Aggressively pursue new partners to join our Group taking advantage of the growth potential of the paint market and stability of cash flows

Overview of our M&A strategy

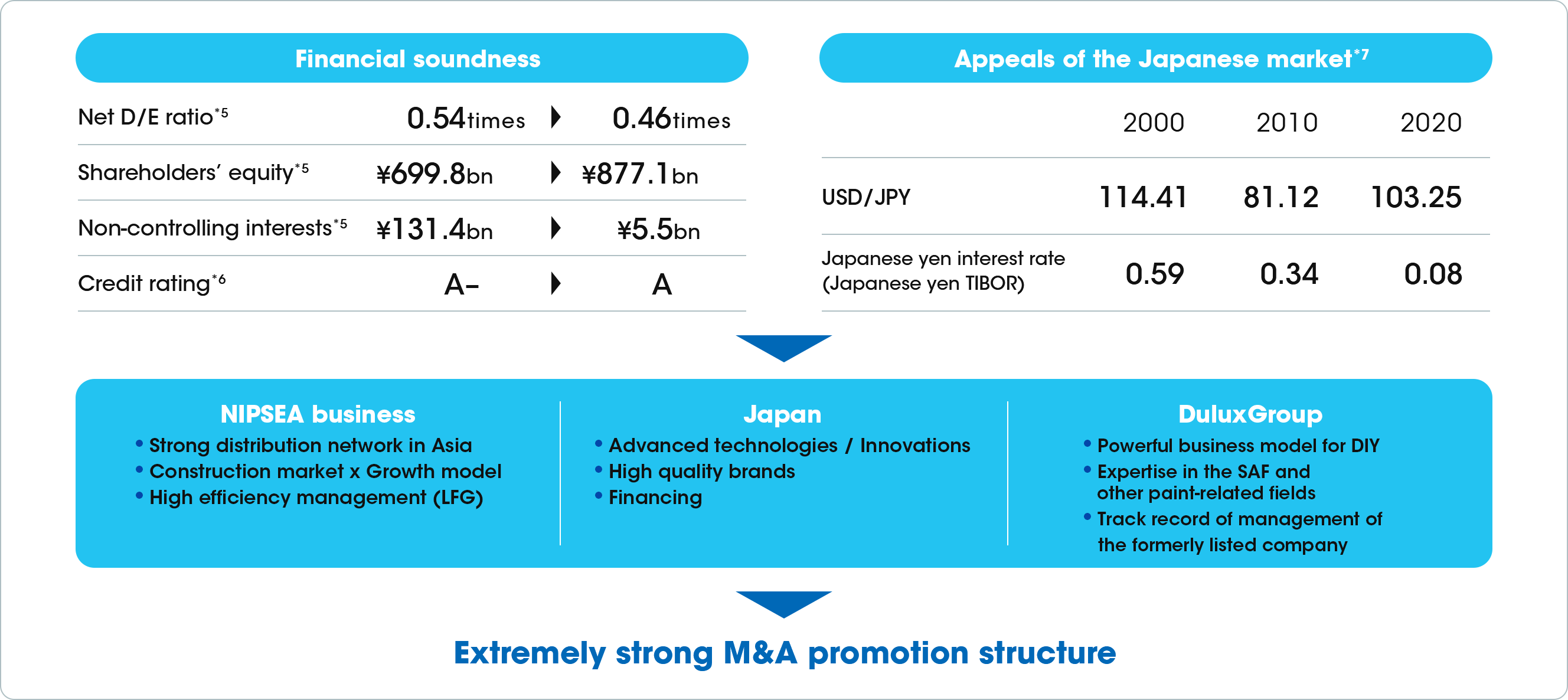

The paint industry is characterized by a sustainable growth potential and a high stability of cash flows. In addition, the recent market environment allows financing at low interest rates. As a result, the paint industry is well positioned for M&As.

The decorative paints market, which accounts for more than 50% of the total paint market, features local production for local consumption. As a consequence, industry players use different business models for different countries including in procurement of raw materials, consumer preferences, distribution networks, and environmental regulations. Paint has low threat of alternative products, and paint products are difficult to differentiate through technology. Therefore, the keys to success in the paint business are: (1) powerful brand, (2) extensive distribution network, and (3) establishment of operations well versed in local markets. Successful players in the paint industry tend to enjoy a virtuous cycle: Once a player which has acquired the top market share based on the above factors, it is not easy for peer players to overtake the No.1 player’s position, allowing the No.1 player to further gain market share and deliver higher revenue.

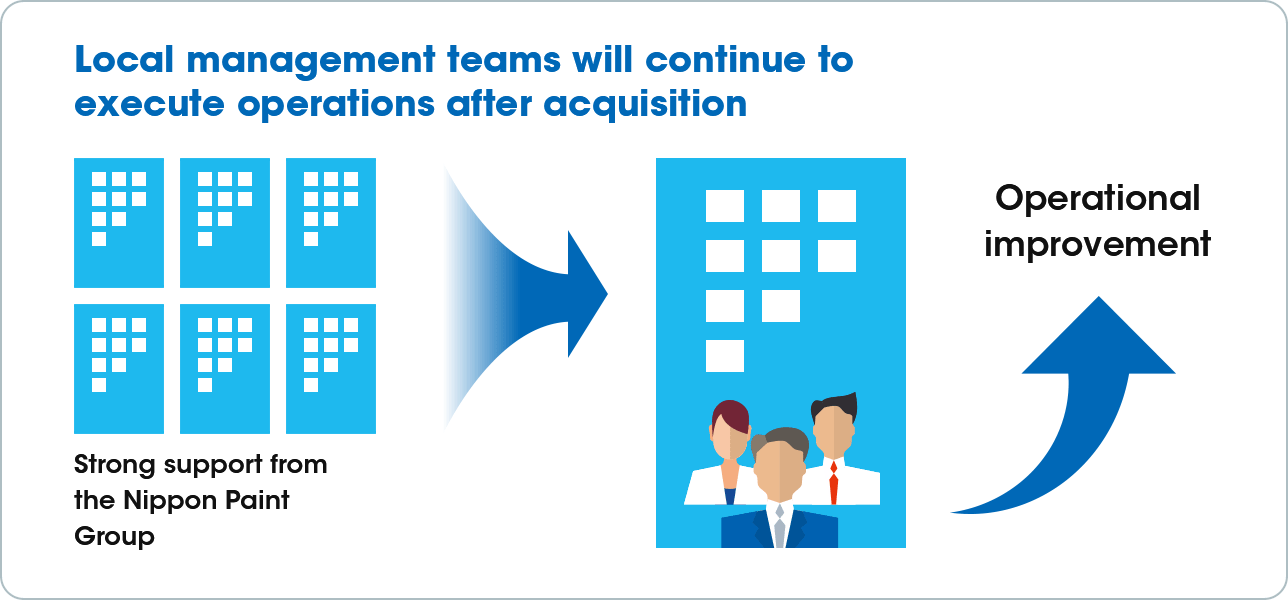

Taking advantage of the above features of the paint market, our Group carries out M&As that are characterized by a solid support system for our Group partner companies to enable acquired companies and management teams and employees who work in those companies to deliver their maximum performance in the local market. Specifically, we will retain the management teams of acquisition targets by respecting their autonomy of management even after acquisitions, if they have the above strengths that are key to success. Our Group will support the acquired companies through the following: (1) sharing expertise and best practices of our Group’s partner companies, (2) joint procurement of raw materials, and (3) providing funds for growth investment to further drive growth such as M&As in the local market besides funds for marketing and capital investment. In this way, our Group’s M&As are characterized by provision of strong support for local operations to make the best of the strengths of our local partner companies.

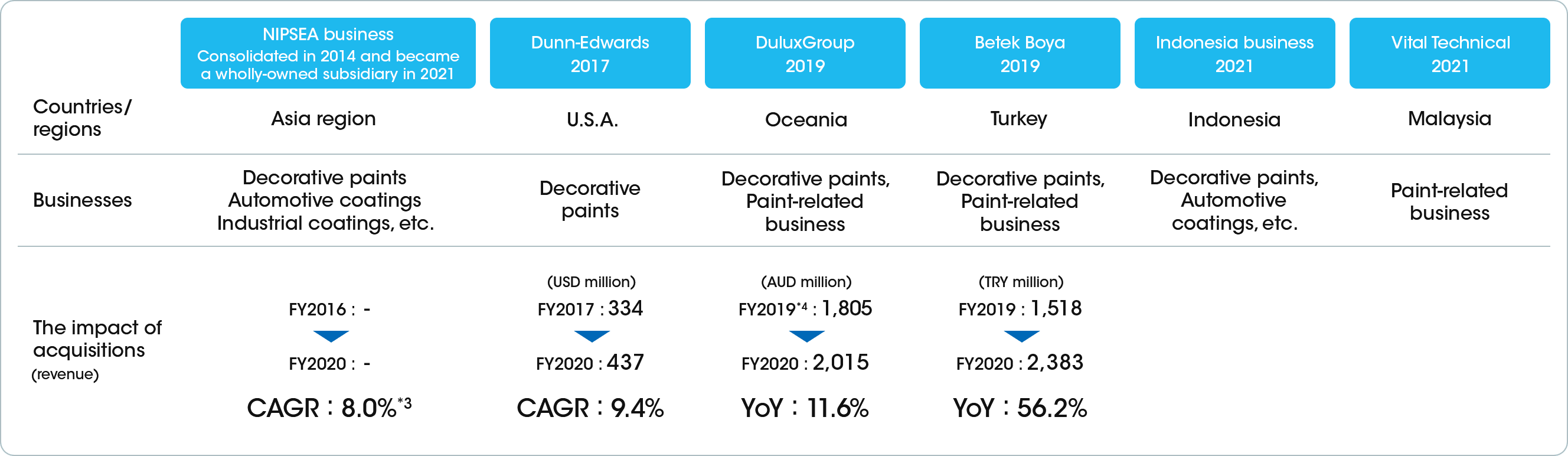

Key acquisition track record of our Group

- Figures are in constant currency.

- DuluxGroup’s revenue for FY2019 is adjusted assuming its fiscal year ended on December 31, 2019.

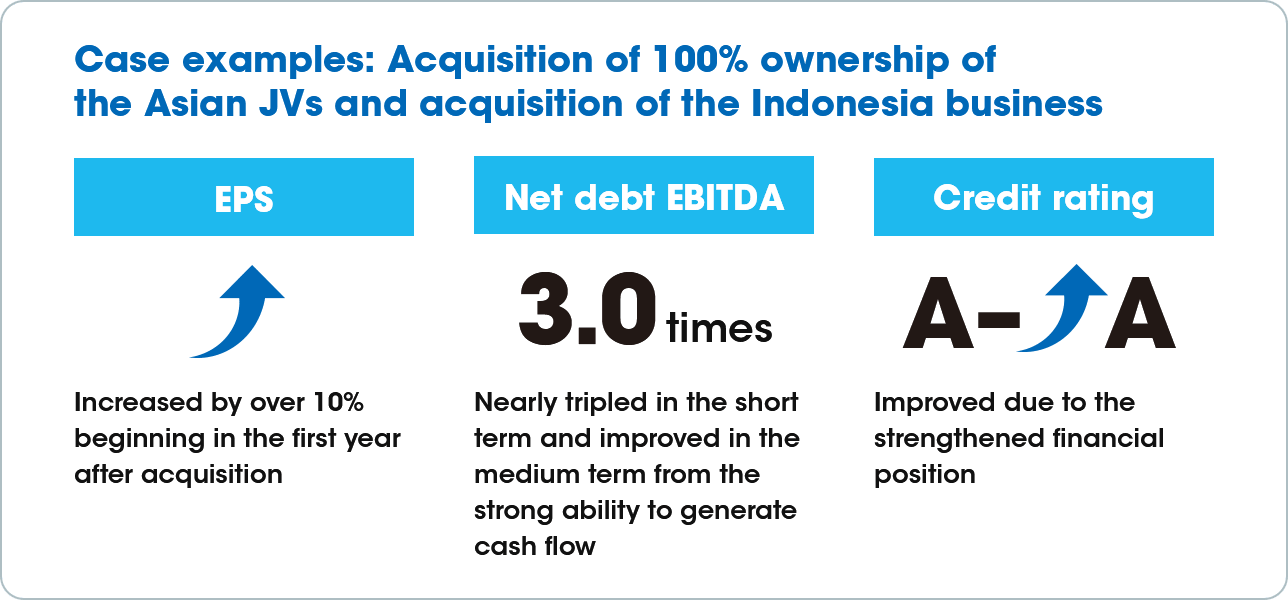

Our Group has been expanding globally since 2014 through consolidation of the Asian JVs and acquisitions of the U.S.-based Dunn-Edwards, Australia-based DuluxGroup, and Turkey-based Betek Boya. In January 2021, we completed the acquisition of 100% ownership of the Asian JVs and the Indonesia business, thereby further strengthening our ability to capture demand in the high growth Asian markets. As a result, we have achieved significant profit growth, driving Maximization of Shareholder Value (MSV).

Our M&A targets are not limited to large-scale companies; rather, we will explore opportunities with medium and small size companies if they will contribute to MSV. For instance, in March 2021, we acquired Vital Technical, a prominent sealant and adhesives manufacturers with the leading market share in Malaysia, in line with our strategy to expand paint related business. In this way, our Group is steadily building the track record of M&As.

Our partner companies have been delivering strong growth after acquisition by our Group. This proves the success of our Group’s unique M&A style of generating synergies by leveraging the strengths of acquired companies.

Emphasis on financial

discipline

Utilize human resources of acquired companies

We pursue M&A within the parameters of financial discipline. We specifically emphasize the following: deals that contribute to EPS accretion, achieve ROIC that exceeds WACC, and maintain sufficient room for financial leverage. Financing for M&A prioritizes debt financing, but equity-based capital raising is an option as long as EPS accretion is achieved. This allows us to carry out M&As constantly without being restricted by shortage of funds.

Promoting M&A by leveraging our Group’s strengths

- After reflecting changes due to the acquisition of 100% ownership of the Asian JVs to the amounts on the balance sheet as of the end of FY2020 (unaudited)

- Rating & Investment Information, Inc.

- Source: Bloomberg

Our Group has significant financial strength and financial soundness, as represented by strong cash flow generating capacity, as well as the net debt to equity ratio of significantly below 1.0 times and the ability to procure low-interest financing in the Japanese capital market. In addition, we have established an extremely solid structure for promoting M&As including sharing and leveraging the strengths of Group partner companies, such as NIPSEA and DuluxGroup. Our M&A strategy with clear target setting, leveraging Group strengths, and emphasizing financial discipline, have yielded great success for our M&A deals in recent years. We will continue to aggressively pursue M&A for our ongoing growth.

- Integrated Report 2021 (Digital Edition)