1. Front Cover

Good afternoon for those in Asia time zone and Greetings to our global investors. Thank you for taking your time to participate in our first IR Day event, this is Yuichiro Wakatsuki, Co-President of Nippon Paint. Let me give you a brief opening remarks for the day.

2. Objective of IR DAY 2024

Some investors have asked me why we are doing an IR Day event for the first time at this juncture.

Well, as a background, we have been holding an annual session by my partner Co-President Wee Siew Kim since 2021, who is also the CEO of NIPSEA, hence his focus is more on the NIPSEA business. As with the division of labor between the Co-Presidents, Wee Siew Kim is more in charge of operations and investor communication is my primary responsibility, so I would rather have him spend time to make money, than spending too much time with investors. That said, hopefully the annual sessions have been helpful to grasp the strength of our NIPSEA business and our operating philosophy. We would like to continue to provide investors with different perspectives.

We have also been conducting an annual session with our Lead Independent Director and Chairman of the Board Masayoshi Nakamura, with an aim to provide a perspective on our governance which indeed with a 58.7% owner, in of itself could be viewed with complexity. We hope these sessions have given comfort that our one and only mission MSV, Maximization of Shareholder Value, applies to both Wuthelam Group and to minority shareholders, and that our Independent Directors, who hold the majority of the board-ship, are there to make sure that is the case. Coupled with our disclosure in past Integrated Reports, I believe there is less concern about our governance model these days.

In a very unfortunate situation whereby our stock price has become cheaper compared to our growth potential, the good news is that we are getting more and more inquiries from new investors who would want to understand more about us. So we thought it may be a good time to provide some comprehensive view of our existing portfolio.

As have been provided in Pages 27 and onwards in our Integrated Report, we believe there are some perception gaps between our fundamentals vs capital markets. So the objective, simply put, is to fill such gap.

I have stated many times that one of our core strengths lies in our brand, especially in our decorative business, which consists 63% of our global business. Unfortunately, many investors and brokerage firms categorize us in the Chemicals sector, which in general is highly cyclical. I believe our business portfolio is far less cyclical, and by understanding the strength of our brands coupled with resilient demand, hopefully people will get it.

China business. Two years ago, about 85 to 90% of investor questions were related to China despite the business being only one-third of our portfolio. These days, the ratio has come down quite significantly with the stabilization of our business, reduced risk related to provisioning etc. The ratio of China would be diluted post closing of our AOC acquisition, but it does not mean that we lose focus on the significant growth potential in China. Let us try to address where we are and where we are heading to.

As stated, less and less concern related to our governance – as a matter of fact, I personally believe we have one of the best-in-class Board with active and diverse discussions, all well versed into our MSV mission. It may still help to review our journey once a year for those who have and have not known us during the period.

Today, we are yet in a position to provide you with the other side of the Asset Assembler equation which is M&A. I believe our AOC acquisition provides you with our low risk, good asset type of targets – but let us not go into that. Hopefully by the end of today’s event, our stable, solid and resilient base of our existing portfolio is to be well understood and helps you establish a positive view towards our stock.

3. Contents for Today

So with all that, contents for today address exactly what I just referred to.

First we wanted to provide you with two of our key partner companies whose brand strategies have born fruit in many ways. We wanted to have two different perspectives, one from our DuluxGroup CEO Patrick Houlihan, whose Australian market represents a western model, with similarities to US, and Europe markets. The other from NIPSEA Group, whose Asian market including Türkiye is more a distributor model. Gladys Goh, who is our brand chief and also doubles hats as our Marine business Chief, will be presenting.

Then we will have Wee Siew Kim, who will talk about our NIPSEA business overall, with focus not only on China but also another strong growth pillar under our Malaysia Group. Hopefully throughout these sessions you will get a sense as to the power of what we call a United Nations of Excellent Companies.

Finally we have Lead Independent Director and Board Chair Nakamura discuss about our governance, provide his perspective on our governance journey and bring to life how our Board of Directors efficiently balances risk taking and soundness.

Thank you again for listening in to our session today. I will be attending throughout the sessions and hope can facilitate some active dialogues for your better understanding.

4. BRAND STRATEGY

With that I will end my opening remarks. I would now like to provide a brief preface to our next two speakers, Patrick Houlihan and Gladys Goh related to our brand strategy.

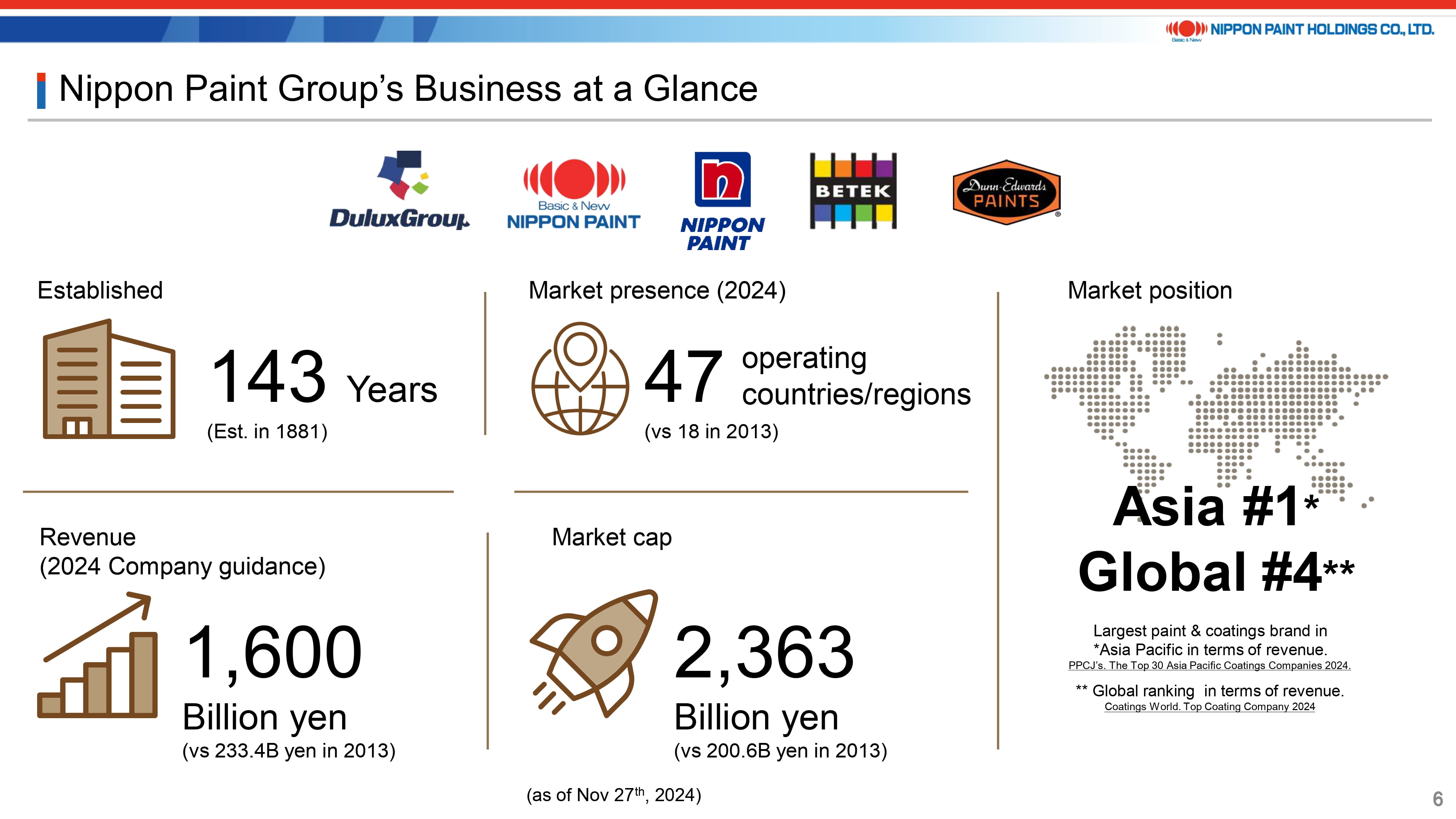

5. Nippon Paint Group’s Business at a Glance

This is Nippon Paint at a glance.

We are a 143-year-old company, originally a very Japan Traditional Corporation, JTC, but with significant growth over the past 10 years or so, be it revenue, market cap, geographic regions. We are No.1 in Asia, No. 4 Globally, but just to put in context, size is not our focus, it is about value creation.

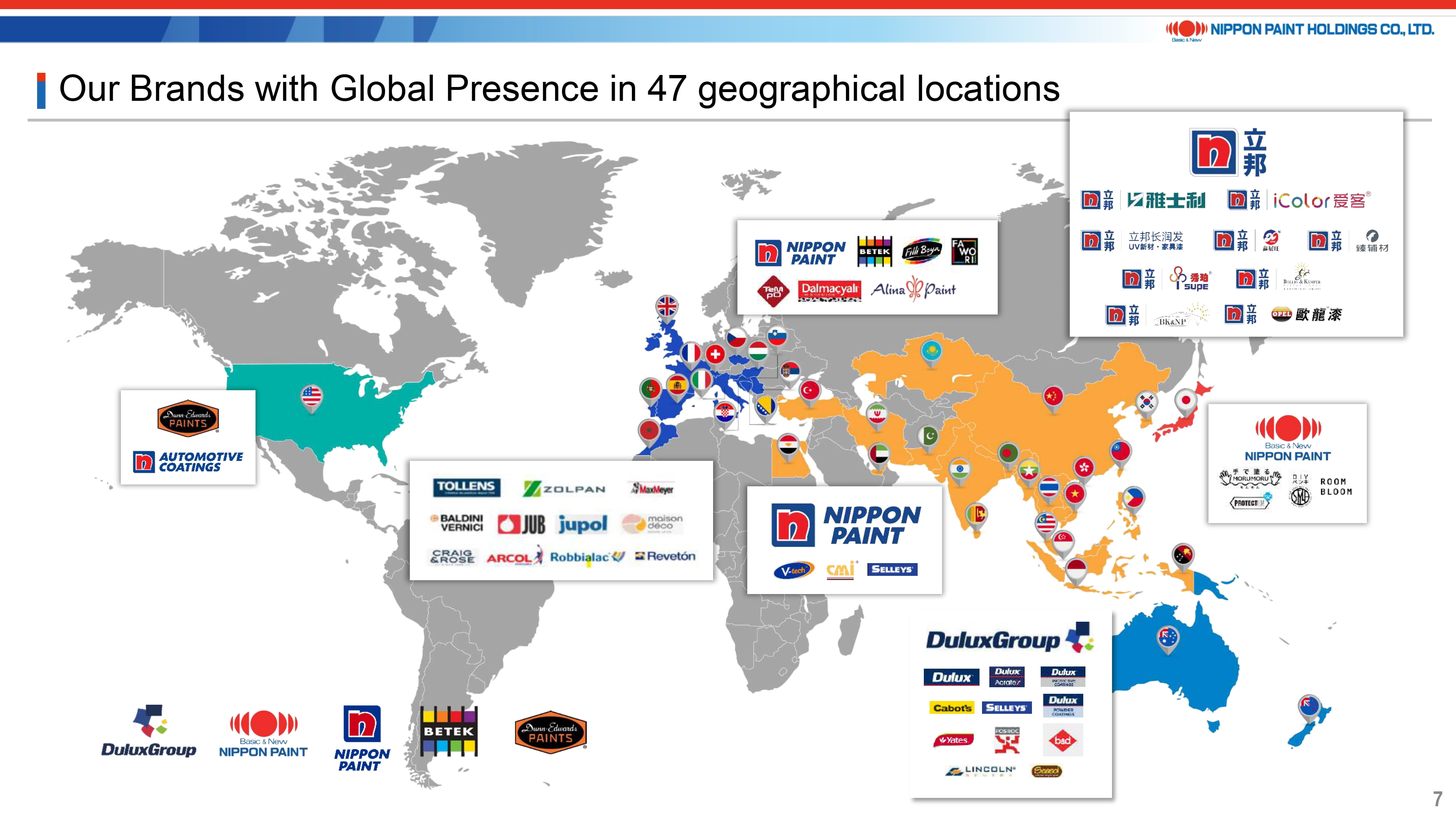

6. Our Brands with Global Presence in 47 geographical locations

We are present in 47 geographical locations – very global but also note it is not Nippon Paint all over.

We manage diverse brands across different regions and partner companies. Brands are locally harnessed but if we consider the scale across the globe, there are many things we can leverage.

7. Zooming into the 2 Powerhouses

The two partner companies actually represents a significant portion of our global business – close to 80% of our 2023 consolidated revenue. So repeating what I mentioned earlier, hopefully you will get a better sense of our solid growth platform with the upcoming presentation.

Thank you for your attention.