1. Front Cover

Good afternoon, everyone, I’m Yuichiro Wakatsuki, Co-President of Nippon Paint Holdings.

Thank you very much for taking the time to participate in our conference call regarding financial results for the 1Q of FY2023.

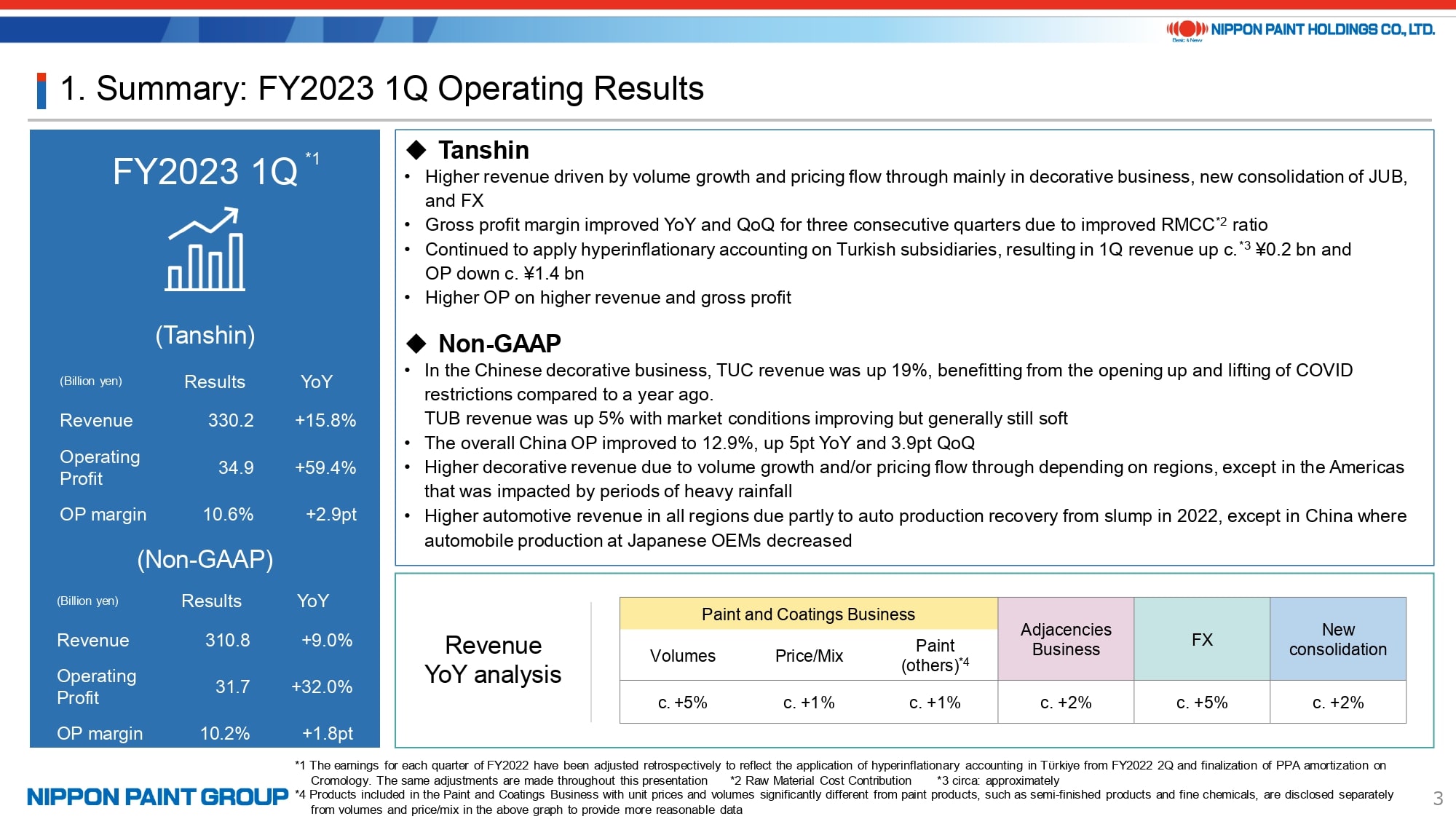

2. Summary: FY2023 1Q Operating Results

I would like to begin by summarizing the financial results for the 1Q of FY2023.

Revenue increased by 15.8% YoY on a Tanshin basis to 330.2 bn yen and operating profit increased by 54.9% YoY to 34.9 bn yen, which is significant growth in both revenue and operating profit. The breakdown of revenue growth is shown on the bottom of page 3 of the presentation. Volumes and price/mix in the decorative business, the adjacencies business, FX, and new consolidations all made positive revenue contributions.

Operating profit steadily improved due to price increases with the impact of raw material inflation continuing to ease, and the gross profit margin steadily improved. We recorded a one-off inventory step-up from Purchase Price Allocation (PPA) associated with the acquisition of Cromology in the 3Q of FY2022. However, we retrospectively adjusted the Tanshin base earnings for FY2022 and recorded the one-off inventory step-up from PPA in the 1Q of FY2022 when the acquisition was completed. Please note this change in PPA adjustments when making a year-on-year operating profit comparison.

On a Non-GAAP basis that excludes new consolidations, FX, and one-off expenses, revenue increased by 9% and operating profit improved by 32%. The operating profit margin continued to recover, increasing by 1.8 point to 10.2%.

We released a preliminary sales report of the Chinese decorative paints business for the 1Q of FY2023 at the Medium-Term Plan (FY2021-2023) update meeting in April. I’m pleased to confirm that the 1Q results of the Chinese decorative paints business significantly improved from a year ago. Specifically, TUC revenue increased by 19% and TUB revenue increased by 5%, and the operating profit margin in the overall Chinese business improved by around 5 points.

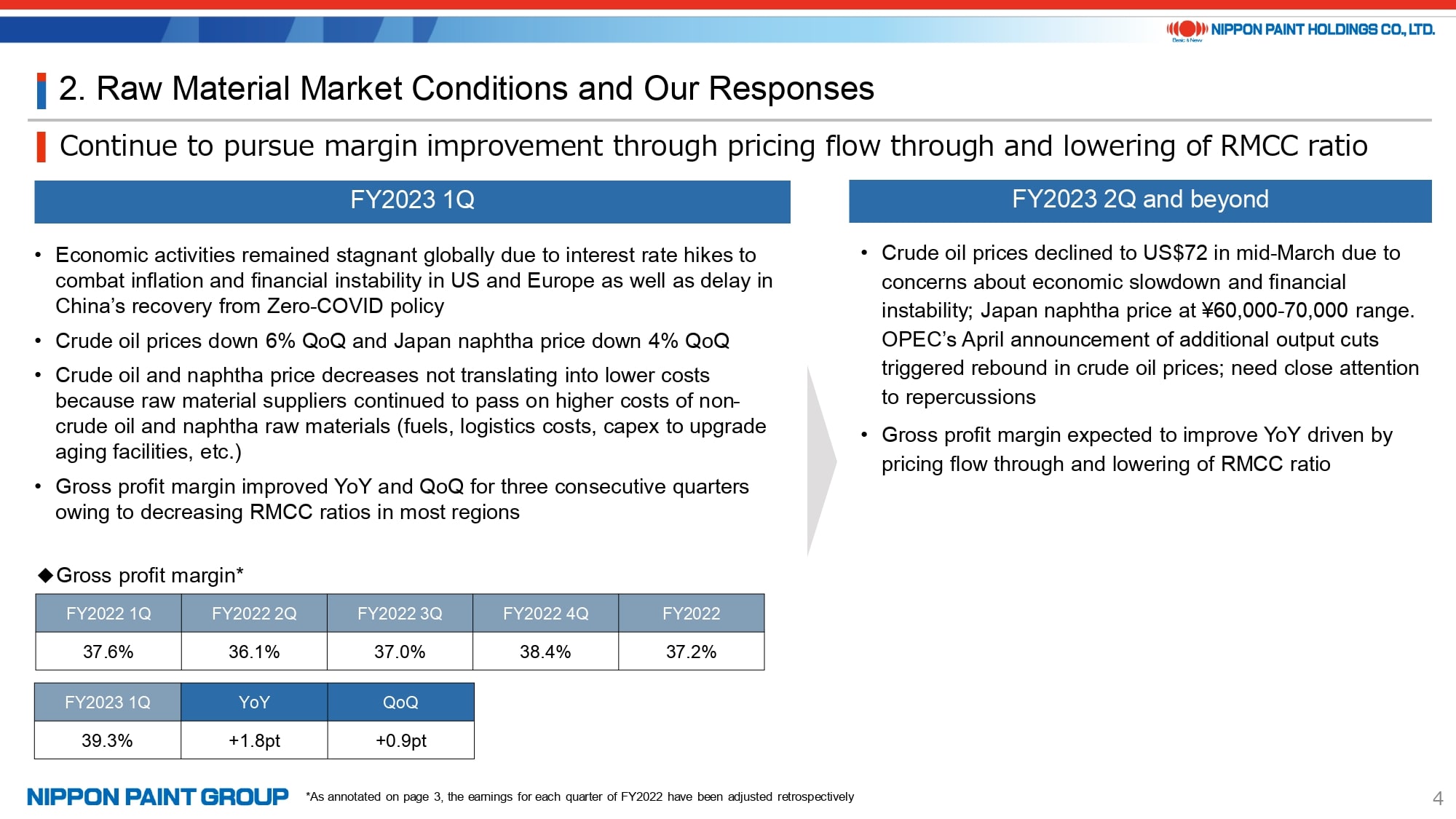

3. Raw Material Market Conditions and Our Responses

The raw material market conditions are as explained on page 4. We believe that the impact of raw material price inflation is considerably easing due partly to a decrease in demand as a result of the global economic slowdown.

As you would expect, the decrease in raw material prices can affect selling prices, but we will continuously pursue margin improvements.

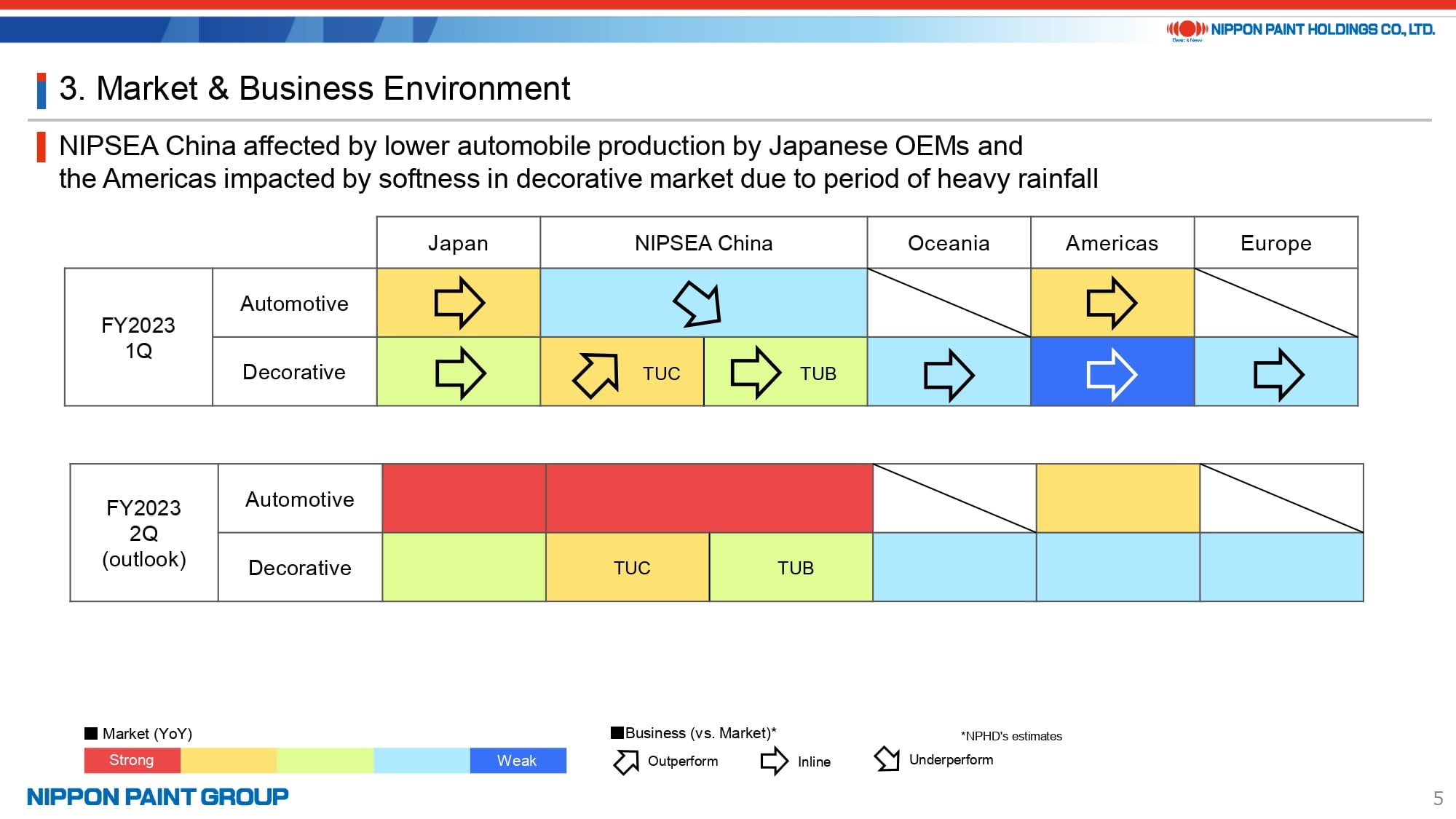

4. Market & Business Environment

The heatmap on page 5 shows the market and business environment.

We believe there was a small decrease in our market share in the NIPSEA China automotive coatings business. This is because our sales to Japanese OEM manufacturers are higher than competitors. Production at these automakers decreased amid the overall sluggish market environment in the 1Q of FY2023, while the market shares of Chinese EV manufacturers increased relative to Japanese OEM manufacturers.

In the NIPSEA China decorative paints business, we believe our market share increased in the TUC market and remained flat in the TUB market.

The decorative paints business in the Americas faced a very challenging environment. Our group is focused on the U.S. West Coast, and we believe the bad weather in this region affected competitors too. As a result, we maintained our market share.

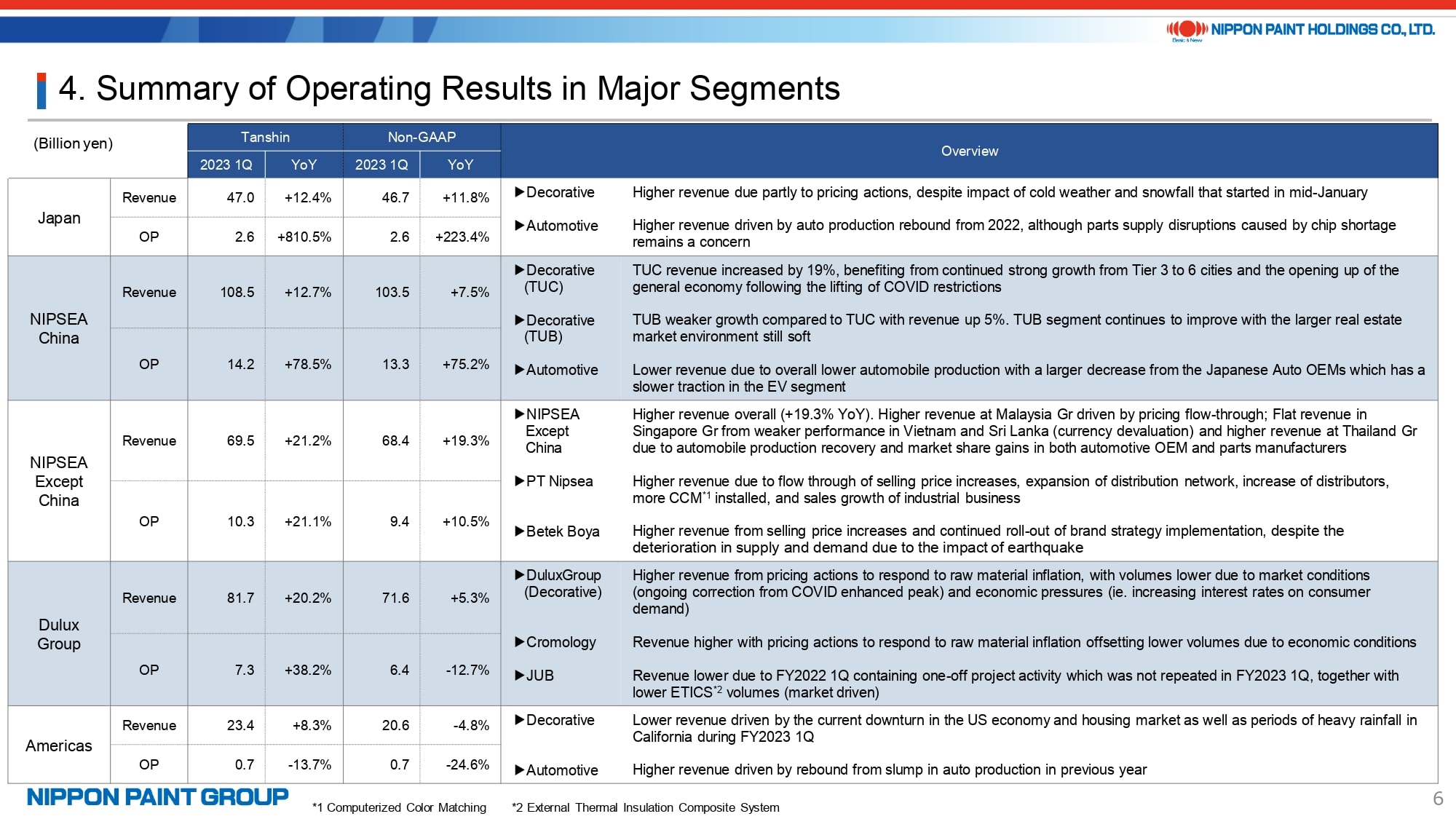

5. Summary of Operating Results in Major Segments

This page summarizes operating results in the 1Q of FY2023 in major segments. I will answer questions about this subject in the Q&A session. Please also see our segment results that start on page 15 of the presentation.

- In the Japan segment, our performance significantly improved from the 1Q of FY2022. However, the Tanshin base operating profit margin was only 5.6%, still leaving room for further improvement. Our performance in the automotive coatings and marine coatings businesses improved significantly. On the other hand, the industrial coatings business continued to be affected by market conditions that remained stagnant, and the decorative paints business was impacted slightly by bad weather. The Japan segment includes expenses related to Nippon Paint Corporate Solutions (NPCS) both in FY2022 and FY2023. Therefore, a YoY comparison under the same conditions can be made beginning in FY2023.

- I have already explained key points regarding NIPSEA China, and I will answer questions about this subject in the Q&A session.

- NIPSEA Except China continued to achieve robust growth and sufficient earnings. Notably, the Indonesia business achieved YoY growth both in revenue and the operating profit margin. In Türkiye, although we achieved revenue growth, the growth was driven mainly by price increases with only negligible volume growth due to the impact of the earthquake. After applying hyperinflationary accounting, operating profit decreased from a year ago. Our performance is not bad when we reverse the impact of application of hyperinflationary accounting on operating profit of around 1.4 billion yen. However, the operating profit margin decreased slightly even before the application of hyperinflationary accounting due to a temporary increase in SG&A expenses mainly for brand investments.

- In the DuluxGroup segment, both revenue and operating profit increased from a year ago due to price increases. Volumes were lower due to soft market conditions in the core Pacific market. In Europe, Cromology achieved revenue growth through price increases but operating profit decreased due to challenging market conditions and cost increases. Cromology was included in our Non-GAAP earnings beginning with the 1Q of FY2023. As a result, the difference between our Tanshin base earnings and Non-GAAP base earnings is whether JUB is included or not. Our Tanshin base earnings in FY2022 have been adjusted retrospectively and posted PPA adjustments including inventory step-up from PPA in the 1Q of FY2022 when the acquisition was completed. Keep this in mind when making a year-on-year earnings comparison.

- In the Americas, our performance in the decorative paints business decreased from a year ago due to a challenging environment in the 1Q. There was a recovery in the automotive coatings business but a slowdown of the residential market caused by interest rate hikes, coupled with periods of heavy rainfall on the U.S. West Coast. For example, the number of days of rainfall from January to March in Los Angeles was 35 in 2023 compared with six in 2022. In addition, rainfall during this period was 22.6 inches in 2023 compared with 1.7 inches in 2022.

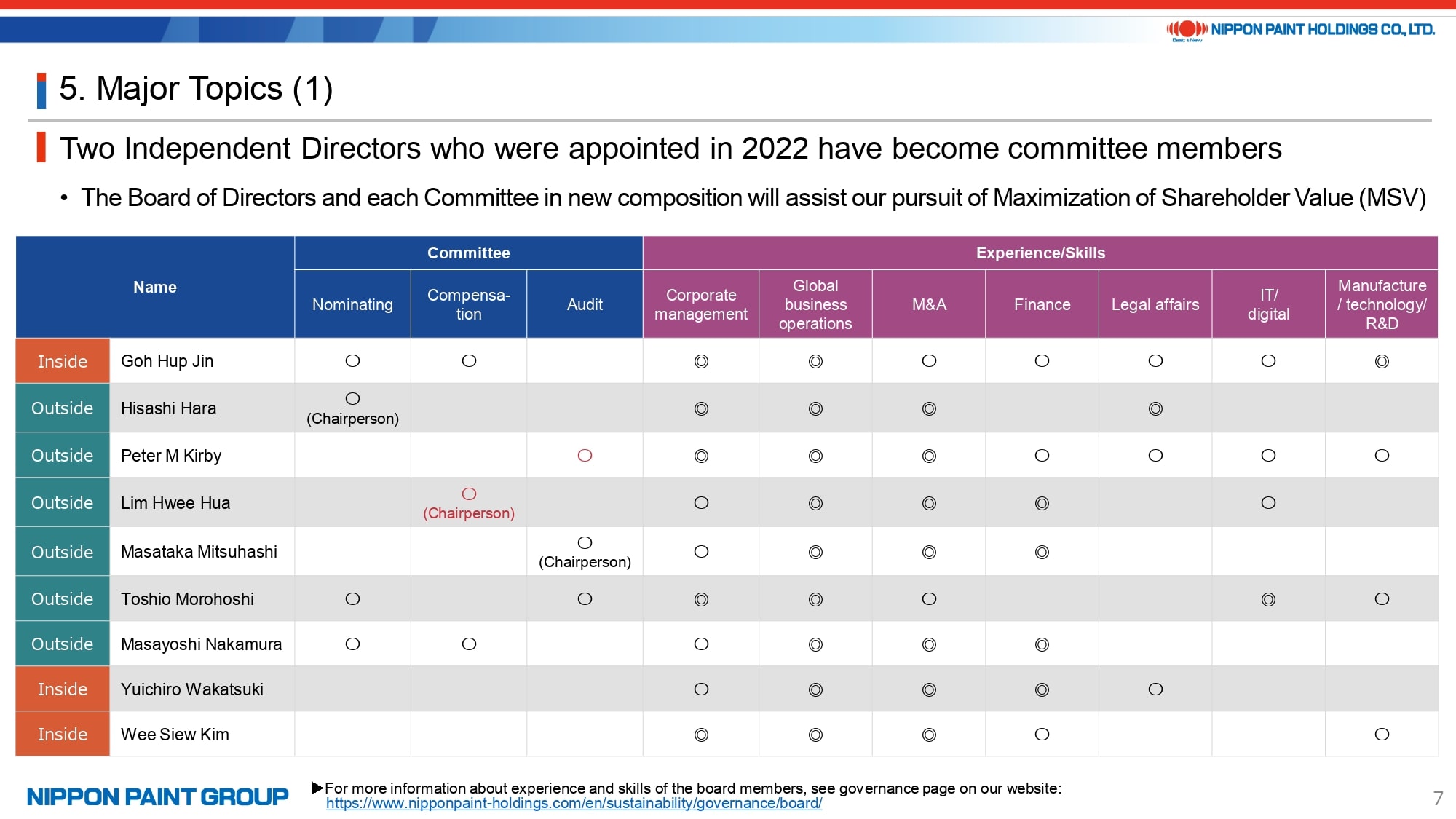

6. Major Topics (1)

Major topics are provided starting on page 7. There are not many updates because I talked about updates at the Medium-Term Plan update meeting in April.

The new Board of Director composition is shown on page 7. Lim Hwee Hua and Peter M Kirby, who were elected Directors in FY2022, have become committee members. Lim Hwee Hua is the Chairperson of the Compensation Committee and Peter M Kirby is an Audit Committee member.

7. Major Topics (2)

Page 8 has articles about our expansion of the disclosure of information regarding governance. Please take a moment to read these articles because they have useful information for understanding the approaches of Nippon Paint Holdings and the Board of Directors.

Thank you for your attention.