Font Size

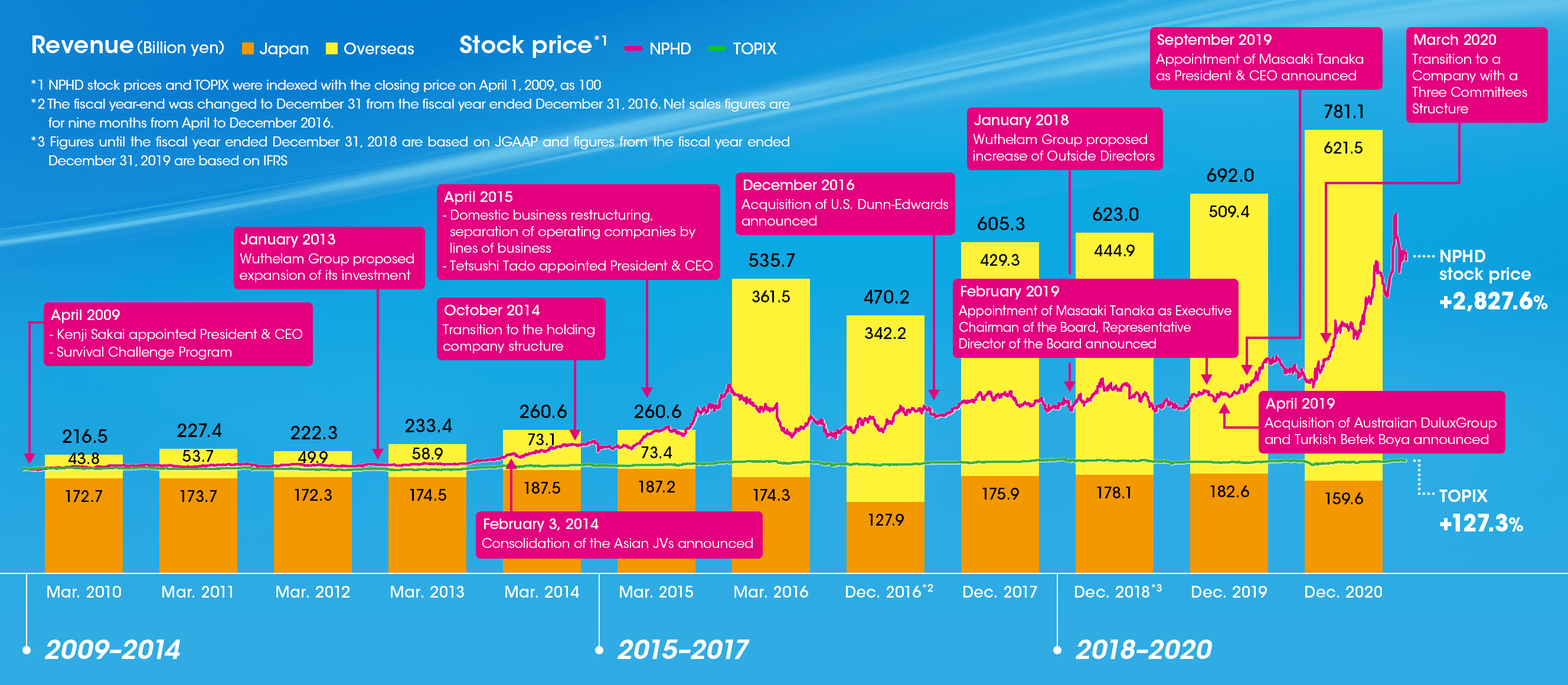

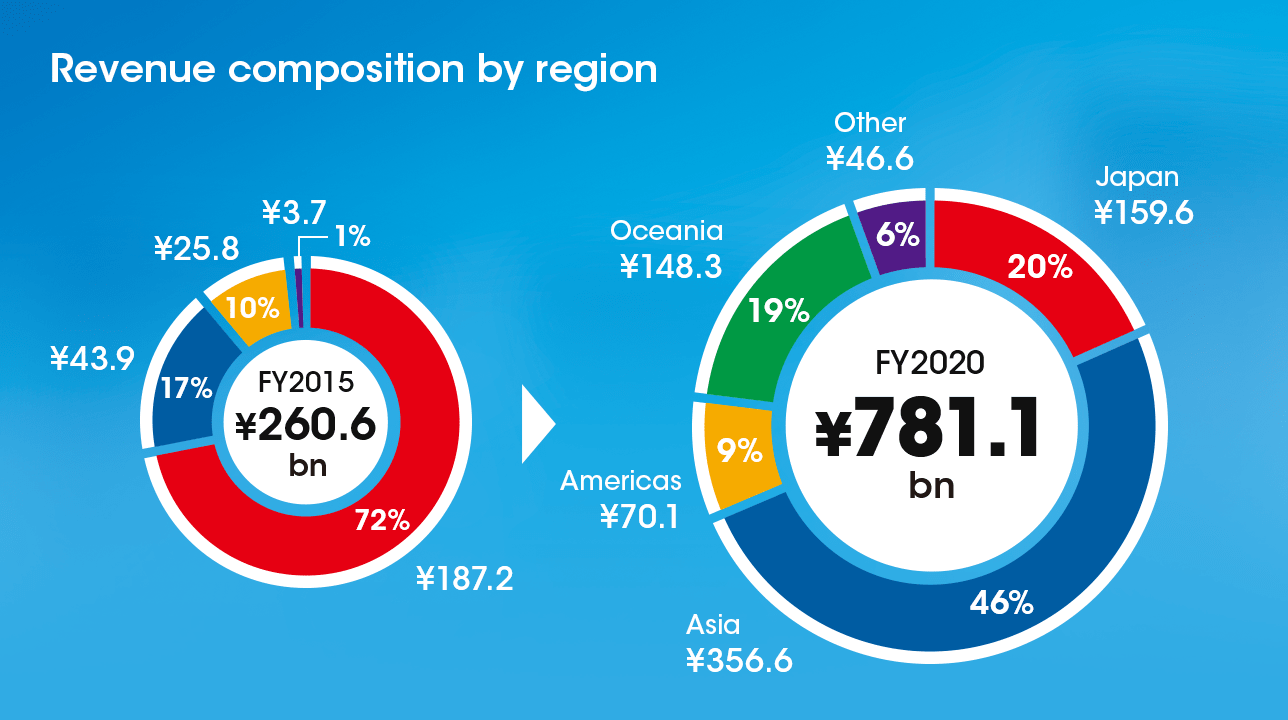

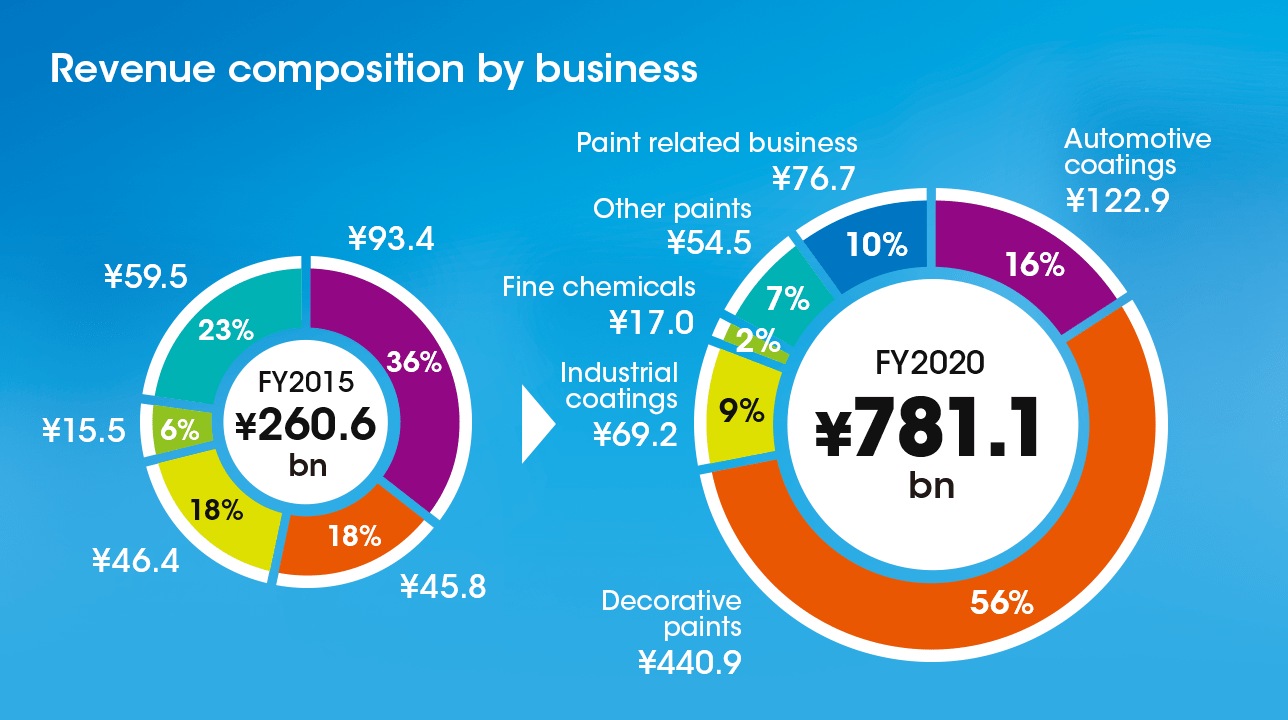

Path of growth strategy through establishing a stable portfolio based on region and business

Survival Challenge Program I & II (Released in May 2009)

Basic Policy

Establish a solid profitable structure

- Turn into a growing company -

(Shift to a structure that can earn profit from the market)

Basic strategy

- Reform the cost structure/Expand sales and profit of existing businesses/Create new markets

- Reinforce sustainable growth and the profitable business structure in Asia/Reinforce the earnings base in North America

Quantitative targets and results

|

|

FY2014 | |

|---|---|---|

| Plan | Results | |

| Net sales | 250.0 billion yen | 260.6 billion yen |

| Operating profit | 25.0 billion yen | 33.4 billion yen |

| OP margin | 10.0% | 12.8% |

Achievements

- Profitability improved significantly and targets achieved through thorough cost reduction mainly in Japan

Challenges

- The cost reduction as an emergency measure in the aftermath of the global financial crisis that curbed long-term-perspective investment has resulted in the current aging of facilities and human resources

- Growth in China and Asia through the Asian JVs that were consolidated in 2014

Survival Challenge Program III (Released in May 2015)

Basic Policy

Coatings and its related businesses respectively acquire a leading position (within the top 3 net sales in each business segment) globally

Basic strategy

- Build a foundation to become a "Dominant" in China, the most important market

- Significantly change the business structure to develop business based on Asia and increase the ratio of decorative paints, which have high growth potential and profitability

Quantitative targets and results

|

|

FY2017 | |

|---|---|---|

| Plan | Results | |

| Net sales | 700.0 billion yen | 605.3 billion yen |

| Operating profit | 105.0 billion yen | 75.0 billion yen |

| OP margin | 15.0% | 12.4% |

Achievements

- Reorganization of domestic businesses, separation of operating companies by lines of business, and transition to the holding company structure

- Significant earnings growth by consolidating the Asian JVs

- Acquisition of Dunn-Edwards in the U.S. and Bollig & Kemper in Germany

Challenges

- The plan was underachieved due to the impact of raw material price increases following more stringent environmental regulations in China, as well as the higher yen against major currencies

- The earnings of Asia JVs incorporated due to the acquisition of their 100% ownership

N-20 (Released in May 2018)

Basic Policy

Establish an unparalleled market position in Asia and accelerate growth globally

Basic strategy

- Strengthen the businesses in existing segments

- Accelerate expansion of the portfolio

- Improve earning capacity

- Enhance the structure of “Global One Team”

Quantitative targets and results

|

|

FY2017 | FY2020 | |

|---|---|---|---|

| Results* | Plan | Results | |

| Revenue | 610.2 billion yen | 750.0 billion yen | 781.1 billion yen |

| Operating profit | 85.4 billion yen | 105.0 billion yen | 86.9 billion yen |

| OP margin | 14.0% | 14.0% | 11.1% |

* Recalculated in accordance with IFRS

Achievements

Steady reinforcement of the organizational foundation for future sustainable growth

- Expansion of business in Oceania and Turkey through M&A (DuluxGroup and Betek Boya)

- Establishment of an advanced governance system (the ratio of independent directors increased to 67%, and transition to a Company with a Three Committees Structure)

- Creation of synergy and establishment of top-level management partnerships across group entities based on Powerful Partnerships

- Record revenue and operating profit in FY2020

- 100% ownership of the Asian JVs and acquisition of the Indonesia business announced

Challenges

Improve sustainability and profitability over the medium- to long-term

- Operating profit margin reached 13.8% in FY2018, but impairment loss was posted in FY2019 and the targets were not achieved in FY2020 due to COVID-19

- Improve sales growth and profitability over competitors in the growing paint market

- Find new business opportunities through ESG engagement and implement carbon neutral initiatives

- Use DX and acquire competent talents to address the aging of domestic facilities and employees

- Integrated Report 2021 (Digital Edition)