1. Front Cover

Good afternoon, everyone. I’m Yuichiro Wakatsuki, Co-President of Nippon Paint Holdings.

Thank you for taking the time to join today’s conference call to review our financial results for the first quarter of 2025.

2. Supplementary Information

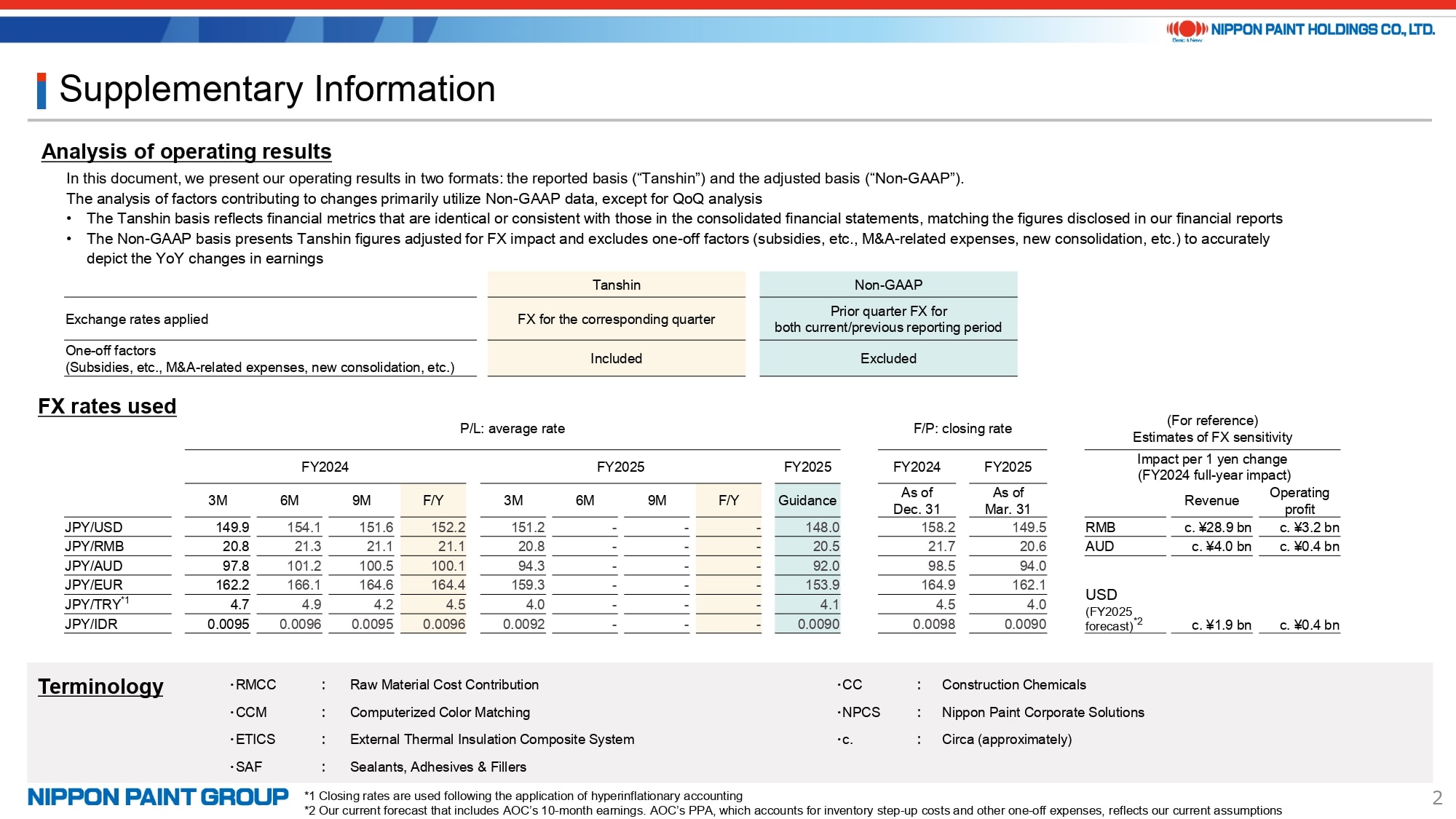

Before we turn to our financial results, I’d like to begin by confirming that we are maintaining the financial guidance announced in April.

We continue to believe that the targets shared in February and April are achievable across all regions. However, it’s important to note that the foreign exchange assumptions announced in April, JPY 148 to 1 USD and JPY 20.5 to 1 RMB, have been subject to some fluctuation. During the first quarter, the yen weakened slightly compared to these assumptions, and exchange rates have remained highly volatile since April. Given this ongoing volatility, there is a possibility that future FX movements could impact our performance relative to the April guidance.

For reference, the table on the right-hand side of the slide provides our estimates of full-year FX sensitivity. Please note that the USD sensitivity figure includes the impact on AOC’s earnings for the 10-month consolidation period.

3. FY2025 1Q Operating Results: Record Revenue and Operating Profit Achieved

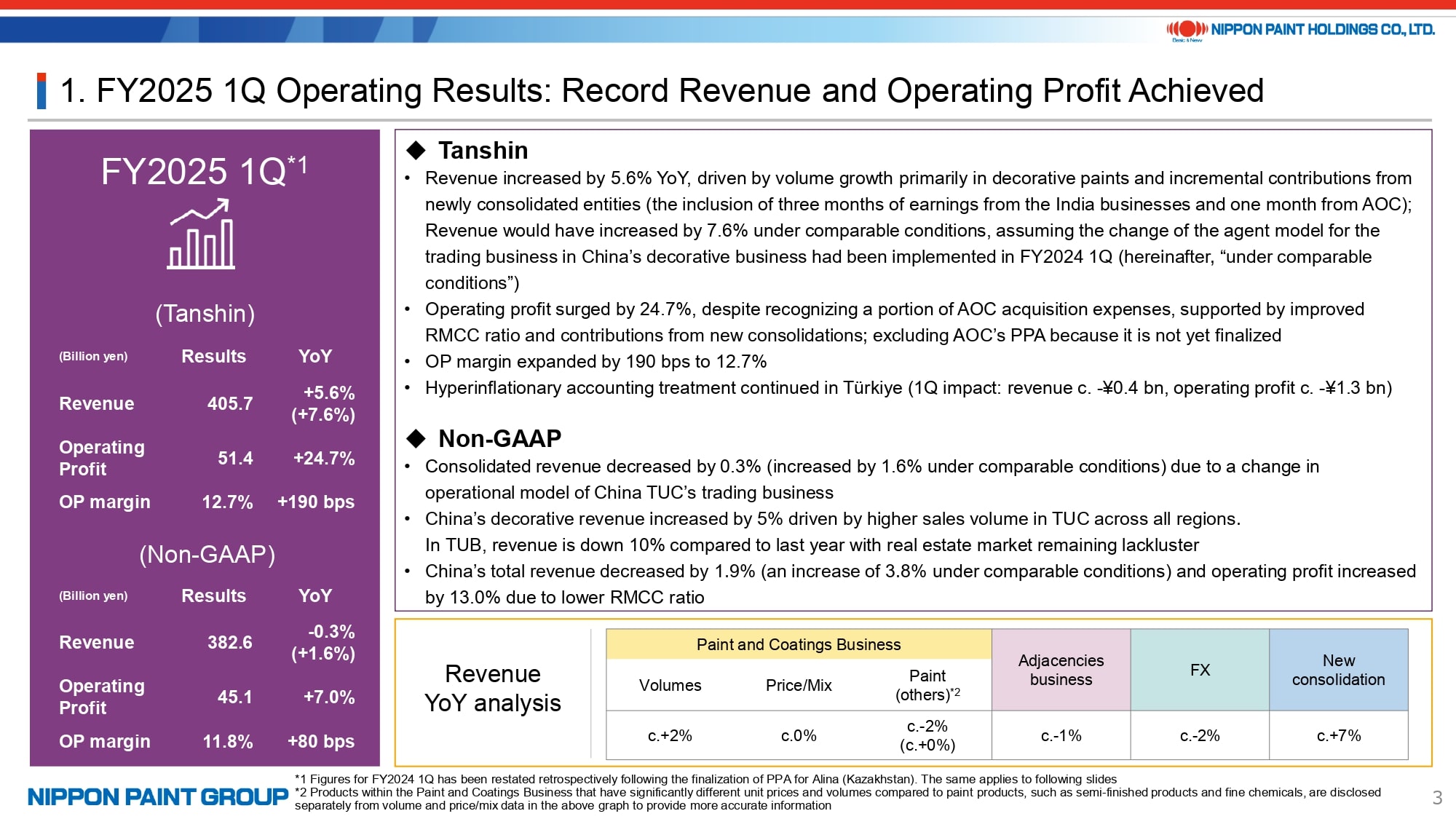

Let me now summarize the key highlights of our performance in the first quarter of 2025.

On a Tanshin basis, revenue reached ¥405.7 billion, representing a 5.6% increase year-on-year. Operating profit rose significantly to ¥51.4 billion, a 24.7% increase, setting a new all-time high for any quarter. Revenue also reached a record high for the first quarter. These results reflect the positive impact of business consolidation, including three months of earnings from our India operations and one month from AOC. In addition, the operating profit margin improved, supported in part by AOC’s contribution to overall profitability.

I would like to highlight two key points.

First, regarding revenue from NIPSEA China: as explained in February, we changed the agent model for the trading business within the decorative segment. When we adjust for this change, referred to here as “under comparable conditions” with 2024, consolidated revenue actually increased by 7.6%, rather than the reported 5.6%. Similarly, consolidated Non-GAAP revenue showed a 1.6% increase, instead of the reported 0.3% decline, under these comparable conditions.

Second, AOC delivered a strong operating profit margin of 35.6% in the first quarter. It’s important to note that this figure is reported before purchase price allocation (PPA) adjustments and excludes amortization of intangible assets and one-off inventory step-up costs. The PPA process is expected to be finalized in the second half of 2025. Once completed, amortization costs will be retrospectively applied to the quarter in which the adjustments are finalized. From the next quarter onward, we expect AOC’s margin to normalize accordingly. Additionally, acquisition-related expenses totaling approximately ¥1.1 billion were recorded as adjustment items in the consolidated financial statements of Nippon Paint Holdings.

On a Non-GAAP basis, excluding the effects of foreign exchange, contributions from newly consolidated businesses, and other one-off items, and under comparable conditions, revenue increased by 1.6%, while operating profit grew by 7%. In NIPSEA China’s decorative business, TUC revenue increased by 5%, whereas TUB revenue declined by 10%. For NIPSEA China overall, Non-GAAP revenue rose by 3.8%, and operating profit increased by 13%, both under comparable conditions.

With regard to the potential impact of U.S. tariffs, our Group primarily follows a local production for local consumption model, resulting in limited import or export of finished products to and from the U.S. Similarly, most raw materials are sourced locally within each region. As a result, we expect the direct, short-term impact of these tariffs to be minimal. That said, we are closely monitoring developments, particularly the responses of raw material suppliers and the production trends of our customers in the automotive and industrial segments. Looking at the medium to long term, as we have consistently emphasized, demand for paints, especially decorative paints, tends to move in line with GDP growth. While broader economic sentiment may influence paint consumption, we believe any resulting impact will remain within manageable levels from a Group-wide perspective.

While exchange rate fluctuations have limited impact on our underlying business performance in local currency terms, since we are not an export-oriented company, they can affect our yen-based consolidated financial results.

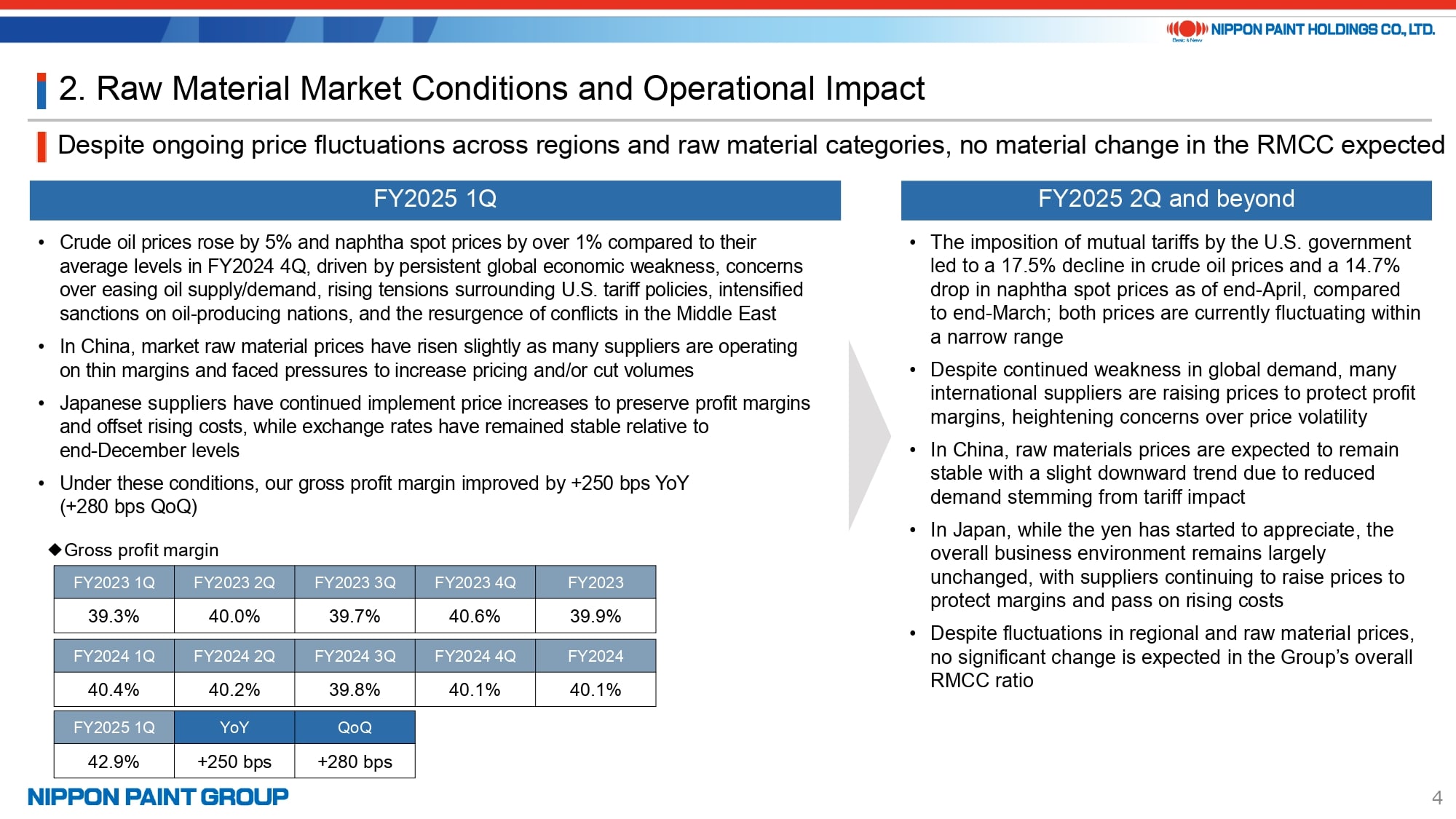

4. Raw Material Market Conditions and Operational Impact

We do not expect any significant overall changes in raw material cost trends, although conditions continue to vary by region. In China, while market prices remained relatively elevated during the first quarter, our raw material cost contribution ratio improved.

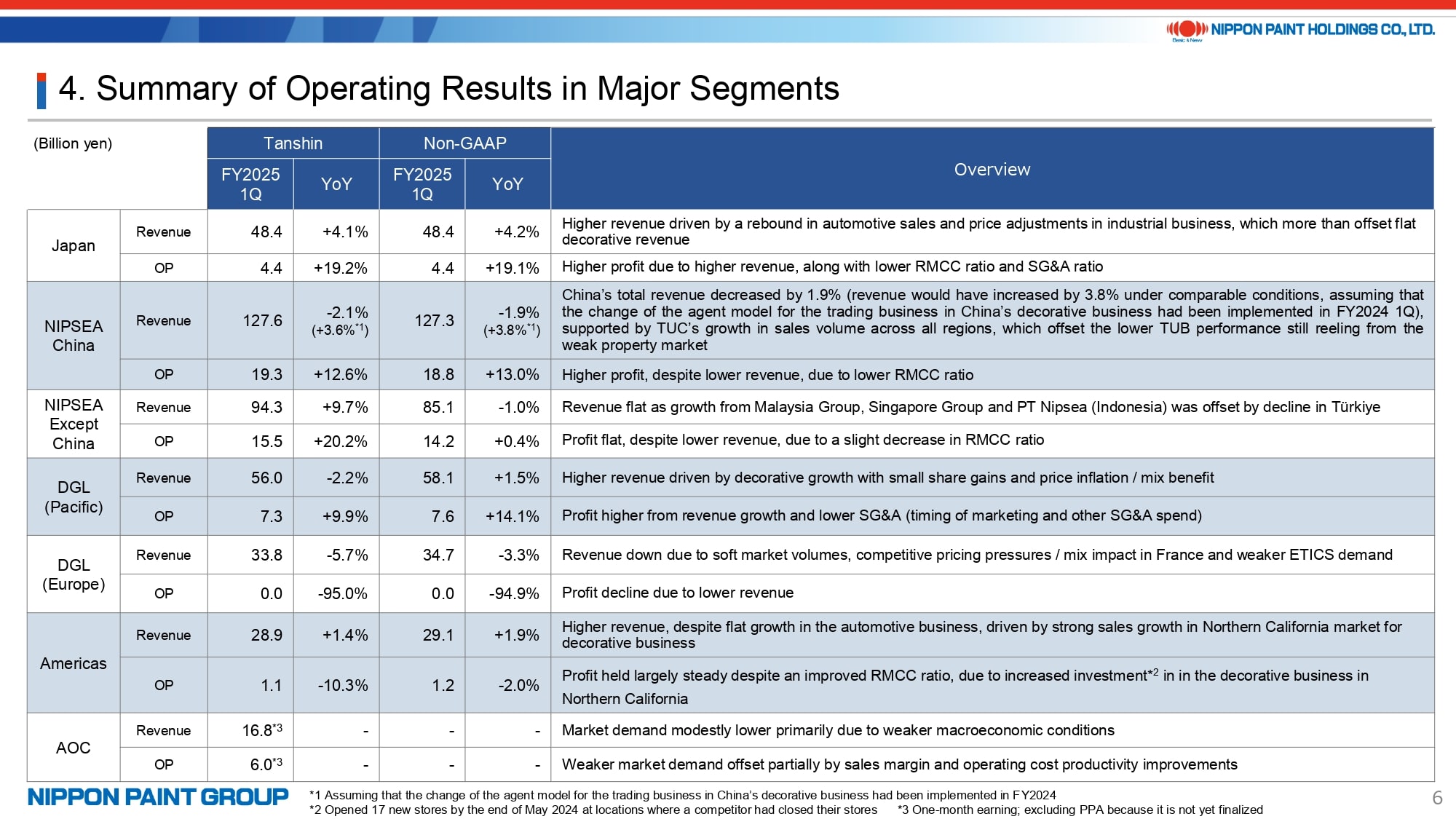

5. Summary of Operating Results in Major Segments

I will skip the heat map shown on page 5 and move directly to page 6, which provides an overview of the performance across our key business segments. While we will cover specific details during the Q&A session, I would like to offer a brief summary of each segment.

- Japan Segment: Revenue grew by 4%, supported by a strong recovery in the automotive business, which saw double-digit growth due to a rebound in auto production from last year’s lower levels. Additional contributions came from expanded sales of new products in the decorative business and price increases in the industrial business. Operating profit increased by 19%, driven by higher revenue, an improved product mix, and cost reductions across various areas.

- NIPSEA China: The macroeconomic environment in China remains relatively challenging. Despite this, the TUC segment delivered solid performance, with volume growth recorded across all regions. In the automotive business, revenue increased, supported by higher auto production and expanded sales to Chinese OEMs. For NIPSEA China overall, we achieved price increases, a more favorable product mix, and a lower raw material cost contribution ratio. These factors contributed to a meaningful improvement in operating profit margin, even without adjusting for the change in trading model. As we have consistently emphasized, we delivered firm and profitable growth.

- NIPSEA Except China: Overall performance in this region remained solid, with strong results in markets such as Indonesia. However, performance varied by country, with Türkiye being the exception. In Türkiye, revenue declined on both a Tanshin and Non-GAAP basis due to the absence of a sales uplift from promotional campaigns run in Q4 2024 and a deteriorating market environment caused by high interest rate policies aimed at curbing inflation. Despite these headwinds, our Türkiye operations maintained firm profitability, achieving a double-digit operating profit margin. This was supported in part by a lower raw material cost contribution ratio, even after applying hyperinflationary accounting treatment.

- DuluxGroup: DGL (Pacific) delivered revenue growth despite broadly flat market conditions. This was driven by price increases and an improved product mix. Operating profit margin also improved, supported by reductions in SG&A expenses, resulting in a 14% increase in Non-GAAP operating profit. In contrast, DGL (Europe) saw a decline in operating profit, reflecting continued weakness in the French market, which contracted by nearly 5% in the first quarter. However, as the first quarter typically represents a seasonal low-demand period following the fourth quarter, we remain cautiously optimistic about a potential recovery starting in the second quarter and beyond.

- Americas: In the automotive business, revenue remained largely flat, as a modest gain in market share helped offset the impact of ongoing market challenges. In the decorative business, revenue grew, driven by price increases and the continued expansion of store locations in Northern California, despite adverse weather conditions in March.

- AOC: As noted earlier, the first quarter reflects only one month of AOC’s earnings contribution, as PPA adjustments are still in progress. Despite a challenging market environment, marked by the absence of expected interest rate cuts and a slight softening in demand, AOC maintained a very high operating profit margin, reinforcing our unchanged outlook for strong profit contributions. In addition, we have identified significant synergy opportunities, particularly in procurement, that benefit both AOC and Nippon Paint Group. We are making steady progress in capturing these synergies and are focused on realizing them as early as possible.

6. Major Topics

Next, I’d like to highlight two key topics, beginning with our Integrated Report.

We are honored to share that our Integrated Report received the Grand Prize at this year’s NIKKEI Integrated Report Awards, an upgrade from the Grand Prize G Award we received last year. This achievement reflects the strong collaboration between our executive team and Independent Directors in articulating the Nippon Paint Group’s long-term growth story. Our sole mission, Maximization of Shareholder Value (MSV), remains a clear and powerful message. However, we recognize the challenge of keeping the message engaging and relevant with each annual publication. That’s why we remain committed to continually refining the content and presentation of the Report, no matter how modest, to enhance its value for investors. We greatly appreciate your continued input and feedback to support these efforts.

Second, I’d like to touch on the recent appointment of a new Independent Director.

At the General Meeting of Shareholders held in March, Andrew Larke was appointed as an Independent Director of Nippon Paint Holdings. Mr. Larke has served as a Non-Executive Director of DuluxGroup since its time as a listed company on the ASX and continued to play a key role in overseeing DuluxGroup’s governance following its acquisition by NPHD. He has worked closely with Wee Siew Kim, Goh Hup Jin, and myself during this time. Having strongly aligned with our sole mission, Maximization of Shareholder Value (MSV), he has graciously accepted the role at the NPHD Board. Following his appointment, our Board structure remains unchanged: six of the nine members are Independent Directors, and four of the nine are non-Japanese. This diversity reinforces our commitment to safeguarding the interests of minority shareholders and advancing our mission of MSV.

Thank you for your attention.