1. Introduction

Good afternoon everyone. It’s a pleasure to be here with you.

I’ve been with DuluxGroup for 36 years, initially joining as a chemist in our R&D team back when we were owned by ICI plc from the UK. I led that team for the first 9 years, then for my second 9 years, I was in our Dulux sales team. I was the Dulux Marketing Director, and I also worked in our adjacencies business of Selleys SAF (Sealants, Adhesives & Fillers) and Yates garden products as the General Manager. And then 18 years ago, I became the CEO of DuluxGroup, and during that time I had 9 years leading the company as a listed company on the ASX (Australian Securities Exchange), and we’ve now had just over five years being part of Nippon Paint Group.

I’ve titled the presentation today, “Brand Strategy for Profitable Growth.” The reason I’ve done that is that in my 36 years, I’ve seen us transform many of our businesses to be now profitable market leaders. In fact, when I think back to joining the company in 1989, just prior to that, our Dulux decorative paints business, our largest business, was making no profit at all, and here it is today with 50 percent volume market share and very strong operating margins reflecting the power of our strategy across those nearly four decades.

I’ll bring this to life for you, but I’ll also talk to you about how we’ve consistently done this across many of our businesses, where they now have double-digit operating profit margins and they all have leading market shares.

Before I move to the content of the presentation, I just wanted to speak to this front cover because it epitomizes how we think of DuluxGroup in that, first and foremost, we think of ourselves as a marketing brand and consumer- and customer- led company.

It’s not to say that we don’t see ourselves in manufacturing, of course we manufacture, but most companies we meet around the world think of themselves firstly as a manufacturing company. In the paint industry, we’re the opposite and we summarize our core purpose that binds our businesses together with these words, “Imagine a Better Place,” around DuluxGroup being a leading marketer and manufacturer of premium branded products that enhance, protect, and maintain the places and spaces in which we live and work. I think that distinction as a marketing, brand-led company is quite unique versus some of the many peers we have.

2. DuluxGroup Pacific context

Today I’m going to focus my presentation around the DuluxGroup Pacific business given it’s the one that reflects outcomes over the recent decades.

3. Strong performance as an ASX listed company – Top 10% TSR

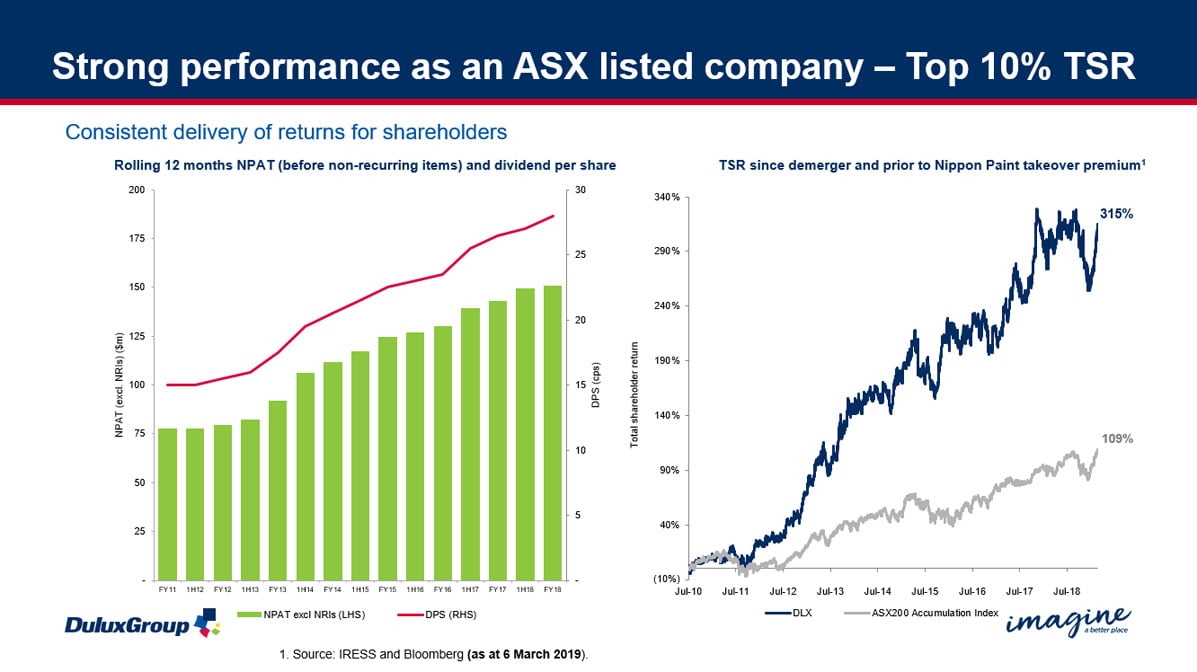

There’s a little bit of context. I mentioned for 9 years we were listed on the ASX. If you look at this page, it summarizes our underlying net profit after tax every 6 months (refer the green bars), which was our reporting period, for the 9 years. We grew profit consistently half in, half out, no matter what economic, competitive and other changes were presented to us. During that time, you’ll see the red line go up. The red line was our dividend per share, which also consistently increased for our shareholders.

On the right-hand side of the page, this manifested itself in terms of total shareholder return during that period where we outperformed the ASX top 200 company average by more than three times. And this does not include the takeover premium that Nippon Paint offered our shareholders. If that was included, our total shareholder return was nearly 450 percent over that period. But the main reason for sharing this is ultimately by doing the right things, being branded, marketing led, driving innovation, focusing on our consumers and customers, we consistently have been able to deliver the right outcome for our shareholders.

4. Dulux – consistent long-term growth above market

And the largest business that underpinned this was our Dulux paint and coatings business.

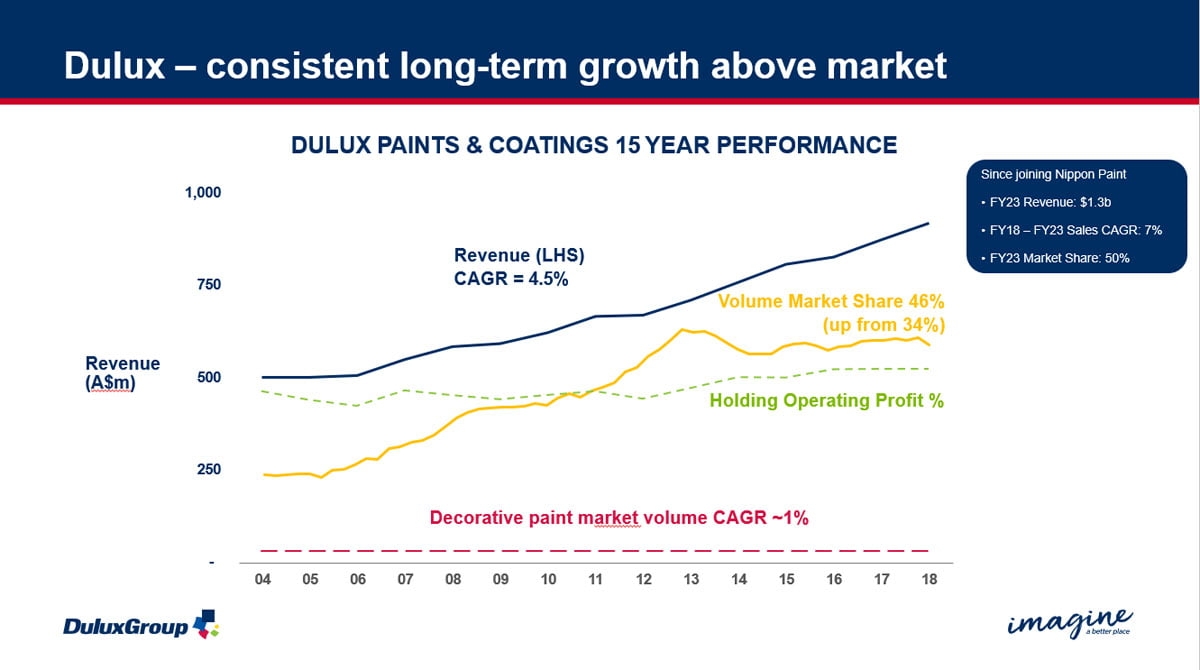

What I’ve done here is just showing you the 15 years leading up to the point where we were no longer listed from 2004 to 2018 inclusive.

If you look at this, we were able to deliver revenue with a compound annual growth rate of just under five percent, and that’s shown on the blue line. If I could then draw your attention to the red line at the bottom, the largest part of our paint and coatings business is in the decorative paints market. It makes up over 60 percent or nearly two-thirds of our paint and coatings overall business. The market grew during that time in volume terms at a compound annual growth rate of about one percent. In fact, it was slightly less than that.

What we’ve been able to do is, despite operating in a relatively low growth mature market that grows at sort of half the rate of Australian GDP, we’ve been able to deliver that blue line revenue outperformance. Importantly, if you look at the green dotted line, we did it while we held our operating profit percentage, which is actually in the mid-teens.

Our consistent profitable growth delivered by the business - one of the key drivers of that was the yellow line, which is actually our volume market share in decorative paints. Over the years from 2004 to 2018, we took that from 34 percent to 46 percent. By getting a small bit of market contribution, by getting to step up in our decorative volume market share, by driving innovation and being able to get some influence on price through the mix and actually the premiumness of our products, and then complementing that with some small adjacency efforts within Dulux paint and coatings over that time, we delivered the market outperformance. If I draw your attention to the little blue box on the top right of the page, these are the numbers for the end of 2023.

Without sort of going into that detail, we’re being able to continue that growth. In fact, if anything, we’ve marginally accelerated that under the ownership of Nippon Paint Group and the partner company model.

5. Consistent investment in long term fundamentals

Whether it’s been during my time being owned by ICI plc, whether we were owned by Orica on the ASX, which was the former ICI Australia, then during the nine years from 2010 to just halfway through 2019 when we were listed, and now the five years we’ve been part of Nippon Paint Group, these long-term fundamentals are exactly the same.

We drive our business through consistent focus on consumer insight and brand marketing communication, which I’ll elaborate on. We then support that through a strong R&D technology and innovation pipeline. In fact, when we were part of ICI plc worldwide, Dulux R&D laboratories in Melbourne were one of the three global R&D centers, with the others being in London and Cleveland in the United States. Interestingly, if you look at point three and point four, we’re not only strong in retail channels where we go to market to Do-It-Yourself consumers through other resale specialists.

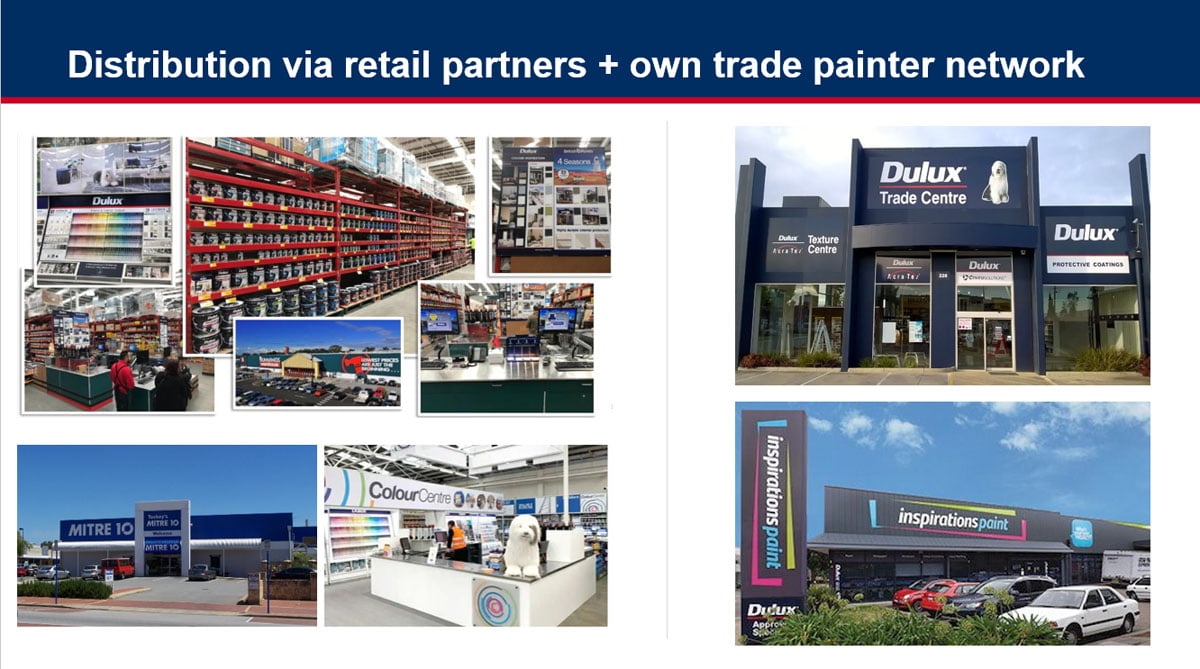

Bunnings, the number one retailer in Australia in terms of big box retailing, and also independent hardware players like Mitre 10 shown at the bottom, but in addition, we go direct to trade painters through our own trade distribution of our own store network and, where it’s not economically sensible to put our own store in the ground, we have a trade agency partnership with a group called Inspirations, which these days we are the franchisor for.

We’re somewhat unique compared to many paint companies in the world where they might be strong at retail paint to do-it-yourself whereas others are strong at trade, own store distribution primarily to trade painters. We’re essentially 50-50 in each of those. And then finally, we complement that with excellence in supply chain in terms of in-full and on-time responsiveness and all the other elements that go around the quality, production and delivery of our products.

6. Dulux brand strength

Let me now just quickly bring to life our brand strength and how that sits behind the fundamentals in that excellent shareholder performance over the period.

7. Consumers love their homes – paint protects and beautifies

Firstly, I just want us to start with the mindset around the consumer because without the consumer there’s no consumption, there’s no business.

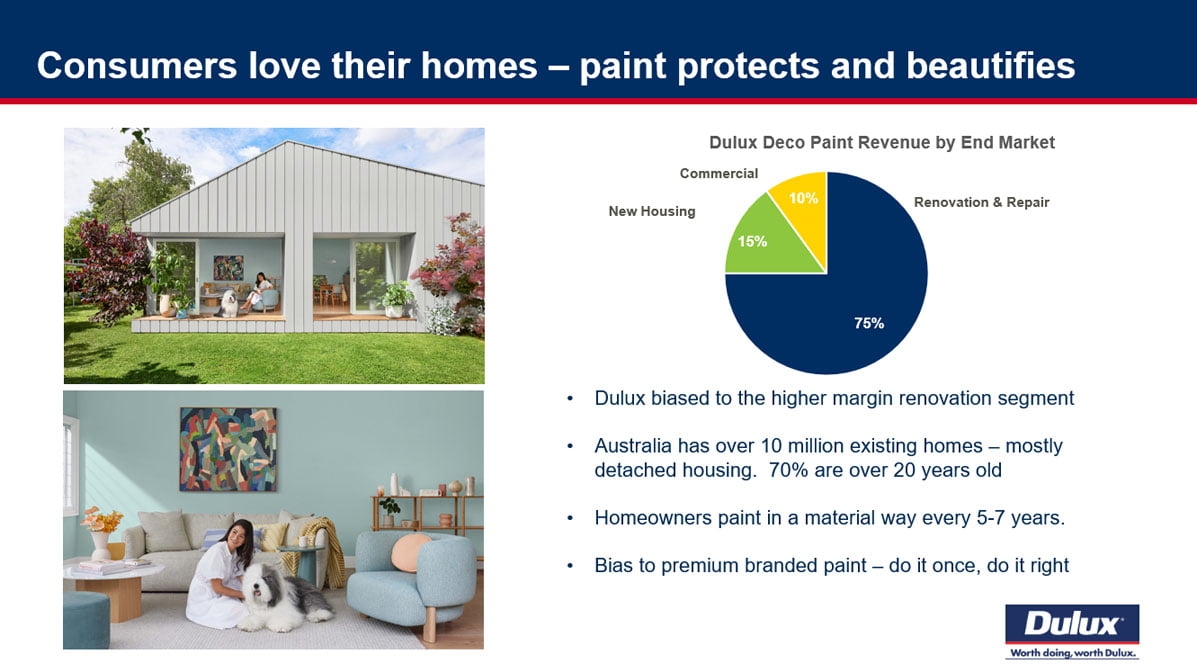

In Australia there are about 10 million existing residential homes of which 70 percent are more than 20 years old. Now in terms of people’s homes, there’s a great love of the home. Whilst for many people this is their greatest financial asset, it’s also psychologically an extension of themselves. I’m sure whatever part of the world you’re in, many of you, in Japan but others elsewhere, people’s connection to their home around self-esteem is really strong. There is a saying, certainly in many countries around, ‘my home is my castle’ and that’s the mindset that prevails in Australia and New Zealand and certainly in the other Western markets I deal with within DuluxGroup. Furthermore, you’ve also got the reality that people paint in a material way about once every five to seven years. So, it’s a relatively infrequent task.

In some ways if you think in marketing, you can have fast-moving consumer goods, we’re slow-moving consumer goods. But the reason why that’s important is because in Australia when people paint their own homes, probably on two-thirds of occasions, they’ll do it themselves, but on the other one-third like painting the exterior or doing a larger, more complicated job, they’ll pay a trade painter to do the job. There’s a real propensity to do it once and do it right. That’s because first of all, it costs you a lot of time if you do it yourself and it costs you a lot of money if you get a trade painter. And then beyond those functional dimensions, people ultimately want it to look good because it’s an extension of them. This is why we then take that knowledge and we then disproportionately focus our efforts around the renovation and repair of existing homes.

This little pie chart shows you 75 percent of our Dulux decorative paints revenue comes from that segment, whereas we’re still present in residential, new-built housing but we’ve only got 15 percent exposure there and the market’s probably more like 20 to 25 percent.

So, we’re deliberately underweight in that because it tends to be lower-margin business.

We focus our efforts on the more premium-valued renovation segment, where we take a view if it’s important to you and it’s worth doing, it’s worth Dulux. And that leads to the famous tagline, “Worth doing, worth Dulux.” This really is the mindset that underpins the nature of our consumer market.

8. Dulux is consistently Australia’s most trusted paint brand

If I think about the Dulux brand itself, we’re consistently investing in our brands.

In fact, we invest in them at a level in line with our revenue growth.

You heard me mention earlier we’ve tended to grow revenue historically about 5 percent per annum. We’ve accelerated that a bit more during our five years we’ve been part of Nippon Paint Group. That means our marketing investment is going up at that rate, higher than inflation which is generally how we manage the rest of our fixed cost base. As a result of this sort of disproportionate investment, we’ve now got to the position where Dulux is consistently voted as the most trusted paint brand in Australia.

If I could draw your attention to the right-hand side of the page, even this year we were voted as the 5th most trusted brand in Australia across any category, banks, airlines, cars, household groceries, etc. There’s a really iconic position built over decades.

9. Dulux has twice the brand strength of competitors

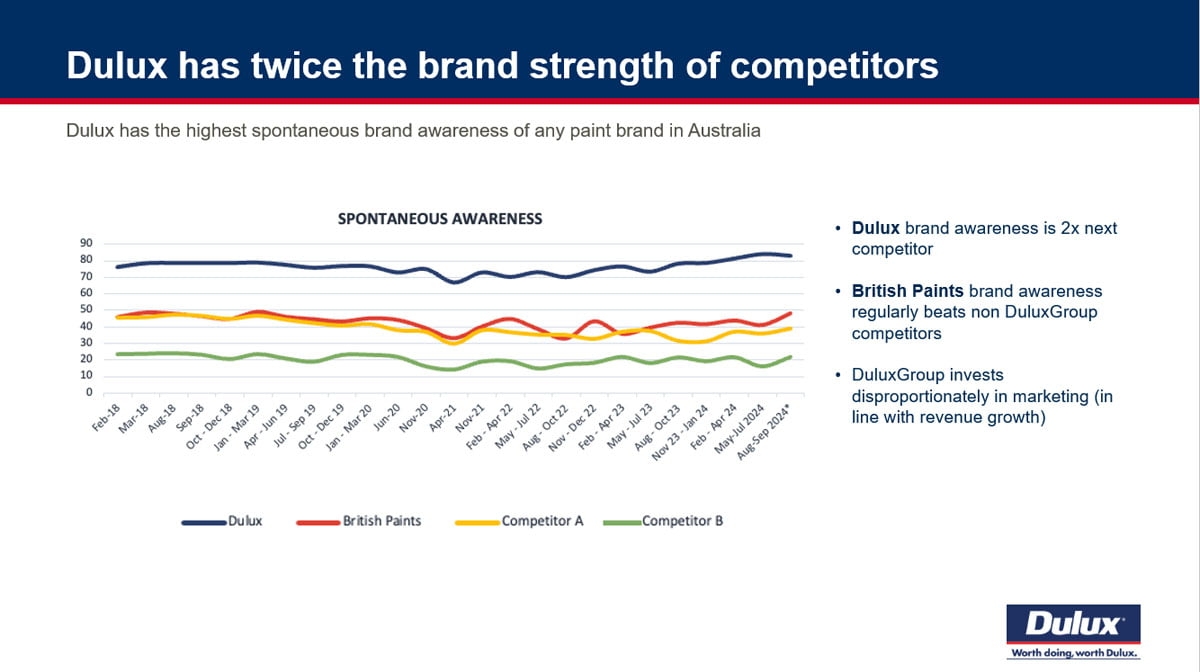

In terms of what this means relative to our competitors I’m just showing you here the spontaneous brand awareness from 2018 through to today. This simply is measured by asking a consumer to name a brand of paint, so it’s not even leading them with any brands. Over 80 percent of consumers will say Dulux which is the blue line, and it is more than double our two main competitors which are the yellow line and the green line. That’s point number one.

Point number two. British Paints, which is also our brand, and think of it as our second brand - in fact, we give it exclusively to Bunnings, our big-box retail partner - British Paints has spontaneous brand awareness as strong, if not slightly stronger than our largest competitor.

And again, a lot of this brand strength gets back to that disproportionate investment.

10. Distribution via retail partners + own trade painter network

As I mentioned earlier, we then bring that to life through the strength of our retail partners like Bunnings and Mitre10 for Do-It-Yourself and then through our own trade networks where we have the relationship with the painter and we set the pricing and manage everything directly per those images above of the Dulux trade center and Inspirations.

11. Dulux brands – Do-It-Yourself consumer offer (by price point)

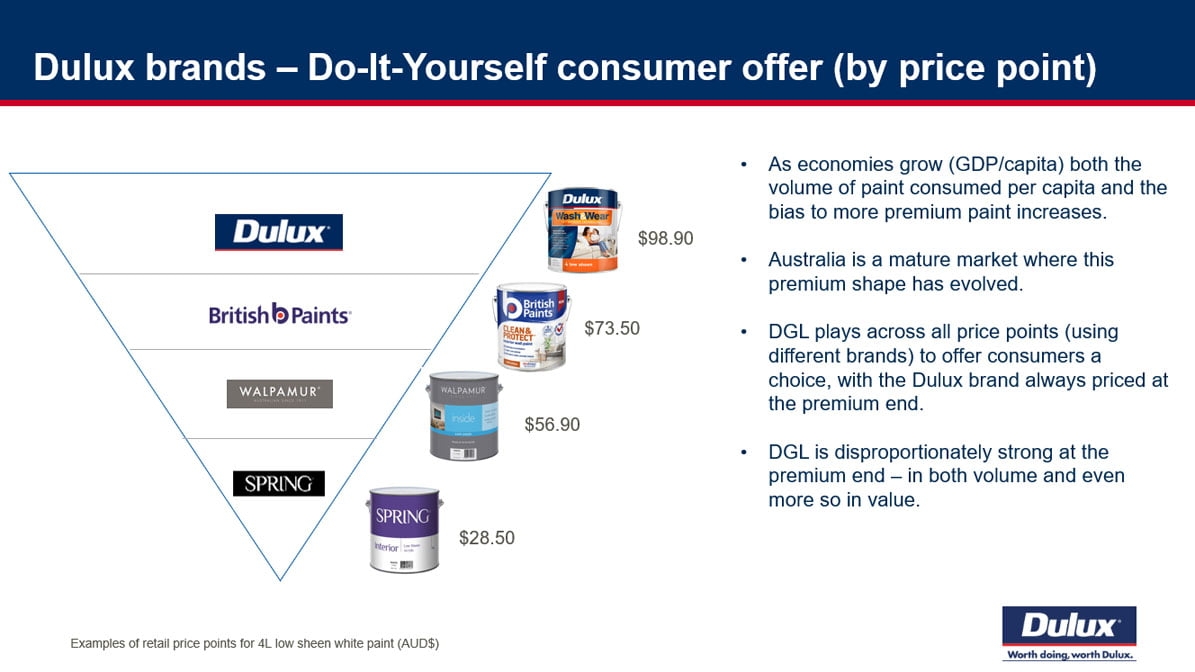

To try and bring to life, how does that manifest itself in terms of consumption. This first page is then about the Do-It-Yourself consumer that goes to a retail store like Bunnings, a big box warehouse store, and actually what they consume.

Now the paint category itself is fascinating because the volume of it is disproportionately shaped like an inverted pyramid. I just made the bullet point on the top right for your notes that we know from the decades when we were part of ICI paints worldwide. As any economy in the world grows, its GDP per capita grows and as the GDP per capita grows, the volume of paint consumed per capita increases and the bias to more premium paint increases. So, you actually go from being a normal pyramid to an inverted pyramid. It’s happened in every country over time.

Here, we come to the mature market of Australia where we the DuluxGroup company and the Dulux paint division, we offer products at each price point. You can see, for examples, here with the Dulux brand, our British Paints brand, our Walpamur brand and the cheapest, our Spring brand. But whilst consumers have a choice with all of that, over 65 percent of the volume we sell in decorative paints is in the Dulux brand, which is only sold at the top, premium, end. And because it’s disproportionately greater on selling price, it’s over 75 percent of the value of the paint we sell.

Ultimately this is what drives the economics of the overall business model. But it’s important to link this page back to the one where I just spoke to you about the psychology of consumers that love their homes; do at once, do it right; it’s an infrequent task.

This is why the characteristics of a premium branded market are really strong, and for a sort of a simplistic analogy, think about people buying cosmetics. Why do they spend what they spend? It’s about making themselves look good, feeling good. This is just like cosmetics for the home if you want to think of it in terms of that sort of simplistic analogy.

12. Dulux brands – Do-It-For-Me Trade Painter offer (by price point)

If I turn our attention to the trade paint side of the business, you can see we do the same.

Again, we offer trade painters choice at all levels but disproportionately they buy Dulux for the confidence in the products and then they represent those products to their end consumer, the homeowner. It follows the same logic.

13. Brand execution / Dulux – broad and dynamic marketing agenda

These are some examples of brand execution. We’re really strong in color leadership, engagement with consumers and our distinctive brand communications.

14. Dulux – growing the market through new categories

Beyond the main decorative products, where we’ve got the normal substrates like plaster board and so on, we actually create brand new categories.

This is an idea we took actually from Europe. We saw in France, where instead of someone being confronted to build a whole new kitchen, we came up with products that could be used on laminated surfaces that traditional paint products wouldn’t work on. And now, if you look at the image on the left, you get a before and after example of how paint can be a much more simple and cheaper option for the consumer looking at driving this sort of change.

15. Dulux – growing the market through ‘super premium’

We’ve also created a super-premium category where beyond Dulux Wash & Wear, which is at the top of that inverted pyramid selling for just under 100 AUD for a four liter can of paint, this sells for 150 dollars. So, it’s more of a niche product that we positioned around for the most beautiful room in your home. These are some of the different ways we’ve extended the marketing capability.

16. Dulux – ‘Help & Advice’ whenever consumers need it

Beyond the product, we also are innovative in terms of the service.

What we’ve been able to do with our help and advice team you can now take your iPhone and you can go online for a live chat with a color consultant where they will then prescribe what colors would work for your home.

We can send out samples to give the consumer confidence and then in a sense a bit like a doctor, we can give them the prescription of what they should buy and they can go to our retail partner like Bunnings or Mitre10 or Inspirations to actually get the paint to do the job.

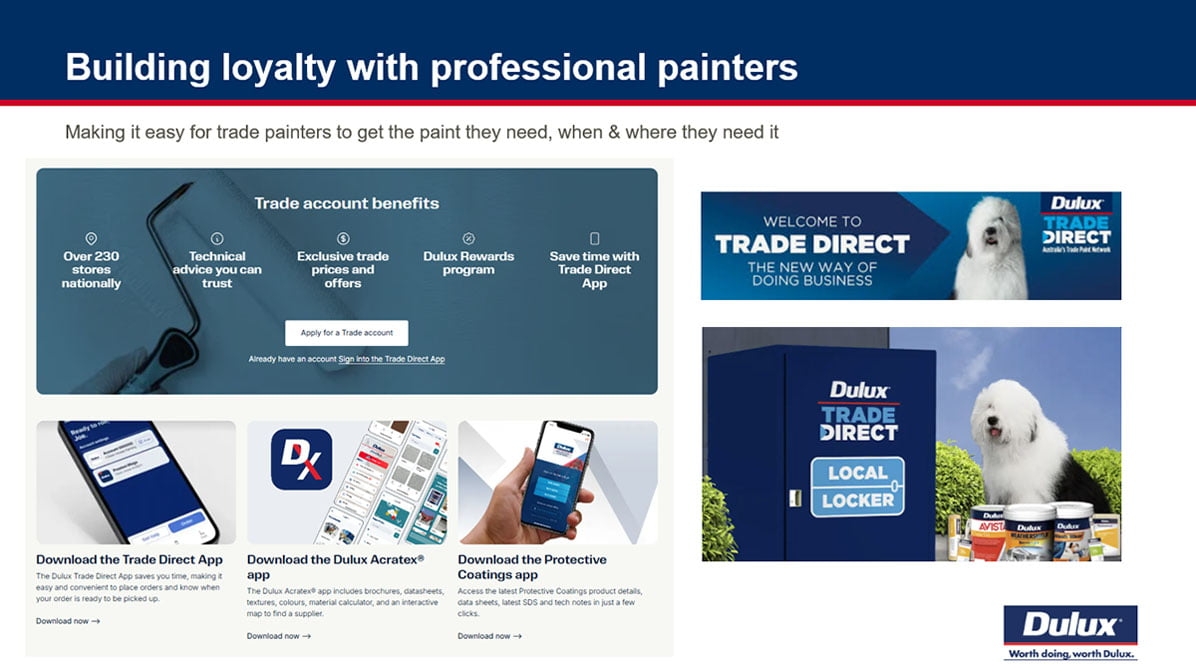

17. Building loyalty with professional painters

We also have taken digital in a whole another dimension into new leagues for our trade painter customers. We have a simple view for our 30,000 trade painters they can buy anything, anytime, anywhere. The digital applications we’ve created for both decorative paints and our other specialty coatings are part of this.

18. Leveraging our brand with the best painters in market

We then marry the two together.

In some cases, the consumer, as I mentioned earlier, doesn’t want to do the job themselves for a particular nature of the task at hand. We get our best Dulux accredited painters who actually are engaged with us. They pay us a fee which we reinvest in the program. As you can see from this image, they’re branded Dulux and we marry together the consumer with the accredited painter to make sure a quality job gets done.

19. Emotive brand connection through community engagement

We also do a lot of work in the brand front in the broader community. And this image is a great example of something that started 15 years ago where we took our leading exterior product, Dulux WeatherShield, and we thought how can we marry this up with something to do with the community?

And in Australia these are a huge part of the fabric of our community, there’s what we call our surf lifesaving clubs that are positioned on every beach around our extensive ocean.

The surf lifesavers are predominantly volunteers that are there to stop people, mainly kids but sometimes adults, drowning.

We painted every surf lifesaving club in Australia for free, and we did that with our own staff with the Bunning’s team members, Mitre10, other different people that are in our customer groups across that journey.

We’re really ultimately protecting those that protect us and then we use this in television advertisements and a whole lot of other things that we do.

20. Long term investment in Australia’s #1 interior paint brand

Just finally on Dulux, we have just literally in the last couple of months done our largest launch in over a decade on our leading Dulux Wash & Wear products.

On the left we’ve got the Dulux Wash & Wear, where our main products at the different gloss levels that you can buy, and we’ve used the tag line “the Best Just Got Better.”

And then on the right, where we found we had the technology to deliver some other features and benefits.

We’ve actually launched some more specialist products that sell at a higher retail price to give consumers the option where they might want that extra degree of innovation and they’re willing to pay for it.

21. Extending marketing and brand capability into Europe

Just finally on decorative paints we’ve obviously in recent times extended into Europe, so we’ve now got a very strong brand portfolio and distribution.

In Europe, it’s obviously a challenging economic period, particularly in some markets like France. But we are very confident in terms of our strategies, our capabilities, and we are undertaking a transfer of the capabilities we discussed through that decades-long journey in Australia and we’re marrying that into the western markets of Europe.

22. Beyond Dulux decorative paint – adjacent categories

I’ll just give you a little flavor that beyond decorative paints, how have we driven the same approach and we’ve bought many businesses and as I said earlier, all of these now are actually double-digit operating profit returns and nearly all of them have the number one market share.

23. Cabot’s woodcare – ‘Bringing the beauty of timber to life’

Firstly in 1993, we acquired the Cabot’s wood care business. We probably had 10 percent market share. We’re now the clear market leader and we’ve got a powerful wood care range across three key brands, Cabot’s, Intergrain and Feast Watson.

24. Dulux Protective Coatings – ‘Protection you can count on’

In Dulux protective coatings, where we’ve got the brand position “Protection you can count on.”

We’re doing everything from the Sydney Harbor Bridge to big LNG projects, infrastructure projects, etc.

We again started with more of a smaller position here, and we’re now in a very strong position here against many other competitors who are globally specified.

25. Selleys Sealants, Adhesives & Fillers – ‘If It’s Selleys It Works’

In 1988, we acquired the Selleys Sealants, Adhesives & Fillers business, and in fact I was the sales director there in 2003 and we were making low-single-digit operating margins.

Now we make double-digit operating margins, leading share, and the whole premise with these sort of jobs on sealants and adhesives is brought to life through the tag line: “IF IT’S SELLEYS IT WORKS.”

26. Yates Gardencare – ‘Live the Joy of the Garden’

In 2003, we stepped out of sort of the paint and related product space and we bought a garden care business. In fact, it was over 100 years old and we were the 6th owner in 25 years, and it had been largely run into the ground. It was making a minus five percent operating margin.

Now it makes double-digit operating margin. It’s the clear market leader and it brings itself to life through this image you can see here about helping the end homeowner ‘live the joy of the garden’ whether they do it themselves or have a gardener come and do it for them.

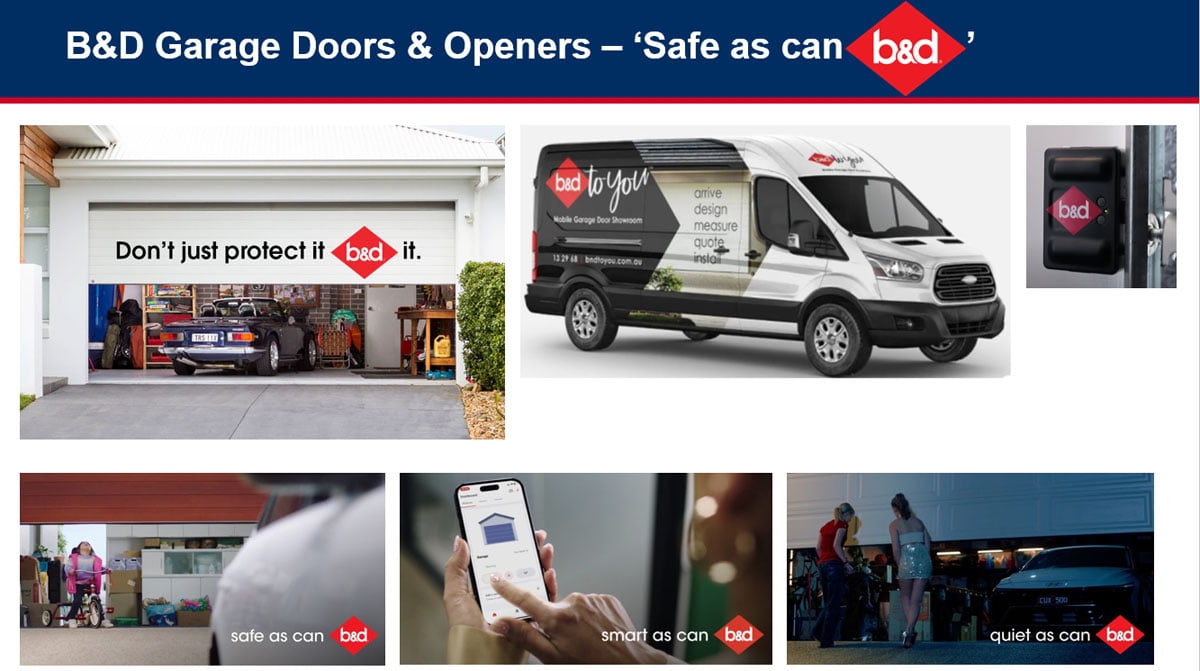

27. B&D Garage Doors & Openers – ‘Safe as can B&D’

Finally, we acquired in 2013 the B&D garage door business.

Now this one’s fascinating, I’ll be brief given the time, but here we have not a consumer chemical business but a metal fabrication and engineering business. We put the Dulux marketing team experts in there, and they came up with the insight when people shut their garage door by pushing the remote, the transmitter, it’s shut but it’s not locked. People thought it was locked. So, we then push the position “Safe as can B&D,” “Don’t just protect it B&D it.”

We have a whole lot of new innovations that come from that. And if you just look across the bottom, you can convey through the power of marketing “safe as can B&D,” “smart as can B&D” through what you do with your iPhone in opening and shutting your door and “Quiet as can B&D.”

28. Marketing capability strategy reaches all ~250 marketers

My final page before I throw it open to questions was just to then say across all of DuluxGroup, we have about 250 marketers, and about 10 years ago I was fortunate enough to meet Ian Rowden, who works for us as our Chief Marketing Officer. Ian ultimately went on to be the Worldwide Lead for Coca Cola in Atlanta for brand marketing leadership, and he also worked for Richard Branson for 7 years running the Virgin brand worldwide.

And he and I met as he was helping me to recruit someone for this space, and ultimately he made the decision to come and join us. He’s driven right across this whole spectrum of activity a lot of marketing capability in the Pacific, now working with our team in Europe and also working in conjunction with Gladys Goh and Wee Siew Kim and the team in Asia.

I’ll leave my presentation here. Thank you for your time.