1. Introduction

Hello everyone. I am Masayoshi Nakamura, Board Chair of NPHD.

As you know, NPHD has a majority shareholder. Therefore, it is absolutely necessary for us to implement thorough governance and operate the Board, focusing on the protection of minority shareholder interests.

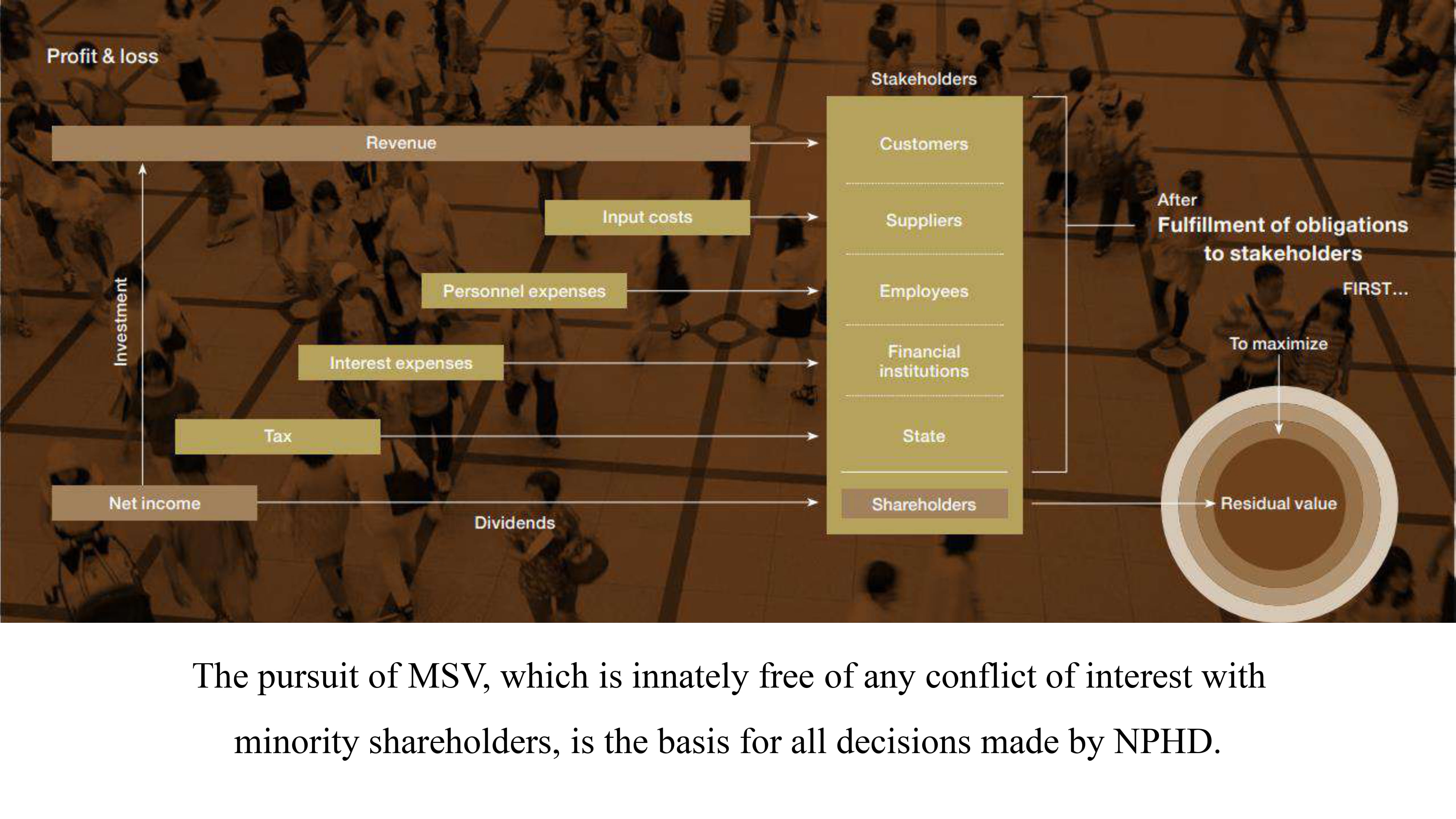

Today, I will be explaining how we arrived at the current governance structure and how the Board operates now. I also hope to gain your understanding that “the pursuit of Maximization of Shareholder Value (MSV), which is innately free of any conflict of interest with minority shareholders, is the basis for all decisions made by NPHD.”

2. Nine Directors are currently responsible for NPHD’s corporate governance

Let me introduce the nine members of the current Board. To your left are Co-Presidents Wakatsuki and Wee. Next is Chairman Goh, representing the Wuthelem Group, which holds 58.7% of NPHD shares. The three in the center are Directors Hara, Kirby, and Lim. Mr. Hara is a leading corporate law expert in Japan; he chairs our Nominating Committee. Mr. Kirby is a distinguished figure in the global paint and coatings industry. Ms. Lim is a former member of the Singapore Cabinet; she also has in-depth knowledge of the private equity business. She chairs our Compensation Committee. Next to Ms. Lim is Director Mitsuhashi. Mr. Mitsuhashi has extensive experience as a CPA and is very resourceful in the areas of ESG and sustainability management. He chairs our Audit Committee. Next is Director Morohoshi, who has a wealth of experience at global electronics and IT companies. He strongly supports business model transformation that leverages the power of IT. The last one is myself. I come from the global investment banking field, mainly M&A advisory and capital raising, and I serve as the Lead Independent Director.

All Directors have business management experiences at global companies. In particular, we share solid experience in human capital management.

3. MSV is at the core of our corporate governance

So, how did these nine people come to assume their current governance roles? For this, we need to trace back to the shareholder proposal made by the Wuthelem Group in 2018.

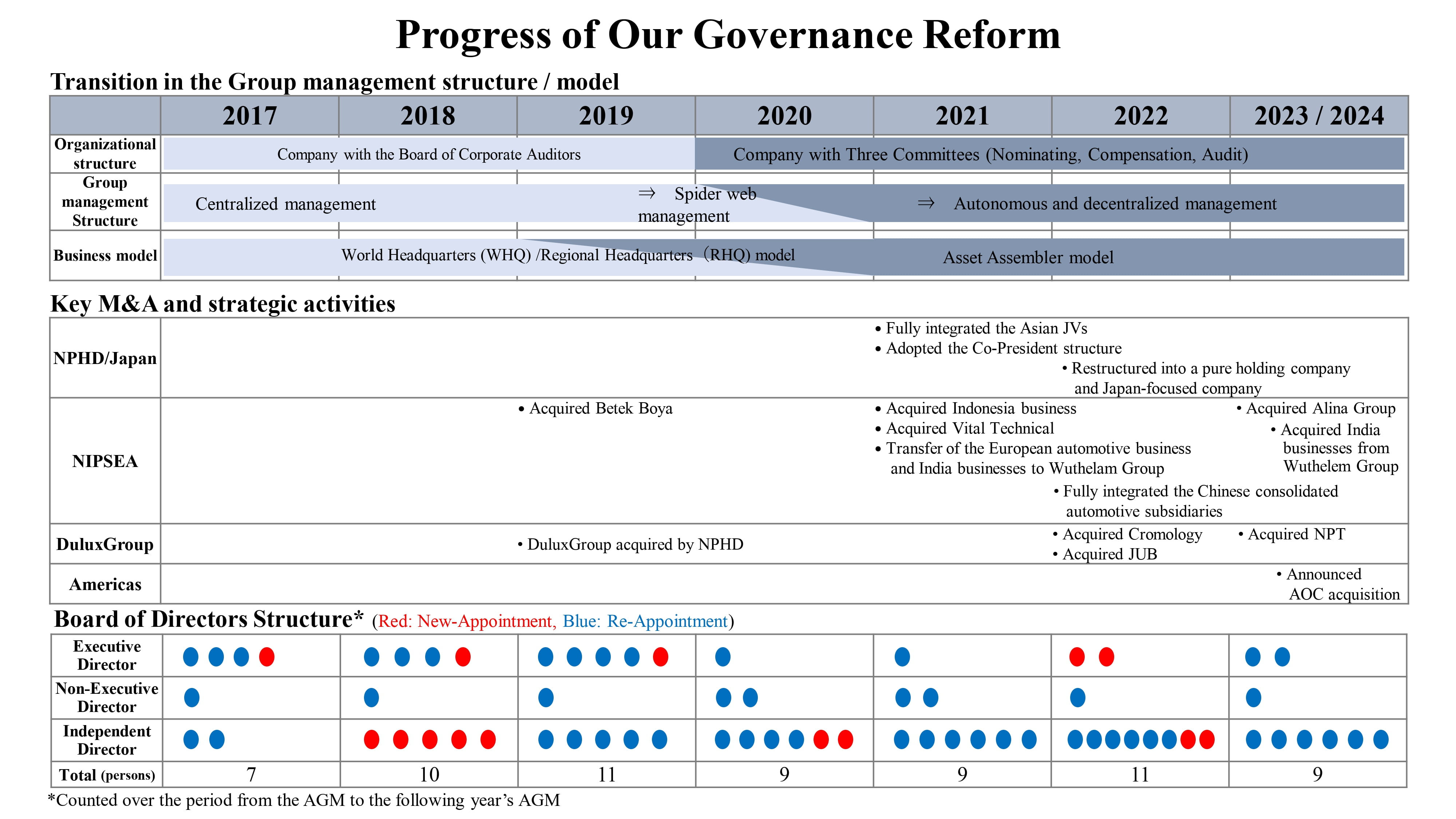

4. History of Our Governance Reforms

At that time, five members who were fully in support of the MSV, championed by Mr. Goh, became Independent Directors. In fact, the first time I met Mr. Goh in early 2017, immediately after shaking hands, he started to explain what MSV meant and asserted that MSV should be the sole mission of a publicly traded company like NPHD. It didn’t take more than five minutes for me to completely agree with him, since this was what I had been believing in throughout my career as an investment banker. MSV is about maximizing residual value after fulfilling our obligations to all stakeholders. These obligations include not only legal ones but also social, ethical, and sustainability obligations.

Going back to the history, soon after this change of Board composition, the Company poured efforts into the acquisitions of DuluxGroup and Betek Boya, working to improve capital efficiency and EPS. Around that time, NPHD invited a CEO from outside the company. In 2021, it made NIPSEA Group—an Asian joint venture with the Wuthelem Group—a wholly owned subsidiary, and also acquired the Indonesian paint business from Wuthelem Group. These two transactions resolved our potential conflict of interest with the majority shareholder, Wuthelem Group. From then on, the Company expanded its businesses into the Paint+ and Paint++ domains. To pursue further expansion under Asset Assembler model, we also adopted the Co-President structure, which we have in place today.

Along the way, we adopted the most advanced governance structure at the Board level, transitioning to a Company with Three Committees with a majority of Independent Directors. Since 2018, eight Directors left and seven new Directors joined the Board. Perhaps this is a result of the Board positioning MSV—the Company’s sole mission—at the core of corporate governance, and consistently pursuing it.

5. Pursuit of MSV

In essence, the pursuit of MSV, which is innately free of any conflict of interest with minority shareholders, has been the basis for all decisions made by NPHD dating to the Board changes and governance reforms of 2018.

6. How we run the Board

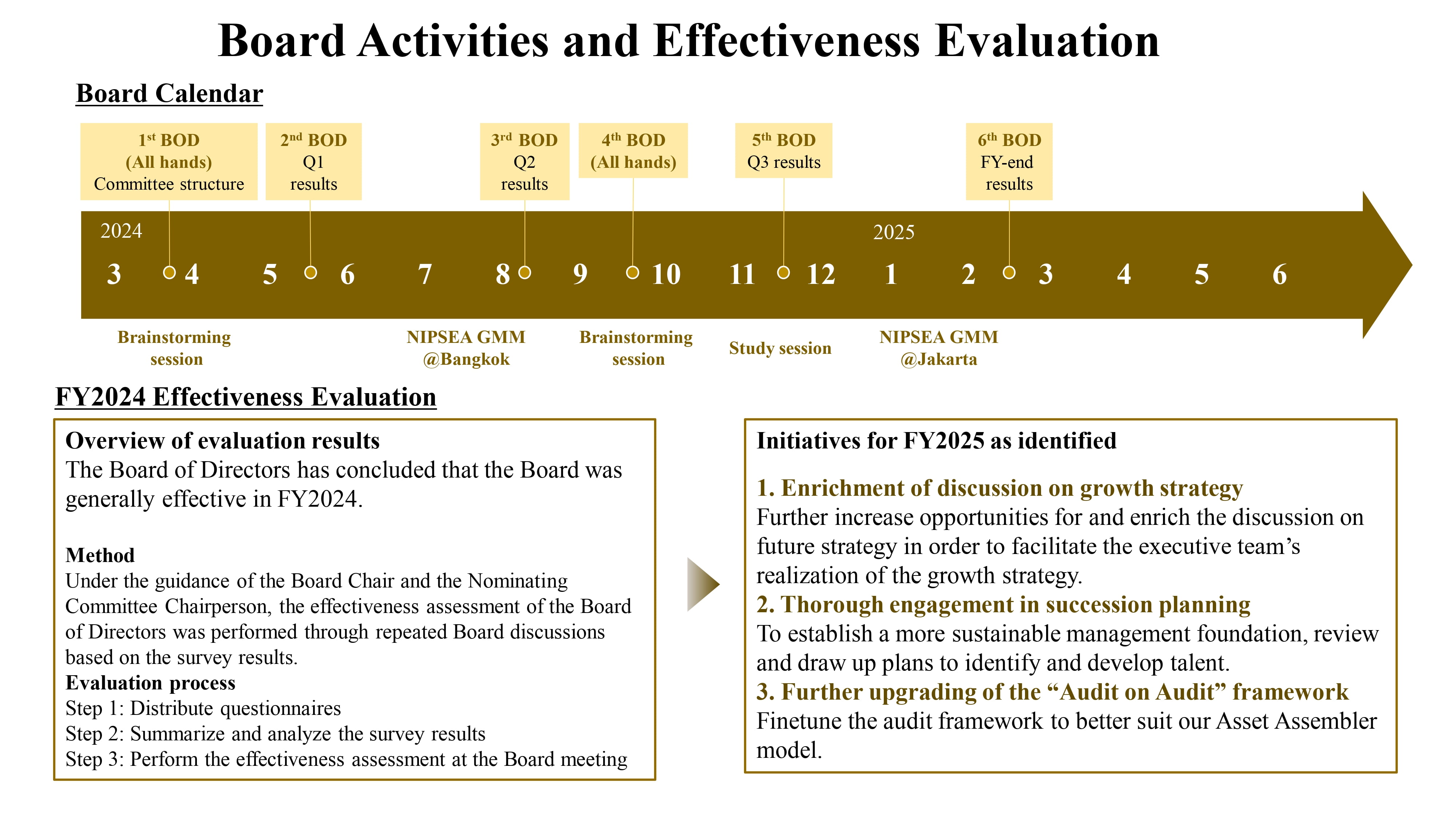

How do we run the Board? The annual Board calendar includes two Board meetings held in the format of a two-day strategy session at the Company’s Osaka and Tokyo headquarters. In 2024, one session was held at the end of March, after the General Meeting of Shareholders, and another at the end of September. All members of the Board assembled in person to engage in intensive discussions, including some brainstorming. In addition to these two-day sessions, regular Board meetings are held once every quarter—in May, August, November, and February of the following year. This means that our Board meetings are held six times a year.

With the exception of significant corporate decisions, the Board delegates the majority of business execution authority to the executive team. The Board and the three committees, which are all chaired by Independent Directors and whose majority are also Independent Directors, monitor the activities of the executive team.

The Nominating Committee selects Director candidates and advises the Board with the selection of Executive Officers. The Compensation Committee determines the compensation of Executive Officers after evaluating the performance of each Executive Officer jointly with the Nominating Committee. And, it determines the compensation of Directors. The Audit Committee is responsible for appointing the Accounting Auditor. It also oversees whether each Director and Executive Officer is fulfilling his or her responsibility and monitors the design and effectiveness of the internal control system.

Along with the Board meetings, we hold the Meeting of the Independent Directors with the aim of enhancing Board effectiveness. In these meetings, we try to capture the actual state of business, risk management, and talent development on the ground, by directly exchanging opinions with the management teams of individual Partner Company Groups. Our findings are used to evaluate the performances of the Co-Presidents and Executive Officers.

The Directors work actively to exchange opinions with each other in a timely manner, participate in the biannual NIPSEA Group Management Meeting, where all the senior management of the Asian business units get together. We also have regular meetings with the DuluxGroup management, including those in Europe. Additionally, we individually maintain communication with the management teams of each Partner Company Group. In other words, our activities are not limited to the scheduled Board meetings. The Board is “always on.”

At the Board meeting held last month, we had a chance to discuss the results of the Board effectiveness evaluation. The Board concluded that it was generally effective in fiscal year 2024. In addition, to further improve our effectiveness toward the next fiscal year, we have decided to focus on three points moving forward.

The first point is the enrichment of discussions on growth strategy. We will create more opportunities for in-depth strategic discussions, also improving the quality of such discussions in support of the executive team’s realization of growth strategies.

The second point is thorough engagement in succession planning. We will review and form plans for talent discovery and development so that we can create a more sustainable management foundation.

The third point is further upgrading of the “Audit on Audit” framework. We will move onward to establish an audit framework that is most suitable for the Asset Assembler model.

The third point is particularly important because, as we continue to implement autonomous and decentralized management, we must further refine our risk management system that is founded on mutual trust.

7. Pursuit of MSV based on Asset Assembler Model

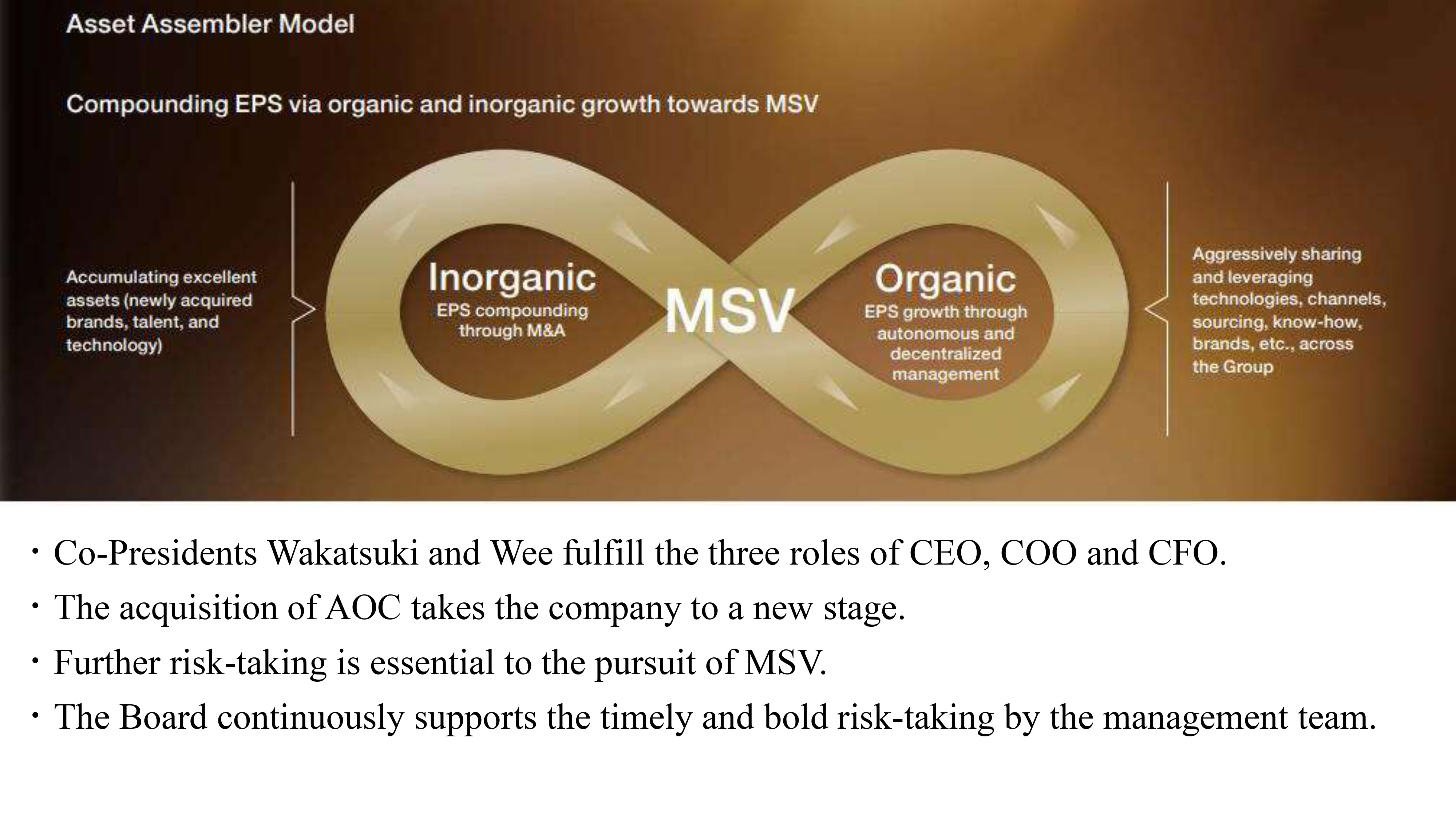

This was a quick rundown, but I hope I was able to present our Directors, who are responsible for the Company’s governance, give you an idea of the reforms leading up to the current Board, and update you on how the Board is being operated today. I would like to emphasize once again that at the core of our governance is the pursuit of MSV.

In effect, Co-Presidents Wakatsuki and Wee share the roles of CEO, COO, and CFO between the two of them. They have been leading Asset Assembler model, which is a two-pronged approach for achieving MSV. The first of the two is EPS growth from existing businesses through autonomous and decentralized management based on mutual trust and accountability. The second is EPS accretion through acquisitions of inexpensive but high-quality assets using low-cost funding.

The acquisition of AOC, announced last month, represents another step in the asset assembly that takes NPHD to the next stage. I’d like to emphasize that further risk-taking is absolutely necessary. There are three types of risks we should consider taking: the risks associated with measures to improve the value of existing business assets, the risks associated with building new business assets, and the risks related to balance sheet management, including financing from the capital markets. The Board, in its monitoring role, carries the mission of working together with management to determine where we aspire to be in the future as a company. For this, the Board has been devoting more efforts into discussions on growth strategies for a more sustainable leap forward, while also working to resolve existing issues. The Board frequently exchanges views with the management team. For instance, we conduct brainstorming sessions to discuss the Company’s long-term roadmap, and for its implementation, we hold off-site meetings to discuss strategy options. Using these opportunities, we encourage the management team to boldly take risks in a timely and appropriate manner.

As Asset Assembler, we are committed to pursuing MSV, which is the goal we share with minority shareholders. To the analysts and investors who have kindly joined us today on our IR DAY, we would appreciate your understanding for our corporate governance efforts and ask for your continued support.

Thank you.