1. Front Cover

Thank you for taking the time out of your busy schedule for participating in today’s briefing on the Integrated Report.

In this session, I’ll be discussing the major components of the Integrated Report 2023, which was released at the end of September 2023.

As we have begun preparing the 2024 edition of the Report, your candid feedback would be immensely valuable to us.

2. The Aim of Today’s Briefing

I’d like to start by outlining the purpose of this briefing.

Our objectives are threefold:

- Given the extensive length of the Integrated Report 2023, totaling 134 pages, we understand that fully reading the Report can be time-consuming. This briefing will highlight the core aspects of the Report to enhance investors’ comprehension of our strategies centered on Maximization of Shareholder Value (MSV) in a more efficient manner.

- Engage with investors regarding our business model, competitive advantage, management strategies, and sustainability initiatives, among other aspects. The insights gained from this engagement will be instrumental in enhancing our future corporate management and Investor Relations (IR) activities.

- These efforts will contribute to the maximization of PER and provide valuable insights for the creation of the 2024 edition of the Report.

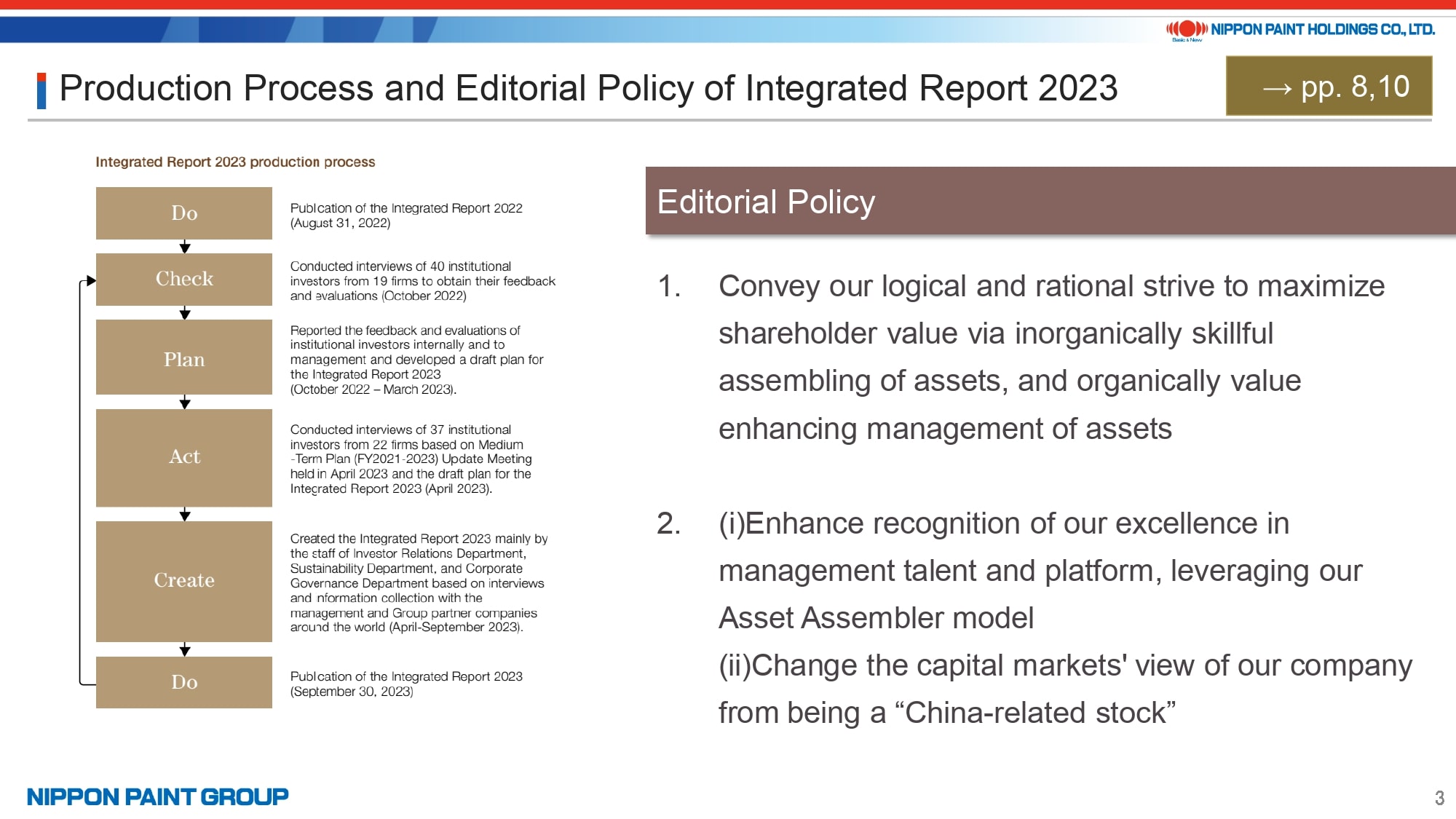

3. Production Process and Editorial Policy of Integrated Report 2023

The editorial policy for the 2023 edition was primarily guided by two goals:

- Communicate our methodical and reasoned pursuit of MSV through inorganically skillful assembling of assets and value enhancing management of assets.

- (i) Enhance recognition of our unique Asset Assembler model being a model backed by excellence in management talent and platform, not just by the advantage in funding and (ii) Shift the capital markets’ perception of our company from a “China-related stock”.

The diagram on the left side of this page illustrates the production process of the Report.

I want to extend my thanks to the investors for their time and the invaluable feedback they provide us in our annual meetings.

Our management team’s engagement in producing the Report is intensifying, and the Report’s completion is made possible through the cooperation and assistance of our Co-Presidents Wakatsuki and Wee, and it’s further enhanced by the contributions of our Lead Independent Director Nakamura and Chairman Goh.

The quality of the Report has consistently improved over the years, largely thanks to your valuable feedback. But we recognize that there are still many areas where we can enhance it further.

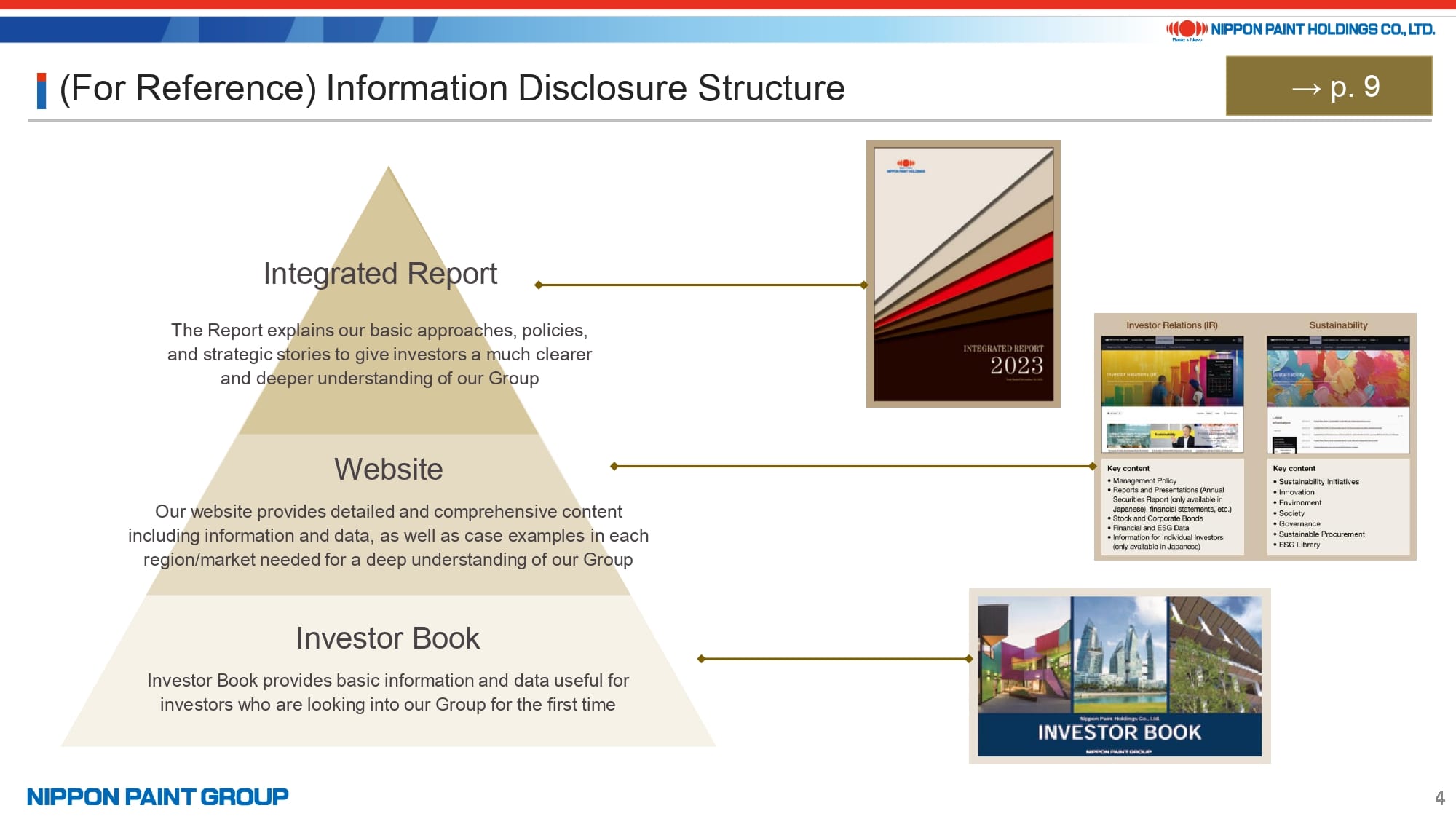

4. (For Reference) Information Disclosure Structure

The diagram on this page demonstrates how the Integrated Report fits into our overall structure of information disclosure.

As we broaden the scope of information in the Report, naturally, its volume grows. Some investors have commented that while they value the enhanced information, it does require a significant amount of time to read through it all. Our approach with the Integrated Report is to focus on outlining our fundamental strategies, policies, and key strategic initiatives with the aim of providing investors a clearer and deeper insight into our Group.

Our Report may have fewer on-the-ground case studies and employee features compared to other companies’ integrated reports. We have the Investor Book as a complementary tool to the Report.

Our corporate website serves as the comprehensive platform that offers detailed and extensive content, including essential information and data, along with case examples from various regions and markets.

Our Investor Book is designed to offer basic information and data useful for investors who are researching our Group for the first time.

In FY2024, we’ll enrich our website with more detailed and elaborate case studies and content that showcase the dedication and passion of our staff, extending beyond what is presented in the Integrated Report.

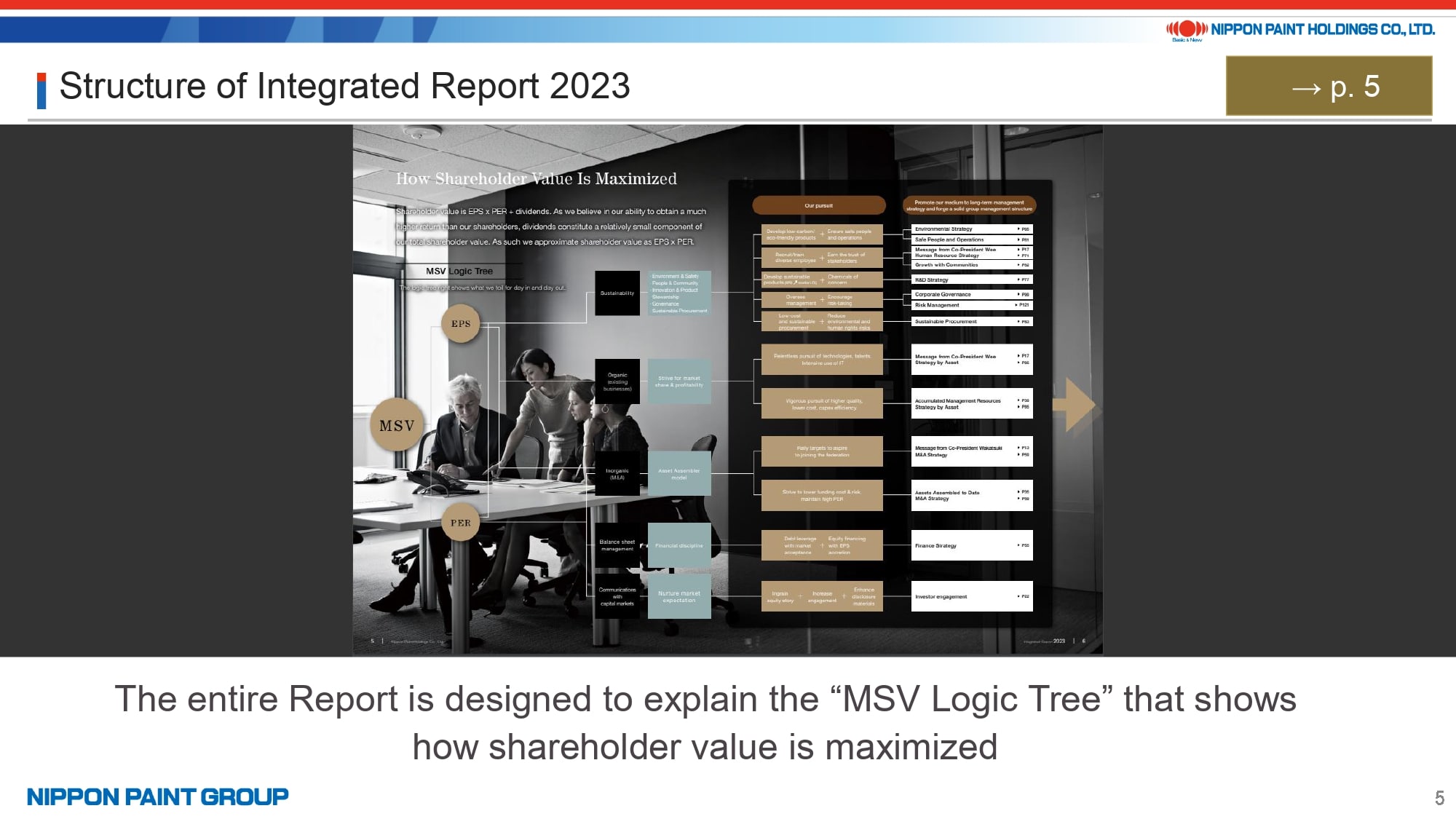

5. Structure of Integrated Report 2023

Let’s now examine the structure of the Integrated Report 2023.

On page 5, you’ll find the MSV Logic Tree that visually represents how we maximize shareholder value. A notable change in this year’s edition is our use of the MSV Logic Tree as a guiding framework throughout the Report to logically outline our roadmap to achieving MSV.

Every effort we make, whether it’s in sustainability initiatives, managing our existing businesses, engaging in M&A activities, overseeing balance sheet management, or interacting with the capital markets, is geared towards achieving MSV through the maximization of EPS and PER. The formula we’ve laid out is a straightforward representation of our approach to MSV. It clearly outlines the objectives of each of our activities and directs you to the specific pages in the Report where you can find more detailed information.

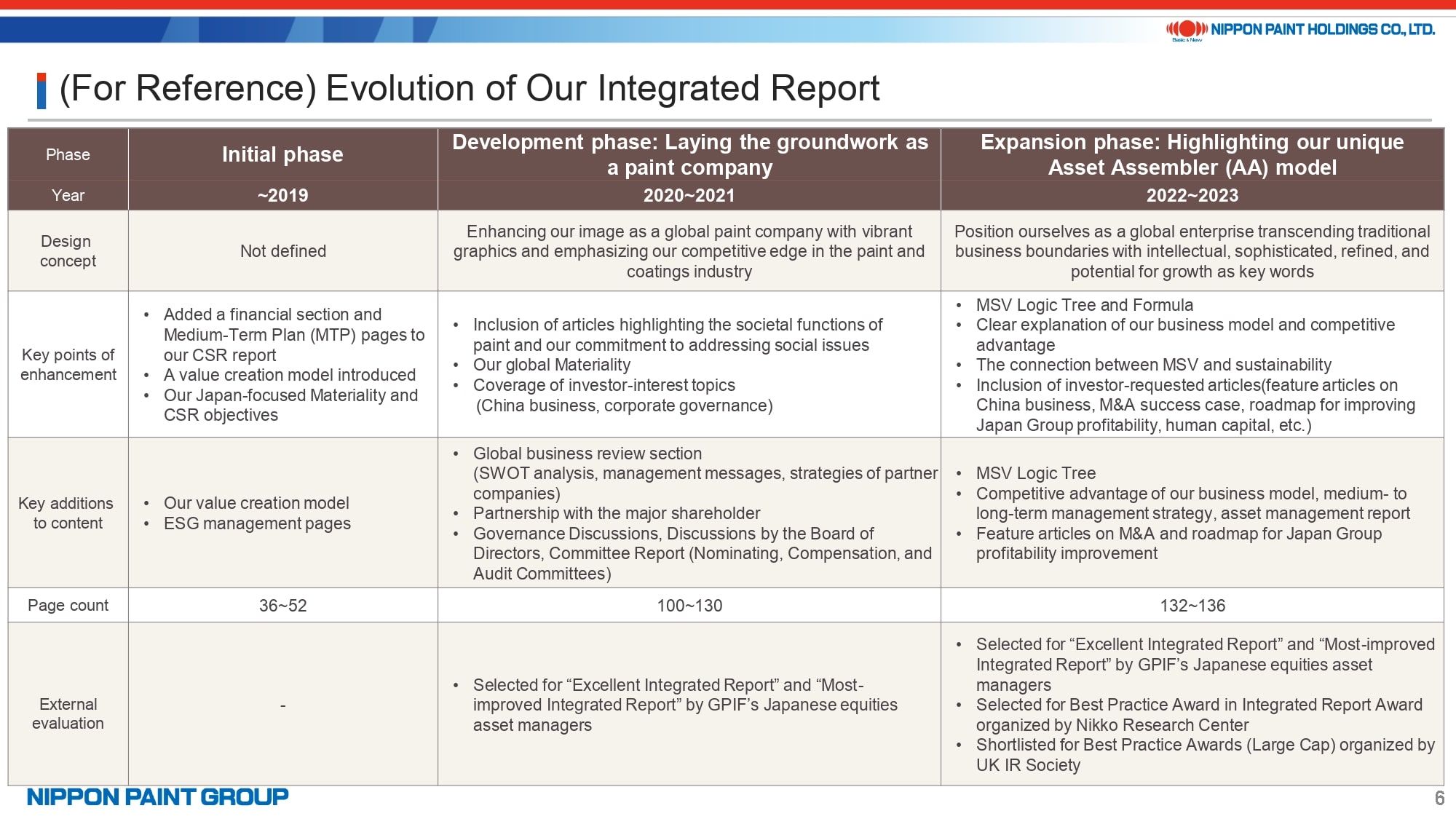

6. (For Reference) Evolution of Our Integrated Report

This page summarizes the evolutionary stages of our Integrated Report.

Ever since our current management structure started in FY2020, we have recognized the Integrated Report as a vital means of communication with our investors. We’ve continuously enhanced and evolved the Report each year, incorporating the feedback and suggestions from our investor community.

With the redefinition of our company as an Asset Assembler that goes beyond the traditional paint company, our primary objective from the 2022 edition onwards has been to effectively communicate our strategies and methods for achieving MSV, as well as our distinctive competitive advantage.

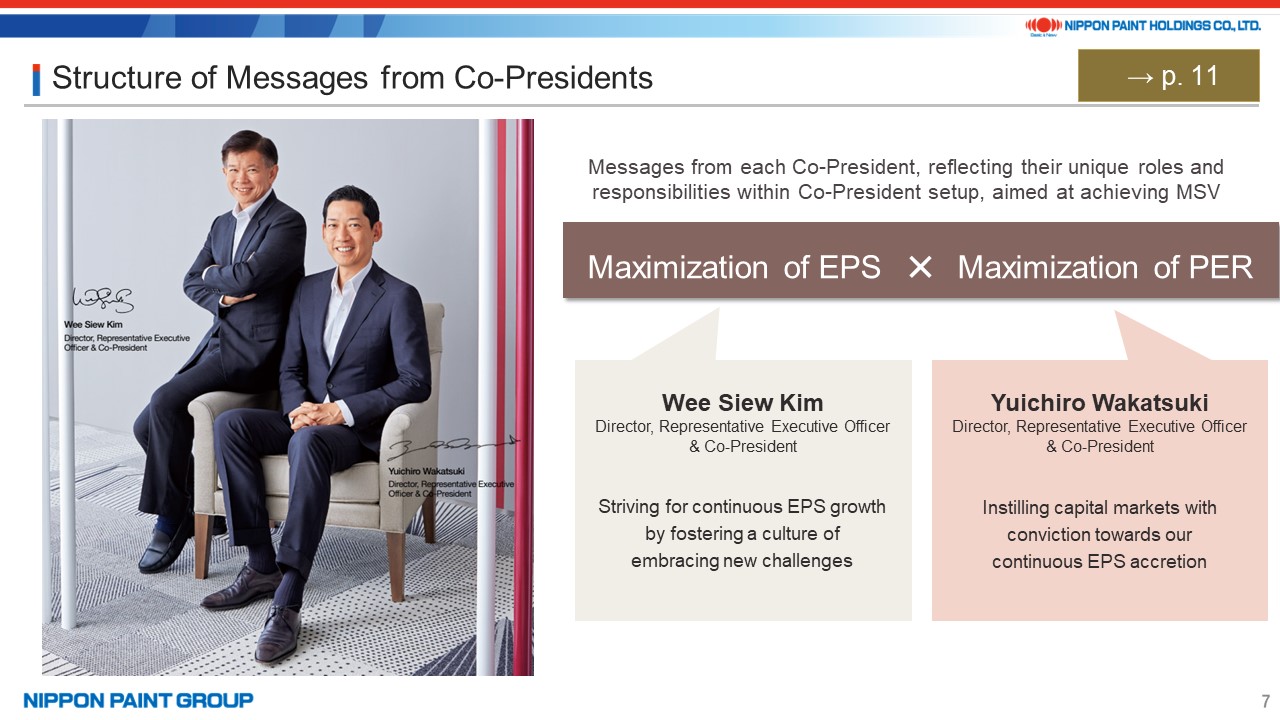

7. Structure of Messages from Co-Presidents

Let’s now focus on the key elements of the Report.

Starting on page 11, you’ll find messages from each of our Co-Presidents. Nippon Paint Group, under our unique Co-President structure, is collectively striving towards MSV, spearheaded by the leadership of our two Co-Presidents, with Co-President Wee concentrating on the maximization of EPS and Co-President Wakatsuki focusing on the maximization of PER.

Both Co-Presidents Wee and Wakatsuki have crafted their messages to reflect their individual passions and perspectives, based on their key roles and responsibilities.

8. Message from Co-President Wakatsuki

In his message on page 13, Co-President Wakatsuki outlines our approach to firmly establishing in the capital markets our commitment to continuous EPS growth as a means to maximize PER.

He does this by defining six key approaches, including:

(1) “As a federation of excellent assets, we derive our strength from our unwavering commitment to Integrity in our pursuit of MSV.”

Here, he discusses how our strengths are rooted in the rapid decision-making facilitated by our effective Co-President structure and the open, dynamic discussions among Board members, built on a foundation of trust.

In the sections titled (5) “Emphasizing our unwavering commitment to sustainability as the fundamental premise for MSV,” and (6) “Transforming the demands of customers, suppliers, and society into viable business opportunities,” he addresses the misconception among some investors that MSV equates to shareholder primacy, emphasizing that fulfilling our obligations to stakeholders is a major premise for achieving MSV. This commitment is what drives our sustainable growth and opens up new business opportunities.

Co-President Wakatsuki’s message is fashioned to reflect his deep-seated beliefs and philosophy.

9. Our Finance and M&A Strategies to Achieve MSV

On page 55, Co-President Wakatsuki dives into our finance and M&A strategies to achieve MSV aligned with the MSV Logic Tree.

When discussing our finance strategy, he introduces the individual ROIC for our major assets companies, demonstrating our keen awareness of the cost of capital. As we’ve seen a growing interest on the prioritization of EPS maximization and ROIC among investors over the past year, he provides a more in-depth explanation than in previous editions.

In the M&A strategy, Co-President Wakatsuki delves into essential components, including the criteria we use to identify potential M&A target companies, our financial discipline, and the M&A selection process. These aspects are all rooted in our Asset Assembler model, which serves as the mainstay framework for our M&A endeavors.

Co-President Wakatsuki underscores how our unique Asset Assembler model for driving growth for both our existing businesses and acquired companies has played a pivotal role in ensuring that all our M&A transactions since FY2019 have exceeded expectations in terms of outcomes, as well as reasons why this platform can effectively reduce the costs and risks associated with post-merger integration in M&A deals.

10. Message from Co-President Wee

On page 17, Co-President Wee outlines five key actions and a mindset aimed at ensuring a consistent growth in EPS by nurturing a culture that embraces new challenges.

He provides insights into the factors that contributed to our EPS growth during the Medium-Term Plan (MTP) that concluded in FY2023, as well as our outlook for the future, supported by an analysis of our existing businesses with the China business as an example. Additionally, he provides updates on the adjacencies area, our new market segment.

To emphasize the significance of our human capital, Co-President Wee elaborates on the creation of human resource and organizational structures that actively embrace new challenges. His insights stem from his extensive experience in leading the growth of Nippon Paint Group, serving as the CEO of NIPSEA Group since 2009.

Co-President Wee has crafted his message to communicate our ongoing commitment to cultivating a culture of embracing new challenges among our highly skilled and dedicated colleagues.

11. Progress of Structural Reforms in Japan Group and Roadmap for Improving Profitability

On page 91, Co-President Wee offers a detailed explanation on the progress of structural reforms in Japan Group and roadmap for improving profitability.

As improving profitability of Japan Group stands as a primary concern for investors, Co-President Wee outlines the specific actions currently underway. These include, (1) Ongoing actions to restore our operating profit margin to the levels witnessed in the fiscal years 2017-2018, which exceeded 15%, as well our progress and cost structure reforms including task force activities, (2) Progress of reforms in the marine and automotive coatings businesses that had been underperforming as of FY2021, (3) Changes of corporate culture and employee mindset inspired by NIPSEA Group’s “Lean for Growth (LFG)” culture, and (4) Encourage acting with courage by moving beyond traditional methods and thinking patterns in Japan towards cultivating leaders capable of contributing to continuous EPS growth.

These actions have been highly effective as evident in the significant improvement in the operating profit margin for Japan Group, to approximately 10%, in the second and third quarters of the fiscal year 2023.

The process of reassessing and reforming tasks and organizations, coupled with the evolution of employee mindsets, is ongoing and evolving. We invite you to read the updates in our 2024 edition of the Report.

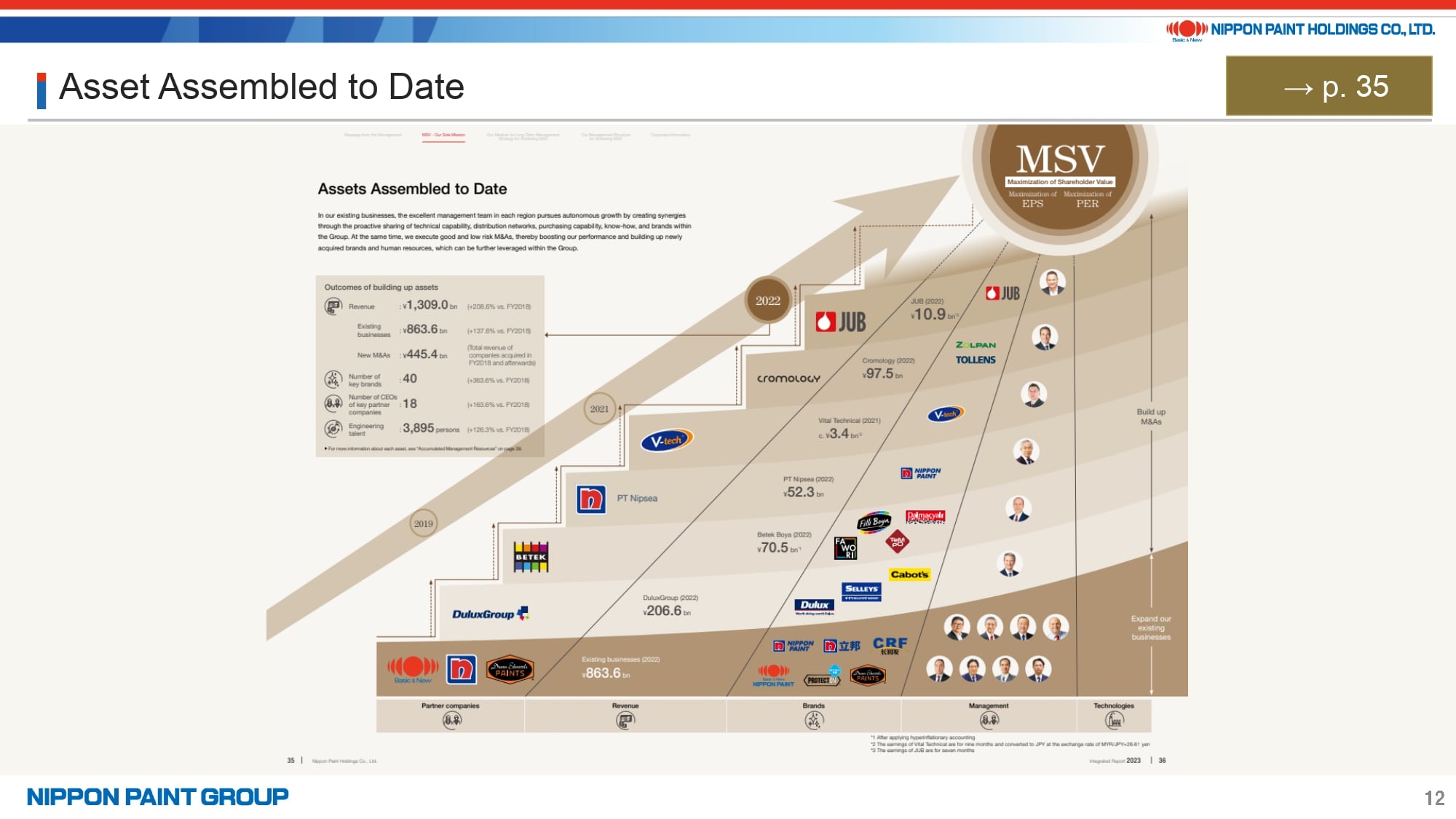

12. Asset Assembled to Date

Page 35 outlines the assets we have accumulated so far, guided by our Asset Assembler model to pursue MSV.

Nippon Paint Group is propelling growth by building up strong brands and exceptional talent through existing businesses and strategic M&A activities.

In the fiscal year 2022, we welcomed Cromology and JUB into our Group. In this manner, we are continuing and accelerating efforts in assembling assets.

Using revenue as a key example of our financial assets and comparing our current revenue to that of the base year, fiscal year 2018, revenue from our existing businesses in fiscal year 2023 saw an impressive increase of 138% and an addition of 445.4 billion yen through new consolidation.

Our non-financial assets has been growing consistently in tandem with our M&A activities, such as the number of major brands within our portfolio, the talented CEOs who spearhead our operations in various countries and regions, and the skilled engineering professionals dedicated to our research and development activities.

We aim to enhance EPS and improve PER by accumulating these outstanding assets in our journey towards achieving MSV.

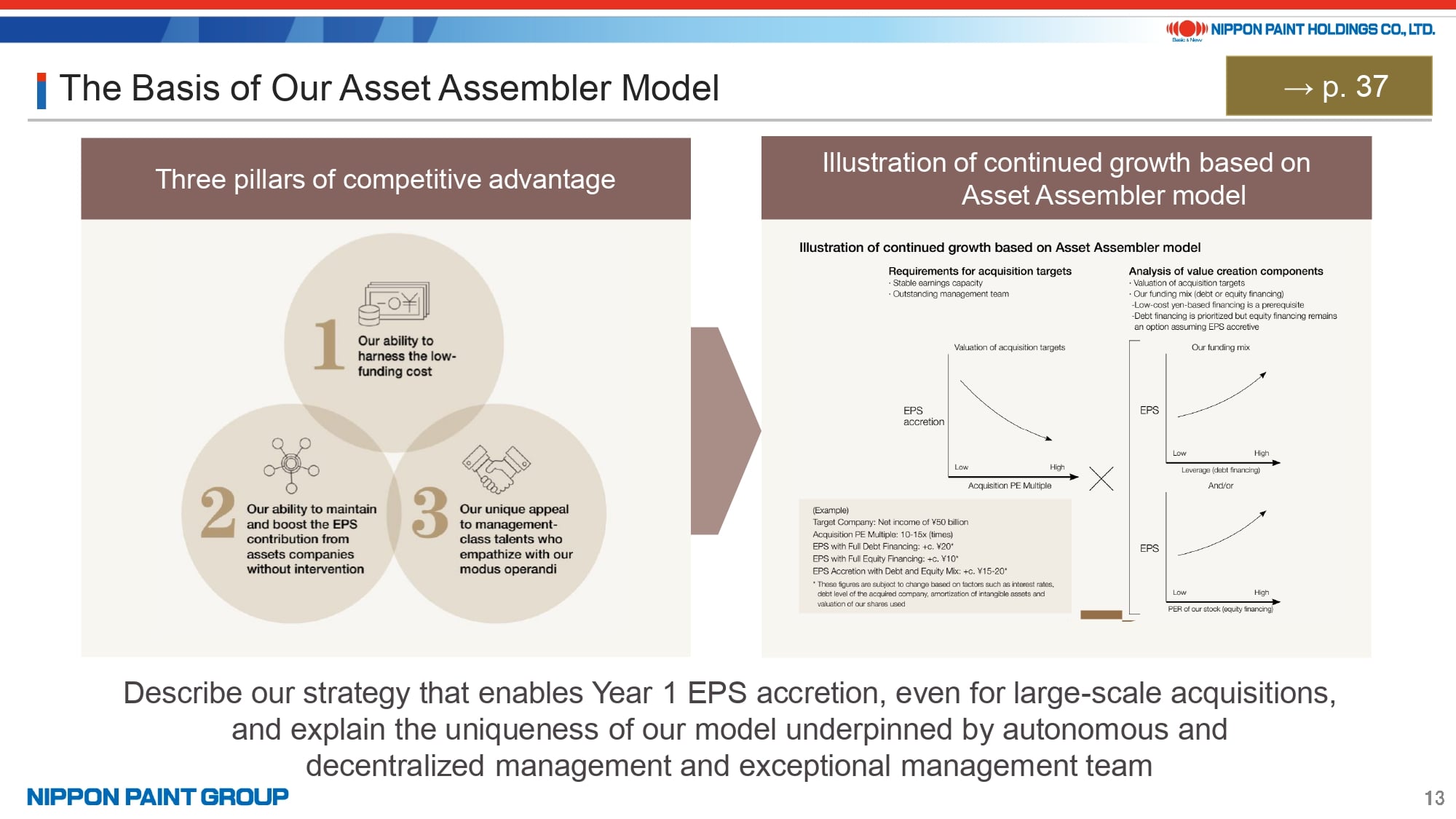

13. The Basis of Our Asset Assembler Model

On page 37, we spotlight the competitive advantage provided by our Asset Assembler model.

We’ve shifted our approach to emphasize our strengths in M&A compared to the competitive advantage outlined in the 2022 edition. A key highlight in this year’s presentation is our in-depth discussion on the first pillar of our competitive advantage, which is “Our ability to harness the low-funding cost.”

While we have received feedback that requested inclusion of our former strengths, the updated competitive advantage’s second and third pillars align with our former strengths, focusing on autonomous and decentralized management as well as exceptional management talent.

Our management talent and platform cannot be replicated by other companies and form the very backbone of our Asset Assembler model.

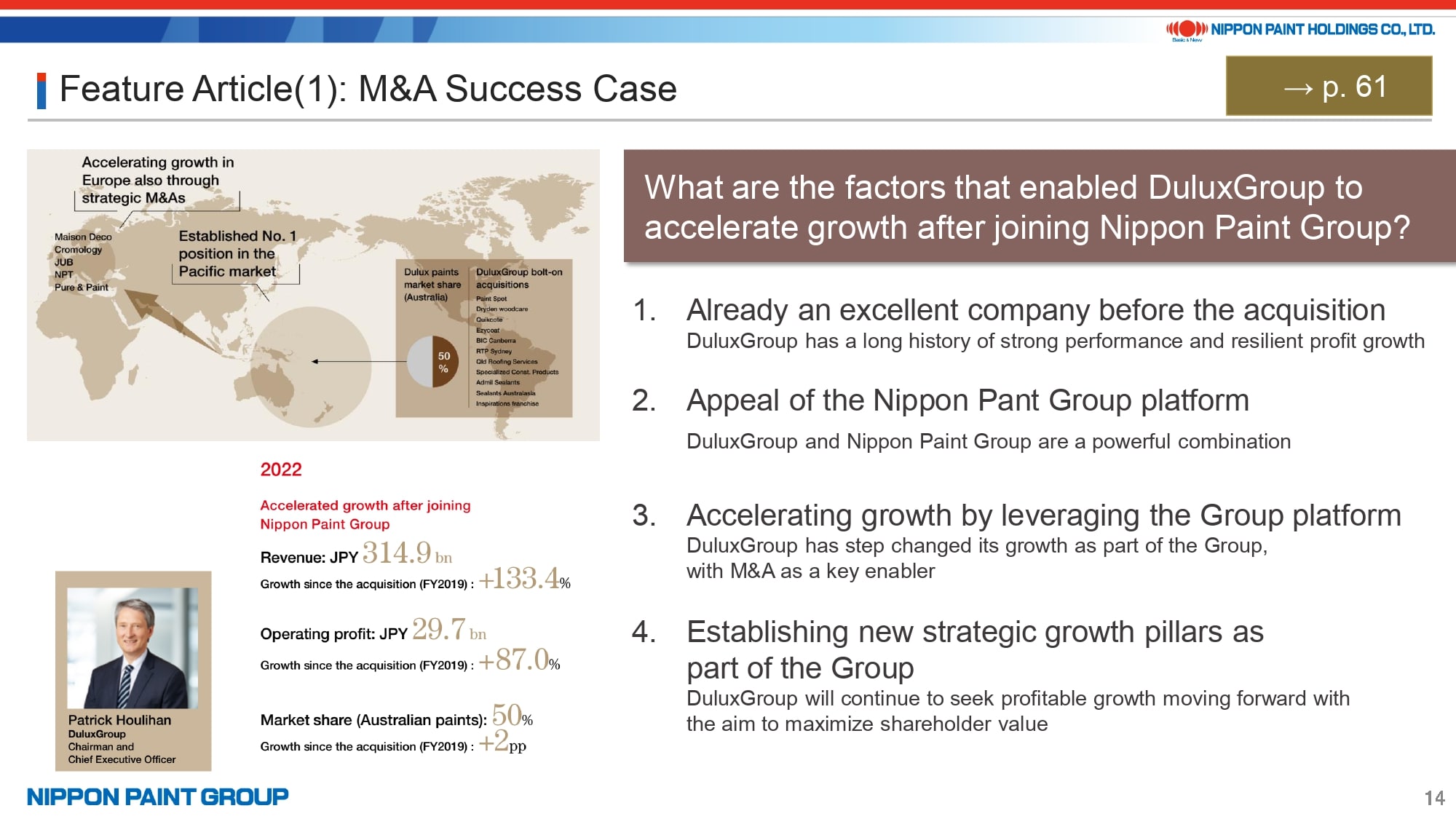

14. Feature Article(1): M&A Success Case

Starting on page 61, we discuss the feature articles in the 2023 edition.

The first feature article is a deep dive into one of our most successful M&A transactions: “What are the factors that enabled DuluxGroup to accelerate growth after joining Nippon Paint Group?” This feature article showcases the key elements of the M&A strategy as outlined by Co-President Wakatsuki.

Since becoming a part of Nippon Paint Group in 2019, DuluxGroup has experienced accelerated growth enabled by the four key factors:

- DuluxGroup has a long history of strong performance and resilient profit growth

- The appeal of Nippon Paint Group’s platform as evaluated by DuluxGroup’s management team in pursuit of further growth

- Leveraging this platform has allowed DuluxGroup to pivot to further growth with mainly through bolt-on acquisitions

- Finally, DuluxGroup has established the pillars of additional strategic growth based on Nippon Paint Group’s policy of respecting autonomy in pursuit of MSV

When DuluxGroup was acquired by NPHD in 2019, some players in the capital markets raised concerns about the high acquisition multiples. However, we firmly believe that this acquisition holds significant value for several reasons:

- DuluxGroup has consistently contributed to the accumulation of EPS every year, even in mature markets.

- The acquisition has acted as a catalyst, accelerating our M&A activities in Europe.

- The brands and expertise owned by DuluxGroup have been instrumental in driving business growth in other regions.

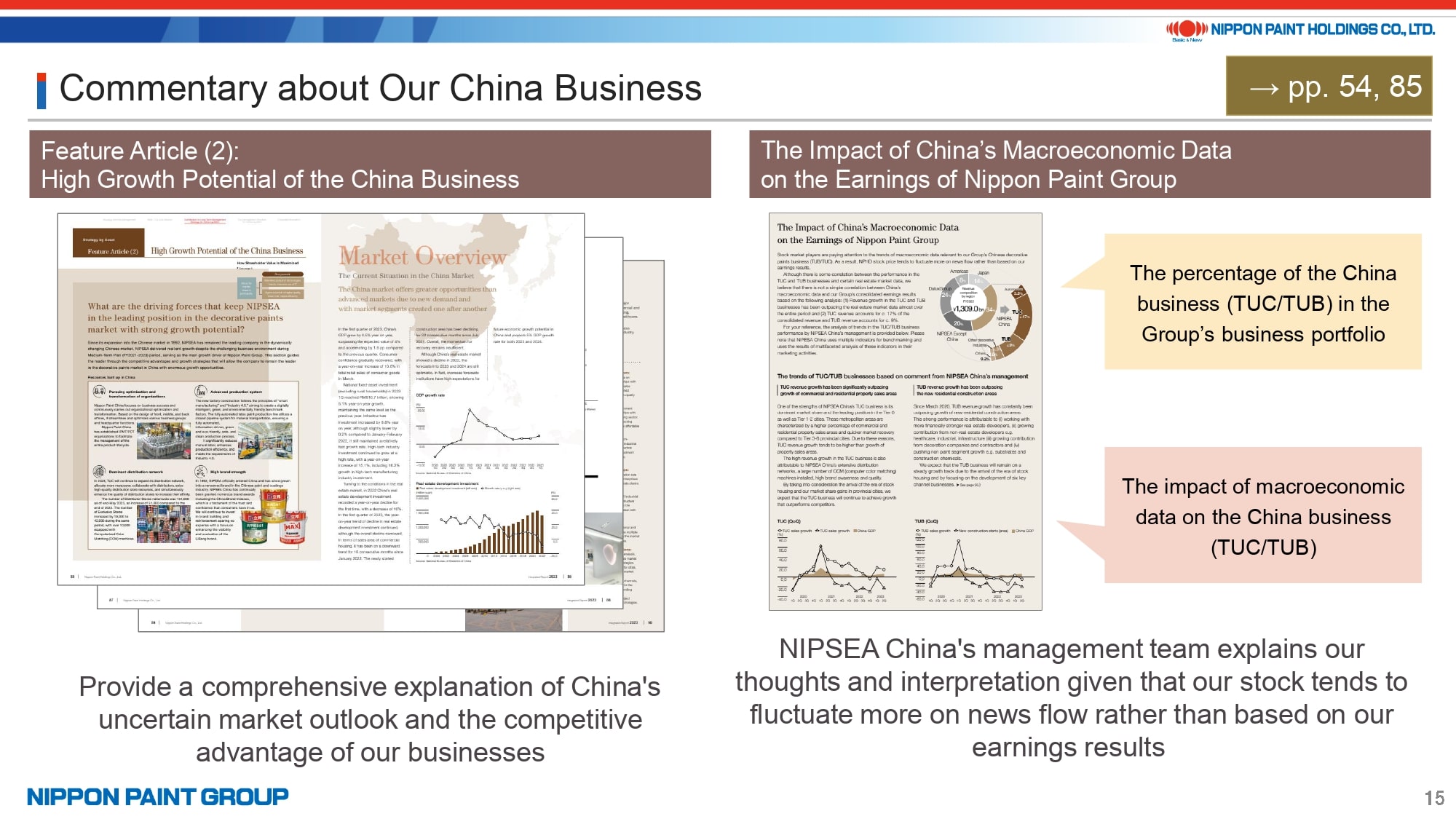

15. Commentary about Our China Business

On page 85, we introduce the second feature article, titled “High Growth Potential of the China Business.” This article directly addresses the keen interest of investors in our operations in China, especially in light of the uncertainties surrounding the Chinese economy.

In this feature, we delve into an in-depth analysis of the market climate, with a focus on the real estate sector, elaborate on how our Group has been responding to these market conditions, and outline our strategies aimed at driving further growth.

While the current macroeconomic situation in China may lead many to adopt a cautious or even pessimistic view of our business there, our Integrated Report is designed to offer a more long-term perspective. To this end, under the title “Rapid Expansion of Repainting Market Driven by Arrival of Stock Housing Era,” the Report furnishes detailed explanations about the market data available to us and the measures we are implementing to address recent trends.

On page 54, we feature a column titled “The Impact of China’s Macroeconomic Data on the Earnings of Nippon Paint Group.”

Our stock price often reacts more to news coming out of China than to our actual business performance. Recognizing this, the column explains the percentage of our Chinese businesses, namely TUC and TUB, within our overall business portfolio. Moreover, the executive in charge of NIPSEA China provides a detailed explanation, focusing on the correlation between the macroeconomic data and our performance in China business, grounded in factual data.

This particular column was developed in response to suggestions from our investors, and for this, we are extremely grateful.

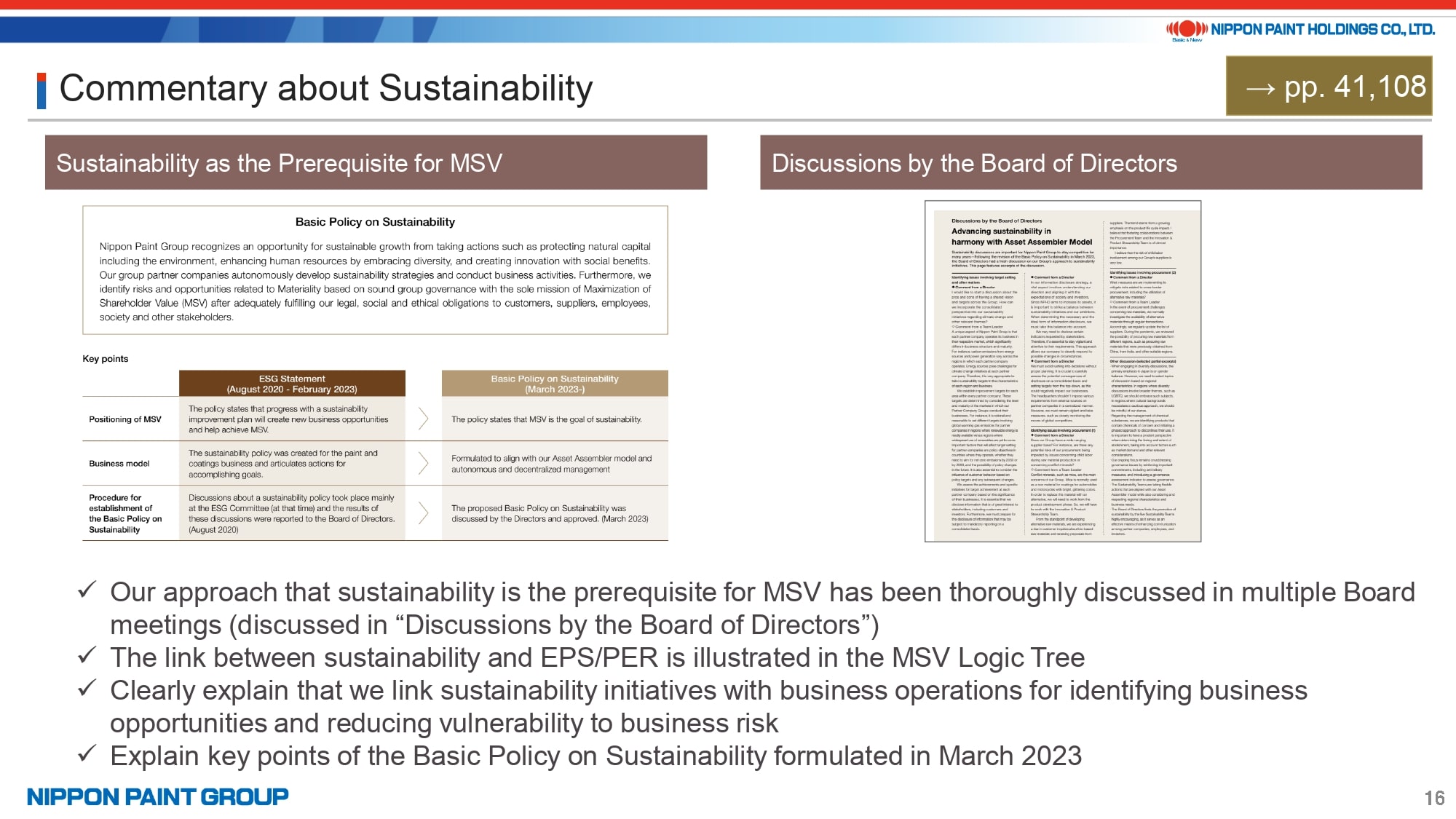

16. Commentary about Sustainability

Let’s now look into the Sustainability section. To us, sustainability is a fundamental requirement for achieving MSV.

Page 16 outlines these key elements. Additionally, the “Discussions by the Board of Directors” on page 108, highlight how our Board has engaged in extensive deliberations, viewing sustainability as a cornerstone of MSV. This is further explained in the MSV Logic Tree on page 5, demonstrating the interplay between sustainability, EPS, and PER.

Beginning on page 65, the sustainability section explains our approach to identifying business opportunities and directly linking them with our business activities, while mitigating business risks through sustainability initiatives. Furthermore, page 41 provides the key aspects of our Basic Policy on Sustainability, formulated in March 2023.

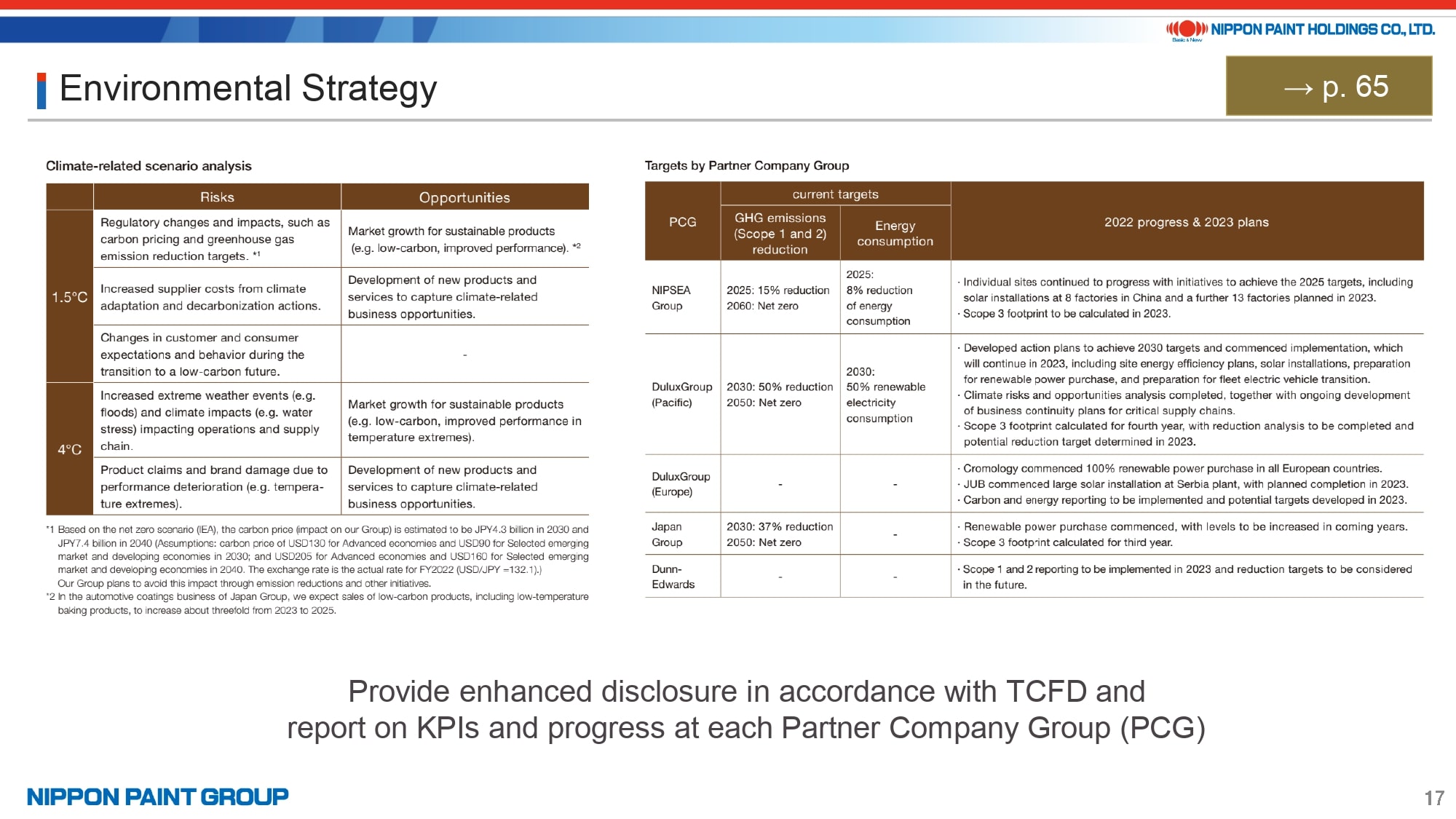

17. Environmental Strategy

In the Environmental Strategy section starting on page 65, we expanded our disclosure based on the final recommendations of the Task Force on Climate-related Financial Disclosures (TCFD), which we endorsed in September 2023.

Specifically, we conducted climate-related scenario analysis and provided KPIs, progress reports, and recent initiatives of each Partner Company Group (PCG) under the autonomous and decentralized management.

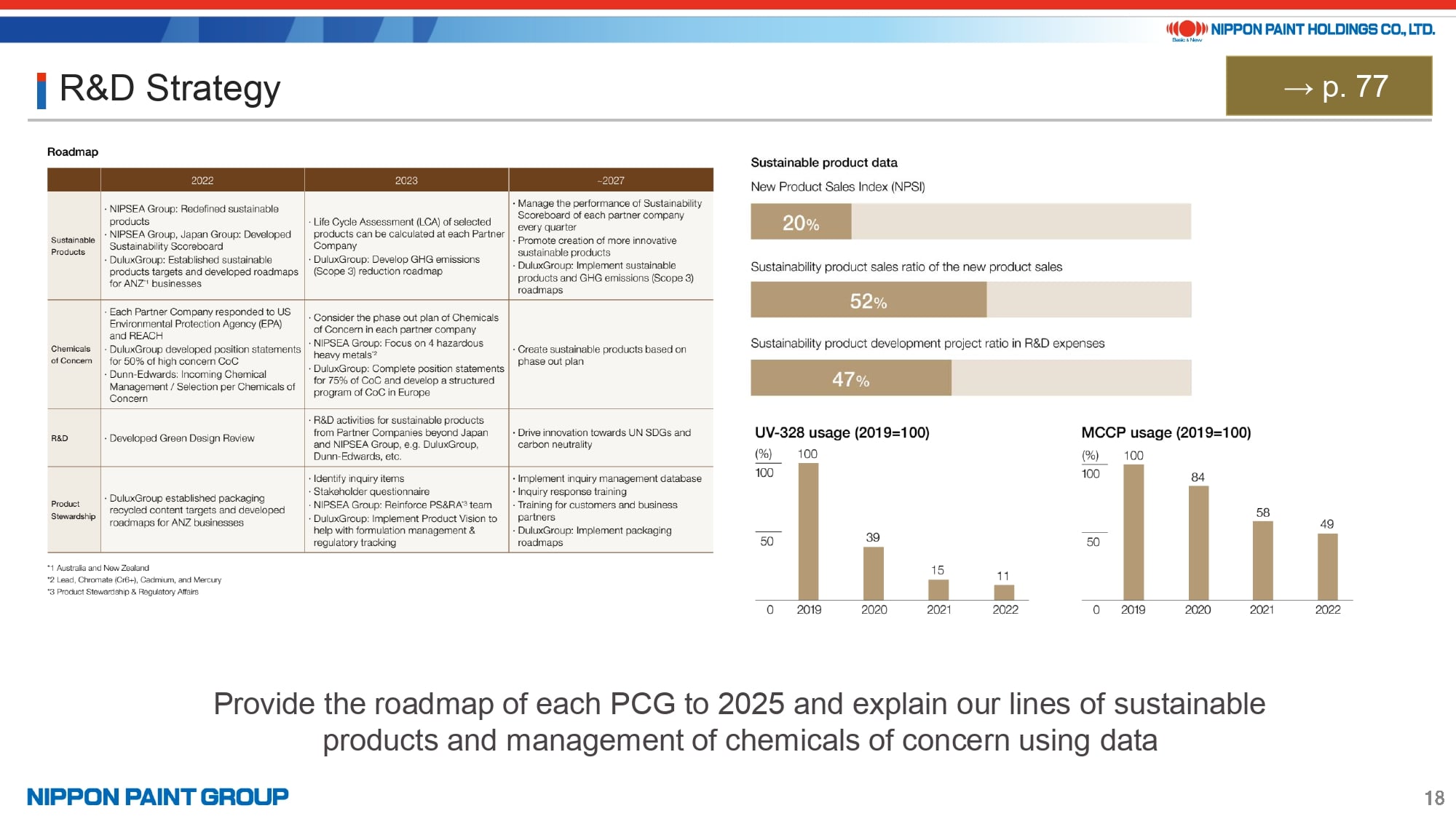

18. R&D Strategy

In the research and development (R&D) Strategy section on page 77, we’ve laid out a clear path and various initiatives that are instrumental in our pursuit of MSV. This includes our roadmap for each PCG leading up to 2025, our sustainable products and the responsible management of chemicals of concern, supporting this with robust data.

We added an explanation about management of chemicals of concern in the Report through discussion with the innovation team, based on suggestions that many investors pay attention, in particular, to the risk of chemicals of concern we face as a chemical sector company, although, being a paint company, the risk is not high.

We are very grateful again for investor suggestions.

19. Human Resource Strategy

In the Human Resource Strategy on page 71, we have outlined the approach of each PCG to achieve MSV with a roadmap leading up to the year 2025.

To outline our approach to human capital to achieve MSV, using Japan Group as a case study to demonstrate this strategy, we discuss human resource investment as the “INPUT,” look at the ideal human resources and organizational structure that align with our J-LFG model as “OUTPUT,” and explain our approach to improve EPS using KPIs to measure the progress.

In the information disclosure structure we introduced earlier, we’ve positioned the Integrated Report as a key tool to articulate our fundamental approaches, policies, and strategic narratives to provide our investors with a clearer and deeper insight into our Group.

In this Report we chose not to include direct inputs from our employees, such as their voices in the workplace or feature articles in the Human Resources Strategy page. Instead, these were made available on our website. But, based on the feedback we’ve received, this approach may have inadvertently obscured the emphasis we place on human capital, which was highlighted by Co-President Wee. Acknowledging this, we’re planning to better organize our information disclosure structure and to enrich our website with more case examples.

20. Corporate Governance

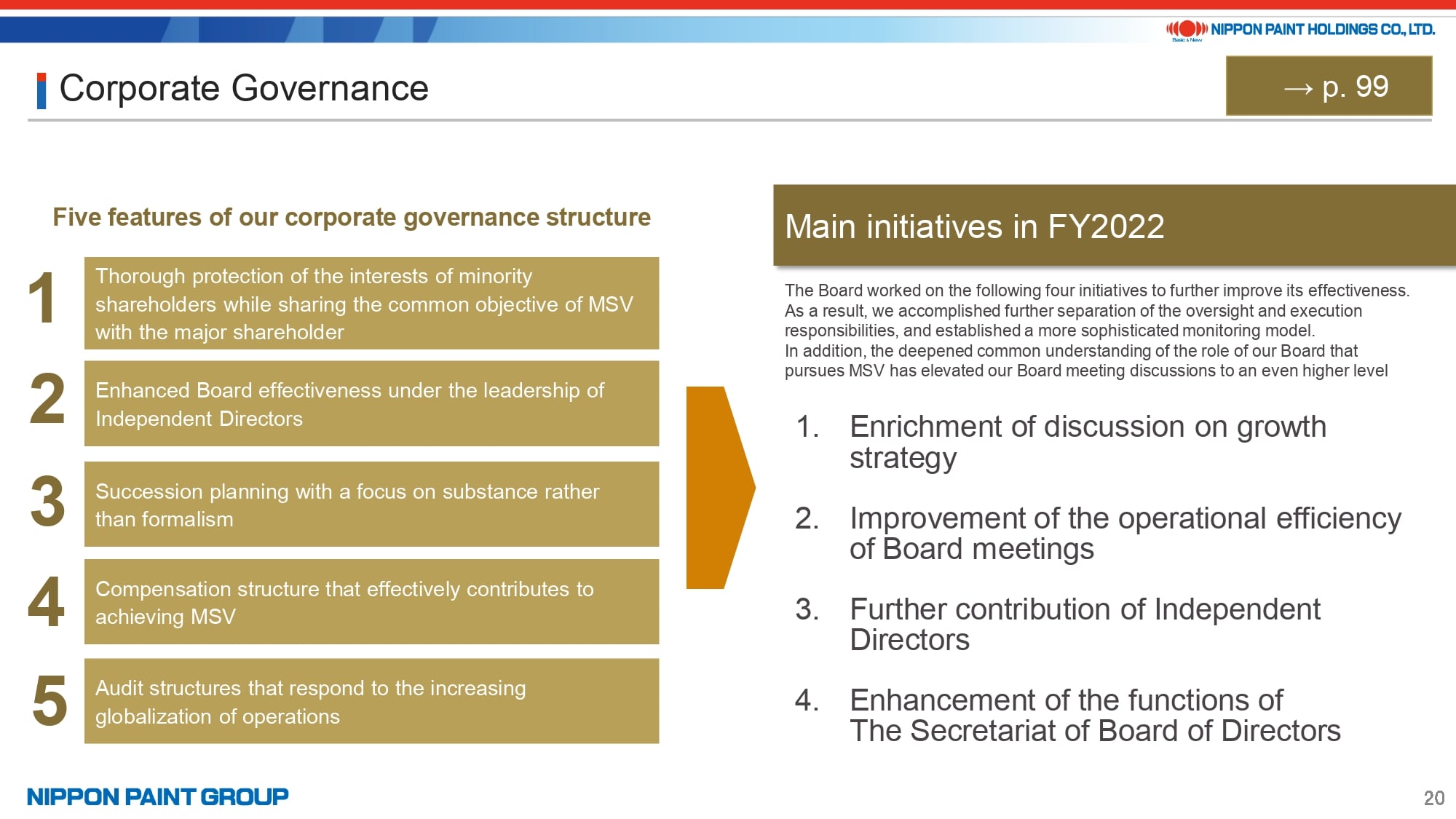

I’d like to highlight the key aspects of the Corporate Governance section, which starts on page 99 of the Report.

Our corporate governance structure has five distinct features. We see corporate governance as a fundamental pillar of our competitive advantage.

On the other hand, we often receive concerns about the effectiveness of our protection of minority shareholders because we have a major shareholder.

In the corporate governance section, therefore, we collaborated with Board Chair Nakamura and the Corporate Governance Department to outline the transition, current activities, and policy for the future, along with the “Discussions by the Board of Directors” that showcases the effectiveness of the Board’s discussions. On our website, we offer content that deepen investors’ understanding about the effectiveness of corporate governance at our Group, including interviews of each Independent Director in which they discuss the protection of the interests of minority shareholders and their thoughts about how we pursue MSV.

21. Message from Board Chair

On page 102 of our Report, we have an insightful section where Board Chair and Lead Independent Director Nakamura shares his thoughts revolving around the theme of “Supporting bold and timely risk-taking by the management team.”

The key takeaways are:

Mr. Nakamura highlights the critical role of risk-taking in achieving MSV. He points out that this involves several key areas: Firstly, taking risks to enhance the value of existing businesses and assets. Secondly, the risks involved in acquiring new businesses and assets. And thirdly, managing risks related to the balance sheet, particularly in terms of financing from the capital markets. Importantly, Mr. Nakamura emphasizes that the Board of Directors is actively encouraging the management team to engage in appropriate and timely risk-taking to achieve these goals.

In order to deepen understanding of our corporate governance structure, we actively engage with the capital markets by covering messages from our Board members in the Integrated Report, organizing small investor meetings, and featuring “Q&A with the Independent Director” on our website.

22. Message from Chairman

On page 104 of our report, you’ll find an important message from Mr. Goh, the Chairman of the Board of NPHD and the Representative of our major shareholder, Wuthelam Group. In his yearly message, Mr. Goh articulates the most essential points he wishes to share with the capital markets at that particular time.

This year, Mr. Goh’s message is titled “Nippon Paint’s Appeal as an Asset Assembler,” expressing his belief that achieving MSV should be the sole mission, particularly for listed companies. He also delves into the competitive advantages of Asset Assembler model.

Furthermore, Mr. Goh addresses Wuthelam’s policy regarding voting rights and emphasizes that the interests of Wuthelam are completely aligned with those of the minority shareholders.

23. Committee Report

Beginning on page 109, the Report offers detailed reports from the Nominating, Compensation, and Audit Committees, in alignment with our company’s structure as a “Company with Three Committees.”

In the Report, the Chairperson of each Committee provides an overview of the progress made in tackling identified issues, as well as an explanation of future policies. Furthermore, the Report includes a concise summary, details the roles of each committee, and describes their key activities from the past year that were not included in the Corporate Governance Report.

The Report also explains our strategies and significant discussion topics, such as the composition of the Board of Directors, training of next-generation management talent, process of determining executive compensation, and optimal structure of the group audit system.

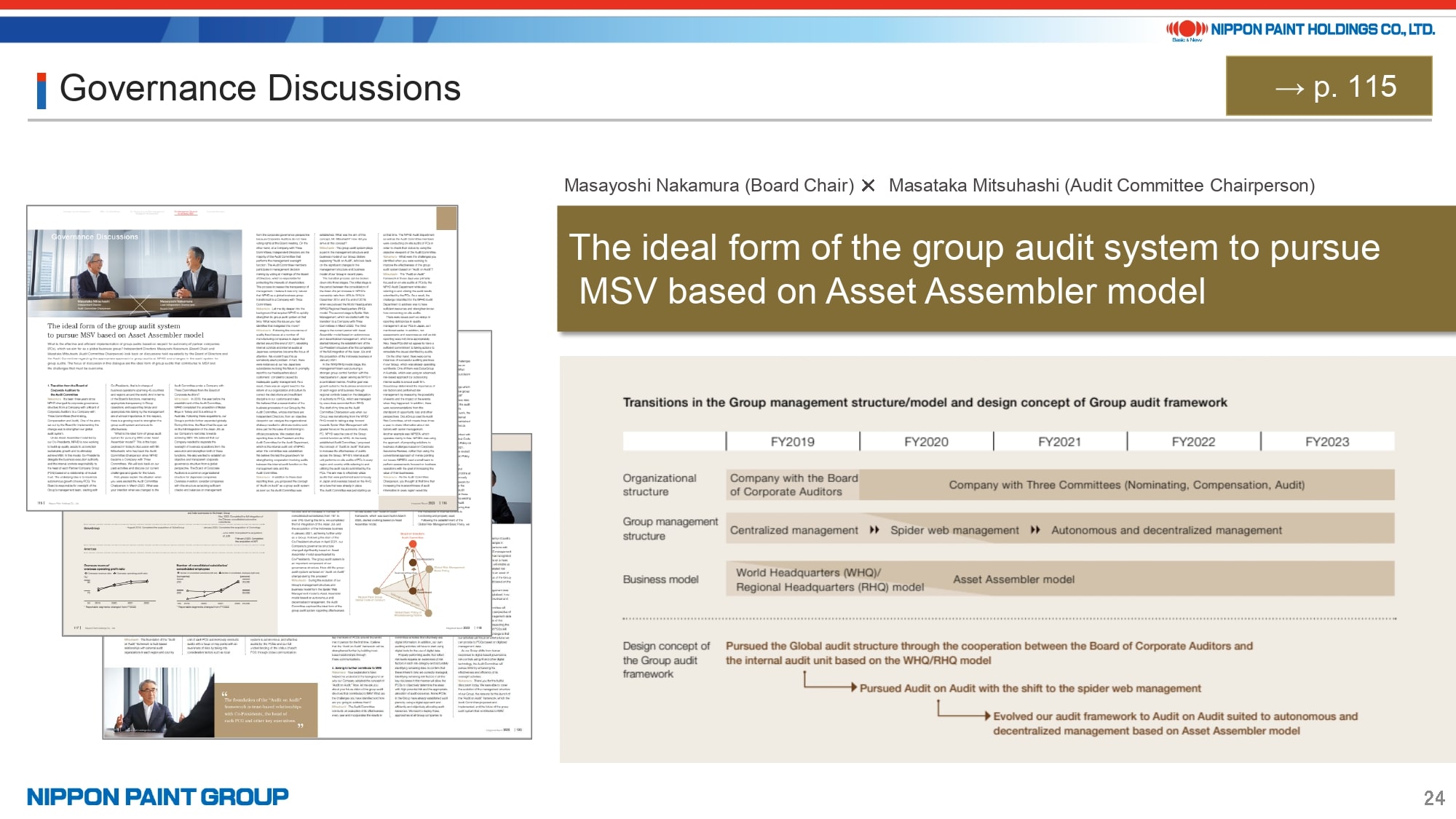

24. Governance Discussions

Our Report annual features an article, titled “Governance Discussions by Independent Directors,” centered around the theme of governance and its role in contributing to MSV.

Page 115 of the 2023 edition offers a compelling exchange between Board Chair Nakamura and the Chairperson of the Audit Committee, Mitsuhashi, under the title “The ideal form of the group audit system to pursue MSV based on the Asset Assembler model.”

In their discussion, they discussed the “Audit on Audit” policy backed by our Asset Assembler model, which is underpinned by autonomous and decentralized management, reflecting on the perspectives and concepts that shaped our group audit framework as we transitioned to a Company with Three Committees and underwent changes in our group management structure and business model.

I encourage you to take a moment to read this article.

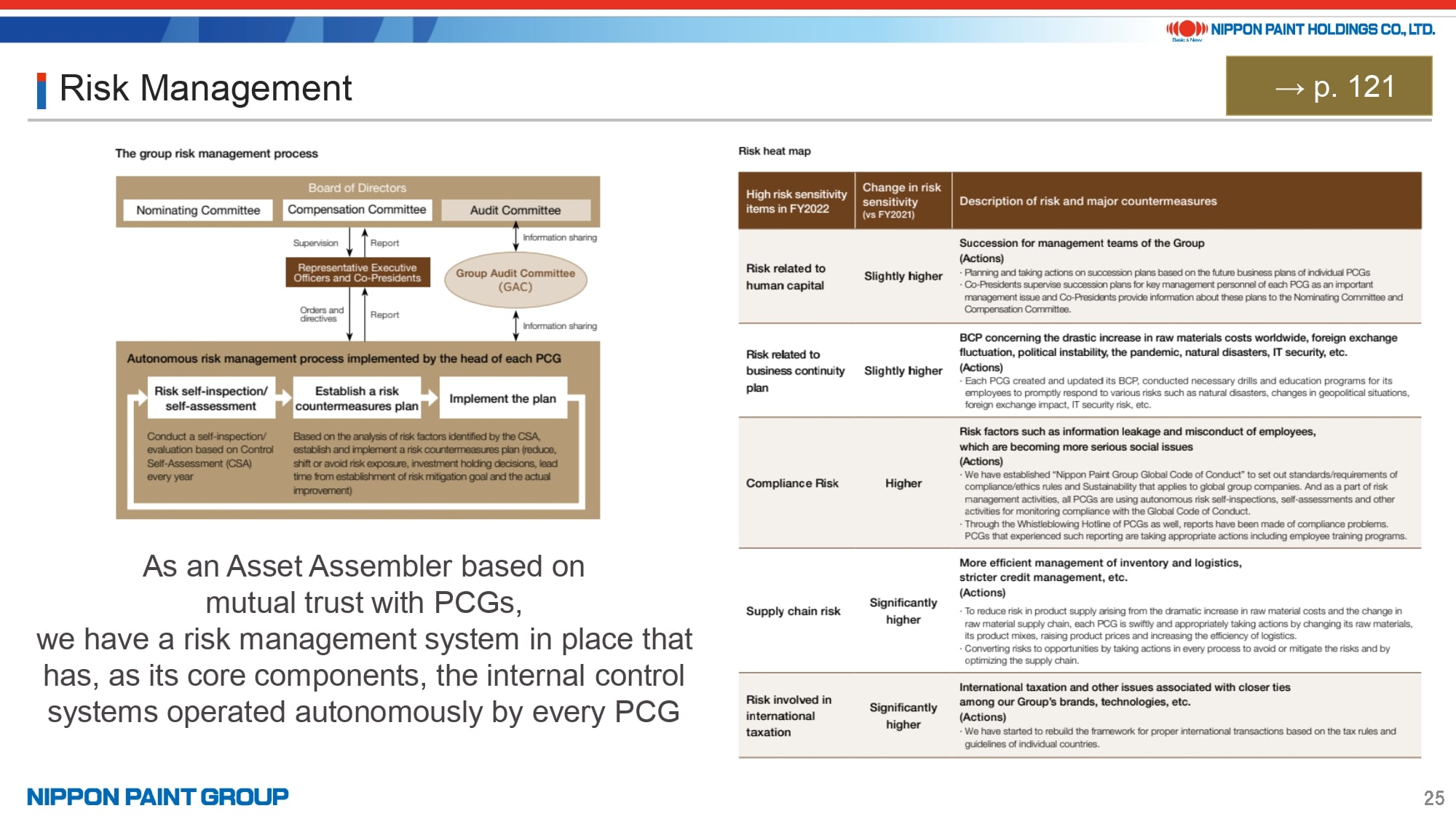

25. Risk Management

Page 121 outlines our risk management approach based on Asset Assembler model with significant improvements and expansions made by reflecting our investors’ requests.

Specifically, we delved into our risk management framework in which each PCG autonomously operates its own internal control system, grounded in the mutual trust we share with our PCGs as an Asset Assembler.

Furthermore, we explore the specifics of this system and our risk management processes and the evolution of our risk sensitivity and planned policy responses for high-risk items, as identified in our Risk Heat Map.

26. In Conclusion

This brings us to the end of my presentation on the key elements of the Integrated Report for 2023.

To wrap things up, I’d like to briefly touch on what’s on the horizon for the 2024 edition. On this page, you’ll see a list of the main points we’re currently contemplating for next year’s report. These points are still in the discussion phase within our team, so the content may undergo significant changes.

Now, allow me to provide some additional explanations on these topics.

- Presenting a further approach towards maximizing PER

MSV can be dissected into two key components: Maximization of EPS and Maximization of PER. We plan to offer actions aimed at maximizing both EPS and PER from a medium to long-term perspective. - Offer a more clear description of the competitive advantage of Asset Assembler model

We intend to offer a more comprehensive and clearer explanation, illustrating how our Asset Assembler model is instrumental in achieving MSV and detailing our unique competitive advantages. - Present our company from diverse viewpoints, moving beyond the perception of being China-focused

We plan to offer a more clear insight into our Group as an Asset Assembler, building up assets backed by Asset Assembler model. - Update on the progress of individual assets companies

Recognizing the importance of explaining the performance of our assets companies, we plan to develop feature articles focusing on topics that have garnered high interest from investors in our investor meetings. - Present an article that includes case studies demonstrating the connection between sustainability and EPS and PER

Our intention is to highlight our initiatives that have a direct and positive impact on EPS accretion. - Showcase the strengths of our talent, which forms the foundation of our unique business model and strategies

Our Asset Assembler model and management strategy are deeply rooted in our exceptional talent and culture. We intend to shed light on how our talent and culture give us a competitive advantage. - Provide a more clear explanation of our strategy towards capital efficiency

We intend to give a more clear insight into our strategy based on the feedback and discussions we had in investor meetings following the release of the 2023 Report. - Present further explanation surrounding Scope 3 emissions with an expanded boundary of disclosure

While our current disclosure boundary encompasses Japan Group and DGL (Pacific), we are planning to broaden this scope, providing a more comprehensive view of our Scope 3 emissions. - Make the Report more concise to save readers’ time

We’ve received feedback that requests a more concise report without sacrificing quality because the current length requires a significant time investment to read through. - Arrange content for dissemination through the company’s website, Investor Book, and the Integrated Report, aiming at the specific target audience

The Integrated Report will serve as a high-level overview of our Group. For detailed data and case studies, we will provide links within the Report directing readers to our website. By doing so, we can effectively meet their requests for specific types of content, while still maintaining the comprehensive volume of information that they have access to.

Thank you for your attention today.