1. Introduction

I would like to express my gratitude to you all for listening in to our IR Day sessions and I am happy to elaborate on our M&A strategy.

We have been somewhat consistent in strategy since MSV became our sole mission back in 2018, but with some evolvements we have really endeavored to maximize the potential of our platform through our Asset Assembler Model. Today I would like to summarize where we stand, our strength and where we are heading towards the longer-term future.

2. Executive Summary

Page 2 gives the executive summary for today.

I would like to stress three key points:

- Our strategy to assemble good assets and drive growth both organically and inorganically remains unchanged, and our aspiration to compound EPS in a safe and sound manner should prove effective in the long run. Our M&A aspiration may be split into 2 dimensions – one whereby our partner companies aspire for growth through bolt-on M&As which would generally be in the nearby geography or business arena, usually effectuating real synergies. This is probably not so different from the typical M&As you see and we encourage our partners companies to look into those more aggressively compared to pre Nippon Paint ownership days.

The other is the assembly of assets, or build out of pillars which would be more stand-alone, more autonomy but with accountability, less reliant on synergies to justify our valuation, and may be more sizeable. Acquisition of DuluxGroup in 2019, and more recently AOC this year, would fall into this category.

Bear in mind that our most recent decision to acquire our own stock is, as stated, a pure financial decision, with our stock price extremely low. One investor put to me – as an ex M&A banker wouldn’t you recommend your client to buy Nippon Paint at this valuation, without a premium, and without due diligence? So, in a sense, it is a slightly different form of EPS compounding and remains consistent with our overall strategy. - We started to publicly state “Asset Assembler” back in 2022 at which point in time the intent was to not limit ourselves to just a “Paint assembler” but with a broader arena to acquire. Adjacencies we referred to then were more SAF, sealants adhesives and fillers, or Construction Chemicals.

I have to confess that given our share price trading at a premium, may be 40 to 60x PER around then, coupled with a significantly low cost of debt, and with targets highly cash generative, our primary focus was on EPS accretion, and may be less about ROIC as you can imagine our “real”, not the theoretical, cost of capital was very low.

Unfortunately, with our share valuation coming low on the back of slowdown in China and other macro issues, which implies a much higher cost of capital, we came to revisit our arena further and in 2024 April medium-term strategy briefing, we have stated no limits to our acquisition targets. This is a reflection of us redefining our strength as a buyer, not just reliant on low-cost yen funding but other features which I will talk about later. Still we have also made clear that it should be low risk and good return, which means good assets, good management, less geopolitically sensitive, EPS accretion from year 1 et al. Acquisition of AOC is a reflection of such evolution and we are happy to have such a high margin, cash generative company with excellent management be part of our group. Going forward, we would most likely still keep our Chemical hat on as we see ample attractive opportunities in the space that there is less need to broaden our universe.

That said, are we regretting historical acquisitions at higher multiples? – the answer is no. We have been acquiring very capital efficient companies with good cash generation, and have been improving returns over the years. They have been making a lot of contribution to our group, including but not limited to, best practices. The Selleys example later shown highlights some of those successful effects brought to our Group which may not directly show in the individual ROIC numbers. - With that in mind, I would like to remind you that I am not on vacation for the pursuit of M&A. We have made some offers which either were rejected or we declined thereafter recently post AOC acquisition. Whilst keeping in mind our strong deleveraging status, our BOD continues to believe the pursuit of further attractive M&A is the right place to allocate capital in order to maximize the potential of our platform.

We are also very mindful of the financial discipline to ensure the trust we obtained from financial institutions remain in tact. I always state the possibility of an equity offering only when it is meaningfully EPS accretive post money, but you can imagine that we would be somewhat reluctant to issue shares under this level of valuation for our stock. This does not mean that I cannot go beyond the 4x Net Debt to EBITDA at all – with the strong cash generation, I may still obtain comfort from our lending banks to go beyond the 4x and wait for the deleveraging to go through before the next acquisition thereafter. But this is all predicated on a good acquisition opportunity. I always state M&A is only a means to an end, and in of itself is not the objective. The good news about our portfolio is that there is no “must do” deal for us. This precludes the possibility of an overpay at the expense of shareholder value.

3. Our M&A Strategy: Overview

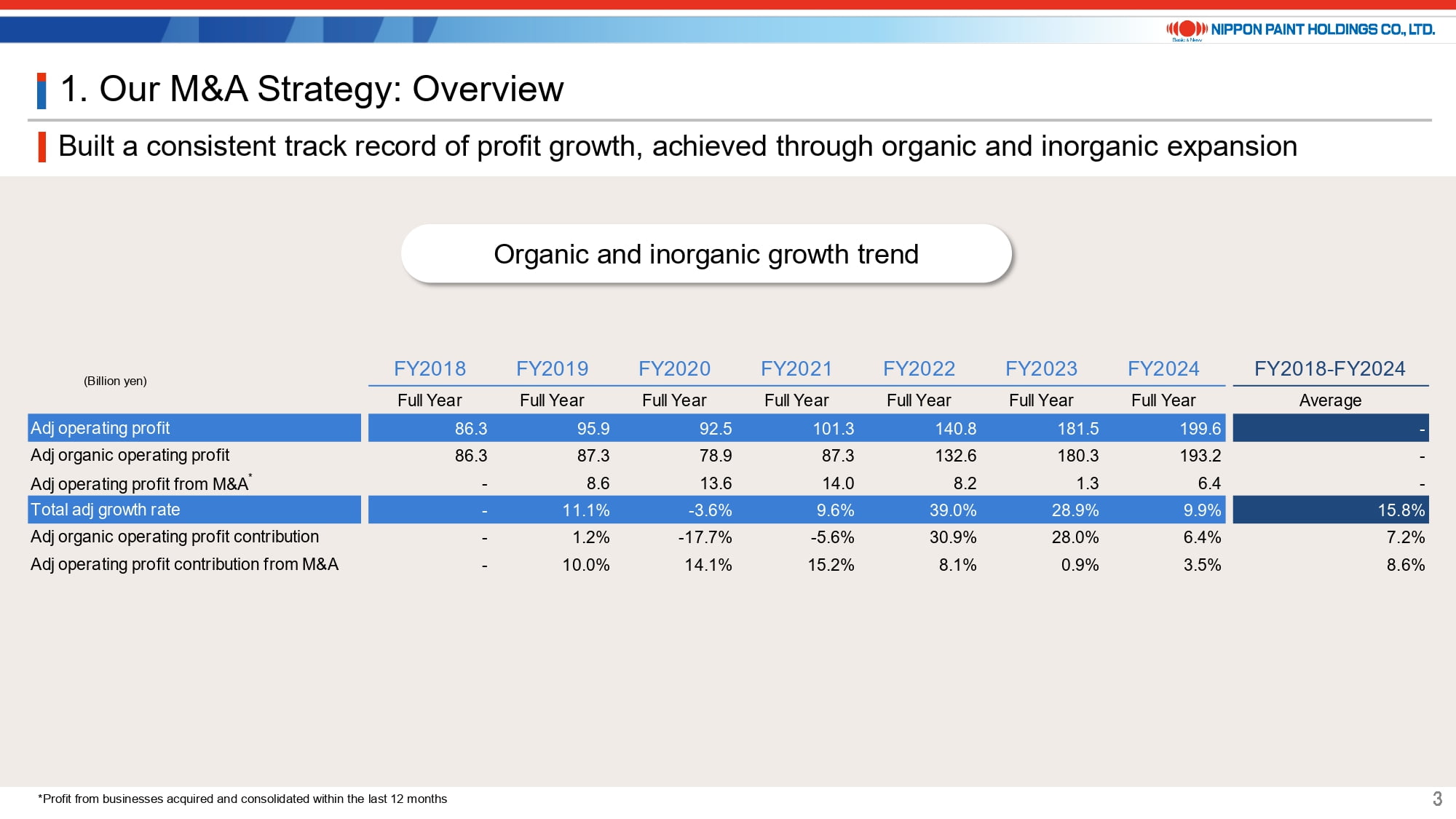

3-1. Built a consistent track record of profit growth, achieved through organic and inorganic expansion

This is the full year version of what we have started to show in the FY2025 3Q presentation.

You can see that our Asset Assembler model is working with the growth engines coming both from organic and inorganic activities – this would continue as we end year 2025 with another successful growth as we include the addition of AOC. We are here to say that we look to continuing and even accelerating our growth journey going forward through this model.

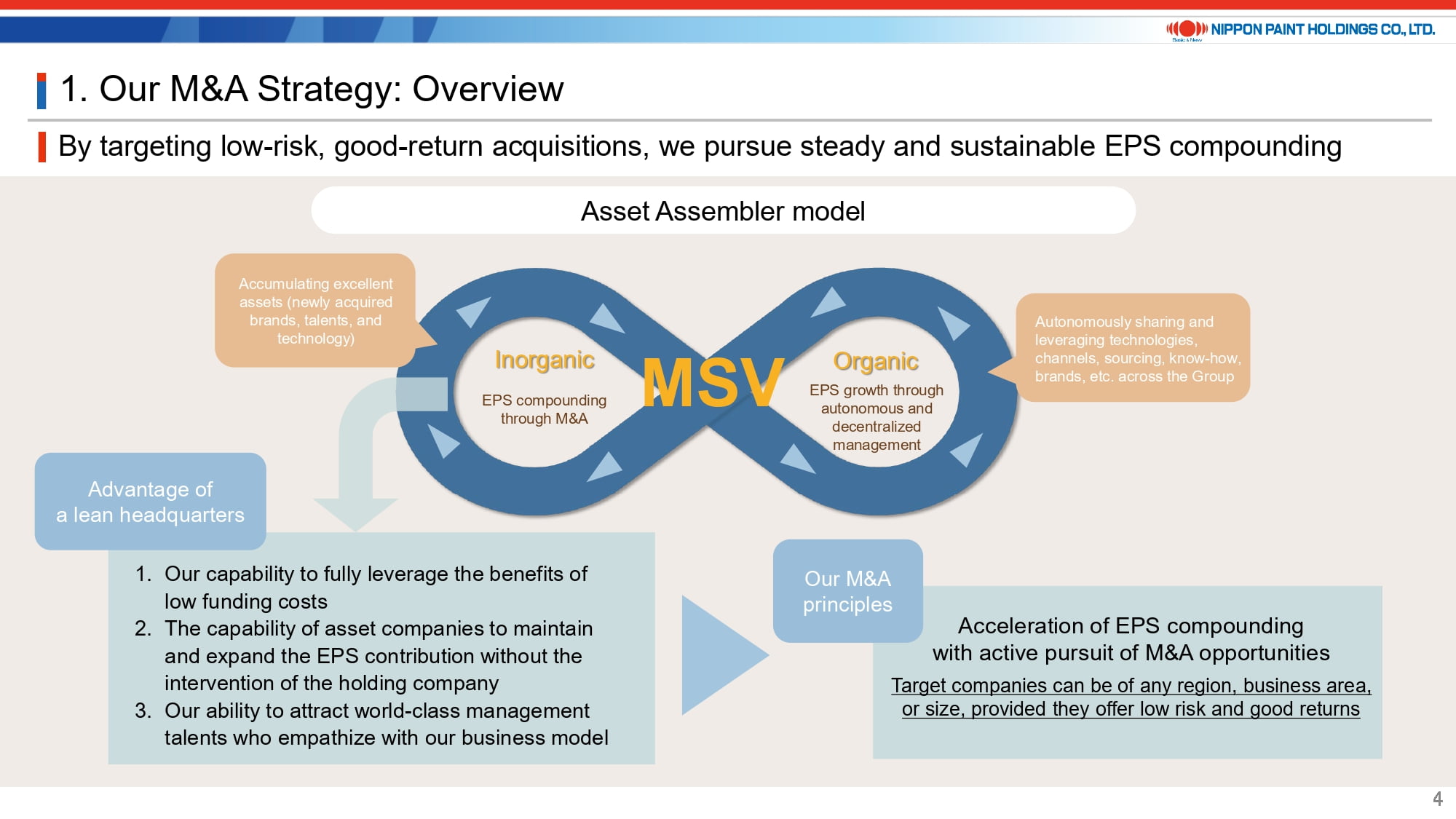

3-2. By targeting low-risk, good-return acquisitions, we pursue steady and sustainable EPS compounding

This page is a recap of our infinite growth model for Asset Assembler.

Our advantage over many corporations around the world stems from (a) Low cost funding, but not just that, our “will” to make use of such low cost funding, (b) our discipline to motivate and enhance the ability of our assets in EPS contribution, and (c) our ability to attract world class talent who empathize with our business model.

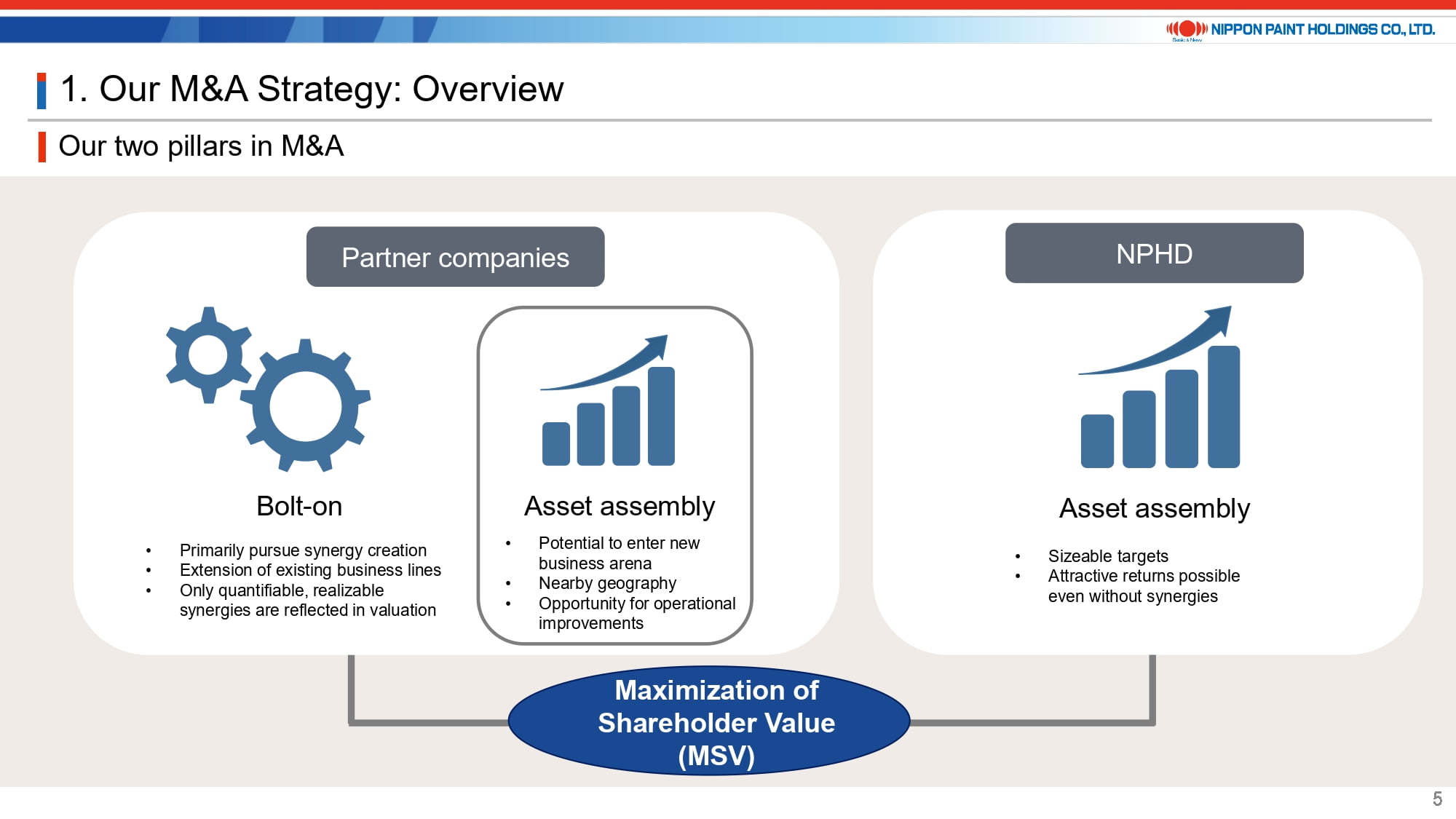

3-3. Our two pillars in M&A

Next I would like to explain our 2 pillars in M&A – one deriving from our partner companies which we would call bolt-on’s. But we are not limiting them to buy only in their arena – as management shows their confidence for returns, we would encourage them to look beyond the traditional zone, noting that management resource in of itself is limited thus encouraging them to look for high value-added ones, but only with reasonable valuations. Goh Hup Jin, our Chairman, Wee Siew Kim, my partner Co-President, and myself, all three of us sit on the Board of NIPSEA, DuluxGroup and AOC, and for certain transaction size requires the approval of NPHD’s Board – thus our discipline would still be kept.

Then comes the right hand side where we talk about a larger Asset assembly. Given our holding company only having 50 people, we are not here to do massive standardization and Post Merger Integration, and I definitely do not want to build bureaucracy into our organization. Still one M&A takes a lot of effort to complete – in which case we would rather have a higher return on our resource investment, so size matters.

All in all, any M&A have to serve for our sole mission, MSV. It not only has to be EPS accretive from year one. It also has to provide meaningful return on capital employed with good prospect for a sustainable contribution to Nippon Paint.

3-4. Mindset change at partner companies: The DuluxGroup example

Here we show case the mind set change in our partner DuluxGroup. From its ASX-listed days it has completed 9 acquisitions in 9 years. Since it joined Nippon Paint Group, a slightly more aggressive growth mindset has resulted in 24 acquisitions including Cromology and JUB in the last 6 years. It is quite important to note that the parent never forces them to buy – it is upon their conviction and will to acquire these with discipline. It is not what NPHD as the holding company wants them to do, but what DuluxGroup wants to do and the question is how the parent company can help. Needless to say, money is not free and there are several cases where the Board of DuluxGroup rejected the proposal. At the end of the day, it all has to make sense and we are not afraid to have a healthy debate about it.

4. Our M&A Track Record

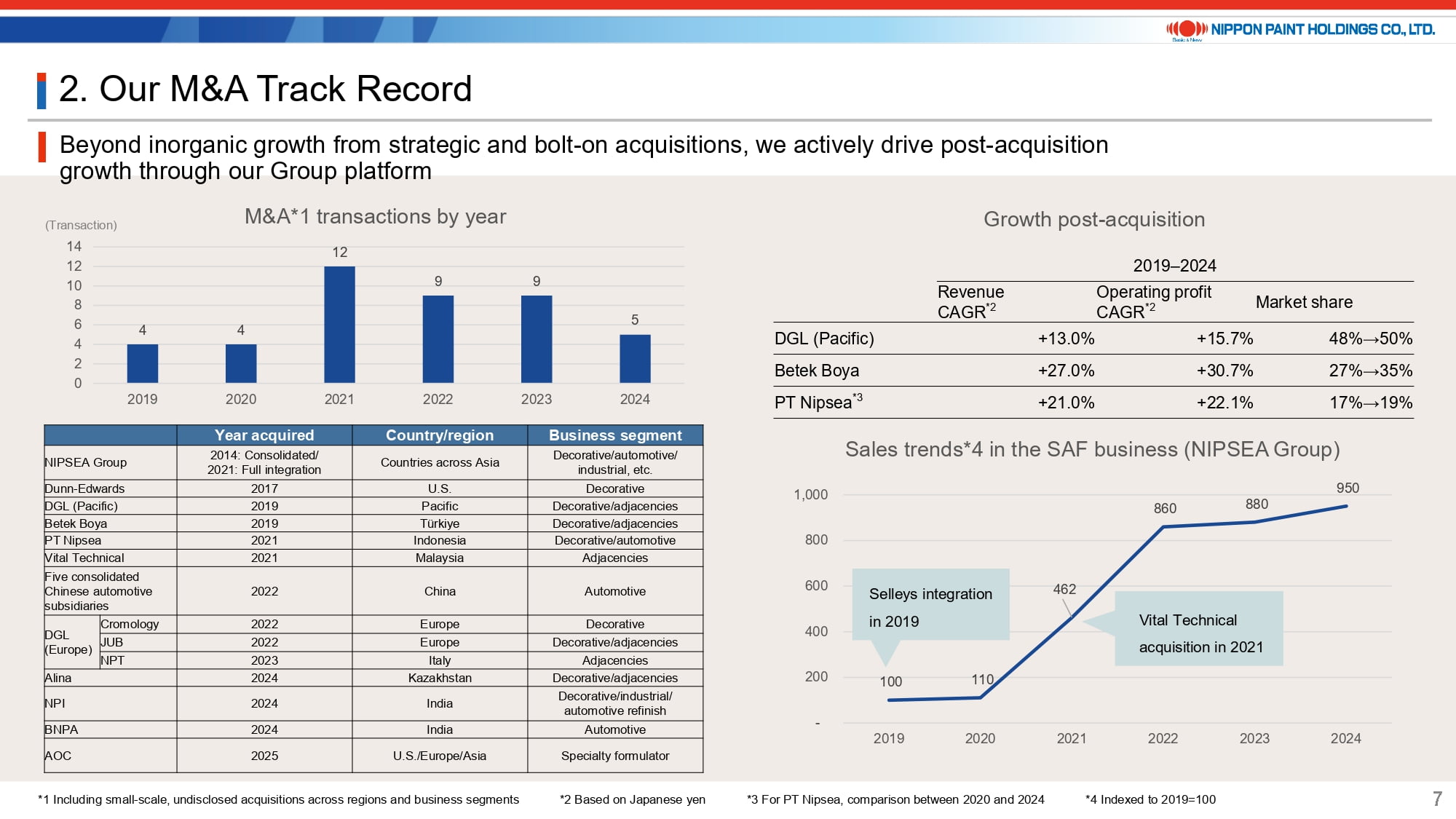

4-1. Beyond inorganic growth from strategic and bolt-on acquisitions, we actively drive post-acquisition growth through our Group platform

From here onwards, I would like to touch upon our excellent track record which seems to be a bit underestimated and undervalued.

I understand we are not yet a Danaher or a Berkshire Hathaway and of course M&A comes with certain risk. That said, we do invest in very easy to understand, cash generating assets that serves for MSV. Since 2019 we have continuously acquired companies as seen on the left hand of the chart. Number includes some of the smaller ones undisclosed.

A quick glance on the improvement post being part of our group on the right-hand side – with good improvement in revenue, operating profit, and market share. Bottom right shows our growth in SAF business within NIPSEA. The DuluxGroup acquisition accompanied the Selleys business which is an excellent non-paint business in the SAF arena. DuluxGroup had a standalone Asian business before our acquisition, which were not really making progress, and eventually sold it to NIPSEA, which already had a scalable distribution. With the initial launch being successful we have become more confident in this field, leading to the acquisition of Vital Technical in Malaysia in 2021. This area has shown significant growth, which stems from our partner companies talking to each other and making sense, as opposed to the holding company instructing to do this and that. This highlights the power of our group with very strong growth mindset.

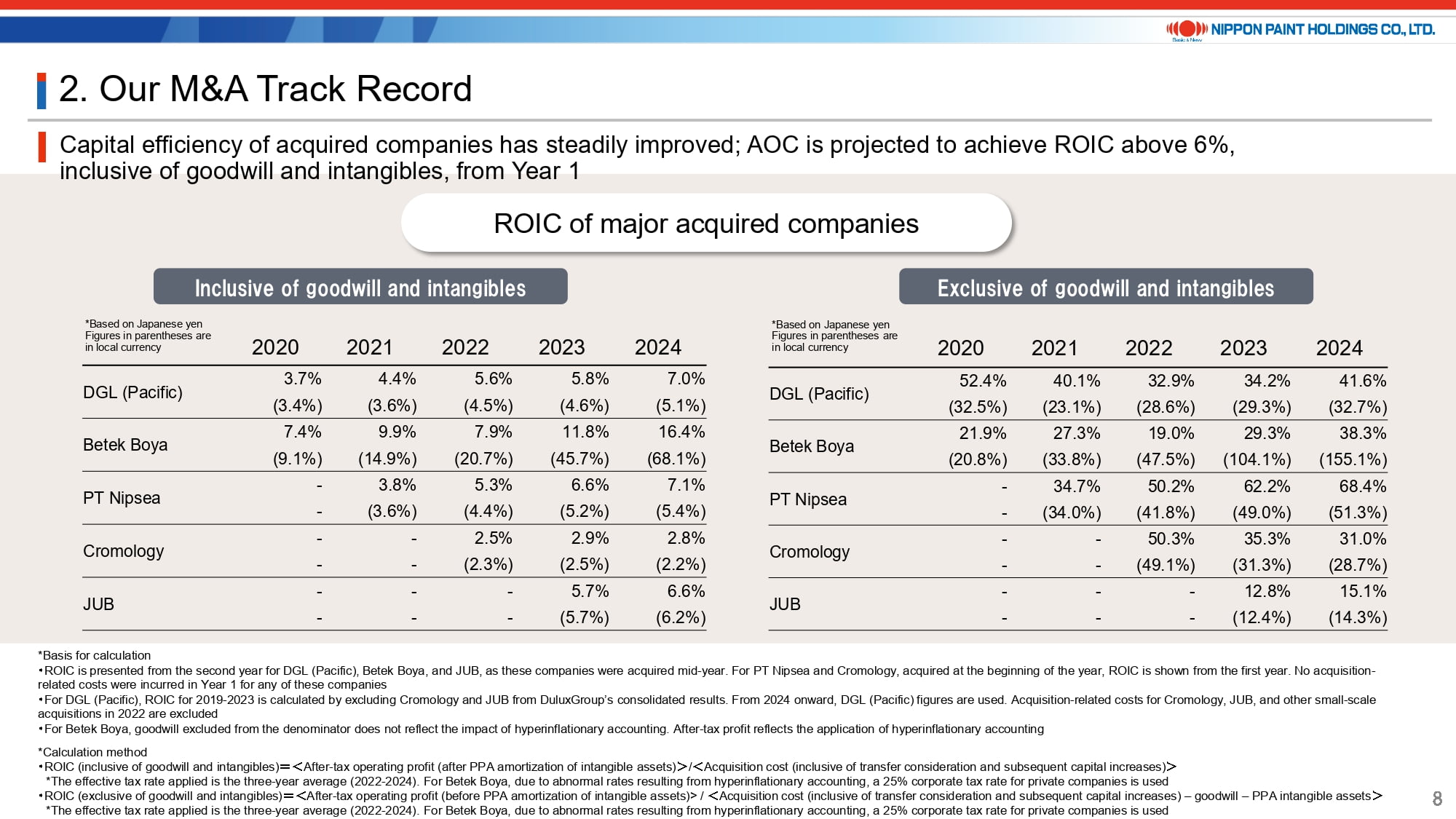

4-2. Capital efficiency of acquired companies has steadily improved; AOC is projected to achieve ROIC above 6%, inclusive of goodwill and intangibles, from Year 1

Here we display our ROIC inclusive and exclusive of goodwill and intangibles.

Yes we pay for the goodwill so may not be able to omit this totally. Still, these chart shows you that each asset is improving year on year, may be with the exception of Cromology; also noting that exclusive of goodwill and intangibles, these provide very high return on tangible assets, which indicate a very asset light model. We have disclosed the ROIC on a local currency basis, noting that the funding is all Japanese-yen based, with no hedging, so we believe yen-based returns are similarly important.

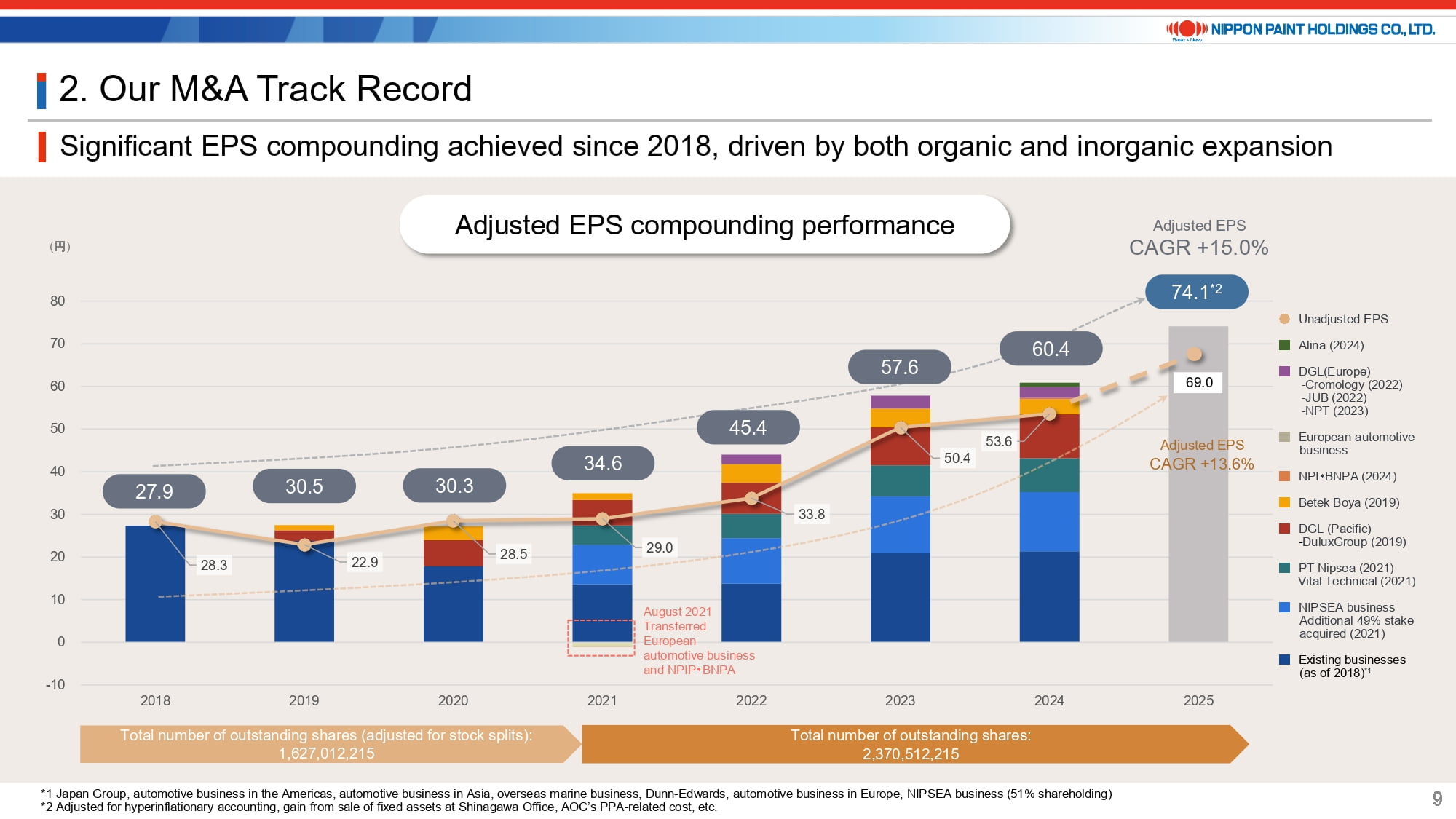

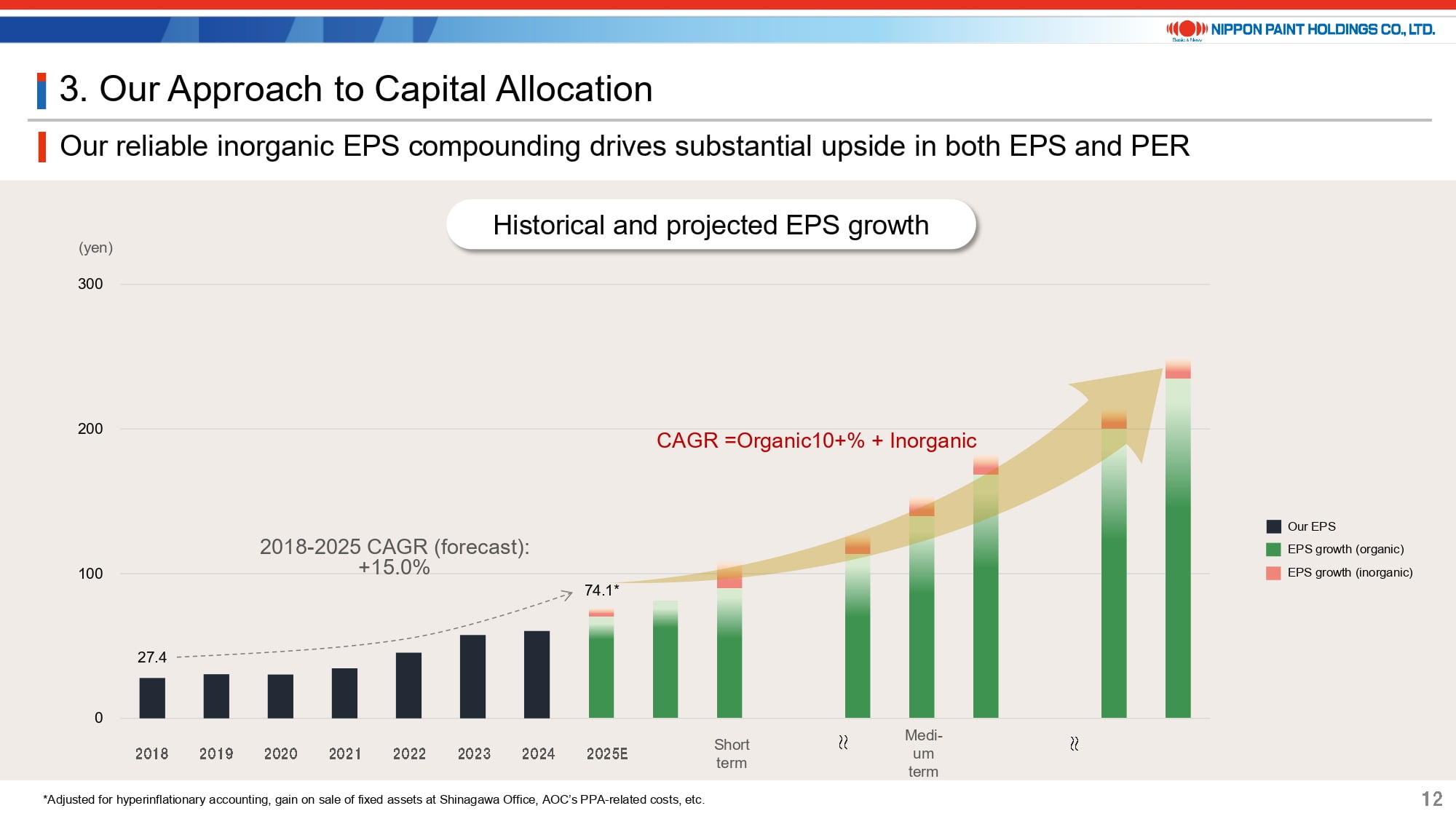

4-3. Significant EPS compounding achieved since 2018, driven by both organic and inorganic expansion

This page illustrates our EPS compounding journey through asset assembly.

Some people get misguided by the dark blue bar, which represents the existing businesses, being lower in 2021 and 2022 compared to previous years – this is all EPS and you have to take into account the 46% increase in share count in 2021 and the addition of the 49% of NIPSEA business as in light blue color, altogether of which have shown significant growth over the years. We have made a high-level estimate of adjusted EPS guidance in 2025 to be 74.1 JPY by adjusting the EPS guidance of 69.0 JPY, effectuating a 15.0% CAGR since 2018. I have to stress that I am not sure there are many companies that have delivered this level of consistent and stable growth under such volatile and uncertain times.

5. Our Approach to Capital Allocation

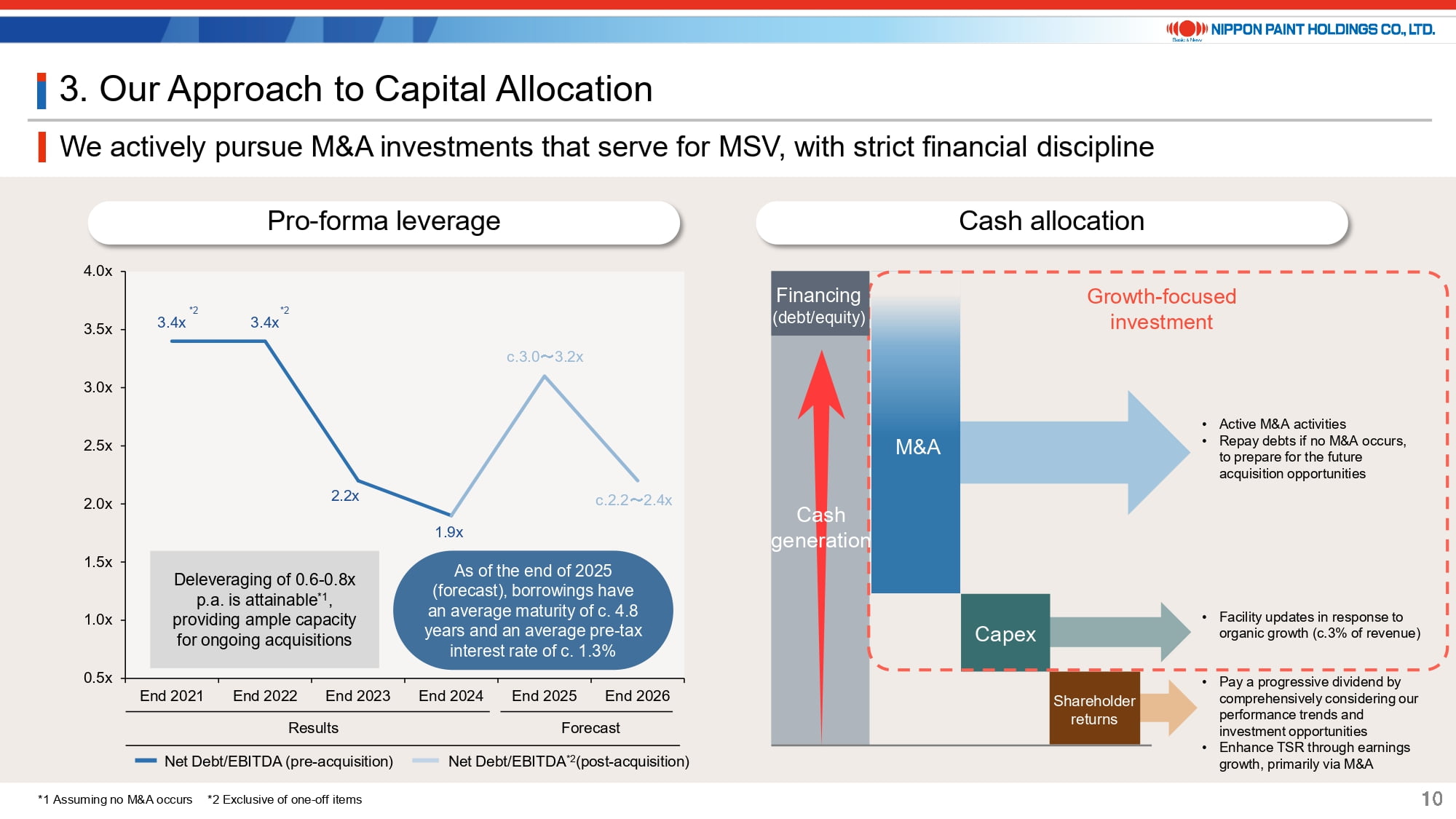

5-1. We actively pursue M&A investments that serve for MSV, with strict financial discipline

Let me turn to Capital Allocation.

Coupled with our stronger focus on cash conversion across our partner companies recently, we believe a deleveraging of 0.6 to 0.8 times to EBITDA per annum is attainable, which implies we are ready for the next one. One banker told me that the chart on the left side, which we previously included in our disclosure materials, could imply that I am either busy working on PMI or on vacation and thus the next one is way ahead. Very important point is that we only buy companies that require minimum PMI. AOC is already in good shape under our umbrella. Just to be clear, the chart was meant to show our readiness for the next one.

Also note that we are in the process of finalizing permanent financing for the bridge we borrowed upon closing of AOC acquisition. Indicative duration post such completion is c. 4.8 years in total duration, with average interest rate at 1.3% pre tax.

Right hand side is a repetition of what has been shown and also stated. There is no change in our dividend policy. Share buyback is not the primary use of capital: we will continuously look for M&A opportunities.

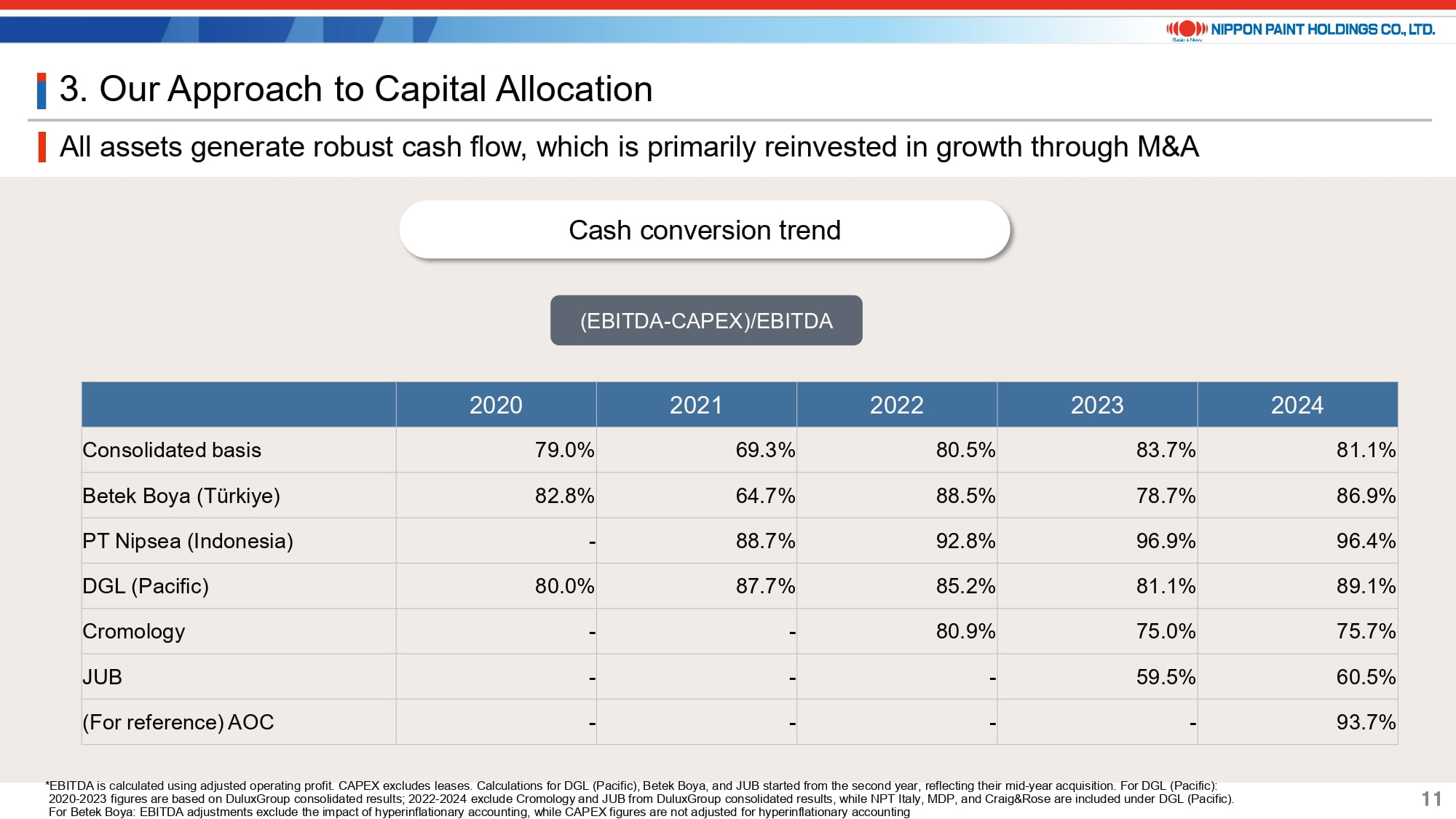

5-2. All assets generate robust cash flow, which is primarily reinvested in growth through M&A

I wanted to supplement the high cash conversion of our asset base.

As a holding company, I have very limited concerns on the day to day cash operation of our assets as they are so much cash generative. We are putting a further emphasis on the cash conversion cycle. My job is not to be annoyed for the redistribution of capital for normal operations; they can organically grow without any capital injection. It is pretty much all about M&A that requires additional capital at our partner companies which we examine carefully with discipline.

5-3. Our reliable inorganic EPS compounding drives substantial upside in both EPS and PER

This is an illustration of our mid to long term growth.

Organically we would look for a 10+% growth on EPS. This is unchanged. Inorganically we would want to meaningfully add to such good growth by reinvesting the capital for good and sizeable companies. We see our way to achieving 100, 200 and even 300 yen EPS in the long run if we execute right. I believe the key is to obtain conviction from our investors about the certainty of organic and inorganic capabilities which I understand is difficult to model. I hope I can continue to show a meaningfully successful track record going forward.

6. Conclusion

I would like to conclude my presentation here with our usual statement of continued commitment towards MSV.

We are very proud of being a unique company that has the strong will towards unlocking our full potential through the assembly of assets, backed with a very vigilant mind and always keeping the option to say no to opportunities that do not serve for MSV.

Thank you very much for listening.