1. Front Cover

Good afternoon, everyone. I’m Yuichiro Wakatsuki, Co-President of Nippon Paint Holdings.

Thank you very much for taking the time today to participate in our conference call regarding financial results for the 2Q of FY2022.

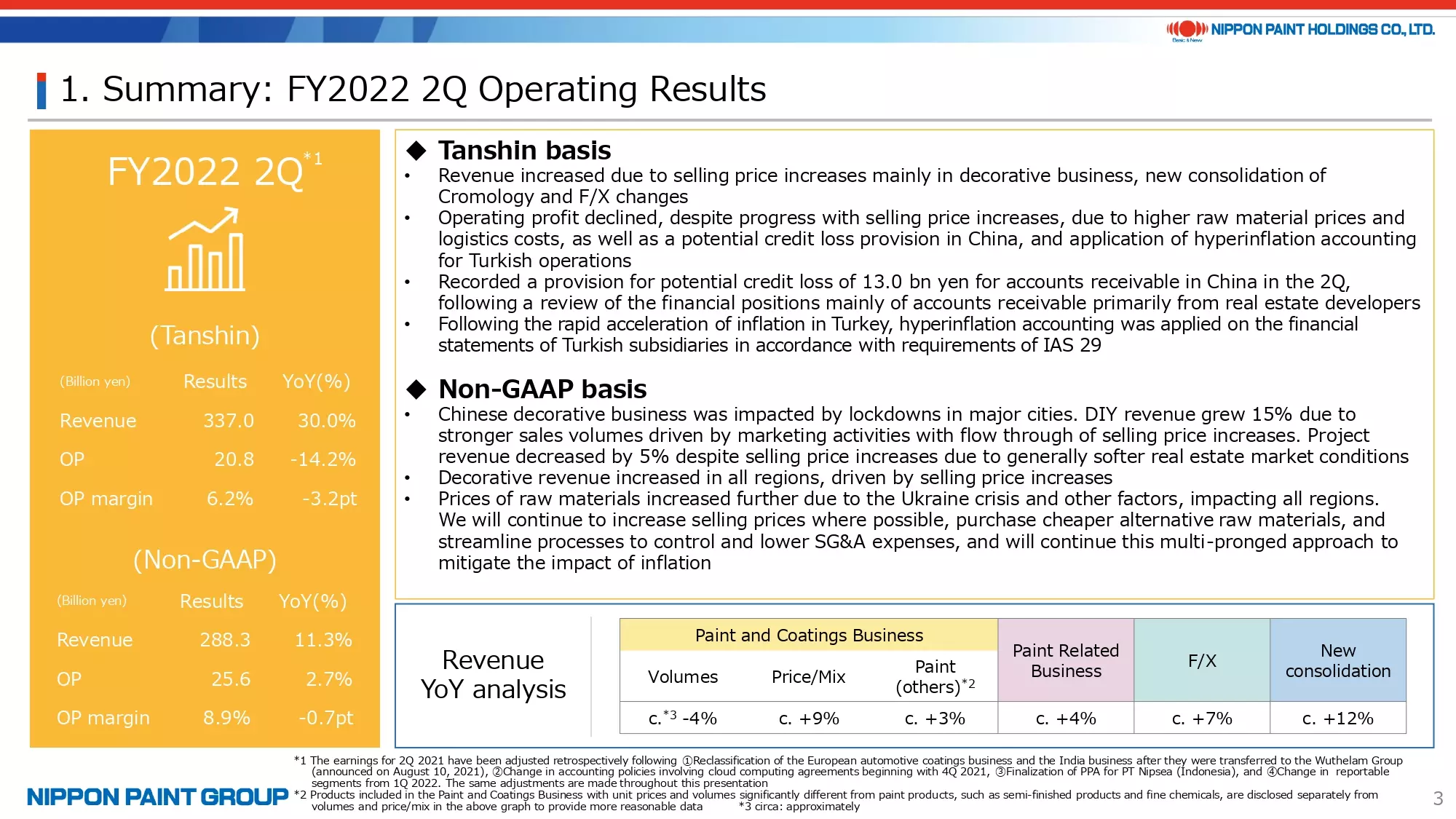

2. Summary: FY2022 2Q Operating Results

I would like to begin by summarizing the financial results for the 2Q of FY2022.

Revenue increased by 30% on a Tanshin basis to 337.0 bn yen, staying on a strong growth path continuing from the 1Q. Unfortunately, operating profit decreased by 14%. This revenue growth was attributable to the new consolidation of Cromology, the weaker yen, as well as a price/mix improvement that offset lower volumes and higher revenue in the paint related business. Operating profit declined, despite the contribution from foreign exchange gains and the new consolidation, due to the impact of lockdowns in China on our operations in the April-June quarter and a provision for potential credit loss mainly on receivables from Chinese real estate developers totaling 13.0 bn yen as we announced in May.

On a Non-GAAP basis, revenue and operating profit from our existing businesses, excluding the effects of the new consolidation, exchange rate movements, and one-off expenses, increased by 11% and 2.7%, respectively. I believe this reflects the strength of our business fundamentals.

The operating profit margin improved by around 9% and slightly declined from a year earlier on a Non-GAAP basis. However, the margin did not improve as much as we had expected and was unchanged compared to the 1Q due to the impact of the pandemic in China, combined with the application of hyperinflation accounting in Turkey, which I will explain later. Regardless of these unforeseen events, we were able to consistently expand our businesses. This, I believe, reaffirms the resilience of Nippon Paint Group. We will continue to implement selling price increases and control SG&A expenses in the 3Q and thereafter in order to improve our operating profit margin.

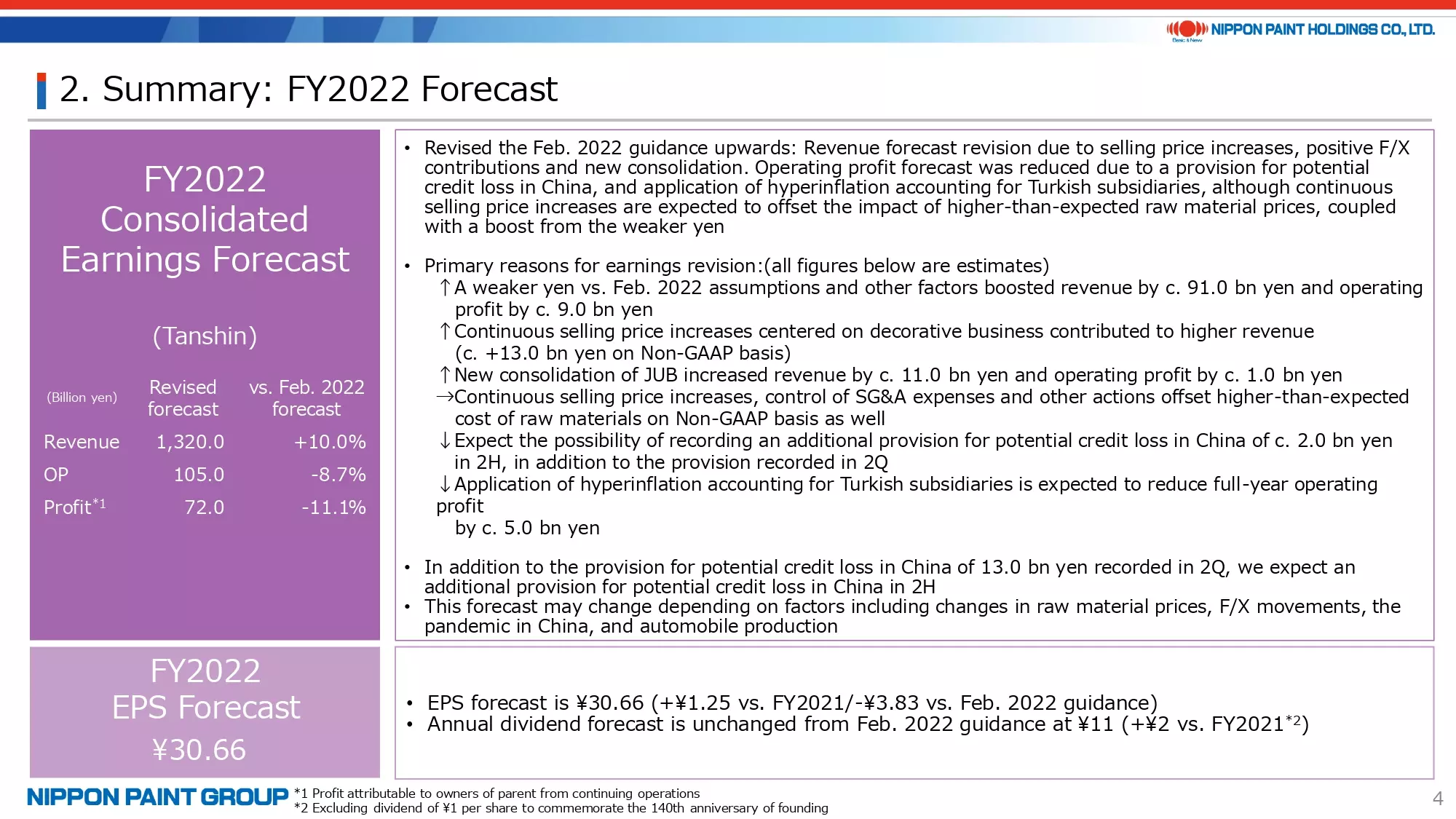

3. Summary: FY2022 Forecast

This page explains revisions to our guidance announced in February 2022.

Revenue exceeded the previous guidance by around 13 bn driven by business growth. In addition, seven months of JUB revenue of around 11 bn yen was newly consolidated, while the acquisition of this company had not been finalized when the previous guidance was announced. There were also contributions from the application of hyperinflation accounting for our Turkish subsidiaries of around 5 bn yen on a full-year basis based on rough estimation at this time, and from the weaker yen of slightly over 90 bn yen. All in all, we increased our revenue guidance by 10% to 1,320.0 billion yen.

Operating profit from our existing businesses was roughly in line with our forecast. With revenue expected to be higher than initially expected, we expect to be able to offset higher expenses so that there will be no impact on our earnings. However, we expect a slight decrease in the operating profit margin. Our operating profit guidance was lowered by 10.0 bn yen, from 115.0 bn yen in the February 2022 guidance to 105.0 bn yen. The breakdown is as follow. There was a foreign exchange gain of around 9 bn yen, a revenue gain from the new consolidation of JUB of around 1 bn yen, a negative impact from recording a potential credit loss provision of around 15 bn yen, which includes 13.0 bn yen recorded in the 2Q and a potential additional provision, and the application of hyperinflation accounting for Turkish subsidiaries that is expected to reduce operating profit by around 5 bn yen on a full-year basis.

This revised guidance incorporates the following factors that were not included in our outlook in May when we released the 1Q FY2022 results: ① we now have a more accurate outlook about the potential credit loss provision in China, ② we estimated the foreign exchange impact when there were six months left in this year, although the impact is naturally subject to change, ③ increases in raw material prices have settled down to a certain extent, giving us a better outlook for price levels in the 2H, and ④ the acquisition of JUB closed at the end of May. In addition to these factors, there were also the following factors that led to the revision of our guidance this time.: ⑤ our outlook for lockdowns in China was extremely uncertain as of May but has become clear to a certain extent, although the situation remains unpredictable and ⑥ the new application of hyperinflation accounting for our Turkish subsidiaries, which we did not expect as of May.

We made this guidance by factoring in numerous external factors and uncertainties that continue to impact our operating environment, such as exchange rate movements and inflation, as well as the pandemic. When our assumptions change significantly, we will make an announcement promptly whenever possible without being restricted by the criteria for the disclosure of earnings forecast revisions.

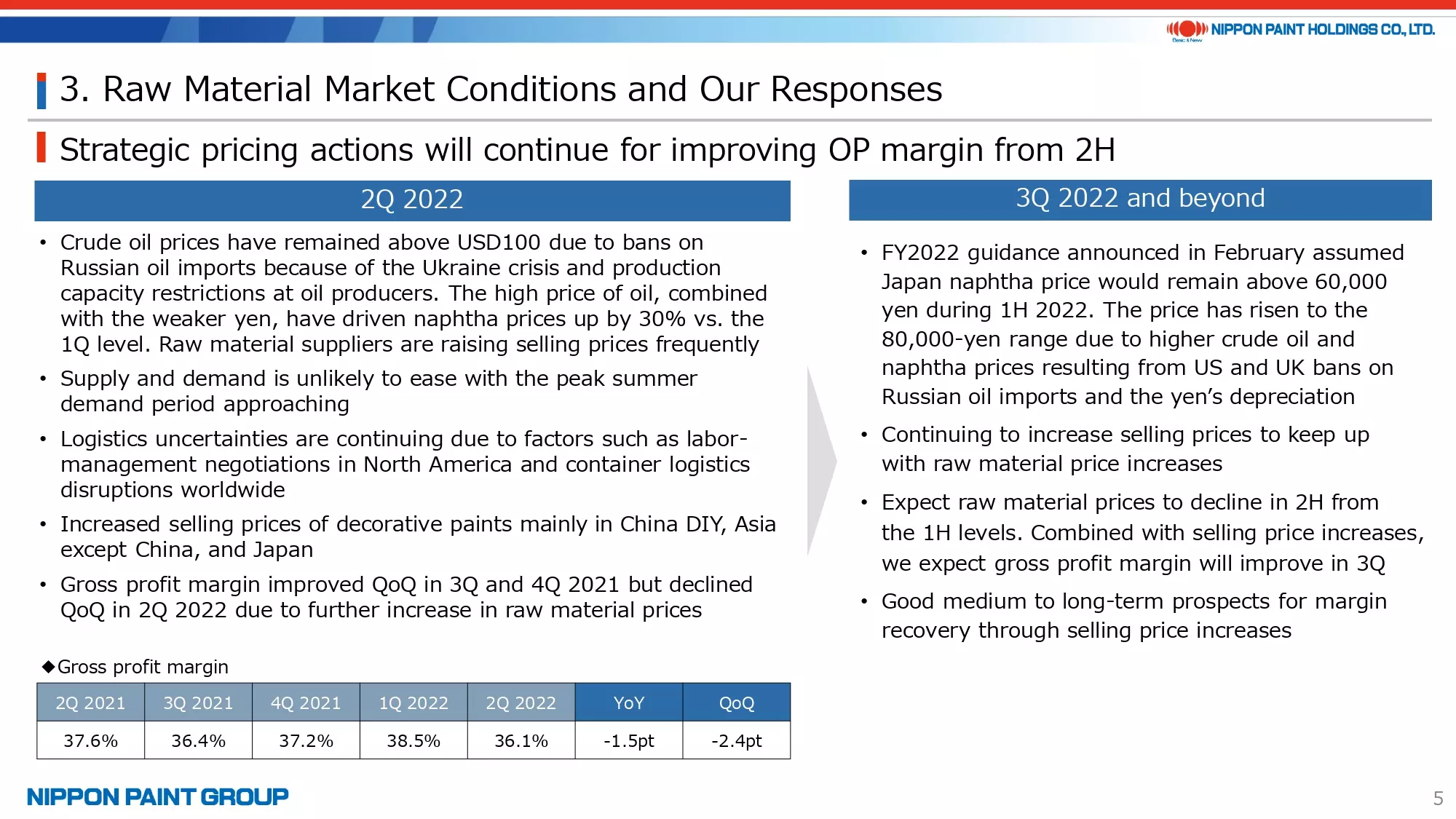

4. Raw Material Market Conditions and Our Responses

This page explains conditions in raw material markets.

Our operating profit margin improvement in the 2Q did not progress as much as we had expected despite our continuous pricing actions due to the prolonged Ukraine crisis, cooling of consumer sentiment, and lockdowns in China. But we achieved solid growth including market share gains in every region. Therefore, we are capable of improving our operating profit margin in the 2H if the pace of raw material price increases eases as we expect.

We do not assume that raw material prices will decrease in the 2H. If prices decline, our operating profit margin may improve even more.

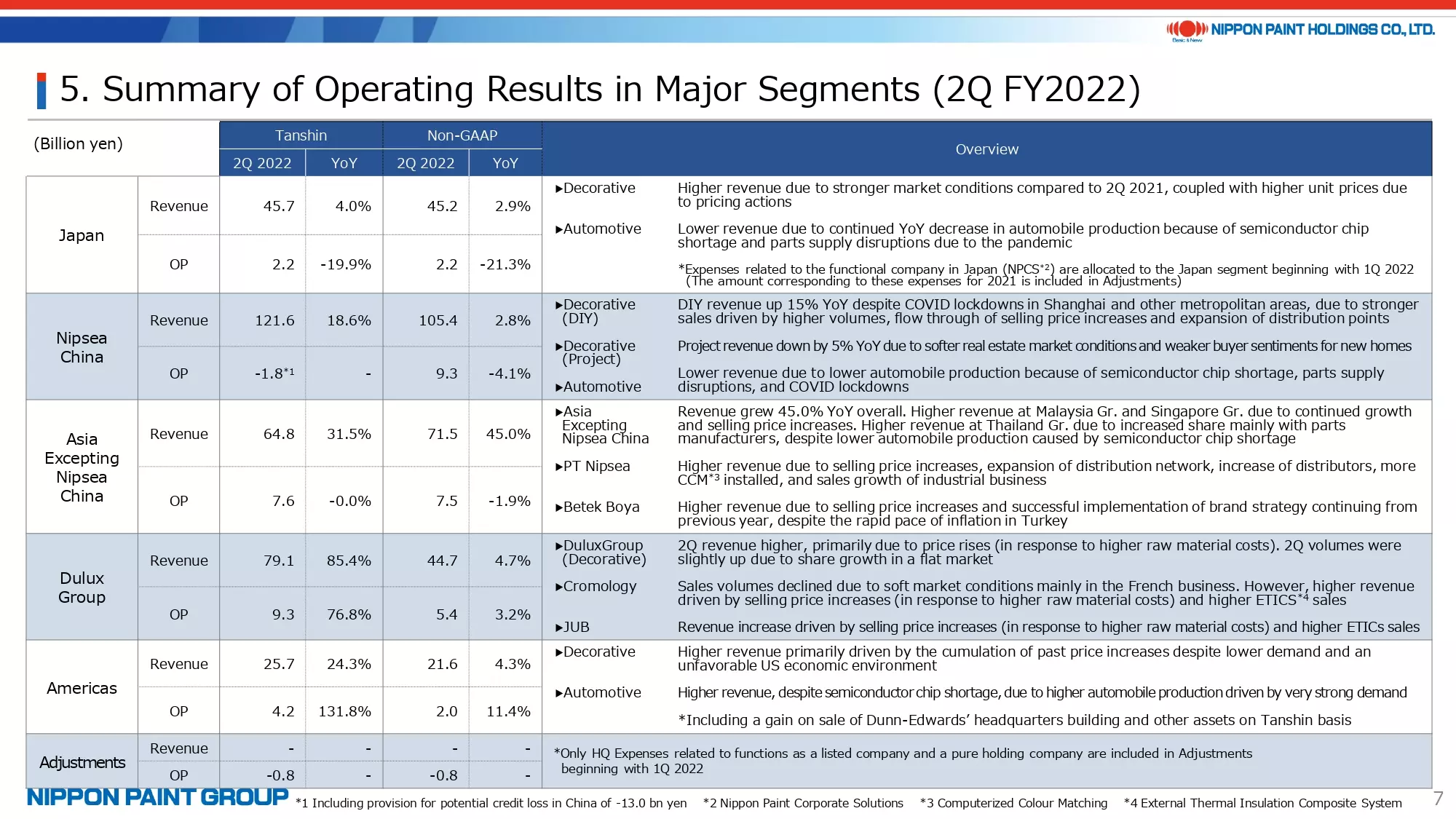

5. Summary of Operating Results in Major Segments (2Q FY2022)

This page summarizes the operating results in our major segments. For more information, please see the Reference Data that starts on page 14.

To give you some supplementary information, our operating profit of 2.2 bn yen in Japan includes expenses related to Nippon Paint Corporate Solutions (NPCS). When we reverse the additional allocation of NPCS-related expenses of around 1.2 bn yen to make a comparison based on the same conditions as in the prior year, the operating profit would be around 3.4 bn yen (OP margin: 7.4%). Then, compared with operating profit of around 2.8 bn yen (OP margin: 6.4%) in 2Q FY2021 and around 1.6 bn yen (OP margin: 3.8%) in 1Q FY2022, you can see that our operating profit margin is improving.

Revenue in NIPSEA China increased by 2.8% overall on a Non-GAAP basis due to the weaker yen. Revenue in the decorative business, which accounts for 80% of total NIPSEA China revenue, grew by 7.1%. Of this, DIY revenue increased by 15% and the Project business decreased by 5%. On the other hand, our automotive and industrial businesses were impacted significantly by lockdowns and revenue in these segments decreased by 12% and 24%, respectively, although they are a small portion of total revenue.

Turning to Asia Excepting NIPSEA China, we performed well in every market, including Indonesia and Turkey. In nominal terms, earnings growth in Turkey appears greater due to inflation. We shouldn’t talk about “what if”, but we could have achieved operating profit growth both on a Tanshin and Non-GAAP basis without the negative profit impact from the application of hyperinflation accounting for our Turkish subsidiaries.

DuluxGroup has continued to grow consistently in Australia and New Zealand with steady progress with selling price increases. At Cromology, although cooling of consumer sentiment in Europe is a concern, we are raising selling prices and reducing expenses whenever and wherever we can. Cromology’s contribution to consolidated operating profit is expected to be about 5 bn yen, a must-achieve target, after one-off expenses in the first year after the acquisition. It’s encouraging that following the completion of JUB’s acquisition, collaboration with the new JUB team has started not only with the DuluxGroup team and Cromology team but also with the Betek Boya team in Turkey.

In the Americas, our automotive revenue increased slightly and our decorative paints revenue at Dunn-Edwards continued to increase in the 2Q amid heightened uncertainty about the outlook for the US market. As a side note, our Tanshin-base earnings in the Americas include a gain on the sale of Dunn-Edwards’ headquarters building and other assets of around 1.8 bn yen.

6. Major Topics ①

This page explains hyperinflation accounting that was applied beginning with the 2Q of FY2022 because the cumulative inflation rate in Turkey over three years has exceeded 100%.

This accounting policy is nothing new and was applied to countries including Argentine, Iran, and Sudan before. However, this is the first case in which the accounting policy was applied to Nippon Paint Group companies. Also, Betek Boya was a successful acquisition by Nippon Paint Holdings, so I will explain a little more about this.

The key point is that hyperinflation accounting requires adjustments of income statement and balance sheet items according to changes in the local price index. Therefore, revenue will be higher after adjusting for inflation but the prices of raw materials and inventories, which are normally held for a relatively long time until sales are recorded, will be adjusted at even higher inflation rates. These inflation adjustments, combined with the inflation adjustment for non-current assets and other expense items, will put pressure on profits.

I understand the risk of declines in monetary and non-monetary values in a hyperinflationary state. But in reality, I feel there is a discrepancy between intuition and judgment of the local management and the accounting rules. For instance, raw materials which were stocked in anticipation of price increases in the future need to be reevaluated. I believe we need to adopt some new approaches to business operations while responding to the application of these accounting principles.

Hyperinflation accounting was applied to our Turkish subsidiaries beginning with the 1H of FY2022. The application is estimated to increase revenue by 3.0 bn yen and reduce operating profit by around 3.3 bn yen in the 1H of FY2022. The impact on a full-year basis is estimated to be an increase in revenue of 5.0 bn yen and a decrease in operating profit of 5.0 bn yen. These estimates are also reflected in our Non-GAAP results.

Our profit before tax may decrease even more because a loss on net monetary position will be recorded as a non-operating expense.

7. Major Topics ②

We are currently implementing the Next Career Plan, so I cannot tell you much about it. What I can tell you is that this plan targets employees in certain age groups in order to review our businesses from every aspect. We want to create an efficient and lean organization with the goal of enhancing the growth potential of the Japan segment, as I have mentioned on various occasions.

We have no set limit on the number of people who can apply for the plan, and therefore its impact on our earnings is undetermined. However, this plan is scheduled for completion at the end of this year. Therefore, I believe I can tell you about the plan’s impact on our operating results to a certain degree in early October or November when we announce our financial results for the 3Q of FY2022, at the latest.

8. Major Topics ③

We have completed the acquisition of JUB and full integration of our Chinese consolidated subsidiaries. By making the Chinese subsidiaries wholly owned subsidiaries, our plan is to integrate our automotive OEM business and automotive plastic business, which have been operated separately, in order to further increase efficiency.

Our integrated report 2021 received very high evaluations. This year’s report, which is expected to be published by the end of August, will have even more improvements and enhanced content. I appreciate your taking a moment to review this report and welcome your feedback and suggestions for improvements.

9. Major Topics ④

This page summarizes the status of our inclusion in ESG indexes. We remain committed to ESG initiatives in order to expand our investor base.

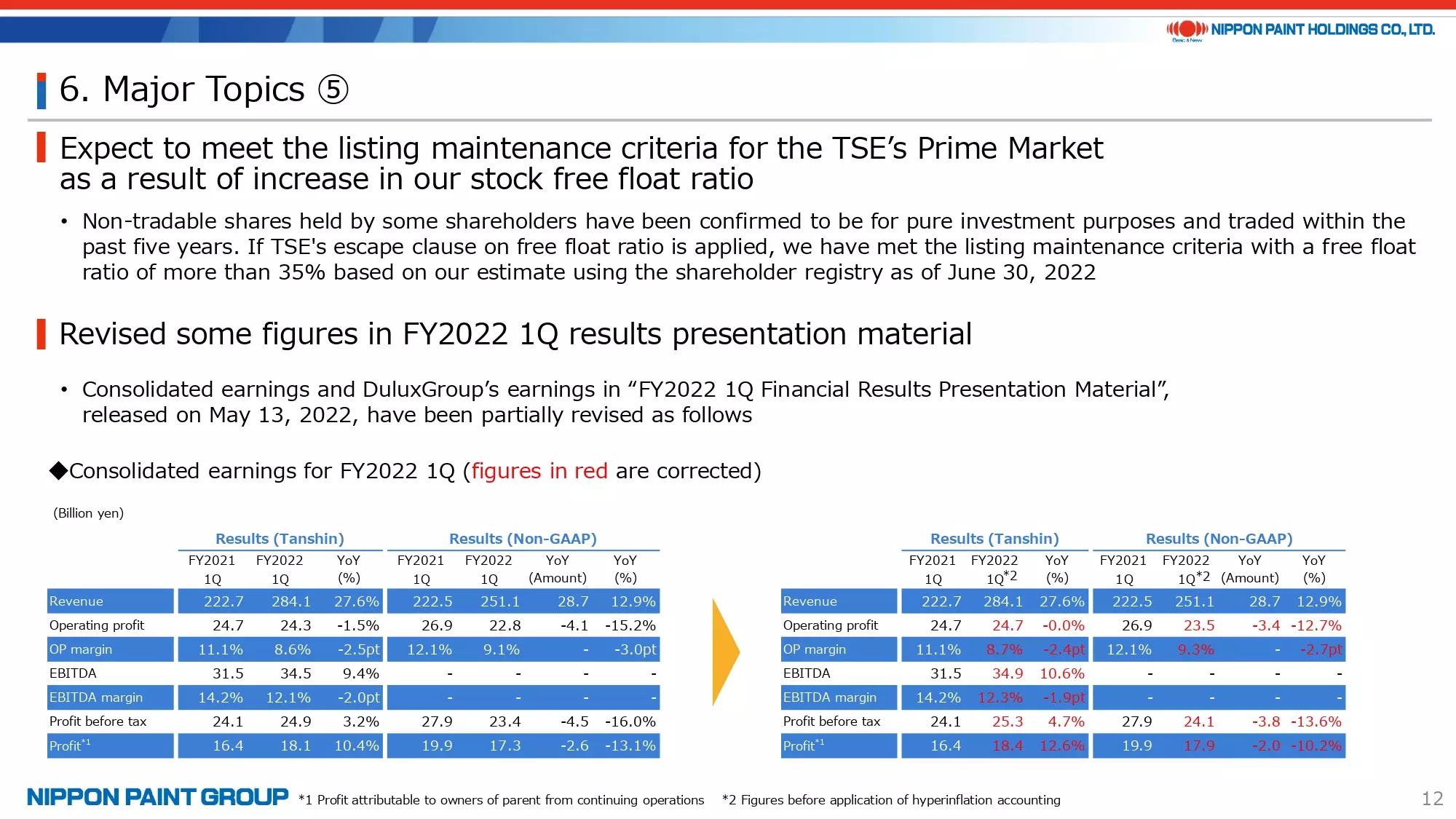

10. Major Topics ⑤

This page explains the listing maintenance criteria for the Prime Market of the Tokyo Stock Exchange.

I have explained that the secondary offering at the beginning of this year would only increase our free float ratio to around 32%, which is below the required 35%. However, this ratio has exceeded 35% as of June 30 based on our estimate. We will need to wait until the end of this year for the final eligibility decision, but we do not expect the number of our free float shares to decline during the remainder of 2022.

Finally, please note that we revised DuluxGroup’s earnings in the presentation material for 1Q FY2022.

Thank you for your attention.