“Acquisition of 100% ownership of the Asian JVs, Indonesia business”

Decided by resolution of the Board of Directors based on repeated discussions to ensure the protection of minority shareholder interests

NPHD’s Board of Directors is focused on improving the transparency, objectivity, and fairness of management through lively exchanges of opinions and discussions, mainly by the independent directors who comprise the majority of the Board. The acquisition of 100% ownership of the Asian JVs was decided based on repeated discussions held by the Board of Directors to ensure the protection of the interests of minority shareholders. These pages present the outcomes of the discussions held by the Board and the opinions of each Director.

Increasing net profit by more than 60% and EPS by more than 10%

NPHD has evolved its partnership with the Wuthelam Group through joint ventures for nearly 60 years. With our acquisition of a 100% stake in Asian JVs following their consolidation in FY2014, we can bring our partnership with the Wuthelam Group to full maturity, allowing us to further accelerate growth of our Group by building a management base that unites the two companies in both name and reality.

According to a simulation based on certain assumptions, this acquisition will increase profit attributable to owners of the parent by around 60% and EPS by more than 10%, making it sufficiently attractive from the perspective of protecting the interests of minority shareholders as well.

In addition, increasing capital through a third-party allotment has allowed us to strengthen the financial base to accelerate M&A activities in the future, as well as improve our credit rating. For these reasons, this acquisition has contributed to the Maximization of Shareholder Value (MSV).

Simplifying our ownership structure to one that is beneficial to all shareholders

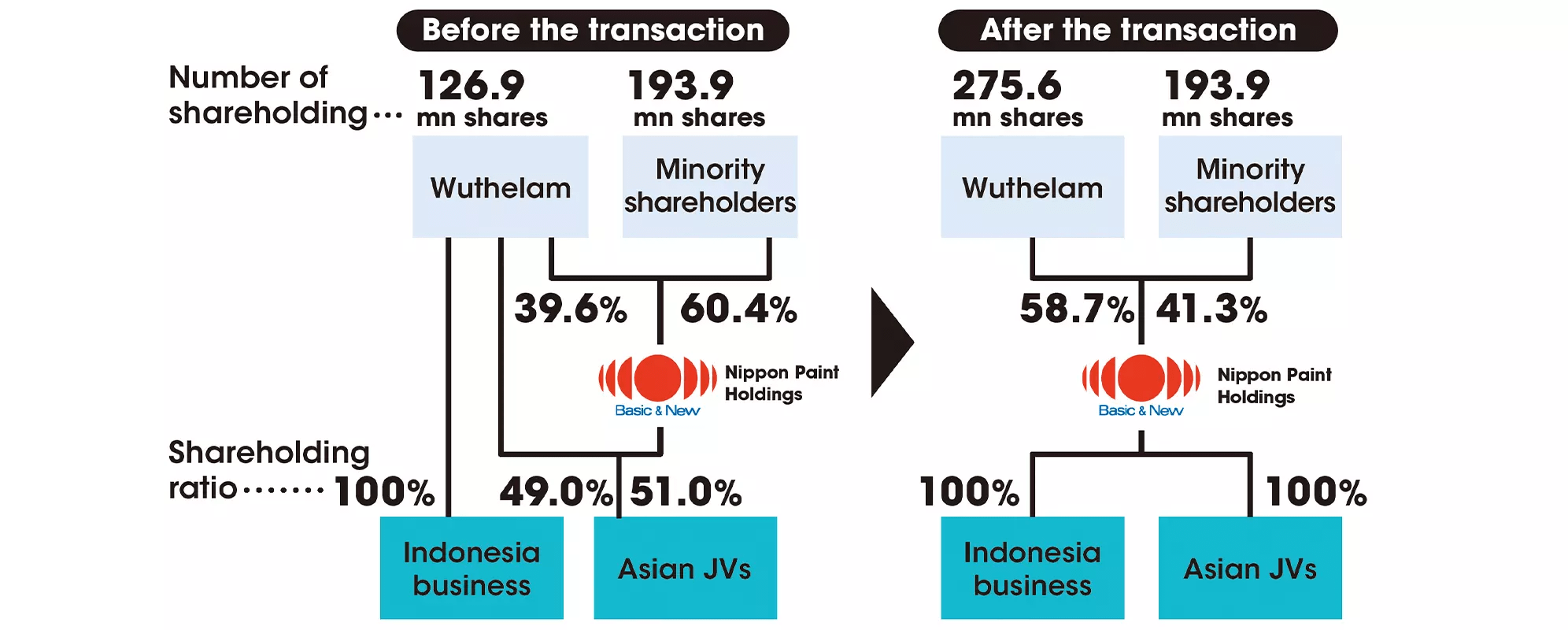

Prior to this transaction, the Wuthelam Group held 39.6% of NPHD’s shares, a 49% stake in the Asian JVs, and a 100% stake in the Indonesia business. This ownership structure has been criticized as complex, with outflows of profits from the Asian JVs that are the engine of the Group’s growth, and a possibility of conflicts of interest in terms of governance. Accordingly, we held discussions and negotiations premised on protecting the interests of minority shareholders. For example, we have (1) shifted to a Company with a Three Committees Structure; (2) changed the composition of the Board of Directors to one where six out of the nine directors are independent directors; and (3) established the Special Committee, consisting of independent directors who are well versed in M&A, which has held eight Special Committee meetings and seven Board of Directors meetings.

After the implementation of this transaction, the Wuthelam Group owns 58.7% of NPHD shares and NPHD holds a 100% stake in the Asian JVs and the Indonesia business, making the ownership structure simpler and easier to understand.

As a result, the interests of both major and minority shareholders are perfectly aligned, and our Group’s MSV is now a shared objective for both the Wuthelam Group and our minority shareholders.

For our minority shareholders, while the ratio of voting rights per share decreased, earnings per share (EPS) increased, which is an important point of the transaction.

The transaction simplified the ownership structure and aligned the interests of the major shareholder and minority shareholders

*The denominator used for the calculation of the shareholding ratio is the number of outstanding shares (excl. treasury stock) as of June 30, 2020

Increase in the Wuthelam Group’s shareholding is a result of our financing

After this transaction, the Wuthelam Group became a shareholder, with 58.7% shares of NPHD. The purpose of this transaction was not for the Wuthelam Group to acquire NPHD or make it a controlling subsidiary, nor did we receive a takeover bid (TOB) for our shares from the Wuthelam Group. The increase in the Wuthelam Group’s shareholding in NPHD is merely the result of our negotiations to obtain financing from the Wuthelam Group to achieve further growth.

Sample comments from the Directors of the Board on the acquisition of 100% ownership of the Asian JVs

Significance of the transaction, the financing method, and major shareholder risks

- We believe that the benefits to our minority shareholders also include the ability to fully capture Asian businesses with high growth potential and the ability to better incorporate a culture of ambitious new challenges into our Group’s businesses in Japan.

- One important issue is to sort out the complicated capital relationship. What would change if a shareholder with a 39% stake in NPHD became a shareholder with more than 50%? MSV remains our Group’s paramount mission, and we believe that this can be fully explained by pursuing a higher quality of business and service with this major shareholder and the current management team. In addition, assuming the future growth of our Group mainly through M&A, there would be various methods such as leveraging borrowings and share exchanges. If so, it would be disadvantageous to choose a scheme that would complicate the capital structure.

- The financing method in this transaction should be examined adequately. Financing the entire acquisition price using borrowings could lead to a loss of equity capital, and funds could be raised by issuing shares through public offering. However, new share issuance may entail some problems such as the issue price being offered at a discounted price and the number of shares issued not being able to be fixed. This is a matter of choice between the risk of incurring such problems and the risk of having a shareholder with a majority shareholding. From the perspective of growing EPS, the latter option is considered to have a smaller risk.

- Regarding the absence of a 58.7% retention clause, we believe that the risk of further increase in the Wuthelam Group’s stake is not that significant in terms of liquidity and the maintenance of market listing. On the other hand, given that capital can be increased in the future through M&As that are expected to improve EPS, I believe the absence of this clause has some advantages in terms of selection of a superior financing method and the potential reduction in the Wuthelam Group’s stake.

Minority shareholder interests

- After this transaction, the Wuthelam Group will become the major shareholder. However, since they are not an operating company but an asset management company, their interests are aligned with those of the minority shareholders in that the Nippon Paint Group’s growth is important for the asset management of the Wuthelam Group, and this structure will not allow the Wuthelam Group to make decisions that conflict with the interests of minority shareholders.

- What is important is the relationship of trust between the major shareholder and the management team. This will lead to the MSV that both sides aim for, and that is why we will be able to explain it to shareholders including potential shareholders and the capital market. It is important for the Nippon Paint Group’s growth as One Team, instead of causing confrontation, and the basis of that growth is not the ownership ratio but the mutual trust between the major shareholder and the management team. We believe that the system represented by the upcoming new management structure will also be acceptable to minority shareholders.

Governance

- The Special Committee is composed of three independent directors who are well versed in M&A, and resolutions by the Board of Directors will require the Committee’s recommendation. We believe that the Special Committee functioned as a framework for making objective and independent judgments without the influence of the Wuthelam Group.

- It is generally not a good thing when a listed company concludes a special contract with some of its shareholders that includes involving the exercise of voting rights. Therefore, we do not need to insist on continuing the strategic alliance contract concluded in 2014. Because we will need to build a relationship of trust with the Wuthelam Group through closer communication than ever before, we must promote management and business execution that constantly keeps achieving MSV in mind.

Resolution as Directors of the Board

- Companies keep changing. If the management team has a view that is not aligned with the shareholders, as the major shareholder, the Wuthelam Group should replace the management team. The purpose of this transaction is not to protect the management team, but for the Nippon Paint Group to move on to a new phase. It is normal in capitalism for shareholders to have an appropriate authority. And it is more important to take a step forward to future development than to impose any kinds of restrictions to preserve the present form.

September 30, 2021

- Integrated Report 2021 (Digital Edition)