Setting a medium-term milestone towards our long-term goals

The Nippon Paint Group released a three-year New Medium-Term Plan (FY2021-2023) in March 2021. This New Medium-Term Plan was drawn up based on the following three policies.

Firstly, the plan was created with the significant involvement of the management teams of our partner companies. The aim is to clarify accountability and enhance the sense of involvement among our partner companies in order to maximize the Group’s comprehensive power and increase prospects for the plan’s success.

Secondly, we determined our “Purpose” concurrently with the New Medium-Term Plan. The Purpose defines the Nippon Paint Group’s shared “Identity” while respecting management autonomy at partner companies based on their own Mission, Vision, and Value. The Nippon Paint Group, which consists of diverse members, is dedicated to conducting business operations based on the shared values ingrained in the Purpose.

Thirdly, the positioning of the New Medium-Term Plan. In today’s rapidly changing business environment, companies should always look ahead five to ten years. Therefore, we set long-term goals and positioned the Medium-Term Plan as a three-year milestone to achieve those goals.

We will implement the growth strategies in the New Medium-Term Plan in all our operating regions and businesses by mobilizing the Power of Teamwork with our partner companies with the goal of building a powerful base for sustainable growth.

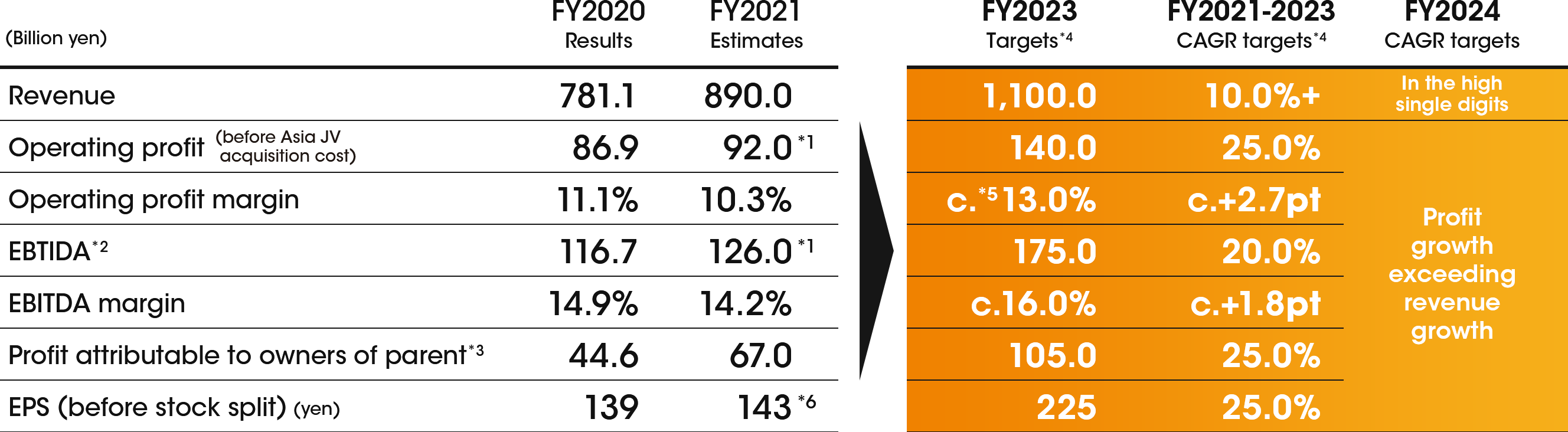

Our Group’s long-term financial targets are to achieve a revenue CAGR in the high single digits beginning in FY2024. Our goal is to exceed the revenue CAGR targets of our major benchmarked competitors of 4-6%. The operating profit and EBITDA CAGR are based on the plan to use additional marginal profit as sales grow in order to increase profit margins, thereby achieving profit growth exceeding revenue growth.

Our milestones for FY2023 are revenue of 1,100.0 billion yen, operating profit of 140.0 billion yen, and EPS (before stock split) of 225 yen. Furthermore, our targets are revenue CAGR of more than 10%, an operating profit margin improvement of 2.7 points, and EPS growth of 25%.

Policies for formulating the New Medium-Term Plan

1. Formulating the Medium-Term Plan through proactive involvement of our partner companies

With a focus on maximization of our Group’s comprehensive power to ensure the feasibility of the plan, this Medium-Term Plan was formulated through involvement of our partner companies in the formulation process to create a business plan of the Nippon Paint Group.

2. Setting a shared “Purpose” of our Group

We set the “Purpose” that defines shared “Identity” of the Nippon Paint Group and respects the autonomy and accountability of our partner companies.

3. Setting a Medium-Term milestone based on the long-term perspective

We always look five to ten years into the future and update our management goals according to changes in actual business circumstances. This Medium-Term Plan is formulated to set a three-year milestone.

New Medium-Term Plan (FY2021-2023)

Setting a medium-term milestone towards our long-term goals

Financial plan

- Before one-time expenses

- EBITDA: Operating profit + depreciation and amortization + impairment loss

- Targets for profit attributable to owners of parent are calculated by multiplying operating profit by effective tax rates

- Exchange rate assumptions: USD/JPY is at 106.0 yen; RMB/JPY is at 15.7 yen; AUD/JPY is at 75.0 yen; naphtha price: 40,000 yen/kl

- circa : approximately

- Estimated based on the number of shares (excluding proration adjustments) after the capital increase on January 25, 2021

Our long-term vision

Regional and business strategy (overview)

|

High-growth markets such as Asia (including China) and Turkey: Grow profits through revenue expansion while maintaining margins |

|---|---|

|

Stable growth market of Oceania: Secure revenue and profit growth outperforming the market growth |

|

Japan: Make investments in updating and streamlining production facilities with a medium to long term perspective. Secure competitive advantage and improve productivity while creating new demand |

|

Automotive coatings: Assuming recovery of automobile production, aim to increase market share and acquire new customers by capturing customer needs on a global basis and reinforcing technological strengths and quality assurance system |

|

Paint-related businesses: Expansion of business into China and the other Asia region by applying the experiences of DuluxGroup’s SAF*1, CC*2 and Betek Boya’s ETICS*3 |

- Sealants, Adhesives & Fillers

- Construction Chemicals

- External Thermal Insulation Composite System

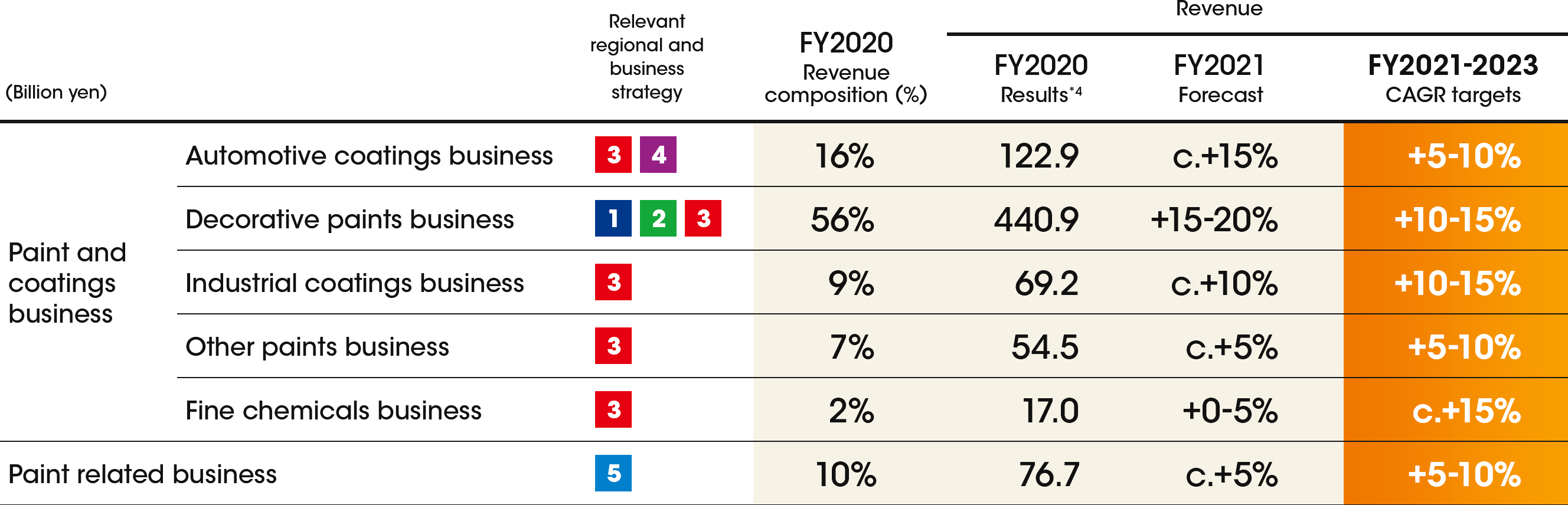

Our Group’s regional and business strategies to achieve the New Medium-Term Plan are outlined below.

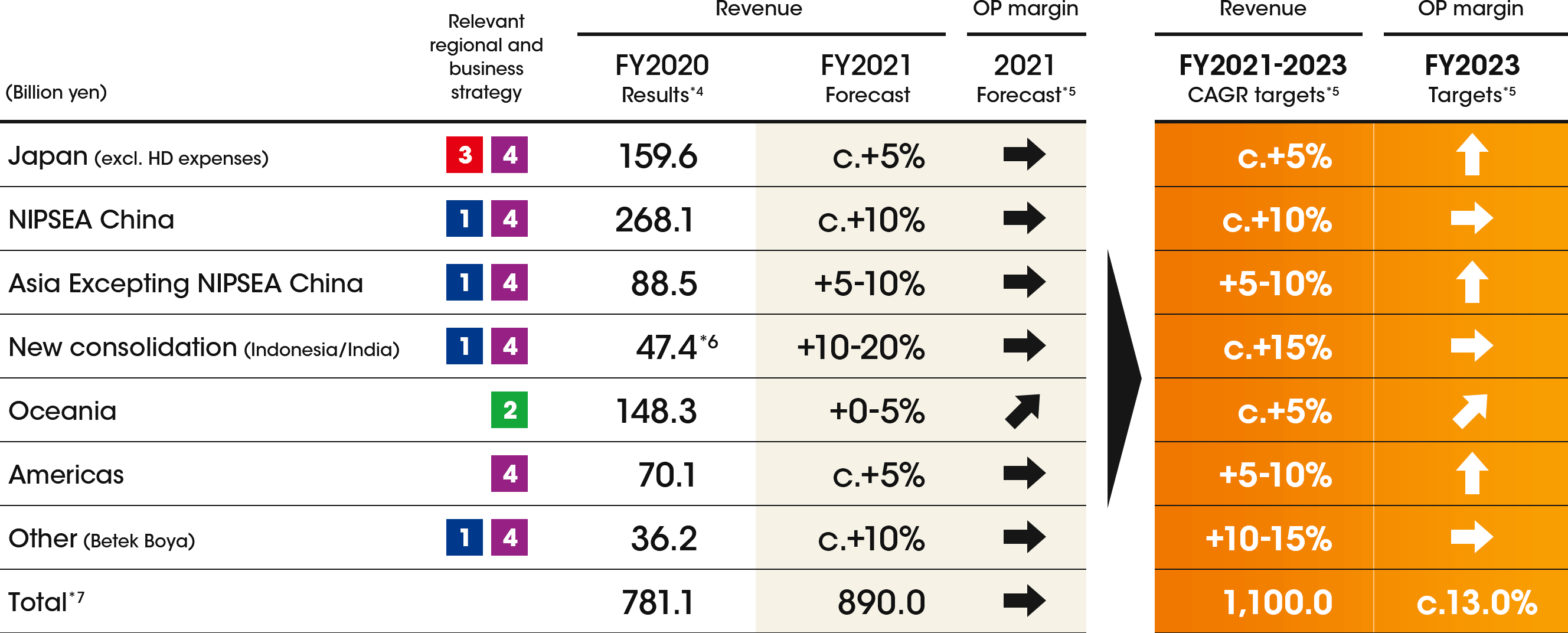

- In the world’s largest market of China, we will leverage our strong brand power, distribution network, and alliances with real estate developers to increase our market share and achieve revenue CAGR of approx. 10%. While we expect marketing and other expenses to increase in the ever more competitive environment, we will maintain profit margins by growing revenue.

In Turkey, where population and GDP growth is expected, we will use a multi-brand strategy to increase our market share. We will also strengthen the ETICS business and expand into adjacent markets outside Turkey to achieve revenue CAGR of 10-15%. - In Oceania, we expect a market expansion mainly in the home renovation and repair markets based on the stable GDP growth and population growth and will speed up our growth in these markets. We will also work to enhance the customer engagement by using digital platforms for achieving revenue CAGR of approx. 5% and operating profit margin improvement.

- In Japan, we see growing opportunities for water-based paint in the decorative paints market due to an increase in environmental awareness. In addition, demand is increasing in new product categories such as anti-viral paints. As key strategies for this segment, we will expand the product lineup and strengthen sales and promotion activities for anti-viral products. Our focus will also be on promoting the automation of production using DX. By taking these actions, we will aim to achieve a revenue CAGR of approx. 5% and operating profit margin improvement in the Japan segment as a whole.

- According to the results of various surveys, automobile production will recover to the pre-COVID-19 level in FY2023. In the automotive coatings business, our Group will leverage the marketing capabilities of NIPSEA China and the technological strengths in Japan for rapidly increasing our market share in China. We will steadily strengthen our competitive edge also in Europe and the U.S. By taking these actions, we plan to achieve revenue CAGR of 5-10%.

- The paint related business is expanding worldwide with the growing customer need, we see this market as promising. Our Group can use Powerful Partnerships to sell DuluxGroup’s Selleys brand adhesives, Betek Boya’s ETICS and other paint-related products using our Group’s distribution networks.

Demand for paint-related products is growing also in the Project segment of NIPSEA China’s decorative paints business. Therefore, we will leverage our existing distribution networks and partnerships and make strategic investments to grow in this market category with the goal of achieving revenue CAGR of 5-10%.

As described above, our Group expects to achieve revenue growth in all operating regions and businesses with operating profit margin maintained or improved in FY2023. Our Group as a whole expects to achieve best-in-class growth.

Revenue growth projections by business

Revenue growth projections by region

- Tanshin basis

- Local currency basis

- Pro-forma figures

- Revenue figures in the above table do not add up to the total revenue in FY2020 because the total revenue excludes the effects of new consolidation (Indonesia/India) but includes revenue for automotive coatings, etc. in Other region that is not shown in the table. Total revenue in FY2021 onwards will include both new consolidation effects and revenue for automotive coatings, etc. in Other region.

- Integrated Report 2021 (Digital Edition)