1. Front Cover

Good afternoon, everyone. I’m Yuichiro Wakatsuki, Co-President of Nippon Paint Holdings.

Thank you very much for taking the time today to participate in this progress report briefing on our Medium-Term Plan for FY2021-2023.

2. Executive Summary

I would like to begin with an executive summary.

To recap our progress, we are well positioned to achieve our Medium-Term Plan target. Year 1 of the plan provided the foundation for our Asset Assembler model to deliver solid growth. I would like to take this opportunity to explain our robust model for pursuing Maximization of Shareholder Value (MSV).

Wee Siew Kim and I were appointed as the Co-Presidents on April 28, 2021. We were involved with the formulation of the Medium-Term Plan. This has allowed us to smoothly and speedily implement business strategies based on the plan with the goal of driving autonomous growth in every operating region while aggressively pursuing M&A.

After we became the Co-Presidents, we had thorough discussions at meetings of the Board of Directors regarding our management policy. Our conclusion was to adopt a business model in which we, with a smaller headquarters at the holding company (NPHD), assemble assets focused on attractive markets in the paint and adjacency arena through M&A, while driving autonomous growth of the existing Group partner companies, resulting in strong growth with limited risk. We decided to call this policy the Asset Assembler model. The launch of Nippon Paint Corporate Solutions at the beginning of this year was based on this concept. The Asset Assembler model is not necessarily a change of management policy from the Medium-Term Plan. Rather, we believe Asset Assembler will more clearly define our visionary growth model with MSV as our sole mission.

Looking back on Year 1 of the Medium-Term Plan, we achieved strong revenue growth despite the pandemic, which reaffirms the strengths of our platform. We are well positioned to capture firm demand, in particular in decorative paints, and the current challenging environment allows us to utilize our strengths in regions where we have a high market share to increase our market share. As we announced in February 2022, we expect to achieve our Year 3 revenue target by the end of this year, which is one year early.

On the other hand, we were unable to achieve a satisfactory operating profit due to higher than expected raw material price increases and supply chain disruptions that are affecting our businesses and customers alike. However, we effectively achieved operating profit growth after excluding one-off expenses, backed by solid earnings growth in Australia, Turkey, and Asia except China and the contribution from the newly consolidated Indonesia business. There were also significant savings of head office expenses compared with the initial plan due to the smaller headquarters at the holding company. I believe this highlights our success as an Asset Assembler for assembling excellent assets through M&A.

Based on our results and achievements in Year 1, we maintained our operating profit target for FY2023. Despite various uncertainties, such as the Ukraine crisis and subsequent raw material price movements, we see good prospects for achieving our operating profit target due to revenue growth. This growth is underpinned by solid decorative paint demand and market share gains, coupled with margin improvement due to progress with selling price increases. We will continue to fuel our insatiable appetite for medium- and long-term growth based on the Asset Assembler model after the Medium-Term Plan.

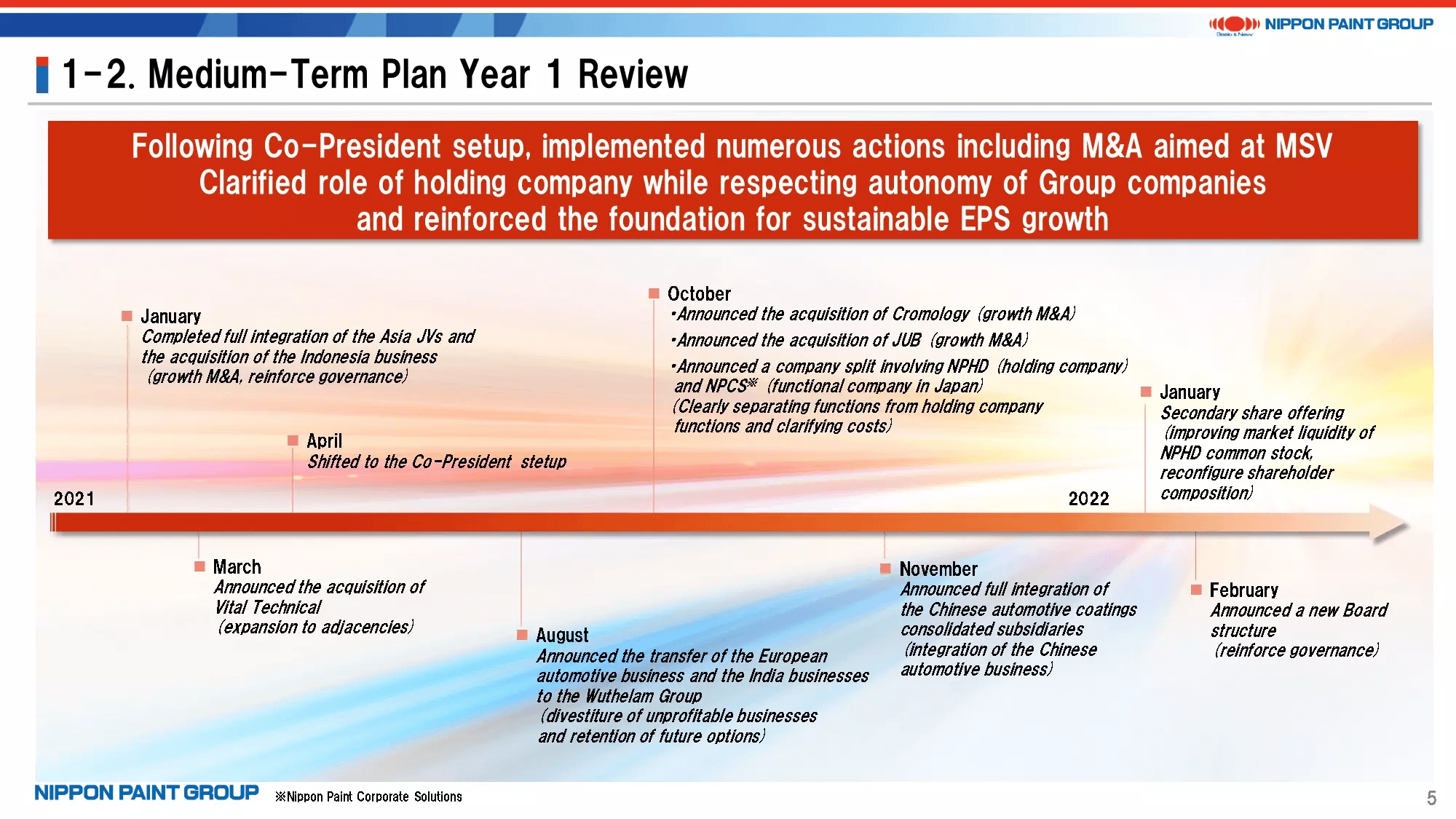

3. Medium Term Plan Year 1 Review

This page lists corporate actions we have announced since January 2021.

There were some concerns, such as a possible slowdown of decision-making, in the early days after the launch of the Co-President setup, which is a rare management structure among listed companies. However, the two of us were able to implement numerous corporate actions speedily through very close communications, with MSV as our shared decision-making guideline.

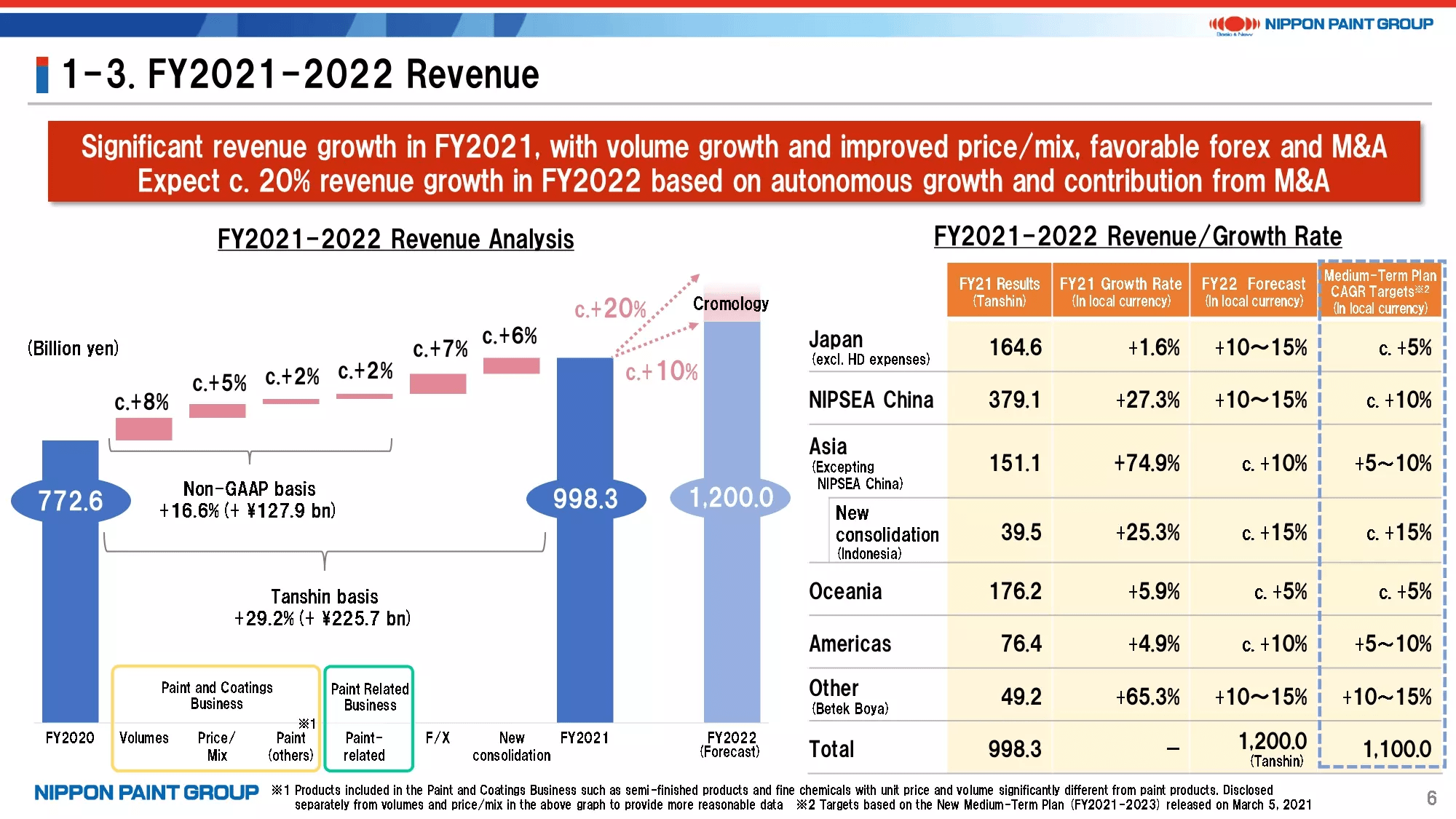

4. FY2021 2022 Revenue

My next subject is our FY2021 performance. This page provides the revenue analysis.

We have provided the volumes and price/mix breakdowns of revenue growth in the paint and coatings business on a trial basis. I hope this information will be useful.

The Medium-Term Plan CAGR targets in the table on the right side of this page are the FY2021-2023 targets announced in March 2021. The FY2022 revenue growth forecast is slightly lower compared to the FY2021 growth rate but is higher than the Medium-Term Plan CAGR targets in almost every region.

Please note that we have increased the FY2022 revenue growth forecast for the Indonesia business and Asia excepting NIPSEA China from the guidance announced in February this year.

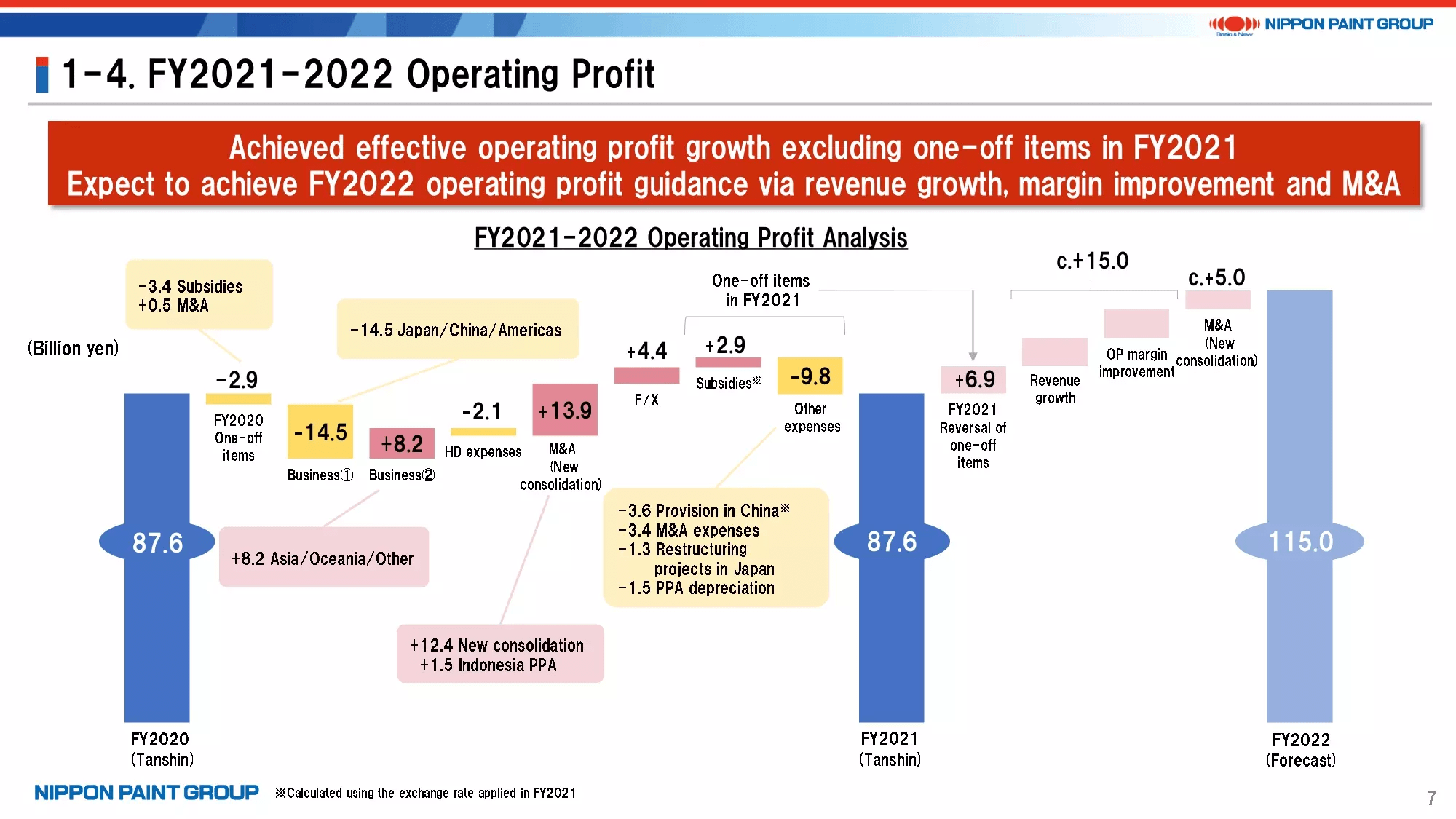

5. FY2021 2022 Operating Profit

This page is an analysis of our operating profit.

Looking at the operating profit bridge analysis between FY2020 and FY2021, you can see that our revenue in Japan, China, and the Americas (Business ①) declined, while our revenue in Asia except China, Oceania, and Turkey (Business ②) increased even in last year’s challenging environment.

Head office expenses increased from FY2020 but declined significantly compared to the increase of around 9.5 billion yen planned at the beginning of FY2021. This is the result from the small headquarters at the holding company I mentioned earlier.

The contribution from M&A was 13.9 billion yen after reversing the one-off inventory step-up in the Indonesia business of 1.5 billion yen, and the forex impact was 4.4 billion yen. After adding one-off subsidies and deducting other expenses, our operating profit was 87.6 billion yen on a Tanshin basis.

Provisions and subsidies related to the Project business in China were reported under adjustments and were 3.2 billion yen and 2.6 billion yen, respectively, based on the exchange rate applied in FY2020. Since this page discusses our operating profit forecast for FY2022, these figures have been revised to 3.6 billion yen and 2.9 billion yen, respectively, based on the exchange rate applied in FY2021.

The effective starting line of our operating profit in FY2021 was 94.5 billion yen, which is the amount obtained by reversing the net one-off items of around 6.9 billion yen to the FY2021 operating profit of 87.6 billion yen. Our road map for achieving an operating profit of 115 billion yen in FY2022 is through an effective operating profit increase of around 15 billion yen. This increase does not include the expected contribution of around 5 billion yen from the new consolidation of Cromology. We aim to fill in this gap regarding our operating profit target with a higher operating profit due to higher revenue and margin improvements. This is our plan for FY2022. Our assumptions are 10-plus% revenue growth excluding Cromology, which will add around 100 billion yen to FY2022 revenue. If we assume a 10% operating profit margin, then, we can expect a 10 billion yen increase in operating profit. We believe that the remaining 5 billion yen operating profit needed to achieve the FY2022 operating profit forecast can be achieved through a margin improvement of 0.5pt on a full-year basis. We believe this target is well within reach. To improve the operating profit margin, we will take actions such as raising selling prices and reducing fixed costs to an optimal level.

6. Towards FY2023 Year 3 of the Medium Term Plan

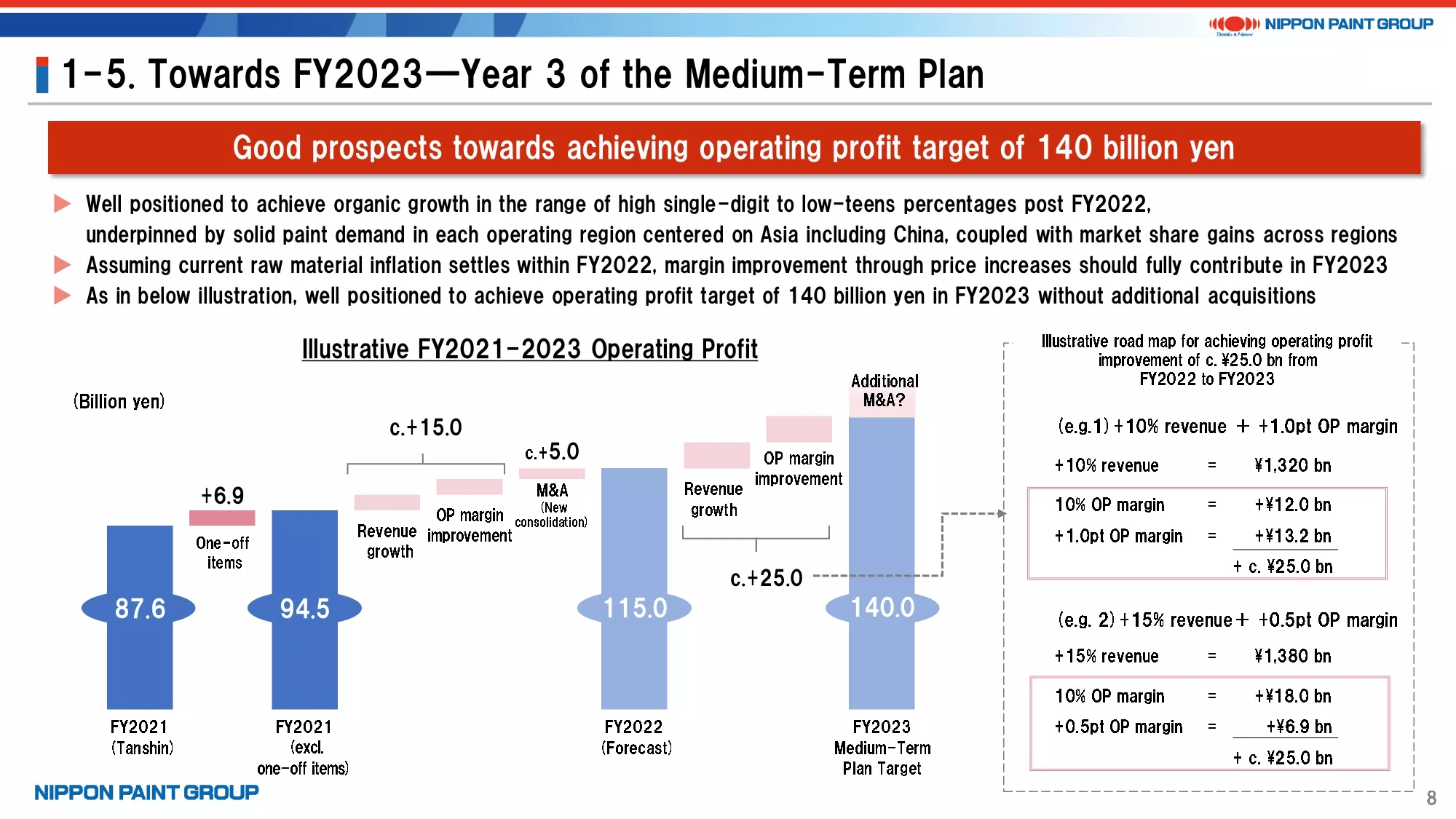

Looking ahead to FY2023, Year 3 of the Medium-Term Plan, we have maintained the operating profit target of 140 billion yen as I mentioned at the start of my presentation.

We have not announced our FY2023 guidance yet. However, based on the FY2022 operating profit guidance of 115 billion yen, we will need to improve our operating profit by 25 billion yen to achieve our FY2023 guidance of 140 billion yen. We plan to accomplish this with profit growth linked to revenue growth and margin improvements. The right side of this page provides two examples. One is the combination of 10% revenue growth and a 1.0pt margin improvement. The other is the combination of 15% revenue growth and a 0.5pt margin improvement. In both cases, an operating profit increase of around 25 billion yen is well within our reach.

Even so, the assumed margin is still lower than our Medium-Term Plan target of 13%. Therefore, we will aim to raise the margin from this level. If we can add contributions from new acquisitions, and we will certainly aim to do so, we have good prospects for achieving an operating profit of more than 140 billion yen.

Although these numbers are only approximations of possible outcomes, they clearly demonstrate the strengths of our Asset Assembler model.

7. Asset Assembler ①

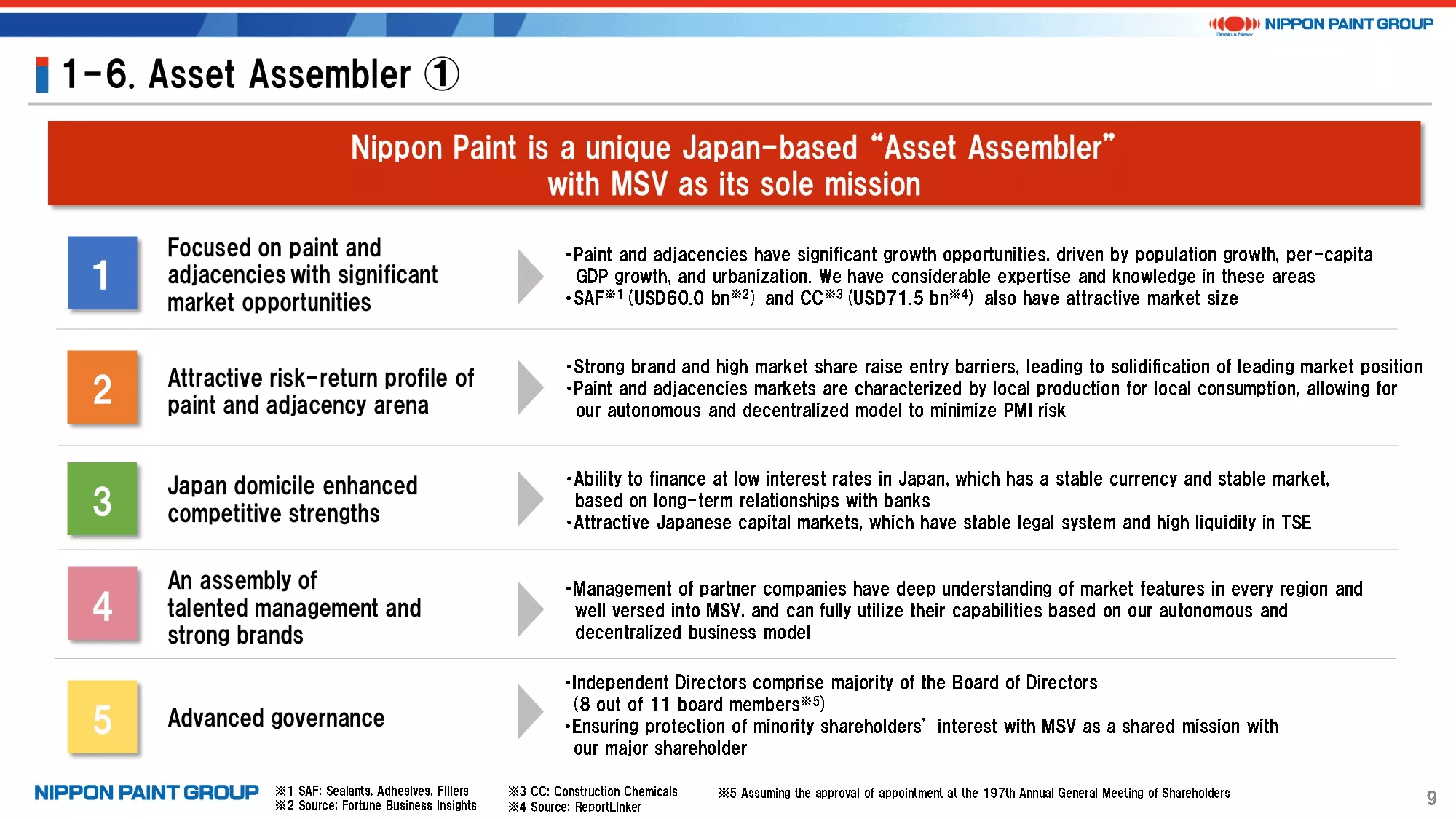

This page explains the strengths underlying our Asset Assembler model.

First, we are focused on paint and adjacencies with significant market opportunities. These are areas where markets are enormous and growing and where we have considerable expertise and knowledge.

Second, paint and adjacencies markets have low risk and good returns. These markets may not have the potential for explosive growth, but we can expect profit and cash flow generation with some degree of certainty. These characteristics make those areas well suited to M&A.

Third, our Japan domicile enhances our competitive strengths. The ability to obtain funds with low interest rates, the stability of the yen, and the support of Japanese financial institutions give us valuable competitive advantages over our global competitors.

Fourth, our strengths as an assembly of excellent talent and brands. We believe that our focus on paint and adjacencies markets makes it possible to generate greater than expected synergies based on our Asset Assembler model. We use this model to assemble talent and brands that are outstanding on their own with synergies expected from this model that may be different from global standardization and cost reduction synergies expected based on Western M&A models. The Asset Assembler model can bring out the full potential of every Group partner company in the paint and coatings industry, which is characterized by local production for local consumption. We believe that these strengths will attract more potential partners to join the Nippon Paint Group.

Fifth, we have established an advanced and effective governance structure with independent directors comprising the majority of the Board of Directors. In addition, all members of the Board of Directors use the clear decision-making guideline of realizing MSV. This governance structure, along with the robustness of the concept of MSV, makes our competitive strengths stand out among competitors.

8. Asset Assembler ②

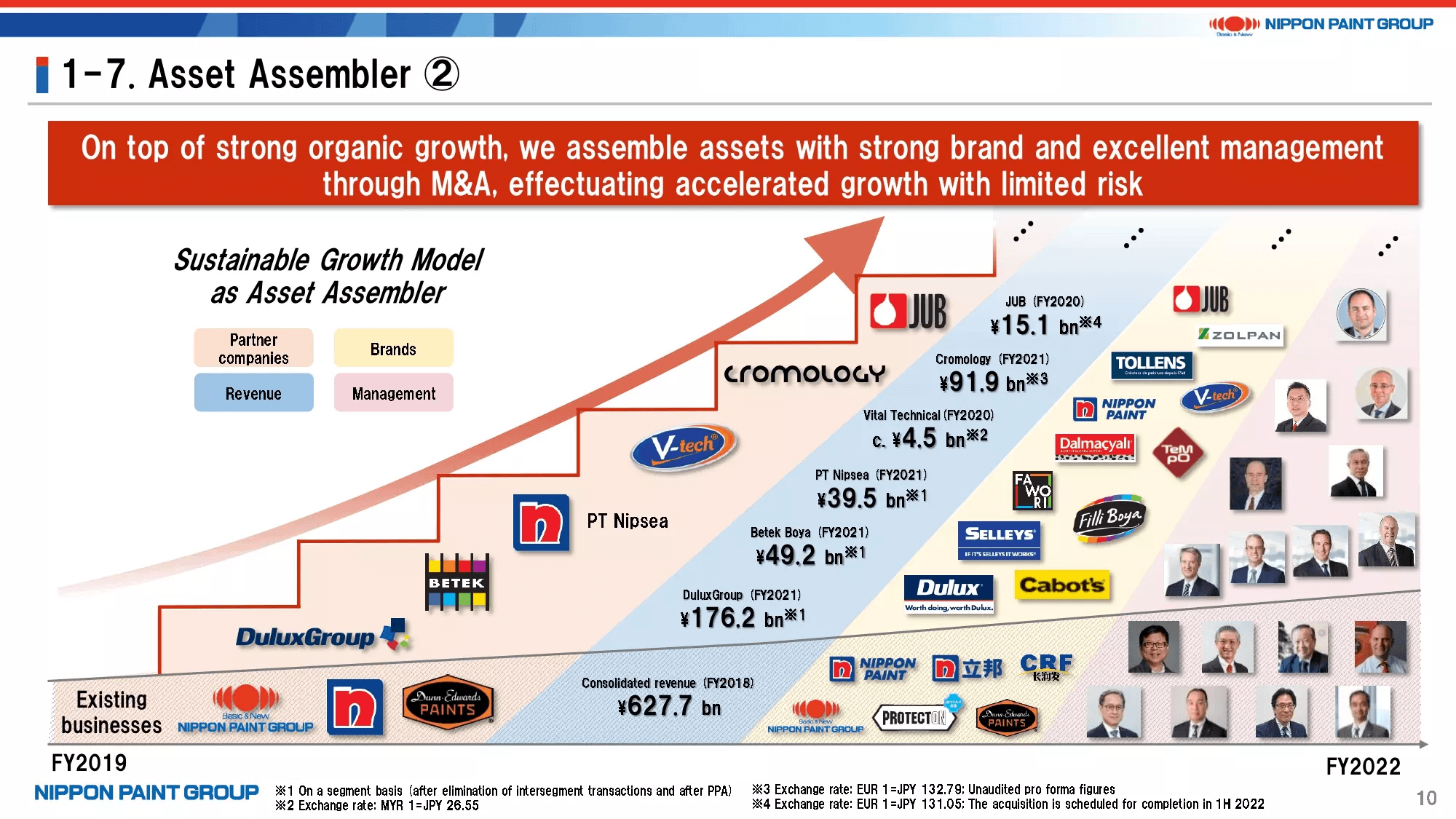

This page explains the Asset Assembler model.

The key element of this model is that excellent management teams pursue autonomous growth in the Nippon Paint Group and exploit the technological strengths, distribution networks, purchasing capabilities, and financing capabilities of the Nippon Paint Group platform, rather than relying on initiatives of the headquarters. This will allow us to accumulate expertise in various areas and generate synergies as well as to attract new partners to the Nippon Paint Group.

By focusing on the paint and adjacencies markets, which are growth markets with the ability to generate substantial earnings and cash, Asset Assembler model allows us to accelerate growth with limited PMI (Post Merger Integration) risk involving M&A.

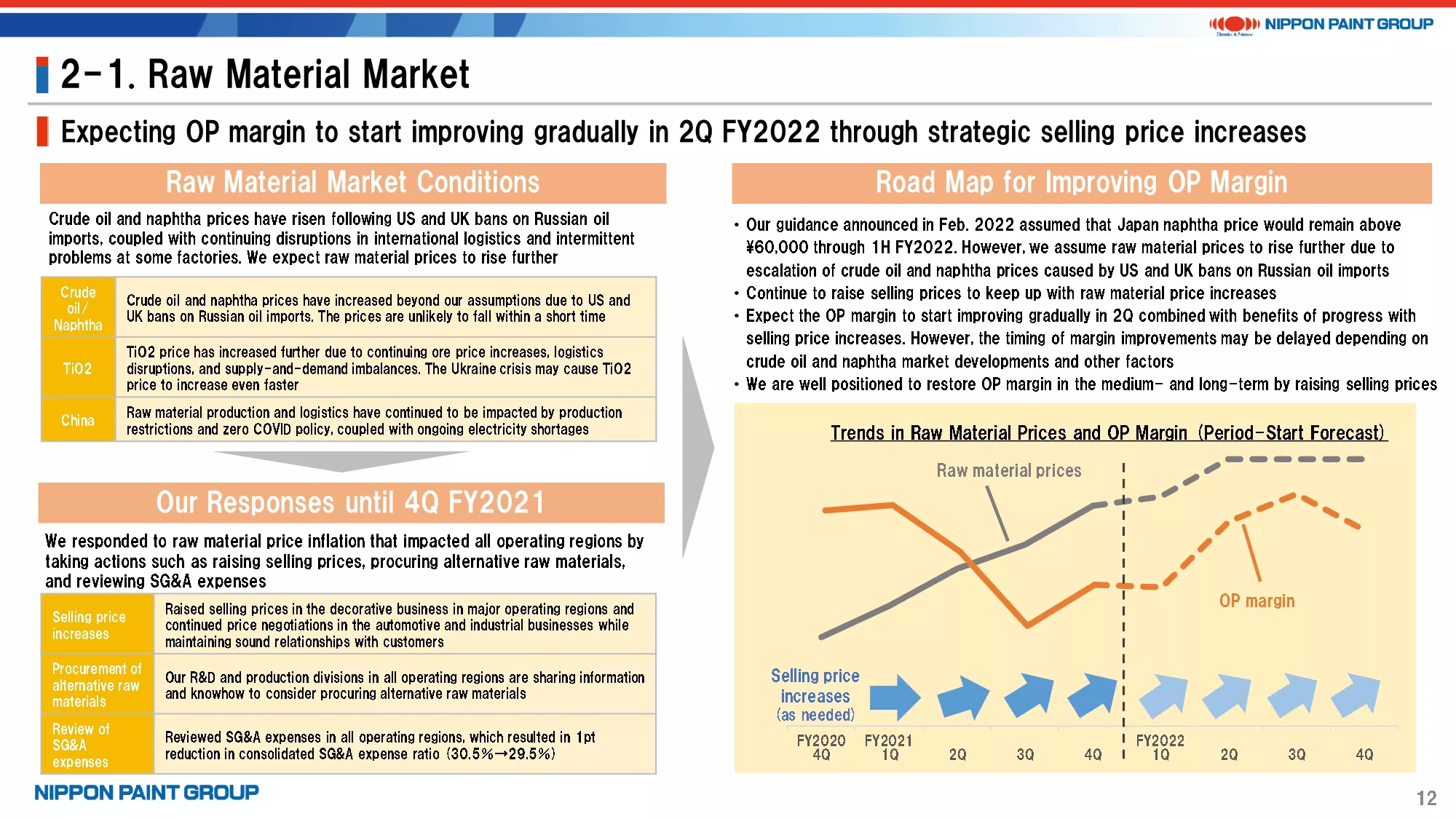

9. Raw Material Market

My next topic is our strategy for individual regions and businesses. Many of the points in this section were covered in our financial results conference call in February. Therefore, I will only give a brief explanation to leave more time for the Q&A session.

I will start with discussing the raw material market, which many investors are concerned about. This is one of the top questions we receive from investors. Our assumption is that raw material prices will continue to increase through the first half of this year. Coupled with uncertainties involving the Ukraine crisis, the situation remains uncertain. We will continue to take actions to raise selling prices wherever and whenever possible.

As shown in lower right graph on this page, our plans are to gradually improve the operating profit margin due to progress with selling price increases after this margin stopped declining in the 3Q of FY2021, and then to significantly improve the margin during the 2Q or 3Q this year, when demand is highest. We expect the 4Q operating profit margin to be lower than in the 3Q because demand is off-peak but to be higher than one year earlier.

Uncertainties such as the impact of the Ukraine crisis on raw material markets, disruptions of logistics, and more recently, the impact of lockdowns due to the resurgence of the pandemic in China, have not eased since our FY2022 guidance announcement in February this year. As a result, our margin recovery may be delayed. Based on a medium- and long-term perspective, given that price sensitivity of paint demand is not necessarily high due to characteristics of the paint industry, we believe we can achieve a certain margin improvement sooner or later, although with some delays. For instance, paint demand is shifting to water-based paint in some regions and market sectors. We believe this shift could lessen the impact of high crude oil prices compared to when demand is mostly for solvent-based paints.

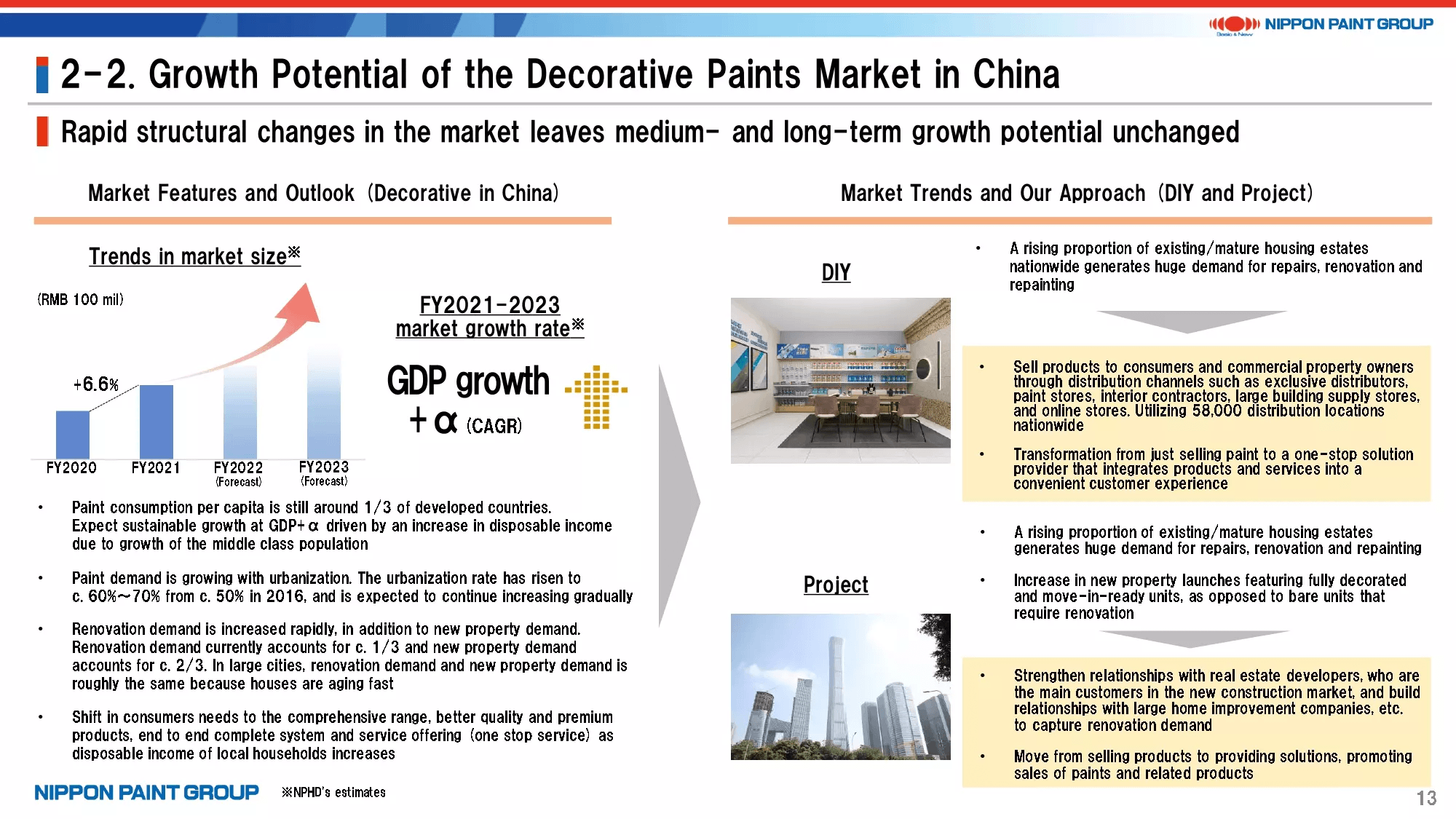

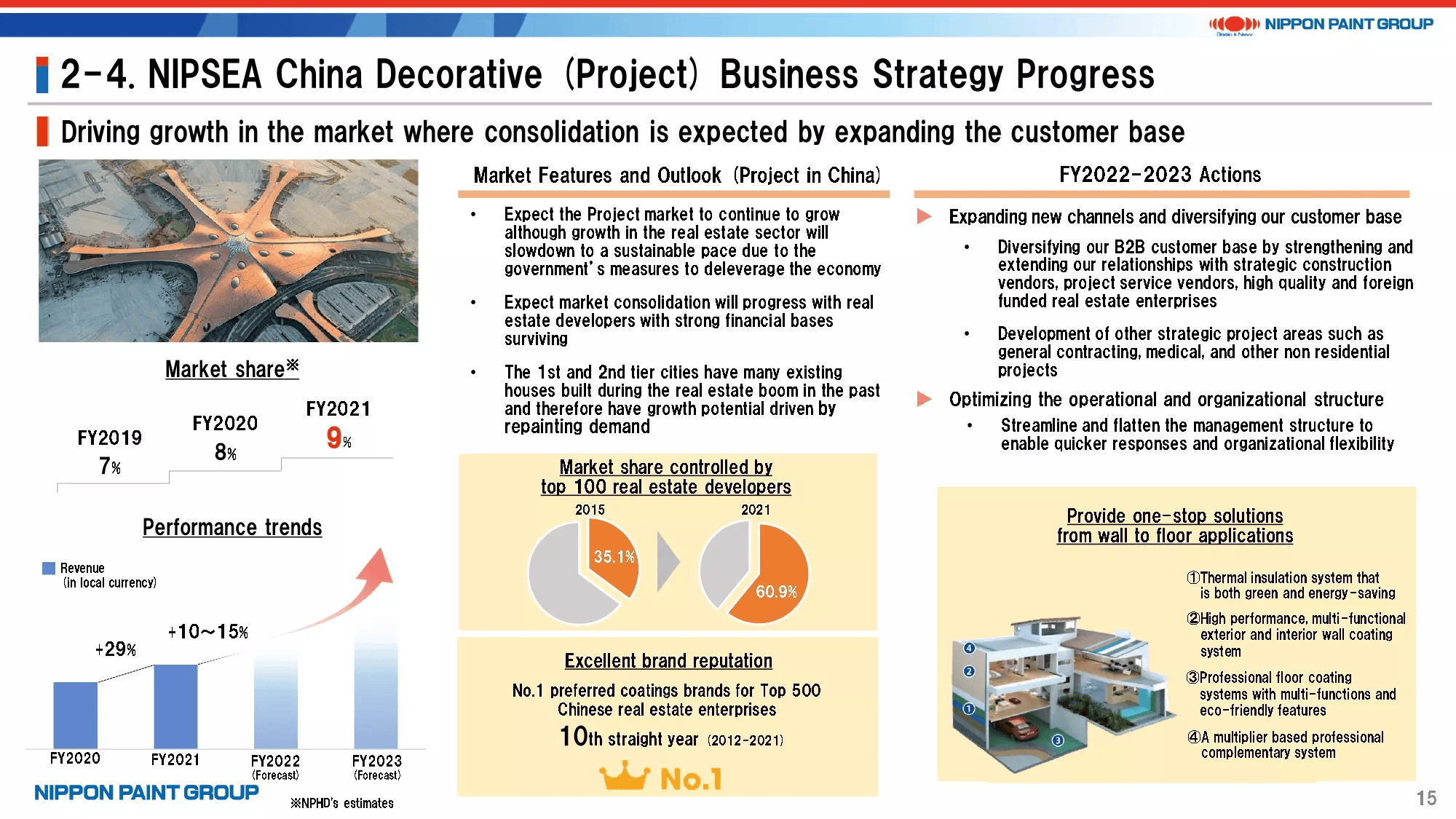

10. Growth Potential of the Decorative Paints Market in China

I will move on to our Chinese business, which is another topic of strong interest among investors.

There are many views about paint demand in China. We believe decorative paints in China is an excellent market with potential for GDP + α growth. Per-capita paint consumption in China is only around one-third that of developed countries, urbanization is continuously increasing, the Chinese government has a consistent policy of providing high-quality housing to its citizens, and there is enormous repainting demand, mainly for private-sector houses that were built in large volumes beginning in the late 1990s.

Decorative paints in China is a dynamically changing market and we will anticipate and take aggressive actions to respond to any changes. In fact, our Chinese team has done this and will maintain this approach in the future. Our strategy is to remain competitive by enhancing added value as a solution provider, by improving the user experience and by expanding our product range beyond paint.

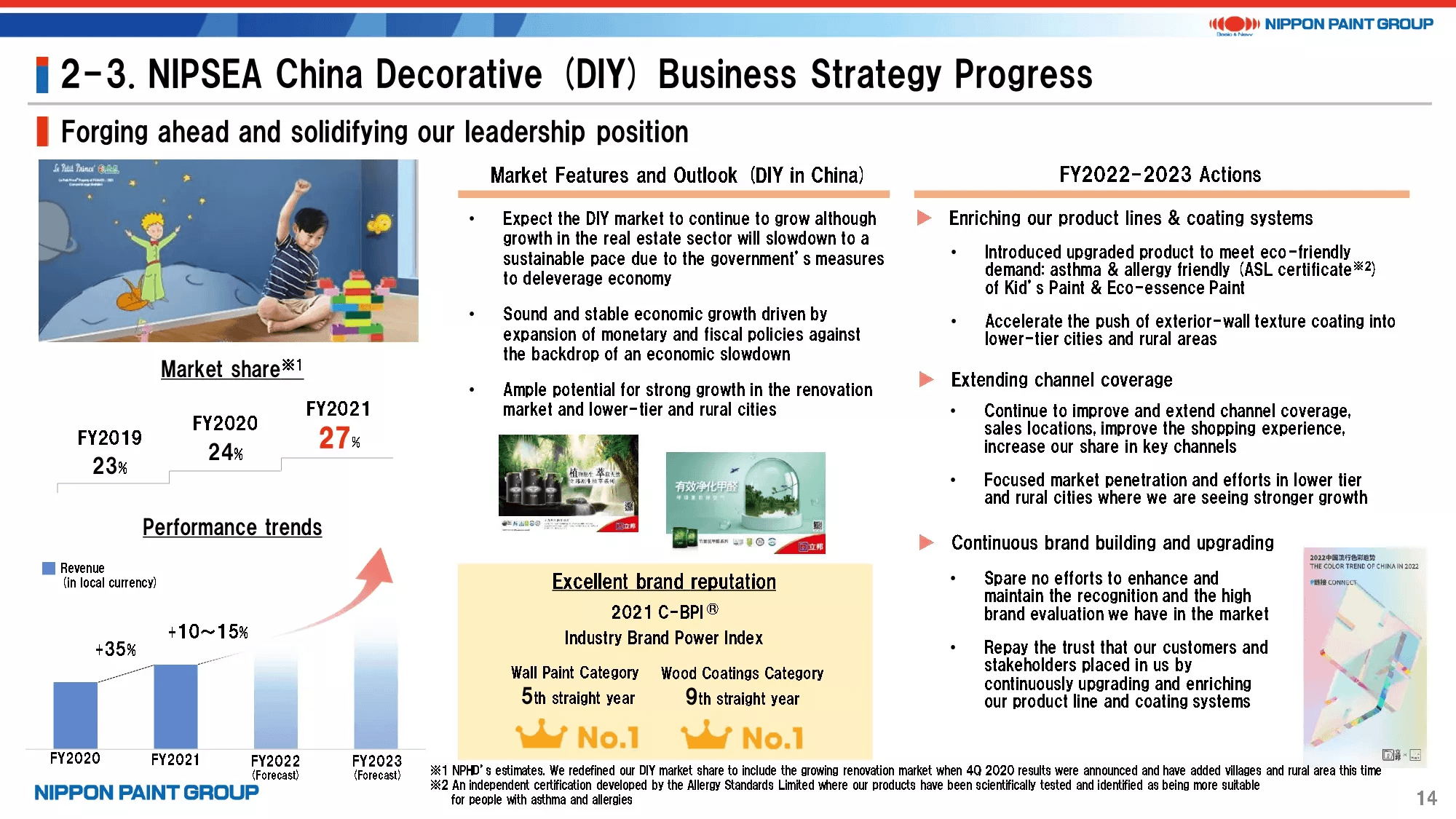

11. NIPSEA China Decorative (DIY) Business Strategy Progress

I will not cover pages 14 and 15 because I have discussed developments in the Chinese DIY and Project markets on prior occasions. But I would like to point out one thing: we updated our market share numbers from those announced at the Investor Briefing on the NIPSEA Business in September 2021.

In particular, we have revised our market share in the DIY segment from 33% to 27% in FY2021. This market share revision is due to the larger denominator as a result of the inclusion of repainting demand and demand in rural markets, with sales remaining constant. This is an example of the dynamism of the market, while at the same time shows our potential for further market share gains.

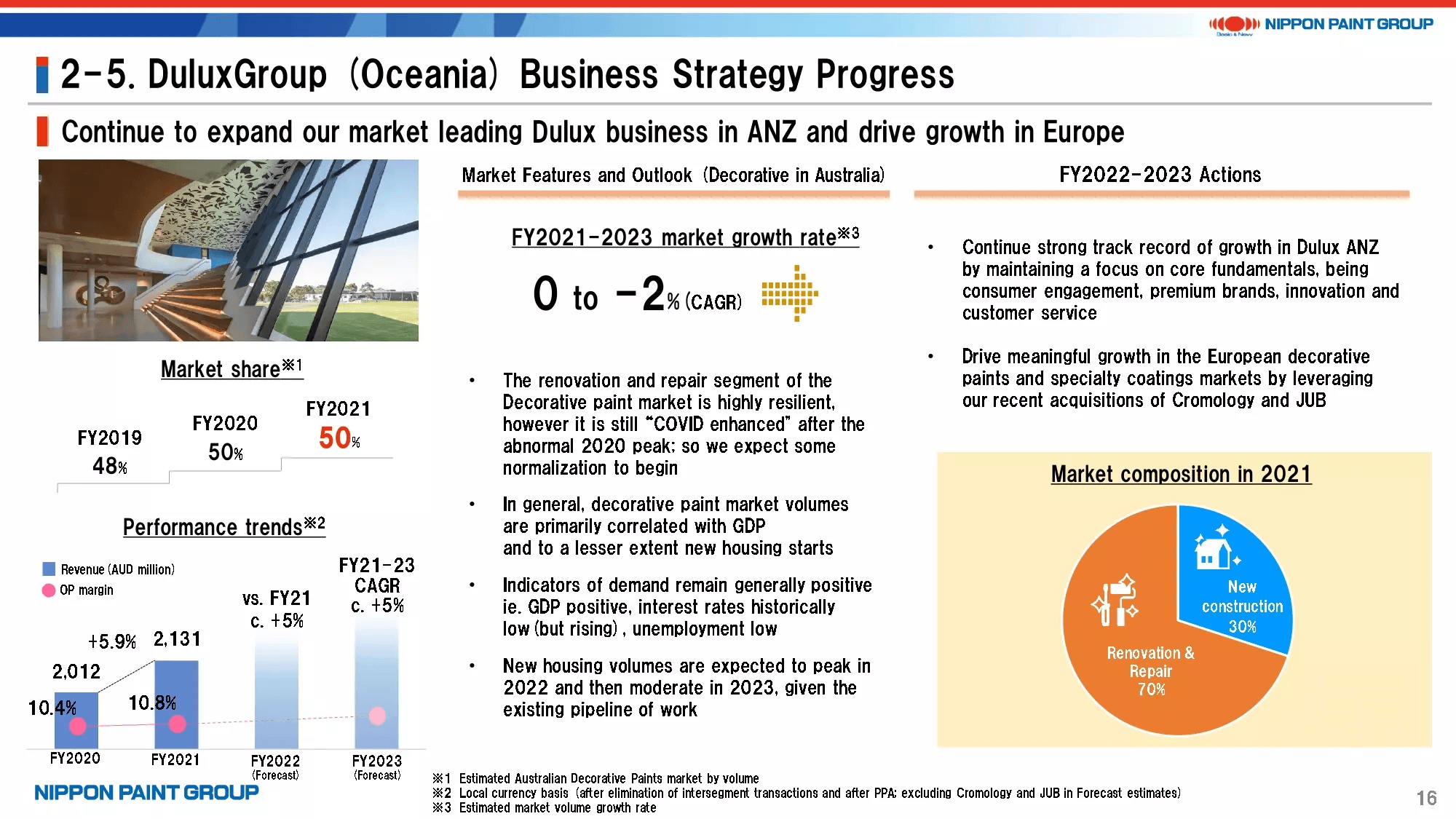

12. DuluxGroup (Oceania) Business Strategy Progress

DuluxGroup is highlighted by very stable growth in the Group and we expect this growth to continue. As a side note, DuluxGroup achieved solid revenue growth in FY2021 despite a contraction in the DIY market compared to the pandemic-fueled stay-home demand in FY2020.

I have great trust in the DuluxGroup team led by the CEO Patrick Houlihan. I’m confident that they will continue to grow in FY2022, including the new consolidation of Cromology and JUB.

We forecast that DuluxGroup’s revenue growth will be slightly lower in the 1H of FY2022 compared to the pandemic-fueled demand a year earlier. However, DuluxGroup expects that its revenue will start increasing YoY in the 3Q to 4Q of FY2022 and achieve solid growth on a full-year basis.

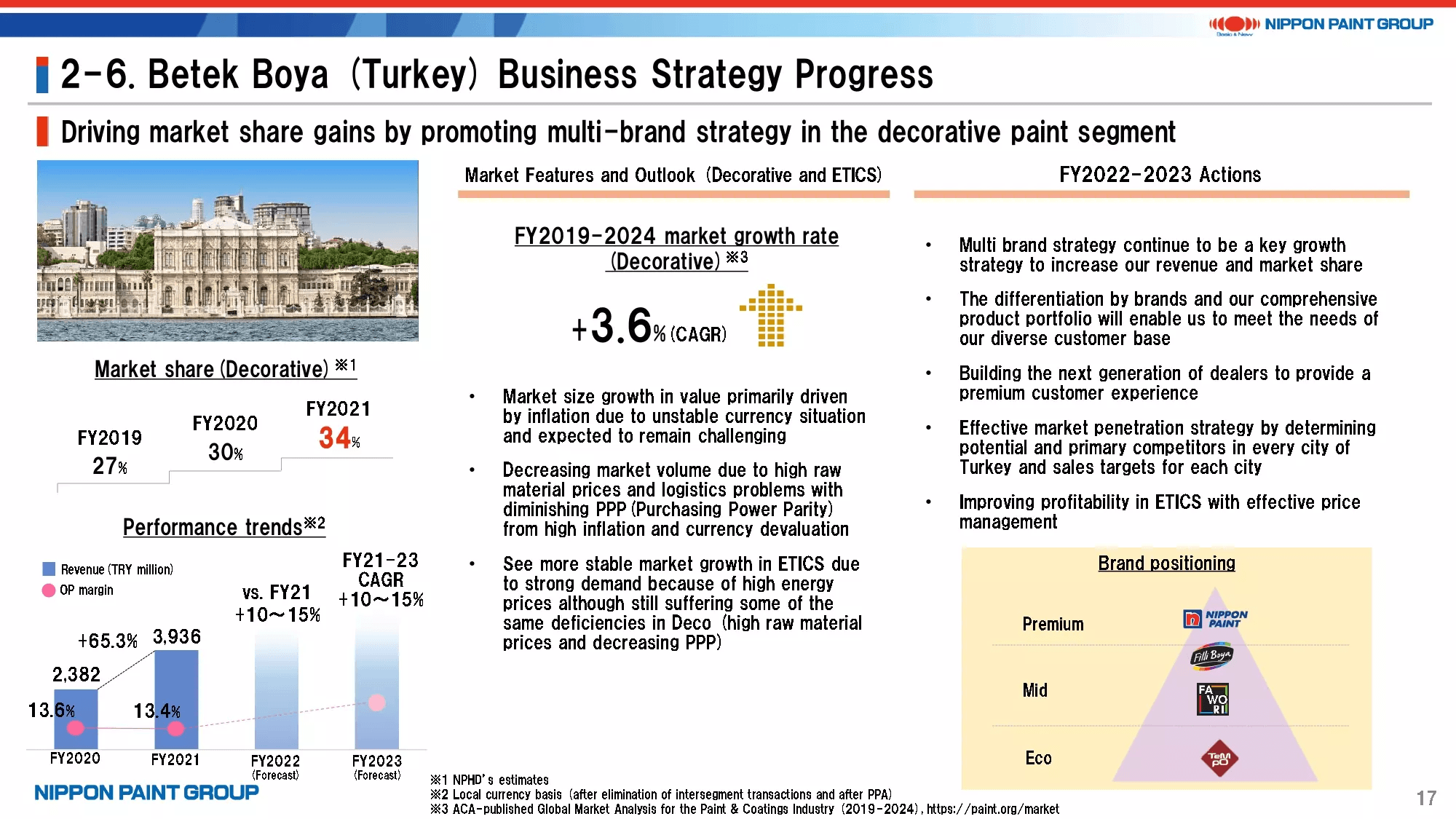

13. Betek Boya (Turkey) Business Strategy Progress

The Betek Boya team also achieved a solid market share increase and earnings growth despite hyperinflation by responding with agility to drastic changes in the business environment. There is some pre-consumption of demand occurring in the inflationary environment, but we expect that strong growth will continue at Betek Boya.

However, their contribution on a yen basis in FY2022 will probably be smaller than in FY2021 due to the sharp depreciation of the Turkish lira.

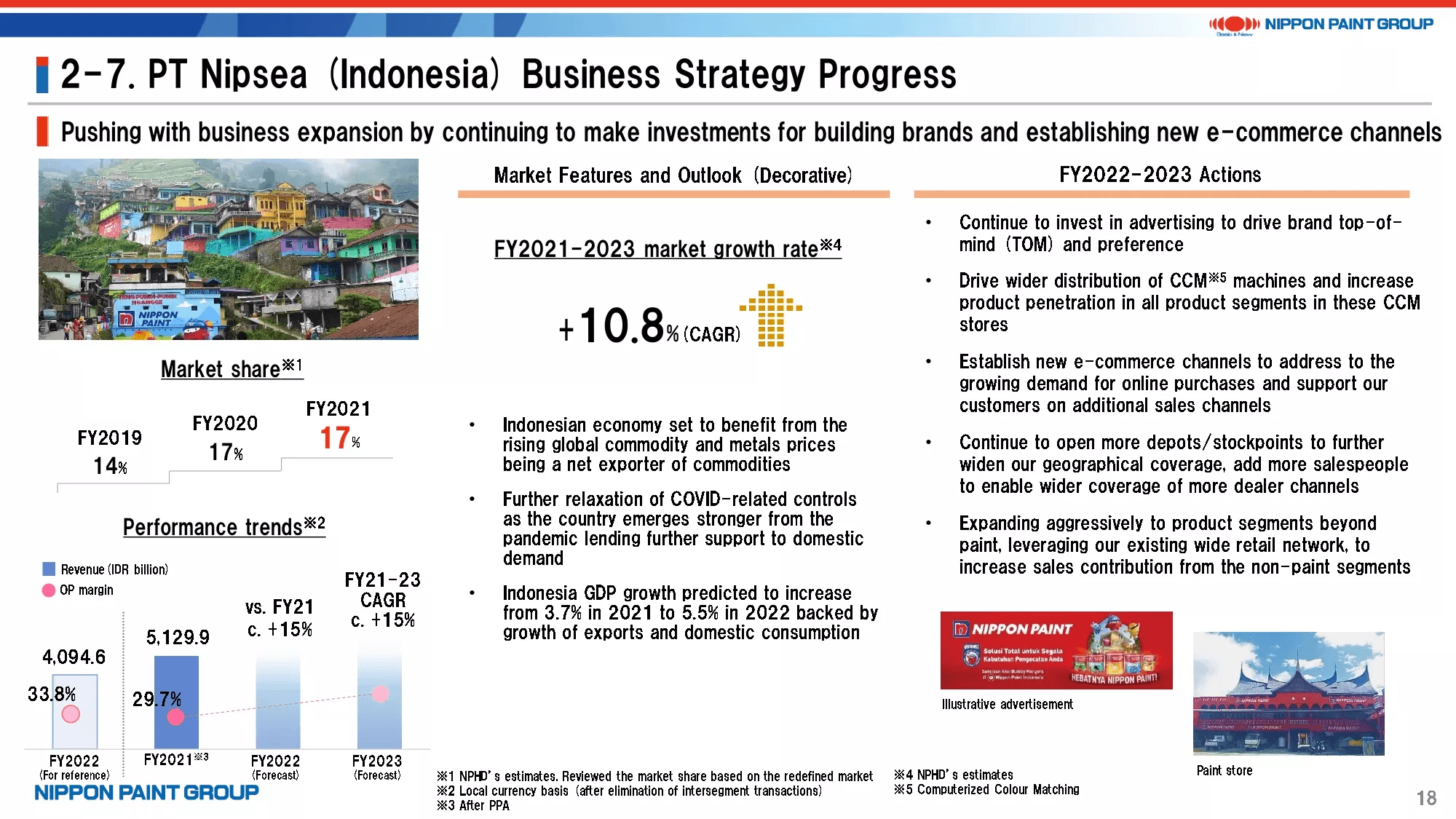

14. PT Nipsea (Indonesia) Business Strategy Progress

The Indonesia business achieved solid revenue growth of 25% YoY in FY2021 despite the lockdowns in the 3Q. Our medium- and long-term outlook factors in a high operating profit margin and high growth.

Based on the information disclosed in the IPO prospectus of an Indonesian paint manufacturer in FY2021, our market share is the second largest following this local paint manufacturer. Our current market share of 17% is not satisfactory at all and we will take many actions to further increase our market share. We had assumed that we had the largest market share in Indonesia, but I would like to take this opportunity to correct this information.

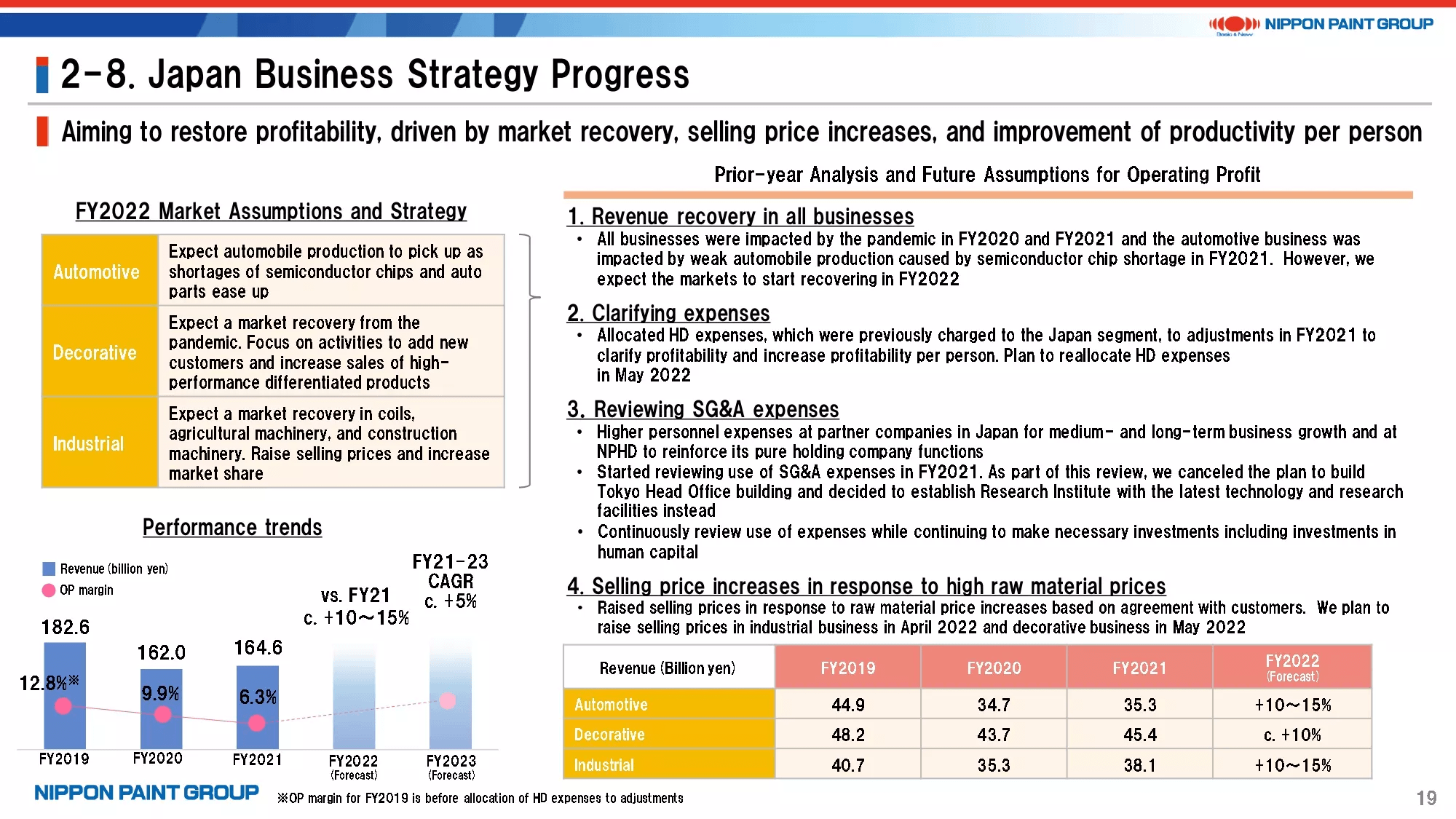

15. Japan Business Strategy Progress

The Japan segment is also a topic of much interest among investors.

In the Japan segment, the automotive coatings business accounts for a large percentage of total revenue. As a result, this segment faced a challenging environment in FY2020 and FY2021 because a decrease in automobile production due to the pandemic and semiconductor chip shortage caused its revenue to decrease and fixed costs to increase. In addition, the situation was exacerbated by raw material price inflation. We will have no choice other than raising our selling prices based on negotiations with customers if the impact of this inflation gets too large to be offset by our own actions. In fact, we have been implementing selling price increases since the second half of FY2021.

End-user demand is strong for automobiles, so we believe our revenue is very likely to recover if production at automobile manufacturers increases when shortages of semiconductor chips and other components end.

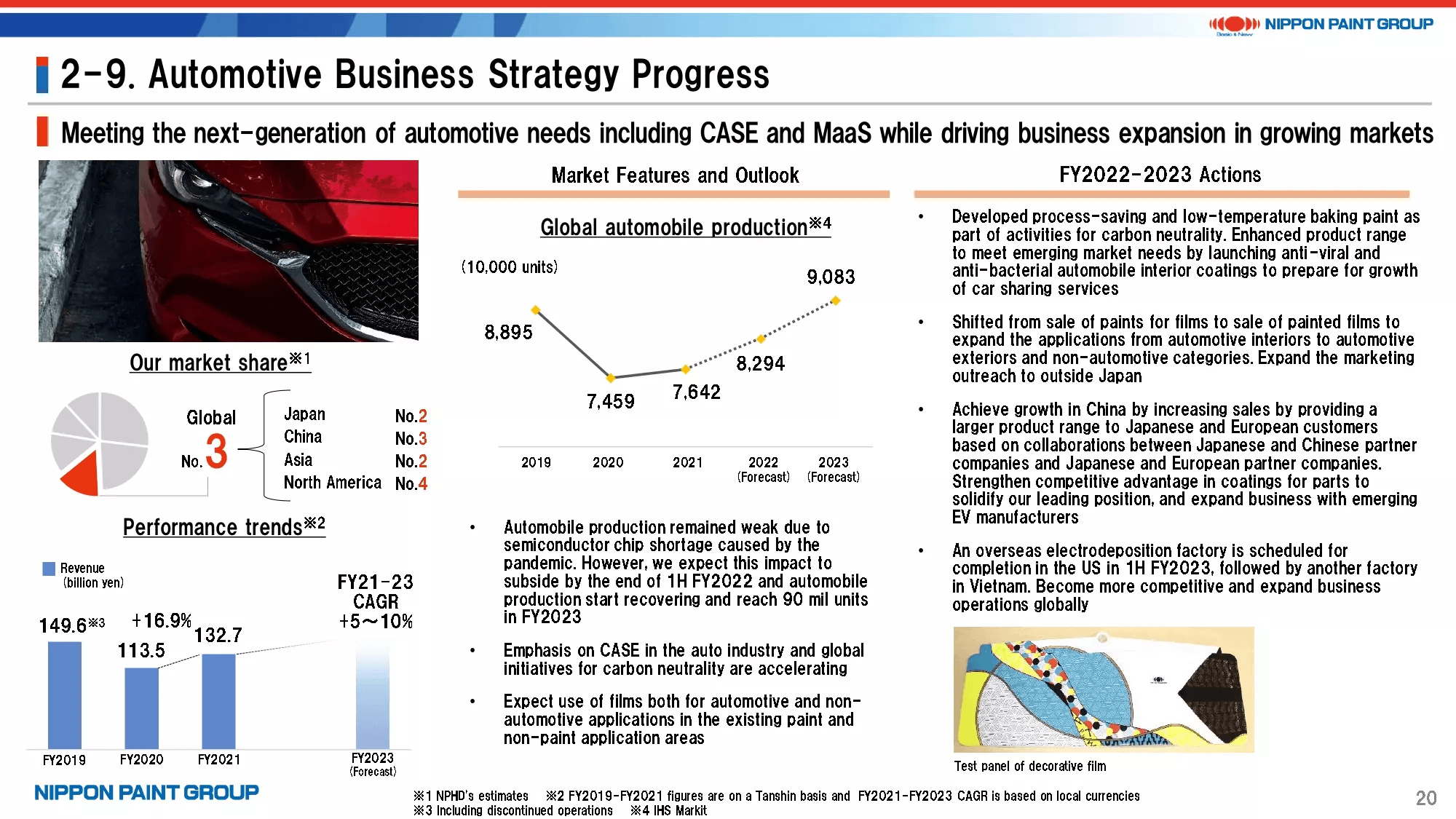

16. Automotive Business Strategy Progress

In addition to revenue recovery with automobile production recovery, we will pursue differentiation by selling environmentally friendly products that leverage our technological strengths.

With initiatives for carbon neutrality accelerating in the auto industry, we plan to develop low-temperature baking energy-saving paint and expand the environmentally friendly film business with the goal of reducing VOC (Volatile Organic Compounds) emissions from paint production processes. We believe our film technologies can be applied to other areas such as construction.

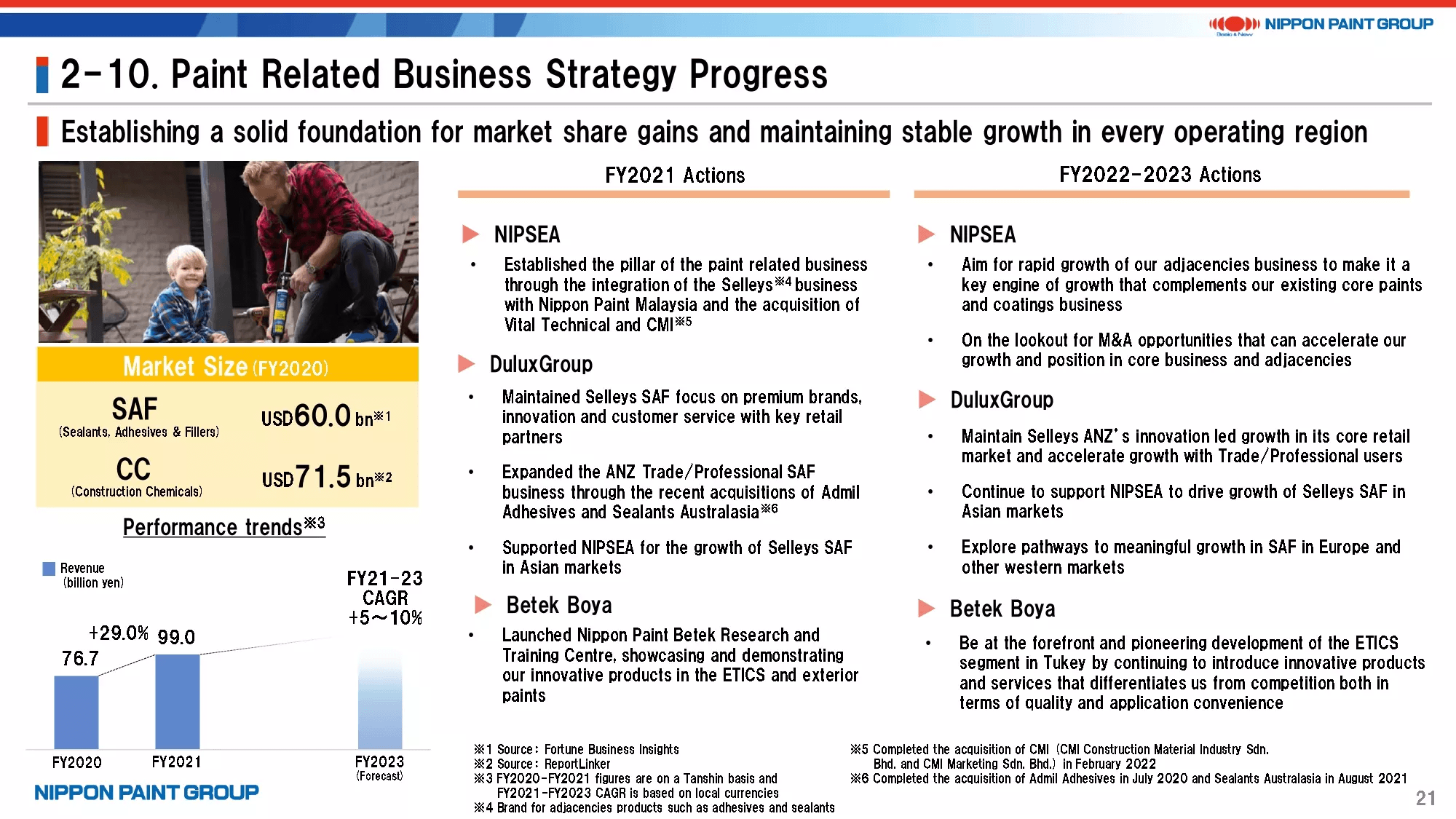

17. Paint Related Business Strategy Progress

The final business strategy topic is progress in the paint related business.

The paint-related market including SAF (Sealants, Adhesives & Fillers) and CC (Construction Chemicals) has huge demand globally with much potential for market growth driven by construction demand, just as for paint and coatings. In addition, this market is brand-based, CAPEX-light business and can share many of our paint distribution networks. Considering these factors, we believe this market is very promising.

We did not start the paint related business from scratch. This business started when we acquired the Selleys brand of highly profitable adhesive products with the acquisition of DuluxGroup. We have subsequently built on a broad range of experience. For instance, the Selleys business was recording losses in Asia but has become a profit-making business after we rolled out Selleys brand products in Asia using NIPSEA’s distribution network.

This experience led us to acquire Vital Technical in Malaysia in March 2021, and this company also has achieved significant earnings growth since the acquisition. Betek Boya’s business includes a construction materials business with a high market share and high margin. We are considering the expansion of sales of Betek Boya’s ETICS and other construction materials to Europe following the recent acquisitions of Cromology and JUB.

The key point is that the holding company is not directly involved in these initiatives. Rather, our Asset Assembler model has enabled Group partner companies to aggressively pursue growth by leveraging their own resources.

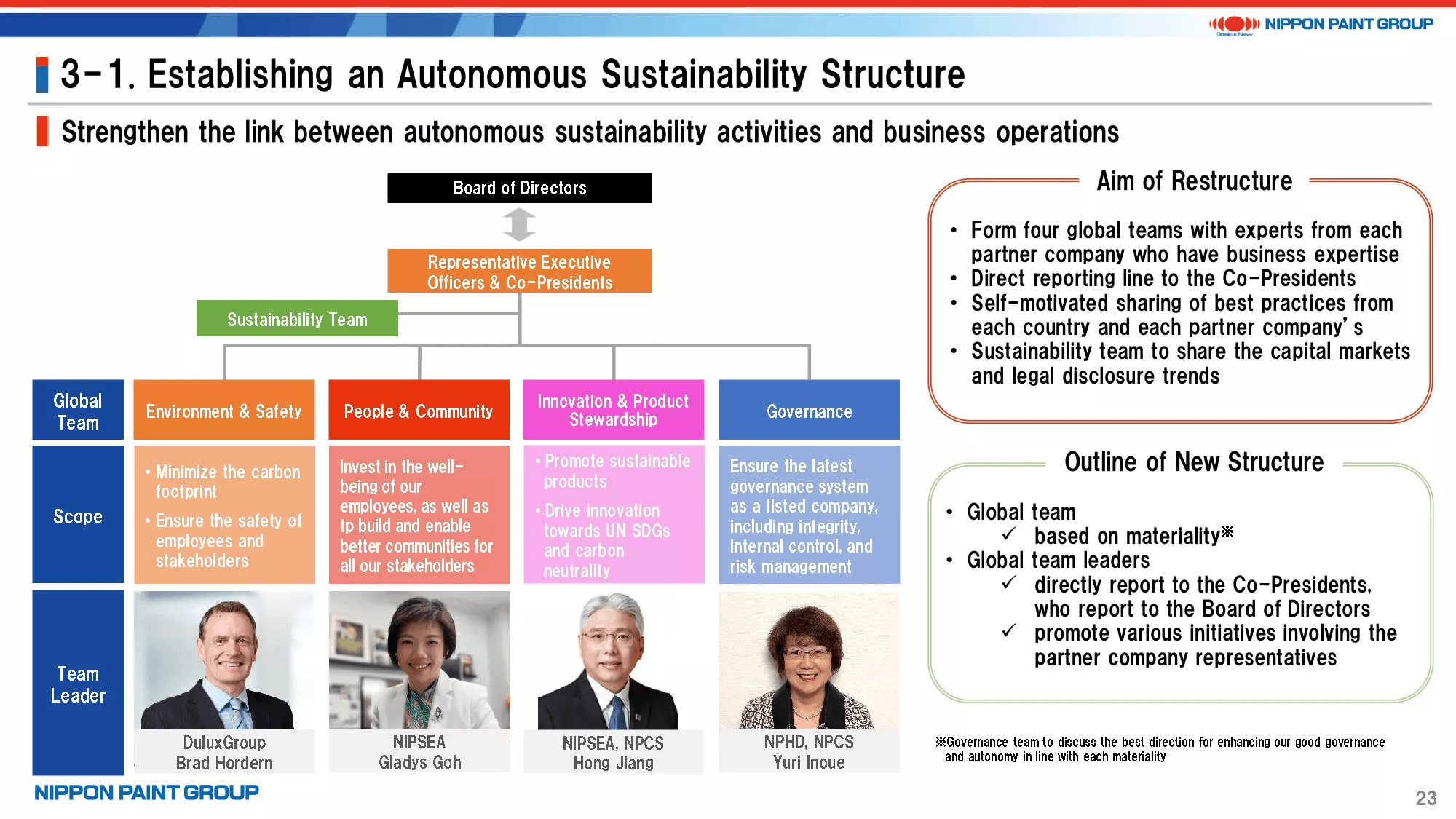

18. Establishing an Autonomous Sustainability Structure

Next is an explanation of our sustainability strategy.

We reorganized the sustainability structure into an autonomous team structure by strengthening the link between sustainability initiatives and businesses. This replaces a structure to promote sustainability initiatives led by the holding company. We established four global teams based on materiality directly under the Representative Executive Officers & Co-Presidents. Our sustainability initiatives will be conducted on a global scale led by four global business leaders.

From the perspective of sustainability governance, each global leader directly reports to the Co-Presidents, who will then report progress and proposals to the Board of Directors whenever necessary. This structure allows the Board of Directors to supervise our sustainability initiatives.

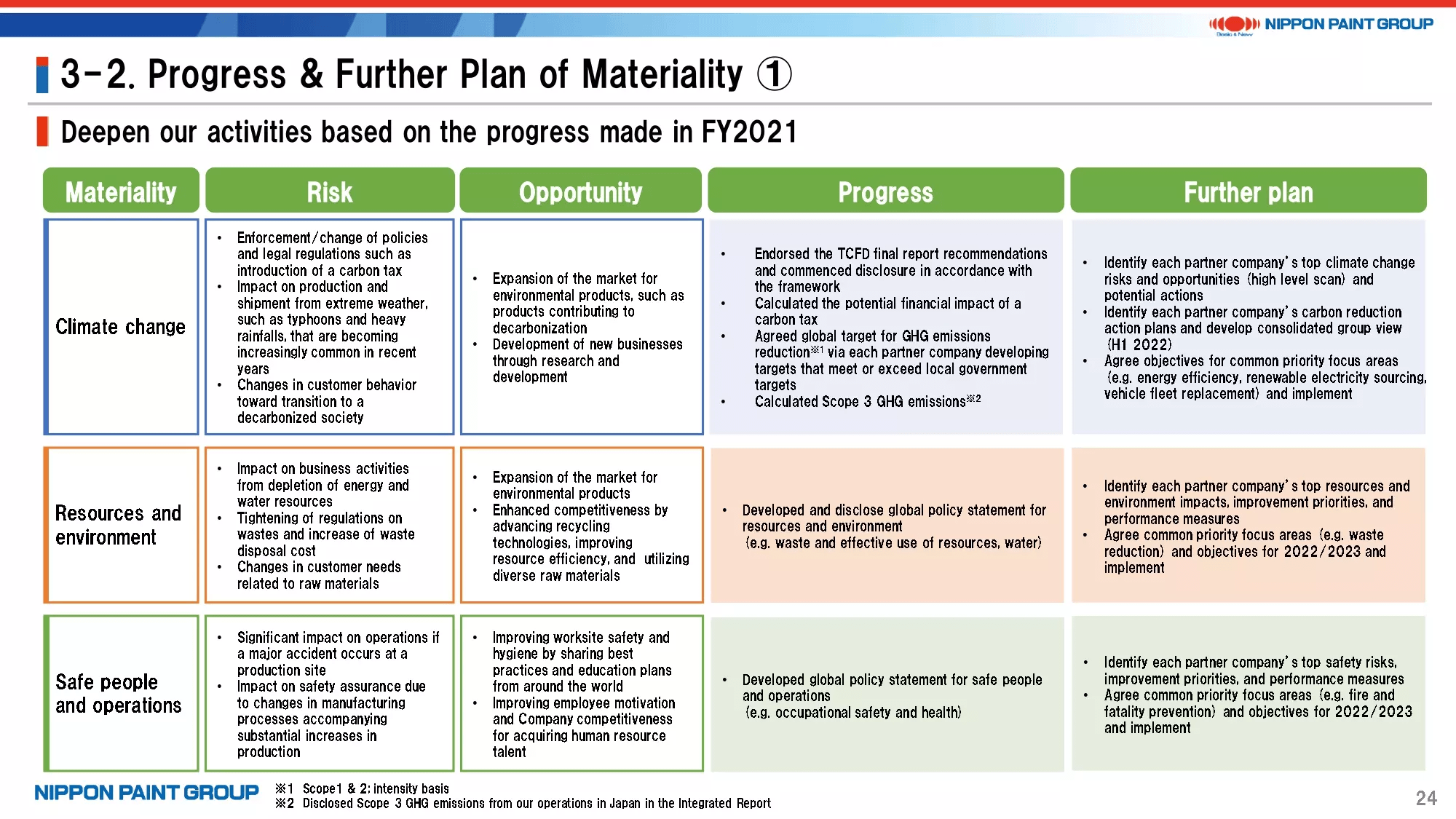

19. Progress & Further Plan of Materiality ①

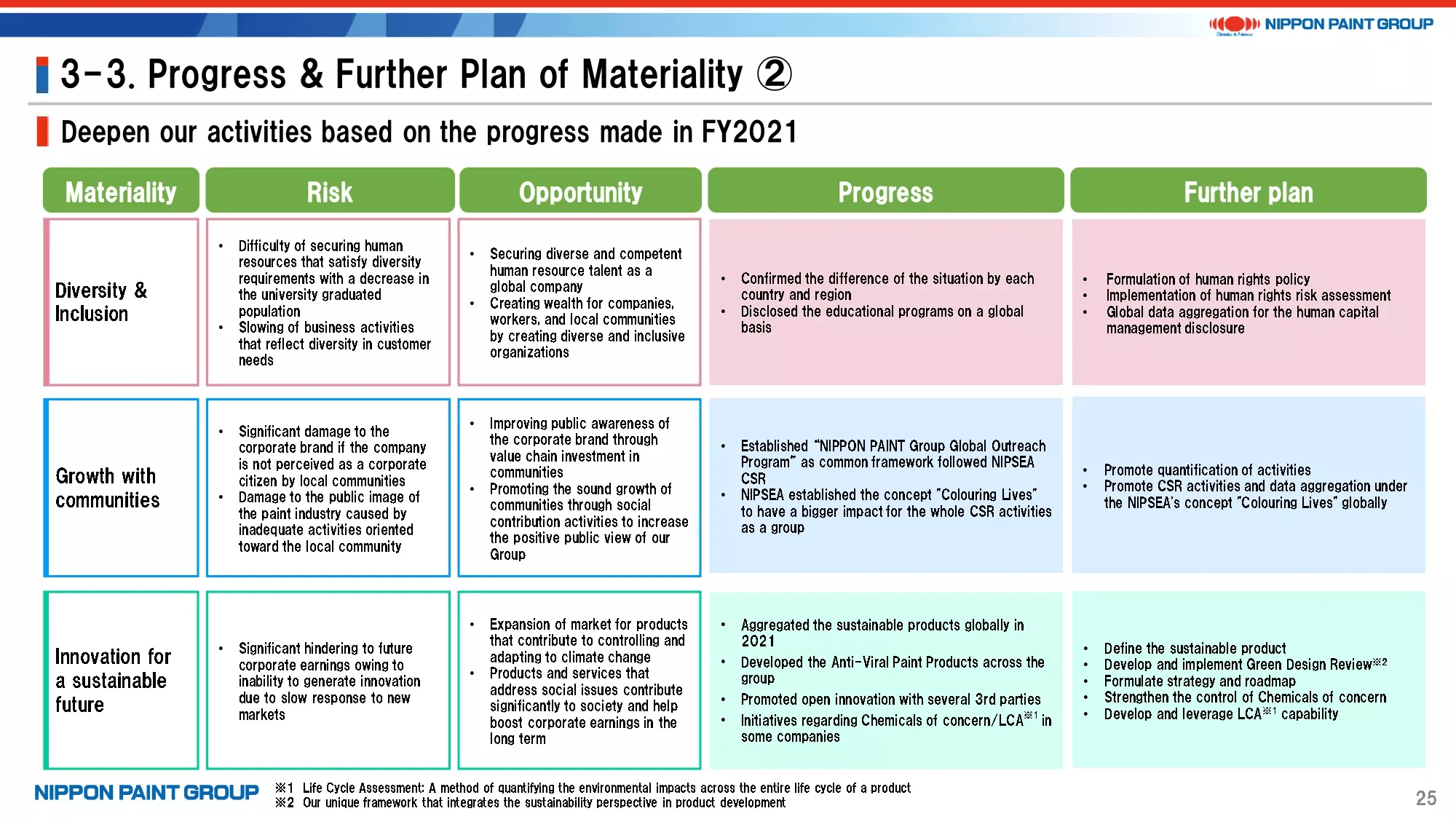

Pages 24 and 25 provide information about our progress with each materiality.

After we identified materiality in FY2020, we explained risks and opportunities related to each materiality item in our Integrated Report 2021 and have taken actions associated with those risks and opportunities.

To combat Climate Change, we commenced disclosure in accordance with the framework based on the TCFD final report recommendations and agreed with every Group partner company to establish a target for net zero CO2 emissions. I will discuss specific activities regarding these targets, such as starting to use renewable energy, later.

The bottom row of this page has information about Resources and Environment and Safe People and Operations.

20. Progress & Further Plan of Materiality ②

For Diversity & Inclusion, we shared information about the status of countries and regions and recognized the need to formulate a human rights policy and implement a human rights risk assessment. FY2022 marks the start of the execution phase of these initiatives. Diversity & Inclusion initiatives will include global data aggregation for human capital management in line with moves towards mandatory disclosure.

For Growth with Communities, we quantified and disclosed our social contribution activities in order to further clarify the link between sustainability initiatives and businesses. We will continue to step up these activities in FY2022 onwards.

As an example of Innovation for a Sustainable Future, we have developed and distributed anti-viral paint products through cross-functional activities throughout the Group. Going forward, we will strengthen the control of chemicals of concern and step up initiatives in life cycle assessment (LCA) and other areas where social concerns are rising.

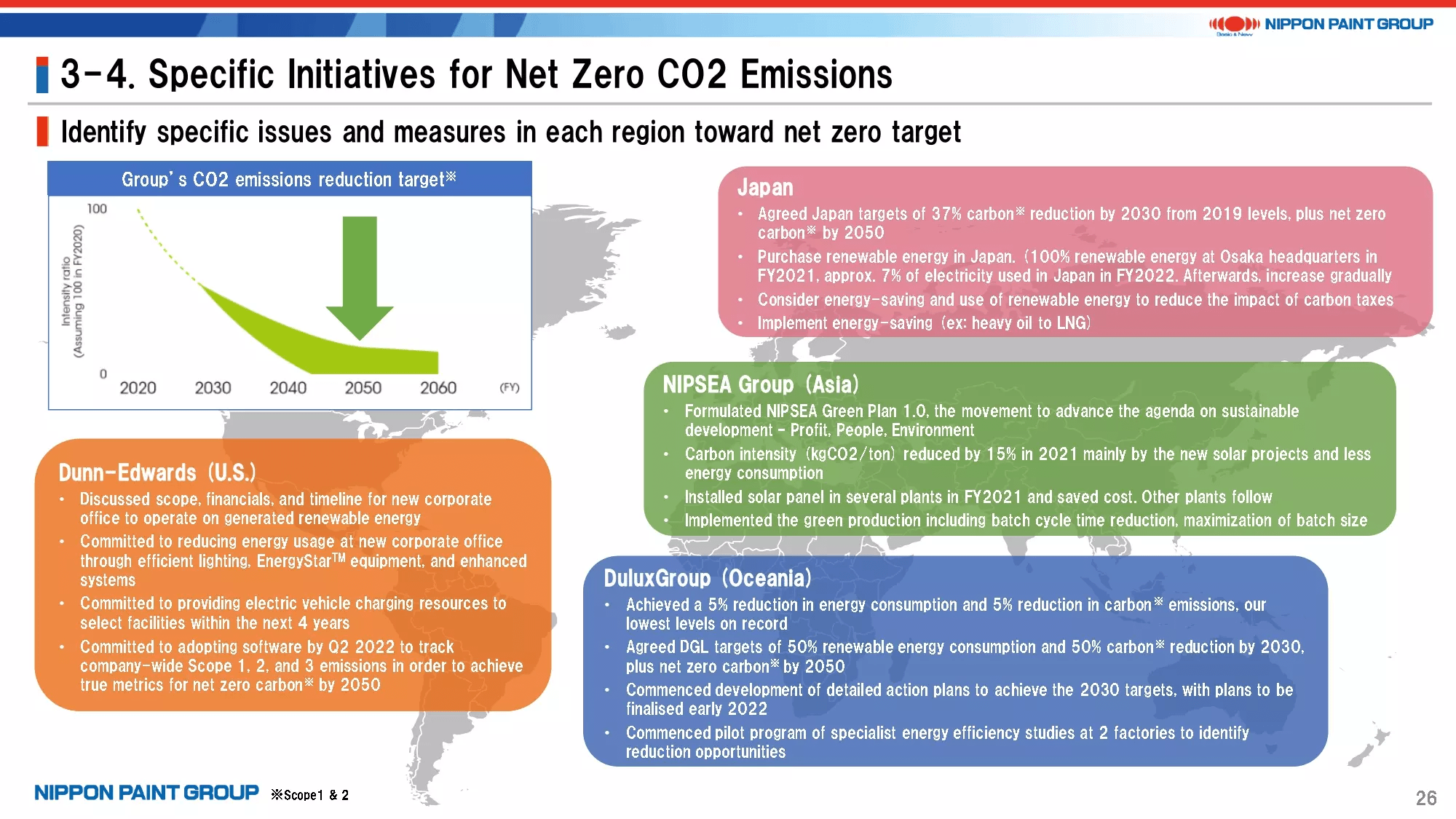

21. Specific Initiatives for Net Zero CO2 Emissions

My next subject is two sustainability initiatives.

The first is our initiatives for net zero CO2 emissions. By sharing information about the initiatives in each operating region and learning from best practices while respecting the characteristics of every operating region, we will continue our cross-functional activities throughout the Group.

For instance, the NIPSEA Group has reduced carbon intensity by 15% in FY2021 by taking actions such as installing solar panels to utilize renewable energy and conducting energy saving activities.

DuluxGroup established its own target of achieving net zero CO2 emissions in FY2050, with interim targets of achieving 50% renewable energy consumption and 50% CO2 emissions reduction by FY2030, and is taking actions to achieve these targets.

Dunn-Edwards is considering building a new corporate office that operates on renewable energy.

In Japan, we started purchasing renewable energy in FY2021 and achieved 100% renewable energy use at the Osaka headquarters.

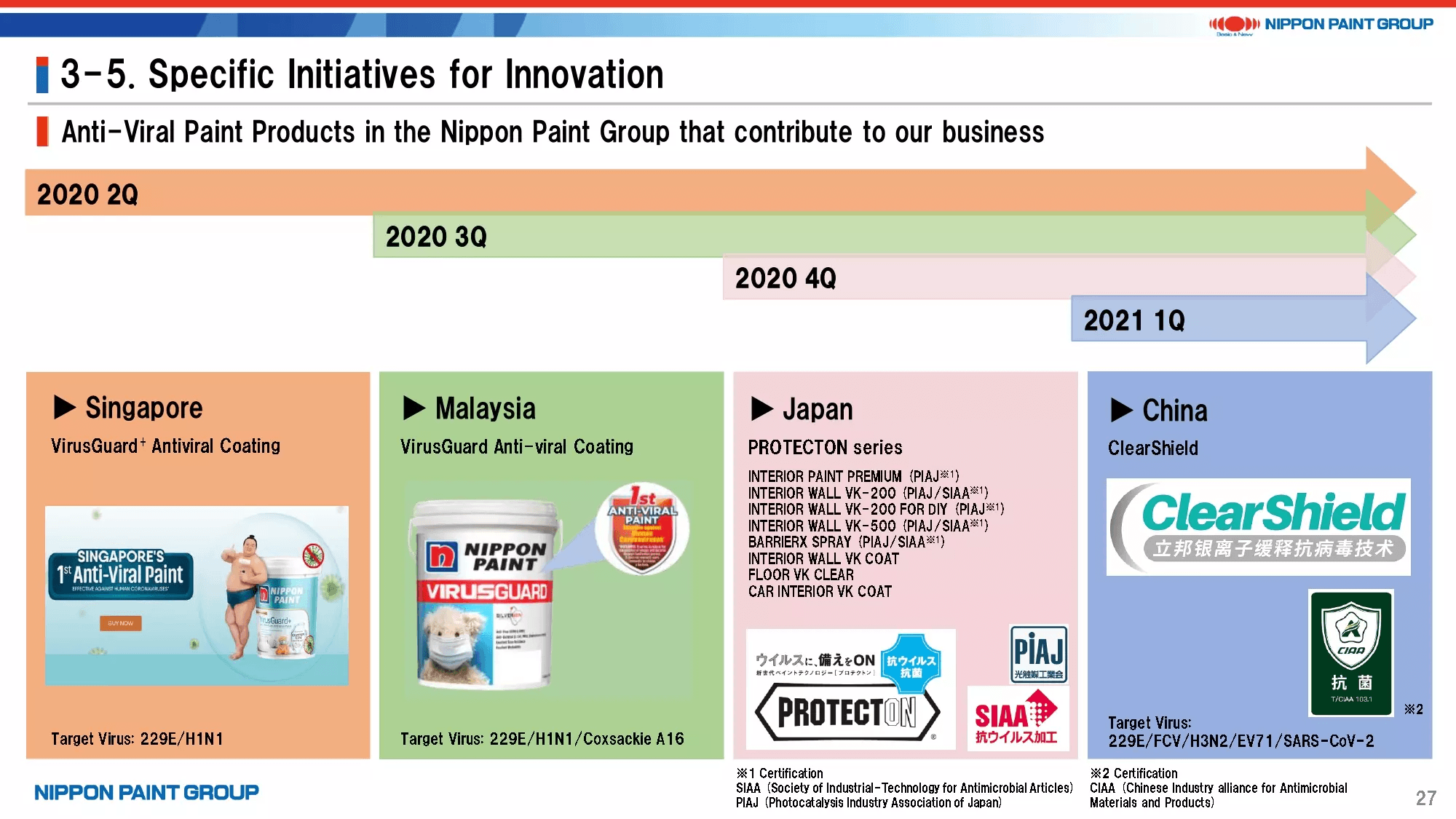

22. Specific Initiatives for Innovation

The second example is innovation initiatives.

The Nippon Paint Group has started selling anti-viral paint products in Singapore, Malaysia, and China, where NIPSEA Group companies operate, as well as in Japan, since FY2020.

We will continue to mobilize resources within the Group to develop and sell products that contribute to addressing social challenges.

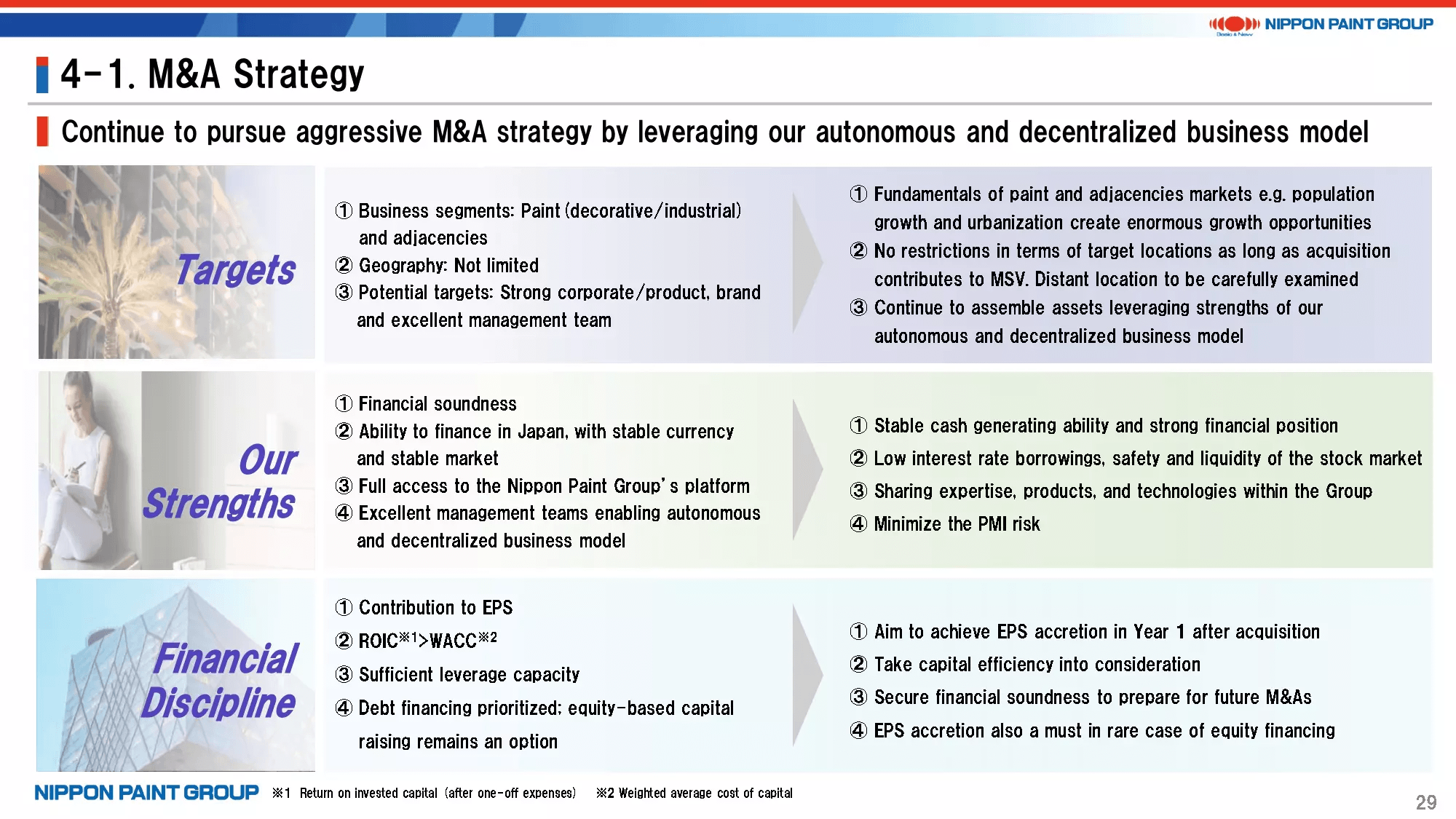

23. M&A Strategy

The next topic is our M&A strategy.

As I have mentioned before, we cannot disclose specific target names and locations. What I can tell you is that our M&A strategy remains unchanged. There are no limitations regarding business categories and locations. A contribution to MSV, in particular with EPS accretion, is expected in the first year following an acquisition along with an attractive risk-return profile.

As I have explained earlier, our business model is not based on the so-called global standardization and common cost reduction programs. Rather, our Asset Assembler model pursues autonomous growth by assembling excellent companies with potential for a sustainable EPS contribution. We encourage collaborations with existing Group partner companies around the world and allow the use of financial resources provided by Nippon Paint Holdings. We believe this is the right model to create medium- and long-term value in the paint and adjacencies businesses, which are characterized by local production for local consumption.

The three pages that follow provide information about our M&A best practices that demonstrate our approach. These examples are self-explanatory, so I will skip the explanation. The second page that covers M&A in the adjacencies area includes some acquisitions that were not disclosed before. They are minor acquisitions in terms of cost but show how we accumulate expertise in the adjacencies area through these acquisitions.

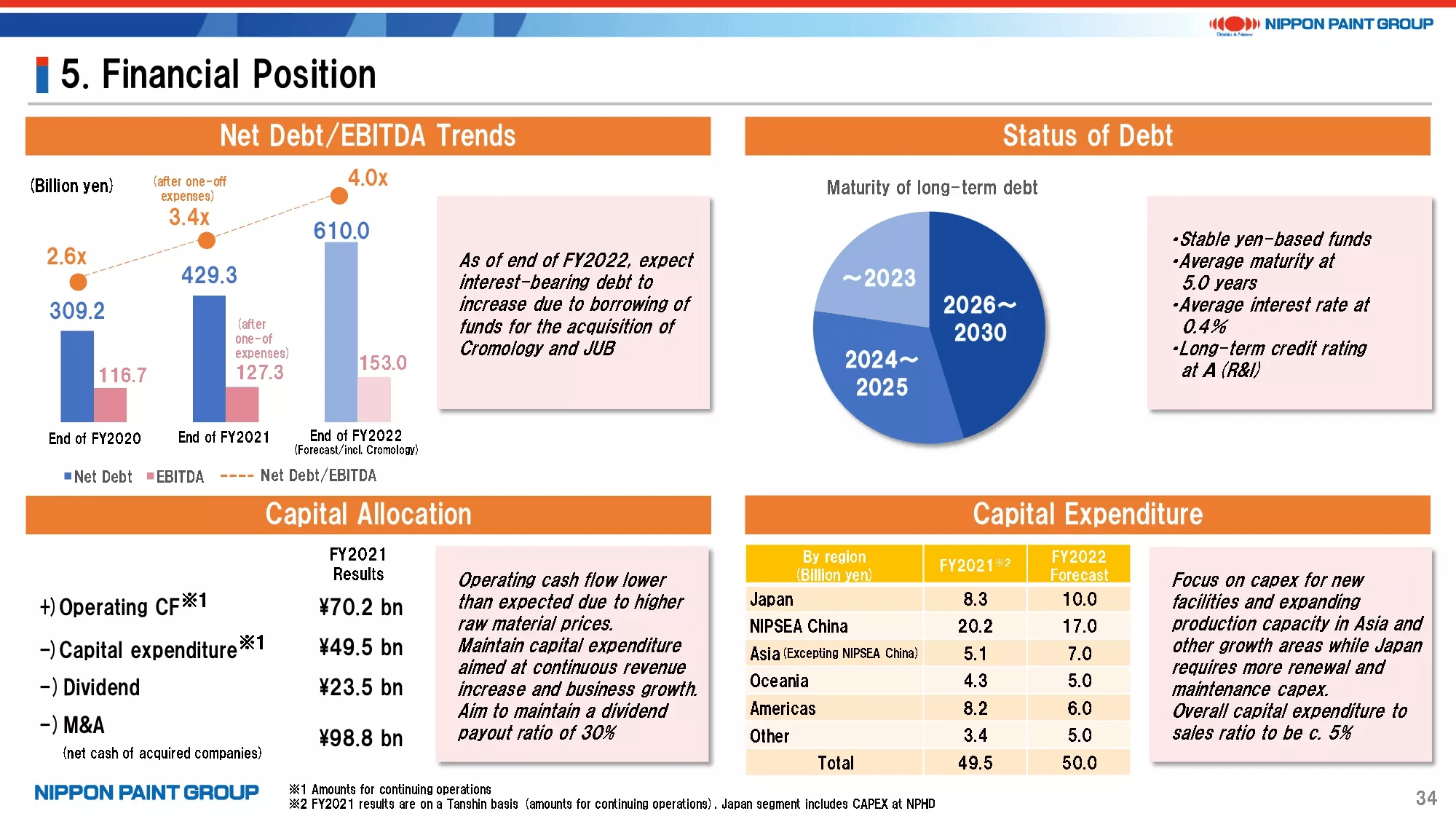

24. Financial Position

The final topic is our financial plan.

Our financial leverage capacity was 3.4x as of the end of FY2021, which is before the closing of the acquisition of Cromology, and is forecast to be around 4x as of the end of FY2022.

Regarding debt, we basically procure funds in yen, and we have a very stable debt structure with the average maturity at five years and average interest rate before tax at 0.4%.

As I have mentioned before, we believe the characteristics of the paint business allow for higher leverage capacity than for a company in the general chemical sector without impairing our financial position. We will continue to aggressively seek significant acquisitions without setting an upper limit on leverage for growth in FY2023 and beyond while maintaining sound relationships with financial institutions and credit rating agencies.

Our operating cash flows were lower than expected in FY2021 due to a decline in margins and an increase in working capital for the stable procurement of raw materials. We plan to review the cash conversion cycle (CCC) in every operating region in FY2022.

The paint industry does not require large capital expenditures. We will make investments based on careful examinations for future growth, centered on investments to expand capacity in Asia and China. Capital expenditures will be basically focused on renewal and maintenance projects in Japan. Please note that the Other region includes Cromology in FY2022, and most of the 5 billion yen planned for this region will be allocated to Cromology.

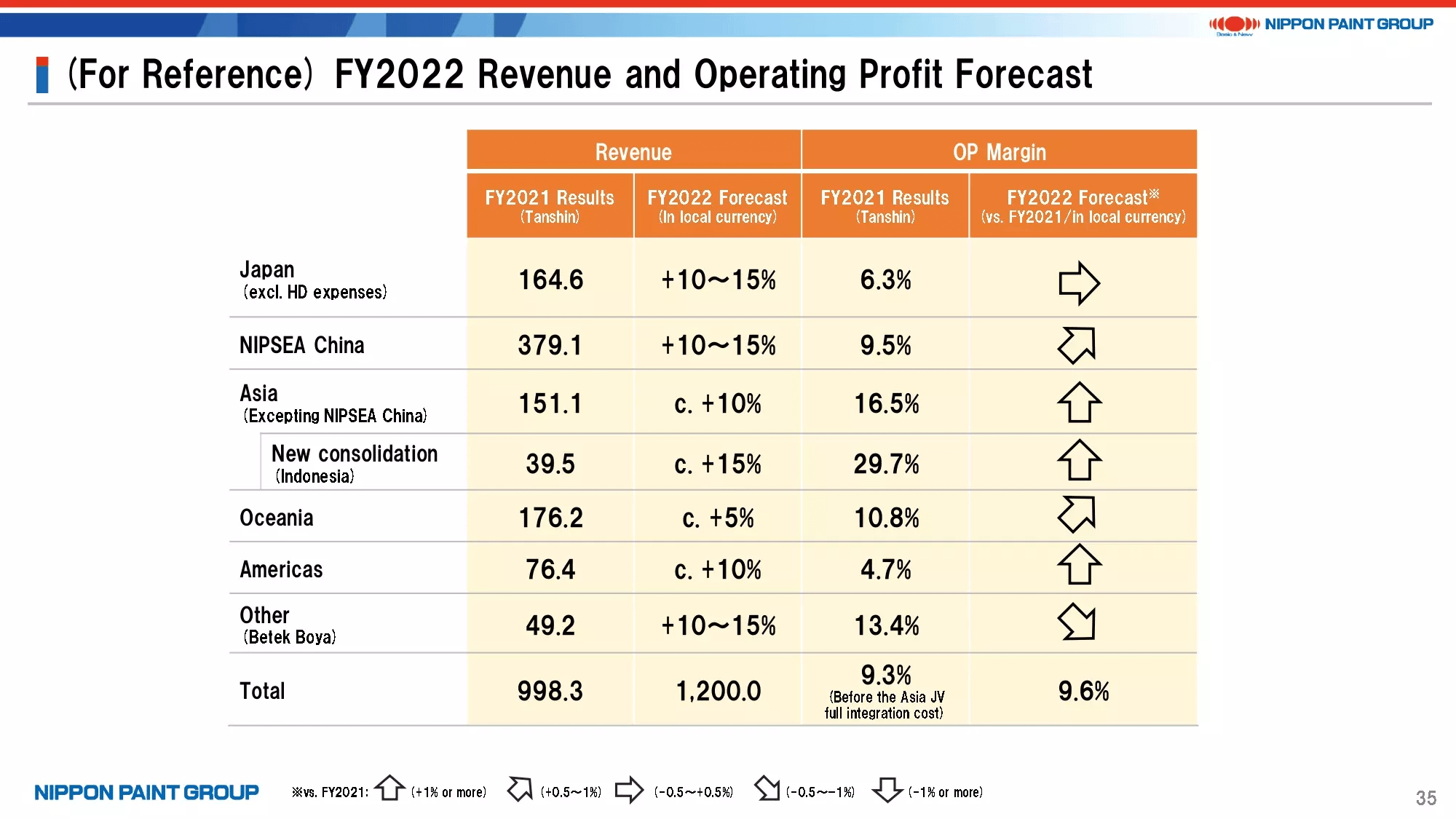

25. (For Reference) FY2022 Revenue and Operating Profit Forecast

This page shows the outlook for operating profit margin by region for FY2022 in response to requests from investors. I hope this information will be useful.

26. Conclusion

Before concluding my presentation, I would like to summarize the key points of today’s presentation.

- We achieved the Medium-Term Plan revenue target one year early. We will maintain our operating profit target and aim to achieve the target through revenue growth and margin improvements.

- Nippon Paint will retain an insatiable appetite for growth as a unique Japan-based “Asset Assembler” with MSV as its sole mission.

Our primary focus is on the second point regarding our policies as an Asset Assembler. We will place value on the characteristics of local businesses and the autonomy of Group partner companies; remove bureaucratic functions from the small headquarters at the holding company; and use M&A to assemble a group of excellent companies, management teams, and brands specializing in paint and adjacencies. Based on our Asset Assembler model, we will aim for continuous earnings growth with limited risk while retaining a firm commitment to MSV. We appreciate your continued support for the Nippon Paint Group.

Thank you for your attention.