1. Front Cover

Good afternoon, everyone.

I'm Yuichiro Wakatsuki, Co-President at Nippon Paint Holdings.

I would like to express my gratitude to each of you for joining us today at such short notice. Your presence is greatly valued.

Today, I'm here to share details about our recently disclosed buyback of the India businesses from the Wuthelam Group.

2. Executive Summary

Allow me to commence by providing a concise overview of this transaction.

Today, our Board approved the buyback of the two India businesses, which were divested in August 2021 to the Wuthelam Group. However, it's important to note that the European automotive business is not included in the scope of this current buyback. In particular, we have successfully negotiated an arrangement to acquire 100% of NPI's shares. NPI is actively involved in various sectors including decorative paints, industrial coatings, and auto refinish businesses. Additionally, we've secured 51% of BNPA's shares, a 51:49 joint venture with Berger Paints India Limited (Berger). It's important to note that the European automotive business will remain under the umbrella of the Wuthelam Group and will not be part of the current buyback initiative.

Reflecting on the year 2021 when the decision for divestiture was made, it's evident that the India market confronted a challenging operating environment marked by external factors. These factors included fierce competition, the effects of the pandemic, rising raw material prices, and the emergence of new market entrants. During that period, NPI was operating at approximately breakeven, while BNPA was consistently incurring losses. Given this scenario, we recognized it imperative for both of these Indian businesses to undertake substantial business restructuring and reinforcement measures. Simultaneously, we aimed to retain the flexibility to capitalize on prospects within India's expanding market landscape. Consequently, we decided to divest these Indian enterprises to the Wuthelam Group, while also incorporating a call option to potentially buy back these businesses at a later date.

While NPHD continued to provide administrative and management support services to these companies, the two India businesses have successfully undergone measures, such as drastic management structural reforms and strategic promotion activities. The choice to buy back these businesses is grounded in our assessment that they currently hold promising potential for consistent and profitable growth following a period of losses. These two enterprises have notably captured substantial market share in the two southern states of India, which are central to their decorative business focus. Furthermore, they are now operating with positive profits. Bolstered by their robust brand recognition, the two businesses present considerable avenues for further growth.

Similar to the transaction that was executed two years ago, we have obtained an evaluation report from an independent third party, alongside a report from the special committee formed to scrutinize the transaction. Taking these reports into account, we reached an agreement with the Wuthelam Group on prices that align with the principle of Maximization of Shareholder Value (MSV), and today, the Board has granted approval for the transaction. This transaction is expected to be concluded in the first half of FY2024, accounting for the time necessary to secure approval from Indian authorities. Furthermore, it is projected to contribute to EPS from the first year.

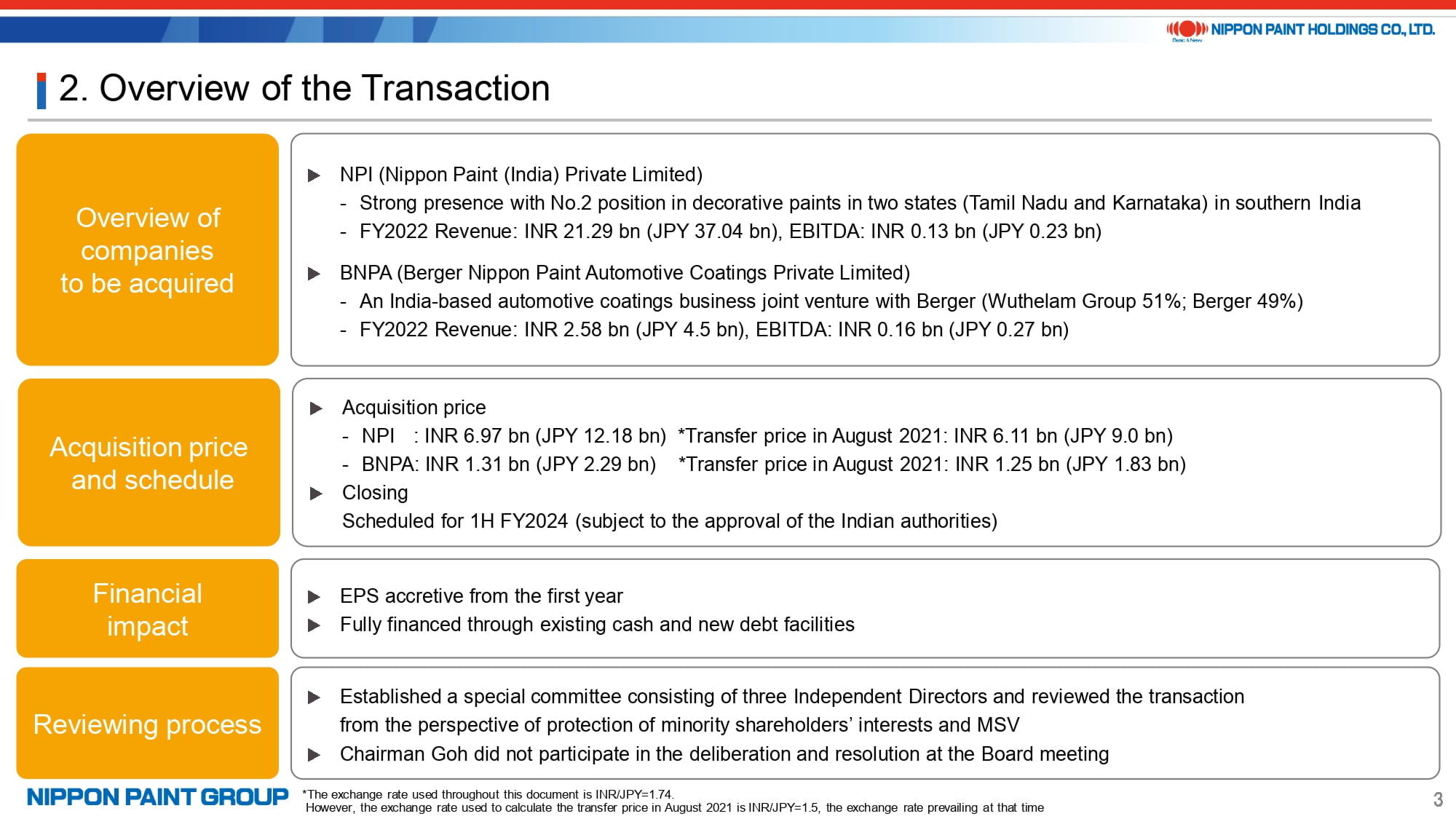

3. Overview of the Transaction

I will now proceed to provide an outline of the transaction.

The overview of the companies slated for acquisition is provided on page 3 of the presentation. Both entities returned to profitability in FY2022, and there are promising signs of further growth and improvement in profitability in FY2023.

The total acquisition price amounted to approximately JPY 14.5 billion, signifying a 33.5% increase over the initial transfer price of JPY 10.8 billion. Factoring in the yen's depreciation relative to the time of divestiture, the total acquisition price translates to roughly 12.5% higher than the transfer price when converted to Indian rupees, and remains nearly consistent when measured in US dollars at USD 100 million.

The acquisition will be completely financed with cash and is expected to contribute positively to EPS starting from FY 2024, the first year after acquisition.

The transaction was reviewed by the previously mentioned special committee. It is also important to note that Chairman Goh did not participate in the Board's decision-making process.

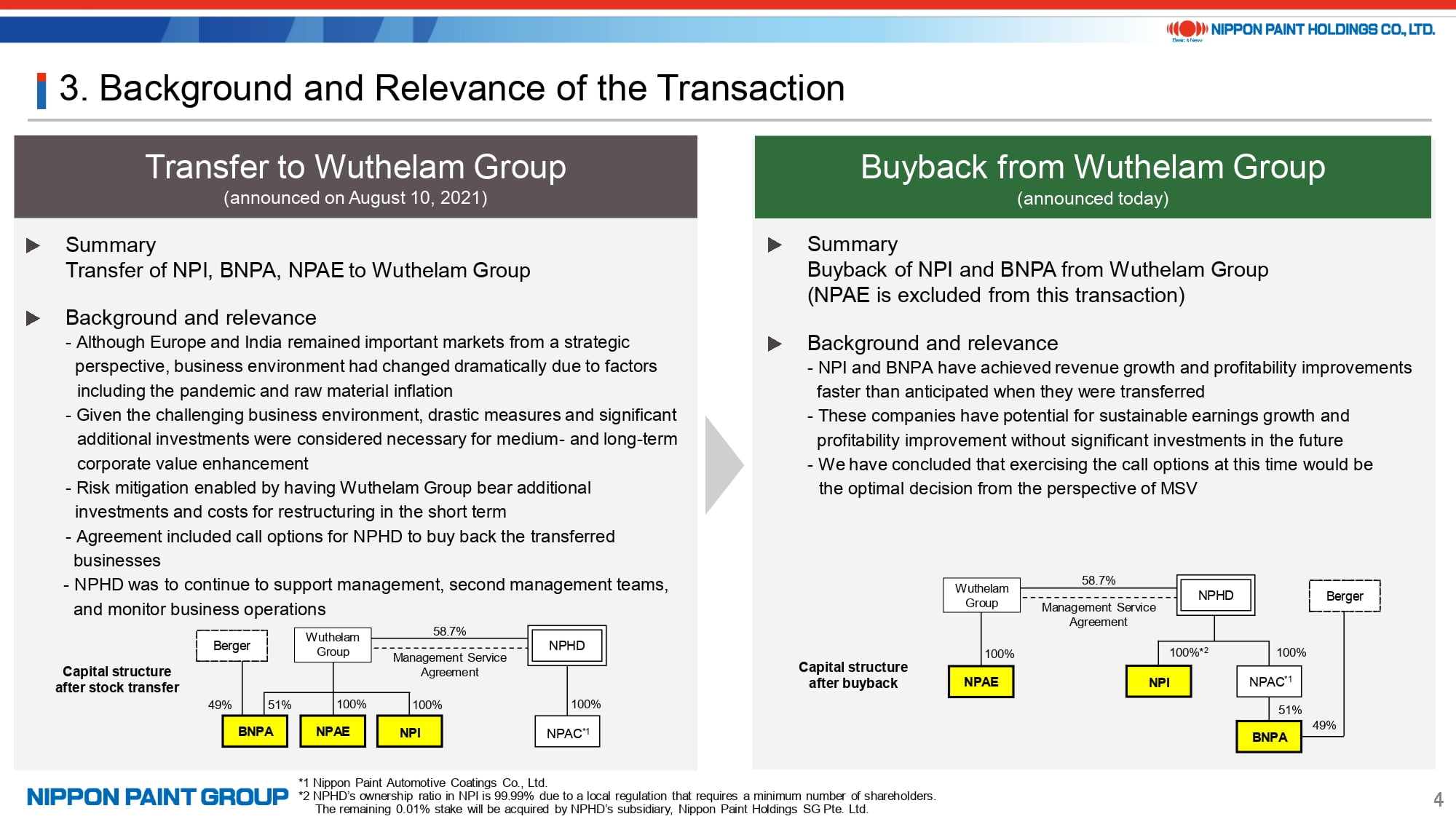

4. Background and Relevance of the Transaction

I've already covered the transaction's background and significance. I'll now offer some additional insights.

To begin with, the buyback was agreed ahead of schedule due to the unexpectedly rapid growth and improved profitability of the India businesses. This outcome contrasts with our initial projections, which had anticipated a more extended turnaround period considering the challenging market conditions we foresaw two years ago.

Secondly, a pivotal factor in our decision-making process was that while ongoing investments will be necessary for these two businesses, we expect that such expenditures can be largely covered by the cash flows generated by these businesses.

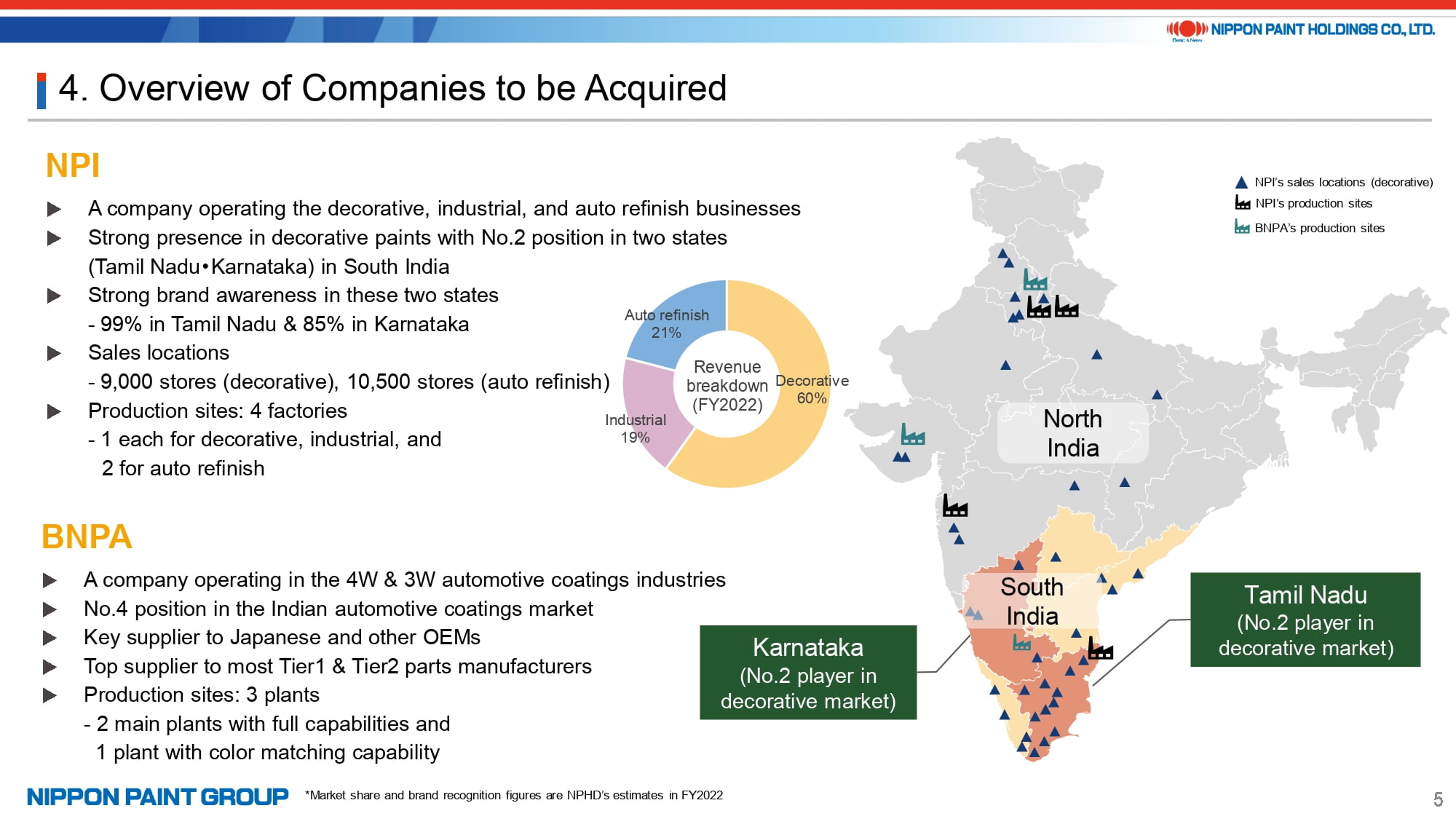

5. Overview of Companies to be Acquired

I will now provide an overview of the two Indian businesses.

NPI operates decorative, industrial, and auto refinish businesses, with the decorative business contributing to approximately 60% of the total revenue. As you might be aware, each state in India possesses unique characteristics, and the northern and southern regions differ significantly both linguistically and culturally. NPI commenced operations in FY2009, slightly trailing competitors, with a strategic focus on the southern states, particularly Tamil Nadu and later on Karnataka.

Roughly 65% of its decorative revenue originates from these two states. According to our assessments, NPI has effectively increased its market share to become the second-largest player in decorative paints in both of these states.

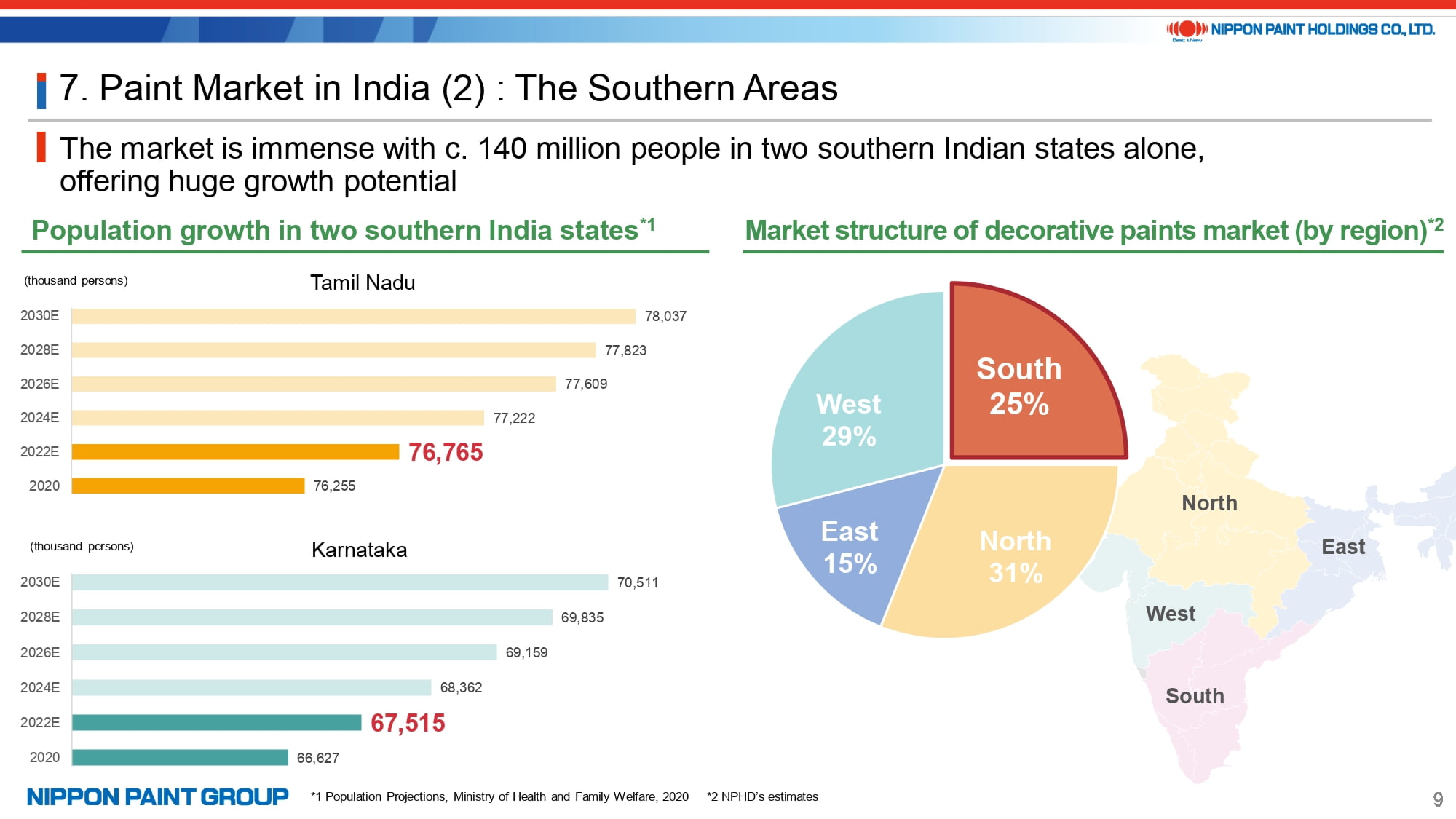

Although being states, Tamil Nadu and Karnataka boast populations of approximately 76 million and 67 million, respectively. Together, their combined population surpasses that of Japan and is continuing to grow.

Established in FY2016, BNPA started as a joint venture between NPHD and Berger. With its core operations centered on automotive coatings, the company is presently the fourth-largest player based on our estimates. BNPA's primary clientele in the OEM business consists mainly of Japanese automotive manufacturers, and also holds a notable market presence in automotive parts.

6. Performance of Companies to be Acquired

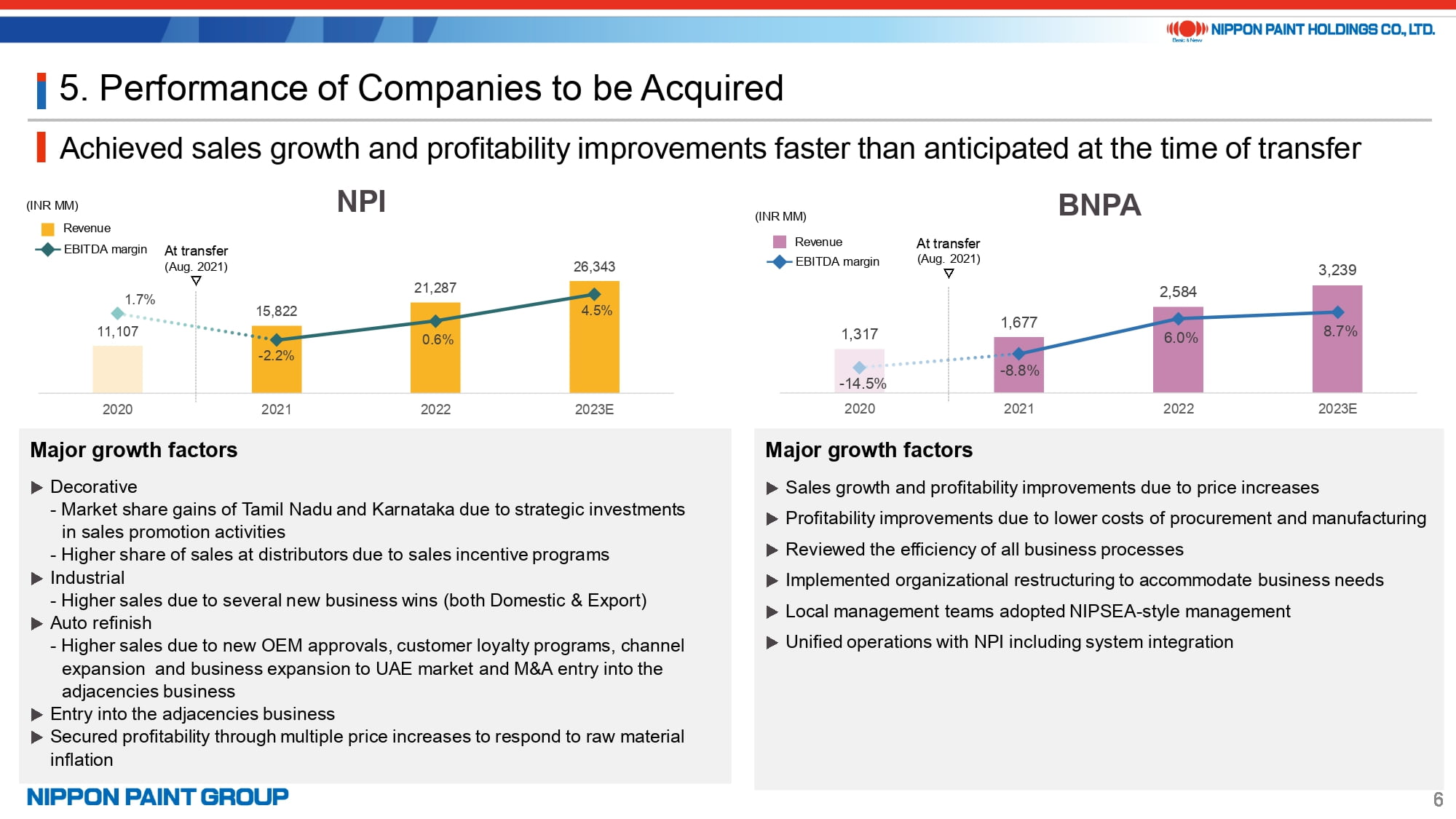

The performance trends of the two India businesses are illustrated on Page 6 of the presentation.

NPI strategically invested in sales promotion activities for its decorative paints business, resulting in a substantial increase in market share in the two states.

Furthermore, the company successfully completed a modest yet lucrative M&A transaction in the auto refinish sector. Additionally, NPI intensified its collaboration within the Nippon Paint Group for industrial coatings, extending even to Japan. This strategic approach facilitated the acquisition of new accounts, encompassing both domestic sales and exports. After incurring losses in FY2021, the company regained profitability in FY2022 and anticipates achieving an EBITDA of approximately INR 1 billion, equivalent to around JPY 1.7 billion, in FY2023. Please note that these figures are provided solely for reference, as the closure of the transaction is slated for the first half of FY2024.

Since its inception as a joint venture, BNPA had consistently experienced losses and even reported an impairment loss in FY2019. Nevertheless, significant operational reforms such as aligning operations with NPI instead of maintaining a standalone structure, streamlining operational systems, and revamping the management team, were enacted. Coupled with a comprehensive streamlining of sales operations and cost structures, BNPA achieved positive profits in FY2022, and the projections indicate further growth in profitability for FY2023.

These significant reforms entailed certain risks, yet the local management teams resolutely pursued the restructuring initiatives to meet our anticipations. As a result, they accomplished accelerated growth and margin enhancements, surpassing our initial projections. This once again underscores the capability of the NIPSEA team.

The enhancement in the decorative paints business performance holds special significance. To be precise, we are confident that we have effectively formulated what can be referred to as the winning strategy within these two states. With the belief that these businesses can achieve both growth and profitability even in a fiercely competitive market, we envision potential expansion into other states, although no concrete plans are in place at this moment.

7. India Market: Macroeconomic Data

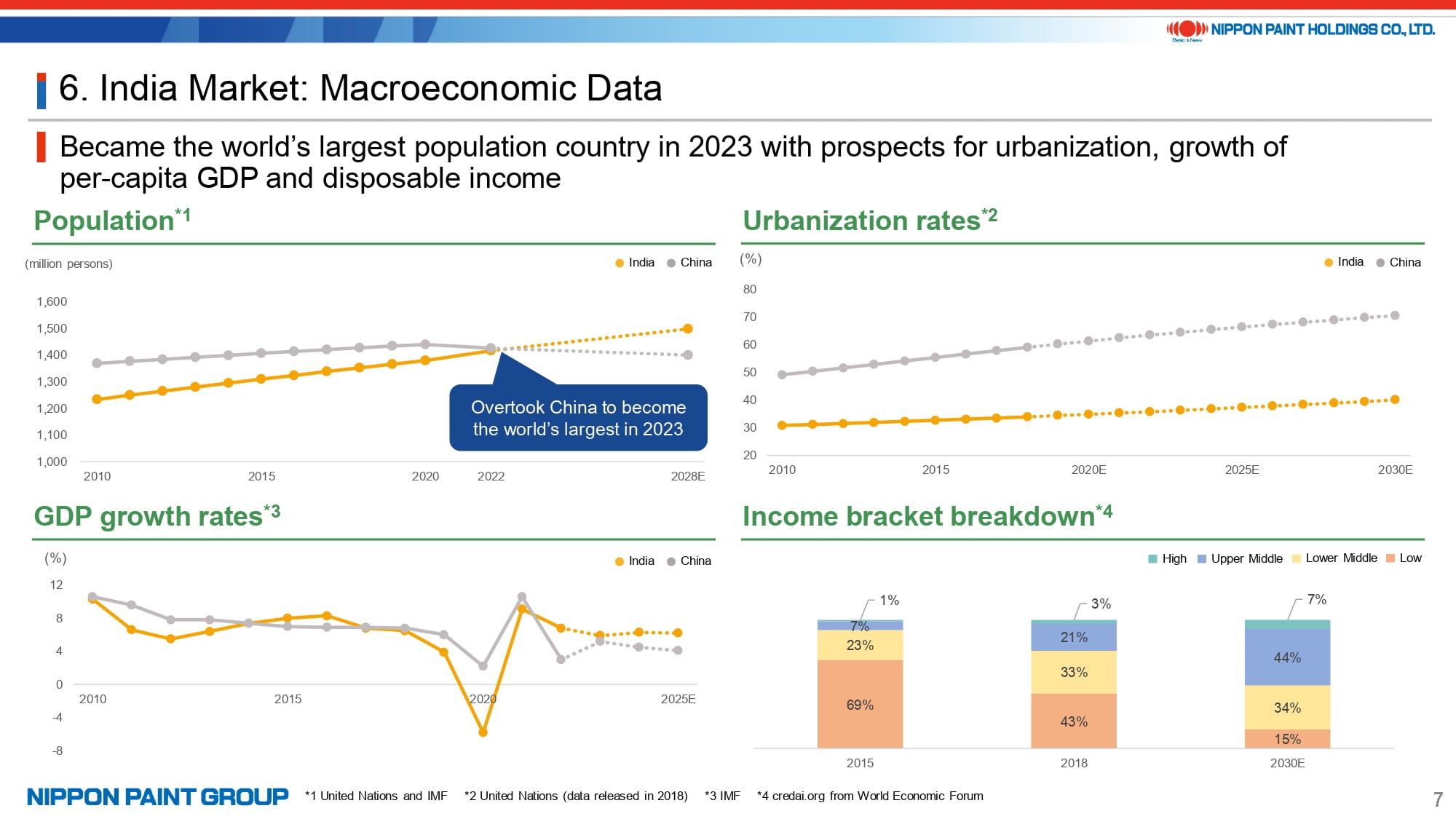

It's evident that the Indian market offers substantial growth potential, given factors such as its large population, advancing urbanization, and the projected income distribution aligned with population growth.

8. Paint Market in India (1) : The Entire India

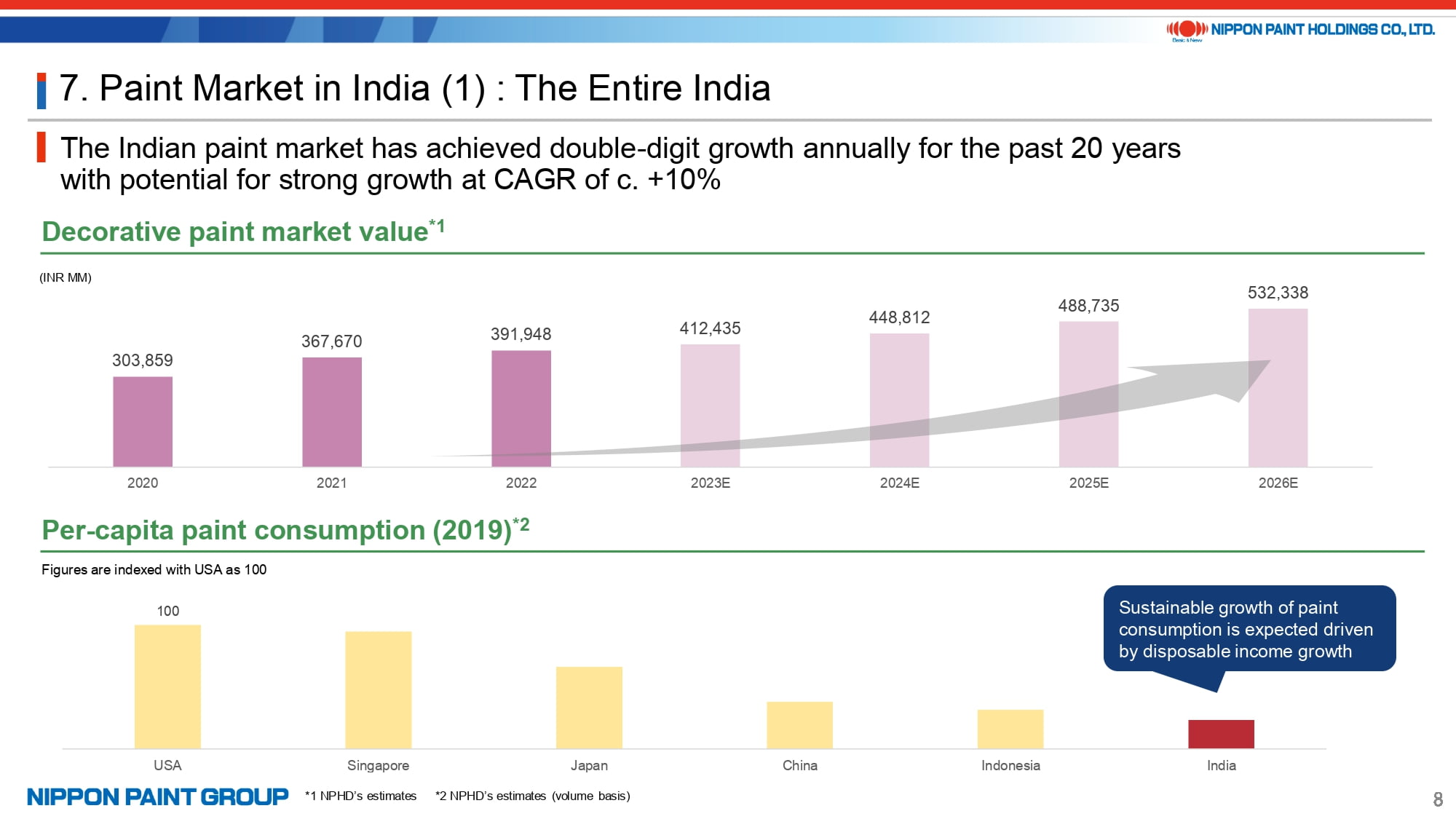

The Indian market holds substantial growth prospects, particularly in terms of the potential expansion of the decorative paints market and per-capita paint consumption. Based on our calculations, it essentially qualifies as a growth-oriented market, with a growth rate surpassing 10%.

9. Paint Market in India (2) : The Southern Areas

As previously mentioned, the combined population of the two southern states alone stands at approximately 140 million. Moreover, owing to distinct linguistic distribution patterns, the southern states prove more conducive to targeted promotional efforts than their northern counterparts. Given our market positioning in India, we hold the belief that this region-focused strategy is the most effective approach.

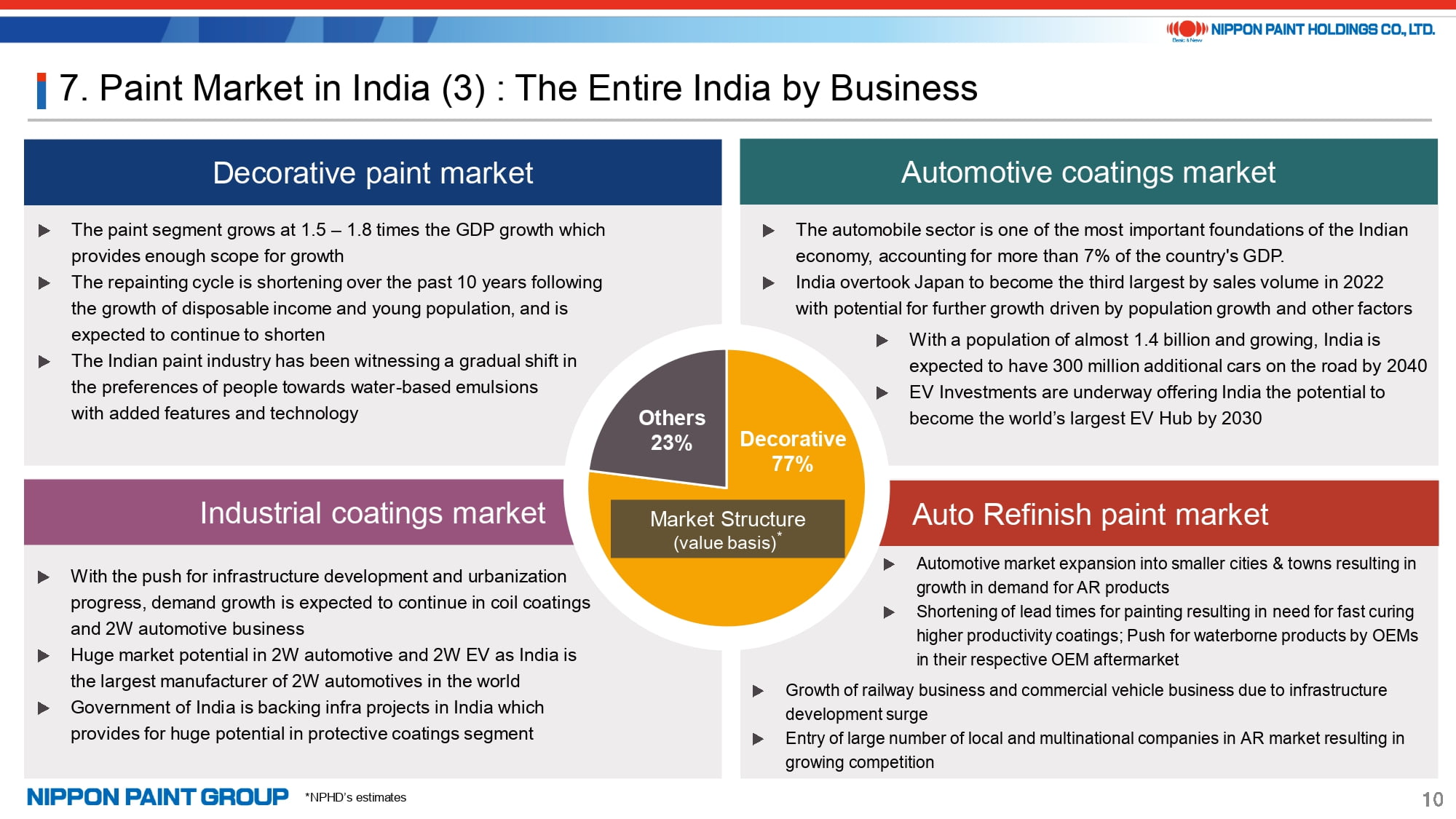

10. Paint Market in India (3) : The Entire India by Business

In terms of business segments, as expected, the decorative paints sector offers the most significant growth potential, closely followed by a robust growth potential in the automotive coatings market. It is indeed gratifying to witness the Nippon Paint Group's foothold in the Indian market beginning to take root.

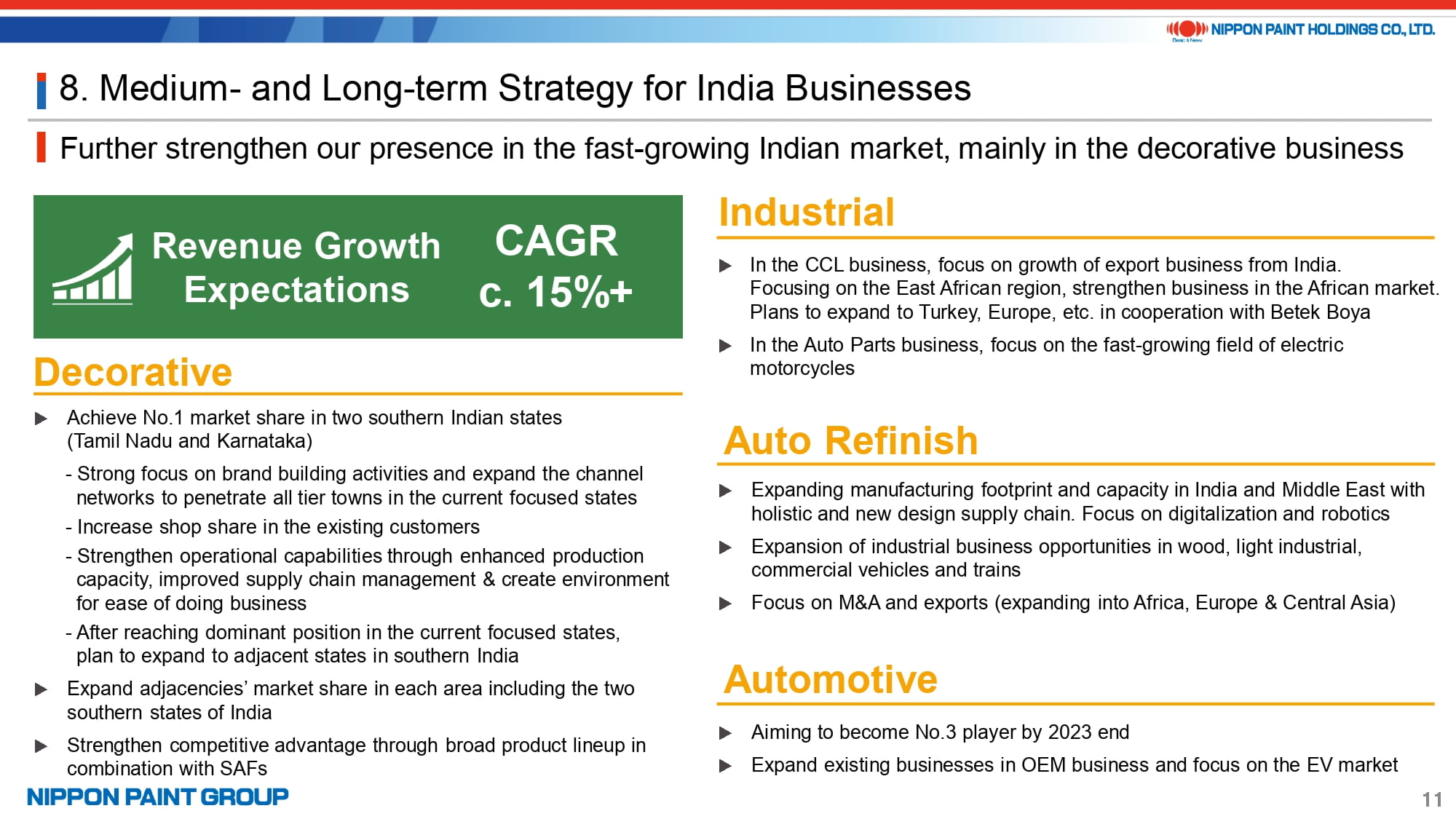

11. Medium- and Long-term Strategy for India Businesses

Page 11 provides a concise overview of our medium and long-term strategy for the India businesses.

With the objective of attaining growth exceeding 15% to outperform the market and securing the top position in the decorative paints market, especially in the two southern states, our focus remains on investing in sales channels and enhancing productivity. Once we confidently harvest the benefits of these endeavors, our intention is to progressively expand into neighboring states. Furthermore, we will actively seek to increase our market share in adhesives and other adjacencies markets, aiming to attain a competitive edge by establishing dominant positions in both the paint and adjacencies markets.

Regarding the automotive coatings business, the local management is actively implementing strategies to achieve a position as the third-largest player in the market by the end of FY2023. It goes without saying that addressing the burgeoning electric vehicle (EV) market in India is also of paramount importance.

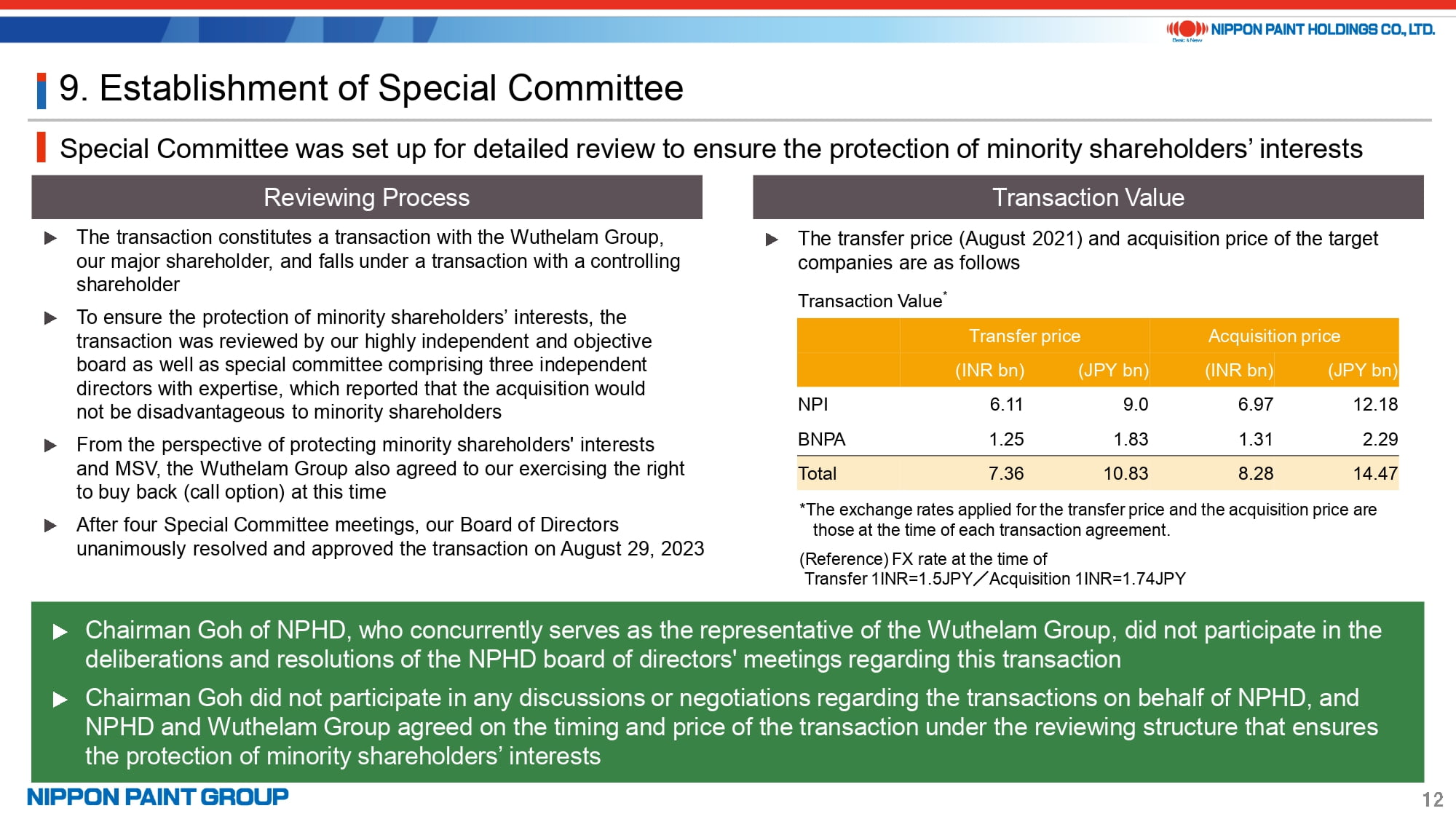

12. Establishment of Special Committee

Before wrapping up my presentation, I will explain the review process for this transaction.

Similar to the transaction that took place two years ago when the two businesses were divested, we established a dedicated special committee to thoroughly assess the transaction, with a particular focus on safeguarding the interests of minority shareholders. The Board received a comprehensive report from this special committee following its four meetings. Ultimately, the transaction received unanimous approval at the Board meeting, with Chairman Goh abstaining from participation.

Thank you for your kind attention.