1. Front Cover

Good afternoon, everyone. I’m Yuichiro Wakatsuki, Co-President of Nippon Paint Holdings.

Thank you for taking the time to join our conference call to discuss the financial results for the first quarter of 2024.

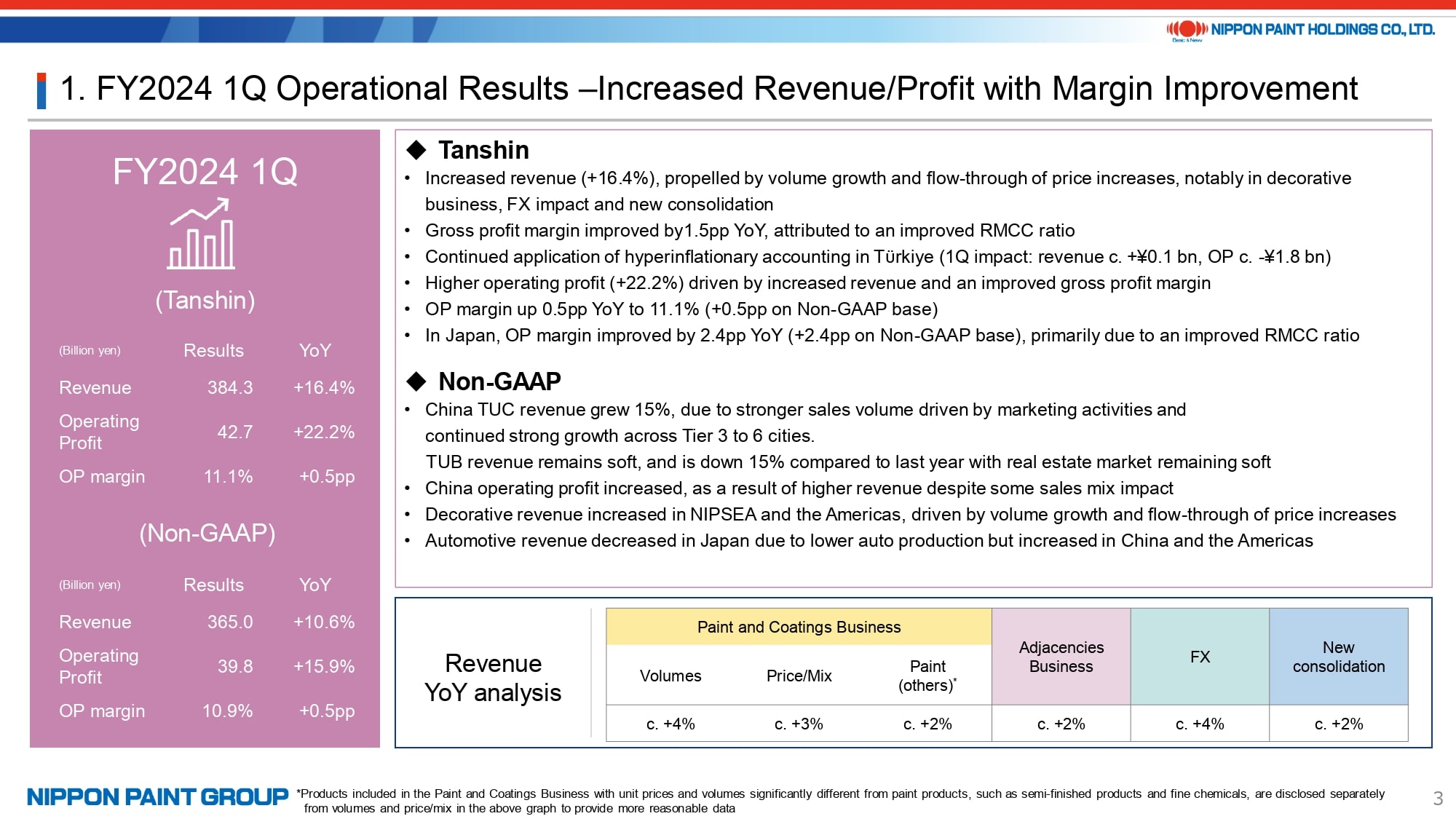

2. FY2024 1Q Operational Results –Increased Revenue/Profit with Margin Improvement

I would like to begin by summarizing the financial results for the first quarter of 2024.

On a Tanshin basis, we achieved significant growth in both revenue and operating profit. Revenue increased by 16.4% year-on-year, reaching 384.3 billion yen, while operating profit surged by 22.2% year-on-year to 42.7 billion yen. Please refer to the year-on-year revenue growth breakdown at the bottom of page 3. This positive trend was driven by increased sales volumes, favorable price/mix in the paint and coatings business, contributions from our adjacencies business, FX impact, and new consolidations.

On a Non-GAAP basis, our revenue increased by 10.6%, and operating profit grew by 15.9%. In the decorative paints sector of NIPSEA China, revenue from the TUC segment rose by 15%, while it declined by 15% in the TUB segment. Despite this, NIPSEA China overall demonstrated strong growth, achieving a 12.2% increase in revenue and an 11.6% rise in operating profit, driven in part by a robust performance in the automotive segment.

These results have surpassed our original guidance, which anticipated 7-7.5% growth in revenue and 7.5-8% growth in operating profit, excluding the impacts of acquisitions in Kazakhstan and India and FX impacts. They also exceeded the medium-term Compound Annual Growth Rate (CAGR) targets from our Medium-Term Strategy, which included the impacts of acquisitions in Kazakhstan and India, projecting an 8-9% growth in revenue and a 10-12% growth in EPS. Although foreign exchange rates have moved favorably since we announced our original guidance three months ago, we are not revising our guidance at this time. This decision is partly due to the relatively short period that has elapsed. Additionally, despite a delay in the expected closing of the buyback of the India businesses, which I will discuss later, our performance remains largely in line with, or slightly above, our original projections.

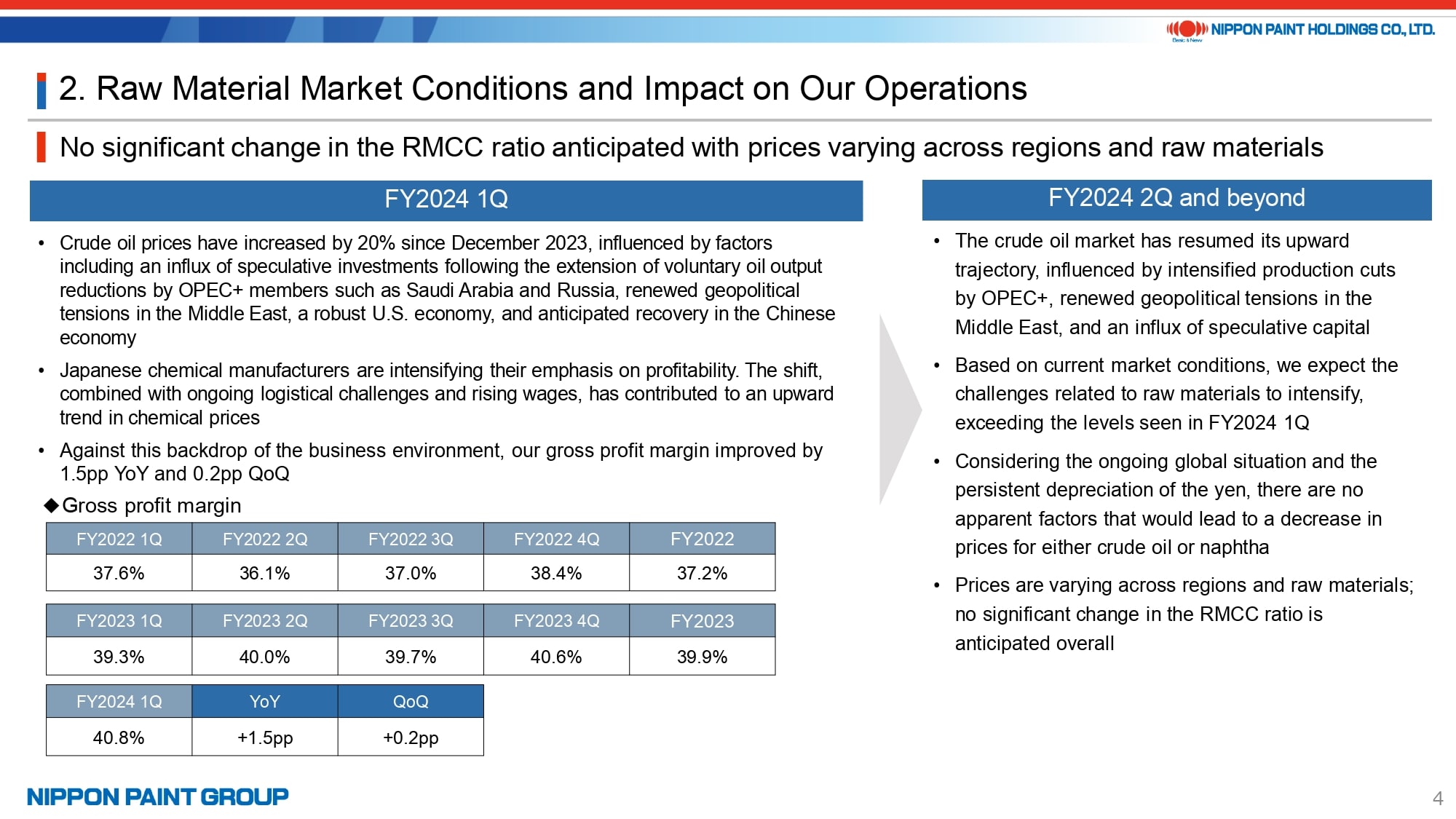

3. Raw Material Market Conditions and Impact on Our Operations

While raw material market conditions remain challenging with prices fluctuating across different regions and types of materials, we do not expect significant fluctuations in the overall raw material cost contribution (RMCC) ratio. Our response to these price impacts is tailored to each region and business sector, taking into account local factors such as the depreciation of the yen in Japan.

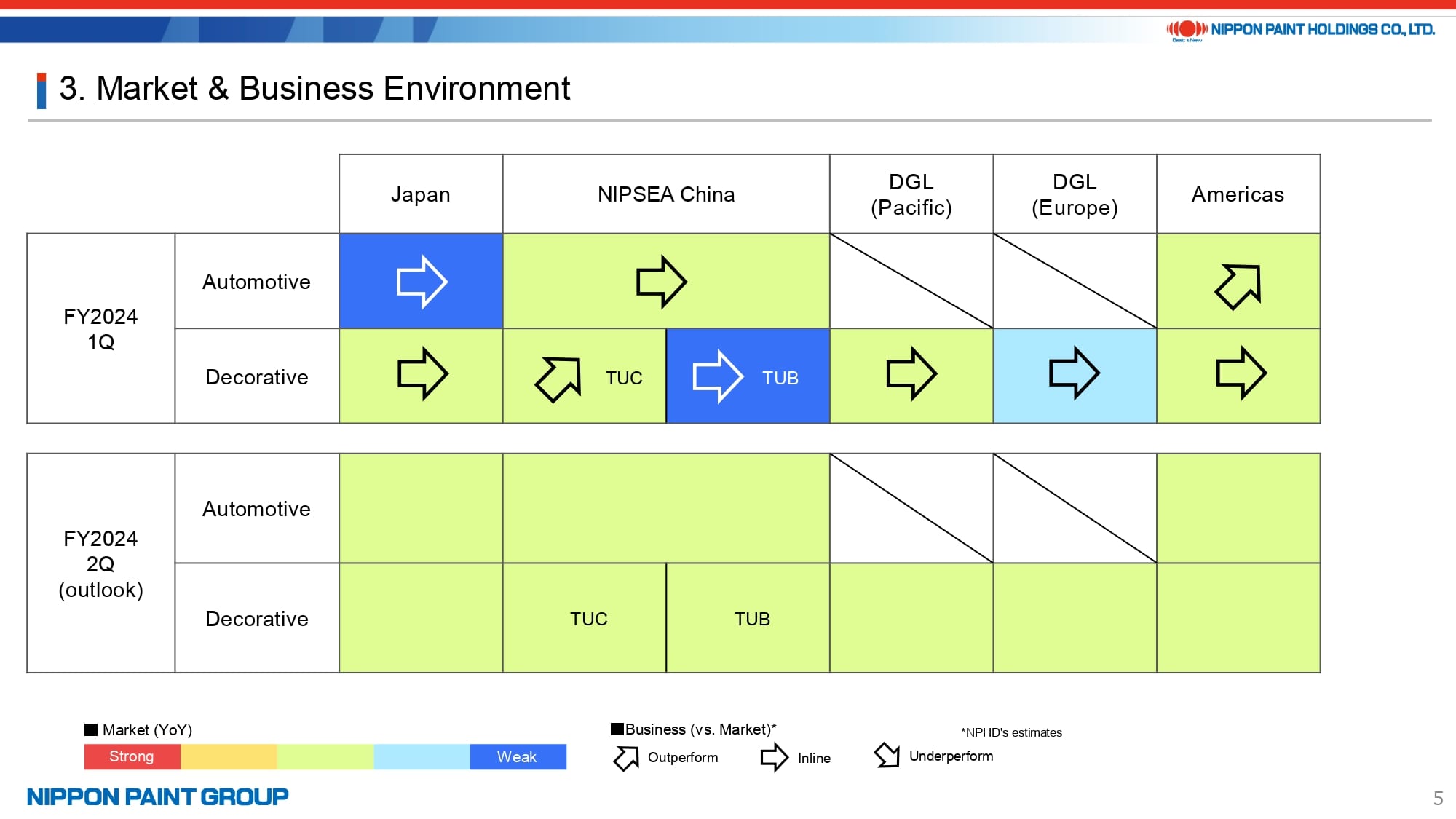

4. Market & Business Environment

The heatmap used to illustrate market conditions and the business environment shows no significant changes overall. However, in the first quarter, the automotive market in Japan was marked with dark blue, reflecting a 12% year-on-year decrease in auto production. Similarly, the TUB market for NIPSEA China was also shaded dark blue, reflecting the continued softness in China’s property market. Despite this overall stability or slight softening in other markets, our strategy remains firmly focused on expanding market share.

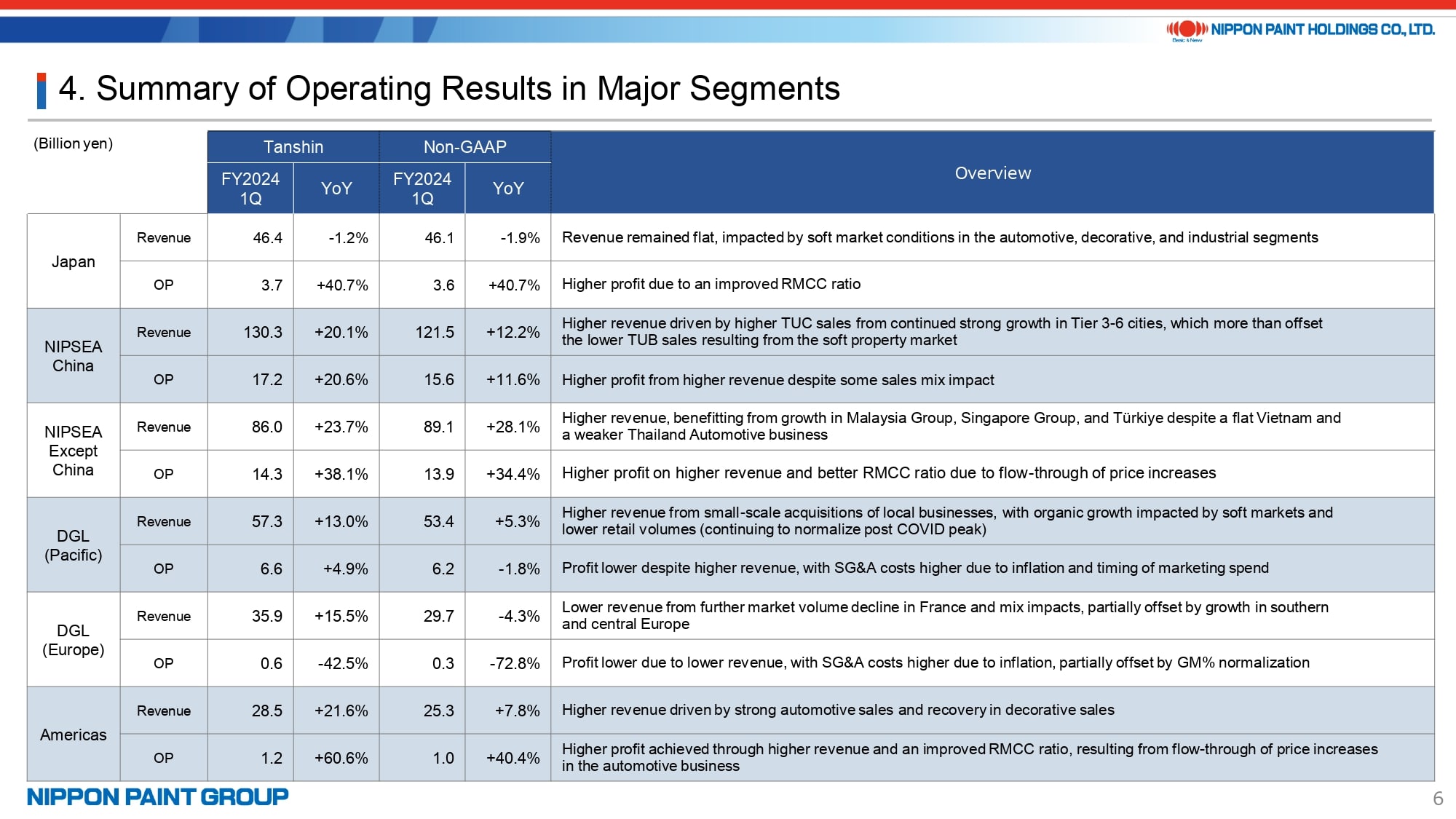

5. Summary of Operating Results in Major Segmentss

Page 6 provides an overview of our operational outcomes across key segments for the first quarter of 2024. I will briefly discuss the performance of each segment and will be available to address any related questions during the subsequent Q&A session.

- The performance of our Japan segment was notably impacted by a decline in automobile production. Although market conditions in the decorative and industrial sectors also remained challenging, we mitigated the decrease in sales volume through strategic price increases.

Conversely, our marine sector continued to perform well. Despite a slight decrease in overall revenue, the Japan segment achieved a 40.7% year-on-year increase in operating profit. - As previously discussed, NIPSEA China’s overall performance varied across segments. The TUC segment exhibited strong performance, while the TUB segment encountered some challenges, and the industrial segment performed relatively well. We successfully increased our revenue, while maintaining the same level of operating profit as the previous year. Specifically, margins in the TUC segment remained stable, while the TUB segment experienced a margin decrease due to a decline in revenue. Conversely, the industrial segment saw an increase in margins. Within the TUC segment, all regions continued to grow, with Tier 3-6 cities achieving higher growth rates.

- Excluding China, NIPSEA continued to register strong growth with high margins. This segment includes our operations in Türkiye, which achieved 100% revenue growth on a constant currency (Non-GAAP) basis. Apart from Türkiye, the rest of this segment saw an overall revenue growth of approximately 5%. Although Indonesia experienced slightly slower revenue growth due to the earlier-than-usual start of Ramadan, other regions maintained steady performance. Additionally, Alina in Kazakhstan, which has been part of our consolidated results since January, has made a promising start.

- Both the Pacific and Europe segments of DuluxGroup encountered challenging market conditions. Despite this, the Pacific segment achieved a 5.3% increase in revenue with respectable margins, largely due to contributions from small-scale acquisitions the adjacencies arena. In contrast, our operations in France faced particularly tough conditions, leading to a decrease in revenue; however, we estimate a slight increase in our market share in Europe. NPT in Italy, acquired in 2023, has been contributing steadily. Looking ahead with a slightly longer perspective, we anticipate solid results for the European segment as a whole in the future.

- In the Americas, the automotive segment achieved a 12.5% increase in revenue, despite flat automobile manufacturing, primarily driven by strong production from Japan-based automakers. Similarly, our decorative segments managed to secure revenue growth under challenging market conditions, aided partly by more favorable rainfall compared to the previous year. Following a competitor’s bankruptcy in northern California, Dunn-Edwards is expanding its paint store presence, which has incurred some upfront expenses. However, we anticipate these investments will yield positive results in the future.

As I’ve mentioned previously, we should not overreact to the results of a single quarter, particularly given the impact of seasonality factors. Nevertheless, we have delivered solid results overall. In regions where performance was less than satisfactory, respective leaders have already begun to implement remedial strategies. We will review and adjust our guidance as necessary and at the appropriate times.

6. Major Topics

Moving on to other topics, today we announced an adjustment in the expected timeline for the buyback of our two Indian businesses, shifting from the first half of 2024 to later in the year. This change is not due to any issues within our operations; it is instead a result of delays in the approval process with Indian authorities, which can be attributed to the ongoing campaign for the general election scheduled for June.

In our original guidance released in February, we reported that the 2023 total revenue for our two Indian businesses was approximately 44 billion yen. For 2024, we projected revenue growth of 10-15% for NPI, our decorative business, and 0-5% for BNPA, our automotive operations. We also anticipated contributing six months’ worth of this revenue in 2024. The operating profit margins for NPI and BNPA in 2023 were 4.5% and 6.4%, respectively, with expectations for these margins to remain stable in 2024. Therefore, even if there is no contribution from these two Indian businesses this year, the impact on our consolidated performance for 2024 will be limited, affecting only about 2% of the consolidated revenue guidance of 1,600 billion yen and less than 2% of the consolidated operating profit.

I am pleased to announce that our Integrated Report 2023 has won the Grand Prize at the Nikkei Integrated Report Awards 2023. For those who have not yet reviewed it, I encourage you to visit our website and access the report.

Before concluding my presentation, I would like to express my gratitude for the feedback we have received since presenting our Medium-Term Strategy on April 4. The results of the first quarter, announced today, align with the goals we have outlined. We remain committed to fulfilling our promises, with our consistent organic growth serving as a testament to this commitment. Regarding our M&A endeavors, another key pillar of our strategy, we are actively exploring various opportunities, both large and small, always with the pursuit of Maximization of Shareholder Value (MSV). Despite occasional questions about the status of our M&A efforts, I assure you that they continue unabated.

This concludes my presentation. Thank you for your kind attention.