Font Size

Development of Nippon Paint’s Governance as a pillar of the Asset Assembler Strategy

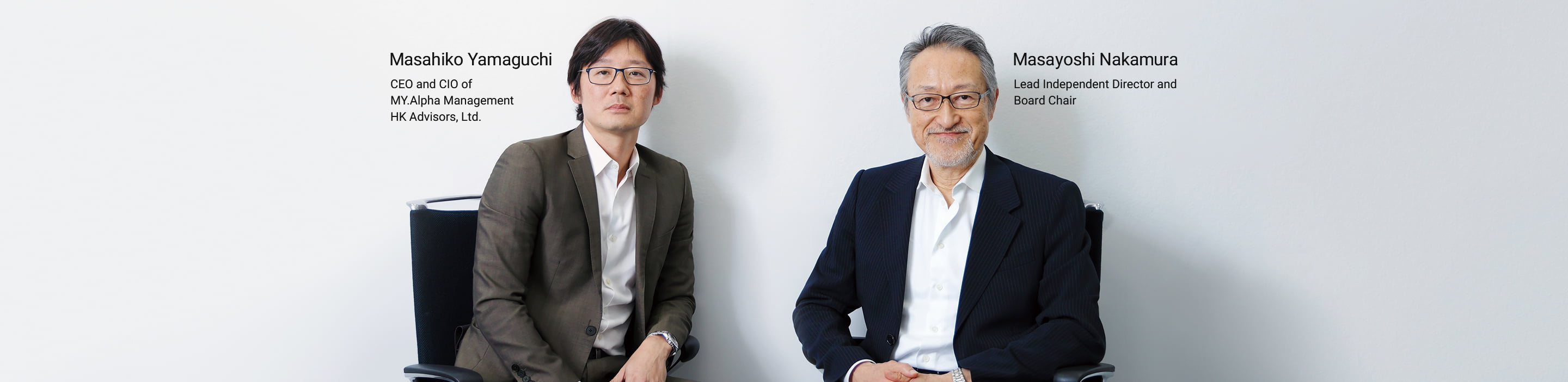

How is our governance evolving in our unwavering commitment to MSV? — In this dialogue, Masahiko Yamaguchi, CEO and CIO of global investment management firm MY.Alpha Management HK Advisors, Ltd. — who has been a long-standing observer of our progress as an investor — and Masayoshi Nakamura, Lead Independent Director and Board Chair of Nippon Paint Holdings, engage in a discussion on our M&A strategy and governance. They also share their insights on the future direction of our governance as we continue to advance as an Asset Assembler.

Masahiko

Yamaguchi

Yamaguchi

CEO and CIO of

MY.Alpha Management

HK Advisors, Ltd.

MY.Alpha Management

HK Advisors, Ltd.

Masayoshi

Nakamura

Nakamura

Lead Independent Director

and Board Chair

and Board Chair

- Masahiko Yamaguchi CEO and CIO of MY.Alpha Management HK Advisors, Ltd.

- Mr. Yamaguchi developed his career at leading global investment firms, including Morgan Stanley and Citadel Investment Group. At York Capital Management, serving as Head of the Asia Division, he significantly expanded the firm’s assets under management. In 2021, he founded MY.Alpha Management as a spin-off from York. He is now recognized for his outstanding investment track record, employing flexible investment strategies that focus on value creation and capitalization on market anomalies by management throughout the Asian markets. MY.Aplha’s AUM as of the 1st quarter 2025 was over USD 2.2 billion.

1. What first sparked your interest?

| Nakamura | To kick things off, what was it that first sparked your interest in Nippon Paint Group? |

|---|---|

| Yamaguchi | I had considered Nippon Paint one of the most attractive companies in Japan and had been closely following its developments even before 2015, when Wuthelam Group’s stake rose to around 39% as a result of the consolidation of Nippon Paint’s Asian joint venture with Wuthelam Group. Then, in early 2021, when Nippon Paint fully integrated the Asian joint venture and acquired the Indonesia business, Wuthelam’s stake rose to 58.7%. This led to a notable EPS growth and further strengthened my positive view of the company. Around the same time, I also noticed meaningful reinforcement in the company’s governance structure, which underscored the company’s strong commitment to enhancing shareholder value and gave me greater confidence as an investor. What is attractive about Nippon Paint includes its continued margin improvement in the domestic market, as well as its strong and rising share in Asia’s fast-growing markets. In particular, Nippon Paint’s recent achievements in both organic growth and M&A-driven step-change growth make it a highly compelling investment opportunity. |

2. The AOC acquisition and the Board’s evolving approach to risk tolerance

| Nakamura | I’m glad to hear you’ve been following our Group for many years. Speaking of recent developments, I’d like to touch on our acquisition of AOC. This was a significant step for our Board of Directors and a clear demonstration of our Asset Assembler model for the next phase of our growth. I’m curious, did this acquisition impact your perception of Nippon Paint Group in any way? |

|---|---|

| Yamaguchi |

What stood out to me about the AOC acquisition is that it represents an expansion of Nippon Paint’s business slightly beyond its traditional scope as a paint company. That said, I see it as a move that could gradually redefine the Group’s overall profile. I remember that around 2022, Nippon Paint introduced the Asset Assembler model, and I am watching with keen interest, as this deal seems to be the first step toward realizing that vision. Expanding into businesses beyond paint and coatings is a strategic move, but to avoid the so-called “conglomerate discount,” it will be important for AOC to contribute steadily to EPS growth. A common issue among Japanese companies is that, when they diversify into too many businesses, it becomes unclear what the company’s core focus is, making analysis more difficult and potentially leading to lower valuations. I believe that EPS growth contributed by the AOC acquisition will help avoid such pitfalls and enable effective portfolio management. AOC’s business segment is somewhat adjacent to your core operations, so it fits well within the portfolio and helps maintain strategic coherence. What’s more, AOC has strong cash-flow generation capabilities, and the business appears to have been streamlined through previous ownership transitions. That likely enabled the company to be acquired as an efficient and lean entity. It is my hope that this development will enhance recognition of Nippon Paint’s robust cash-flow profile, potentially resulting in improved valuation multiples. In corporate acquisitions, securing a high-quality asset at a relatively low valuation multiple often demands a far greater level of decisiveness than acquiring financial products with high liquidity. Opportunities like this typically arise only during economic downturns or when a company is temporarily undervalued by the market. From a long-term perspective in the economic cycle, what are the views on corporate acquisitions of Mr. Goh, the Representative of Wuthelam Group, the majority shareholder of Nippon Paint, as well as those of the Board of Directors and the Independent Directors? |

| Nakamura | The business environment today is far more volatile than in the past, with sharper swings in both directions. Against this backdrop, the Board has placed greater emphasis on two key priorities: heightening risk awareness and raising risk tolerance, especially when evaluating acquisition opportunities. What’s essential is whether the executive team can challenge the limits of their capabilities. As the Board, our role is to help them realize that they often have more untapped potential than they think, even when they feel stretched. We aim to encourage prudent risk-taking by fostering that confidence. At the same time, it’s equally important to ensure we have robust risk management systems in place for our existing businesses. Our basic policy is to build a self-sustaining management structure for each asset, including autonomous internal audits. When issues do arise, partner companies are encouraged to seek inputs from the Co-Presidents, and if needed, bring matters to the Board for further guidance and support. We continue to evolve and strengthen this system so that, with the right framework in place, the executive team can operate with greater assurance and agility. This should ultimately encourage them to pursue strategic growth opportunities, including acquisitions like AOC. |

3. Pursuing MSV through targeted acquisitions

| Yamaguchi | From an investor’s perspective, what gives me the greatest confidence is seeing a strong governance framework combined with M&A activities that clearly aim to maximize shareholder value, not simply serve as a vehicle for Mr. Goh’s interests. The more I am convinced of this combination, the more inclined I am to take a favorable long-term view of the Company. That said, one area I think could unlock further value is market liquidity. Despite a sizable market capitalization, around 2.5 trillion yen, Nippon Paint’s stock still seems somewhat lacking in liquidity. Higher liquidity could be a key factor in unlocking higher valuation. |

|---|---|

| Nakamura | Wuthelam Group has consistently held the view that it would not oppose a dilution of its stake if Nippon Paint were to raise capital through a share issuance, provided the funds are used for a large-scale M&A transaction that clearly contributes to maximizing shareholder value. Do you think this view has been sufficiently recognized and understood by the capital markets? |

| Yamaguchi | It’s hard to say whether that view has been fully communicated to the capital markets. That said, considering Nippon Paint’s strong cash-flow generation and its current levels of net debt and EBITDA leverage, I don’t see a need to raise capital through share issuance for deals on the scale of the AOC acquisition, nor would I wish to see such dilution. By the way, there’s always the risk that certain acquisitions, especially those not immediately understood by the market, could lead to a temporary dip in valuation. But I also believe that the true value of such transactions will be fairly evaluated over time. Even when a premium acceptable for the seller is paid for a business temporarily devalued for some reason, as long as there are meaningful synergies to be realized, the deal will eventually be fairly evaluated by the capital markets over time. |

| Nakamura |

I understand your point. In fact, for many of our past M&A transactions, we’ve set acquisition prices based on the expectation that the deal would be EPSaccretive from the very first year, even without counting in potential synergies. We’ve never regarded synergies as the primary rationale for an acquisition; instead, we view them as additional upside that may materialize over time. I believe that excluding synergies from our valuation reflects a conservative and sound approach. What you are suggesting is that acquisitions that price in anticipated synergies may lead to a temporary drop in share price, but that over the medium to long term, investors may come to appreciate the value of taking on such risk? |

| Yamaguchi | Exactly. As a shareholder of Nippon Paint, I would actually be inclined to increase my holdings when major announcements, such as a significant M&A deal, are made. That’s because if the acquisition has the potential to fundamentally transform the Company and ultimately succeed, I believe a re-rating of the valuation is inevitable. Of course, there may be some short-term pressure on the share price. But after six months to a year, once the synergies become more tangible, I think the market could start to view the transaction as a clear value-creator, something along the lines of “1+1=3 or more.” That said, there’s always a risk of pushback from investors who don’t share that long-term view. Striking the right balance is crucial, and clear and transparent communication about how the acquisition will enhance shareholder value is essential to gain investor trust. |

| Nakamura | Up to now, during the pricing process we’ve deliberately focused on transactions that are EPS-accretive based on our own valuation multiples, without factoring in synergies. This has naturally led us to steer clear of deals with multiples higher than ours. As you mentioned, certain situations may call for actions beyond this disciplined approach. |

| Yamaguchi | That’s a valid point. Sticking too rigidly to a highly disciplined M&A approach may, in some cases, limit your ability to pursue transformative transactions, deals that could potentially double your market capitalization or require financing measures to improve share liquidity. Of course, pursuing major acquisitions during periods of economic expansion often means accepting very high valuation multiples. Ideally, opportunities should be captured when uncertainty around a target’s business or market creates more favorable pricing conditions. At the same time, I think it’s equally important to focus on raising Nippon Paint’s own valuation multiples. Compared with other Japanese companies, Nippon Paint, with the majority shareholder in place, may have certain structural constraints, and it may be more difficult to pursue flexible strategies like share buybacks or aggressive dividend increases. It can also give investors an impression that Nippon Paint has limited options in the market combined with the low liquidity. Given such conditions, I find the idea quite compelling to use large-scale M&A as a strategic lever to both expand the business and improve market liquidity. |

| Nakamura | We share that perspective and hope to see more M&A transactions of this nature take shape. The AOC acquisition marked a meaningful step forward, not just for the executive team, but also for the Board. As we begin to explore even larger opportunities going forward, there may be more room to factor in potential future synergies, particularly as part of our continued commitment to maximizing shareholder value. |

4. Key attributes expected of Independent Directors

| Nakamura | As a company with a Three- Committee structure, Independent Directors make up two-thirds of our Board, six out of nine members. They also form the majority on both the Nominating and Compensation Committees, while the Audit Committee is composed entirely of Independent Directors. In that sense, Independent Directors play a central role in how our Board functions and governs the company. I’d be interested to hear your thoughts, do you have any particular perspectives or observations regarding our Board structure? |

|---|---|

| Yamaguchi | Bringing in new Board members with backgrounds in investment funds or capital markets could go a long way in reinforcing the perception that the Company is attuned to the interests of minority shareholders. It would signal to investors that “this Board understands the voice of the market,” and that, I believe, would strengthen confidence in the Board’s oversight. On a related note, succession planning has been gaining more attention across Japanese companies lately. I’m curious, how is Nippon Paint approaching this increasingly important area? |

| Nakamura | We don’t follow a formal succession plan built around a template program for leadership development or selection. Instead, successors tend to emerge from within the organization for each role. We also have opportunities to collaborate with external executives through various projects, and from time to time, we come across individuals who leave a strong impression. Mr. Yamaguchi, how important is succession planning when evaluating potential investment opportunities? |

| Yamaguchi | I believe that offering some visibility into potential future leaders, at the right time, can reassure the capital markets and helps position the Company in a more favorable light. |

| Nakamura | In addition to succession planning, I believe executive compensation is another area that draws attention from investors. In recent years, I’ve noticed growing interest in how compensation structures are designed, whether they are formula-based, how they balance fixed pay with short- and long-term incentives, and what portion is stock-based. For our Co-Presidents, we begin by determining the total annual compensation and then decide the split between cash and stock-based components. That said, since 2022, we’ve concluded that including stock in their compensation doesn’t necessarily enhance motivation. As a result, we’ve opted to set their total compensation at a slightly lower level than peer benchmarks and deliver it entirely in cash. |

| Yamaguchi | In my view, stock-based executive compensation sends a clear and reassuring signal to the capital markets. By contrast, if compensation is paid solely in cash, it may give the market an impression that the company is not sufficiently attentive to its stock price, which could be less convincing. Ensuring strong alignment between management and shareholders is essential. One approach I find effective is to allocate around 10% of total compensation to short-term stock options with a one-year vesting period. This directly links annual compensation to share-price performance, making it clear that increases in shareholder value are tied to executive rewards. If cash compensation levels are maintained while incentives are enhanced through options, I believe investors would be more supportive. It would also allow the Board to send a clear message to management that they are expected to drive initiatives that contribute to share-price growth on a yearly basis. |

| Nakamura | Regarding alignment with shareholders, although our current compensation framework doesn’t include stock, both Co-Presidents have been purchasing the Company’s shares personally. Of course, opinions may vary on which approach is more effective. If I understand you correctly, you’re suggesting that introducing stock-based compensation equivalent to around 10% of the current total package would only modestly increase overall cost, but could significantly strengthen alignment with shareholders, and likely be well received by the market. We will continue to give thoughtful consideration to the potential introduction of stock-based components. |

5. Key takeaways from the dialogue

| Nakamura |

Hearing your insights has given me a deeper understanding of the long-term perspective that investors like yourself bring to our Company. I also truly appreciate the confidence you’ve expressed in our Asset Assembler model and its role in driving MSV. This discussion has been both meaningful and thought-provoking. We remain committed to continuously evolving our governance framework to enhance our risk tolerance and better meet investor expectations. Thank you very much for your time and valuable input today. |

|---|