1. Front Cover

Good afternoon, everyone. I’m Yuichiro Wakatsuki, Co-President of Nippon Paint Holdings.

Thank you very much for taking the time to participate in our conference call regarding the financial results for the third quarter of fiscal 2023 and the update on the financial guidance for fiscal 2023.

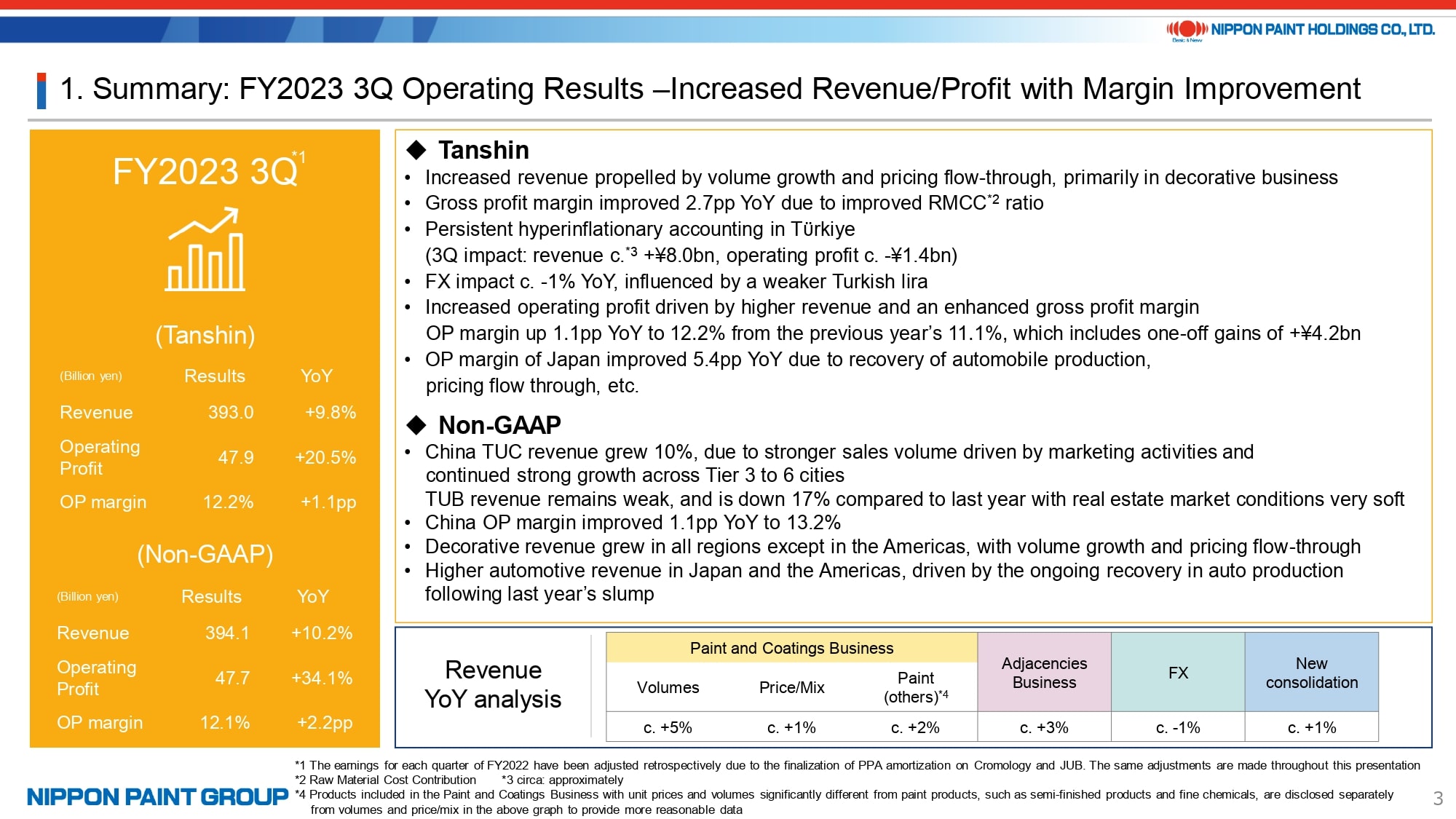

2. Summary: FY2023 3Q Operating Results -Increased Revenue/Profit with Margin Improvement

I would like to begin by summarizing the financial results for the third quarter of fiscal 2023.

On a Tanshin basis, we continued to register a noteworthy growth in both revenue and operating profit. Revenue increased 9.8% year-on-year to 393 billion yen, and operating profit recorded a year-on-year surge of 20.5% to 47.9 billion yen. Kindly refer to the year-on-year revenue growth breakdown shown at the bottom of page 3. Positive contributors include sales volumes and price/mix in the paint and coatings business, adjacencies business, and new consolidations. Nevertheless, there was a slight adverse foreign exchange impact on revenue, primarily attributed to the depreciation of the Turkish lira.

Regarding profitability, the gross profit margin increased by 2.7 percentage points (pp) compared to the same period last year. This improvement can be attributed to revenue growth, ongoing moderation in raw material prices, and effective implementation of pricing adjustments. The operating profit margin reached 12.2%, marking a 1.1 pp improvement from the previous year, which included one-off gains. Despite a challenging macroeconomic landscape, these robust results highlight our strong market shares and brand strengths, among other factors.

On a Non-GAAP basis, there was a 10.2% rise in revenue and a 34.1% increase in operating profit. In the Chinese decorative paints business, TUC revenue increased by 10%, whereas TUB revenue declined by 17%. The operating profit margin for the entire Chinese business reached 13.2%, reflecting a gain of 1.1 percentage points from the corresponding period last year. The Chinese business exhibited strengths in navigating the challenging demand environment, aided by the efficient control of SG&A expenses.

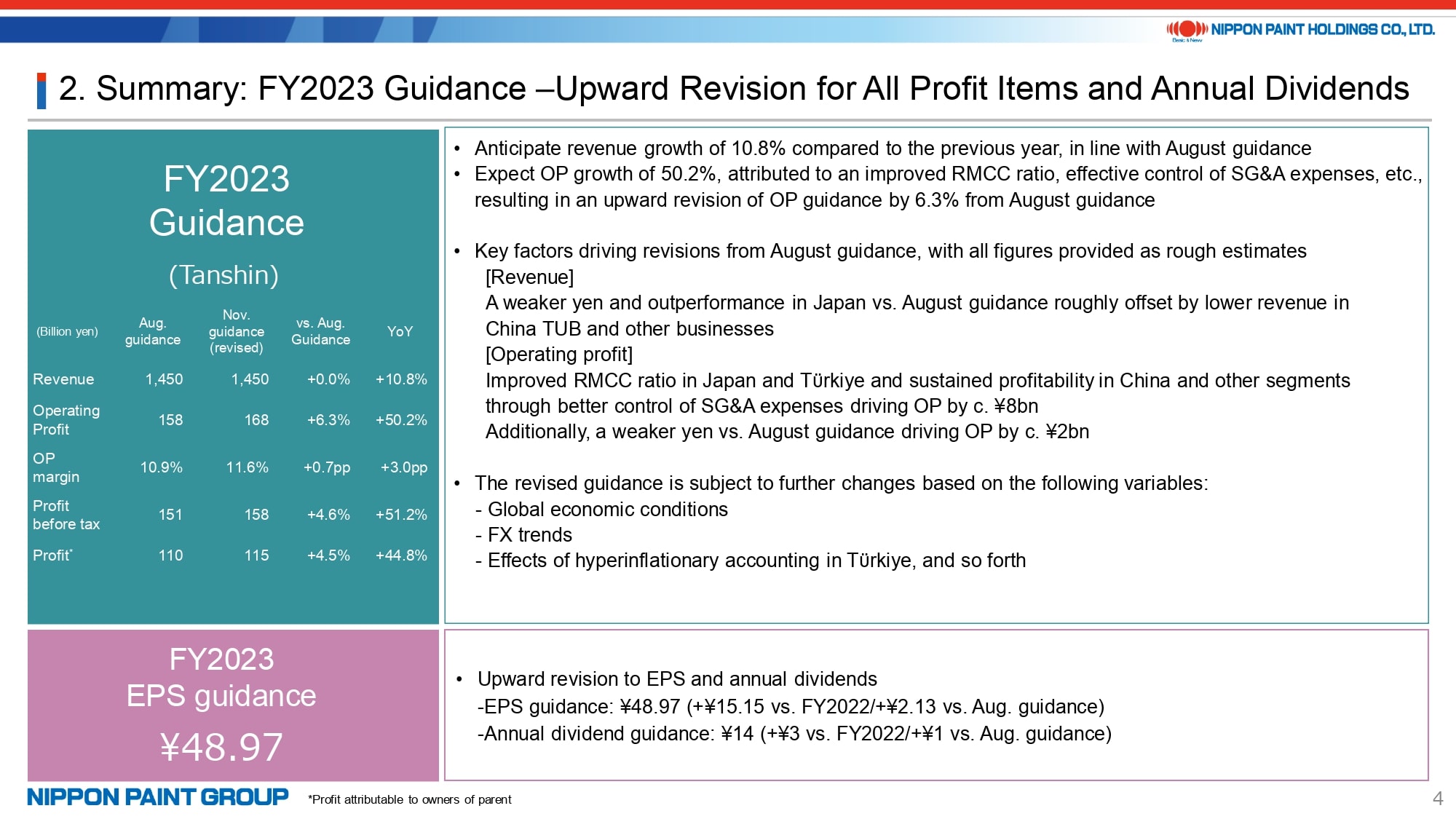

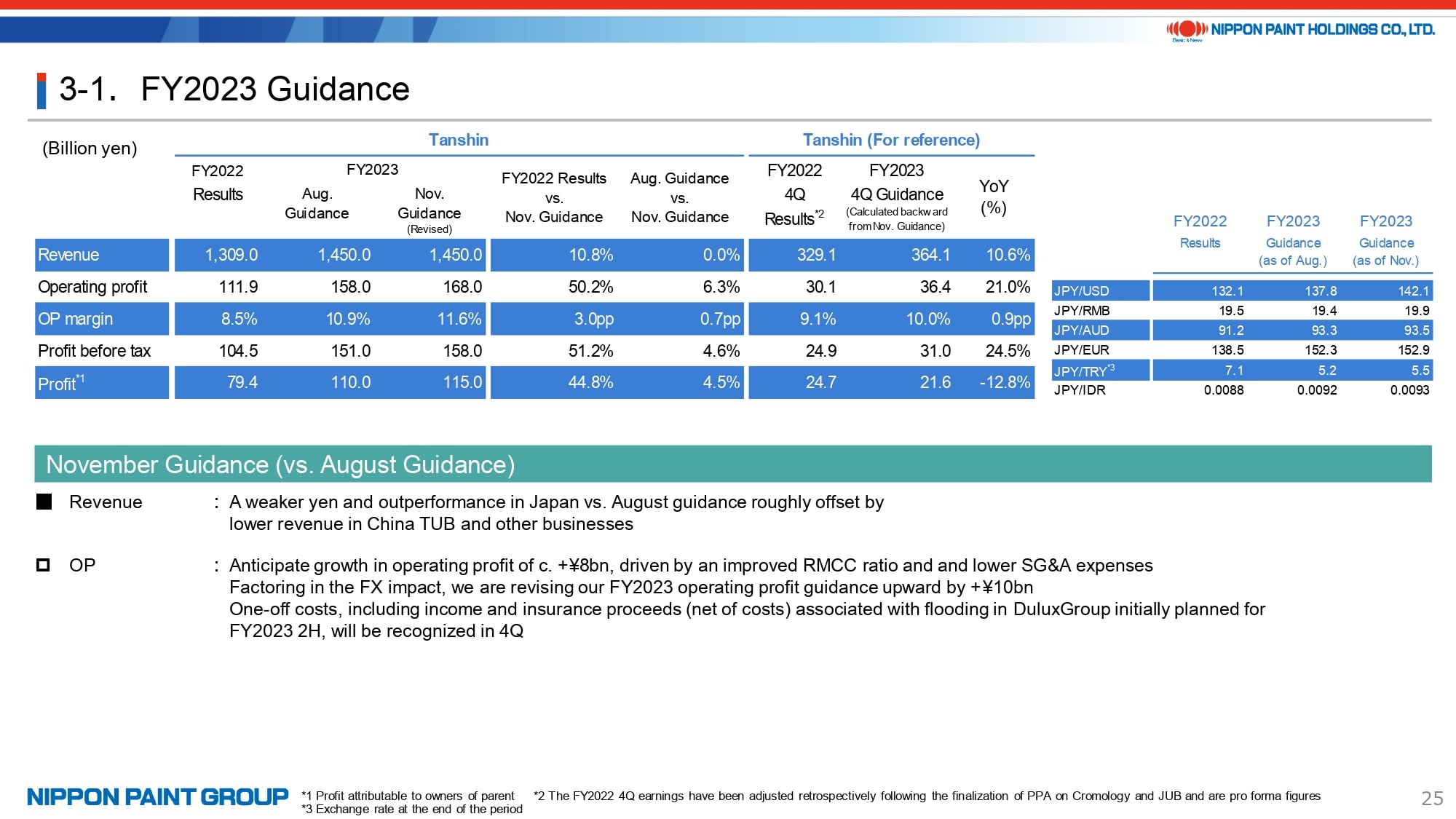

3. Summary: FY2023 Guidance -Upward Revision for All Profit Items and Annual Dividends

We have revised our full-year guidance upwards once again from the guidance provided in August 2023.

Our revenue projections, indicating a 10.8% growth from the previous year, remain unchanged. However, the operating profit guidance has been revised upward by10 billion yen, to 168 billion yen, a 50.2% increase from the previous year.

There has been no revision to the revenue guidance as we anticipate revenue to come in roughly in line with our August guidance due to FX impact and ups and downs in different regions. The breakdown of factors contributing to upward revision to the operating profit guidance are approximately 8 billion yen from an improvement in business performance and approximately 2 billion yen from the positive FX impact.

As we approach the end of the year, we anticipate minimal fluctuations in our performance for fiscal 2023. Nonetheless, the 4th quarter is typically a soft demand period. Additionally, variable factors such as global economic trends, foreign exchange impacts, and hyperinflationary accounting in Türkiye are considerations. With our commitment to stringent cost control, we are determined to meet the operating profit guidance.

Additionally, the EPS guidance has been revised upward. Furthermore, we have raised the annual dividend guidance by one yen compared to our August guidance, resulting in an increase of three yen per share from the previous year to 14 yen per share.

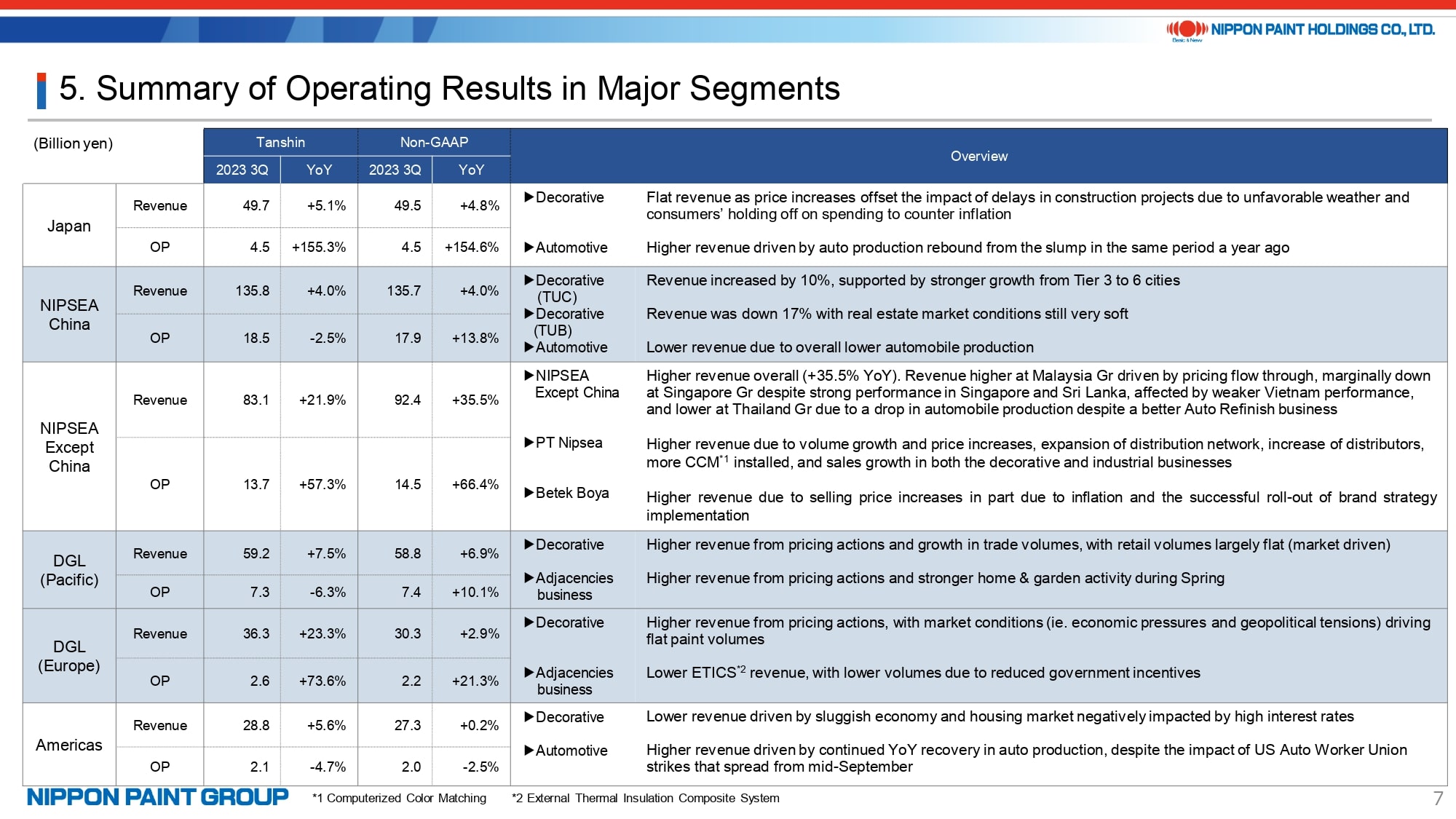

4. Summary of Operating Results in Major Segments

I will skip pages 5 and 6 and turn to page 7. Now, I will provide an overview of our operational outcomes across key segments in the third quarter of fiscal 2023. I will address questions related to this topic during the Q&A session. For detailed information, you can refer to our segment results starting on page 15 of the presentation.

- In the Japan segment, prices and volumes both increased in the automotive and marine businesses. On the contrary, in the decorative and industrial businesses, the decrease in volumes was offset by price increases. The operating profit margin in the Japan segment stood at 9.1%, demonstrating a significant improvement from 3.8% in the same period a year ago.

- The NIPSEA China TUC business consistently achieved revenue growth across all areas, particularly in Tier 3-6 cities. Despite a deterioration in price/mix resulting from stronger sales growth in economy products, the TUC business delivered robust earnings growth. This was driven by generally higher profitability compared to the TUB and industrial businesses, with additional support from operating leverages. Credit loss provisions related to the NIPSEA China business in the third quarter of fiscal 2023 were approximately 1.5% of the overall sales. These provisions are included in both our Tanshin and Non-GAAP figures, in line with my response during the Q&A session for the second quarter of the fiscal 2023 earnings call. The credit loss provision in the third quarter decreased from the amount recorded in the second quarter of the fiscal 2023, which was approximately 2% of the overall NIPSEA China sales. Additionally, we anticipate a further decrease in the amount of provision in the fourth quarter of fiscal 2023, to roughly 1% of the overall NIPSEA China sales. Moreover, the amount of provision is projected to decrease further in fiscal 2024.

- In Asia except NIPSEA China, we maintained a robust trajectory of revenue and profit growth. In our key regions, the operating profit margin in Türkiye improved significantly, specifically by approximately 11% YoY, even after adjusting for hyperinflationary accounting. This improvement was driven by price adjustments in the local currency basis in response to inflation, coupled with an improved raw material cost contribution ratio. Additionally, the Indonesia business sustained a strong performance with a 6.2% revenue growth and an operating profit margin exceeding 30%.

- In the core Pacific segment of DuluxGroup, sales volume remained steady due to sluggish market conditions; however, effective pricing flow-through drove revenue growth of approximately 7%. In the Europe segment, both Cromology and JUB achieved revenue growth driven by price increases that more than offset sales volume declines. JUB’s performance was affected by the reduced sales volume of ETICS, but the operating profit margin in the overall Europe segment improved considerably. Please be advised that DuluxGroup’s performance has been reported under two subsegments: DGL (Pacific) and DGL (Europe) beginning from the third quarter of fiscal 2023. The performance of DuluxGroup’s Europe businesses, including Cromology, JUB, and NPT, is reported under DGL (Europe).

- Regarding our performance in the Americas, the strikes of the United Auto Workers union affected the automobile production volumes at the three largest US automakers (the Big 3). However, our dependence on these companies in terms of sales is not very high. Consequently, our automotive revenue generally remained on a recovery path. On the other hand, our decorative revenue continued to be affected by the slowdown in the housing market. As a result, our decorative revenue slightly decreased from the same period a year ago, with the positive impact of price increases more than offset by a decrease in sales volume. Meanwhile, our operating profit in the overall Americas segment remained roughly stable compared to the same period a year ago.

5. Major Topics (1)

Shifting the focus to major topics, the 2023 edition of the Integrated Report was released at the end of September. We have accomplished great work again this year, and we view this Report as an essential tool for investor engagement. I would like to invite everyone to take a moment to read the Report.

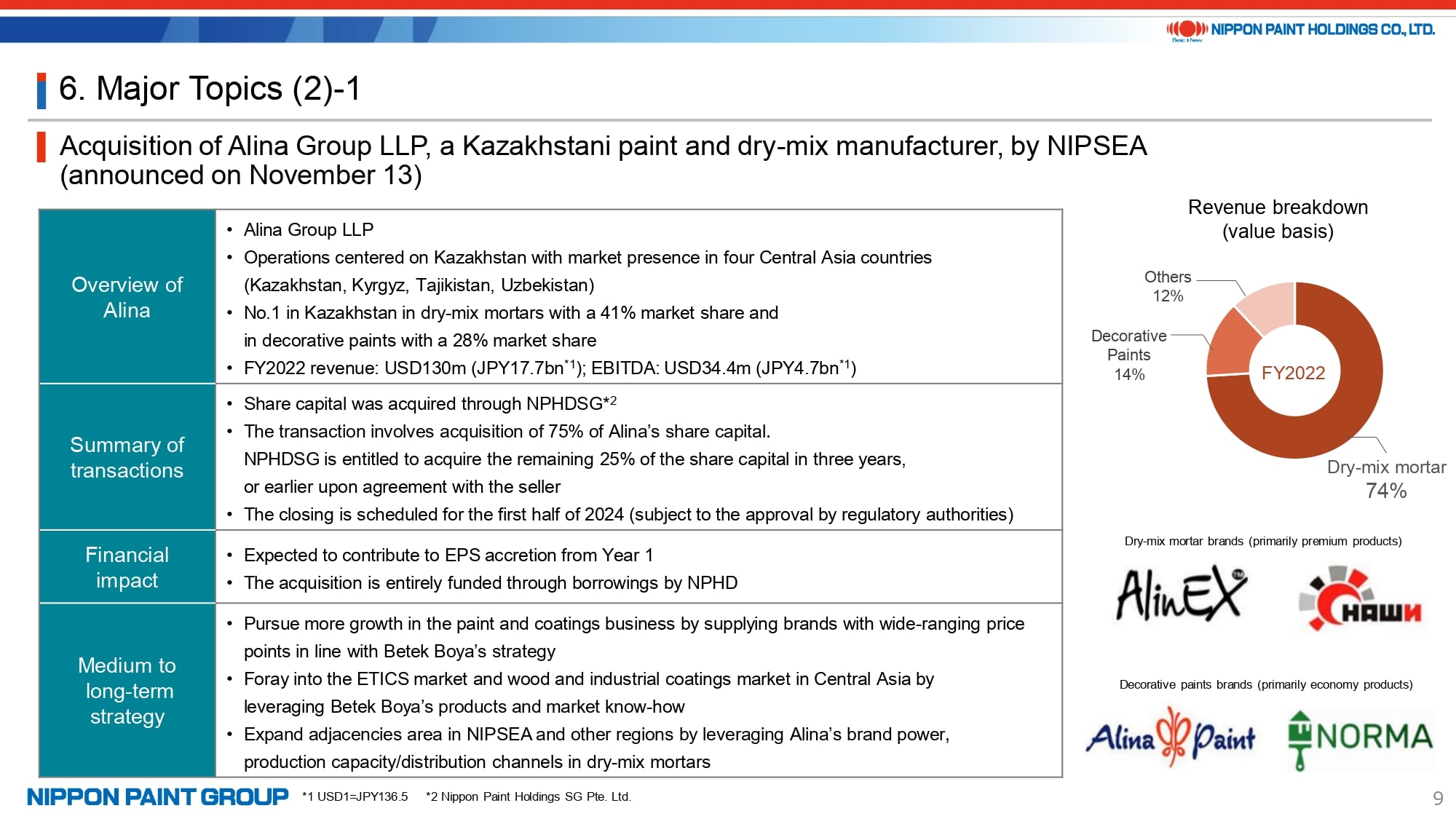

6. Major Topics (2)-1

Now, I will provide some supplementary explanations about the acquisition of the leading Kazakhstani paint and dry-mix mortar manufacturer announced on November 13.

Our Group had already entered the Kazakhstan market through a sales company of Betek Boya in Türkiye. We were exploring the possibility of establishing local operations to facilitate local production for local consumption. It was during this period that we identified this acquisition opportunity, which we primarily examined with the NIPSEA team. Eventually, we successfully signed the acquisition agreement. We anticipate that this company will contribute to EPS accretion from the first year by leveraging the outstanding management team and strong brands, combined with the marketing expertise of our Group. We are excited about this highly promising investment with significant growth prospects, driven by increasing urbanization that will lead to a shift in paint demand towards premium products and other growth drivers. The closing is scheduled for the first half of fiscal 2024, subject primarily to approval by the anti-monopoly authorities.

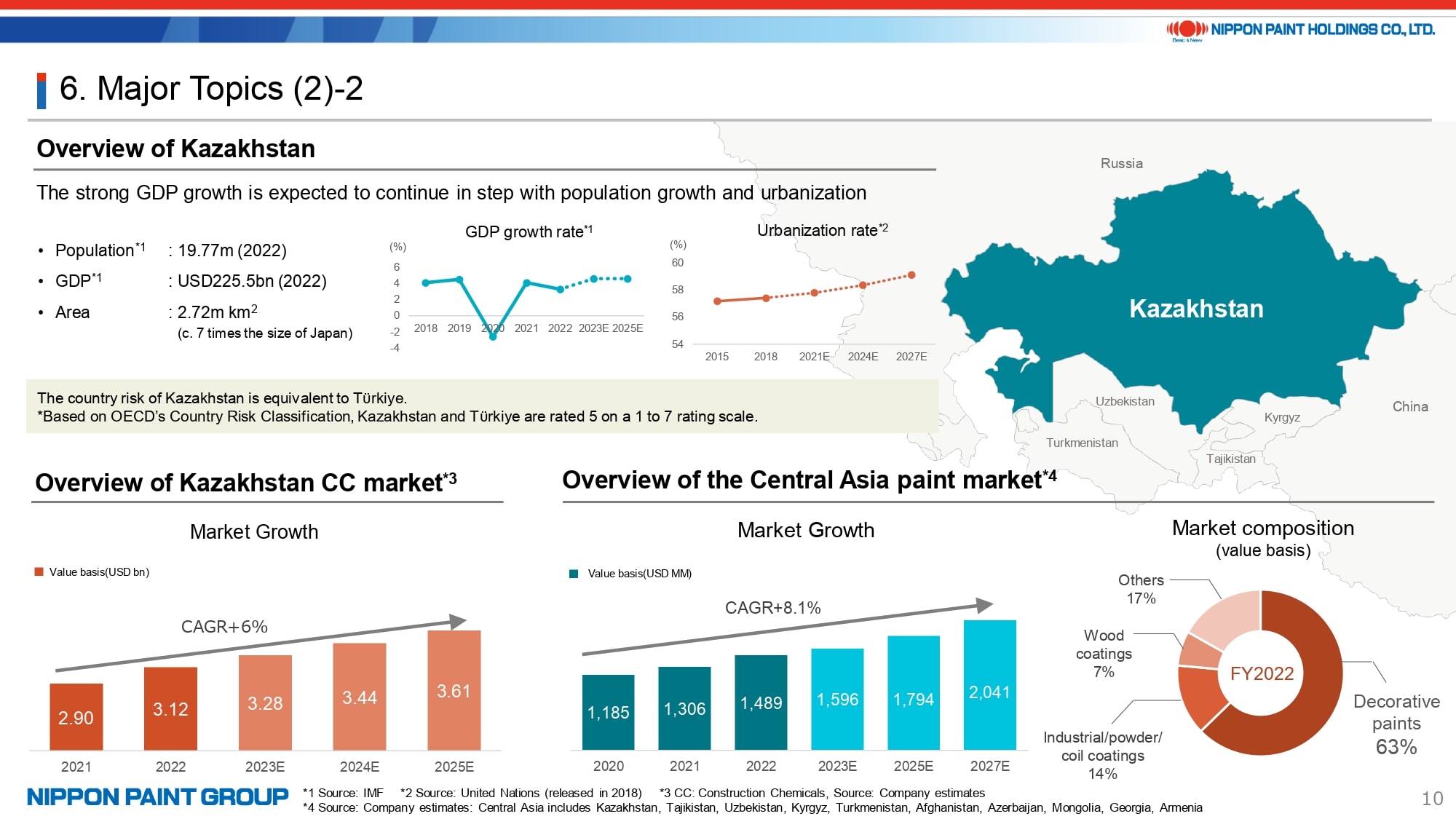

7. Major Topics (2)-2

The decorative paints market in Kazakhstan is projected to grow steadily. We are very pleased that the No.1 paint brand in this promising market will be joining our Group. The presence of NIPSEA Group and Betek Boya, both winning teams in Asia, in our Group will reinforce the strengths of the target companies without unnecessary interference from the headquarters.

8. FY2023 Guidance

Before concluding my presentation, I will provide a supplementary explanation about the financial guidance.

We have provided the fourth quarter guidance, calculated by deducting the third quarter cumulative results from the revised fiscal 2023 guidance, strictly for reference purpose.

As mentioned earlier, the fourth quarter is typically a period of soft demand, and the economic landscape may not be particularly favorable. Nevertheless, we anticipate approximately 10% year-on-year revenue growth and a 0.9 pp improvement in the operating profit margin, to approximately 10%. This projection includes approximately one billion yen in costs related to a flooding event in DuluxGroup, which will be offset by insurance proceeds recorded in the first half of fiscal 2023. Furthermore, the fourth quarter guidance includes approximately one billion yen (or around 1% of sales) in credit loss provisions related to NIPSEA China, along with adjustments for hyperinflationary accounting in Türkiye. As I stated at the outset, the full-year results are subject to change due to market trends, FX movements, and the impact of hyperinflationary accounting towards the end of this year.

I would like to reiterate that the third quarter results and the upward revision to the fiscal 2023 financial guidance are the outcomes of untiring efforts in each of our operating regions, demonstrating the strengths of our Group. With a keen focus, we are continuously exploring M&A opportunities with a commitment to accumulating EPS.

This concludes my presentation. Thank you for your kind attention.