Strategic Implications of AOC Acquisition

In October 2024, we announced the acquisition of AOC, a U.S.-based global specialty formulator, and successfully closed the transaction in March 2025. While AOC operates outside our core paint and coatings business, the acquisition aligns fully with our Asset Assembler model and reflects our future vision.

This section outlines key remarks from our Directors regarding this milestone transaction.

For details regarding the acquisition of AOC, please refer to the “Presentation Material Regarding the Acquisition of AOC” available on our website.

Overview of the Transaction

(Excerpted from the AOC acquisition presentation material released on October 28, 2024)

| Overview of AOC |

|

|---|---|

| Acquisition price and schedule |

|

| Financial impact |

|

Note: USD/JPY=145.0 for AOC figures

*1 Equity value is calculated based on the latest balance sheet. The actual purchase price will be determined after adjustment of some items at the completion of this transaction based on agreement with the seller

*2 2023A EBITDA on IFRS basis

*3 Closing is scheduled for 1H 2025 thereby contribution in year 1 will be pro rated depending on the timing of closing. Post-acquisition EPS in this document is based on a pro forma estimate, assuming a full-year contribution for FY2024 with a preliminary estimate of interest cost, forex and PPA/ITA amortization included

Q&A at the Board of Directors Meeting

-

AAlthough AOC operates beyond our traditional paint and coatings domain, we do not consider the associated risks to be material. The company brings a strong track record, robust cash-flow generation, attractive market fundamentals, and a high-caliber management team. While our distribution channels differ, AOC and our Group share a common foundation in resin-based technologies, making AOC’s business model relatively familiar to us. Notably, both businesses benefit from high profitability and strong cash-flow supported by low capital expenditure requirements, a result of factory operations centered around reactor-based processes similar to those used in paint manufacturing. As such, AOC represents a business adjacent to, rather than entirely outside of, our operational expertise, a feature of which gives us additional confidence to the business risk profile.

-

AAOC operates in a market with high barriers to entry, which supports its ability to maintain strong profitability. Its customer base further reinforces this, enabling stable, long-term performance. At the core of AOC’s success is a disciplined, system-driven approach rooted in principles akin to the Toyota Production System. This holistic business model integrates a structured set of practices and procedures designed to deliver consistent and repeatable performance improvements. AOC systematically applies this framework across key operational areas, including new product development, lean manufacturing, procurement, and commercial excellence, through a cross-functional lens. This ongoing focus on value creation supports the sustainability of its profitability. Additionally, approximately 70% of AOC’s products are customized formulations, enabling the company to meet specific customer needs and differentiate itself by delivering high-performance solutions. Looking ahead, we see further upside in profitability through volume recovery and a greater share of custom formulations in the U.S., alongside the expansion of AOC’s business system into Europe.

-

AWe view the geopolitical risk associated with this acquisition as relatively limited, particularly given that AOC’s core business centers on resin production and involves a modest-sized workforce. As such, its direct exposure to geopolitical dynamics is minimal. While the upcoming U.S. presidential election does contribute to broader market uncertainty, we also see this as a window of opportunity for M&A activity. AOC is currently owned by a private equity fund expected to seek an exit in the near term, and we believe that our ability to offer long-term stability and certainty as part of the Nippon Paint Group strengthens our position as an attractive buyer. Although this marks our first major acquisition outside the paint and coatings sector, we are confident that the associated risks are well within our capacity to manage.

-

ATo assess this risk, our Chairperson and both Co-Presidents held in-person meetings with AOC’s management team, in addition to conducting multiple online interviews. These discussions reaffirmed the CEO’s strong commitment, as well as that of his leadership team, to drive its continued growth post-acquisition. Moreover, we observed a high degree of alignment between AOC’s management and our MSV mission and broader management philosophy. Based on this alignment and the mutual enthusiasm for future collaboration, we view the likelihood of key leadership departures as relatively low. Furthermore, AOC’s business system is deeply embedded across the organization.

As a result, even if certain key members of the management team were to depart, we are confident that AOC would retain its ability to deliver strong, sustained profitability. -

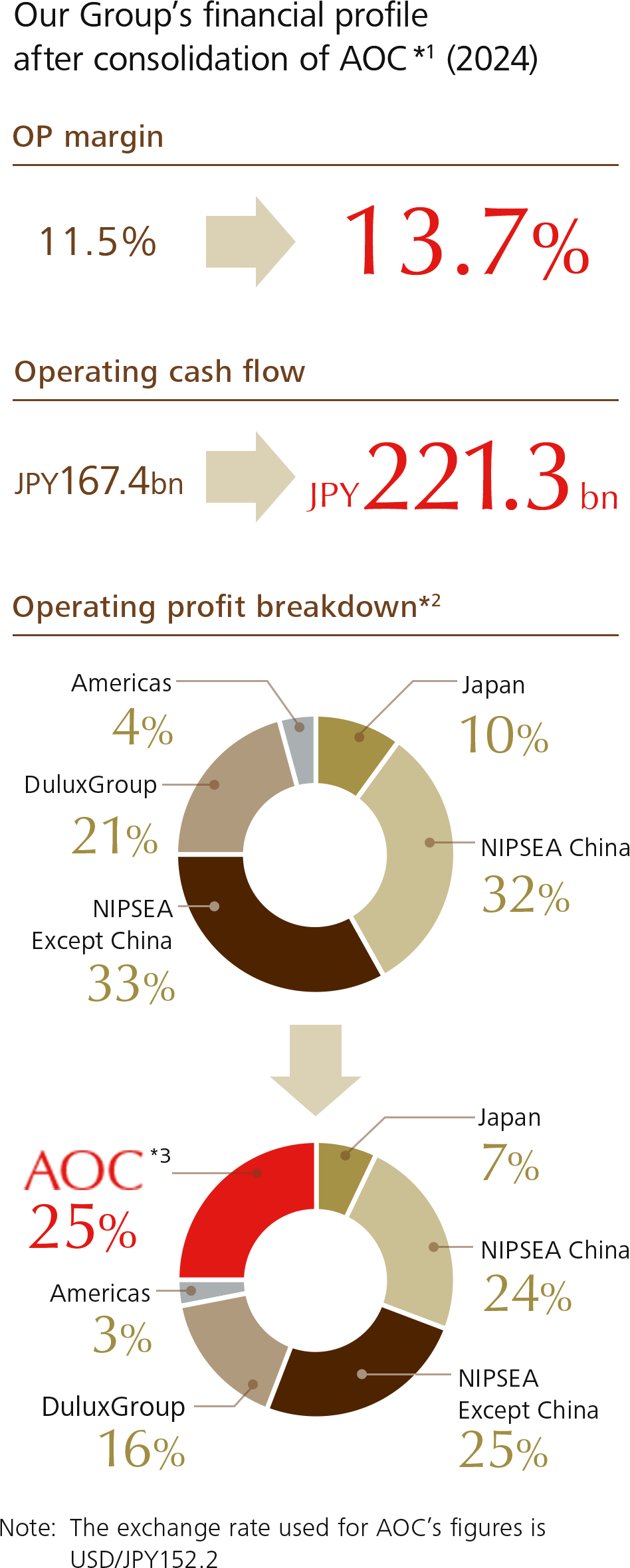

AWith the consolidation of AOC and assuming a simple aggregation of 2024 operating profits, our operating profit composition is projected to change, with approximately 25% coming from AOC and 25% from NIPSEA Except China. Meanwhile, the contribution from NIPSEA China is expected to decrease from 32% to 24%. The addition of AOC as a new growth pillar is anticipated to drive improvements in consolidated margins, cash-flow generation, and other key financial metrics. This transaction is expected to enhance consolidated profitability and deliver meaningful EPS compounding from the first year, while naturally lowering our earnings dependence on China. Given that a “China discount” is currently reflected in some degree by the stock market, we believe this diversification will be positively received by investors. It is important to underscore that the acquisition of AOC was driven by its strategic fit with our Asset Assembler model, not by an intent to reduce exposure to China. The shift in profit composition is simply a result of this strategic alignment, not its primary aim, and we will communicate this point clearly to the stock market.

*1 FY2024 results are proforma, representative as if AOC operated as subsidiary for the whole of 2024

*2 Percentages to the total sum of segment profit

*3 PPA reflects our current assumptions but excludes one-off costs such as inventory step-up. M&A expenses related to the AOC acquisition are excluded. To align with our post-acquisition profit and loss profile, expenses such as payments to India businesses in EMEA and affiliated companies of former shareholders are also excluded