1. Front Cover

Good afternoon, everyone. I’m Yuichiro Wakatsuki, Co-President of Nippon Paint Holdings.

Thank you for joining us today for our presentation of the financial results for the third quarter of 2025.

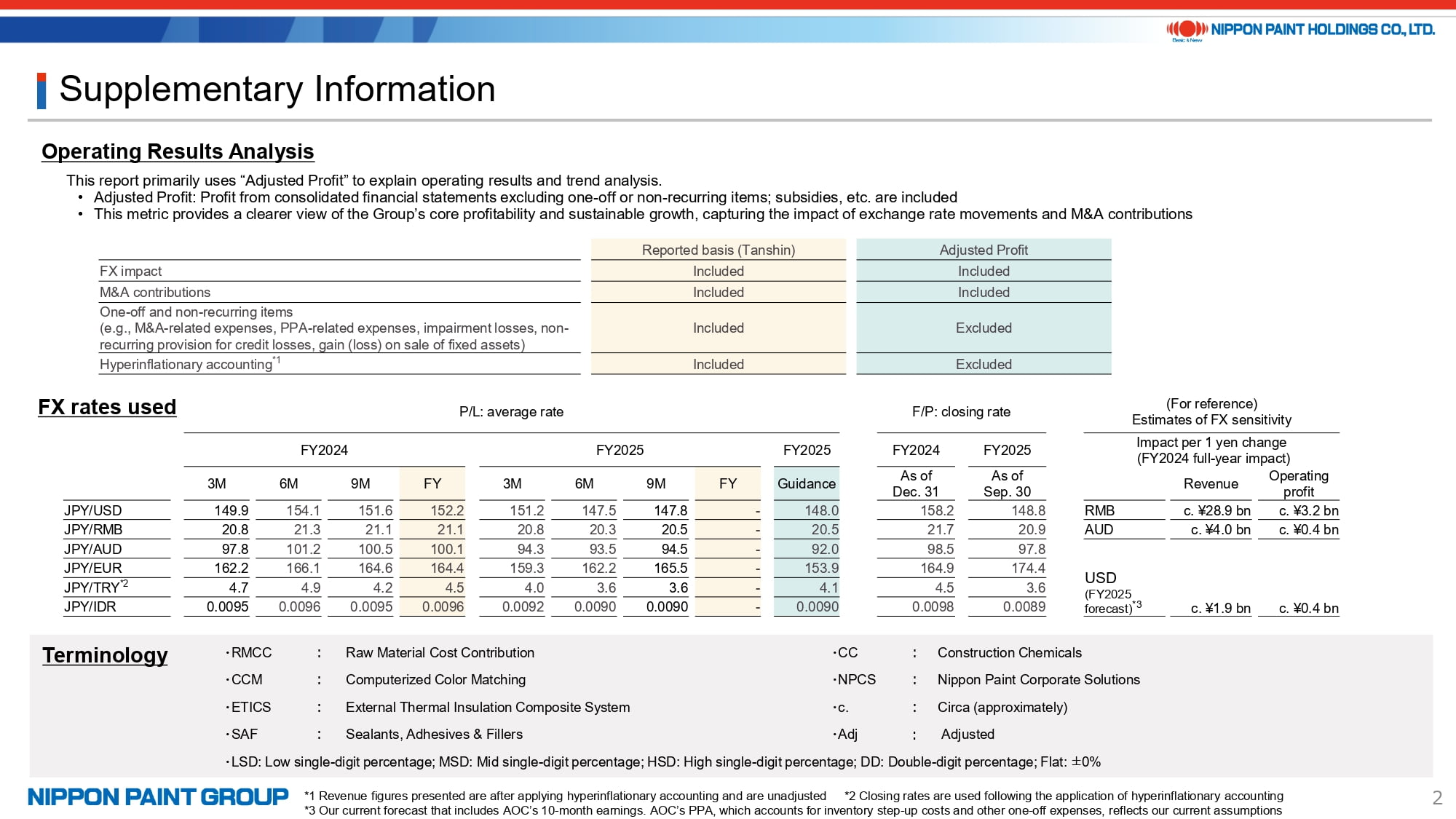

2. Supplementary Information

I’d like to begin by highlighting an important change in our disclosure approach introduced this quarter.

This adjustment reflects the wide range of feedback I’ve been receiving, both directly and indirectly, through many investor discussions. In particular, several overseas institutional investors noted that global peers commonly disclose an “Adjusted Profit” metric that excludes certain adjustment items. While Nippon Paint Holdings has long been recognized for the depth and transparency of its disclosures, many investors have told us that it can be challenging to quickly grasp our overall performance. Some also mentioned that the volume of data we provide sometimes makes it harder for even strong results to stand out immediately. To address these points, and to help investors better understand our underlying performance while enabling more appropriate comparisons with overseas companies, we have now begun proactively disclosing “Adjusted Profit.” You’ll find more information on this in the upper section of page 2 of the presentation.

In addition, we have begun presenting growth rates using standard industry ranges, LSD for low single-digit growth, MSD for mid single-digit, and HSD for high single-digit. We are also disclosing volume and price/mix contributions separately to provide greater clarity.

We intend to maintain this approach for now, while continuing to welcome constructive feedback from our investors. As always, we remain committed to enhancing our disclosures where appropriate, and we sincerely appreciate your ongoing input.

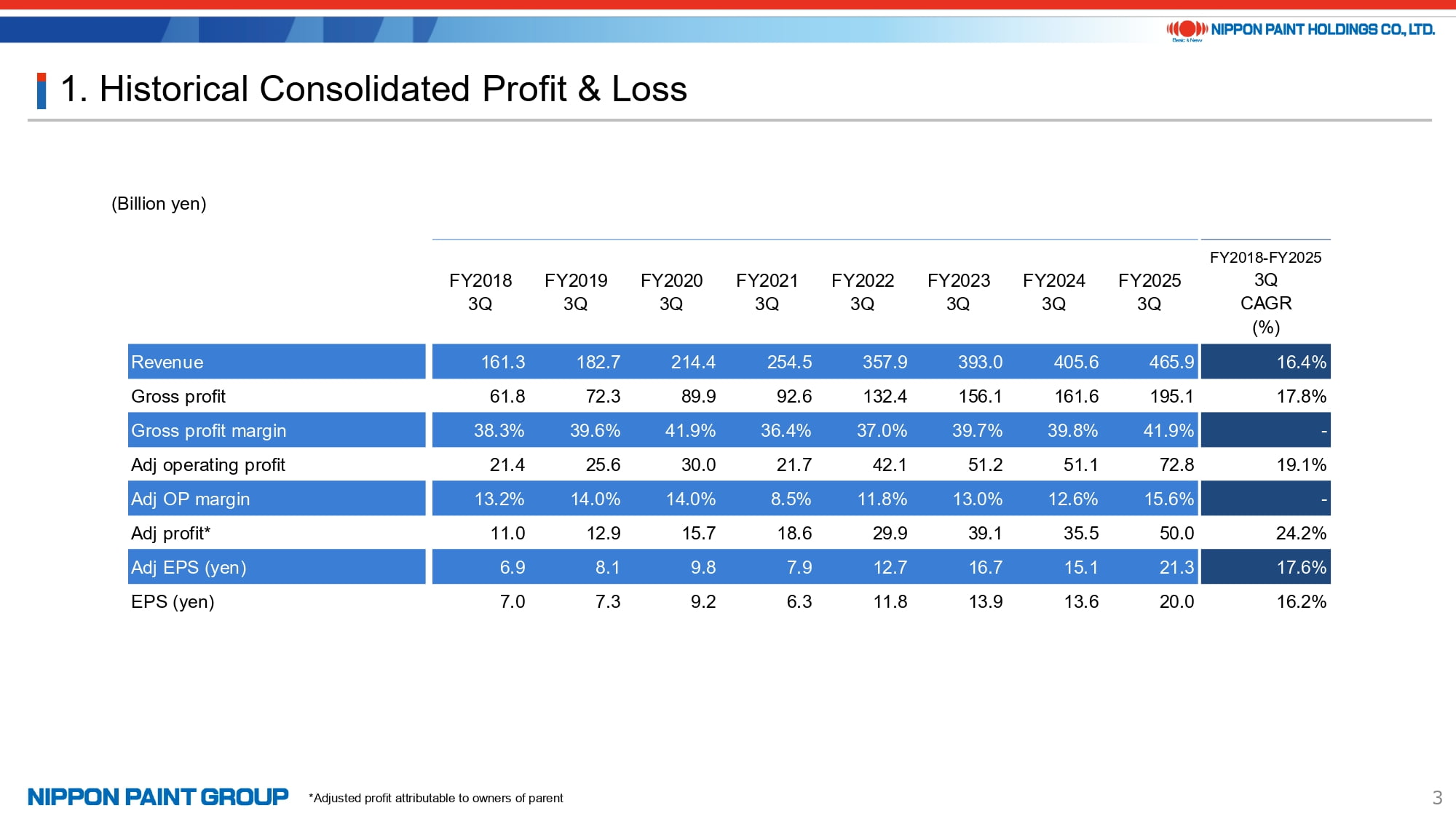

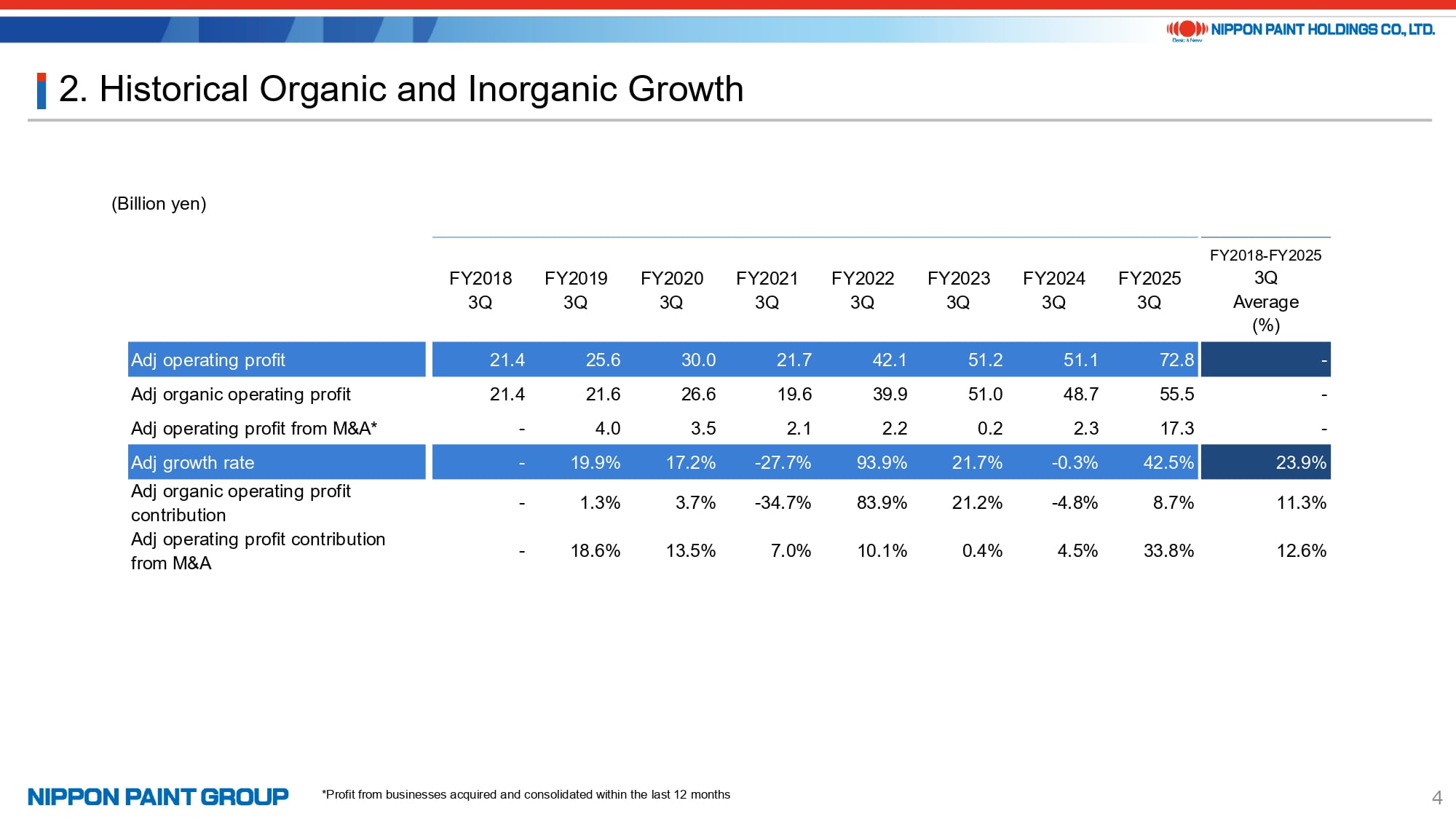

3. Historical Consolidated Profit & Loss / Historical Organic and Inorganic Growth

Please turn to pages 3 and 4, which contain newly added disclosures.

To give investors a clearer view of our profit-and-loss track record, we have summarized our long-term performance trends since adopting IFRS in 2018 and transitioning our Board structure to focus on Maximization of Shareholder Value (MSV) as its sole mission. Page 3 presents third-quarter trends in revenue, adjusted operating profit, and adjusted EPS, while page 4 breaks down the respective contributions from organic and inorganic profit growth. Together, these historical summaries offer an at-a-glance understanding of the strength and consistency of our growth, supported by both organic expansion and disciplined inorganic initiatives. We plan to continue providing these disclosures on a regular basis.

I’d like to draw your attention in particular to the organic profit trend shown on page 4. Although we experienced a temporary dip in 2021 due to COVID-19 impacts and higher raw material costs, we saw a strong rebound in 2022. This performance highlights the underlying resilience of our earnings power.

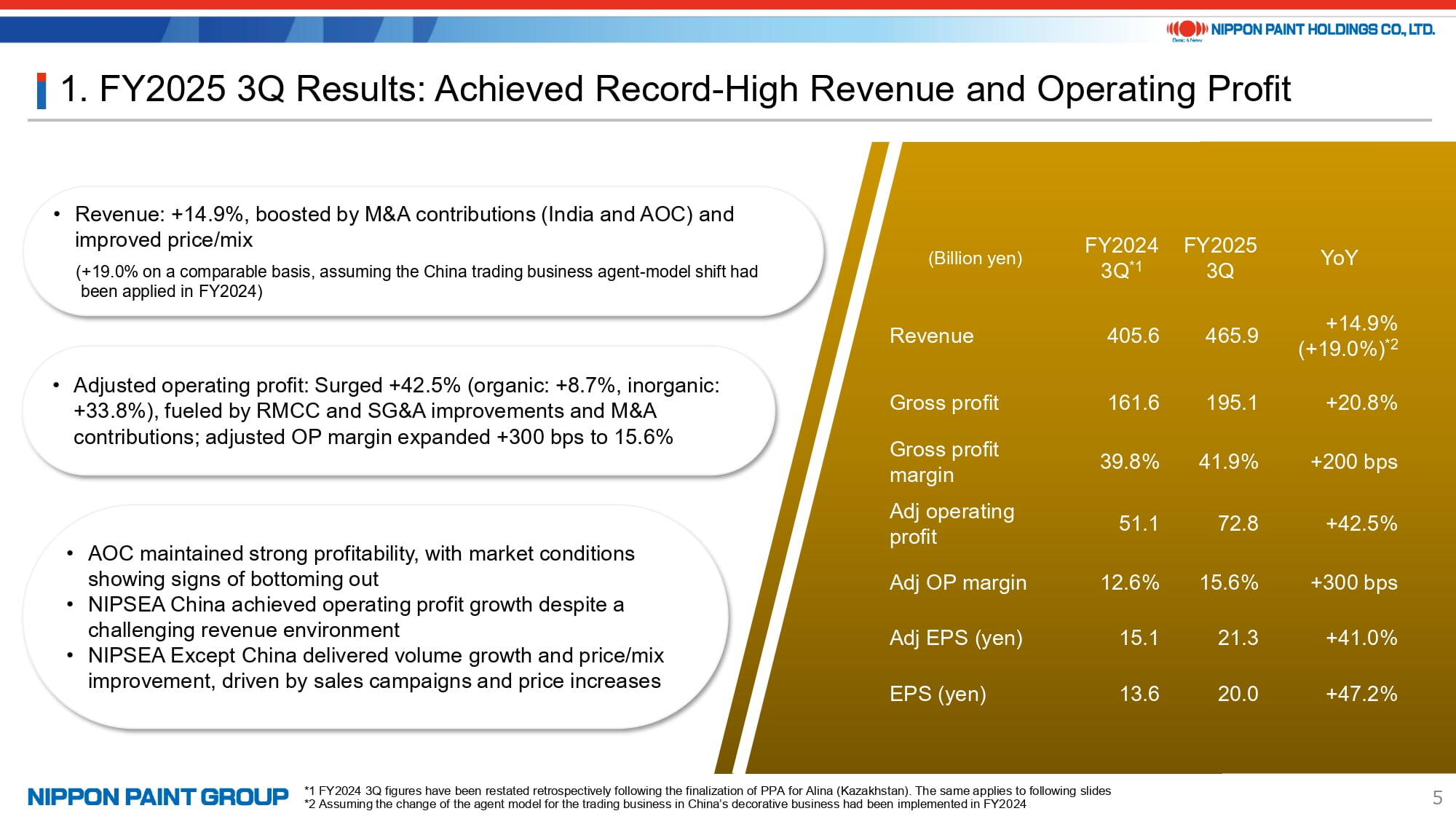

4. FY2025 3Q Results: Achieved Record-High Revenue and Operating Profit

Let me now turn to an overview of our third-quarter results.

We delivered another quarter of record performance, achieving all-time highs in both revenue and operating profit for this period. Revenue rose by an effective 19%, while adjusted operating profit and adjusted EPS each increased by more than 40% year on year.

In terms of foreign exchange, the yen strengthened against major currencies compared with the same quarter last year; USD/JPY moved from 151.6 to 147.8, RMB/JPY from 21.1 to 20.5, and AUD/JPY from 100.5 to 94.5. Even with these currency headwinds, we achieved substantial growth in both revenue and profit.

In adjusted operating profit, organic growth contributed 8.7%, while inorganic growth added 33.8%. Our adjusted operating profit margin also strengthened by roughly 300 basis points.

Turning to performance by segment, AOC continued to be a major driver of overall profitability. We are also seeing early indications that the U.S. market may be nearing a bottom, supported by developments such as interest rate cuts. In NIPSEA China, economic conditions remain challenging, but we have delivered profit growth by prioritizing margin management rather than aggressive top-line expansion. Meanwhile, in NIPSEA Except China, we achieved broad-based improvements across both volumes and price/mix.

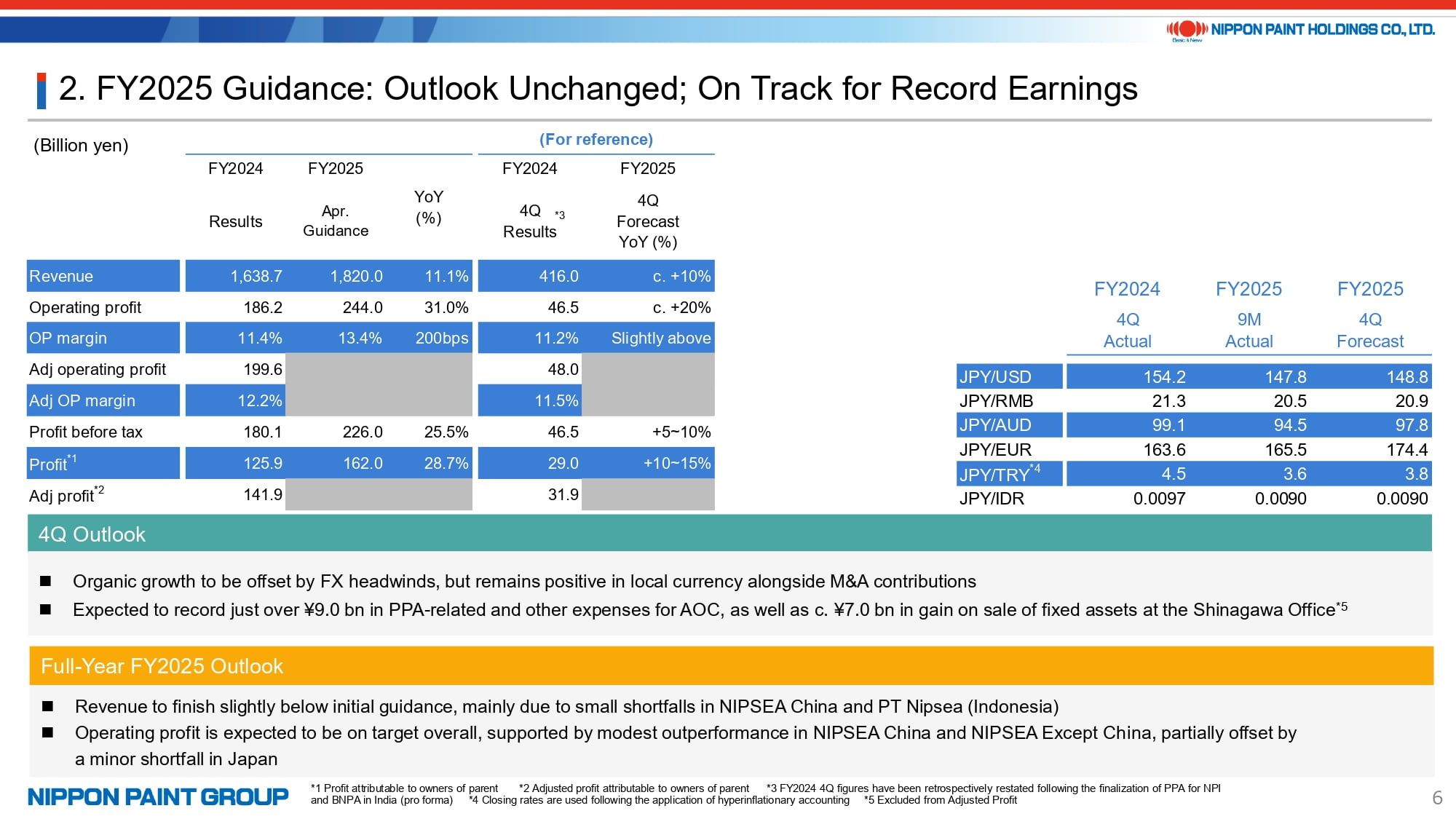

5. FY2025 Guidance: Outlook Unchanged; On Track for Record Earnings

Our full-year outlook for FY2025 remains unchanged, and we continue to anticipate another year of record performance.

In the fourth quarter, we expect to see the usual seasonal softening in demand across many regions, yet our outlook still calls for positive organic revenue growth. Our forecasts incorporate an assumption of year-on-year yen appreciation; however, if the yen remains weak at current levels, there could be some upside to our revenue projections. For the full year, we expect revenue to come in slightly below our guidance of ¥1,820.0 billion, while operating profit before adjustments is projected to be broadly in line with our guidance of ¥244.0 billion.

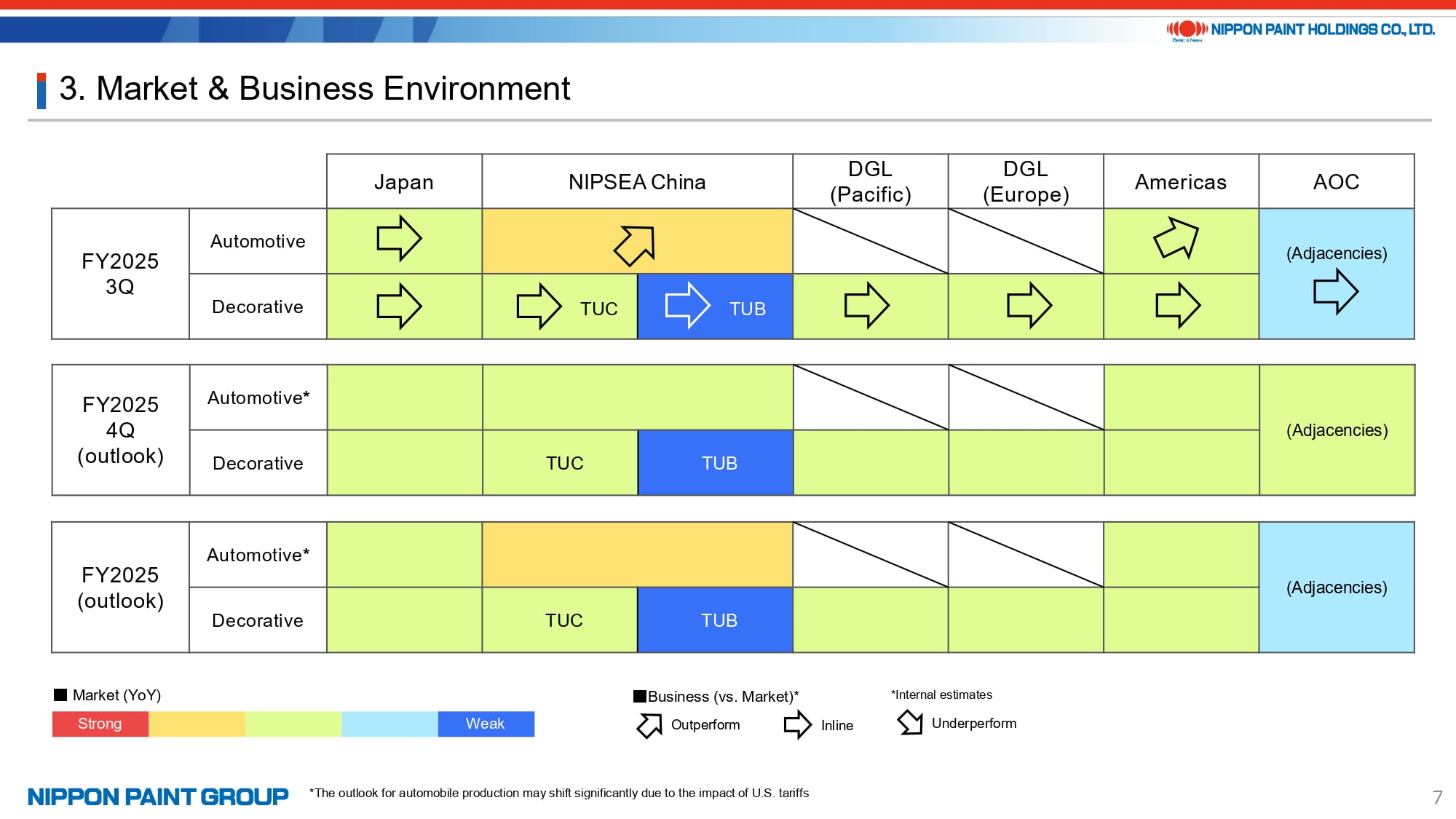

6. Market & Business Environment

Turning to the third-quarter heatmap, overall market conditions were generally flat. The notable exception was the Chinese automotive sector, where conditions improved slightly, allowing us to capture additional market share.

Within the AOC segment, we are starting to see initial indications that the market may be bottoming out. We expect conditions to remain broadly stable as we move into the fourth quarter.

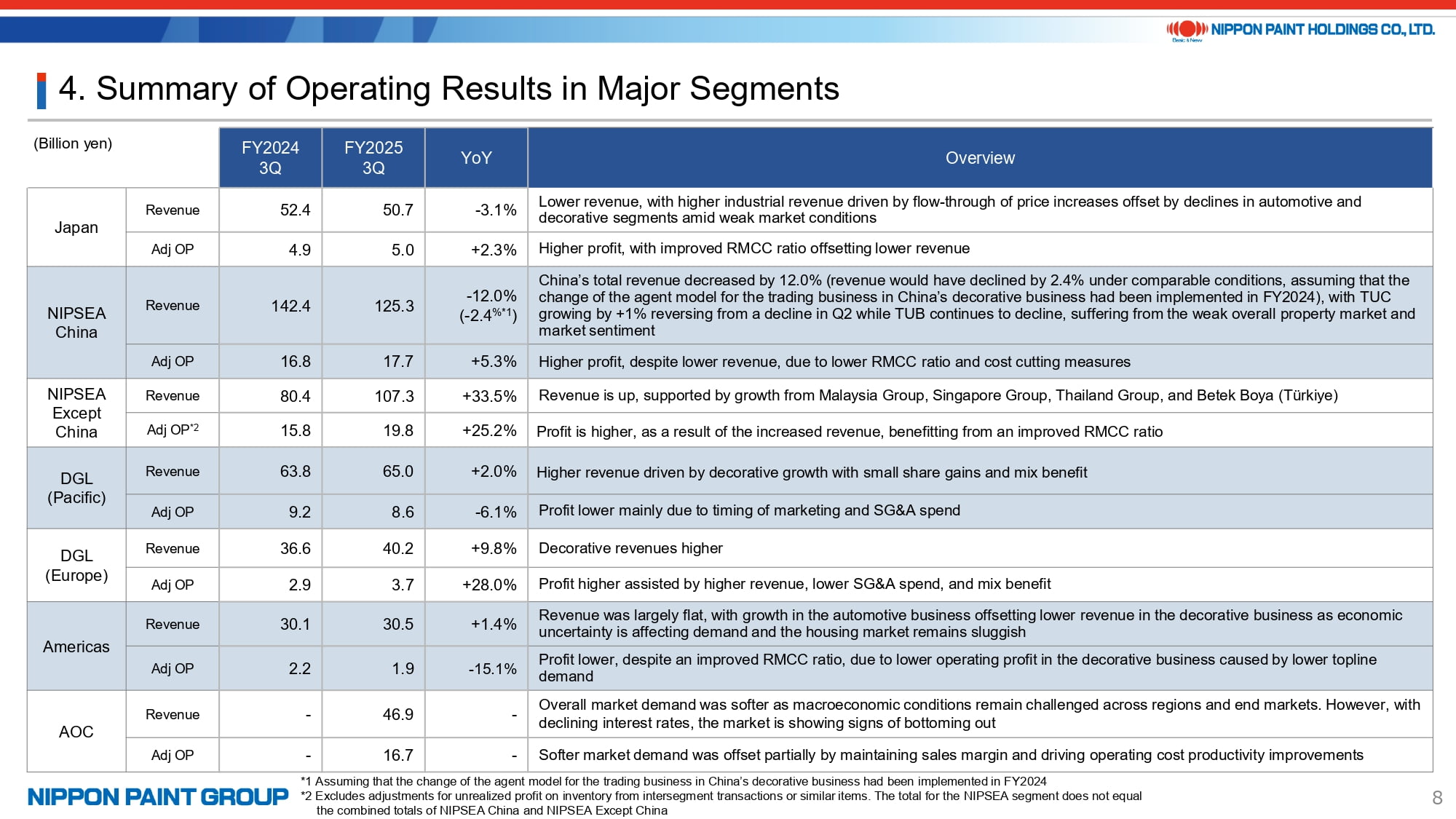

7. Summary of Operating Results in Major Segments

Page 8 provides an overview of our major segments. I’ll save the detailed explanations for the Q&A and instead offer a brief summary of each region.

- Japan: Market conditions remained difficult, resulting in lower volumes. However, improvements in price/mix helped offset this weakness, allowing us to deliver growth in adjusted operating profit.

- NIPSEA China: Despite a challenging environment, TUC achieved a 1% increase in revenue and maintained solid adjusted operating profit. A low single-digit improvement in price/mix more than compensated for a low single-digit decline in volumes. In automotive, revenue grew 7.9%, supported by rising vehicle production and strong demand from Chinese OEMs. For NIPSEA China as a whole, the adjusted operating profit margin improved by 230 basis points year on year. Margin gains more than offset the decline in topline, resulting in overall profit growth.

- NIPSEA Except China: We achieved overall growth in both revenue and profit across the region. In Indonesia, volumes increased by a mid single-digit percentage, although this was partially offset by foreign exchange headwinds. In Türkiye, we recorded double-digit growth in both volumes and price/mix. Please note that Adjusted Profit for our Turkish operations is calculated using hyperinflation-adjusted figures.

- DuluxGroup: In the Pacific region, underlying market conditions were largely flat, yet we still achieved revenue growth supported by improvements in both volumes and price/mix, even after accounting for the impact of yen appreciation. In Europe, although the French market remained soft, revenue increased thanks to continued business growth in Southern Europe and at JUB. The appreciation of the euro also provided a favorable tailwind. Overall, DuluxGroup delivered a significant increase in adjusted operating profit.

- Americas: In the automotive segment, we achieved revenue growth supported by increased vehicle production across the region. However, elevated long-term interest rates continued to weigh on housing demand, resulting in softer performance in the decorative segment and an overall decline in profits for the Americas.

- AOC: AOC continued to deliver exceptionally high margins and remains a major contributor to our overall profitability. Although revenue declined 9% year on year on a reference basis, this business adjusts prices rapidly, so topline figures alone do not fully reflect performance. Volumes decreased by a mid single-digit percentage. While this indicates a subdued market environment, we have successfully maintained our market share. As noted earlier, we are now seeing early signs that market conditions may finally be bottoming out.

Although the architectural markets in both the U.S. and China remain soft, we are confident that our strong market positioning will allow us to capture the benefits swiftly once recovery begins.

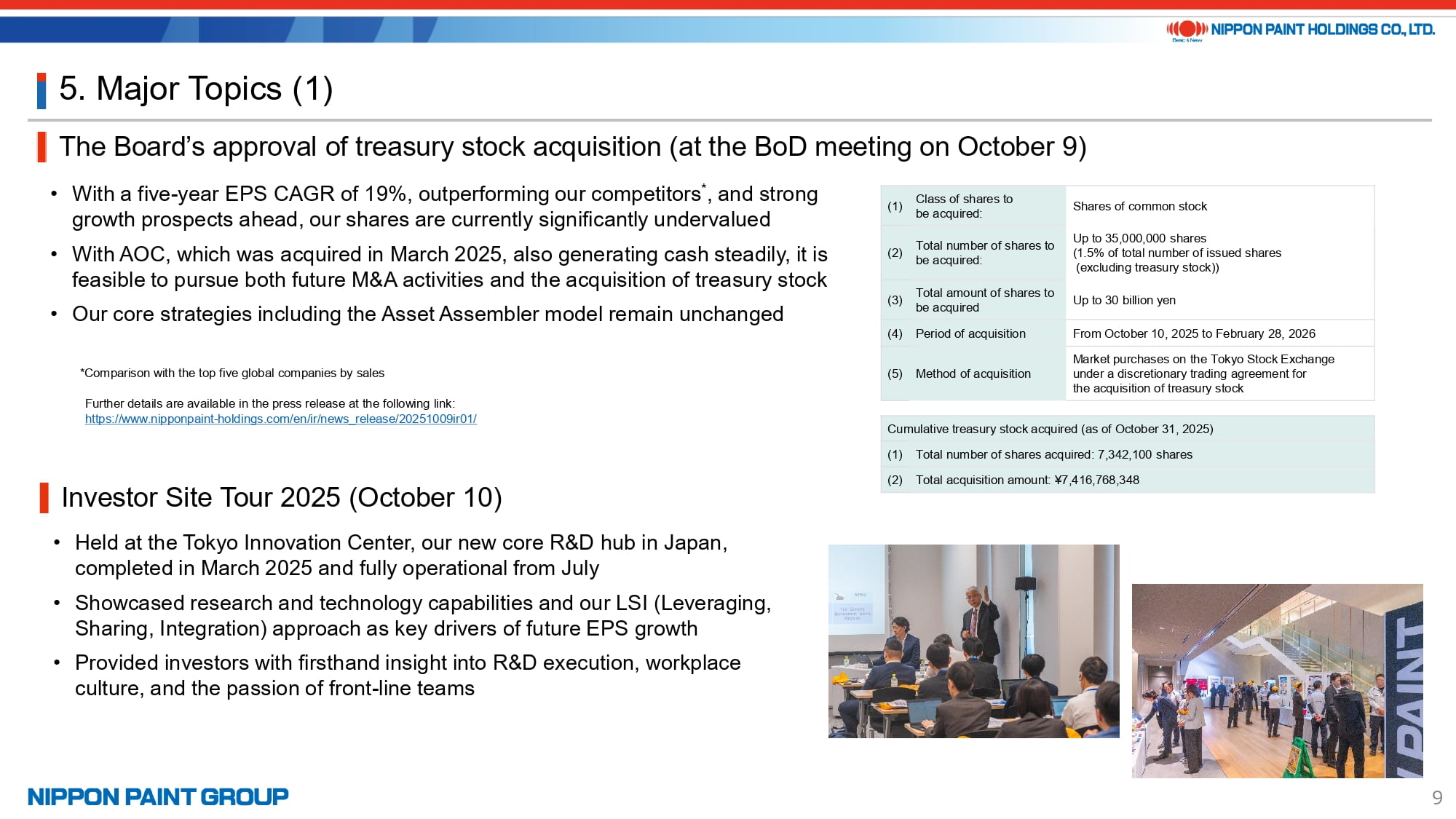

8. Major Topics

There are three main topics I would like to highlight.

First, we announced share buyback on October 9. As of the end of October, we have repurchased shares worth approximately ¥7.4 billion. While our share price remains subdued, one positive aspect is that we have been able to invest at highly attractive valuations, which we believe will contribute to EPS accretion in the future. Please note that, as we have stated previously, our core strategy as Asset Assembler remains unchanged, and we continue to consider M&A opportunities as the primary allocation of surplus cash.

This share buyback decision was made after careful consideration and discussion at our Board meeting in September, reflecting feedback we have received from the capital markets. As demonstrated by our recent changes in disclosure practices, we remain committed to maintaining constructive dialogue with market participants. We greatly appreciate your valuable feedback.

Second, we recently hosted an investor tour of our newly completed Tokyo Innovation Center, which featured presentations and Q&A sessions with the CTO of both Japan Group and NIPSEA Group. We were pleased to welcome many investors and analysts, and I would like to take this opportunity to thank all those who attended.

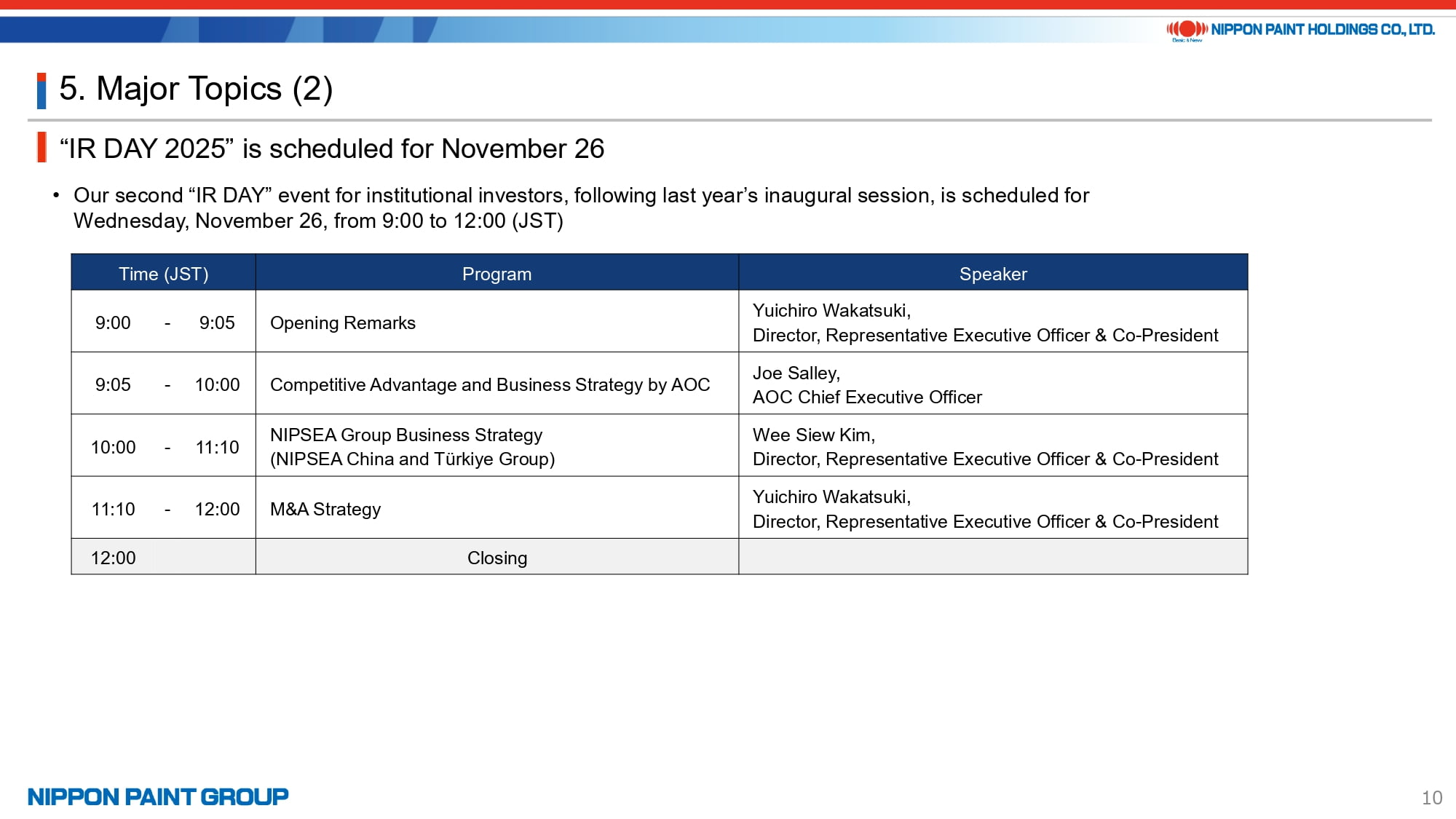

Third, we will be holding our IR DAY on Wednesday, November 26. This time, we will also feature a presentation from AOC, and the event will be scheduled for the morning Japan time. Both Co-Presidents will be presenting, and we sincerely hope you will be able to join us.

Thank you for your attention.