- Organic EPS CAGR target: +10-12%

- Accelerate EPS compounding through aggressive M&A activities

Our Sole Mission: Maximization of Shareholder Value (MSV)

Stock-Price Conscious Management

We are pursuing our sole mission of MSV through the maximization of EPS and PER. We practice management with a stock-price consciousness, which is the outcome of our MSV pursuit. Over the past five years, we have steadily compounded EPS through both organic and inorganic initiatives, and our EPS has significantly outperformed both the TOPIX chemical sector average and the average of our competitors.

However, our stock price declined from 2021 to 2022 despite the growth in EPS, and we carried out an analysis, taking into account macroeconomic factors, sector trends, and our own analysis of stock price trends.

In addition, in light of the uncertain macroeconomic environment prevailing in recent years, we analyzed our stock from the perspective of its characteristics as both a defensive and growth stock.

Trends and changes in stock price, EPS, and PER

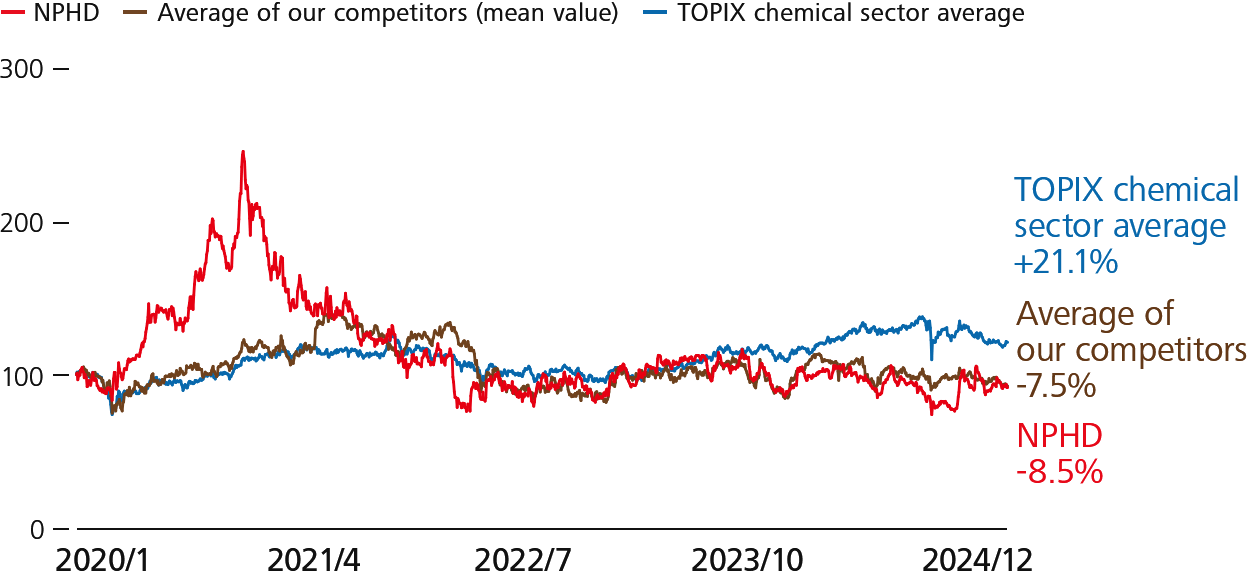

- Stock price trends

-

*1 Source: FactSet, Bloomberg

*2 The stock prices were indexed with the closing price on January 1, 2020 as 100

*3 The average of competitors is the average of indexed stock prices of Sherwin-Williams, BASF, Asian Paints, PPG, AkzoNobel, Berger Paints, Axalta Coating Systems, SKSHU Paint, Kansai Paint, TOA Paint, and Asia Cuanon Technology

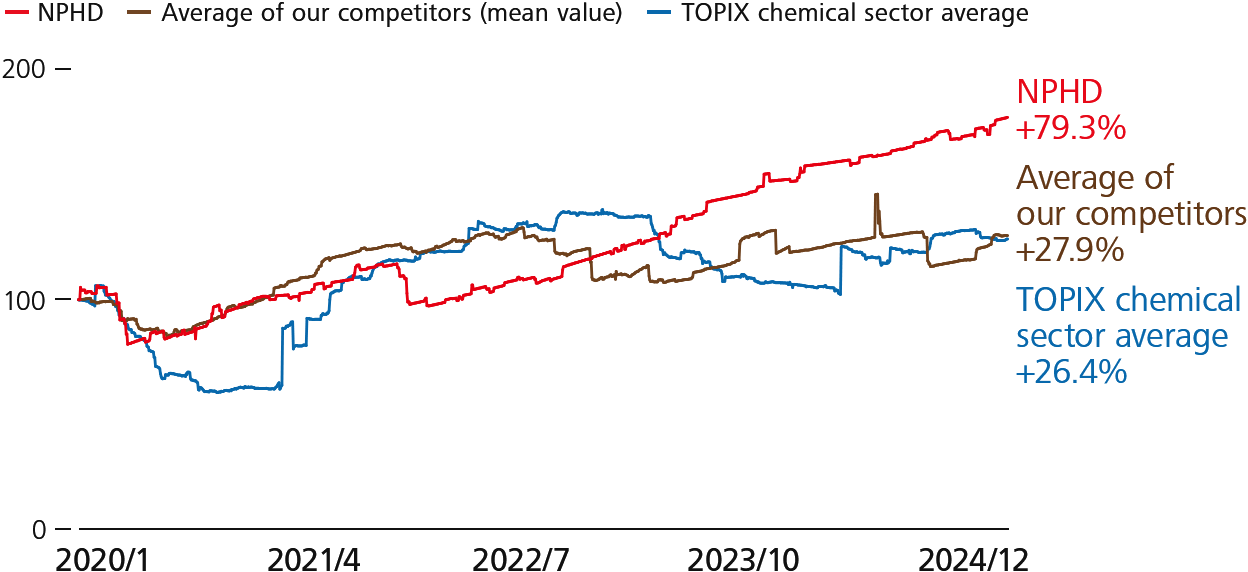

- EPS trends

-

*1 Source: FactSet, Bloomberg

*2 The stock prices were indexed with the closing price on January 1, 2020 as 100

*3 The competitor average is based on the average of stock prices of the following companies, each indexed to 100 at the start of 2020: Sherwin-Williams, BASF, Asian Paints, PPG, AkzoNobel, Berger Paints, Axalta Coating Systems, SKSHU Paint, Kansai Paint, TOA Paint, and Asia Cuanon Technology

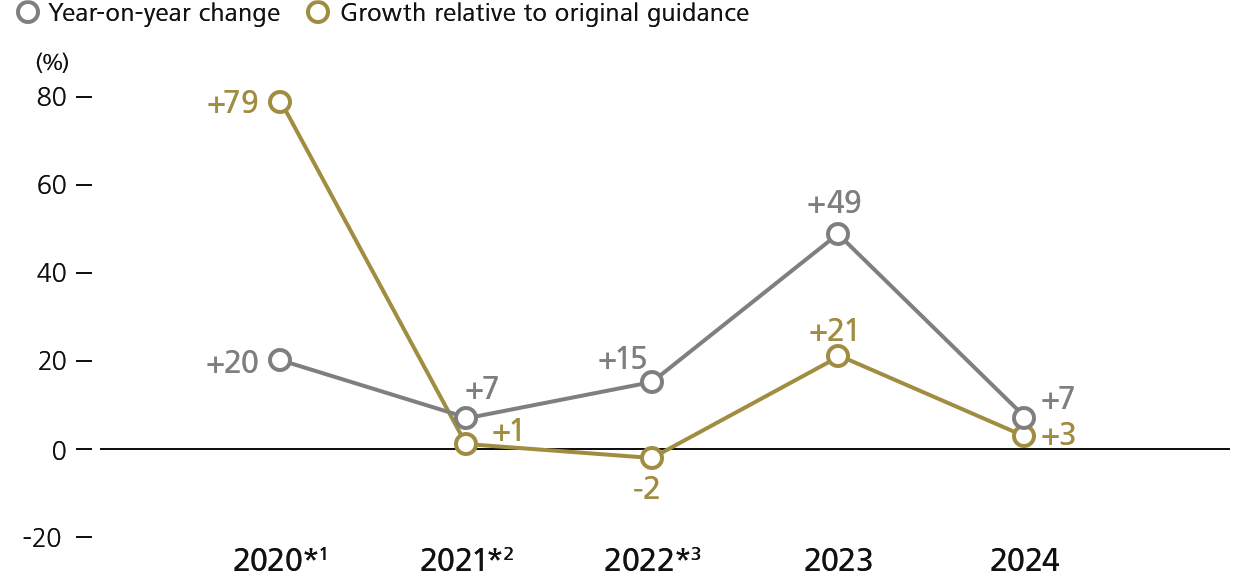

- EPS target achievement rate

-

*1 Original guidance announced in May 2020; EPS was calculated using the number of shares after stock split

*2 Guidance revised downward at mid-term (Factors) COVID, raw material inflation, chip shortage, etc.

*3 Guidance revised downward at mid-term (Factors) Increase in provision in China, hyperinflationary accounting in Türkiye, etc.

- Rate of change of stock price, EPS, and PER

-

Five-year trend (2020-2024) Three-year trend (2022-2024) One-year trend (2024) Stock price EPS PER Stock price EPS PER Stock price EPS PER NPHD -8.5% +79.3% -16.4x -19.7% +78.5% -20.7x -11.9% +12.7% -4.7x Average of our competitors -7.5% +27.9% -8.5x -34.0% +10.0% -10.6x -17.5% -5.2% -2.9x TOPIX chemical sector average +21.1% +26.4% -0.8x +6.0% +4.4% +0.3x +0.4% +19.6% -3.3x

Analysis of current situation and future direction

Over the past five years, our EPS has outperformed both the TOPIX chemical sector average and the average of our competitors. While our PER is not low in absolute terms, its rate of change has been declining compared to benchmarks, and our stock price has been underperforming both the TOPIX chemical sector average and the average of our competitors.

We believe that the main factors contributing to this decline in PER are: (1) market anxieties over China-related risks, (2) an underestimation of our growth potential, and (3) our aggressive M&A strategy being evaluated as high risk. We are working to alleviate these concerns and evaluations. Furthermore, we are committed to accelerating the sustainable EPS compounding through both organic and inorganic growth towards achieving MSV.

Macroeconomic factors

- (1) Rapid rise in long-term U.S. interest rates and acceleration of the tapering pace (reduction of quantitative easing measures) since 2022⇒Significant adjustment of high valuation stocks such as tech stocks and domestic growth stocks with low liquidity, leading to a shift towards large domestic demand-driven stocks and value stocks

- (2) Emergence of debt non-performance by property developers and tightened regulations on tech companies in China since 2022⇒Capital flight of investment money from China and Hong Kong, resulting in increased fund inflows into the Japanese stock market

Analysis of sector trends and our performance

-

TOPIX chemical sector average

- EPS has improved significantly, mainly attributed to stocks of companies that have bounced back from a slump in demand influenced by the pandemic since 2021 and have benefited from the yen’s depreciation

-

Average of our competitors

- PER of high-valuation stocks declined from 2021 to 2022, influenced by the macroeconomic factors (see the analysis above for more details).

-

NPHD

- In 2020, PER climbed to over 60 times due to a combination of factors, including (i) the capital markets’ preference for growth stocks and high interest in China-related stocks, (ii) the realization of our long-term goal: the full-integration of the Asian JVs and acquisition of Indonesia business, and (iii) the low liquidity of our stock. Despite the significant growth in EPS, PER has been greatly influenced by the macroeconomic factors (see the analysis above for more details) since 2021

- Although our PER follows a similar trend as China-related stocks, businesses outside of China make up as much as 64% of our consolidated operating profit. Over the past three years, our China business has demonstrated stable growth with a CAGR of +12.4%(on a local currency basis) in revenue and operating profit margin at 12.5% (on a Tanshin basis) in 2023, showing a relatively low correlation with Chinese macroeconomic trends

Analysis of our investment profile as a defensive/growth stock

One clear indication of the soundness of our assets is that, although various events occur within our broad business portfolio, we have consistently delivered solid results overall. Even amid a highly volatile business environment — including a sharp rise in raw material prices in 2021, as well as the recording of provisions in China and the application of hyperinflationary accounting in Türkiye in 2022 — we have continued to achieve year-on-year EPS growth. This consistent performance highlights our strength as a growth stock. Furthermore, we have largely achieved the original guidance over the past five years. This demonstrates that our Asset Assembler model, which enables low-risk and sustainable EPS compounding, also provides the characteristics of a defensive stock — one that is less susceptible to shifts in the macroeconomic environment.

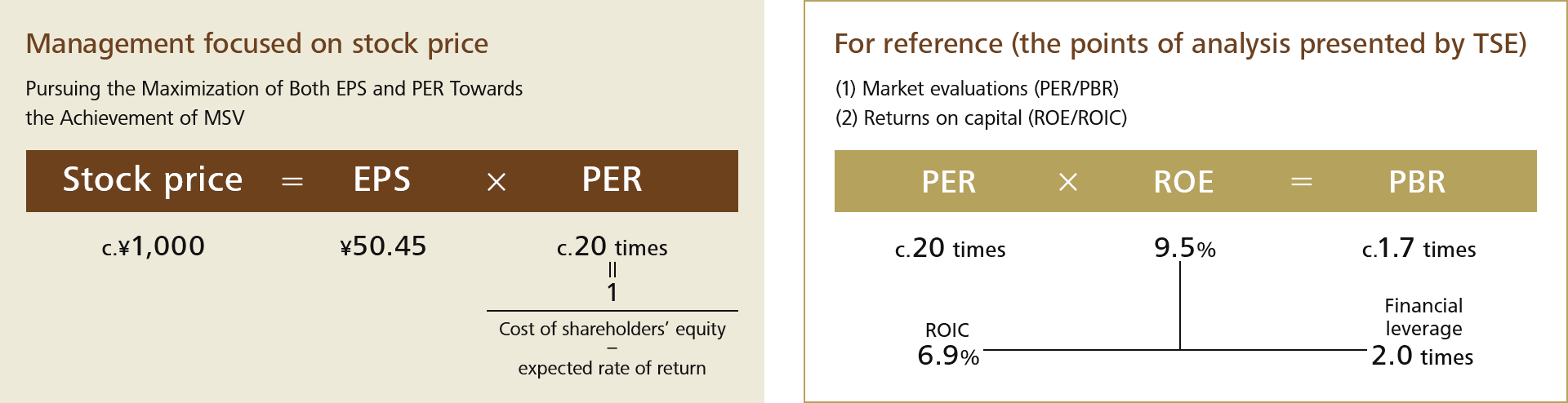

Management focused on stock price

- Elevate capital markets’ conviction and expectations in the business acumen of the management team

- Elevate capital markets’ conviction and expectations in growth potential and profitability

- Continuously improve the individual ROIC of acquired companies

- Accelerate EPS compounding through aggressive M&A

- Pursue an optimal capital structure while maintaining leverage capacity

- Secure trust and creditworthiness from financial institutions and rating agencies

- Accelerate EPS compounding across both organic and inorganic growth, leveraging the combined advantages of autonomous and decentralized management and lean headquarters

- Promote understanding of our business model, track record, and growth potential

- Encourage recognition of our portfolio as a collection of low-risk entities

- Enhance investor engagement opportunities and disclosure material

- Rigorously select only low-risk, high-return deals for M&A activities

- Ensure that the individual ROIC surpasses WACC within 3-4 years of acquisition through improvement in CCC

- Aim to balance capital efficiency with profit growth

- Enhance cash generation capabilities by improving earnings growth and CCC

- Repay debt when there are no M&A activities

- Implement debt financing in yen to maintain a stable debt composition

* The stock price is as of June 30, 2024; the EPS, ROE, ROIC, and financial leverage are based on the 2023 results; and the PER and PBR are as of June 30, 2024.