1. Introduction

Good morning, good afternoon and good evening to all of you.

At the IR Day last year, I gave a presentation on NIPSEA Group, with specific focus on our China Group and Malaysia+ Group as together they constitute a very substantial part of our business.

Today, I will update on our business in China. I will also spend some time on our Türkiye Group as I only spoke briefly about it as part of the Malaysia+ Group last year.

2. NIPSEA China in 2025 and Balanced Growth Strategy

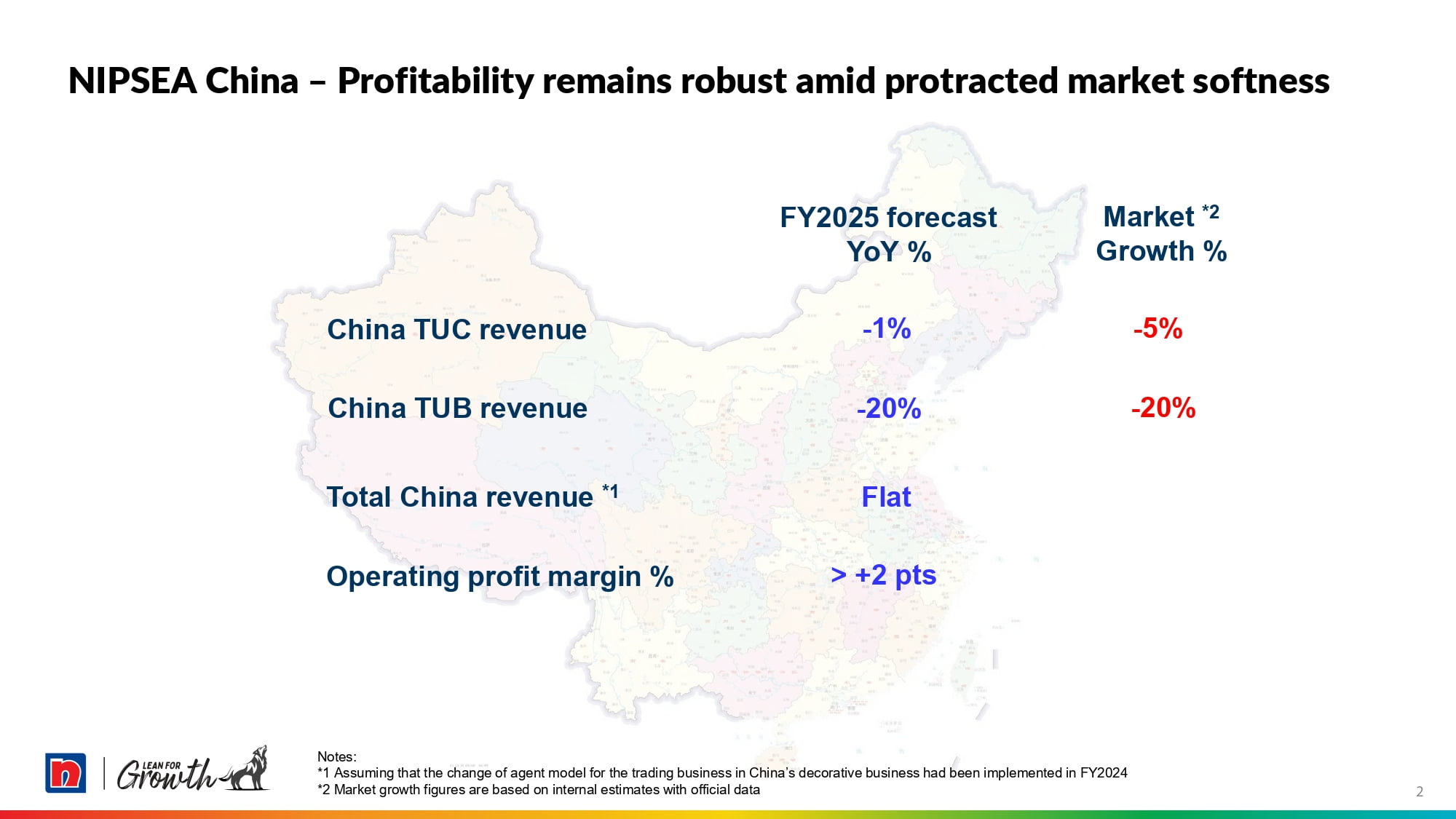

2-1. NIPSEA China – Profitability remains robust amid protracted market softness

For 2025, we estimate that our addressable decorative market in China for TUC (which is the business unit focusing on consumers) is down by about 5%, while we expect our TUC revenue to end the year by a drop of 1%. For TUB (which is the business unit facing the business enterprises), we believe that because of the measures we have taken to manage our risks, our TUB revenue will drop by about 20%, which we estimate to be about the same decrease as that in our addressable TUB market.

The expected lower revenue growth performance in TUC reflects the ongoing weak consumer sentiments in China. The continual decline in our TUB revenue stems from the long winter in the residential property sector, and our efforts to pivot to other sectors for TUB is just beginning to bear fruit.

Overall, together with our automotive and industrial coatings segments, NIPSEA China’s operating topline revenue will be flat, but we will have margin growth and increased operating profits.

2-2. Brand leadership & Gaining ground across the different tiers cities

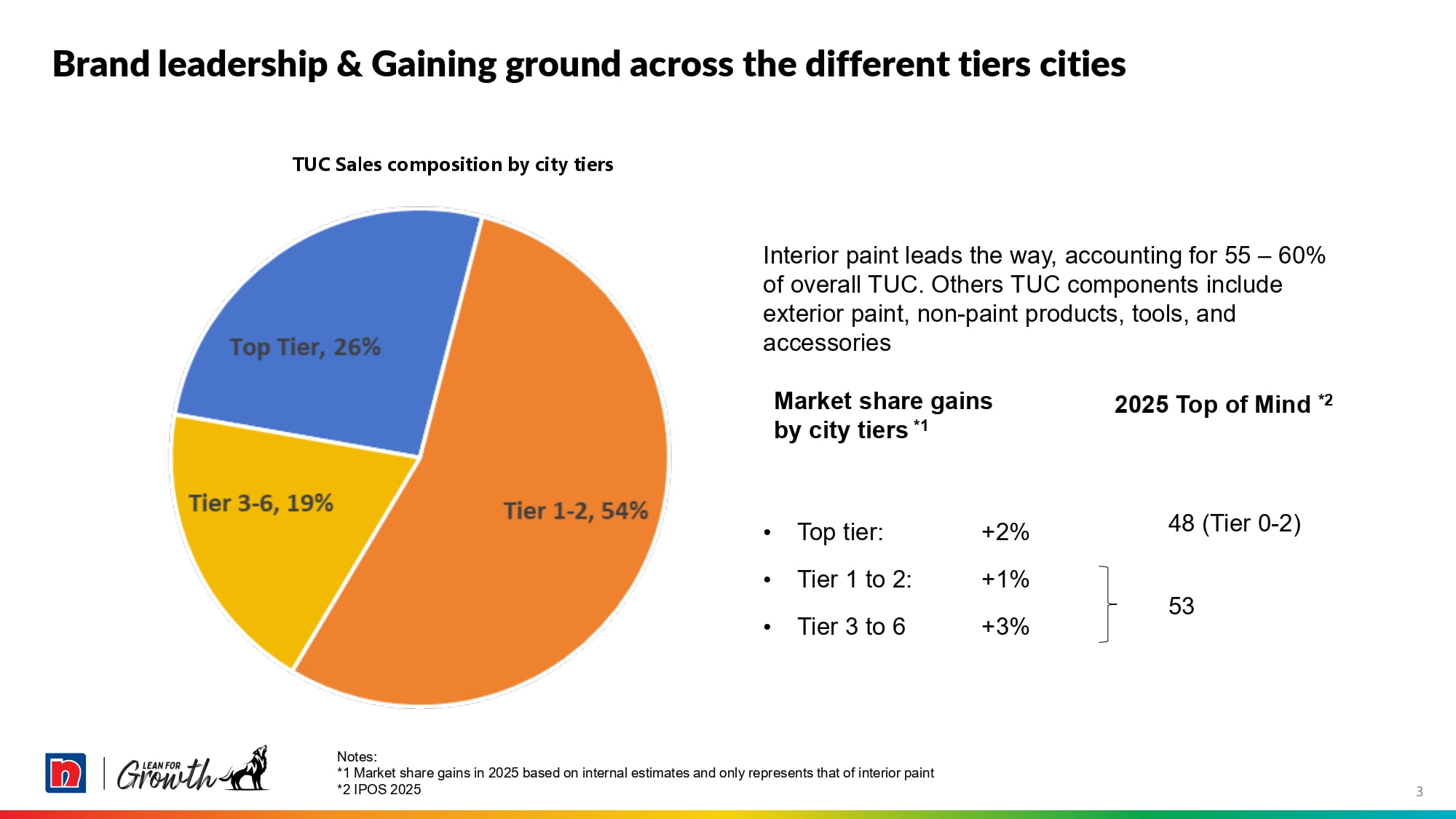

Our investors are familiar with Nippon Paint’s sole mission of Maximizing Shareholder Value (MSV). In NIPSEA China, this comes to life in our balanced growth strategy of delivering profitable growth through a careful balance between market share gains and profit margin. We try not to chase after market share at the expense of long-term sustainable profitability. As a responsible market leader with the key premium brand in China, it is always incumbent upon us to resist major price adjustments to avoid precipitating a race to the bottom, especially in these trying market conditions. Cost optimization is a constant in the equation to increase profit margin and profitability, and it is ingrained in our operating culture. Our efforts in utilizing our scale to extract further cost improvements as well as innovative ways to manage our supply chains are reflected in the current margin growth. This chart is a depiction on where we think we are in the TUC market space in 2025. In a shrinking market, we achieved small market share gains in all city tiers in China whilst maintaining relatively high Top of Mind and higher operating profits.

We are also taking the time to strengthen internally and manage our risk exposure. For example, in TUB, cash collection is top priority, and we had actually walked away from a lot businesses that carried high credit risk. For TUC, where account receivables from specific customers become significantly overdue, we tighten credit terms. Where stocks remain high in certain regions of our market, we hold back from pushing sales in these areas.

As our responses to these continuing sluggish market conditions are different in TUC and TUB, I will attempt to discuss them separately.

3. Leading and Expanding the TUC Business

3-1. Solidifying our brand’s dominance as the decoration effects leader

For TUC, it is about leading and expanding. NIPSEA China currently holds about 25% of the TUC market in China, while the next two competitors each hold high single-digit shares. In TUC, what continues to be of critical importance for our business going forward are:

- A strong brand that reflects the quality and value of our products and allows us to find willing and able partners to forge mutually beneficial relationships (the strong brand and partners linkage);

- An effective and efficient distribution network that allows us to penetrate markets and deliver quality service to our customers to the last mile (efficient distribution and penetration/quality service linkage); and

- A sufficiently comprehensive product portfolio that allows us to target different markets with suitable products at appropriate price-points and also complementary non-paint products to meet our customers’ complete needs (competitive and broad-range product portfolio).

By following these three guiding points, we had achieved significant success in the China market in the past. These points remain relevant as we respond to the changing competitor landscape and consumer needs and preferences in China. And in the course of the next 10 minutes, I will illuminate with actions we have taken in 2025 along these lines.

Going forward, the TUC market is supported by stable and recurring re-painting demand each year. In this stable, and possibly sluggish environment, in order to capture additional growth, we continue to:

- Pursue a color and texture strategy;

- Penetrate into Tier 3-6 cities with paint and complementary products; and

- Enhance customer service at the last mile through operational innovations.

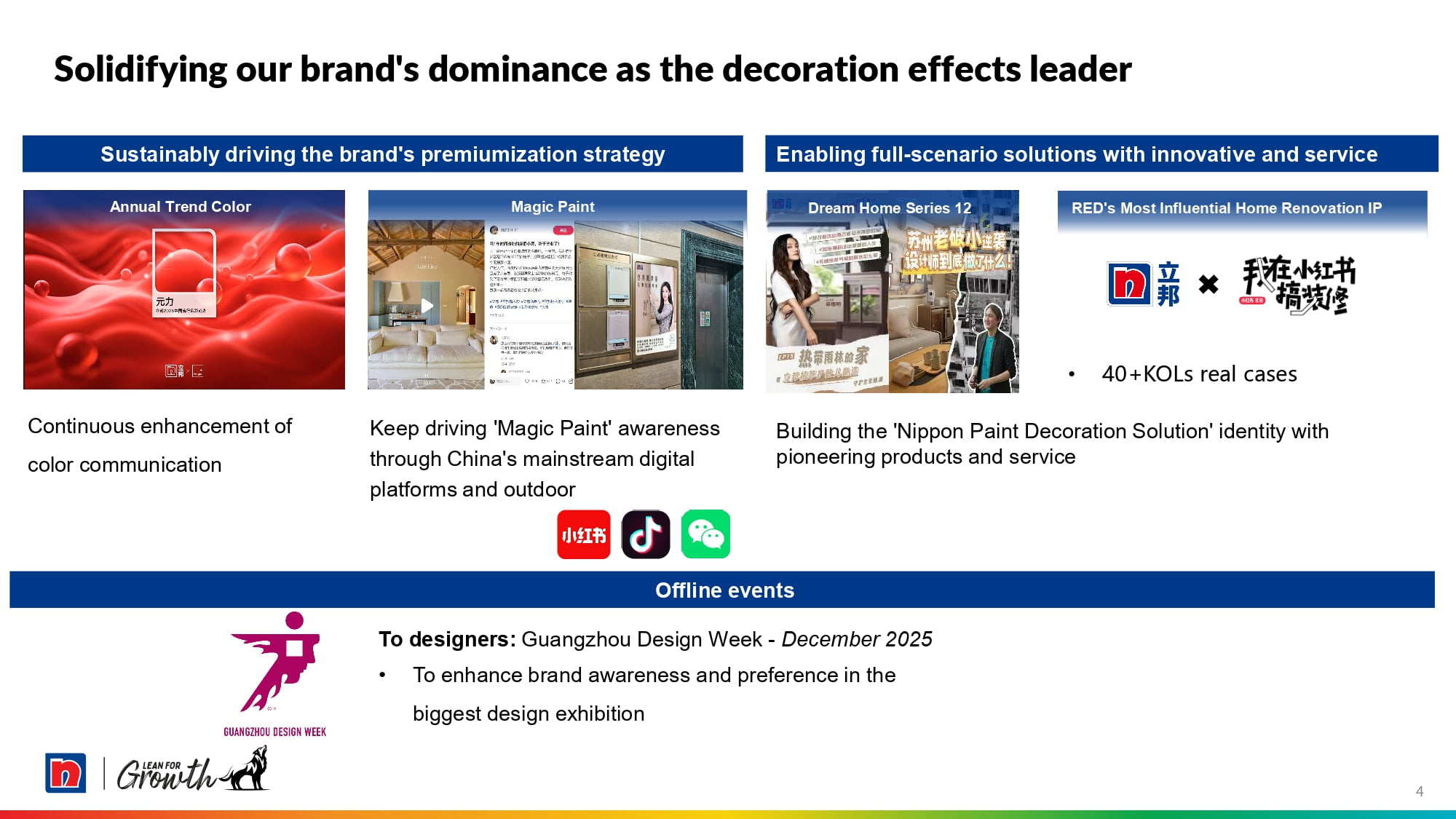

As you may recall from last year, we are in the 4th year of our color and texture strategy with the aim to dominate the TUC market. As market leader, NIPSEA China has to take the lead in color innovation and color trend-setting. As for texture strategy, Magic Paint is our superior texture paint product, and coupled with our advantage of having the infrastructure to train a large group of painters in the specialized application of texture paint. In this regard, NIPSEA China holds the distinction of being the first foreign private enterprise to be certified by the Chinese Government for extending this type of training.

3-2. Tier 3-6 cities County Distributor – Application Service Partner (ASP) model to build direct service to painters and grow texture exterior coatings

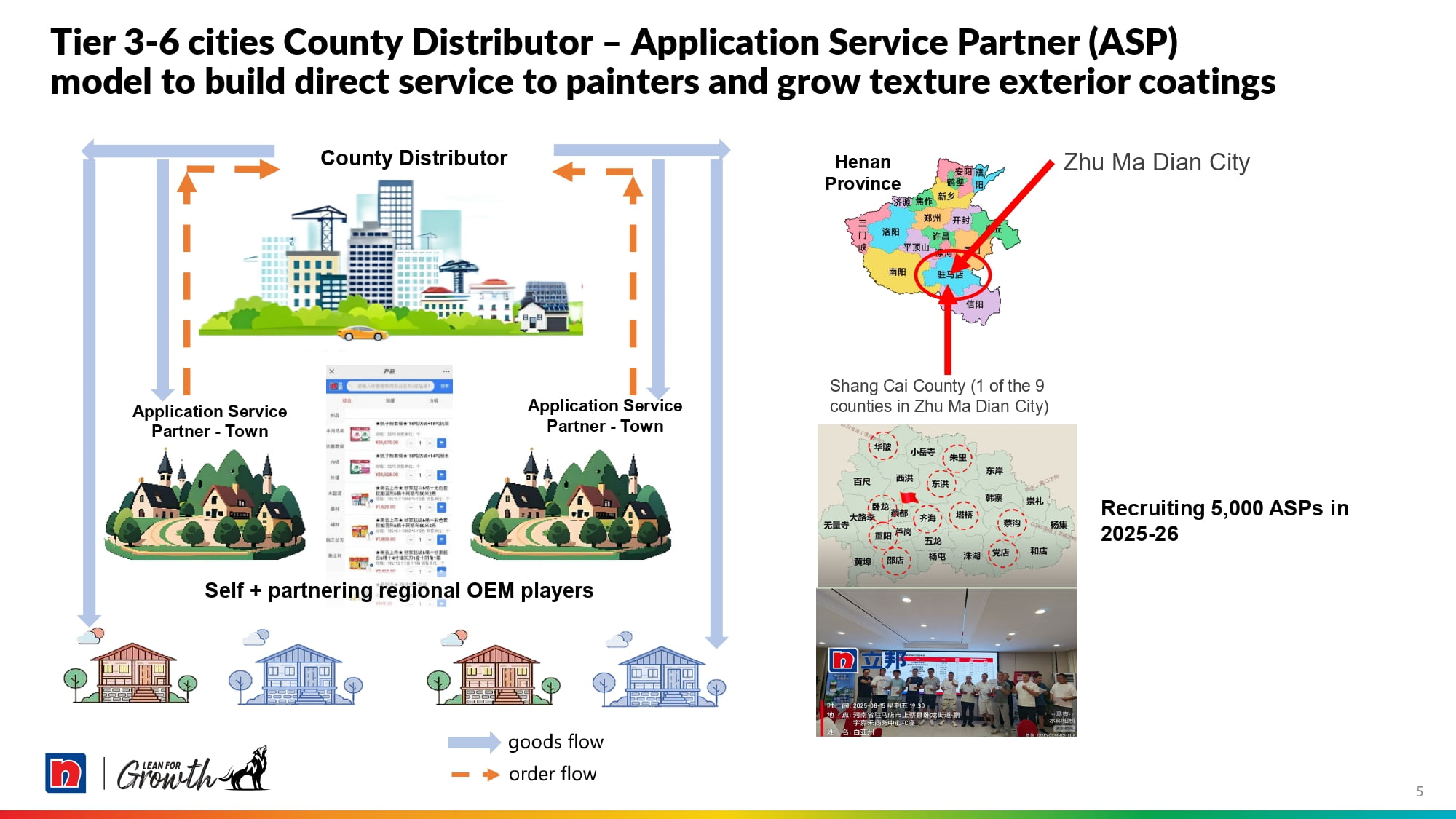

As for growing our business in the Tier 3-6 cities (the smaller cities in China), I also mentioned previously that we have adopted an asset-light approach of partnering regional players also in the paint industry as our tollers to produce our formulations. In this win-win arrangement, we bring our brand, technologies and formulations while they bring their local capabilities to the partnership. We also adopted a similar asset-light approach for our complementary product offerings of dry-mix, putty and mortar, although for these non-paint products we started by setting up our own factories to learn the trade until we gained enough confidence. Now by adopting this asset-light approach, NIPSEA China is able to expand quickly into Tier 3-6 cities, some in far-flung regions of China, without the need to invest hard assets on the ground.

Remember, I mentioned 3 guiding points earlier. In our progress in texture paint and the Tier 3-6 cities business expansion in 2025, the strong brand and partners linkage; and the efficient distribution and penetration/quality service linkage guiding points are clearly seen in action. As we become more attuned to the different market dynamics in the smaller Tier 3-6 cities from our experience in the bigger metros, we adapted our distribution concept to the county distributor – application service providers (or ASP) model. (See right hand chart of an illustrative example of Zhu Ma Dian City in Henan Province.) By having the ASPs who offer application services for paint jobs to sell paint and also complementary products typically needed in any building refurbishment or home renovation, we believe we are beginning to accelerate the penetration into the Tier 3-6 cities.

Here, both the strong brand and partners and penetration/quality service linkages are in play: the strong Nippon Paint brand attracts service providers as our partners, and the support by key county distributors to the web of service providers ensure that these ASPs can focus on customer acquisition and service delivery. Specifically on texture paint, we have enhanced our production efficiency and reviewed our raw material purchases to enable our texture paint to be price-competitive in these smaller markets, which is the third guiding point of competitive and broad-range product portfolio. With these adjustments in our texture paint and the Tier 3-6 cities business expansion activities in 2025, we are confident that we will be able to further gain ground by leaning on our 5,000-plus ASPs.

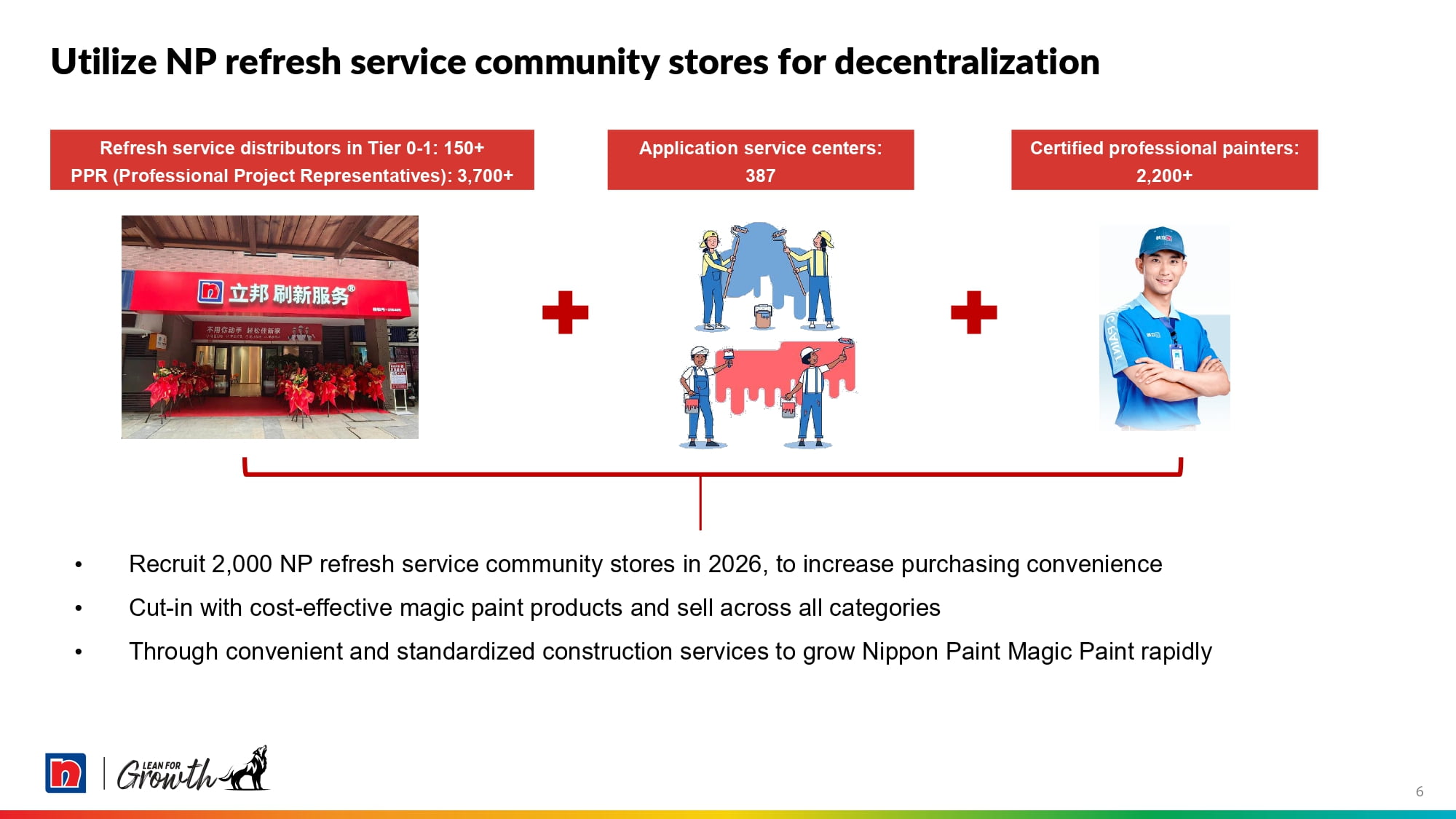

3-3. Utilize NP refresh service community stores for decentralization

While we are holding well in the Tier 0 and Tier 1-2 cities, there is no room for complacency, and we will continue to innovate and improve. As it is our belief that the repainting market in the Tier 0-2 cities will continue to grow, we are enhancing our sales reach and consumer experience beyond our traditional retail store model. Working with partners, we are setting up community stores dedicated to our repainting service so as to be closer to the customers, with a target of 2,000-plus community stores in 2026. With the community stores carrying our flagship texture Magic Paint and other quality paint products; tapping on professional service by painters trained and certified by us offering a standard menu of products and services, we believe we will make renovation and repainting so much more accessible and appealing to our customers.

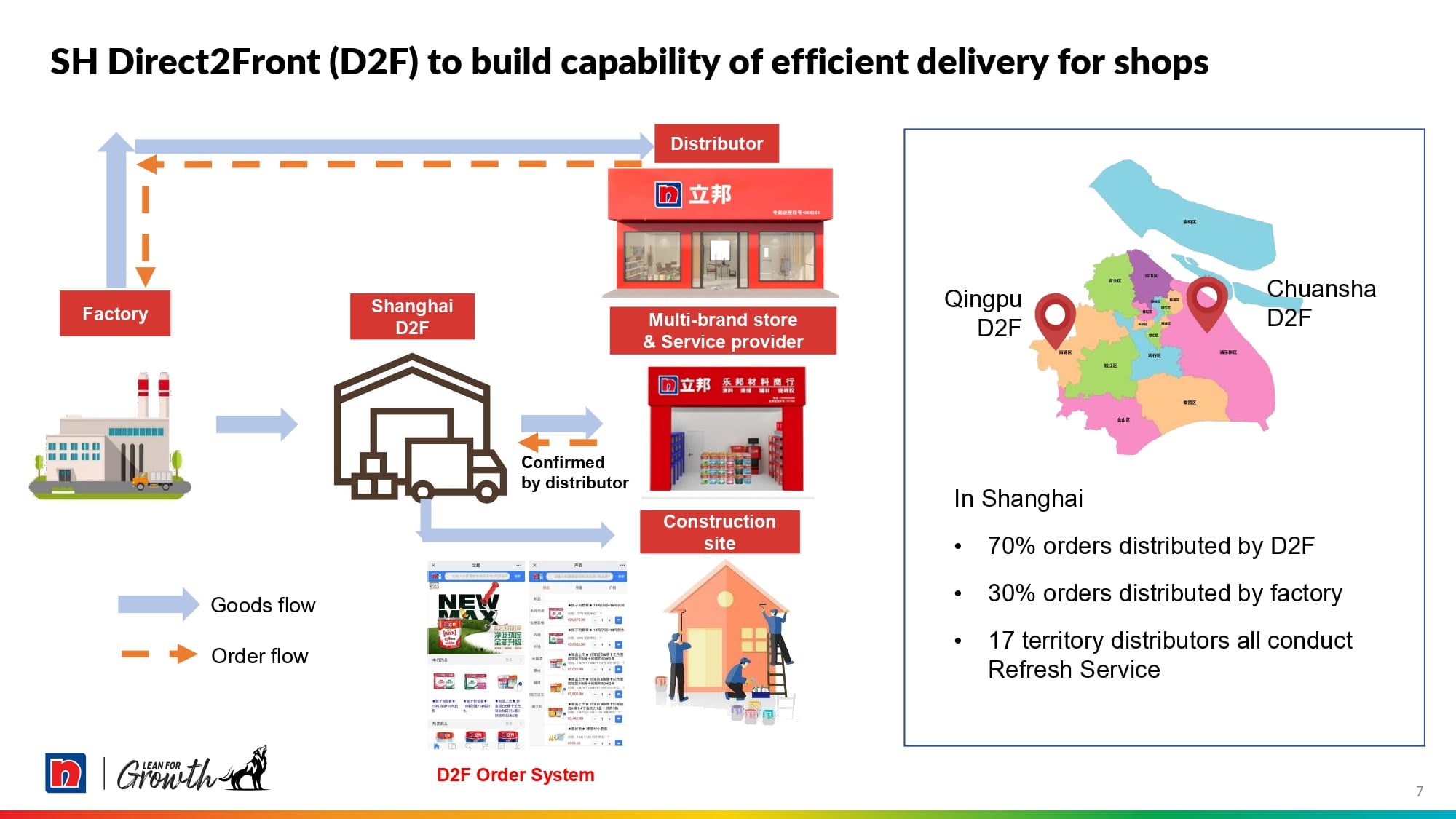

3-4. SH Direct2Front (D2F) to build capability of efficient delivery for shops

As an operational innovation, we have developed and implemented a concept to centralize supply chain management and execution for our distribution networks in Tier 0 and selected Tier 1-2 cities. The key idea of this centralized Direct2Front logistics concept for large urban cities is to leverage our better logistics capabilities, coupled with our advantage of scale, to send products directly to the retail stores and also construction sites, reducing friction in the current process. This way, our distributors can save on logistic overheads and the retail stores can focus on customer acquisition and experience. We have successfully implemented this concept in Shanghai with two central depots and are working to implement it in other cities.

China comprises different complex markets (even for TUC) and we have adapted different approaches to appropriately tackle the multitude of markets and their dynamics.

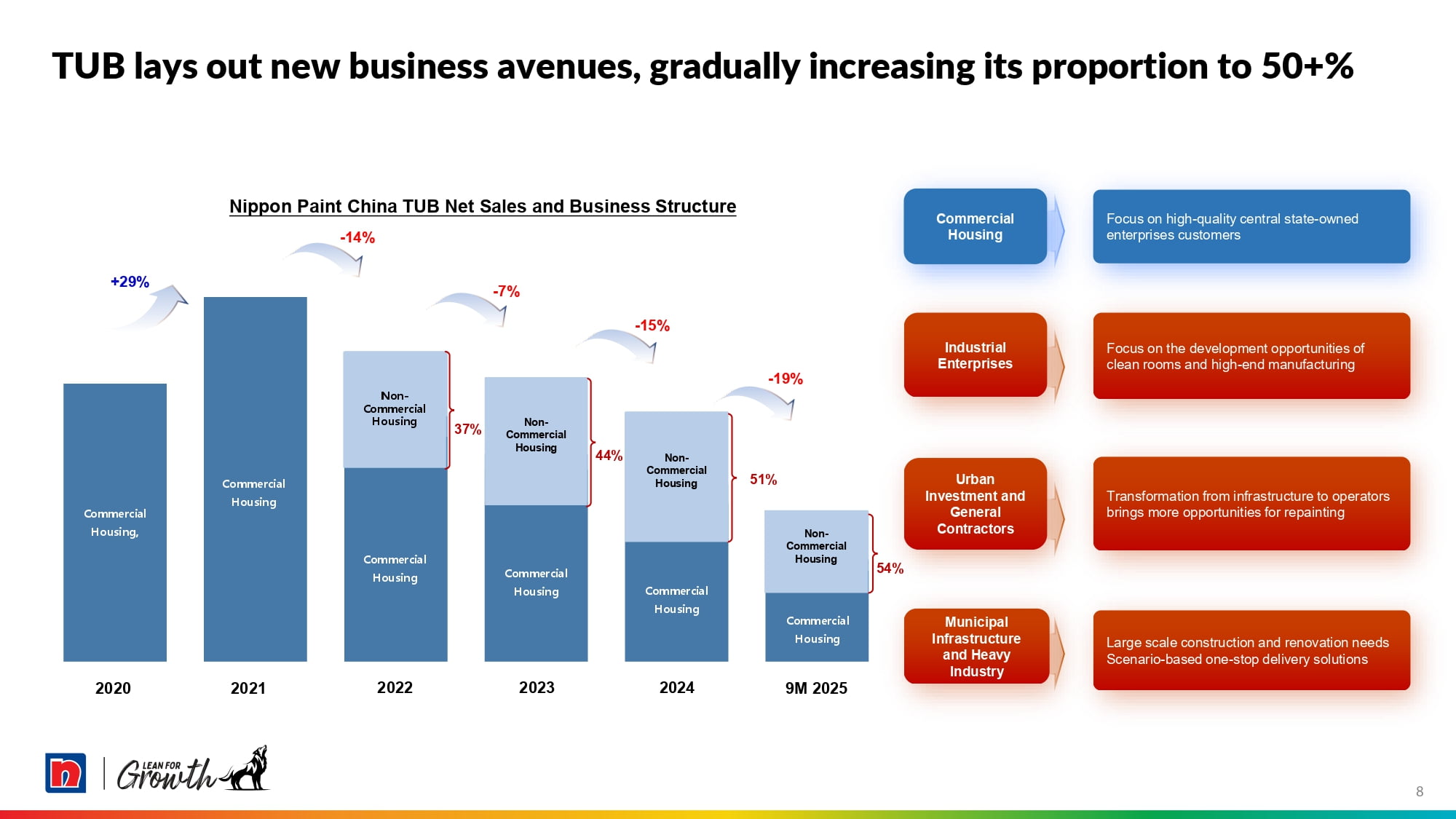

4. Stabilizing and Diversifying the TUB Business

4-1. TUB lays out new business avenues, gradually increasing its proportion to 50+%

Now I will turn to TUB in which the focus is stabilizing and diversifying. We have stabilized our TUB business in China following the serious downturn in the residential property sector. We went on a very strict credit regime and exited from many of the troubled counters. As a result, we have successfully reduced debt associated with TUB customers. If there was a silver lining to this difficult period, it was that it awakened us to opportunities that we had neglected in the past. In the past, like our competitors, we were single-mindedly focused on providing products and services to the big property developers. And pre-Covid, they were really racing away. Today, our customer base is more broad-based, including regional developers, contractors and service providers, and we are also pivoting to the non-residential sectors, such as government offices, schools, hospitals, district rejuvenation, factories and even central kitchens. In time to come, this diversification of our TUB customer base, which includes those with specialized requirements, will fortify our sales volume and OP margin and reduce our dependence on new build construction in the residential sector.

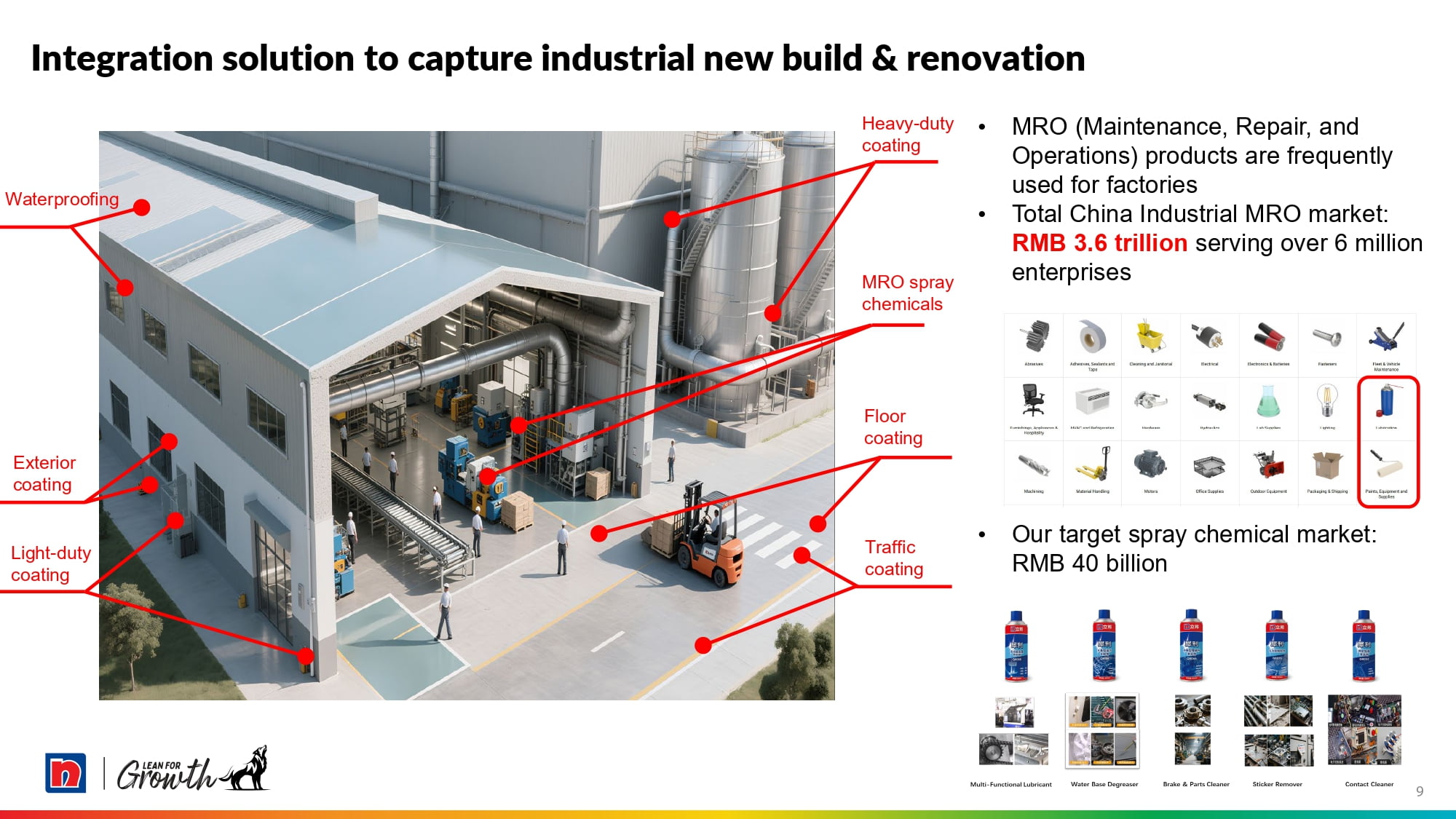

4-2. Integration solution to capture industrial new build & renovation

As our TUB colleagues break new grounds in the non-residential arena, they can utilize the product offerings from Nippon Paint Industrial businesses. One area that we are banking on to grow is to offer integrated solution for industrial new build and renovation. This is a new business segment we call MRO or Maintenance, Repair and Operations to industrial facilities across China. We could potentially count 6 million sizeable enterprises as customers. Apart from our usual provision of industrial coatings, we aim to provide MRO spray chemicals such as lubricants, de-greasers, cleaners for brakes, parts and contact surfaces, and sticker removers, for example. So, watch this space.

5. Continuous Innovation and Improvement

In 2025, we continue on innovation and improvement. As a company, NIPSEA aims to continuously innovate and excite the market. At the China International Import Expo in Shanghai earlier this month, under the theme “Together, Refresh a Sustainable Future”, NIPSEA China showcased its innovative products and scenario-based solutions aligned with China’s key development priorities, which are, namely, the low-altitude economy, AI in manufacturing, new-energy vehicles, high-quality housing and ESG. We had the global debut of our Nippon Paint Low-Altitude Aviation Comprehensive Coating Solution developed by our global R&D. We presented the “protective outerwear” coating for the composite airframe of eVTOL aircraft and the “resilient ground” coating system engineered to withstand rotor downwash and impacts during vertical take-off and landing. At our booth, you would have also seen our radiative cooling coating under our industrial coating solutions, the insulation, fire-resistant and protective polyurea coatings for new-energy vehicles, and integrated solutions for building exterior and interior walls and garages for existing and new houses to be safer, more comfortable and to enhance eco-friendliness. True to Nippon Paint Group’s Purpose Statement, we use the power of Science + Imagination to enrich the living world.

6. NIPSEA China in 2026

Now for NIPSEA in 2026. The business environment in China has not made a meaningful recovery in 2025 that we had hoped for at the start of the year. Nevertheless, we recognize that there are areas where we could have done better and we have undertaken various initiatives to address growth in a sluggish market situation. For TUC, we are targeting for high single-digit growth for 2026. As for TUB, our team in China believe our TUB business has bottomed out in 2025 and we are optimistic that we have arrested the decline that we have seen over the last 4 years. Overall, we believe we have done what we should strategically – staying the course in our balanced growth strategy, managing our risks prudently, and laying the groundwork to strike when the market is ripe again, with many more cylinders firing in our engine of growth.

7. Tailwinds of Domestic and International Growth for the Auto Business

While we have focused on the decorative market, let me round up China by reporting that in the Industrial sector, our Auto business grew at a CAGR of 7.6% over the last 4 years with enhanced profitability, and we are poised to ride the tailwinds of Chinese Auto OEMs internationalizing. We won the lion share of the business in the latest three international competitions in Thailand, Indonesia and Hungary, as a case in point.

Now, moving on from the market of a long and proud civilization in Asia (China) to another at the cross-roads of Asia and Europe.

8. Türkiye Group Strategy

8-1. Türkiye Group Introduction

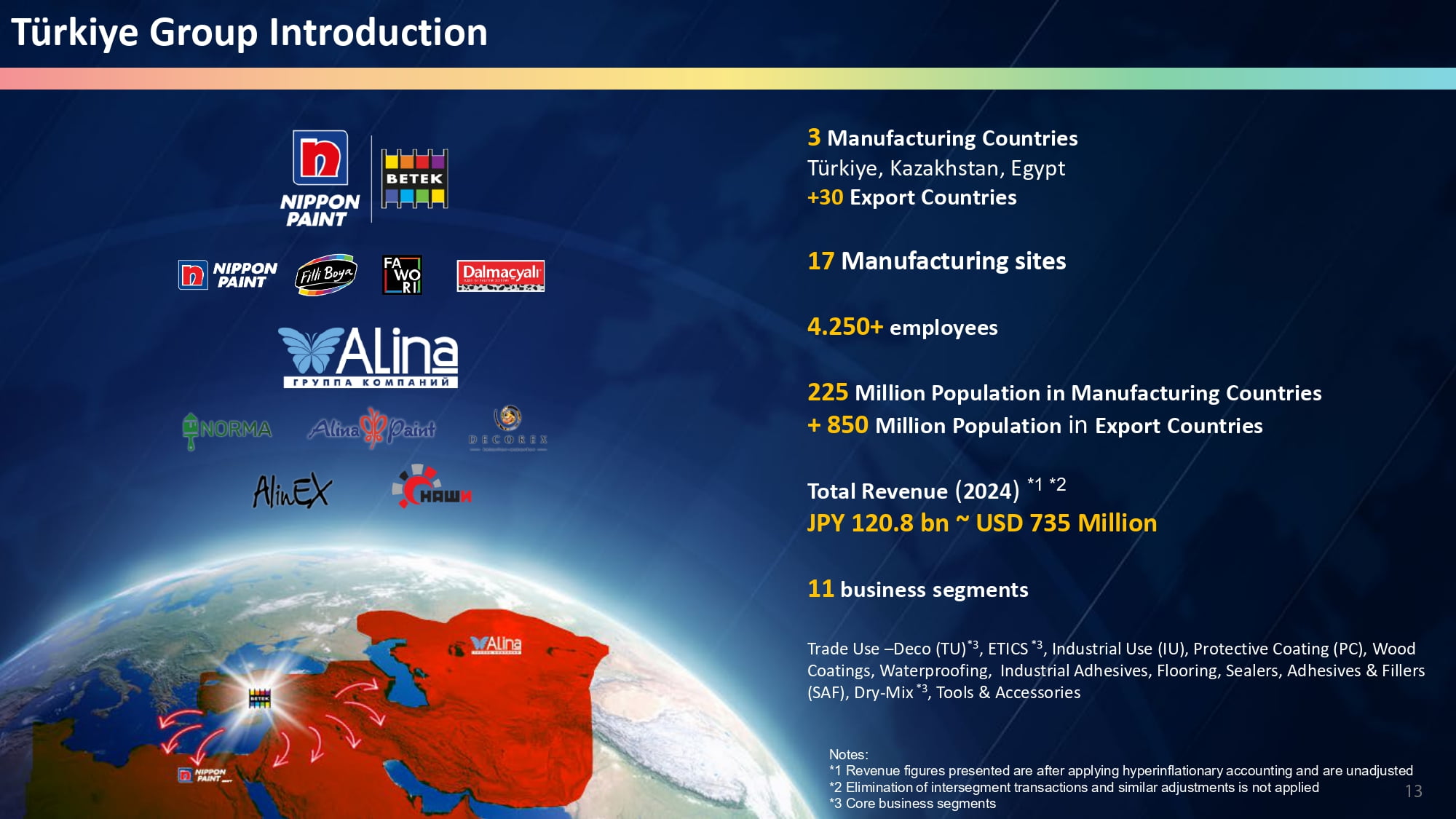

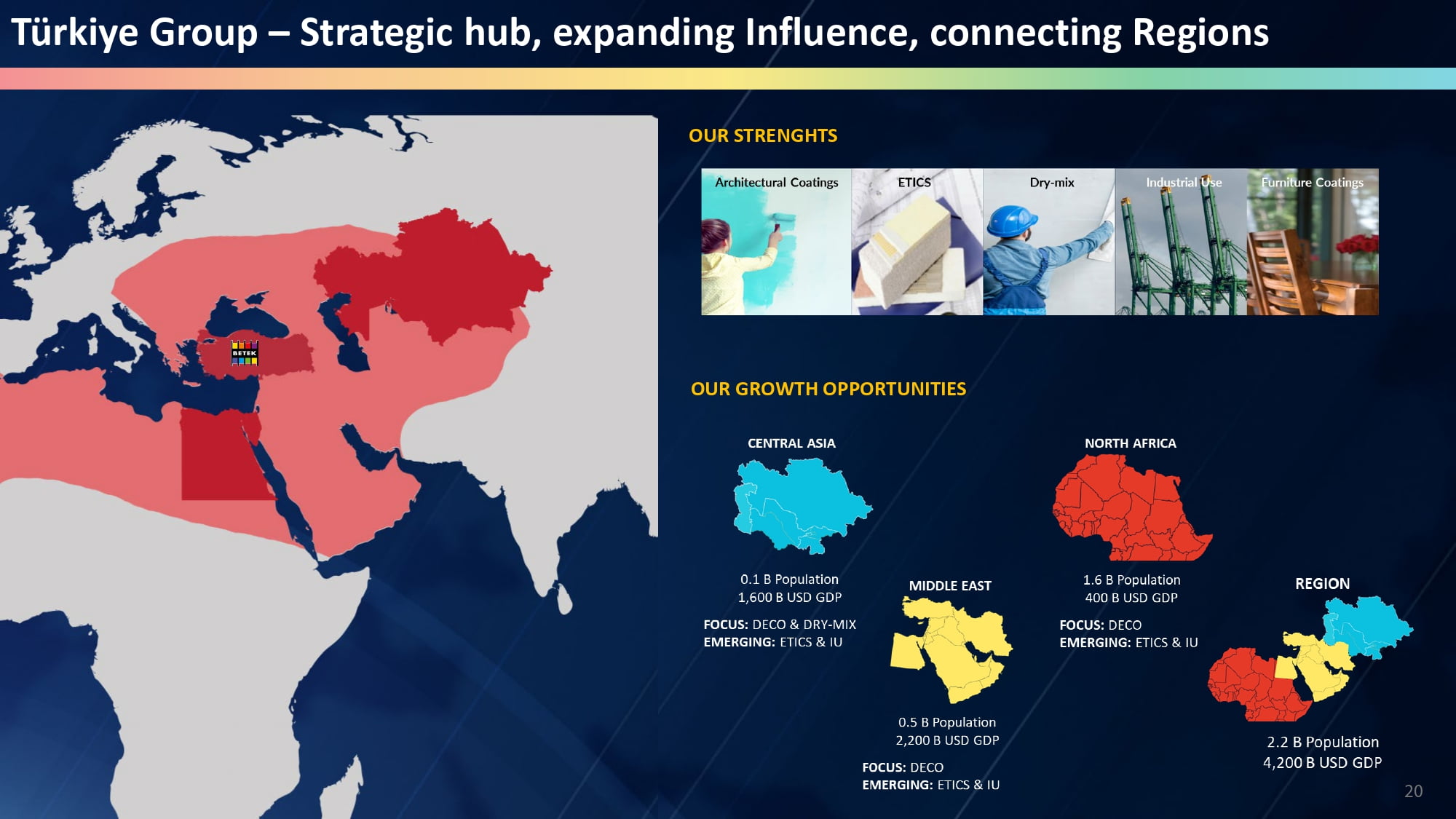

Let me spend a little time on our Türkiye Group. In our NIPSEA organization, Betek Boya is part of the Malaysia+ Group which I covered broadly last year. Grouping in this way in the Malaysia+ Group facilitates sharing and learning. However, as Betek Boya finds its footing and executes its growth, we formed the Türkiye Group in 2024, comprising Betek Boya, headquartered in Istanbul as the core with presence in Türkiye, Egypt and Kazakhstan. Our Kazakhstan presence substantially enlarged with the acquisition of Alina in late 2023. So Alina is bolted onto the Türkiye Group. Centered in Almaty, Kazakhstan, Alina operates in four countries in Central Asia. The Türkiye Group, led by Tayfun-bey, now has over 4,000 employees across 17 manufacturing sites and exports to more than 30 countries.

Betek Boya was acquired in mid-2019, immediately giving us a strong position in Türkiye. With a young and growing population (now 87 million), Türkiye offers high growth potential due to its population, urbanization and rising GDP. In Betek Boya, we gained a company with the highest market share in the decorative paint segment in Türkiye (at the time of acquisition in 2019 of about 25%), a well-established brand portfolio with high recognition, and a strong sales and distribution network in the country. We also benefitted from gaining entry into a new product segment of External Thermal Insulation Composite Systems (or ETICS) in which Betek Boya commanded about 30% of the market in Türkiye at the time of acquisition. Above all, we inherited an outstanding and experienced management team with a positive track record of expanding the business. With Betek Boya leading the Türkiye Group, we are not only seeking to win in Türkiye. We wanted Türkiye Group to be our regional base to expand into the Middle East, North Africa and Central Asia.

8-2. Türkiye Group – Alina (Kazakhstan)

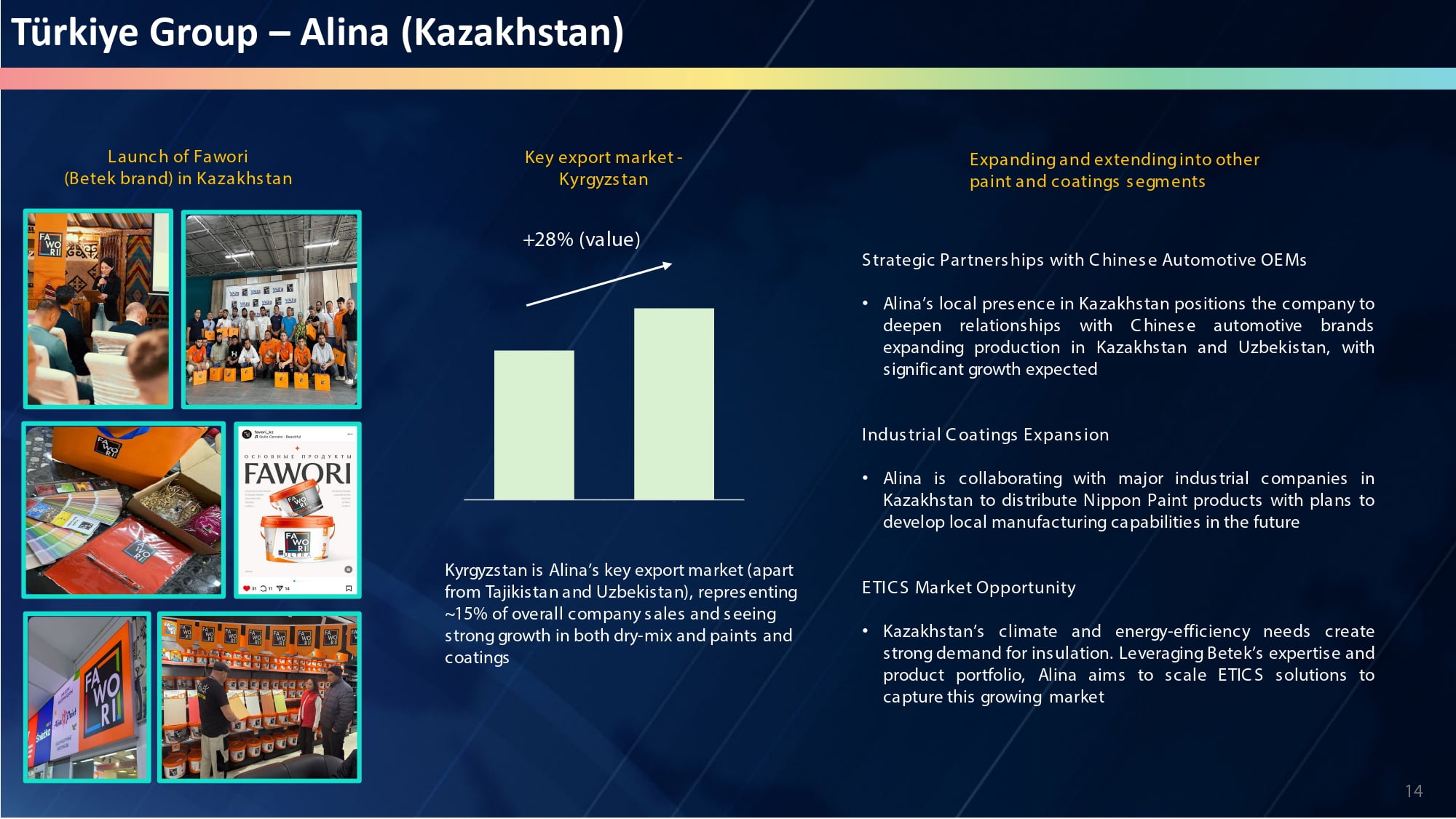

Let me turn to Alina. We acquired 75% of Alina in October 2023 and got to work with a strong local partner (our 25% shareholder). Alina has the leading position in the dry-mix mortar market in Kazakhstan and a good presence in the paint and coatings market. The acquisition of Alina brought enhanced competence in the dry-mix segment (which is a subset of the construction chemicals segment), which we now see as a key adjacency to paint and coatings. Alina together with Betek Boya are intended to be our springboard for expansion into Central Asia.

8-3. Türkiye Group – Market Position, Key Financial Highlights

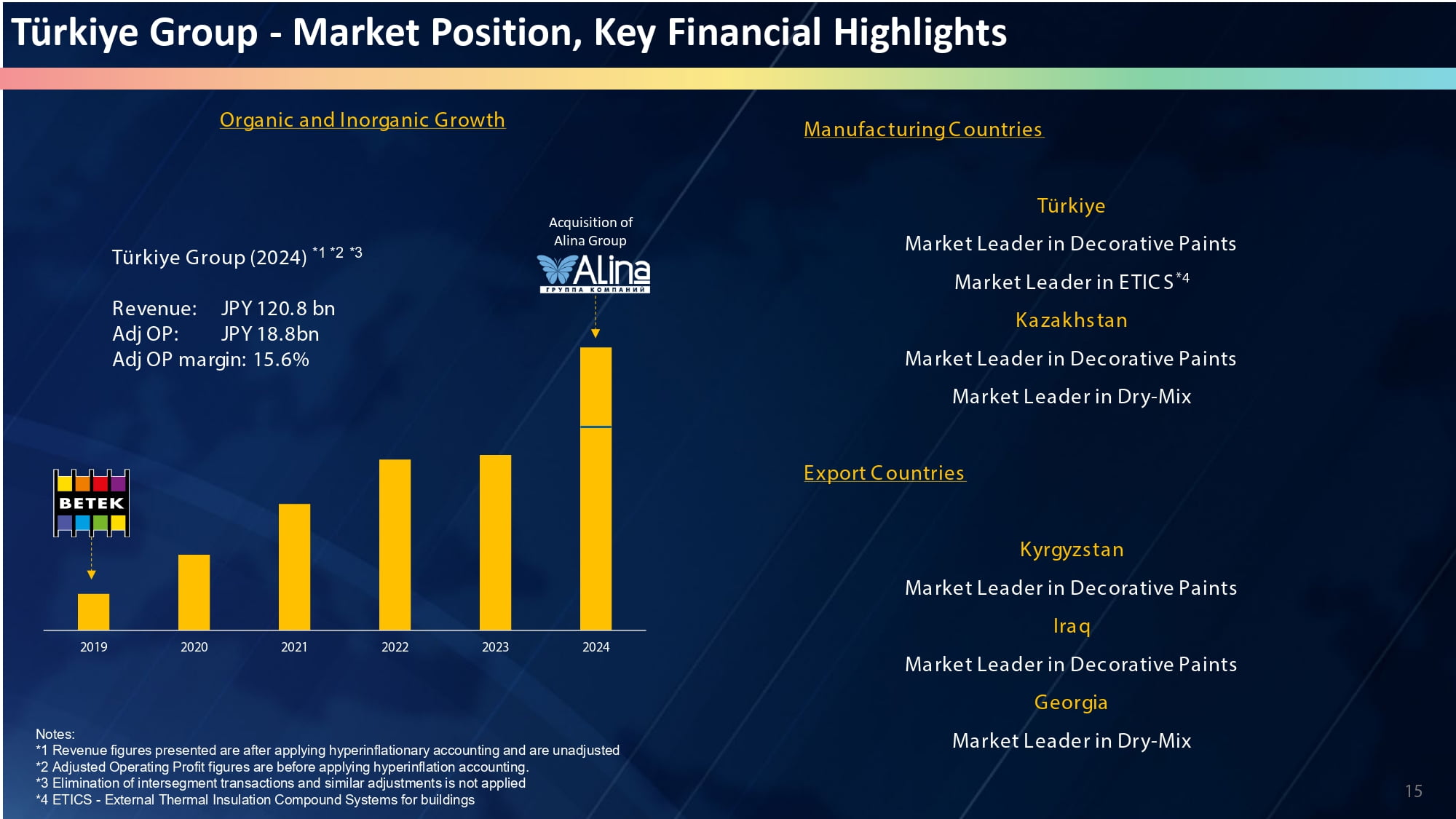

In 2024, the Türkiye Group achieved a topline revenue of 735 million US dollars and an operating profit margin of 15.6% (2024 was the first year when Alina was consolidated with a full year of performance). Betek Boya itself achieved strong growth since our acquisition in 2019, despite the hyperinflationary pressures in Türkiye. From 2022 (when hyperinflation accounting, IAS 29, was first applied) to 2024, the topline revenue grew from 71 to 95 billion yen, a 35% increase over 2 years. Operating profit increased to 13 billion yen. Of course, we will strive to do even better.

8-4. Türkiye Group – Türkiye Competitive Landscape

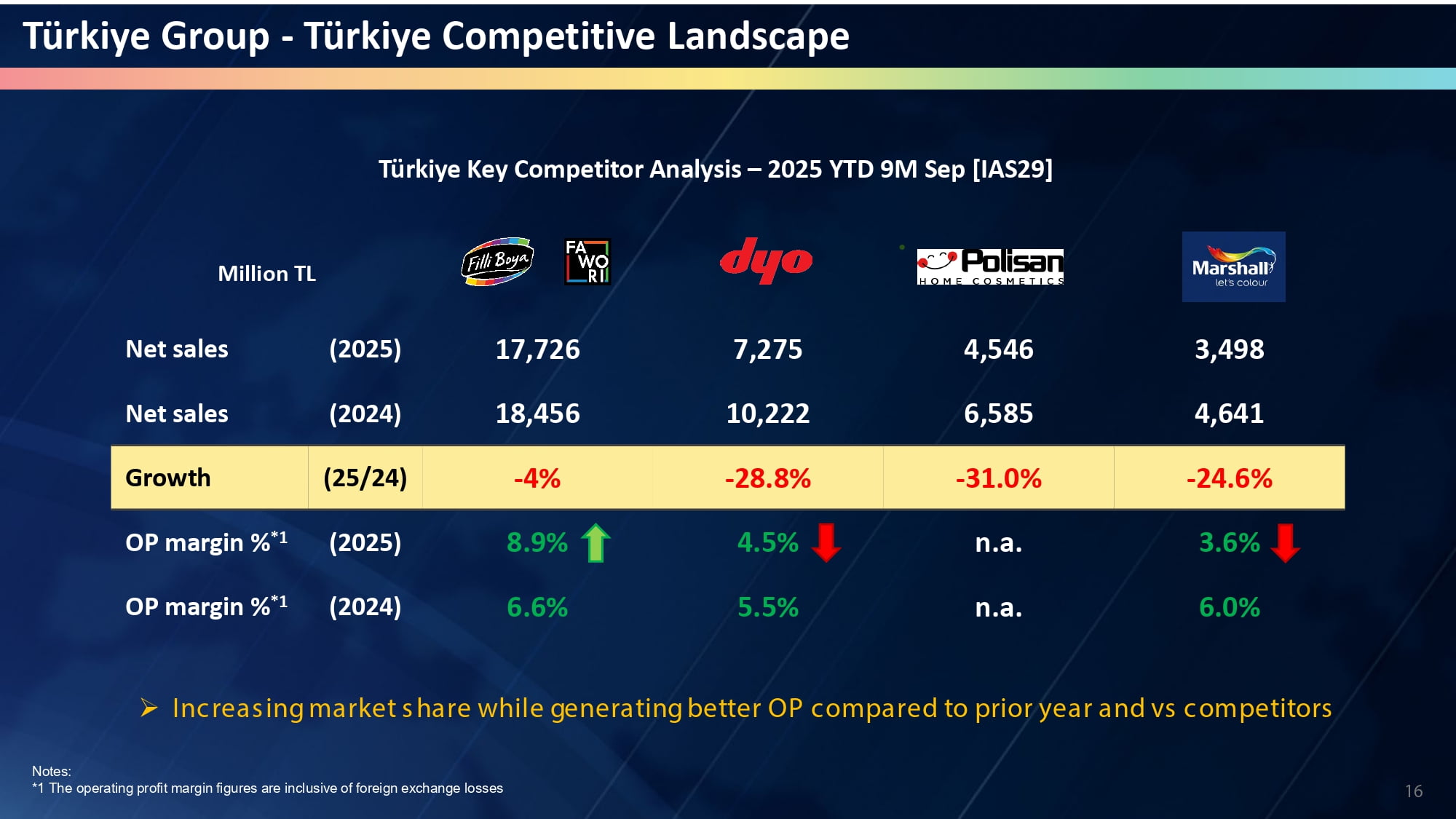

Our investors often wondered how Betek Boya fared in this turbulent, inflationary environment. This slide shows the two paint brands of Betek Boya which are Filli Boya and Fawori, and how they fared against our competing brands in the market over the first 9 months of this year. (These are all publicly available information as the competing brands in Türkiye are all publicly-listed companies.) As you can see, while we did not record positive growth in net sales compared to the same 9-month period last year, we fared significantly better than our main competitors based on this metric. We also achieved an increase in OP margin to 8.9% as compared to last year.

8-5. Türkiye Group – Betek Paint & ETICS (Türkiye)

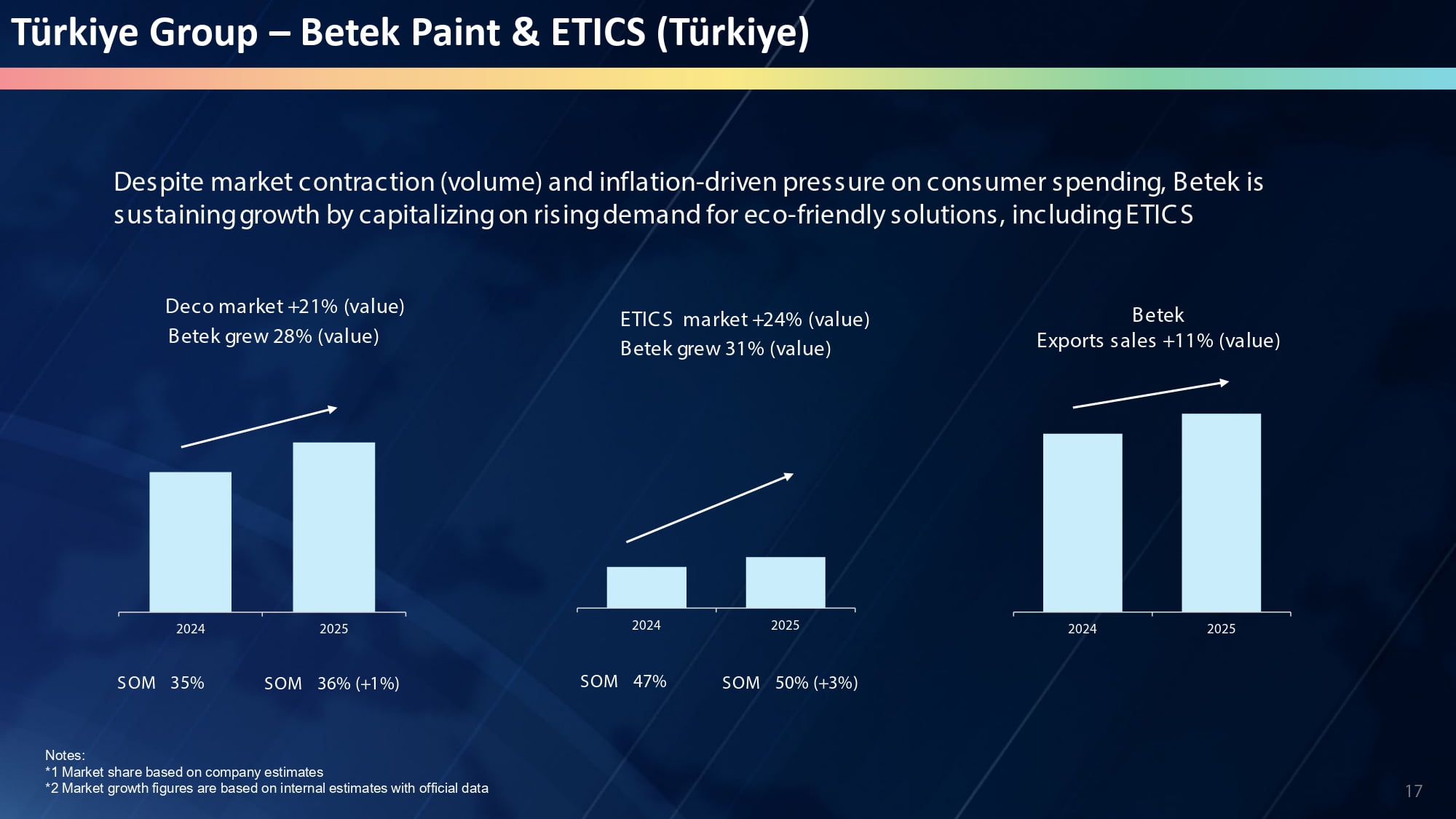

Our market share of the decorative paints market in Türkiye is expected to reach 36% in 2025 – an increase of 100 bps from last year but a massive improvement from the 25% when we acquired the company in 2019. Our share of the ETICS market in Türkiye is projected to grow by an additional 300 bps to 50% this year, from the 30% in 2019. Betek Boya’s sales by value is expected to grow 28% while the Deco market value in Türkiye is expected to grow by only 21% in 2025. For the ETICS market, the comparative numbers are: the market grows by 24% and we grow by 31% (beating the market by 700 bps). In addition, we expect to increase our exports by 11%. From this view, we believe that Betek Boya continues to make good headway, despite the challenging market conditions in the country.

8-6. Türkiye Group – Betek Competitive Strength (Türkiye)

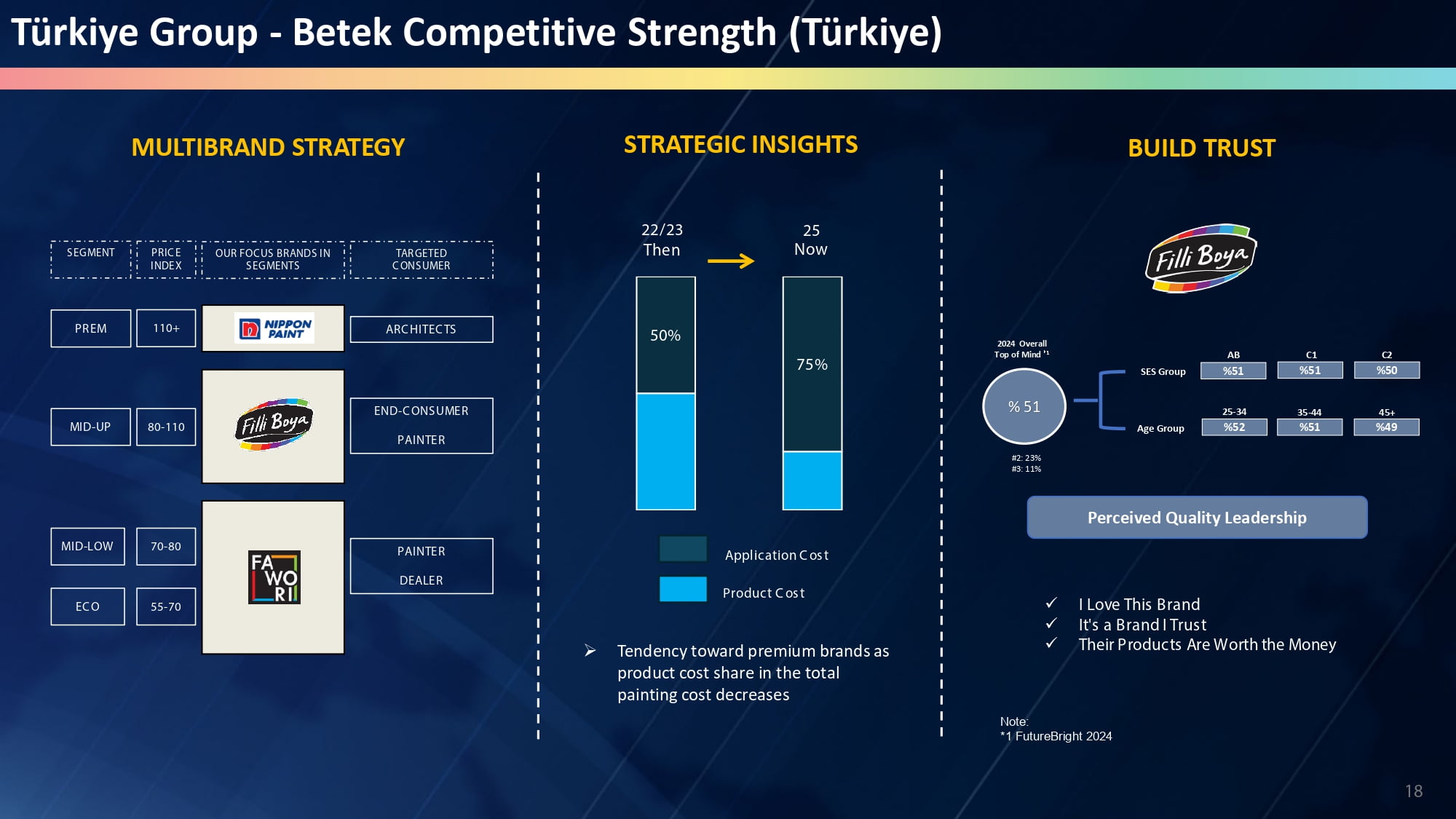

How we think we prevailed? This slide captures the competitive strengths that enable Betek Boya to continue to make good headway despite the headwinds.

- On the left-hand side of the chart, we have a robust multi-brand strategy across the market segments for decorative paints – with Nippon Paint occupying the premium paint segment, Filli Boya the upper-middle segment, and Fawori the economy to lower-middle segments;

- If you look at the center part of the chart – with the cost of application constituting a larger percentage of the overall cost vis-à-vis product cost, we find more consumers moving up to the upper-middle and premium segments over time, which is a very good development for us;

- If you look at the right-hand side of the chart, our Filli Boya brand also occupies top spot in perceived quality and as a trusted brand with Top-of-Mind of 51% across both social economic groups and age groups in a survey done in 2024 by FutureBright, which is a research agency in Türkiye accredited to the Turkish Researchers Institute.

We believed that the initial placement of Betek Boya within the Malaysia+ Group has brought a lot of advantages to both Betek Boya and the Türkiye Group. (And the Malaysia+ Group has also learned from Betek Boya). The things that we have benefitted from are in terms of technical expertise and access to lower cost raw materials. Without these strengths, we believe we would not have prevailed and grown in spite of the difficult operating conditions in Türkiye. The strength of the Nippon Paint Group is clearly demonstrated against standalone competitors in Türkiye.

8-7. Türkiye Group – Betek Key Activities Highlight (Türkiye)

Some photographs to highlight key activities of the Türkiye Group, including Alina, this year. We continue to try harder. Having imbibed the NIPSEA values and ethos, the Group continues to innovate, strengthen its brands, expand the business and drive market share growth.

8-8. Türkiye Group – Strategic hub, expanding Influence, connecting Regions

I started my presentation by recapping and explaining our strategic rationale of acquiring Betek Boya and Alina. Our plans to expand across product lines and regional countries are still very much work in progress. In essence, our expansion plans have not been derailed significantly due to the challenges of hyperinflation in Türkiye. As you can see, the growth story of the Türkiye Group continues to unfold.

Thank you so much for your attention.