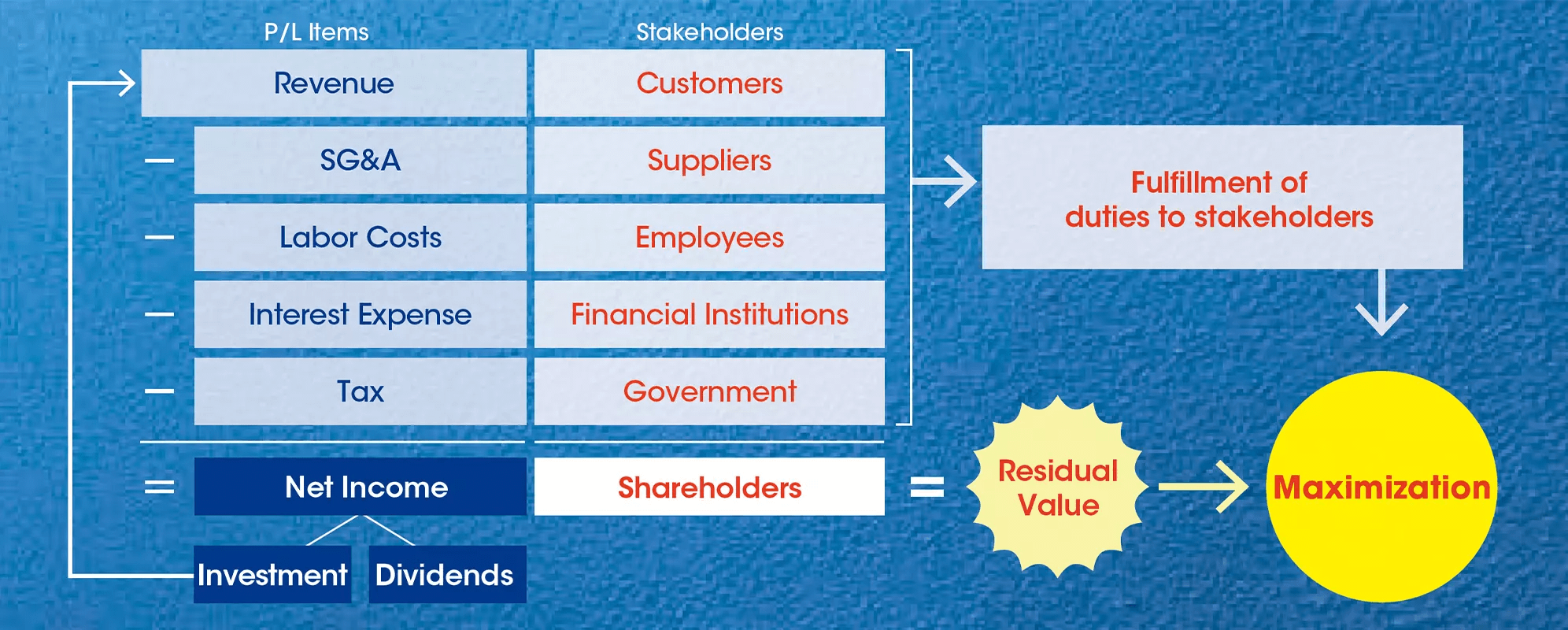

Maximization of Shareholder Value (MSV)

Our ultimate objective is to create wealth through Maximization of Shareholder Value (MSV)

MSV is our ultimate objective. Different from a “shareholder primacy” approach, NPHD focuses on creating wealth through SDG- and ESG-oriented management and maximizing the residual shareholder value after fulfilling our duties to customers, employees, suppliers, and society.

MSV is the ultimate objective of Nippon Paint Group management. The MSV concept is different from a “shareholder primacy” approach in that we seek to create wealth through SDG- and ESG-oriented management with the aim of maximizing the residual shareholder value that remains after fulfilling our duties to customers, employees, business partners, and society.

The illustration above shows stakeholder relationships to profit and loss items—customers and revenue, suppliers and SG&A, employees and labor costs, financial institutions and interest expenses, and government and taxes. MSV is predicated on first fulfilling our duties to each stakeholder group. These duties encompass legal contracts and social and ethical responsibilities as well as the concept of sustainability.

MSV seeks to maximize the value that remains after fulfilling these duties, and reward shareholders who accepted the risks and invested in our company. The MSV approach recognizes that our stakeholder duties are finite and that the value we produce beyond that amount belongs to shareholders. MSV focuses on the maximization of medium- and long-term shareholder value, rather than pursuing short-term shareholder value.

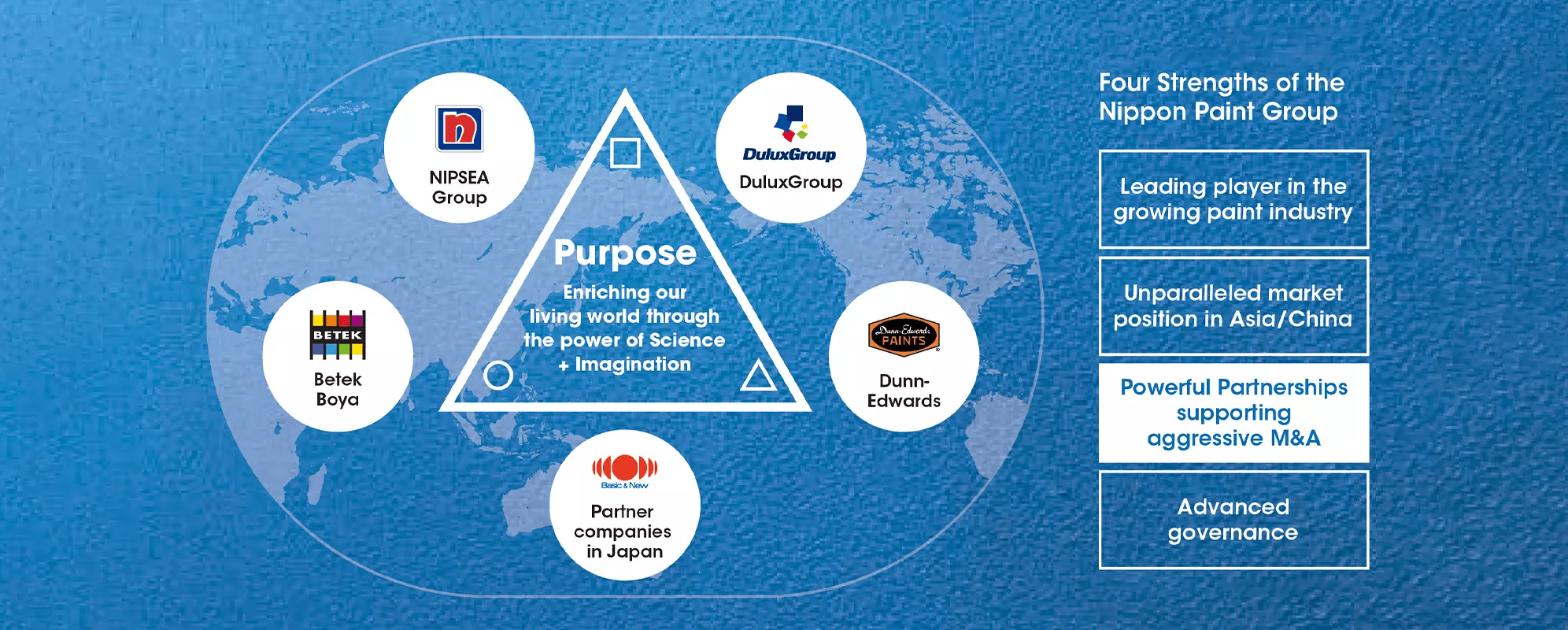

Powerful Partnerships

Creating synergies through trust-based collaborations with partner companies

Our mainstay decorative (architectural) paints business features local production for local consumption. For this reason, NPHD exerting blanket control over the Group’s wide palette of businesses would not be effective. Conversely, providing a platform for our Group companies to share and learn from each other is the most effective way to generate Group synergies.

We adopted a Powerful Partnerships approach to foster organic collaboration and cooperation among partner companies in Japan and overseas and to promote autonomous business growth guided by the Group’s common Purpose. NPHD plays a governance role for the Group, including appointing and dismissing Group partner company CEOs and overseeing financial strategy, but the individual companies are responsible for executing their own autonomous initiatives to create synergies among the Group’s partner companies.

Our aim is to encourage and facilitate our partner companies to create synergies with other Group companies and new additions to the Group to pursue new growth opportunities, reduce costs through joint procurement, acquire human resource talent, and share best practices to improve their businesses.

- Integrated Report 2021 (Digital Edition)