Finance and M&A Strategies

M&A Strategy

No limitations on M&A target areas, regions, or scale

We believe we should be able to compound EPS with limited risk, without setting limitations on the business areas, regions, or scale of our M&A targets by leveraging our competitive advantages as lean headquarters operating under Asset Assembler model. Our competitive advantages are threefold: (1) our capability to fully leverage the benefits of low funding costs; (2) the capability of asset companies to maintain and expand the EPS contribution without the intervention of the holding company; and (3) our ability to attract world-class management talent who empathize with our business model. To date, our M&A activities have been primarily focused on acquiring decorative paints companies. However, our strategic considerations are not confined to the paints and adjacencies arena. We remain open to every opportunity that promises to contribute to MSV.

Rigorous acquisition criteria that minimize risk

When selecting M&A targets, our sole criterion is whether they contribute to MSV. We specifically focus on companies that: (1) present low-risk and good returns, (2) have an excellent management team, and (3) generate good cash flows. Essentially, our acquisitions are centered around what we term “good companies.” We place considerable emphasis on financial discipline, particularly ensuring that a newly acquired company contributes to EPS accretion from Year 1. This reflects our meticulous approach to pursuing low-risk M&A. Moreover, our Co-Presidents and Directors, who have extensive experience in M&A, leverage their discernment abilities to assess the appeal of acquisition targets and the competency of their CEOs. This approach allows us to unlock the growth potential in partner companies through our autonomous and decentralized management.

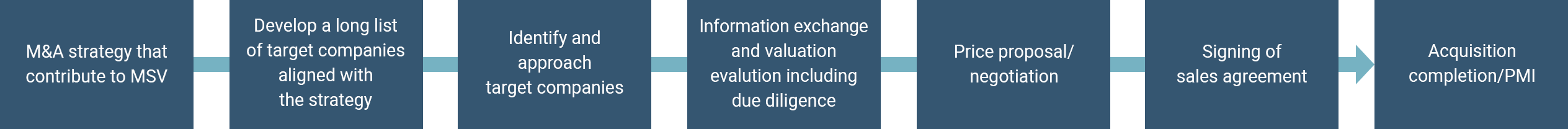

- M&A selection process

-

The flowchart below illustrates our M&A selection process. After creating a long list of target companies, we assign priorities, examine feasibility, and hold thorough discussions, going into details such as the timing and proposal structure of M&A.

When choosing targets, the sole criterion is their potential contribution to MSV. Notably, personal egos, such as the desire to just pursue size or personal achievements, do not influence our decisions. For our Company, achieving the title of the world’s largest company in terms of sales would hold little significance if the journey towards that goal were to harm shareholder value.

Therefore, when we examine a specific acquisition, we make judgment after holding multifaceted discussions on the degree of PMI led by Partner Company Groups and other risks involved with sound vigilance at all times. In the context of Asset Assembler model, human capital holds significant importance. To mitigate risks effectively, we have implemented mechanisms that involve commitments with local management and succession plans.

One essential financial discipline for us is to contribute to EPS accretion from the very first year. We refrain from making overly optimistic assumptions about justifying acquisition synergies, e.g. hoping for positive EPS only after three years of acquisition.

In our value calculations, we take into account not only metrics like PER and EV/EBITDA but also evaluate how executing the deal will impact the cushion in the Group’s balance sheet.

Fostering high growth in acquired companies through autonomous and decentralized management

The decorative paints market is characterized as local production for local consumption, with diverse business models across different countries and market segments. To address this, we implement an autonomous and decentralized management approach. By delegating authority and accountability to excellent local management teams, we facilitate swift local decision-making.

The strength of our platform rests on the collaborative efforts of our colleagues, united by a shared goal of achieving MSV. They assist each other across borders when needed and proactively share growth strategies for both mature and emerging markets. Additionally, they exchange expertise from existing and new businesses among partner companies. This approach is not imposed by the headquarters; instead, each partner company has the autonomy to choose its path. This collaborative and flexible approach fuels synergistic growth across our portfolio, benefiting both our existing businesses and the companies we acquire.

- Characteristics of the paint and adjacencies businesses

-

Notably, the decorative paints market represents a significant portion of the paint and coatings market. It operates on a local production for local consumption basis, with each country and market adopting unique business models encompassing raw material procurement, consumer preferences, sales networks, and environmental regulations.

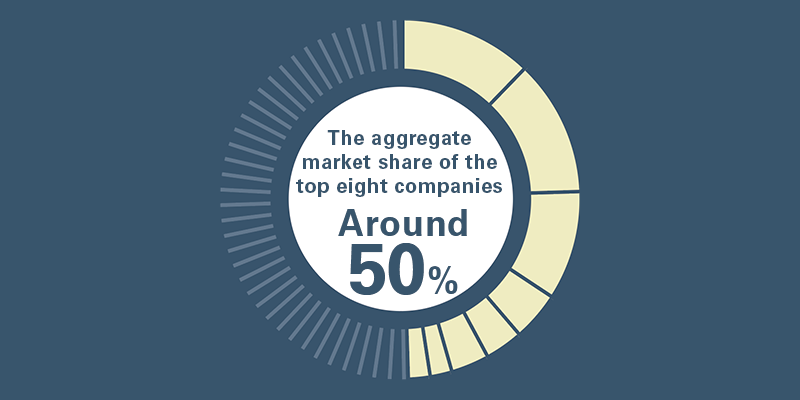

Apart from facing a low threat of substitute products, paints, particularly decorative paints, exhibit significant regional characteristics. Critical success factors in this market are: (1) strong brand power; (2) a well-established distribution network; and (3) the establishment of operations with local expertise. Achieving the No.1 market share based on these factors provides a substantial advantage, making it challenging for competitors to reverse the competitive dynamic.

This market leadership enables further expansion in market share, followed by increased profits, creating a virtuous cycle of growth.-

Businesses characterized by local production for local consumption Customer needs differ across countries and regions

-

High entry barriers A small number of top-ranking brands dominate the markets

-

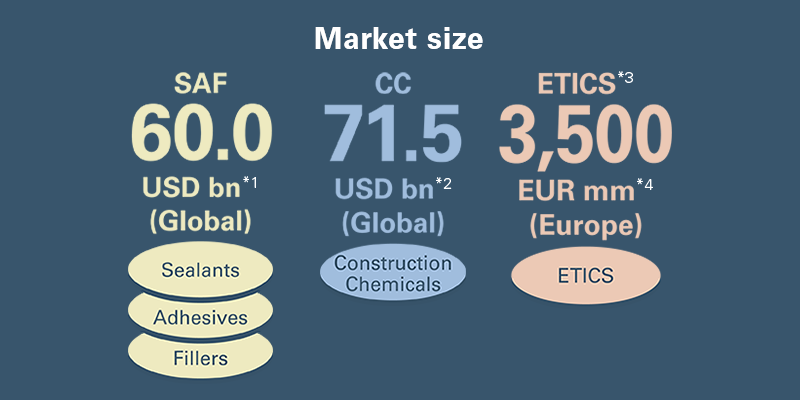

Adjacencies have several areas of attractive markets We supply both paint products and adjacency products in a one-stop fashion

-

*1 Source: Fortune Business Insights

*2 Source: ReportLinker

*3 External Thermal Insulation Composite System

*4 Source: European Commission Paper

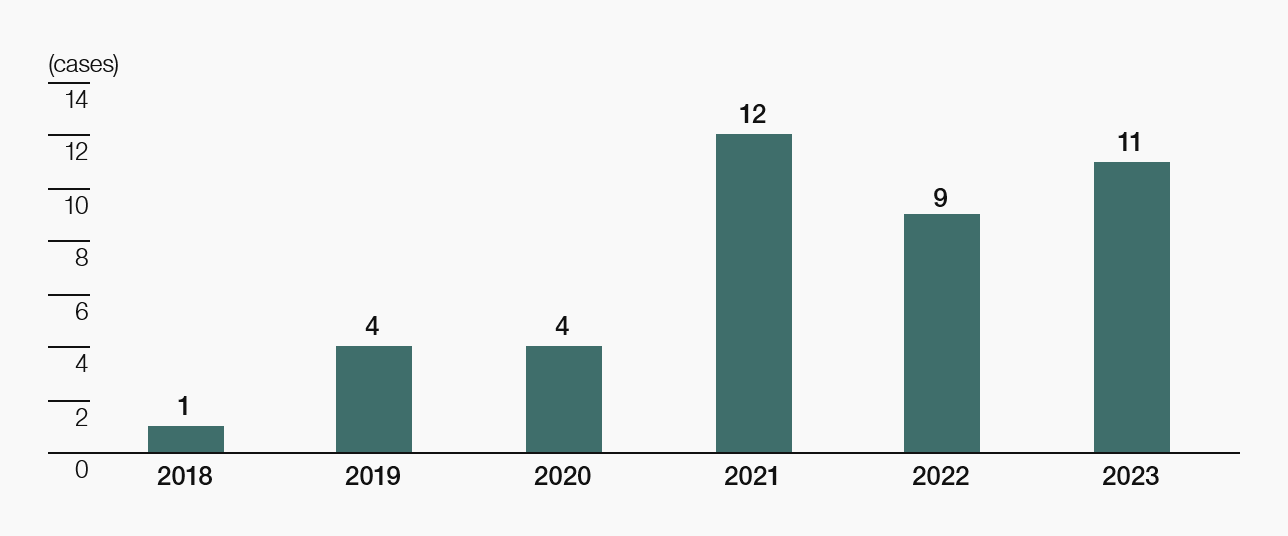

- M&A* transactions

-

- * Including small-scale business acquisitions (undisclosed) across different regions and business segments

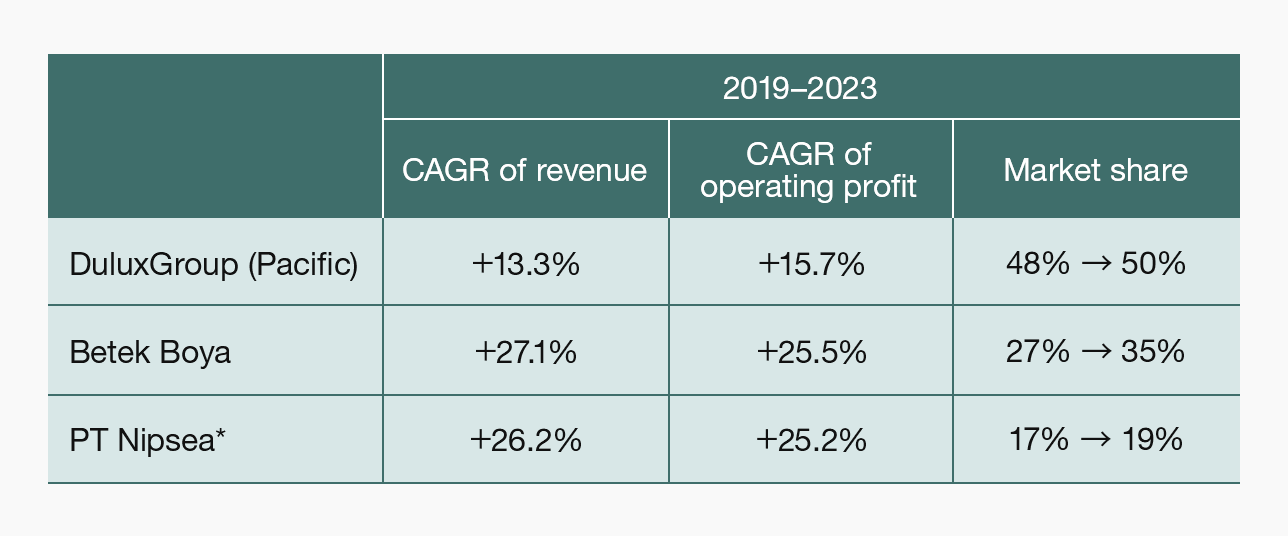

- Growth since joining our Group

-

- * The comparison of PT Nipsea covers the period from 2020 to 2023

New M&A opportunities brought about by Asset Assembler model

Unlike the cost-cutting approach typically seen in Western companies, our approach has been generating new opportunities thanks to our proven track record and solid reputation. We have observed a growing interest from growth-focused local CEOs in joining our Group, as this allows them to fully demonstrate their management skills. Additionally, our commitment to respecting the legacy, brand, and leadership of target companies—especially private ones—appeals to asset owners who have a strong attachment to their companies and are seeking a seamless transition to the next generation.

M&A track record

Our key partner companies, which we have acquired since FY2014, meet our selection criteria for acquisition targets: (1) have low risk and stable earning flow contributing to MSV, regardless of business categories or regions, (2) possess strong brand and talented management teams, and (3) are expected to achieve EPS accretion from Year 1 and offer appropriate levels of risk and returns. These companies have achieved strong growth in both high-growth and mature markets.

(Decorative paints)

Dunn-Edwards

- 2017

37.4 bn yen - 2022

65.7 bn yen

+47.2%

DuluxGroup

- 2019

134.9 bn yen - 2022

206.6 bn yen

+53.2%

Betek Boya

- 2019

28.8 bn yen - 2022

70.5 bn yen

+144.7%

PT Nipsea

- 2020

30.3 bn yen - 2022

52.3 bn yen

+72.7%

NIPSEA Group

(2014: Consolidation

2021: Full integration)

- 2014

236.5 bn yen - 2022

708.5 bn yen

+199.6%

Vital Technical

Cromology

No.2 (France, Portugal)

- 2021

109.1 bn yen - 2022

117.3 bn yen

+7.6%

JUB

- 2021

109.1 bn yen - 2022

117.3 bn yen

+7.6%

Five Chinese

automotive

subsidiaries

NPT

Alina

* The earnings comparison with the time of acquisition are estimates because some assumptions used to estimate market shares at the time of acquisition are different frompresent assumptions due to a change in the accounting policy.

* Market share is based on NPHD’s estimates.

* FY2017 earnings of Dunn-Edwards are for 10 months from March 2017, when the acquisition closed, to December 2017. Earnings changes since the acquisition are calculated using FY2018 earnings.

* The earnings of Cromology and JUB for FY2021 results are pro forma figures. JUB’s earnings for FY2022 are pro forma figures for 12 months and converted to JPY at the following exchange rate: EUR/JPY=138.5 yen