Latest Results

Consolidated Financial Results for the Nine Months Ended September 30, 2025 (January 1, 2025 to September 30, 2025)

For the nine months ended September 30, 2025, Nippon Paint Group’s consolidated revenue rose 7.8% year-on-year to \1,318,378 million. The increase was mainly attributable to contributions from LSF11 A5 TopCo LLC (AOC), including AOC, LLC, a global specialty formulator, and its affiliated companies, subsequent to the completion of its acquisition in March 2025. Consolidated operating profit climbed 36.4% to \190,579 million, while profit before tax advanced 36.6% to \182,552 million. Profit attributable to owners of parent grew 38.6%, reaching \134,336 million.

Japan

Revenue from automotive coatings increased, supported by a rebound in automobile production. Industrial coatings revenue remained largely unchanged, as the favorable impact of pricing flow-through was offset by softer market conditions. Revenue from decorative paints decreased year-on-year, despite efforts to boost sales of high value-added products, including new products, due to the decline in renovation projects caused by inflation. As a result, consolidated revenue grew 1.2% year-on-year to \151,363 million, while consolidated operating profit increased 2.9% to \14,304 million, reflecting higher revenue and an improved SG&A ratio.

NIPSEA

NRevenue from automotive coatings increased, driven by increased automobile production in China and strong sales to

Chinese OEMs, which offset the impact of lower production in Thailand. Revenue from decorative paints decreased

year-on-year, despite growth in sales volumes in key markets, such as Malaysia, Singapore, and Indonesia, due to

deteriorating market conditions including weaker consumer sentiment in other regions in Asia.

As a result, consolidated revenue declined 1.5% from the previous year to \670,979 million, while consolidated

operating profit rose 15.0% to \105,452 million, supported by improvements in the raw materials cost contribution

ratio and successful implementation of cost reduction measures.

DuluxGroup

Revenue from decorative paints was flat year-on-year as positive factors, such as modest market share gains and

flow-through of price increases in the Pacific, as well as other European markets offsetting the softness in France,

were counterbalanced by the impact of yen appreciation. Revenue from the adjacencies business decreased, mainly due

to soft home improvement demand in the Pacific segment and sluggish demand for ETICS (External Thermal Insulation

Composite System) in Europe.

As a result, consolidated revenue decreased 1.7% year-on-year to \293,833 million, while consolidated operating

profit declined 1.5% to \29,208 million.

*DuluxGroup Limited is an Australian company that holds the rights to the Dulux® trademark exclusively in Australia, New Zealand, Papua New Guinea, Samoa and Fiji. DuluxGroup Limited is not affiliated with, nor connected to, the owners of the Dulux® trademark in other regions and does not sell Dulux® products outside these designated markets.

Americas

Revenue from automotive coatings declined, reflecting lower automobile production. Revenue from decorative paints also decreased, due to a decrease in demand caused by the uncertainty in the U.S. economy and weaker housing market.

As a result, consolidated revenue decreased 2.8% year-on-year to \90,549 million, while consolidated operating profit decreased 18.2% to \5,710 million.

AOC

From March 2025, AOC’s income and expenses have been included in the Group’s consolidated results. Revenue from the adjacencies business was impacted by weaker market demand compared with the same period of the prior year, largely due to soft macroeconomic conditions.

As a result, consolidated revenue amounted to ¥111,654 million, while consolidated operating profit was ¥39,693 million.

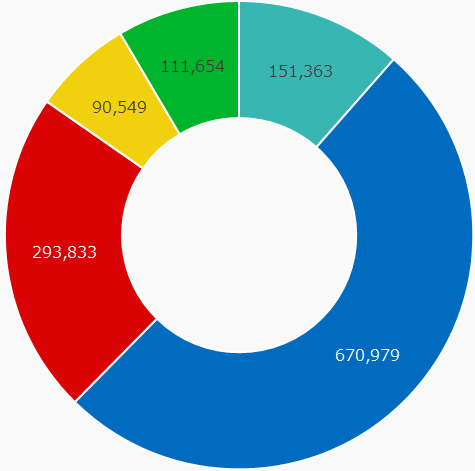

Revenue composition

- Revenue composition by region

-

(Million yen)

- ■Japan: 151,363

- ■NIPSEA: 670,979

- ■DuluxGroup: 293,833

- ■Americas: 90,549

- ■AOC*: 111,654

* Four-month earnings, excluding PPA as it has not yet been finalized.

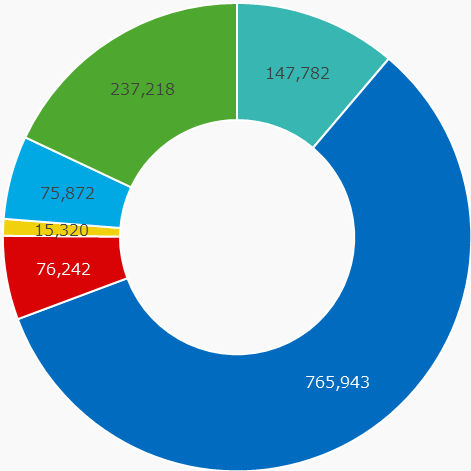

- Revenue composition by business

-

(Million yen)

- ■Automotive coatings: 147,782

- ■Decorative paints: 765,943

- ■Industrial coatings: 76,242

- ■Fine chemicals: 15,320

- ■Other paints: 75,872

- ■Adjacencies business: 237,218

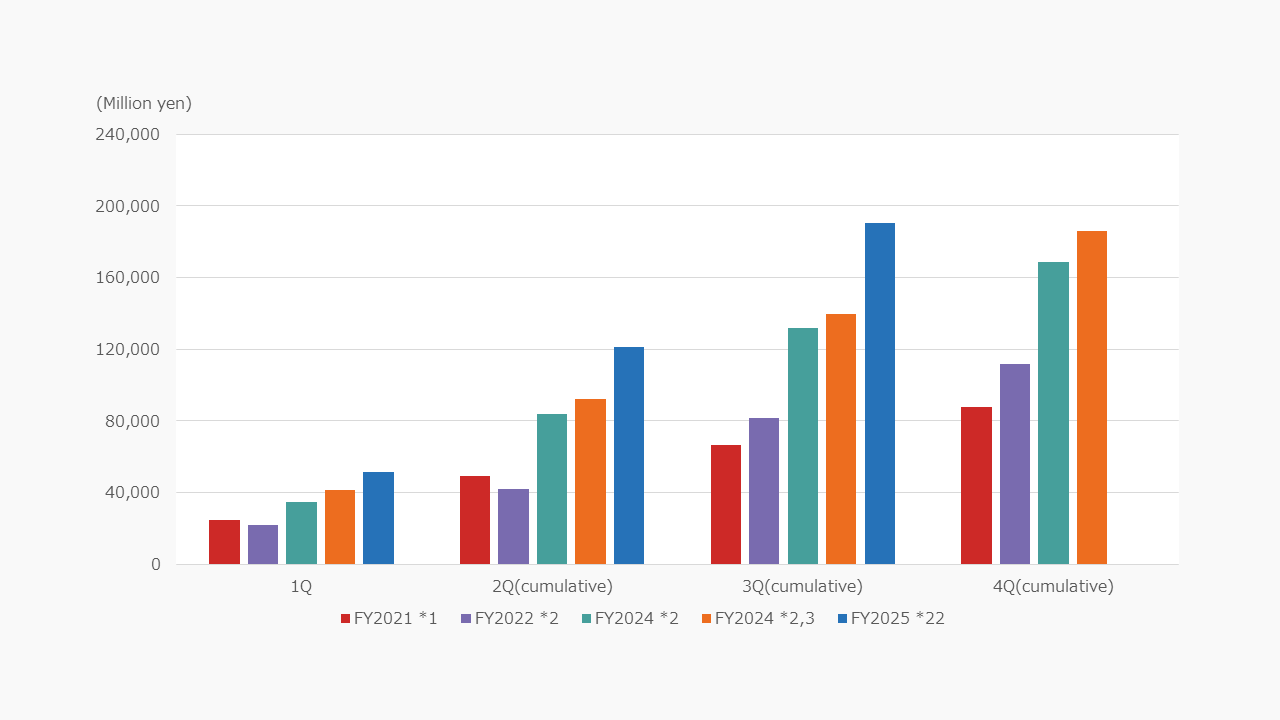

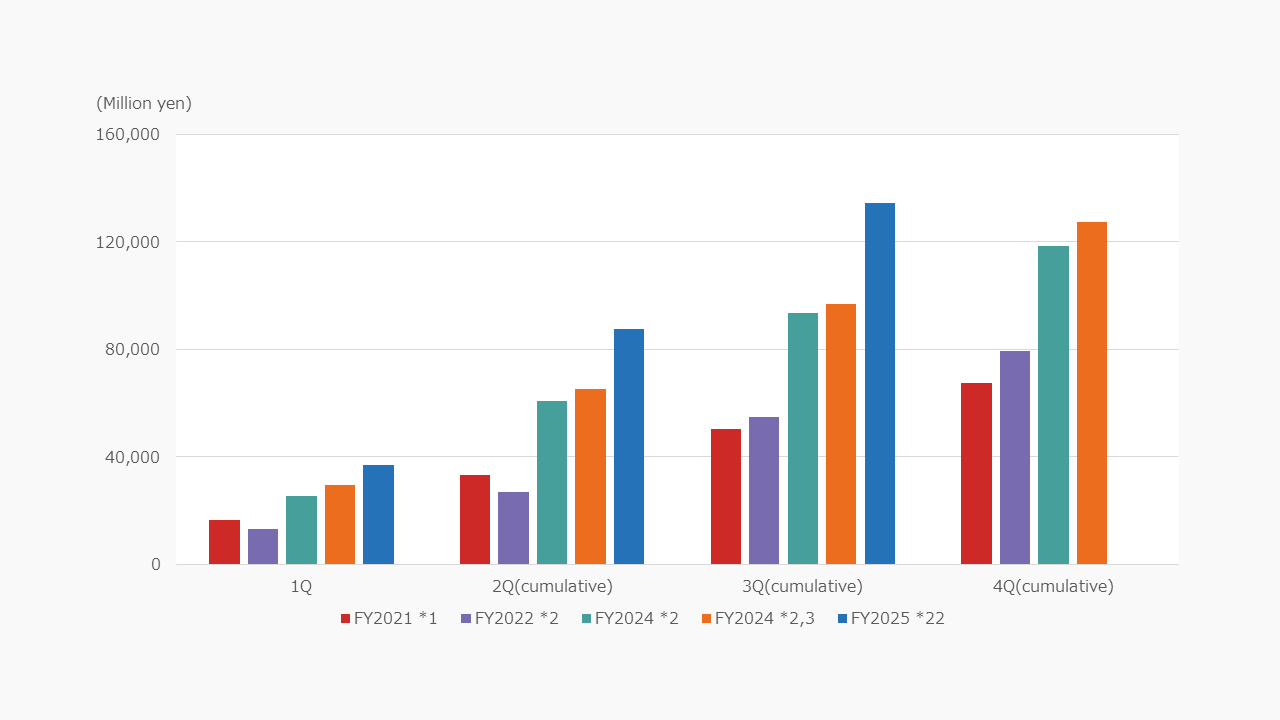

Revenue (cumulative results)

Our revenue growth has accelerated due to the accumulation of assets through multiple M&As executed since 2017, as well as the substantial growth of our decorative paints business in Asia, particularly in China. In 2023, we achieved seven consecutive years of revenue growth and record-high revenue, due to increased sales volumes and the flow-through of price increases, primarily in the decorative paints business, along with new consolidation of NPT and the yen’s depreciation.

(Million yen)

|

|

1Q | 2Q (cumulative) | 3Q (cumulative) | Full year |

|---|---|---|---|---|

| FY2025*2 | 405,724 | 852,428 | 1,318,378 | - |

| FY2024*2 *3 | 384,319 | 817,143 | 1,222,747 | 1,638,720 |

| FY2023*2 | 330,213 | 692,925 | 1,085,878 | 1,442,574 |

| FY2022*2 | 285,096 | 622,049 | 979,916 | 1,309,021 |

| FY2021*1 | 222,678 | 481,787 | 736,257 | 998,276 |

*1: Following the business transfer to the Wuthelam Group announced on August 10, 2021, the European automotive

coatings business and the two India businesses have been classified as discontinued operations. Figures for the 1Q

FY2021, 3Q FY2021 cumulative period, and full-year FY2021 are the amounts for continuing operations excluding

discontinued operations.

*2: Hyperinflationary accounting has been applied to Turkish subsidiaries since FY2022 2Q. Figures from FY2022 onward reflect this application.

*3: Following the finalization of PPA on Alina, NPI and BNPA,

the earnings in each quarter of FY2024 have been adjusted retrospectively (the earnings for FY2024 4Q is pro forma figures)

Operating profit (cumulative results)

Since 2020, our operating profit has seen growth for four consecutive years, keeping pace with our revenue increase. Despite the influence of hyperinflationary accounting in Türkiye, our operating profit reached a record high in 2023, thanks to the growth in revenue and improvement in gross profit margin.

(Million yen)

|

|

1Q | 2Q (cumulative) | 3Q (cumulative) | Full year |

|---|---|---|---|---|

| FY2025*2 | 51,432 | 121,175 | 190,579 | - |

| FY2024*2 *3 | 41,245 | 92,461 | 139,705 | 186,205 |

| FY2023*2 | 34,909 | 83,738 | 131,625 | 168,745 |

| FY2022*2 | 21,898 | 42,104 | 81,831 | 111,882 |

| FY2021*1 | 24,699 | 48,961 | 66,737 | 87,615 |

*1: Following the business transfer to the Wuthelam Group announced on August 10, 2021, the European automotive

coatings business and the two India businesses have been classified as discontinued operations. The figures for

FY2021 are amounts for continuing operations excluding discontinued operations. The figures for FY2021 have been

adjusted to reflect a change in the accounting policy for configuration or customization costs in cloud computing

agreements implemented beginning with 4Q FY2021.

*2: Hyperinflationary accounting has been applied to Turkish subsidiaries since FY2022 2Q. Figures from FY2022 onward reflect this application.

*3: Following the finalization of PPA on Alina, NPI and BNPA,

the earnings in each quarter of FY2024 have been adjusted retrospectively (the earnings for FY2024 4Q is pro forma figures)

Profit attributable to owners of parent (cumulative results)

Profit attributable to owners of parent generally aligns with the trends in operating profit and various stages of profit. Since 2020, it has increased steadily for four consecutive years, driven by the growth in operating profit resulting from increased revenue.

(Million yen)

|

|

1Q | 2Q (cumulative) | 3Q (cumulative) | Full year |

|---|---|---|---|---|

| FY2025*2 | 36,998 | 87,454 | 134,336 | - |

| FY2024*2 *3 | 29,428 | 65,049 | 96,902 | 125,890 |

| FY2023*2 | 25,340 | 60,898 | 93,444 | 118,476 |

| FY2022*2 | 13,225 | 26,971 | 54,695 | 79,418 |

| FY2021*2 | 16,342 | 33,274 | 50,308 | 67,569 |

*1: The figures for FY2021 have been adjusted to reflect a change in the accounting policy for configuration or

customization costs in cloud computing agreements implemented beginning with 4Q FY2021.

*2: Hyperinflationary accounting has been applied to Turkish subsidiaries since FY2022 2Q. Figures from FY2022 onward reflect this application.

*3: Following the finalization of PPA on Alina, NPI and BNPA,

the earnings in each quarter of FY2024 have been adjusted retrospectively (the earnings for FY2024 4Q is pro forma figures)