1. Front Cover

Good afternoon, everyone. I’m Yuichiro Wakatsuki, Co-President of Nippon Paint Holdings.

Thank you for taking the time to join us today as we present and discuss our financial results for the third quarter of 2024.

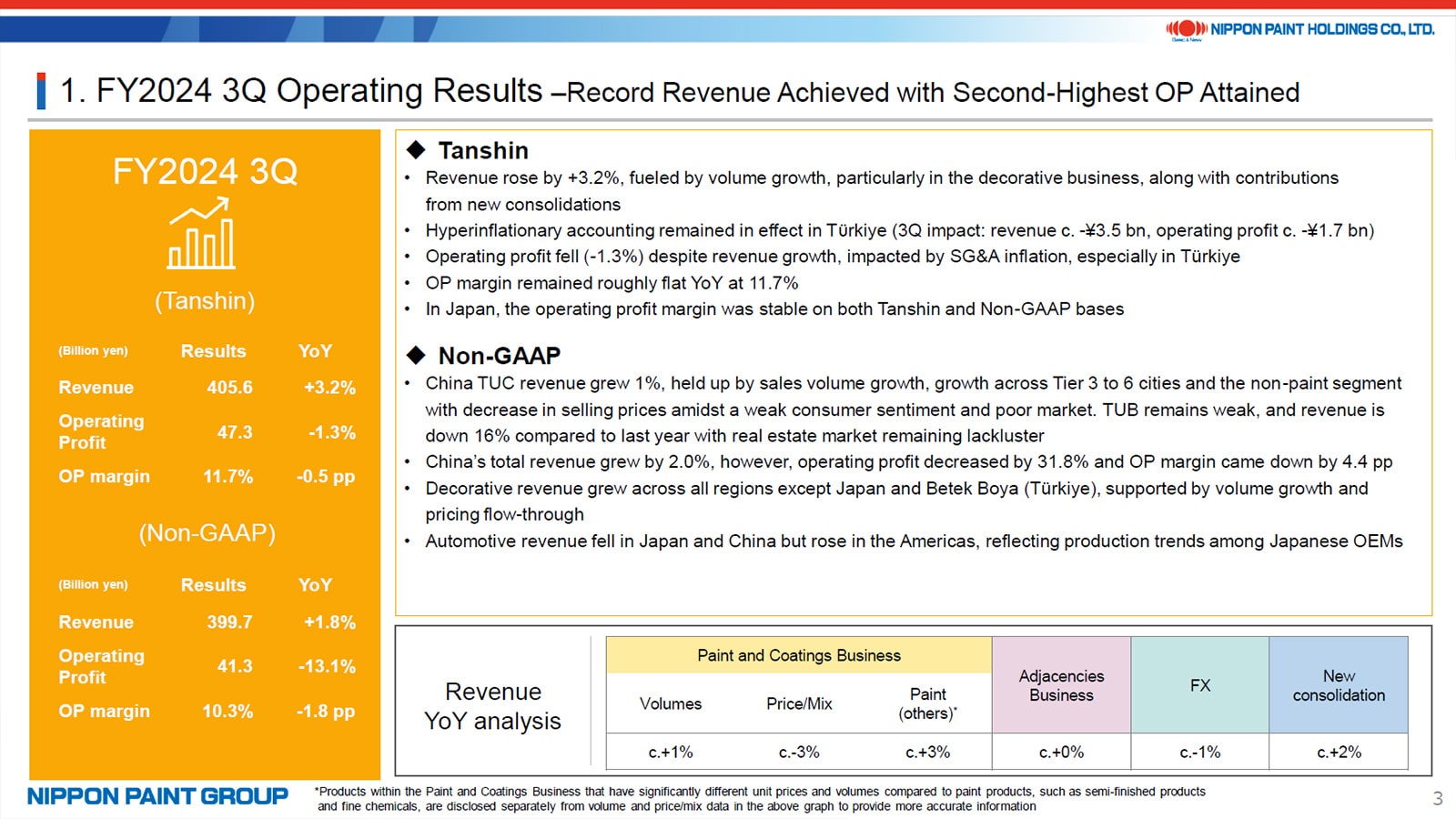

2. FY2024 3Q Operating Results Record Revenue Achieved with Second Highest OP Attained

Let me begin with a brief overview of our financial performance for the third quarter of 2024.

On a Tanshin basis, revenue grew by 3.2% year-on-year, reaching 405.6 billion yen, while operating profit declined slightly by 1.3% year-on-year to 47.3 billion yen. Although revenue hit a record high for the third quarter, operating profit remained largely unchanged. As shown in the revenue analysis table at the bottom of the presentation, the increase in revenue was driven by higher volumes in our paint and coatings business, along with contributions from the adjacencies business and new consolidations. However, foreign exchange fluctuations and price/mix effects negatively impacted our overall revenue.

On a Non-GAAP basis, revenue increased by 1.8% year-on-year, while operating profit decreased by 13.1% year-on-year. In NIPSEA China’s decorative paints business, which faced challenging market conditions, the TUC segment achieved a 1% year-on-year increase in revenue, while the TUB segment saw a 16% year-on-year decline. Overall, NIPSEA China’s total revenue rose by 2%, but operating profit dropped by 32%, primarily due to the exclusion of subsidies in the Non-GAAP calculation. To address these challenges, NIPSEA China has intensified cost-control efforts, including streamlining operations, which are expected to enhance margins starting in the fourth quarter.

In some respects, our performance in the third quarter fell slightly below expectations. Weak results were particularly evident in China, Türkiye, and DGL (Europe), with France facing notable challenges. However, in other regions, our performance held up relatively well despite the difficult market environment.

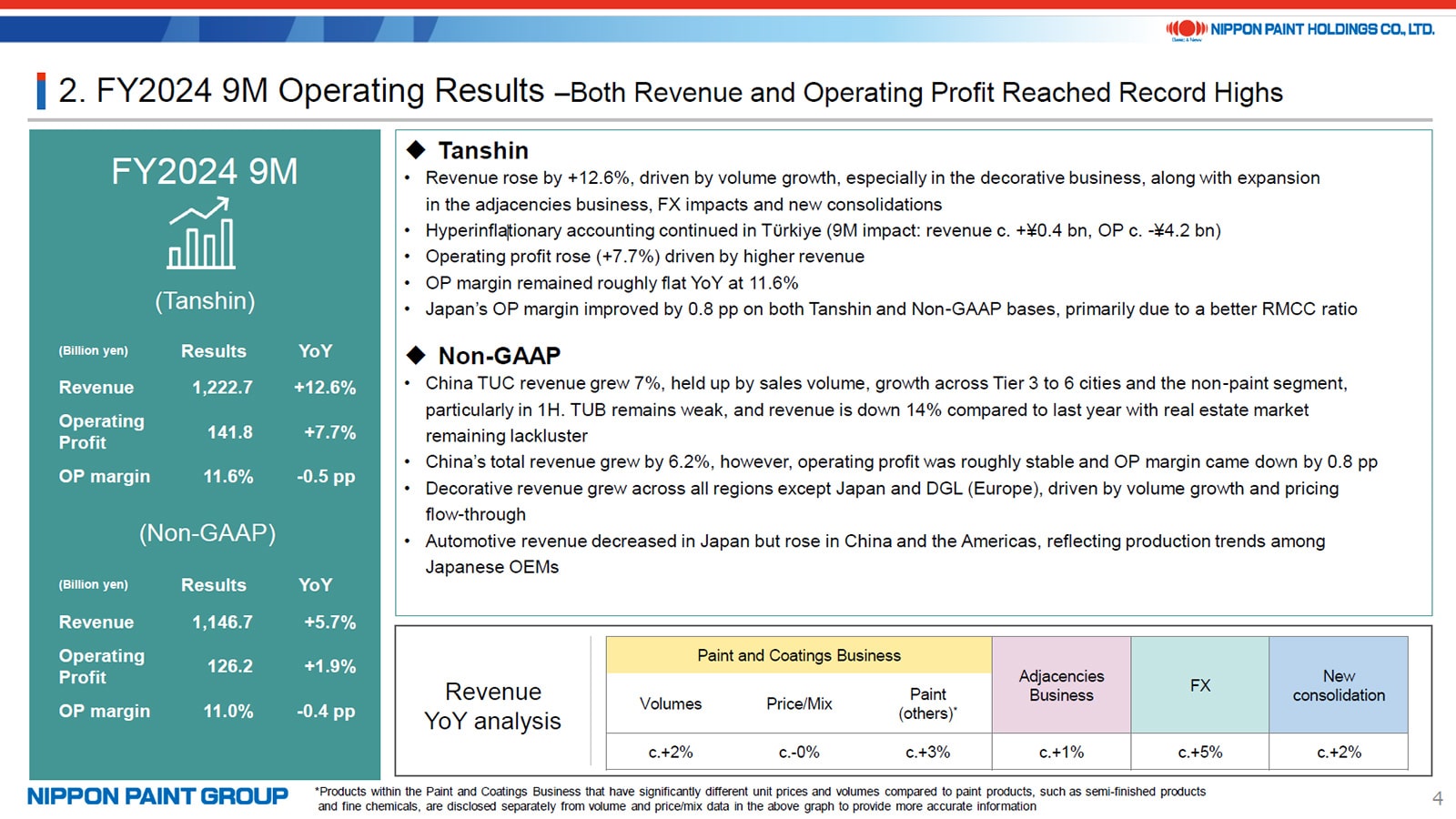

3. FY2024 9M Operating Results Both Revenue and Operating Profit Reached Record Highs

Next, let me provide an overview of our financial performance for the nine-month period.

Both revenue and operating profit have reached record highs during this time. While there have been slight variations in earnings across different regions and quarters, overall, our businesses and regions continue to deliver strong performance.

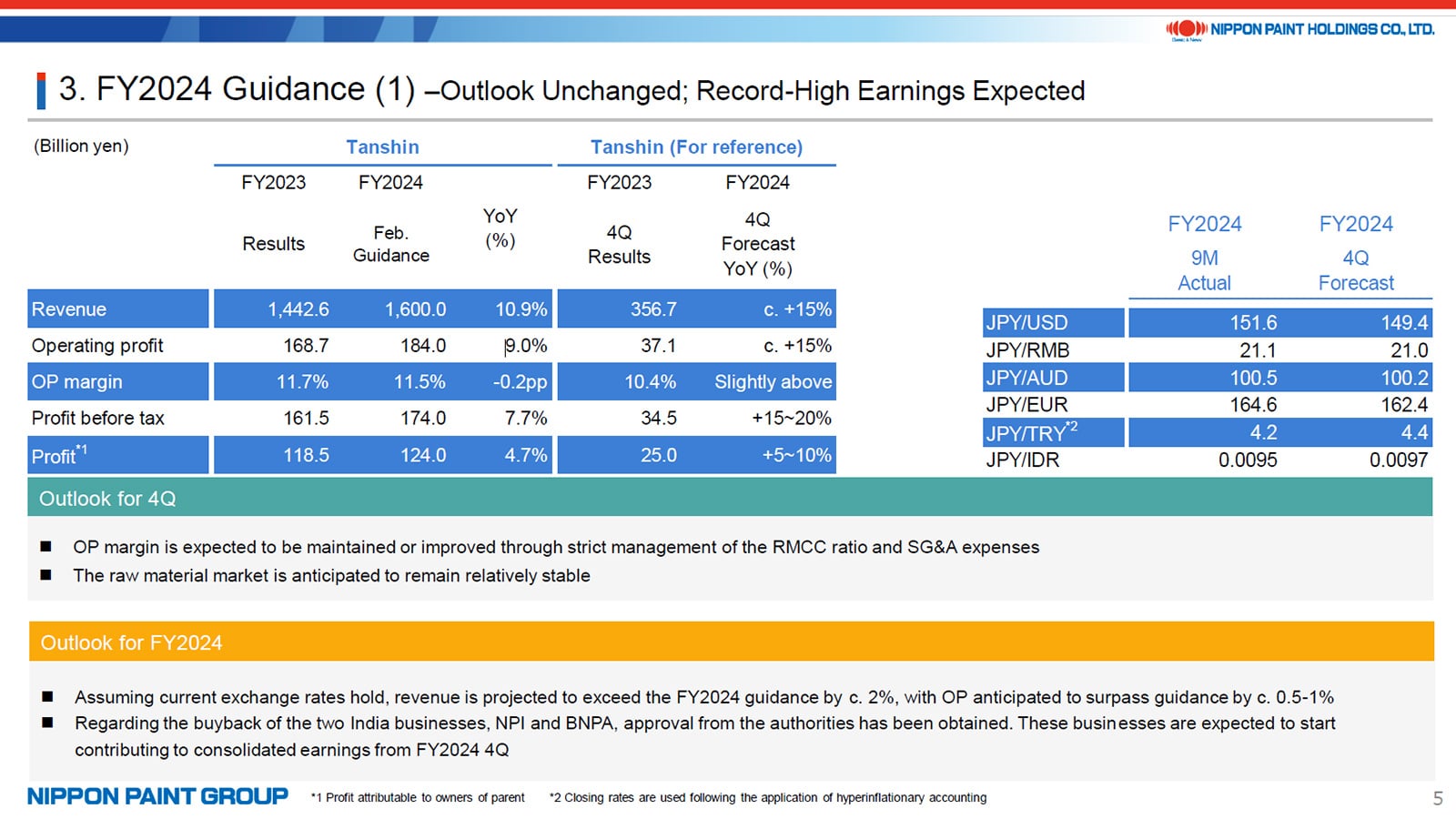

4. FY2024 Guidance (1) –Outlook Unchanged; Record-High Earnings Expected

Regarding the FY2024 guidance, we have decided not to revise our projections, considering slightly weaker performance in certain regions on a local currency basis, as mentioned earlier, despite the continued depreciation of the yen.

That said, we anticipate full-year results to surpass our initial guidance. Based on the exchange rates for FY2024 4Q outlined in the upper-right corner of the presentation, we expect both revenue and operating profit on a Tanshin basis to grow by approximately 15% in the fourth quarter.

For our FY2024 outlook, as outlined at the bottom of the presentation, we expect revenue to exceed the initial guidance by approximately 2% and operating profit by around 0.5–1%.

We have received approval from Indian authorities for the buyback of our two businesses in India; however, the transaction has not yet been finalized. We anticipate these businesses will begin contributing to consolidated earnings in the fourth quarter. As the impact on our overall performance is expected to be minimal, I will refrain from discussing further details.

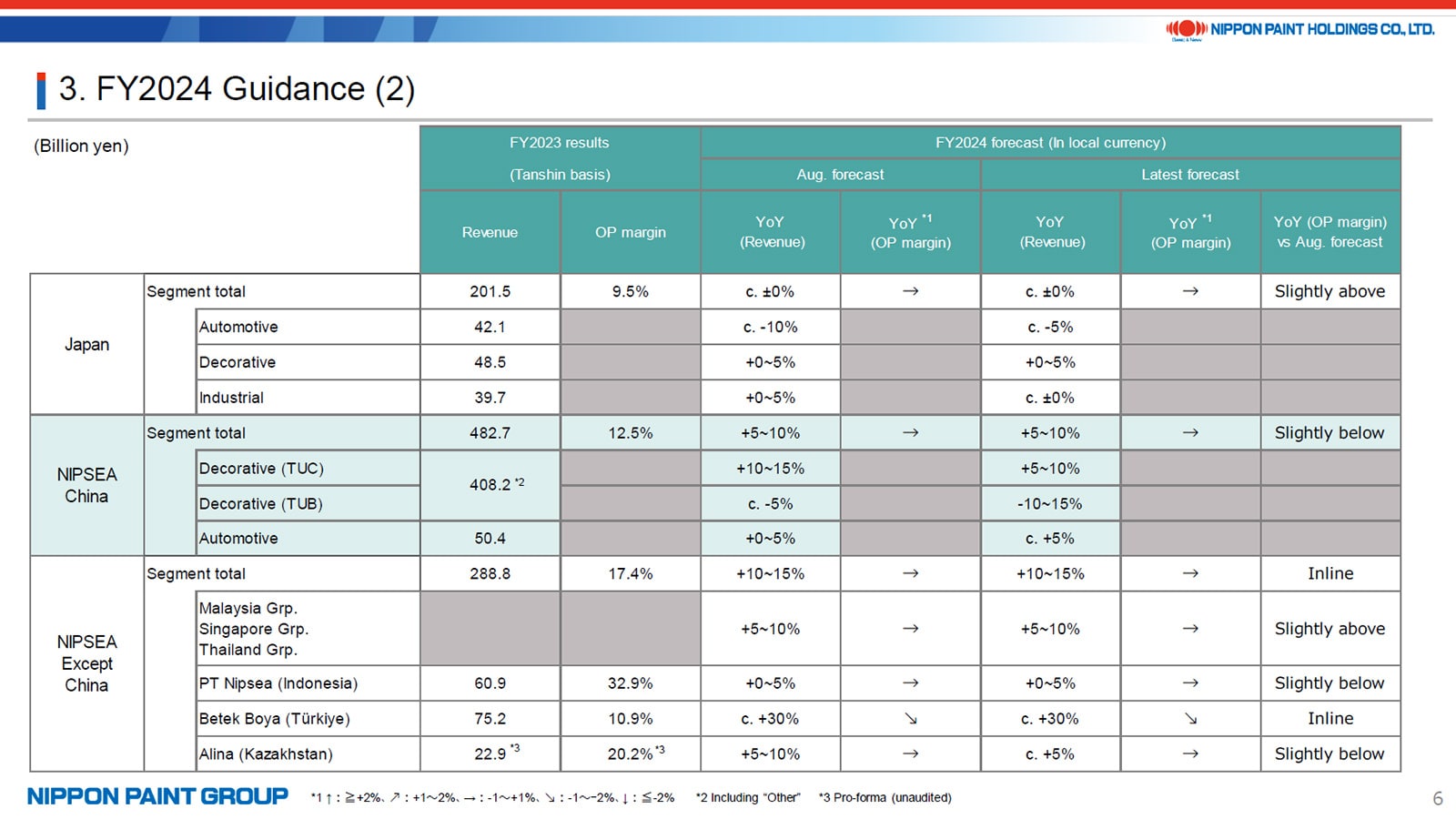

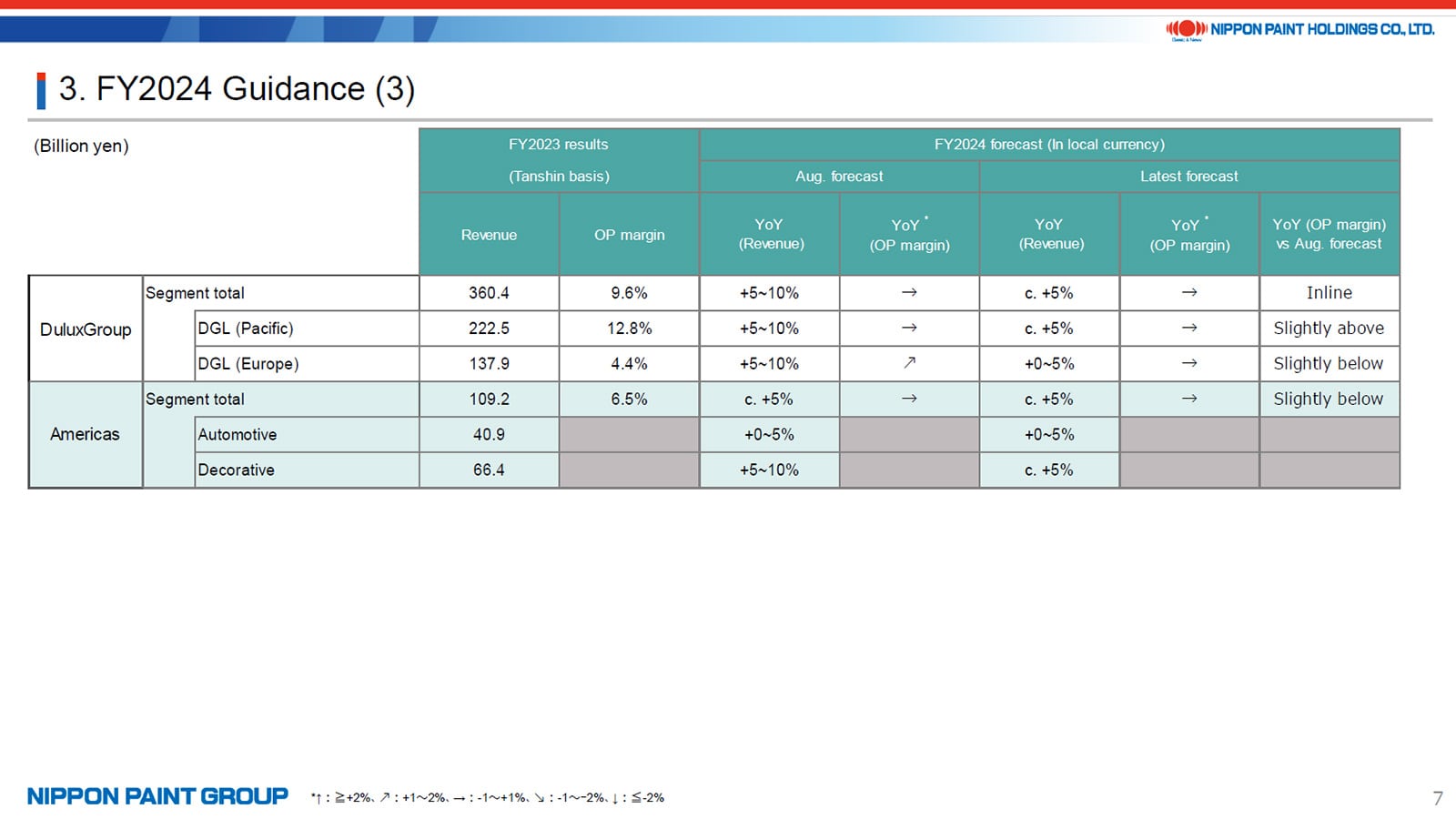

5. FY2024 Guidance (2) (3)

Pages 6 and 7 provide updates on revenue growth and margin trends for each business on a local currency basis, as outlined in our full-year forecast initially projected in August of this year.

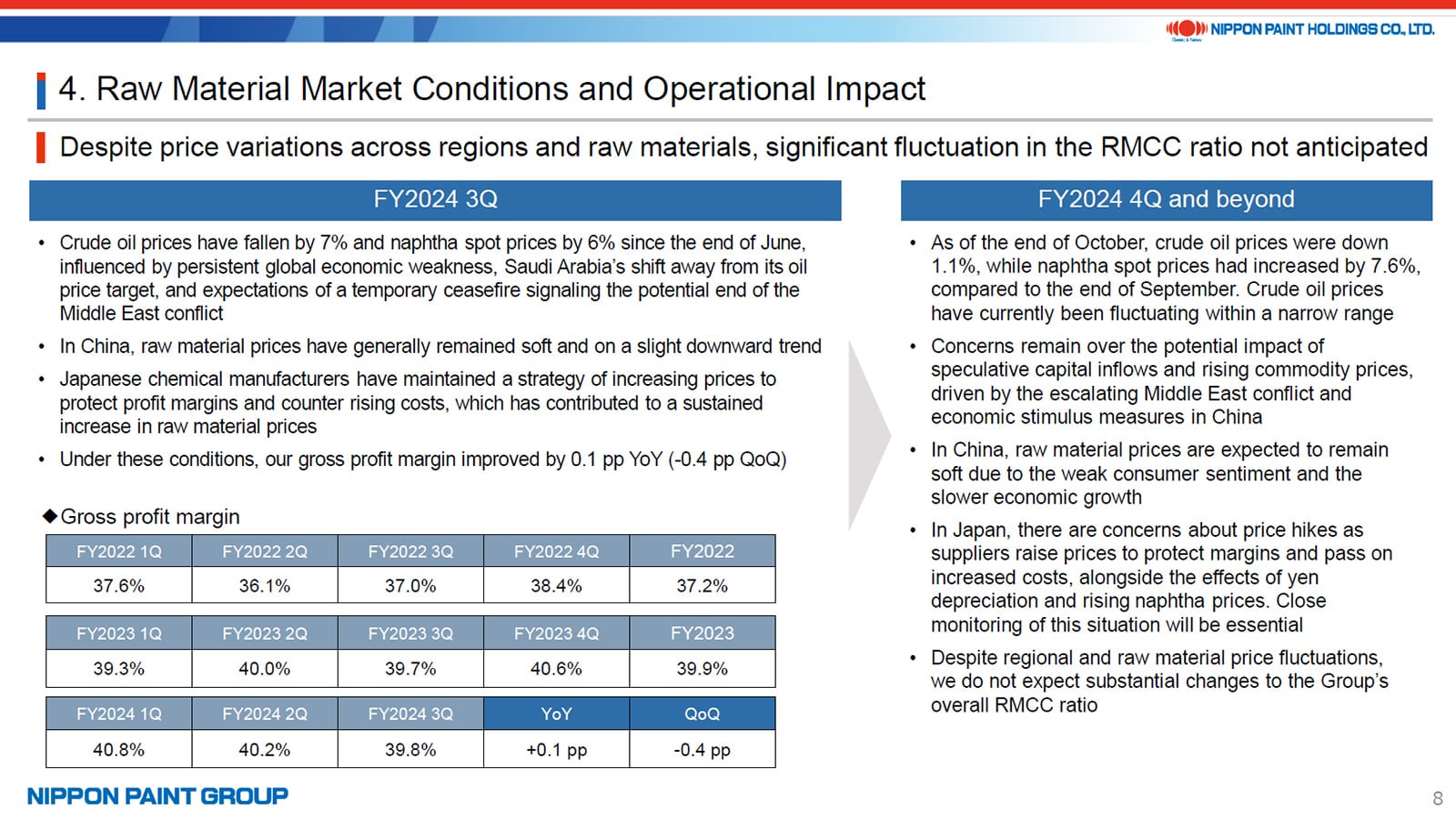

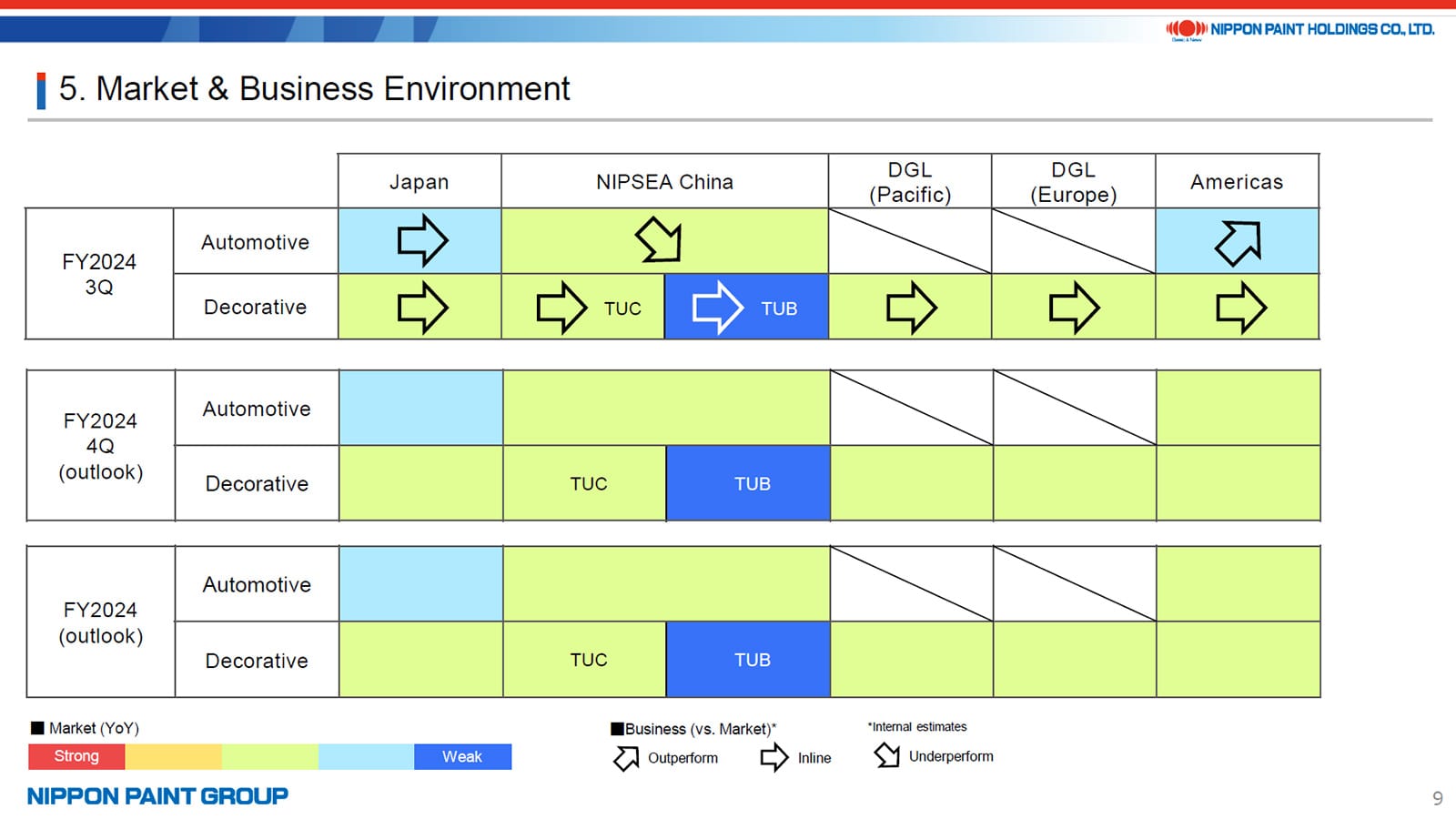

6. Raw Material Market Conditions and Operational Impact / Market & Business Environment

The overall raw material market conditions are expected to remain stable. For a comprehensive view of the market and business environment, please refer to the heat map.

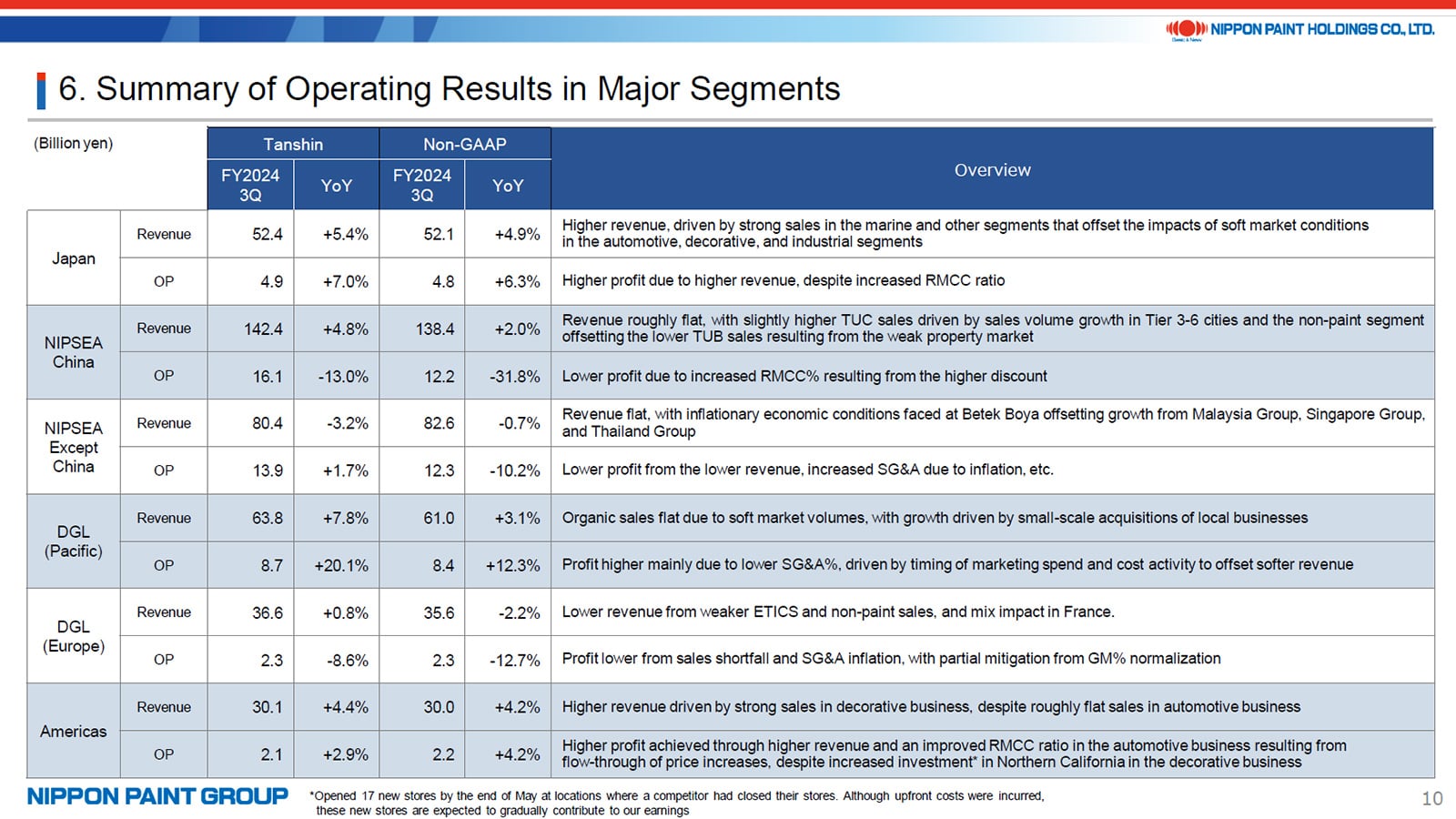

7. Summary of Operating Results in Major Segments

Regarding the summary of operating results for the major segments, I will elaborate on two key points, leaving other details for discussion during the Q&A session.

- NIPSEA Except China: Revenue and operating profit declined year-on-year, primarily due to persistent inflationary pressures and the impact of hyperinflationary accounting in Türkiye. Excluding Türkiye, NIPSEA Except China achieved revenue growth of approximately 5.4%. Notably, Indonesia saw a 7.9% increase in revenue, signaling positive signs of recovery.

- DuluxGroup: Both the Pacific and Europe segments continued to face challenging market conditions. However, the Pacific segment achieved a 3.1% increase in revenue and a 1 percentage point improvement in operating profit margin, driven primarily by contributions from small-scale acquisitions in the adjacencies area. In Europe, the difficult market environment was concentrated in France, resulting in a decline in revenue.

8. Major Topics (1)

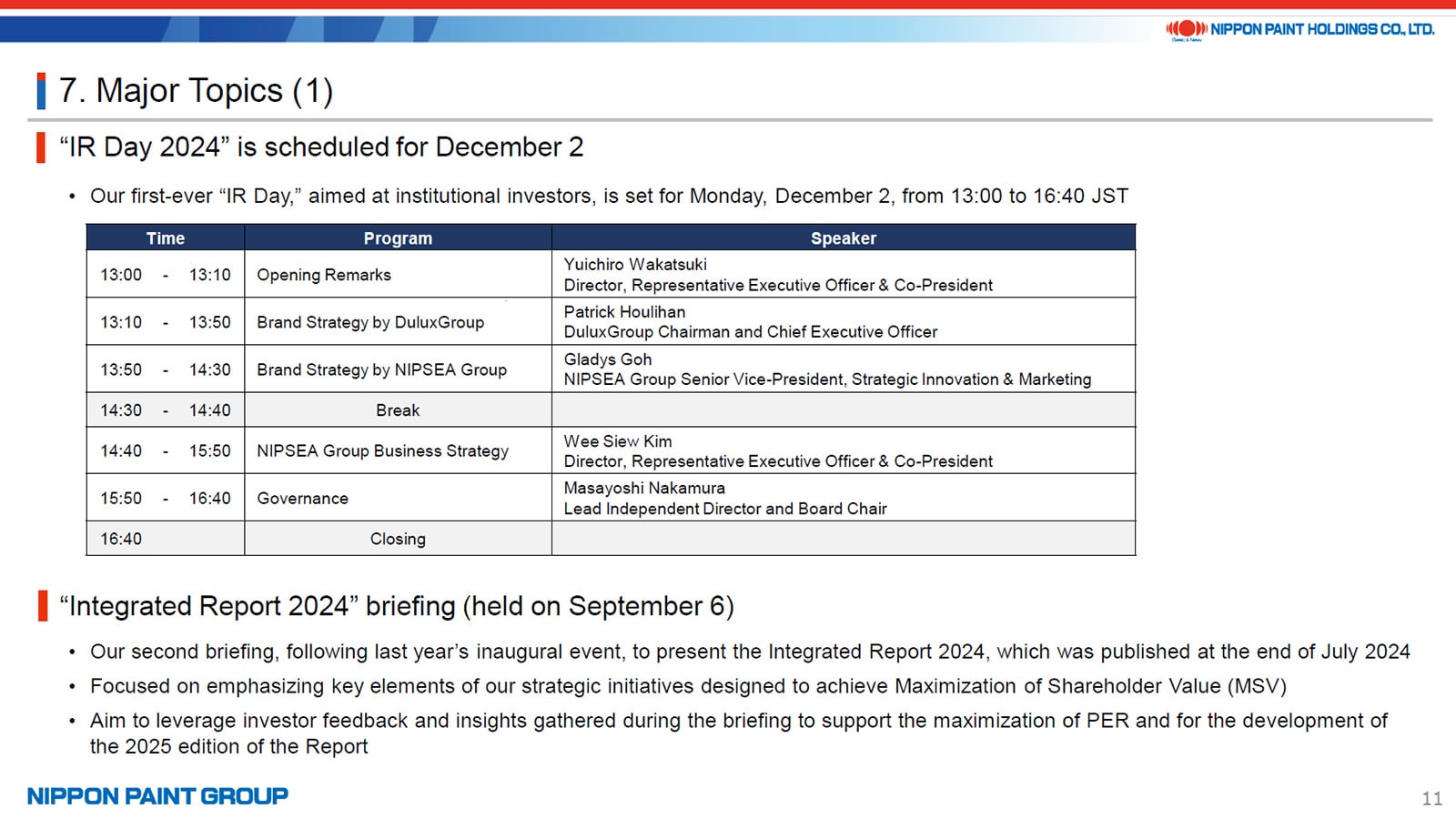

Let me move on to the key topics.

The first topic is our inaugural IR Day event, scheduled for Monday, December 2. This event aims to enhance the capital markets' understanding of our Group from multiple perspectives. Notably, we will introduce new programs focused on our brand strategy. DuluxGroup will present their brand strategies tailored to Western markets, while NIPSEA Group will highlight their brand strategies designed for Asian markets. Additionally, Co-President Wee Siew Kim will provide an overview of the overall business strategy for NIPSEA Group, and Lead Independent Director and Board Chair Masayoshi Nakamura will address governance issues.

The second topic is the Integrated Report briefing held on Friday, September 6. We received valuable feedback from investors both during and after the event, for which I am sincerely grateful. Moving forward, we will continue to focus on producing Integrated Reports that are both more readable and insightful.

9. Major Topics (2)

The third topic is the acquisition of AOC, announced on Monday, October 28. I will be happy to address any questions regarding this transaction during the Q&A session.

Thank you for your attention.