the-ground initiatives.

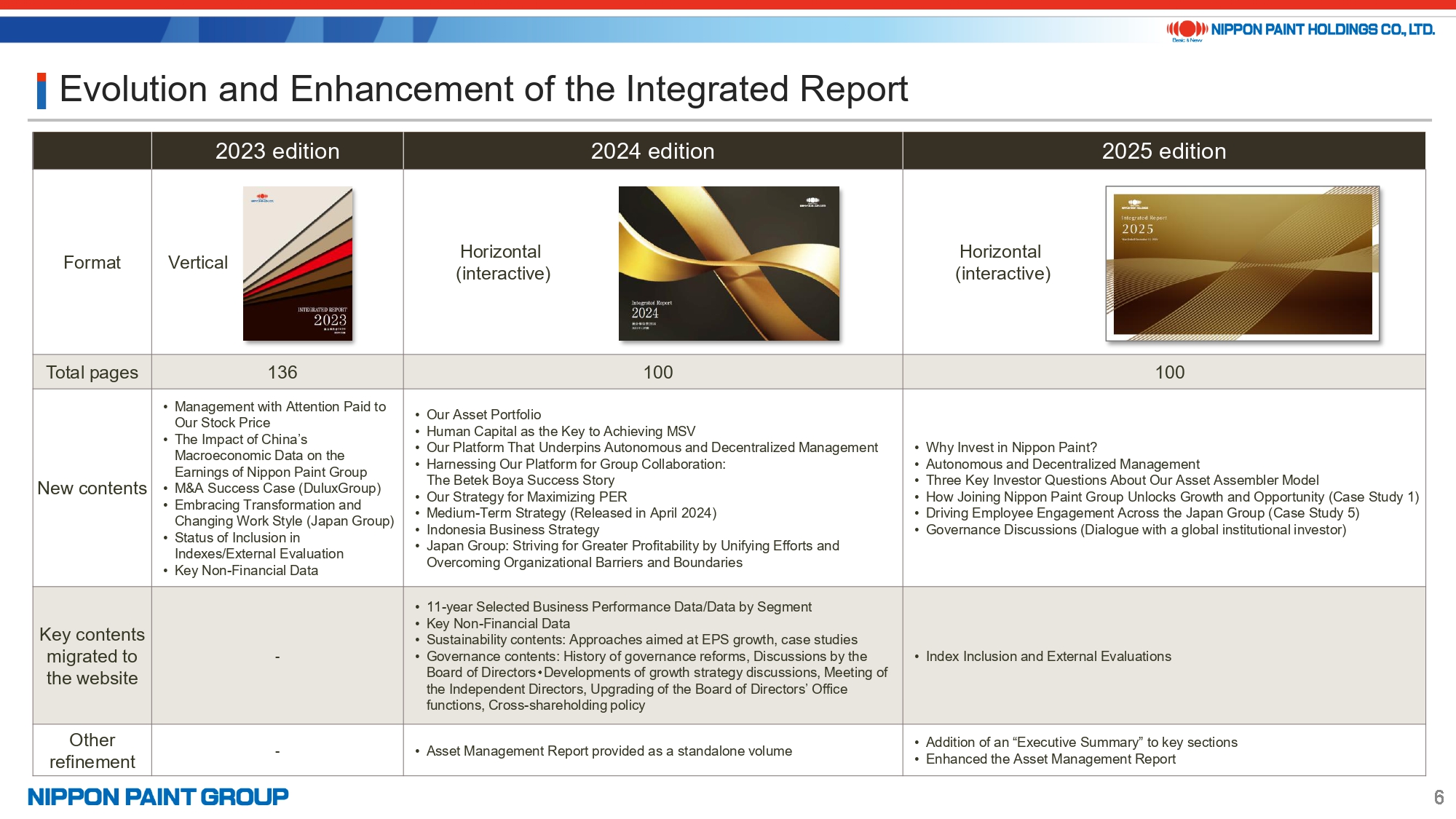

6. Evolution and Enhancement of the Integrated Report

For your reference, this page illustrates the evolution of our Integrated Report over time.

Since strengthening our investor relations framework in 2019, we have continuously enhanced the Report each year, positioning it as a key communication tool with our investors.

We have now entered a phase where we are proactively promoting our distinctive Asset Assembler model, an approach that extends well beyond the conventional boundaries of a paint company. Over the past year, we have observed a notable increase in interest from overseas investors, particularly first-time engagements, following their review of the Integrated Report. This trend underscores the growing effectiveness of the Report in broadening understanding of our business and countering the limited perception of Nippon Paint as simply a China-focused paint manufacturer.

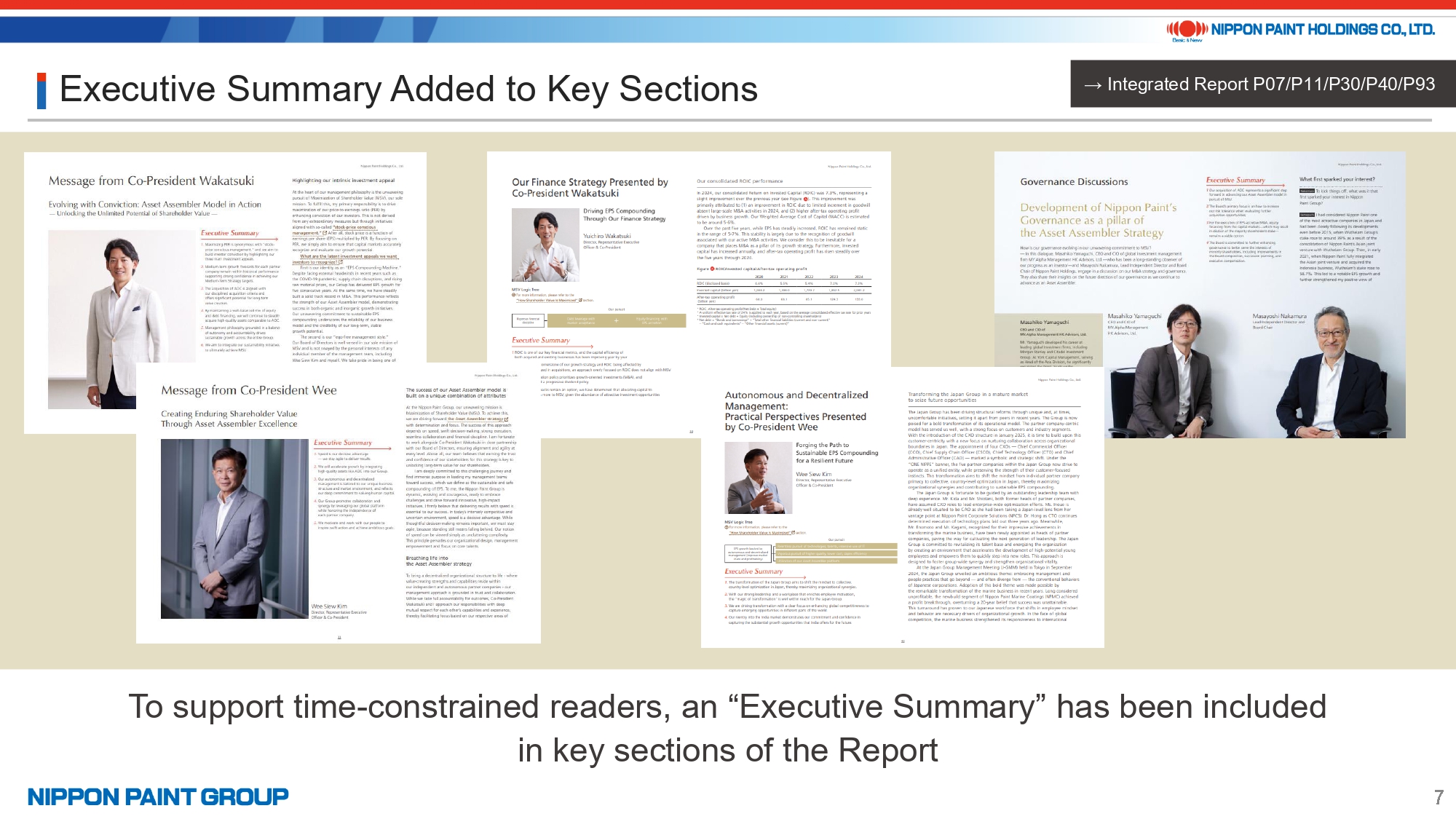

7. Executive Summary Added to Key Sections

One of the key enhancements in this year’s edition is the addition of executive summaries at the beginning of major sections. These are designed to help busy analysts and investors quickly grasp the key messages.

Throughout the Report, we have reflected the questions and feedback received from investors. As the Report is published at the end of June, a period when many of you may have greater flexibility, we hope you will take the opportunity to review it in depth.

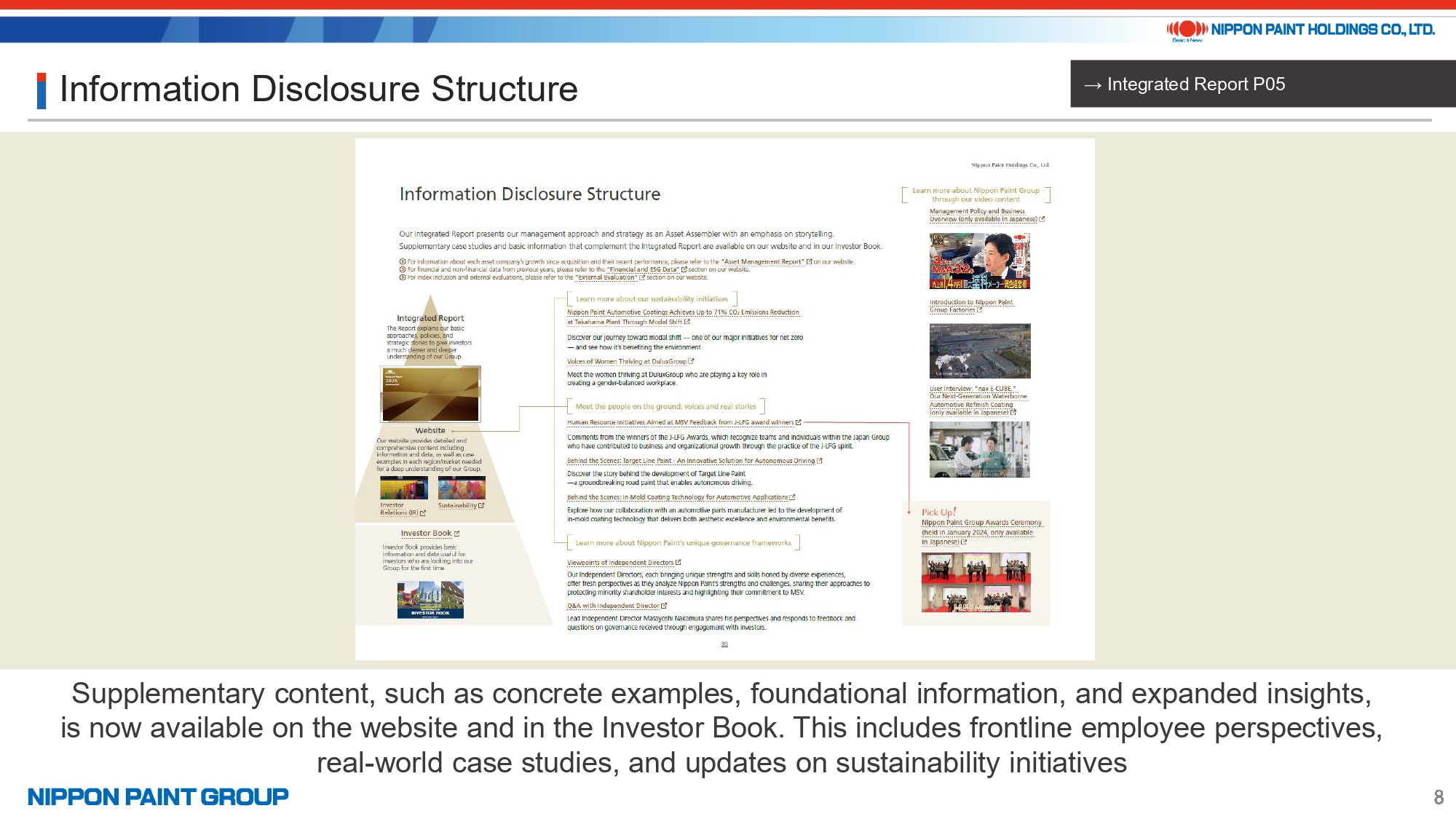

8. Information Disclosure Structure

Let me now provide an overview of our information disclosure structure.

The Integrated Report presents the Group’s core approaches, policies, and strategic direction in a consolidated format. Additional information, including detailed case studies and supporting data, is available through our website and the Investor Book, which serve as complementary resources.

This year, we have enriched our website with expanded content, featuring voices and perspectives from frontline employees, real-world initiatives, and updates on our sustainability efforts. I also encourage you to view the video content located in the upper right corner of this page, which provides a firsthand look at tangible, on-the-ground initiatives across our Group.

9. Strong Investor Focus

Next, I would like to walk you through the specific enhancements we have made, each of them driven by our “Strong Investor Focus.”

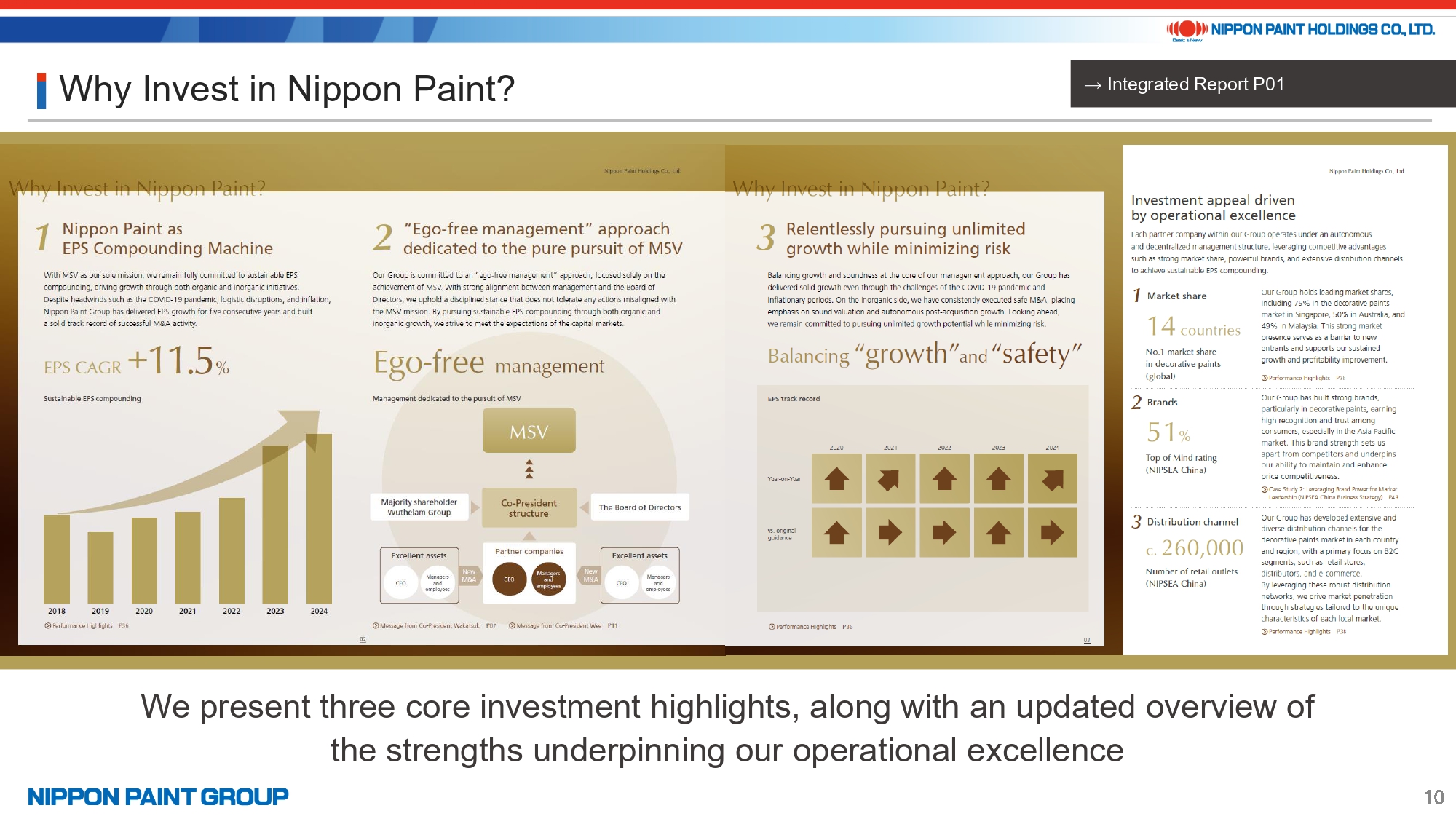

10. Why Invest in Nippon Paint?

First, we have introduced a new section titled “Why Invest in Nippon Paint?” at the beginning of the Report to clearly articulate our investment appeal.

This section highlights three core strengths:

- Nippon Paint as EPS Compounding Machine

- “Ego-free management” approach dedicated to the pure pursuit of MSV

- Relentlessly pursuing unlimited growth while minimizing risk

We believe these fundamental strengths are still not fully recognized or appreciated by the market. Further insights on these points are provided in the messages from our Co-Presidents.

While our operational excellence—summarized on the right side of this page, often draws attention, we view our greatest strength as our distinctive management approach, which continues to earn and reinforce investor trust through a consistent and proven track record.

11. Message from Co-President Wakatsuki

The second highlight is a message from Co-President Wakatsuki.

In his message, Mr. Wakatsuki offers his perspective on the continued evolution of our Asset Assembler model and expresses his strong conviction in its effectiveness as a driver of sustainable growth.

Mr. Wakatsuki also addresses a common investor concern, that M&A inherently carries high risk. He underscores that, while no acquisition is entirely without risk, our approach is grounded in discipline and free from management ego. All M&A decisions are made through a rigorous, thoroughly evaluated process guided solely by the pursuit of MSV. He highlights the recent AOC acquisition as a concrete example to reassure investors and illustrate how our disciplined approach effectively balances growth opportunities with prudent risk management.

12. Message from Co-President Wee

The third highlight is a message from Co-President Wee.

In his message, Mr. Wee shares his perspective on how we can deliver long-term shareholder value by fully leveraging the strengths of our Asset Assembler model.

He highlights the importance of speed and mutual trust as essential drivers of strategic execution and discusses key themes such as organizational design, the empowerment of local management teams, and a focused commitment to investing in core talents.

The messages from both Co-Presidents in the 2025 edition are especially meaningful and insightful, offering deeper perspective and clarity compared to previous years.

13. Three Key Investor Questions About Our Asset Assembler Model

The fourth enhancement is a more clearly articulated response to frequently asked investor questions regarding our Asset Assembler model.

This year, we provide deeper explanations on several key topics, including the potential implications of rising interest rates in Japan, our approach to fostering collaboration and synergies across the Group, and our views on management succession. A central point we emphasize is that the Asset Assembler model is not dependent on any particular executive. It is designed as a systematic and sustainable business model that ensures long-term continuity and resilience.

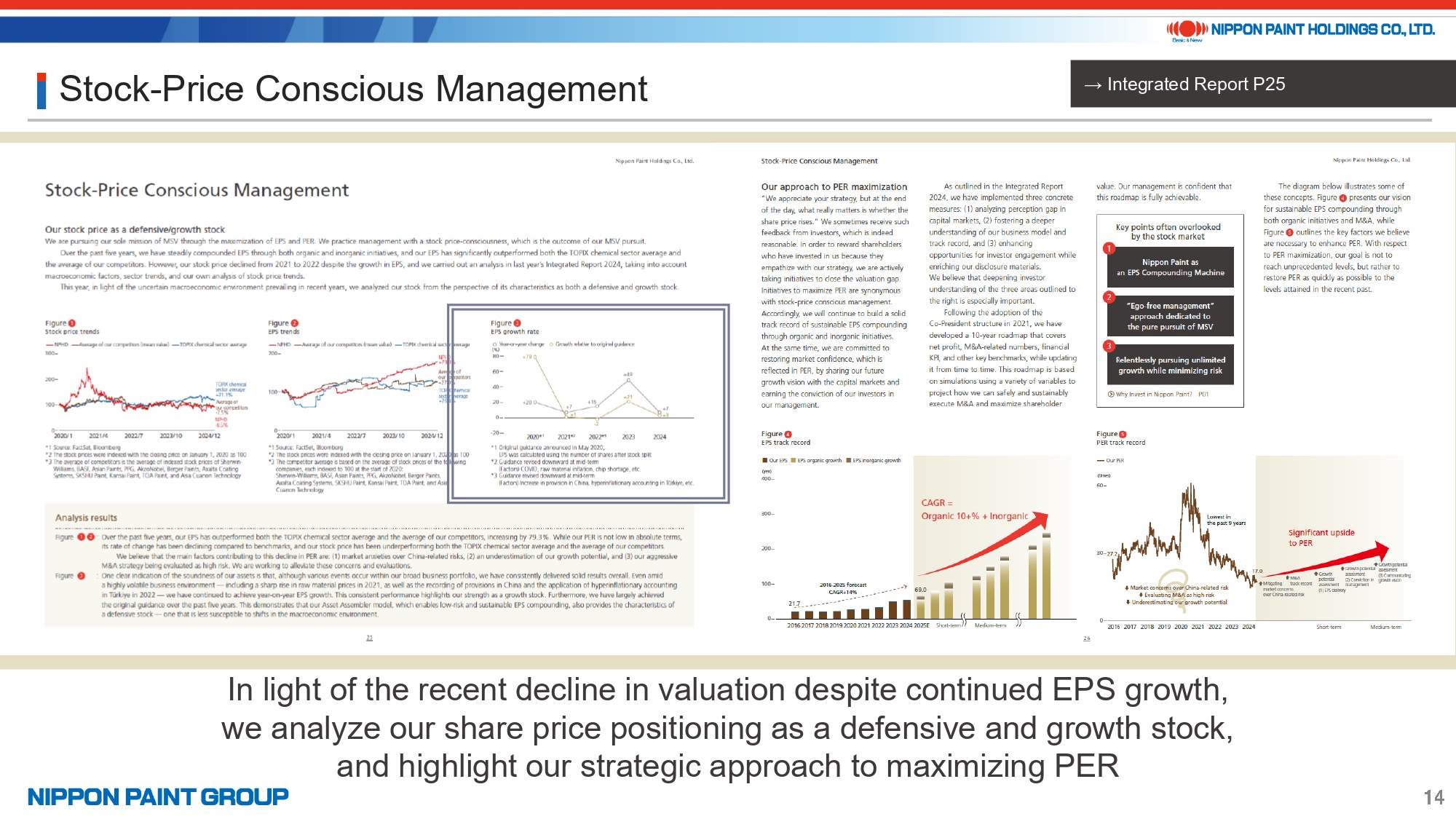

14. Stock-Price Conscious Management

The fifth enhancement is our approach to stock-price conscious management.

While we have continued to deliver steady EPS growth, we recognize that our valuation has declined. Building on the analysis introduced in the 2024 edition, the 2025 edition offers a deeper evaluation of our stock performance, positioning Nippon Paint as both a defensive and growth stock. This analysis draws on our track record, comparing actual results against initial guidance and prior-year performance, and outlines our updated strategy for maximizing PER.

Together with the post-2020 share price analysis presented in last year’s edition, this provides investors with a clearer understanding of the current valuation gap and our initiatives to address it.

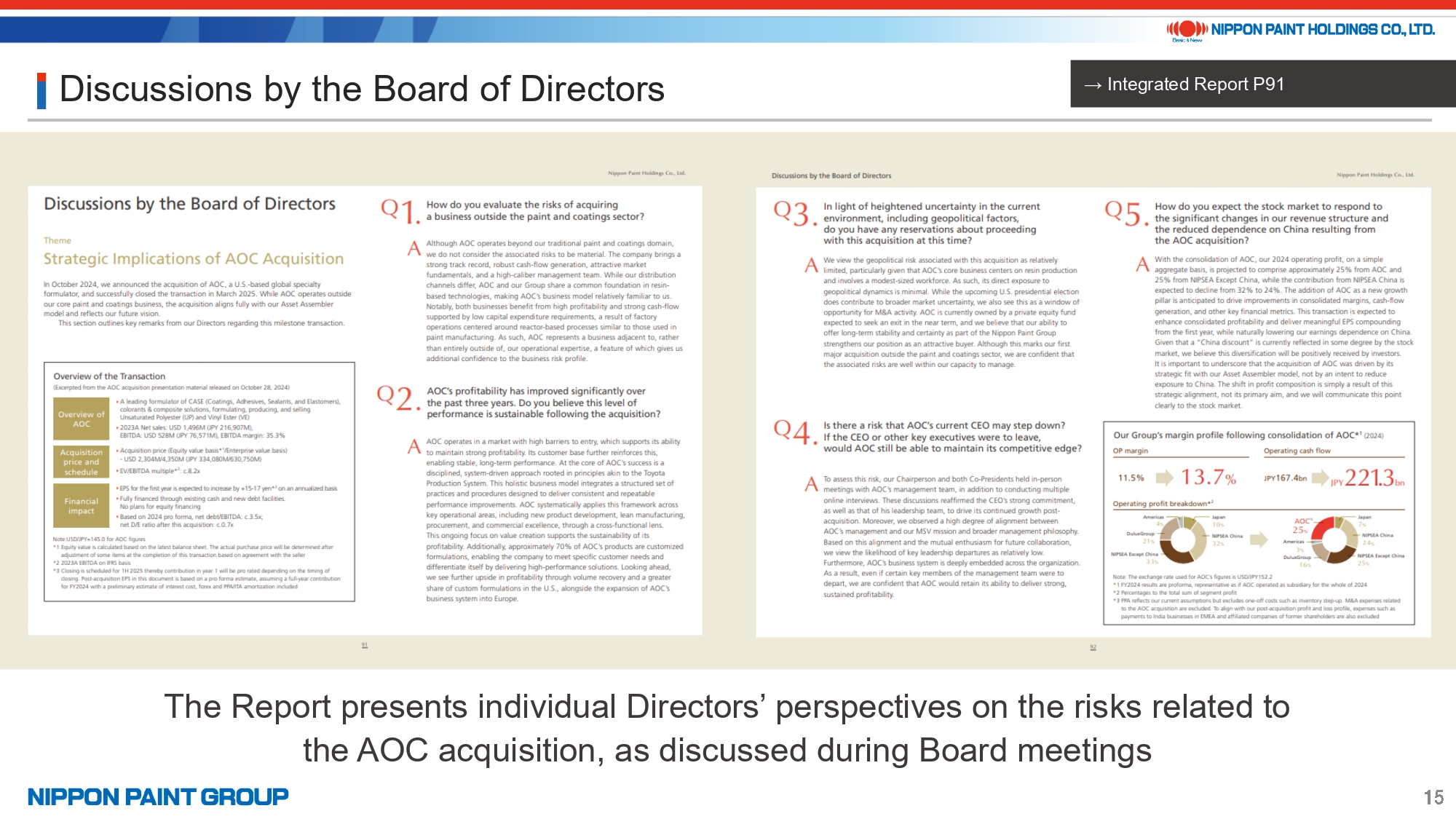

15. Discussions by the Board of Directors

The sixth highlight is the discussions by the Board of Directors.

This section, which has been consistently well received by investors, features a detailed Q&A among Board members focused on the various risks associated with the AOC acquisition, as presented in the 2025 edition. It clearly illustrates that key investor concerns were thoroughly examined and deliberated at the Board level prior to making the acquisition decision.

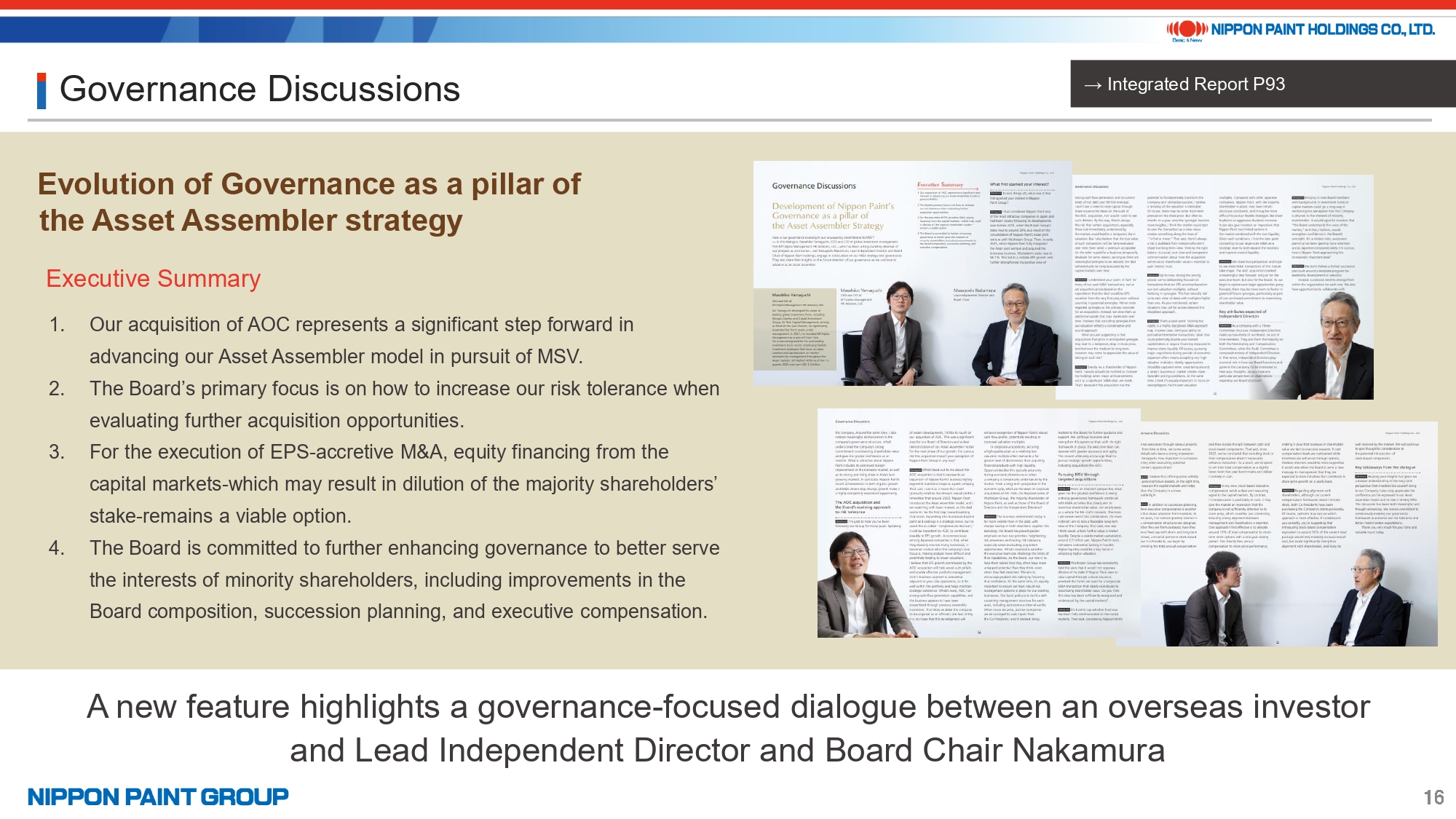

16. Governance Discussions

The seventh highlight is the governance discussion section.

In previous editions, this section featured dialogues with the Chairpersons of the Nominating, Compensation, and Audit Committees, along with insights from Chairman Goh, our majority shareholder. In the 2025 edition, we present a new discussion between Lead Independent Director Nakamura and Mr. Yamaguchi of MY.Alpha Management, offering valuable perspectives from the viewpoint of global investors.

Their discussion centered on our M&A strategy and the future direction of governance. Key topics included the Board’s emphasis on strengthening our risk tolerance when assessing potential acquisition opportunities. They also addressed the view that, in pursuing EPS-accretive M&A, equity financing through the capital markets, while potentially leading to some dilution of the majority shareholder’s stake, remains a viable and strategically sound option.

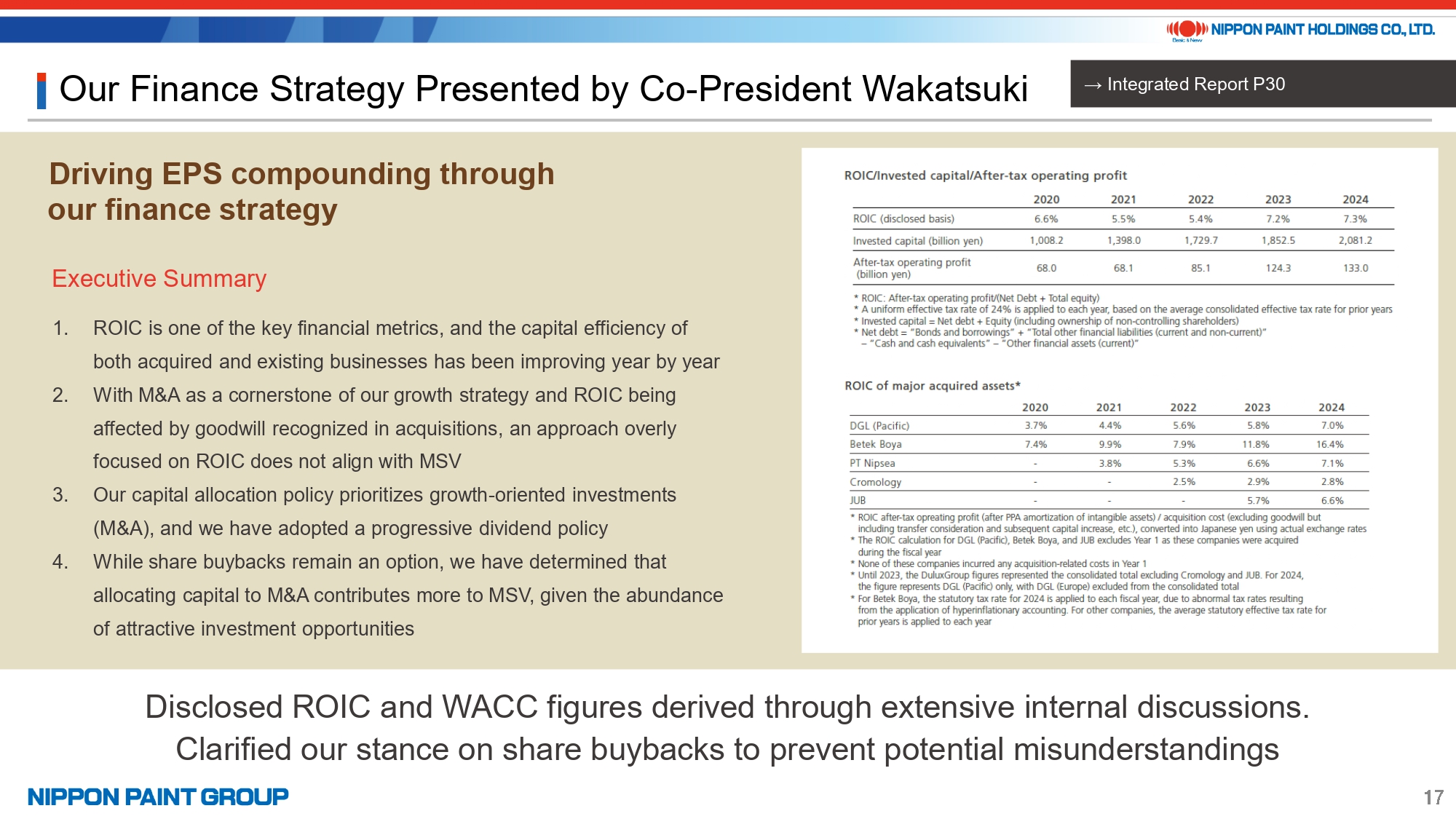

17. Our Finance Strategy Presented by Co-President Wakatsuki

The eighth highlight is our finance strategy, presented by Co-President Wakatsuki.

In the 2025 edition, this section has been enhanced with ROIC and WACC figures developed through multiple rounds of internal discussion. We have also taken care to clearly articulate our position on share buybacks to avoid potential misunderstandings.

The steady improvement in ROIC across acquired companies over the years underscores two key points: (1) we do not take ROIC lightly, and (2) post-acquisition synergies are being effectively realized.

18. Autonomous and Decentralized Management: Features and Advantages

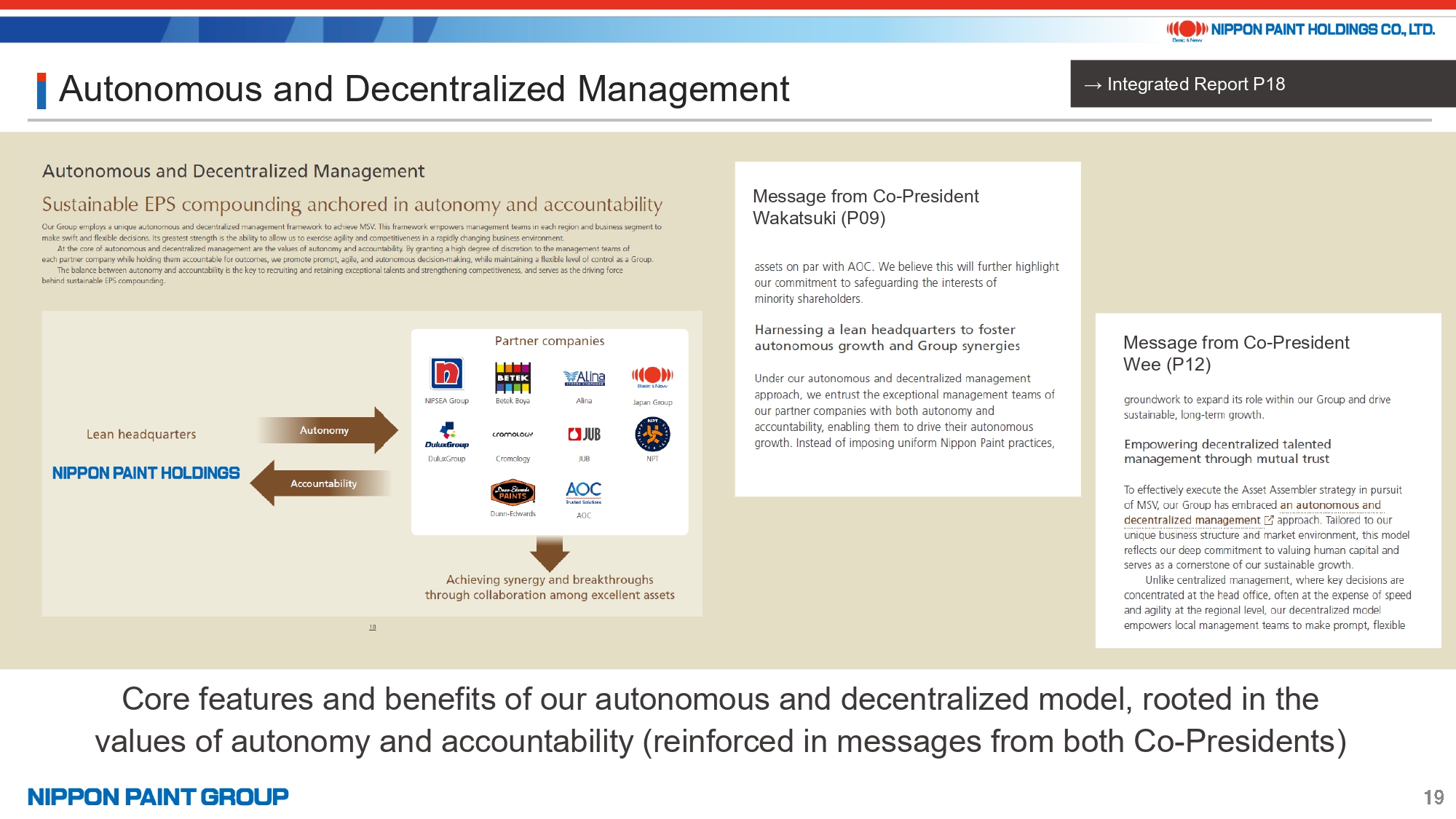

Next, I would like to highlight the key enhancements made to the section titled “Autonomous and Decentralized Management: Features and Advantages.”

19. Autonomous and Decentralized Management

First, we have introduced a dedicated page focused on autonomous and decentralized management, a concept we view as just as essential for investor understanding as MSV and the Asset Assembler model.

In this section, we outline the key characteristics and guiding principles of our approach, with a particular emphasis on autonomy and accountability as its core values. This theme is also reinforced in the messages from Co-Presidents Wakatsuki and Wee.

20. Autonomous and Decentralized Management: Practical Perspectives Presented by Co-President Wee

Second, Co-President Wee discusses the practical application of autonomous and decentralized management, highlighting ongoing transformations within the Japan Group, the automotive business, and the India business through innovative, forward-looking approaches.

Within the Japan Group, profit margins have rebounded to 10%, supported by structural reforms such as the revitalization of our marine coatings business. In his message, Mr. Wee outlines several initiatives aimed at further improving margins toward the 15% level. He expresses confidence in the leadership of the Japan Group, noting their commitment to challenging conventional thinking and driving enhanced collaboration and operational efficiency across the business.

21. Case Study 4

Third, we highlight our initiatives to create synergies by leveraging the strength of our Group platform. As a case study, the 2025 edition features NIPSEA Group’s efforts to expand the Selleys brand across key Asian markets.

Since joining our Group through the acquisition of DuluxGroup in 2019, Selleys has achieved remarkable growth and has become a core pillar of NIPSEA Group’s SAF (Sealants, Adhesives & Fillers) business. This expansion has driven the acquisition of Vital Technical in Malaysia and accelerated our growth in Singapore’s home renovation market, positioning Selleys as a flagship example of cross-group collaboration and successful synergy creation.

22. Our Strengths in M&A

Next, I would like to outline the key enhancements made to the section titled “Our Strengths in M&A.”

23. M&A Strategy/Case Study 1

In addition to outlining our overall M&A strategy, the 2025 edition features messages from the CEOs of partner companies that have recently joined our Group.

Mr. Joe Salley of AOC, which became part of our Group this year, and Mr. Patrick Houlihan of DuluxGroup, which joined in 2019, share, in their own words, the context behind their respective acquisitions and their visions for future growth.

A common theme across both leaders is their confident, action-oriented response to Nippon Paint Holdings’ core principles of autonomy and accountability. Each addresses our fundamental question: “What do you want to achieve, and why? And how can we help you get there?”

24. Expansion of Practical Examples and Data

Next, I will outline key improvements in the “Expansion of Practical Examples and Data” section.

25. Case Study 2/Case Study 3

First, we feature NIPSEA China and DuluxGroup, partner companies that are of strong interest to investors, as case studies.

Building on the presentations from our inaugural IR DAY held in December 2024, the 2025 edition highlights how we are advancing growth strategies in two contrasting markets: the highly uncertain Chinese market and the mature Australian market. In both cases, we are leveraging our well-established brand equity and other competitive strengths.

In particular, we present a detailed analysis of our brand’s Top-of-Mind (TOM) rating in China, broken down by (1) city tier, (2) product positioning, and (3) age group, while highlighting the gap with the second-ranked competitor. The Report also outlines concrete initiatives, including localized sales promotion strategies targeting Tier 3–6 cities and dedicated support programs for professional painters.

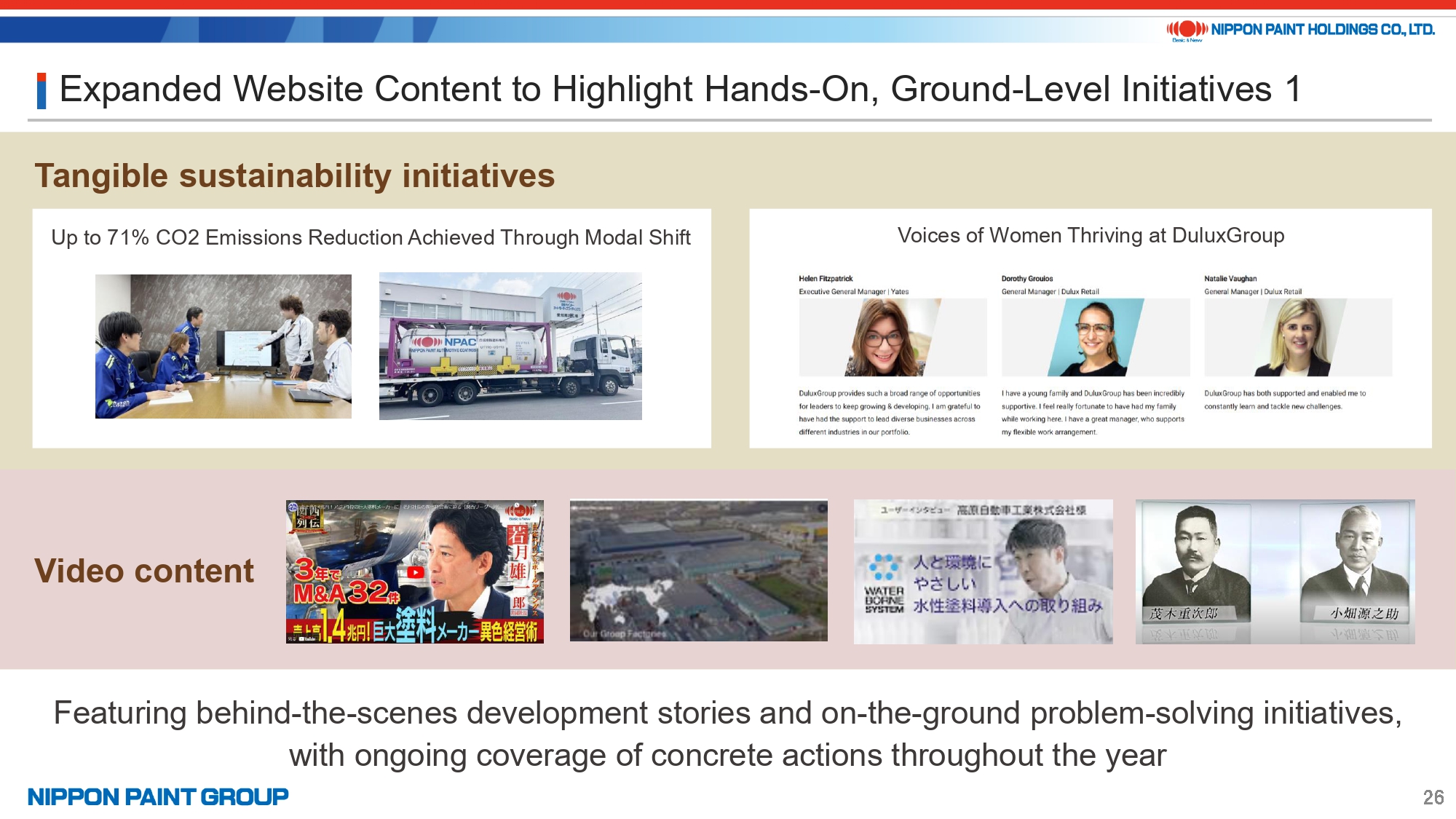

26. Expanded Website Content to Highlight Hands-On, Ground-Level Initiatives

Second, we have enhanced our website content to offer more concrete, on-the-ground initiatives that complement the Report.

Over the course of the year, we will showcase behind-the-scenes development efforts and on-the-ground initiatives that demonstrate practical solutions and the commitment of our team members. Many of these features will spotlight the Japan Group, and a video introducing our company’s history since its founding is also available for viewing.

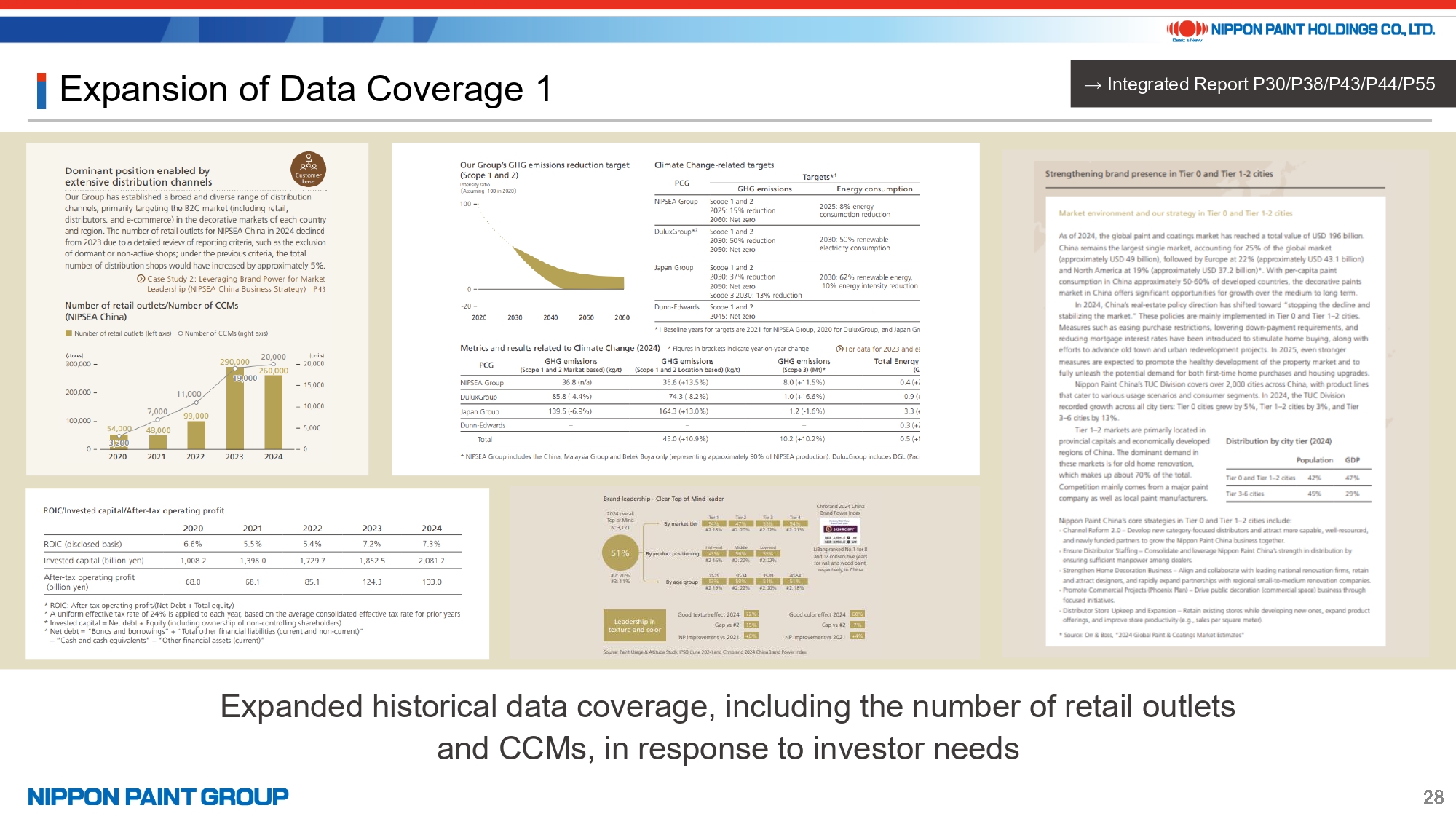

27. Expansion of Data Coverage

Third, we have broadened our data coverage.

In response to investor needs, this year we have increased the volume of disclosed data, including historical figures on the number of retail outlets, CCM installations, and tier-based market data for China. The Asset Management Report, published as a standalone volume since 2024, has also been expanded to 17 pages, consolidating both financial and non-financial results for each asset company, along with their medium-term growth strategies and competitive strengths.

The Investor Book is updated regularly and now includes sales data for the Singapore and Malaysia Groups. It also features detailed company profiles, including SWOT analyses, records of inorganic growth, and a broad range of market data.

While some data cannot be disclosed for competitive reasons, we remain committed to fulfilling investor requests to the greatest extent possible.

28. Integrating Sustainability with EPS and PER

Next, we focus on “Integrating Sustainability with EPS and PER.”

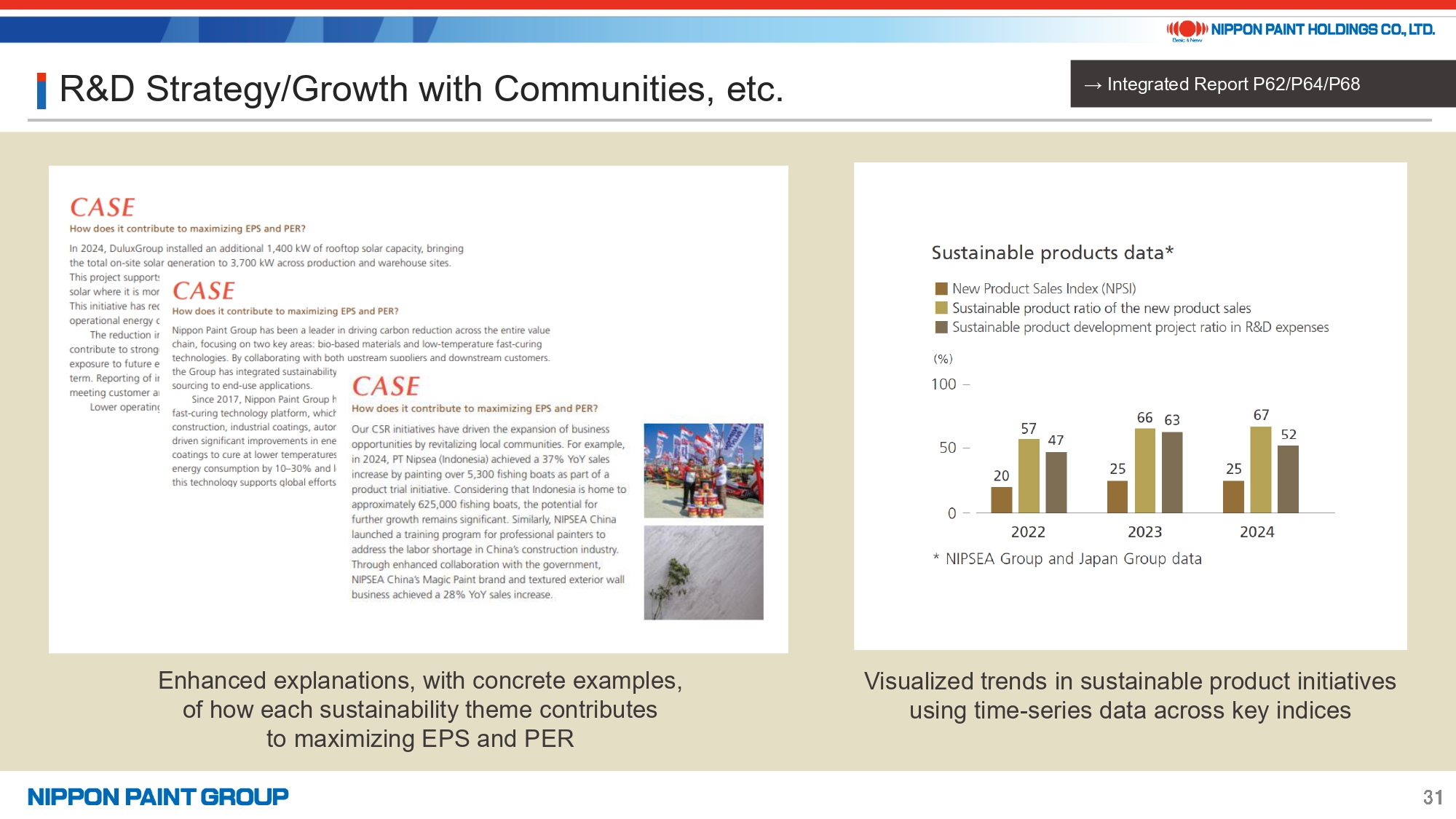

29. R&D Strategy/Growth with Communities, etc.

We have enhanced our explanation of how sustainability contributes to maximizing EPS and PER by incorporating concrete examples. For sustainable products, we also included time-series data for each index to clearly illustrate long-term trends.

For instance:

- In the environmental strategy section, a case study from DuluxGroup highlights reductions in energy costs and improvements in environmental compliance through the addition of solar power capacity;

- In the R&D strategy section, we present examples of sustainable products tailored to local markets, developed using bio-based materials and low-temperature, fast-curing technologies;

and

- In the growth with communities section, we feature data-supported cases from Indonesia and China showing how social contribution initiatives revitalized communities and led to new business opportunities.

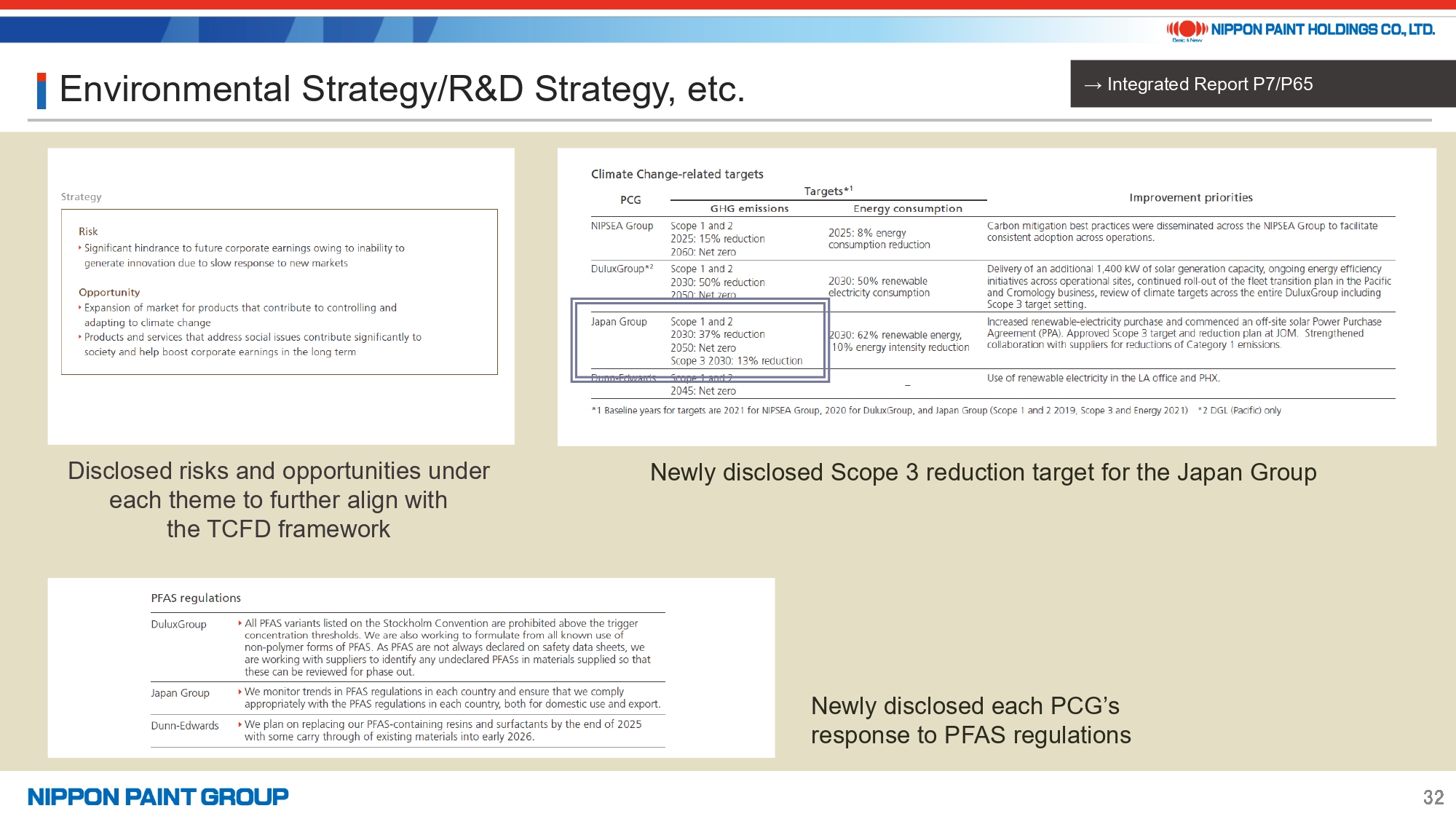

30. Environmental Strategy/R&D Strategy, etc.

Additionally, we have disclosed risks and opportunities for each theme, further aligning our content with the TCFD framework.

For the first time within our Group, the Japan Group has set a Scope 3 reduction targets while DuluxGroup is currently considering setting its own Scope 3 goals.

As global regulations on PFAS (Per- and polyfluoroalkyl substances) continue to tighten, supply chain accountability is gaining importance. In response, we have newly disclosed the status of PFAS management across each PCG (Nippon Paint Group partner companies grouped by region or business).

31. Case Study 5

Furthermore, we presented case studies highlighting our analysis of key challenges and specific initiatives aimed at enhancing employee engagement within the Japan Group.

In 2024, we carried out our first-ever engagement survey. As shown in the lower right of this page, our scores fell below the average for Japanese companies. A gap analysis between the current state (“As is”) and the desired future state (“To be”) revealed three major challenges: (1) a lack of optimism and elevated outlook in the company’s future, (2) insufficient improvement in the work environment, and (3) limited opportunities for employees to develop their skills and career paths. We are currently implementing measures to address these issues and will track progress through ongoing surveys.

32. Other Content in Focus

Finally, I would like to draw attention to two additional noteworthy sections.

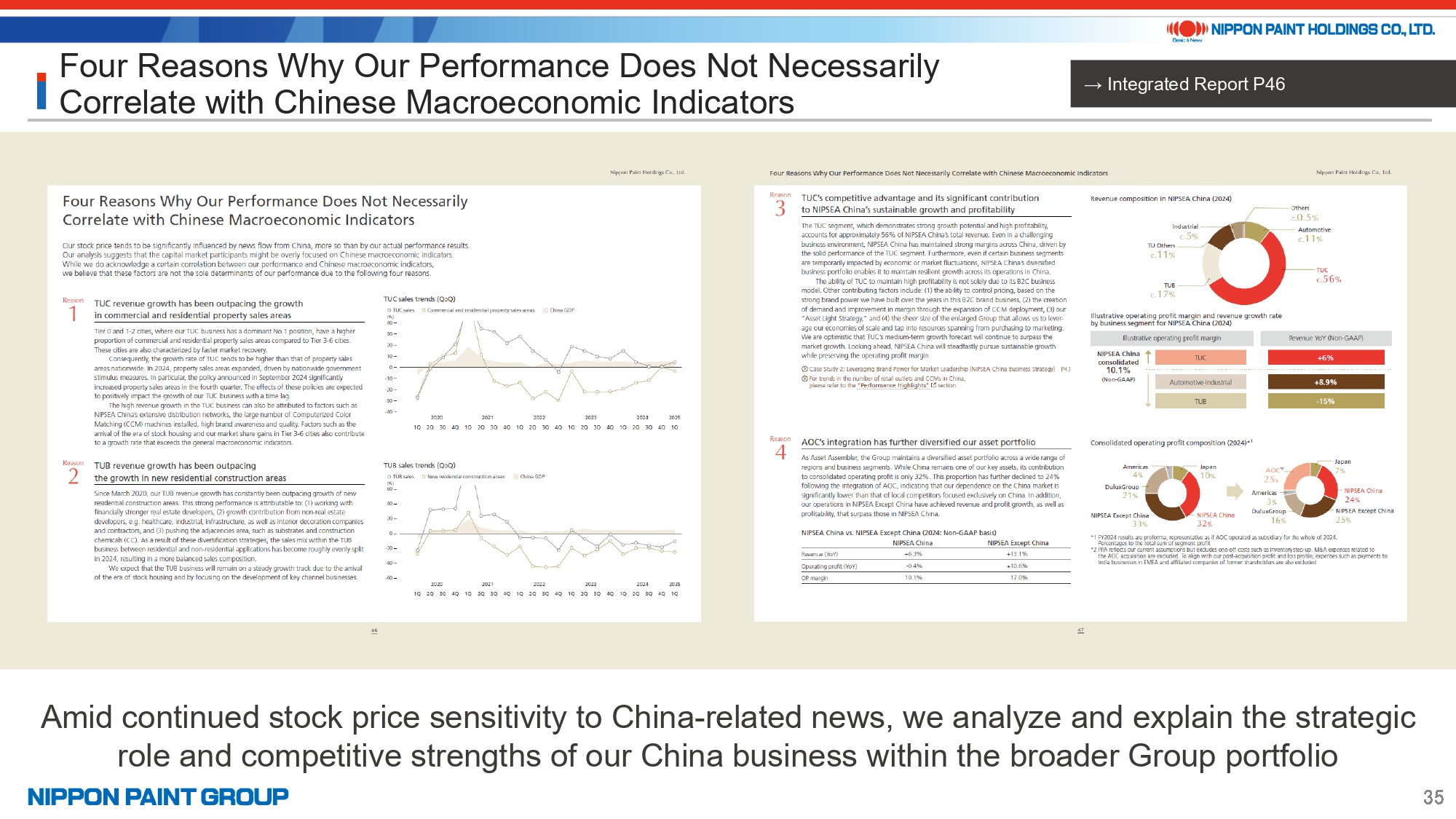

33. Four Reasons Why Our Performance Does Not Necessarily Correlate with Chinese Macroeconomic Indicators

First is the correlation analysis between our performance and Chinese macroeconomic indicators, which was very well received in the 2024 edition. As our stock price continues to be heavily influenced by news flow from China, we took a closer look at the strategic positioning and competitive strengths of our China business within the broader Group portfolio.

Key takeaways include: (1) both market-specific and company-specific factors enable TUC to consistently outperform overall market growth; (2) TUC’s profit contribution and growth rate help stabilize margins within NIPSEA China; and (3) with the consolidation of AOC, and considering that growth rates and margins in NIPSEA Except China exceed those in NIPSEA China, it becomes evident that our stock should not be viewed solely as a “China-related stock” directly tied to Chinese macro trends.

34. Message from the Chairman

The second highlight is a message from our Chairman and majority shareholder.

In the 2024 edition, Chairman Goh participated in a dialogue on governance with our Lead Independent Director. For the 2025 edition, we have returned to the traditional message format, in which Mr. Goh shares his current views and reaffirms his long-term vision for contributing to the Group.

As in previous years, his message focuses on four key themes:

(1) MSV anchors the core values and decision-making principles of both the Board of Directors and

the executive team, and our Co-President setup is remarkably effective, (2) the benefits of having

Wuthelam Group as the majority shareholder, (3) his perspective on potential equity financing for

future acquisition opportunities, and (4) his role as Chairman. In addition, he offers his

perspectives on the recent AOC acquisition.

This concludes my presentation. I will now be happy to take your questions.

Thank you for your attention.