Capital Policy

The Company’s sole mission is to maximize shareholder value that remains after fulfilling its obligations to customers, business partners, employees, society, and other stakeholders. To achieve this, we prioritize growth-oriented investments while maintaining financial discipline, with a strong focus on increasing basic earnings per share (EPS) to enhance total shareholder return (TSR).

Regarding dividends, which are a component of TSR, our fundamental policy is to adopt a progressive dividend* approach, taking into account factors such as business performance trends, investment opportunities, and other relevant elements.

*As a general policy, dividends are maintained or increased, without reductions.

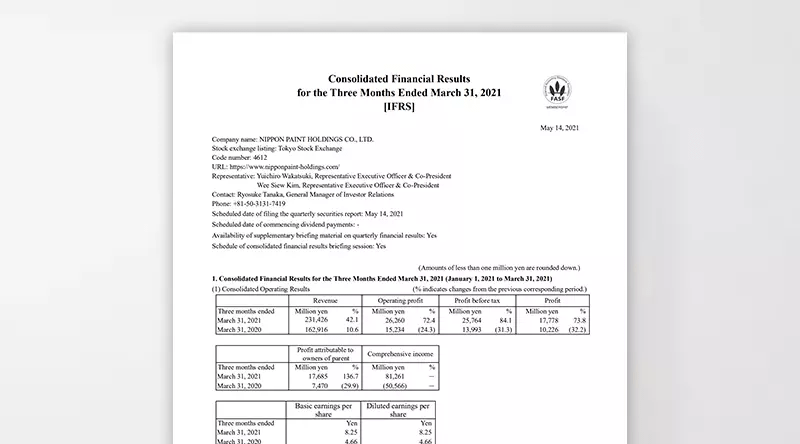

Per Share Information

Details of Dividends

Acquisition of Treasury Shares

NPHD has not acquired any treasury shares since FY2013, which ended on March 31, 2014, except for acquisitions under Article 155, Item 7 (acquisition of shares of less than one unit) of the Companies Act of Japan.

Stock Split

Shareholder Benefit Program

No shareholder benefit program is currently offered.