1. Front Cover

Good afternoon, everyone. I’m Yuichiro Wakatsuki, Co-President of Nippon Paint Holdings.

Thank you very much for taking the time to participate in our conference call regarding the financial results for the fourth quarter and full FY2023 and the financial guidance for FY2024.

Attending our conference calls for both the second quarter (2Q) and fourth quarter (4Q) are investors and analysts, as well as members of the press.

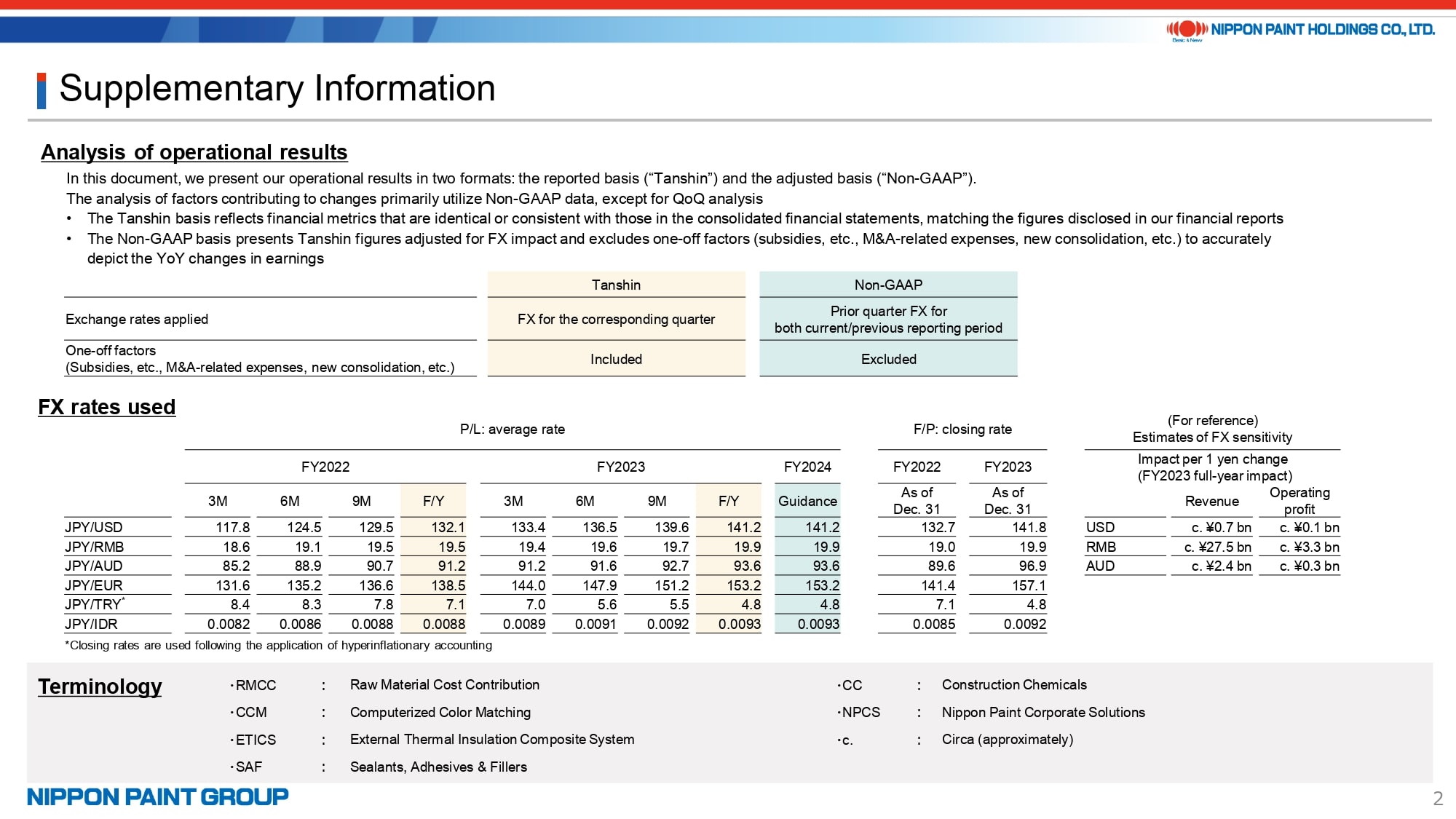

2. Supplementary Information

I’d like to start by offering additional details about the data presented here, aiming to clarify questions commonly raised by investors.

There is no change in the definition of the “Tanshin” basis and “Non-GAAP” basis financial figures.

I’d like to highlight two important aspects concerning exchange rates. First, the exchange rates applied in formulating our FY2024 guidance are based on the closing rates for FY2023. Therefore, a weaker yen relative to the anticipated level will enhance our Tanshin basis outcomes for FY2024, while a stronger yen will produce a contrary effect. Second, we have offered an FX sensitivity analysis using the operational results of FY2023 as a reference. I trust this will be informative for you.

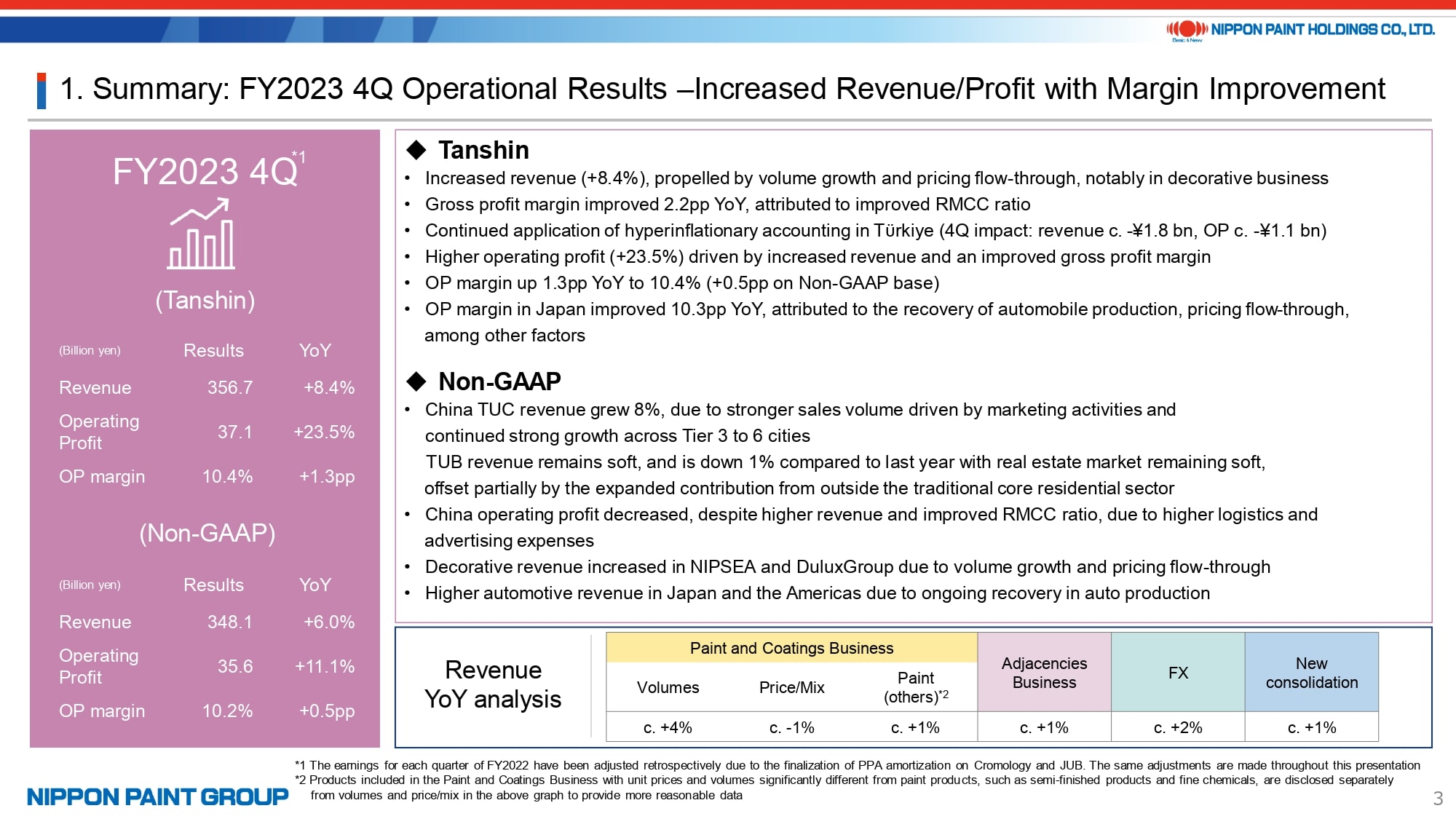

3. Summary: FY2023 4Q Operational Results –Increased Revenue/Profit with Margin Improvement

I will move on to summarize the financial results for the fourth quarter of FY2023.

On a Tanshin basis, we experienced notable growth in both revenue and operating profit. Our revenue saw an 8.4% increase from the previous year, reaching 356.7 billion yen, while our operating profit surged by 23.5% to 37.1 billion yen. The year-over-year revenue analysis on page 3 highlights several key growth drivers: expansion in our paints and coatings business, advances in adjacent market, beneficial effects from foreign exchange rates, and contributions from newly consolidated entities. However, the price/mix showed a slight decline overall, primarily due to some challenges in Asia, including in markets like China and Indonesia. This was somewhat mitigated by improvements in other regions.

On a Non-GAAP basis, revenue increased by 6.0% year-on-year, and operating profit rose by 11.1% year-on-year. In NIPSEA China’s decorative paints business, revenue in the TUC segment saw an 8% increase, while revenue in the TUB segment experienced a 1% decline. Despite higher revenue and an improved raw material cost contribution (RMCC) ratio, operating profit in NIPSEA China as a whole decreased from the previous year, owing to rising logistics costs and advertising expenses.

In the automotive coatings business, revenue increased in Japan and the Americas due to the ongoing rebound in automobile production. However, revenue in NIPSEA China decreased slightly due to the fall in automobile production among Japanese and European automobile manufacturers.

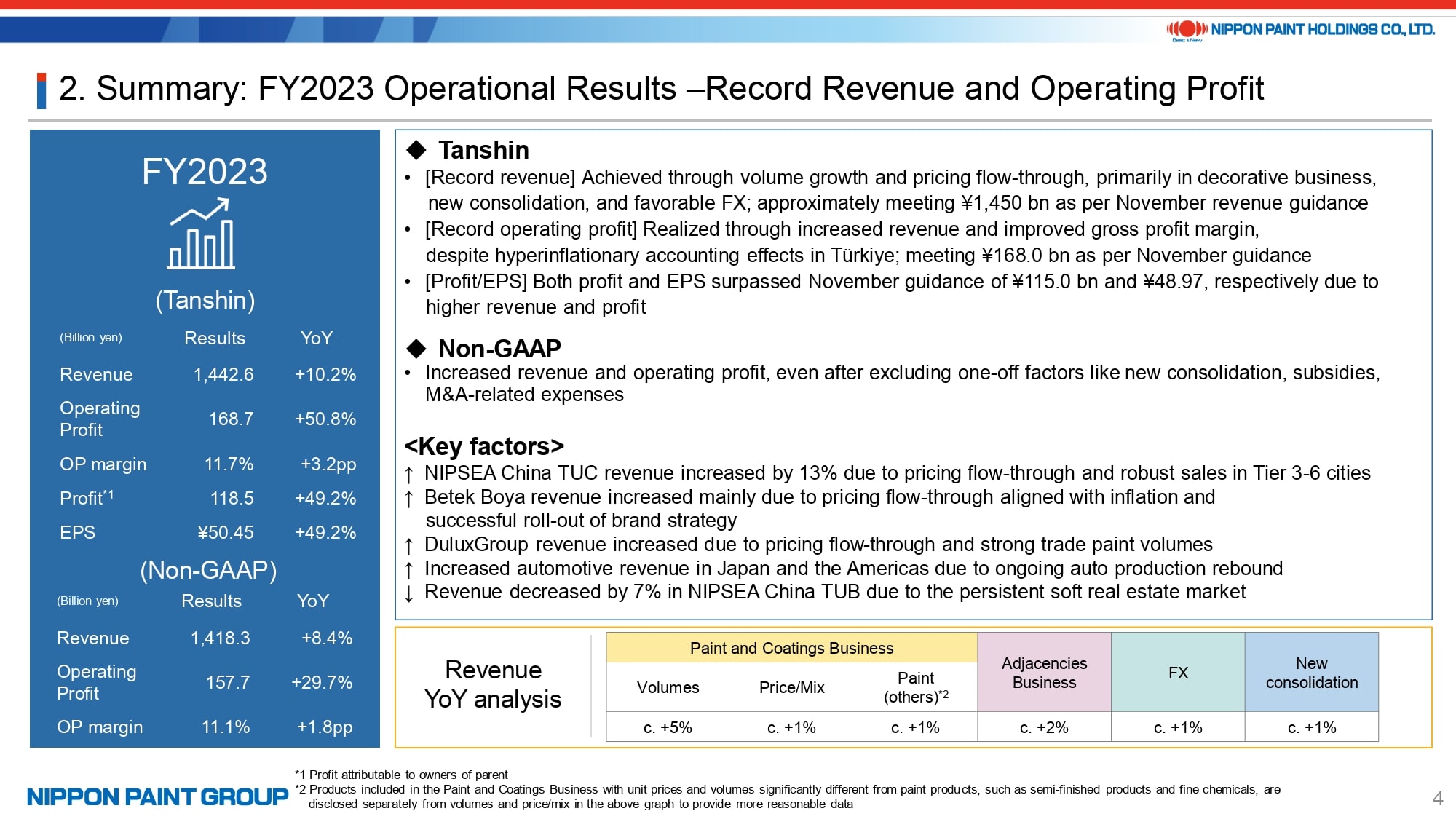

4. Summary: FY2023 Operational Results –Record Revenue and Operating Profit

Next, I will review our full-year results for FY2023.

On Tanshin basis, our financial results have closely aligned with the upwardly revised guidance provided in November 2023. Our revenue saw a growth of 10.2%, while both operating profit and net profit experienced an approximate 50% increase, achieving record highs in both revenue and operating profit.

On Non-GAAP basis, which excludes the impact of foreign exchange fluctuations, new consolidations, and other one-off items, our revenue expanded by 8.4%, and our operating profit increased by around 30%. Our partner companies across various regions are performing exceptionally well despite the challenging operating conditions. Furthermore, we observed consistent growth in our adjacencies business, thanks to our improved delivery of total solutions to distribution channels in all regions.

For FY2023, our operating profit, calculated using both Tanshin and Non-GAAP basis, included provisions in China of just under 6.0 billion yen and the impact of hyperinflationary accounting in Türkiye amounted to approximately 5.0 billion yen for the year. We plan to carry on with hyperinflationary accounting in Türkiye for FY2024, but do not anticipate significant provisions in China at this time. Furthermore, with the expectation that inflation in Türkiye will eventually begin to decrease, I am confident that our Group’s true potential surpasses what is currently reflected in these financial figures.

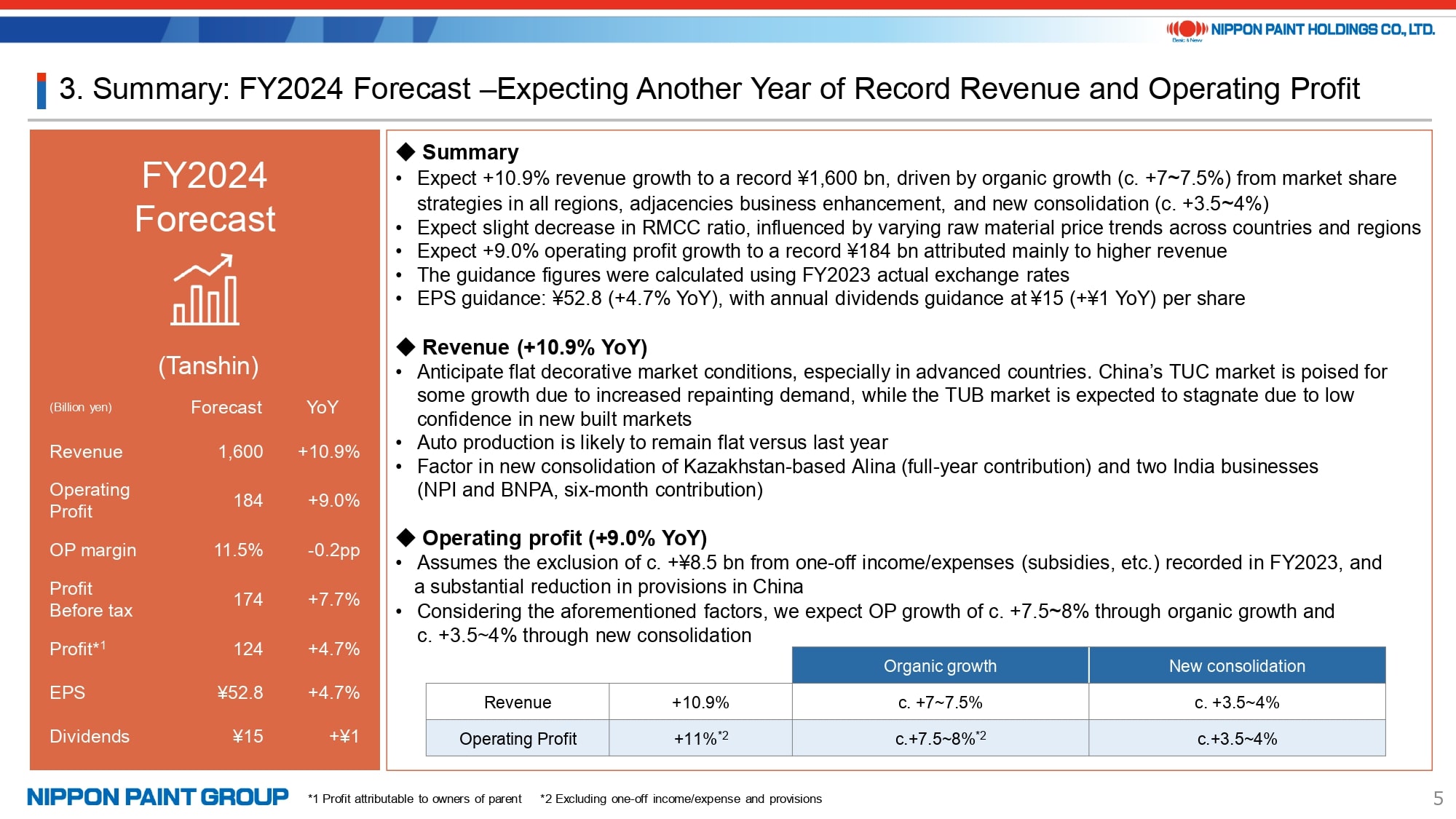

5. Summary: FY2024 Forecast –Expecting Another Year of Record Revenue and Operating Profit

I will move on to the FY2024 guidance.

Based on the assumption of stable exchange rates compared to FY2023, as mentioned previously, we anticipate revenue to rise by about 11% to a record 1,600 billion yen. This growth is expected to comprise an increase of roughly 7-7.5% in our existing businesses, fueled by strategic efforts to capture more market share and improvements in the adjacencies business. Additionally, new consolidations are projected to contribute about 3.5-4% to this growth, thanks to a full year’s inclusion of Alina in Kazakhstan and a six-month inclusion of two businesses in India. The acquisition of Alina has been closed, while the acquisition of the India businesses is subject to the approval by the relevant authorities. As our results show, our accumulation of assets as an Asset Assembler has certainly been bearing fruits. Although our financial guidance for FY2024 does not include any potential M&A transactions, we will continue to pursue strategic M&A activities this year.

Operating profit is projected to increase approximately 9% to 184.0 billion yen, while operating profit margin is expected to remain steady at 11.5% and roughly unchanged from FY2023 even on Non-GAAP basis that excludes one-off items and other adjustments. Our guidance numbers are based on a scenario where the prices of raw materials remain largely stable compared to FY2023, coupled with strategic initiatives aimed at expanding our market share. These efforts are expected to boost our operating profit margin through improved operating leverage. Additionally, gains from the increased margins will be reinvested into sales promotion and various other initiatives to further drive our business forward.

Regarding the newly consolidated subsidiaries, we anticipate that the operating profit margins for Alina in Kazakhstan will be approximately 20%, while the margins for the two subsidiaries in India are expected to be about 5%, based on unaudited financial data for FY2023. For FY2024, the combined operating profit margin across these regions is expected to mirror that of our consolidated operations.

6. Assumptions for FY2024 Forecast

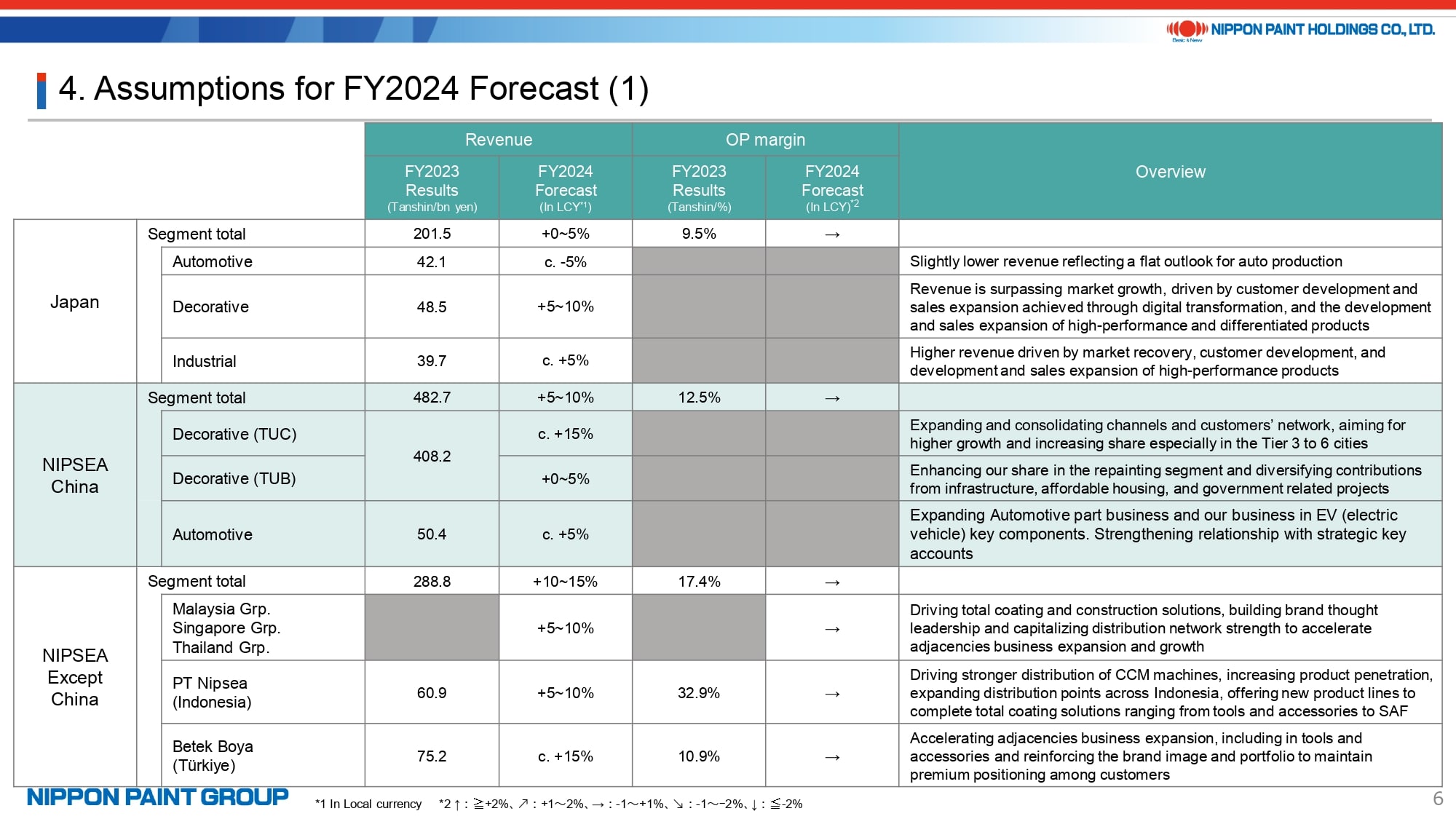

Pages 6 and 7 outline the assumptions behind our FY2024 forecasts for each key segment. While I will delve into the specifics during the Q&A session, let me offer a brief overview of each segment now.

- The Japan segment witnessed a significant rebound in FY2023. For FY2024, we anticipate a slight decline in automotive revenue from FY2023 levels, with automobile production forecasted to remain stable. In the decorative and industrial sectors, we expect to achieve market share growth in the context of a slight market improvement. The marine business is expected to continue to see strong demand. Overall, for the Japan segment, we expect a modest increase in total revenue, with the operating profit margin staying relatively unchanged from FY2023, after taking these factors into consideration.

- NIPSEA China is set to persist with its growth strategy, especially within the TUC segment, while considering the economic deceleration in China. In the TUB segment, our focus will be on aggressively expanding our market presence, targeting not just paints for new construction but also exterior paints for residential and public buildings, to broaden our revenue streams and aim for higher growth and earnings. We also anticipate an increase in automotive revenue by expanding our customer base beyond traditional Japanese automobile manufacturers to include local Chinese carmakers. With these factors in mind, we forecast NIPSEA China to achieve a revenue growth of 5-10% and maintain an operating profit margin consistent with FY2023 levels.

- For NIPSEA excluding China, we anticipate an overall revenue growth of 10-15%. However, when excluding Betek Boya, the expected revenue growth narrows to 5-10%. Despite the ongoing impact of hyperinflationary accounting practices in Türkiye, the operating profit margin in this region is expected to stay consistent with the previous year’s levels.

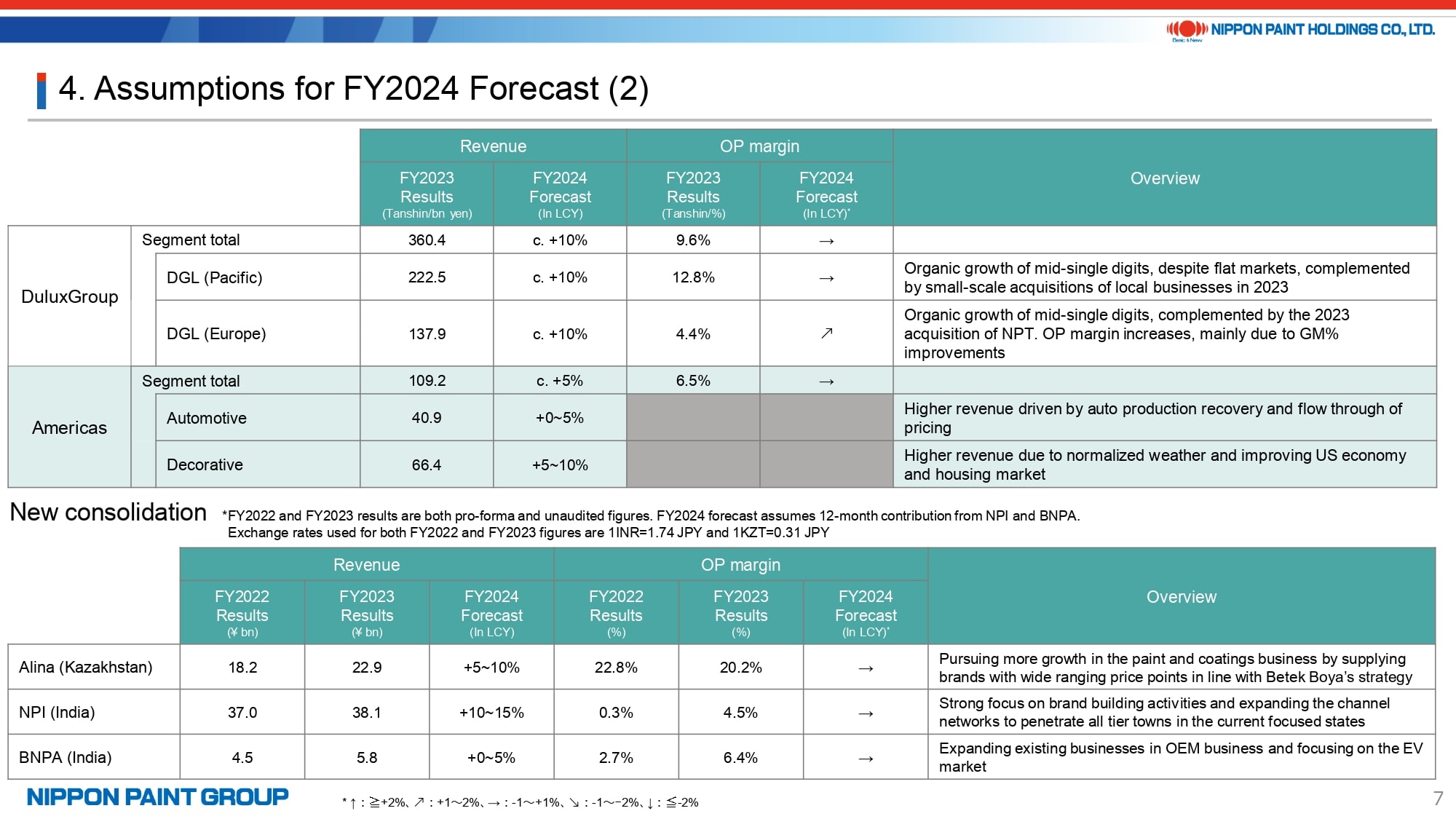

- In DuluxGroup, we anticipate revenue growth to be just under 10% in both the Pacific and Europe regions. The operating profit margin is projected to stay consistent in the Pacific, while we expect an enhancement in Europe. Specifically, DGL (Europe) is forecasting organic growth of approximately 5%, along with a full-year contribution from NPT. For DGL (Pacific), organic growth is expected to be slightly above 5%, and the total growth, including the impact of small-scale acquisitions made in FY2023, will be slightly short of 10%.

- Regarding our performance in the Americas, the automotive revenue is projected to grow 0-5%, while the decorative revenue is expected to increase 5-10%.

- To conclude, I’d like to discuss recent consolidations. Our FY2024 guidance accounts for a full year’s contribution from Alina in Kazakhstan and a six-month contribution from our two subsidiaries in India. It’s important to highlight that the year-on-year comparisons in our presentation also consider full-year results for the Indian entities. Even though these newly acquired subsidiaries have yet to finalize their Purchase Price Allocation (PPA), we anticipate that each of these entities will begin contributing to our Earnings Per Share (EPS) growth starting from their first year in FY2024.

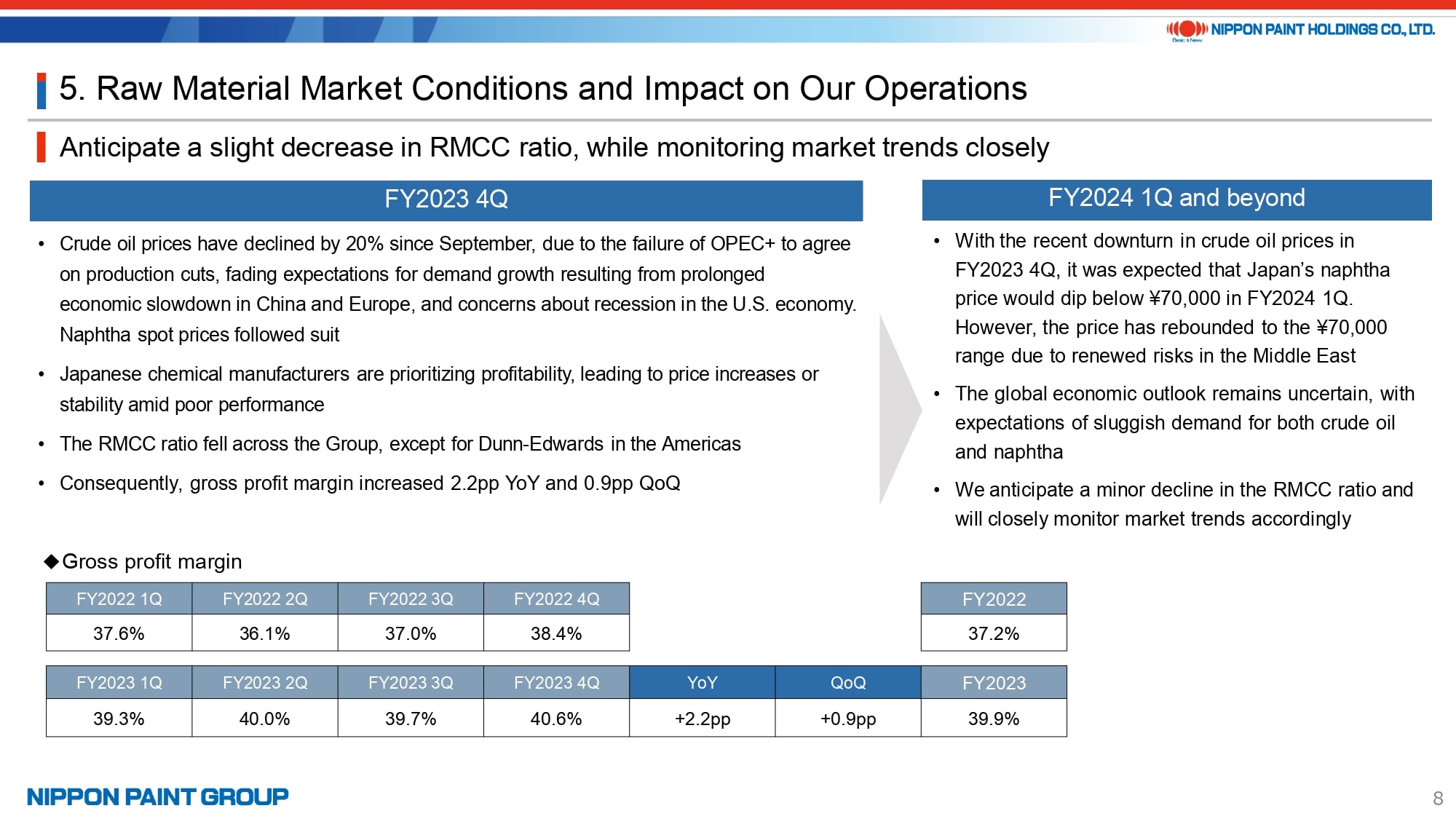

7. Raw Material Market Conditions and Impact on Our Operations

Moving on to an examination of raw material market dynamics, the price/mix continued to show regional variations in the fourth quarter of FY2023. We observed an enhancement in gross profit margin both on a year-on-year and quarter-on-quarter basis. Looking ahead to FY2024, we anticipate a minor reduction in the RMCC ratio. Globally, raw material costs are showing a downward trend, affected by decreasing demand, challenging economic environments, and the impact of foreign exchange fluctuations in certain regions. Given these factors, it becomes challenging to articulate generalized trends.

8. Summary of Operating Results in Major Segments

Page 10 of this presentation provides the summary of operating results in major segments in the 4Q of FY2023. I will go into details in the Q&A session.

Our Group’s overall performance aligned with our financial guidance. Specifically, the Japan segment exceeded our expectations, driven by robust performance in both the automotive and marine businesses.

In NIPSEA China, revenue, when measured on a Non-GAAP basis, showed a decrease compared to the previous year. The fourth quarter, typically the period with the lowest demand, saw revenue in the TUC segment fall slightly short of our guidance, whereas the TUB business exceeded our expectations. Additionally, with a focus on future growth in FY2024, NIPSEA China has been active in deploying CCM (Computerized Color Matching) systems and has raised its investment in advertising and other fixed expenses. Considering all of these factors, we are confident that their performance has indeed met our expectations. In fact, when comparing the second half of FY2023—specifically, the third and fourth quarters—NIPSEA China has demonstrated growth in operating profit after excluding the impact of subsidies, provisions, and other one-off items recorded in FY2023. As I mentioned earlier, we anticipate growth in both revenue and operating profit for FY2024.

9. Major Topics

Turning our attention to significant topics, I’m pleased to share that the M&A transaction with Alina in Kazakhstan has been successfully completed, as previously announced. It’s worth noting that Alina is expected to contribute to our EPS growth for the entire fiscal year of 2024.

We recently conducted the briefing for our integrated report and are thankful for the insightful feedback provided by our investors. The timing of this briefing occurred a bit later than the report’s initial release. We plan to move forward the release of the 2024 edition and ensure the briefing takes place shortly after the report is published.

10. Quarterly Financial Performance Trends in Major Segments

Finally, page 25 provides a concise overview of seasonal influences across each region, responding to a query commonly raised by investors.

Considering our businesses in all regions show quarterly growth, actual demand may not be consistent with the order shown in the top table of this page. The table simply shows the demand levels assuming the same economic environment. I trust you will find this information beneficial.

We have also implemented modifications on other pages to enhance investors’ comprehension. Your feedback and recommendations are highly valued and welcomed.

I am convinced that our FY2023 results and the FY2024 guidance highlight the capabilities of each partner company and validate the effectiveness of our Asset Assembler model. We are dedicated to enhancing EPS while maintaining careful oversight.

I’d like to announce that our New Medium-Term Plan briefing is scheduled for Thursday, April 4. We warmly invite you to join us for this important event.

With that, I wrap up my presentation. Thank you all for your attentive participation.