1. Front Cover

Good afternoon, everyone. I’m Yuichiro Wakatsuki, Co-President of Nippon Paint Holdings.

Thank you very much for taking the time today to participate in our conference call regarding financial results for the 2Q of FY2021.

Today’s conference call is being streamed live (audio only) on the Internet, and is held in Japanese and English with simultaneous interpretation.

2. Summary of Today’s Presentation(1)

I would like to begin by summarizing the results of operations for the 2Q of FY2021.

Revenue and operating profit increased significantly on a Tanshin basis (figures based on legal disclosure), reaching a 2Q record high despite raw material cost increases and the impact of COVID. The difference between the Tanshin results and Non-GAAP results is mainly due to new consolidation and exchange rate fluctuations. The impact of new consolidation in the 2Q includes one-time expenses associated with PPA (Purchase Price Allocation) related to the acquisition of 100% ownership of the Asian JVs.

Revenue also increased significantly on a Non-GAAP basis. The environment was challenging for earnings. Inventories of low-cost raw materials purchased last year declined in the 2Q as we used them and the RMCC ratio increased. As a result, price increases did not contribute fully to higher earnings. Despite these adverse factors, we achieved a higher operating profit overall.

Our Chinese business continued to deliver very strong revenue growth with estimated market share gains both in DIY and Project segments. Operating profit declined YoY due to the impact of raw material price inflation. However, we expect this impact to be short-term. I should not make optimistic remarks with competition increasing in the Project segment all over the country, but our DIY revenue is growing very rapidly, and we believe our market share is gaining ground in both the DIY and Project segments.

In Asia excepting China, revenue increased sharply compared to the 2Q of FY2020, when our performance was hit severely by COVID, despite some resurgence of COVID in Malaysia and Singapore from June. Our performance in Japan continued to be impacted by COVID but we achieved higher revenue and operating profit compared to the COVID downturn in the 2Q of FY2020.

The newly consolidated Indonesia business continued to deliver a strong performance. On a reference value basis, revenue and operating profit increased YoY with a very high operating profit margin. However, we need to pay close attention to the impact of COVID in Indonesia.

The higher cost of raw materials had a significant impact across all regions. As I mentioned in the conference call for financial results for the 1Q of FY2020, inventories of low-cost raw materials purchased last year are decreasing as we use them, while the benefits of price increases and cost reduction are lagging behind. As a result, the 2Q and 3Q are challenging periods in terms of profitability. In the meantime, we can implement price increases, in particular where we have a high market share. So, we see some signs that operating profit margin will stop decreasing in 2H. Then, our strong revenue growth will start contributing significantly to improving our earnings.

3. Summary of Today’s Presentation(2)

I mentioned in the conference call for financial results for the 1Q of FY2021 that we would revise our full-year guidance if necessary, taking into account the raw material price inflation and our sales. We have increased our revenue and operating profit forecast based on certain assumptions although we continue to see various factors that are subject to change. The revised forecast is revenue of more than 1,000 billion yen and operating profit of more than 100 billion yen, both of which are a record high.

Reasons for the revision of earnings forecast are as described in the presentation. We anticipate steady market share gains despite the lingering impact of raw material price increases across all regions, giving us a renewed sense of confidence about our Group’s growth potential. We will significantly reduce headquarters expenses for the current year as we explained in the new Medium-Term Plan. We can say that we are successfully building a foundation for exceeding our financial targets for FY2023.

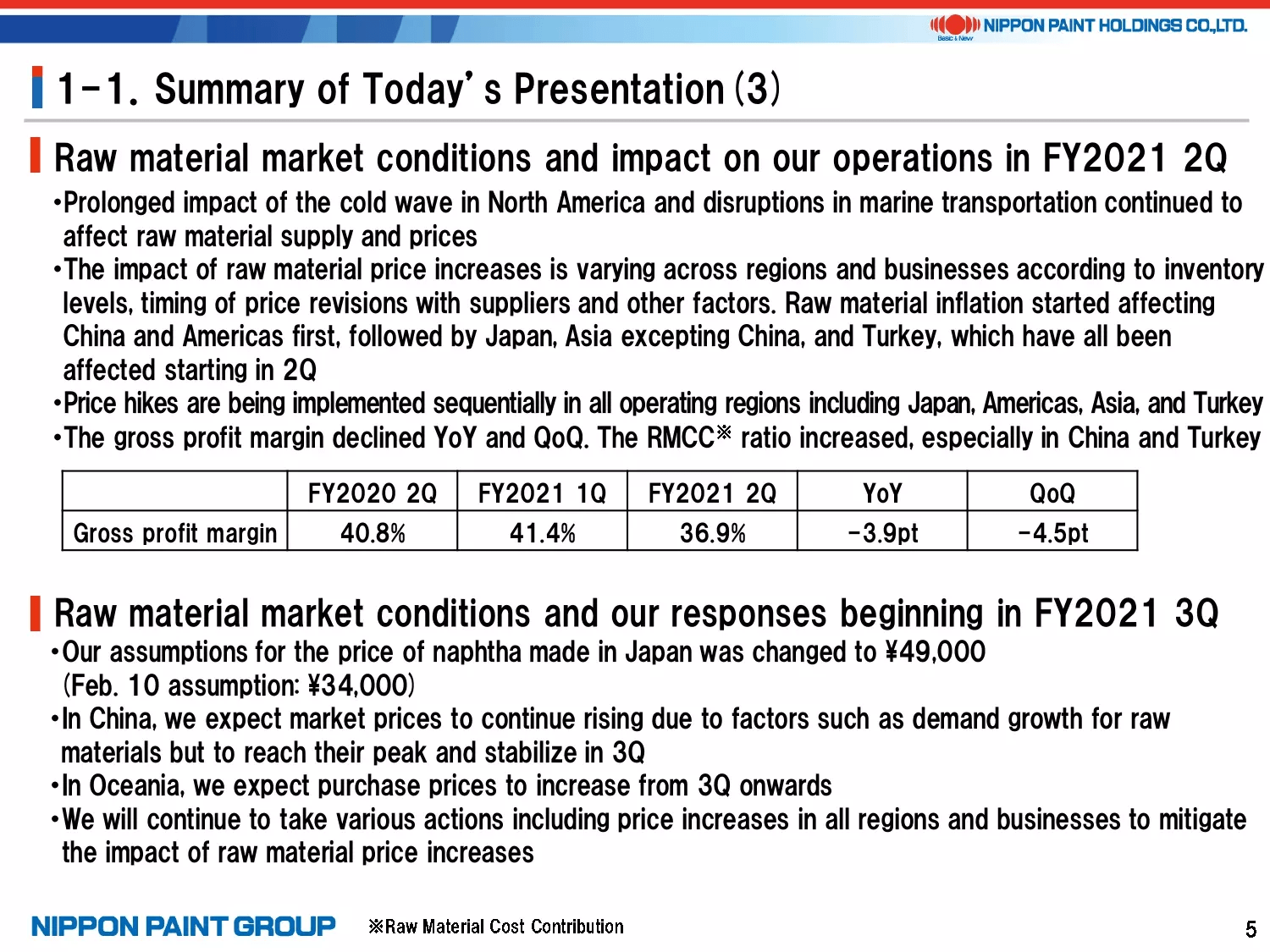

4. Summary of Today’s Presentation(3)

Please see page 5 for the raw material market conditions in the 2Q.

Raw material price inflation started affecting our Chinese business first and significantly impacted our operating profit margin in the 2Q. The overall gross profit margin declined YoY and QoQ. However, we are taking various actions including price increases and the reduction of SG&A expenses to mitigate the impact of raw material price increases. Therefore, we expect the full-year gross profit margin decrease to be smaller than the YoY and QoQ declines.

The situation remains unpredictable in the 3Q and beyond. However, we can manage the situation because we see some signs of peaking of raw materials market conditions and we can effectively implement price increases. The revisions of the full-year earnings forecast are based on these assumptions.

5. Major Topics After Announcement of FY2021 1Q Results ①②

Major topics after the announcement of financial results for the 1Q of FY2021 are provided starting on page 6.

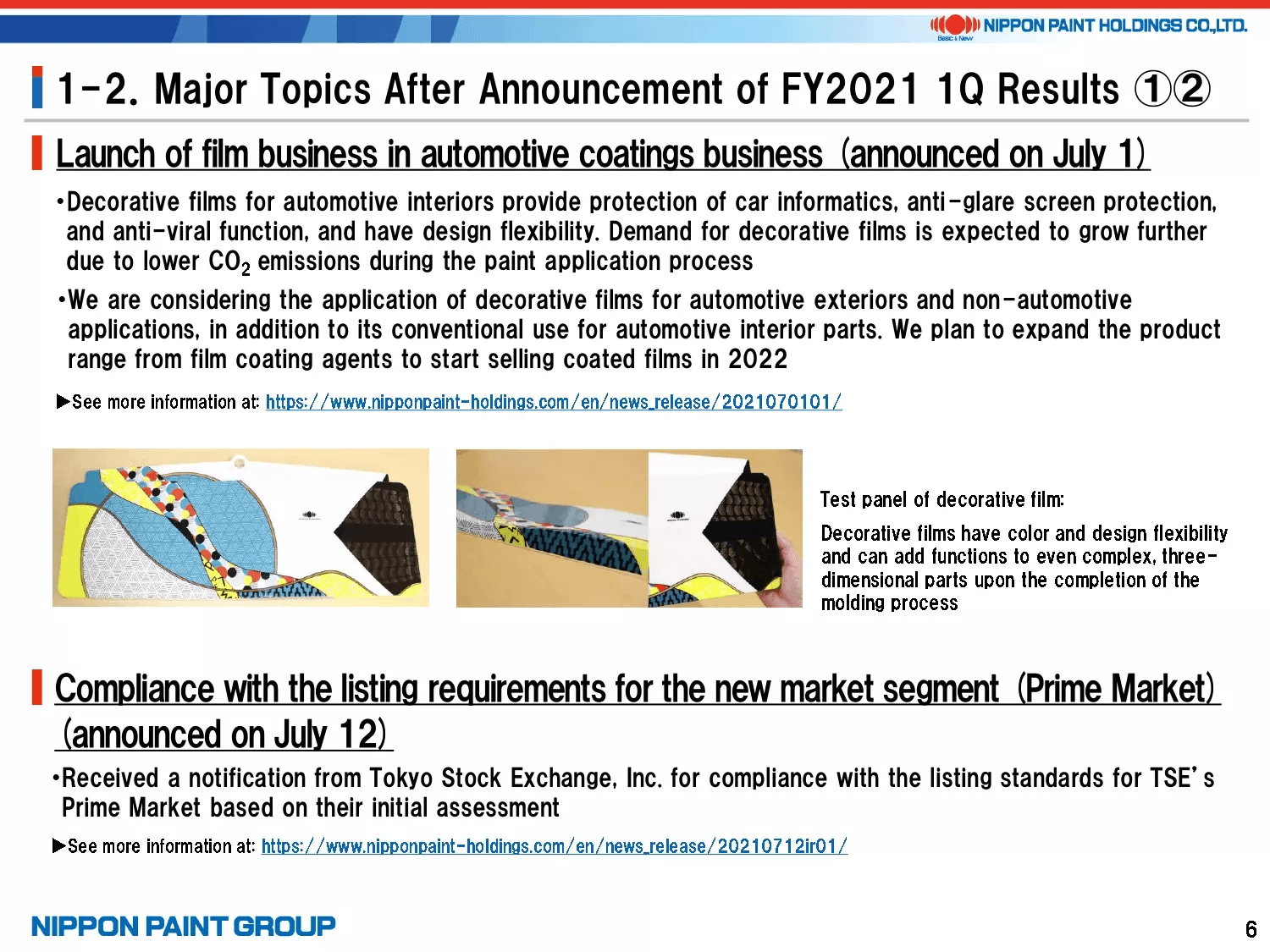

We announced the launch of a film business in the automotive coatings business in July. Decorative films can increase added value of products by adding functions using our Group’s technologies and also contribute to solving social issues such as reducing CO2 emissions. Therefore, we plan to expand the product range of these sustainable products and their applications.

As was announced, we have met the listing standards for the Prime Market of the Tokyo Stock Exchange.

6. Major Topics After Announcement of FY2021 1Q Results ③

Please see page 7. Joint research with the University of Tokyo has proven that our Group’s five PROTECTON brand products are effective in suppressing COVID. We plan to continue these joint research projects involving applications that benefit society.

7. Major Topics After Announcement of FY2021 1Q Results ④

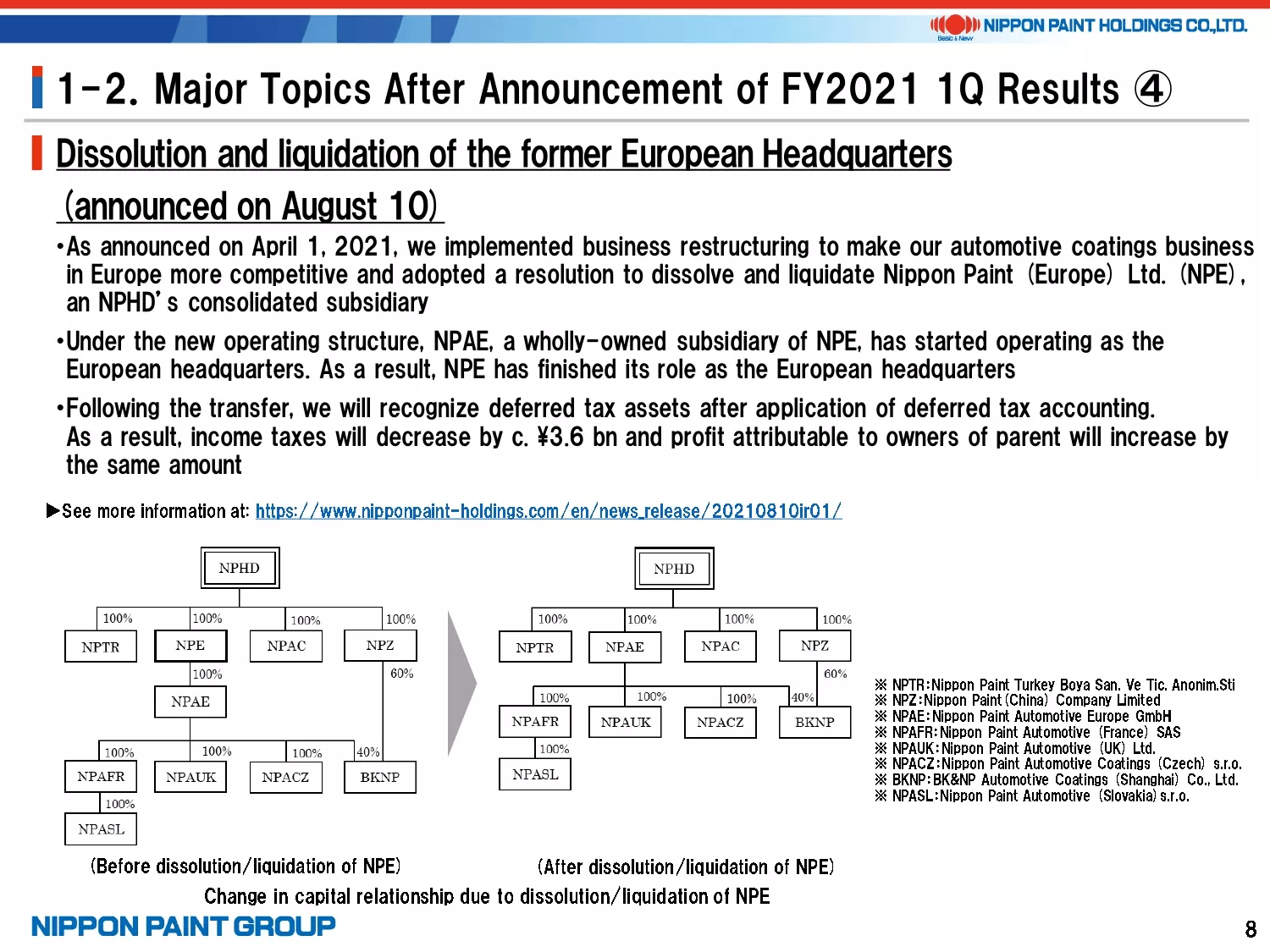

The liquidation of Nippon Paint (Europe) Ltd. (NPE) is accompanying the restructuring of our automotive coatings business in Europe, which we announced on April 1. This liquidation has no direct connection with the divestment of the European business explained on the next page.

As the chart on this page shows, Nippon Paint Automotive Europe GmbH (NPAE), our Group’s German corporation formerly called Bollig & Kemper GmbH & Co. KG, has started operating as the European headquarters for the automotive coatings business. As a result, NPE will be liquidated to reduce an organizational layer. Following this liquidation, income taxes will decrease by about 3.6 billion yen due to the recognition of deferred tax assets after application of deferred tax accounting.

Nippon Paint Turkey Boya San. Ve Tic. Anonim. Sti (NPTR) is wholly-owned by Nippon Paint Holdings, rather than a subsidiary of NPAE, and is excluded from the scope of the share transfer of NPAE to the Wuthelam Group as described on page 9.

8. Major Topics After Announcement of FY2021 1Q Results ⑤ -(1)

Topics on page 9 and page 10 are events that were announced today.

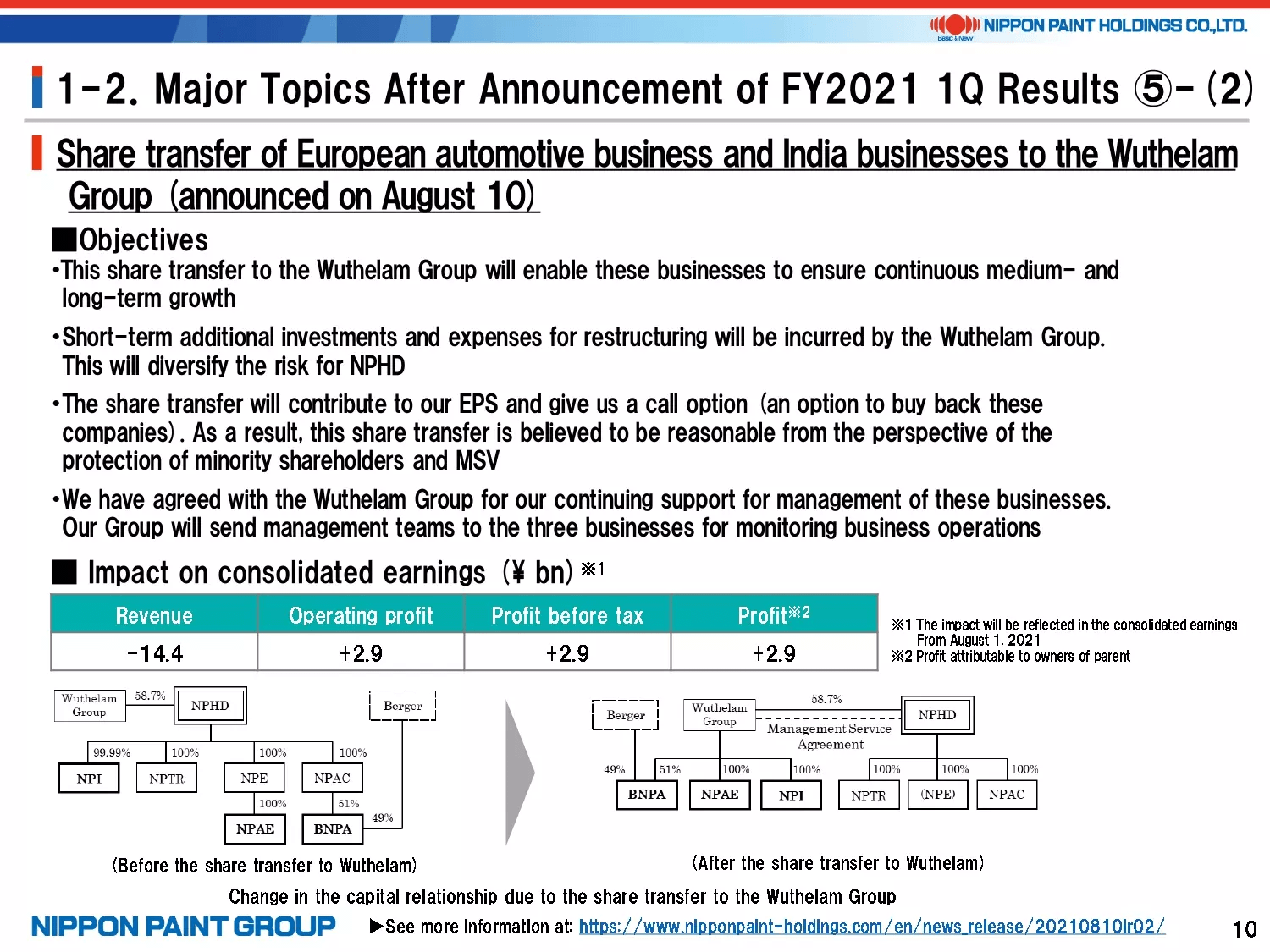

Three companies are subject to the share transfer to the Wuthelam Group. The companies are NPAE and Berger Nippon Paint Automotive Coatings Private Limited (BNPA), which are our automotive coatings companies in Europe and India, respectively, and posted an impairment loss in the fiscal year ended December 31, 2019, and Nippon Paint (India) Private Limited (NPI), a Group company mainly engaged in the decorative paints and auto refinish coatings businesses in India. We have decided that these companies require business restructuring including drastic measures and investments to achieve sustainable growth and profitability. The reasons are challenges shared by these companies and problems specific to individual companies such as the impact of COVID, raw material price increases, and changes in the market environment involving competitors and customers. This decision is not due to the current deterioration of their earnings. In the meantime, significant investments required by the three companies will put financial burdens on the Nippon Paint Group in the short term and create uncertainty about our future operations. Due to these issues, we have considered actions to turn around these companies as Group companies of Nippon Paint Holdings, a publicly owned company.

In the course of examining various options, we had a discussion with the Wuthelam Group, the major shareholder of Nippon Paint Holdings, and came up with a plan to transfer the three companies to the Wuthelam Group. The Nippon Paint Group will be allowed to maintain its presence in the global automotive coatings market as well as have strategic options for the future if the following four conditions are met: (i) additional investments and expenses needed for restructuring of the three companies will be borne by the Wuthelam Group; (ii) Nippon Paint Holdings will retain call options where it may, but not assume obligations to, buy back the shares in the three companies at a time when we see good prospects for success in the restructuring of these companies; (iii) the Wuthelam Group will not sell the three companies to a third party; and (iv) the transfer price will be fair price. In addition, the share transfer will contribute to an increase of the earnings per share (EPS) of Nippon Paint Holdings. Considering these points, we have decided that the share transfer is reasonable from the perspective of protecting the interests of minority shareholders and Maximization of Shareholder Value (MSV).

The transfer will cause a change in the capital relationship involving the three companies. Meanwhile, Europe and India will remain important markets for our Group. Our Group will receive call options to buy back the three companies in the future. In addition, Nippon Paint Holdings will be entrusted by the Wuthelam Group to continue to operate the three companies. Furthermore, the three companies will not change their names following the share transfer. As a result, we believe we can minimize the financial and other impacts of the share transfer, including our business with customers.

Nippon Paint Holdings has agreed with the Wuthelam Group that the repurchase prices are fair. Moreover, at discussions with the Wuthelam Group, we have confirmed that the Wuthelam Group is not expecting to earn profits through the share transfer or capital gains upon exercise of the call options by the Nippon Paint Group.

The impact of the share transfer on consolidated earnings is the estimate for the three companies’ five-month earnings from August to December. Note that exchange rate assumptions are subject to change. Our full-year revenue forecast of 1,010 billion yen takes into account the decrease in revenue resulting from the share transfer as shown in the table on page 10.

To examine the share transfer, which is a transaction with our major shareholder, we set up a special committee consisting of three independent directors. The special committee and the Board of Directors held discussions and approved a resolution for the transaction without Chairman Goh’s involvement. The special committee has confirmed that the transaction is reasonable and protects the interests of minority shareholders sufficiently.

I will discuss the information from page 12 onwards more thoroughly during the Q&A session. But before that, I will explain the information on page 16.

9. Operating Profit Gap Analysis for FY2021 2Q

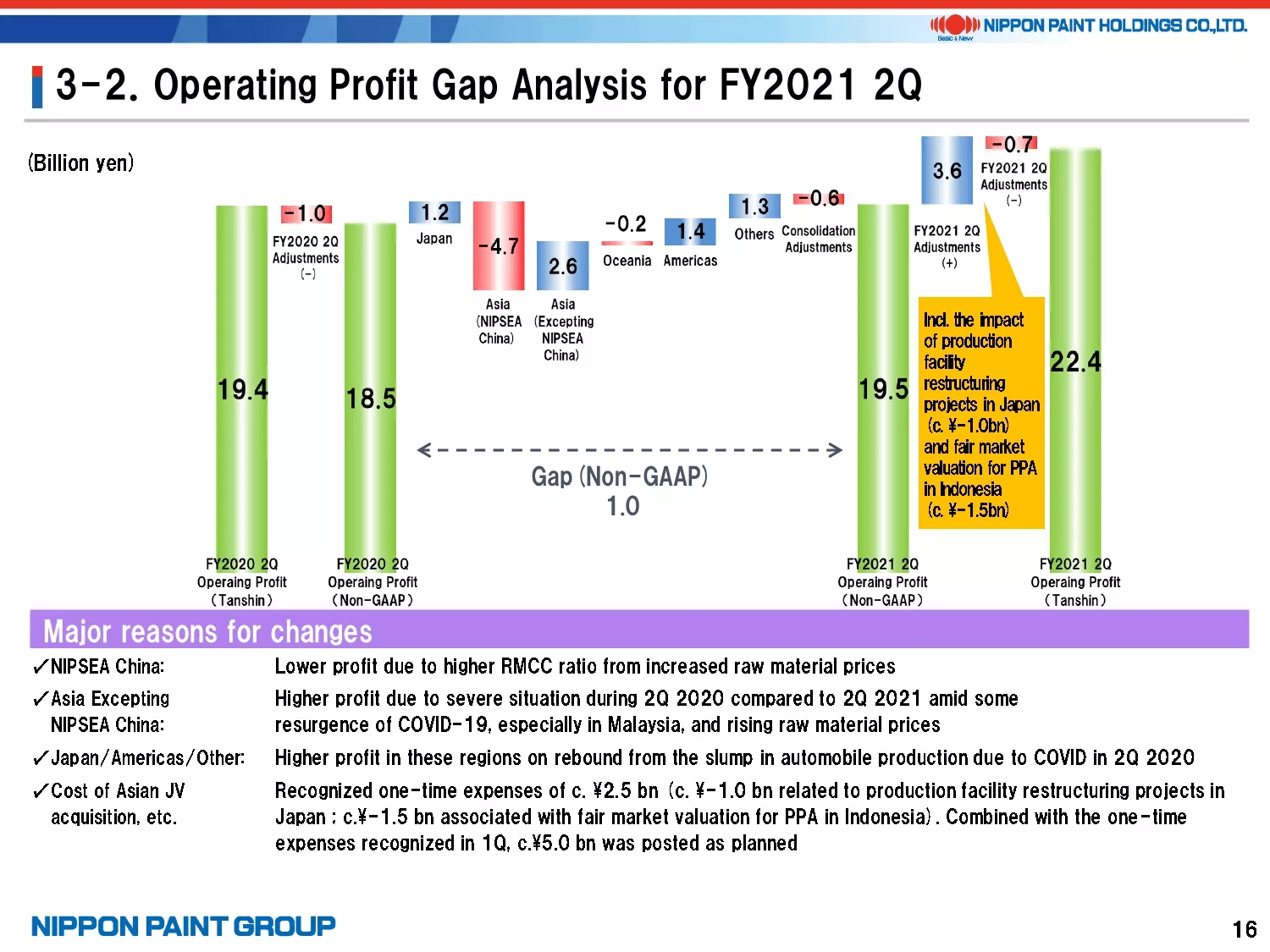

Operating profit in the 2Q increased 1.0 billion yen YoY on a Non-GAAP basis. The increase in operating profit in the 2Q was greater on a Tanshin basis due to adjustments.

Please see the appendix to the presentation for details, but the primary adjustment items are as follows.

- The impact primarily of the new consolidation of the Indonesia business: about +3.2 billion yen

- One-time expense related to PPA for the acquisition of the Indonesia business: about -1.5 billion yen

- Exchange rate fluctuations: about +1.8 bn yen

- Subsidy income for the Chinese business: about +0.4 bn yen

- Restructuring cost related to manufacturing facilities in Japan: about -1.0 bn yen

Combined with the stamp tax and other M&A expenses of 2.6 billion yen that were posted in the 1Q, we recognized a one-time expenses related to the acquisition of 100% ownership of the Asian JVs of 5.0 billion yen in the 1H of FY2021. These are the M&A expenses related to the Asian JVs acquisition, which I explained when we announced our FY2021 earnings forecast in February.

We have increased our operating profit forecast for FY2021 to 102 billion yen. Excluding the impact of the one-time expenses, our operating profit forecast is 107 billion yen.

This concludes the summary of our results for the 2Q of FY2021.